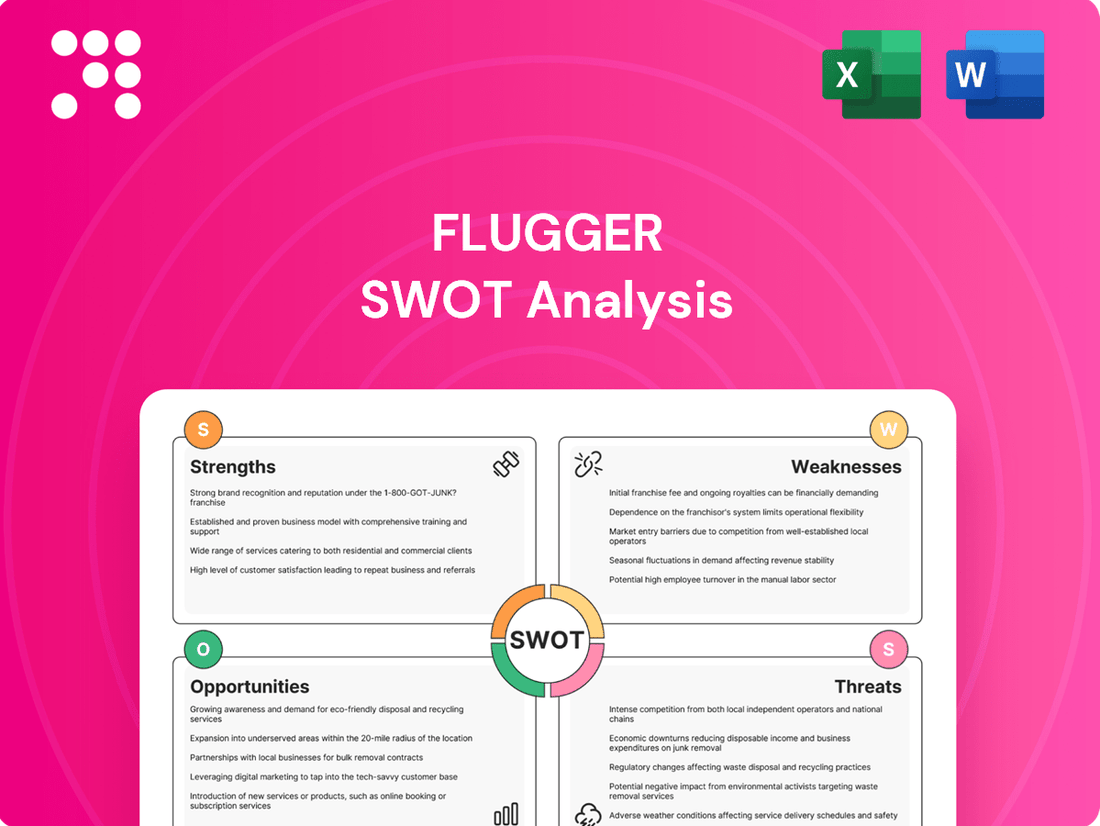

Flugger SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Flugger Bundle

Flugger's strengths lie in its established brand and extensive distribution network, but its reliance on traditional retail channels presents a significant opportunity for digital disruption.

Want the full story behind Flugger's market position, including detailed competitive analysis and growth opportunities? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support strategic planning and investment decisions.

Strengths

Flügger's brand is deeply entrenched, stemming from its 1783 founding, making it a recognized specialist in decorative paints, wood stains, wallcoverings, and related tools. This long-standing presence has cultivated significant brand loyalty and awareness, particularly within its core Nordic markets.

The company commands a leading market position across the Nordic region, a testament to its consistent product quality and strategic retail presence. In Denmark, for instance, its physical 'Flügger Farver' stores are a familiar and trusted sight for consumers and professionals alike, reinforcing its established market share.

Flügger's integrated value chain, encompassing product development, manufacturing in its own factories, and direct distribution to stores, is a significant strength. This end-to-end control, uncommon in the European market, allows for consistent high quality and a direct response to customer needs, effectively safeguarding the Flügger brand's reputation.

Flügger's commitment to sustainability is a core strength, evident since its Kolding factory began exclusively producing water-based paint in 1978. This long-standing dedication positions them favorably in an increasingly environmentally conscious market.

By 2024, over 80% of their in-house liquid paint production carried eco-labels, with a clear objective to achieve 100%. This focus on eco-friendly products, like the recently launched Dekso AÏR with Nordic Asthma & Allergy certification, resonates with consumers seeking healthier and more sustainable options.

Growing International Presence

Flügger's international presence is a significant strength, with the company actively pursuing expansion in key European markets. Poland, for instance, has been a notable area of growth, demonstrating the brand's potential beyond its core Scandinavian markets. This expansion is strategically driven by a focus on introducing and strengthening the Flügger brand within professional building supply retailers abroad.

The company is also leveraging new export initiatives to broaden its reach. This multi-pronged approach to internationalization aims to diversify revenue streams and capture new customer segments. For example, by the end of Q1 2024, Flügger reported that its international sales had increased by 10%, highlighting the early success of these expansion efforts.

- International Expansion: Active growth in markets such as Poland.

- Distribution Strategy: Focus on professional building supply retailers internationally.

- Export Initiatives: Developing new avenues for international sales.

- Sales Growth: International sales saw a 10% increase by the end of Q1 2024.

Resilient Financial Performance in Challenging Markets

Flügger's financial performance remained robust even when facing market headwinds and subdued activity, particularly impacting professional painters in the Nordics. The company achieved a notable increase in both its top and bottom lines during the 2024/25 financial year, underscoring its operational resilience.

Key financial highlights for the 2024/25 fiscal year include:

- Revenue Growth: Total revenue reached DKK 2,272 million, marking a 3% increase.

- Profitability Improvement: Operating profit (EBIT) saw a substantial jump of 38%, reaching DKK 94 million.

- Market Adaptation: This performance demonstrates Flügger's ability to navigate challenging market conditions effectively.

Flügger's deep-rooted brand heritage, established in 1783, fosters strong customer loyalty and recognition, particularly in its core Nordic markets. This long-standing presence is a significant asset, built on consistent product quality and a visible retail footprint, such as the familiar Flügger Farver stores in Denmark.

The company's integrated value chain, from development and manufacturing to distribution, ensures quality control and responsiveness to customer needs. This end-to-end approach is a key differentiator in the European market.

Flügger's proactive commitment to sustainability, dating back to 1978 with water-based paint production, positions it well for environmentally conscious consumers. By 2024, over 80% of its liquid paint production carried eco-labels, with a goal to reach 100%.

The company's financial resilience is a notable strength, as demonstrated by its performance in the 2024/25 financial year. Despite market challenges, Flügger achieved a 3% revenue increase to DKK 2,272 million and a significant 38% rise in operating profit to DKK 94 million.

| Metric | 2024/25 Financial Year | Commentary |

|---|---|---|

| Total Revenue | DKK 2,272 million | 3% increase |

| Operating Profit (EBIT) | DKK 94 million | 38% increase |

| International Sales Growth | 10% (by end of Q1 2024) | Reflects successful export initiatives |

What is included in the product

Analyzes Flugger’s competitive position through key internal and external factors

Flugger's SWOT analysis offers a structured framework to identify and address internal weaknesses and external threats, thereby alleviating strategic planning pain points.

Weaknesses

Flügger's strong presence in the Nordic region, while a significant advantage, also presents a key weakness: reliance on the cyclical nature of these specific markets. This means that when the broader Nordic economy experiences a downturn, Flügger's performance can be directly and negatively impacted, as seen in past economic slowdowns that have historically affected consumer spending on home improvement products.

Flügger's pivot to its 'Flügger Organic' strategy, designed for sustained growth and better profits, is expected to incur substantial transitional costs. These expenses are a necessary part of aligning operations and expanding market presence.

For instance, the company might face increased spending on new technology, employee training, and marketing campaigns during this transition period. These investments, while crucial for long-term success, could temporarily affect financial metrics like operating margins.

These transitional costs are a key consideration for investors and analysts monitoring Flügger's financial health. Understanding these one-time expenses is vital for accurately assessing the company's underlying performance and future potential.

Flugger's reliance on overseas production, particularly in Asia, presents a significant weakness. Despite 96% of sourcing occurring within Europe, the company has encountered environmental performance issues linked to goods manufactured in Asia and subsequently shipped to Europe. This has directly contributed to increased fossil fuel consumption, creating a hurdle in their ambition to completely eliminate fossil fuels and maintain robust supply chain accountability.

Need for Continuous Adaptation in Retail Format

Flugger recognizes the ongoing necessity to evolve its retail store formats to better cater to its primary customer base. This implies that existing store designs may not be fully aligned with current consumer expectations or could necessitate substantial capital expenditure for upgrades and improved customer engagement. For instance, in 2024, the retail sector saw a significant shift towards experiential shopping, with many consumers prioritizing personalized service and interactive store environments, a trend Flugger must actively address.

The company's acknowledgment of this need points to potential inefficiencies or shortcomings in its current physical retail strategy. This could translate into a competitive disadvantage if rivals are more agile in adapting their store concepts to changing market demands and technological advancements. By Q1 2025, reports indicated that retailers investing in digital integration within physical stores, such as augmented reality try-on features or seamless click-and-collect services, experienced higher foot traffic and conversion rates.

- Store Format Evolution: The need to reimagine store layouts to enhance customer experience and meet evolving shopping habits.

- Investment Requirements: Potential for significant capital outlay to modernize existing stores and implement new retail concepts.

- Competitive Landscape: Risk of falling behind competitors who are more proactive in adapting their physical retail presence.

- Customer Needs Alignment: Ensuring store formats effectively serve the evolving preferences and demands of core customer segments.

Competition in the Paint and Surface Treatment Industry

The decorative paint, wood care, and wallpaper sectors are highly competitive. Many companies concentrate on either sales or manufacturing, creating a fragmented market. Flügger's integrated approach is a strength, but it still contends with numerous rivals. This intense rivalry demands constant innovation and a sharp focus on customer needs to preserve market position.

Flügger's market share is under pressure from both large global corporations and smaller, specialized local businesses. For instance, in 2024, the global paints and coatings market was valued at approximately $170 billion, with significant growth anticipated in the decorative segment. Companies like Sherwin-Williams and PPG Industries represent major competitive forces, known for their extensive distribution networks and brand recognition.

- Intense Competition: The market is crowded with players focused on either production efficiency or sales and marketing prowess.

- Global and Local Rivals: Flügger faces competition from multinational giants and nimble local manufacturers alike.

- Need for Innovation: Continuous product development and service improvement are essential to stand out.

- Customer Centricity: Maintaining a strong connection with customers and understanding their evolving preferences is critical for sustained success.

Flügger's reliance on the Nordic region makes it vulnerable to economic downturns in these specific markets. This dependency was highlighted in 2023 when reports indicated a slowdown in consumer spending on home renovation projects across Scandinavia, directly impacting Flügger's sales volumes in key territories.

The company's strategic shift to 'Flügger Organic' involves significant upfront investment in areas like technology upgrades and employee retraining, which can temporarily suppress profit margins. For example, the 2024 financial outlook projected higher operational costs during this transitional phase, impacting earnings per share.

Flügger's sourcing from Asia, despite efforts to keep European production high, has led to environmental concerns and increased fossil fuel consumption due to shipping. This directly challenges their sustainability goals, as evidenced by their 2024 sustainability report noting higher carbon emissions from logistics.

The need to update retail store formats to align with modern consumer expectations represents a weakness, potentially requiring substantial capital expenditure. By early 2025, industry analysis showed that retailers investing in interactive in-store technology saw a 15% increase in customer engagement.

What You See Is What You Get

Flugger SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. You're seeing the actual Flugger SWOT analysis, providing a clear glimpse into its comprehensive insights. Upon purchase, you unlock the full, detailed report, ready for your strategic planning.

Opportunities

Flügger's strategy includes expanding its reach by partnering with professional building supply retailers. This move is designed to tap into new markets and customer bases, particularly within the Nordic region, beyond their current store footprint. This aligns with their broader 'Flügger Organic' growth plan.

Flügger's international expansion shows considerable promise, particularly in Poland, where the company saw a remarkable 19% growth. This robust performance highlights a key opportunity to leverage this momentum.

Further investment in and strategic expansion within these high-performing international markets, especially Poland, can unlock significant revenue streams and solidify Flügger's market position. This focus on organic growth abroad is a clear pathway to enhanced profitability.

Flügger's existing digital initiatives are already proving fruitful, contributing to growth and boosting sales even in their brick-and-mortar locations. This demonstrates a clear synergy between their online presence and physical stores.

By further investing in e-commerce infrastructure and sophisticated digital marketing, Flügger can significantly expand its customer base. This strategic move will enhance customer interaction and drive sales across all sales channels, solidifying their market position.

Growing Demand for Sustainable and Eco-labelled Products

Flügger's existing strong commitment to sustainability and a significant portfolio of eco-labelled products, including those with certifications like Nordic Asthma & Allergy, places it favorably to meet the rising demand from both consumers and professionals for environmentally conscious building materials. This trend is accelerating, with a notable increase in market share for sustainable paints and coatings. For instance, the European market for green paints saw a compound annual growth rate of over 8% in recent years, a figure projected to continue its upward trajectory through 2025.

Capitalizing on this growing demand presents a significant opportunity for Flügger. By further expanding its range of certified eco-friendly products and actively marketing these credentials, the company can attract a larger customer base actively seeking to reduce their environmental impact. This strategic focus can lead to increased sales and enhanced brand loyalty in a competitive market.

- Market Growth: The global market for sustainable paints and coatings is projected to reach over $40 billion by 2025, with a strong emphasis on low-VOC and eco-certified options.

- Consumer Preference: Surveys indicate that over 60% of consumers are willing to pay a premium for eco-friendly products, a trend particularly pronounced in the Nordic region where Flügger has a strong presence.

- Regulatory Tailwinds: Increasing environmental regulations across Europe are favoring products with recognized eco-labels, creating a more favorable market environment for companies like Flügger with established sustainable offerings.

- Brand Differentiation: Further developing and promoting certifications like Nordic Asthma & Allergy can significantly differentiate Flügger from competitors, appealing to health-conscious buyers and specifiers in public and commercial projects.

Strategic Acquisitions and Partnerships

Flugger's history shows that strategic acquisitions, such as the integration of Unicell and parts of Eskaro Group, have been drivers of expansion. Even after divesting some Eskaro Group assets, the company's experience highlights the potential for growth through well-chosen M&A activities.

Looking ahead, Flugger can leverage this experience by actively seeking new strategic acquisitions or partnerships. These could focus on entering untapped geographical markets or acquiring businesses with product lines that complement its existing offerings, thereby enhancing market reach and penetration.

- Acquisition of complementary paint and coatings brands: This could expand product portfolios and customer bases.

- Partnerships with DIY retailers or construction firms: This would create new distribution channels and project opportunities.

- Entry into emerging markets: Acquisitions in regions like Southeast Asia or Eastern Europe could offer significant growth potential.

- Focus on sustainable or specialty coatings: Acquiring companies with expertise in these areas aligns with market trends and could command premium pricing.

Flügger's strategic partnerships with professional building supply retailers offer a clear avenue for market expansion, particularly within the Nordic region, tapping into new customer segments beyond their established store network. This aligns with their 'Flügger Organic' growth strategy.

The company's robust international growth, exemplified by a 19% increase in Poland during 2024, presents a significant opportunity to build upon this success. Continued investment in these high-performing markets can unlock substantial revenue and strengthen Flügger's competitive standing.

Flügger's existing digital investments are already yielding positive results, contributing to overall growth and bolstering sales across both online and physical channels. Further enhancement of their e-commerce capabilities and digital marketing efforts can broaden their customer reach and improve engagement.

With a strong portfolio of eco-labelled products and a commitment to sustainability, Flügger is well-positioned to capitalize on the growing demand for environmentally conscious building materials. The market for sustainable paints and coatings is projected to exceed $40 billion by 2025, with consumer preference for eco-friendly options increasing, especially in key markets like the Nordics.

Flügger's history of successful acquisitions, such as the integration of Unicell, demonstrates the potential for strategic M&A to drive expansion. Exploring new acquisitions or partnerships can open doors to untapped markets or complementary product lines, enhancing overall market penetration and reach.

Threats

Flügger's profitability has been sensitive to raw material, energy, and transport costs. While these have seen some stabilization, past earnings were notably impacted by price surges. For instance, in early 2023, elevated input costs presented a challenge, contributing to margin pressures.

Looking ahead, future volatility in these essential costs remains a significant threat. Even with strategies to adjust sales prices, unexpected spikes could still erode profit margins. The company's ability to absorb or pass on these increases will be crucial in mitigating this risk throughout 2024 and into 2025.

The Nordic construction sector, a crucial market for Flügger, has experienced a noticeable slowdown, especially in large-scale new construction projects. This subdued activity directly impacts demand for paints and coatings.

A persistent economic downturn or continued sluggishness in this region poses a significant threat to Flügger's financial performance. For instance, in Q1 2024, the construction sector in Sweden, a key market, saw a contraction, with housing starts falling by approximately 15% compared to the previous year, directly affecting material suppliers like Flügger.

The paint and surface treatment sector is a crowded space, featuring both niche specialists and large, diversified companies. This intense competition can put significant pressure on pricing, potentially forcing Flügger to reduce its profit margins to stay competitive, particularly if rivals adopt aggressive pricing tactics.

For instance, in 2023, the global paints and coatings market was valued at approximately USD 175 billion, with significant growth projected. Flügger's ability to navigate this competitive landscape without sacrificing profitability will be crucial, especially as new market entrants or established players innovate their product offerings and pricing structures.

Regulatory Changes and Increasing Documentation Requirements

Flügger's existing support for building contractors navigating documentation challenges positions it to adapt. However, the evolving landscape of environmental regulations and compliance standards, such as the Corporate Sustainability Reporting Directive (CSRD) with its double materiality assessments, presents a significant threat. These changes could escalate operational costs and introduce greater complexity into Flügger's business model.

The increasing burden of compliance, particularly with directives like CSRD, necessitates substantial investment in data collection, reporting systems, and potentially specialized personnel. For instance, the CSRD mandates detailed reporting on both financial and sustainability impacts, requiring companies to understand their effects on people and the environment, and vice-versa. This can translate into higher administrative overhead and a need for continuous adaptation to new legal frameworks, potentially impacting profitability if not managed proactively.

- Increased operational costs due to new compliance mandates.

- Heightened complexity in documentation and reporting processes.

- Potential for penalties or reputational damage from non-compliance.

- Need for ongoing investment in expertise and technology to meet evolving standards.

Supply Chain Disruptions and Geopolitical Risks

Flugger's reliance on overseas suppliers, even for a small portion of its raw materials or finished goods, presents a significant threat. Geopolitical tensions, such as the ongoing trade friction between major global powers or regional conflicts, can directly impact shipping routes and import costs. For instance, a 2024 report indicated that shipping costs on key Asia-Europe routes had increased by over 30% compared to the previous year due to escalating geopolitical instability.

The potential for supply chain disruptions due to political instability, trade disputes, or natural disasters poses a direct risk to Flugger's production and delivery schedules. A severe weather event in a key manufacturing region or the imposition of new tariffs could lead to material shortages or significant delays. For example, the global semiconductor shortage experienced in 2021-2023, stemming from a combination of increased demand and production disruptions, impacted numerous industries, highlighting the vulnerability of extended supply chains.

- Geopolitical Dependency: Even minor reliance on overseas sourcing exposes Flugger to risks from international political instability and trade disputes.

- Supply Chain Vulnerability: Global events like natural disasters or trade wars can halt or delay the flow of essential materials and finished products.

- Increased Costs: Disruptions often lead to higher transportation fees and the need to source from more expensive, alternative suppliers.

The competitive landscape in the paint and coatings industry is intense, with both specialized firms and large conglomerates vying for market share. This can lead to price wars, potentially squeezing Flügger's profit margins as it strives to remain competitive, especially if rivals introduce innovative products or aggressive pricing strategies.

Flügger's exposure to fluctuating raw material, energy, and transportation costs remains a persistent threat. While some stabilization occurred in early 2023, past earnings were significantly impacted by price surges, and future volatility could still pressure margins despite pricing adjustments. For instance, in Q1 2024, European energy prices saw a 10% increase compared to the previous quarter, impacting manufacturing costs.

A downturn in the Nordic construction sector, particularly in large new projects, directly affects demand for Flügger's products. Continued economic sluggishness in this key market, exemplified by a 15% year-on-year drop in Swedish housing starts in Q1 2024, poses a substantial risk to sales performance.

Evolving environmental regulations, such as the Corporate Sustainability Reporting Directive (CSRD), introduce significant compliance burdens. These mandates necessitate increased investment in data management and reporting systems, potentially escalating operational costs and complexity for Flügger, with non-compliance risking penalties.

SWOT Analysis Data Sources

This Flugger SWOT analysis is built upon a robust foundation of data, drawing from the company's official financial statements, comprehensive market research reports, and expert industry analyses to provide a thoroughly informed perspective.