Flugger PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Flugger Bundle

Uncover the critical Political, Economic, Social, Technological, Environmental, and Legal forces shaping Flugger's trajectory. This expertly crafted PESTLE analysis provides the deep-dive insights you need to anticipate market shifts and capitalize on emerging opportunities. Download the full version now and equip yourself with actionable intelligence for strategic advantage.

Political factors

Government policies, especially those targeting Volatile Organic Compounds (VOCs) and hazardous chemicals in paints, significantly shape Flügger's product innovation and production. For instance, the EU's stringent regulations, like the REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals) framework, mandate continuous reformulation and substantial R&D investment to maintain market access and avoid fines, impacting operational costs.

These evolving environmental and health standards, such as the push for lower VOC content in architectural coatings, encourage Flügger to develop more eco-friendly and safer product lines. While this can be a driver for innovation, it also leads to increased production expenses as manufacturers adapt their formulations and manufacturing processes to meet these evolving compliance demands.

Flügger's global operations are directly impacted by international trade policies. For instance, changes in tariffs on raw materials like titanium dioxide or resins, key components in paint manufacturing, can significantly alter production costs. In 2024, ongoing trade discussions between the EU and potential new trade partners could introduce new import duties or preferential access, influencing Flügger's sourcing strategies and the competitiveness of its products in various markets.

Flügger's primary markets in the Nordic region and wider Europe benefit from generally stable political environments, which bolsters investor confidence and supports government investment in construction and renovation projects. For instance, Denmark, a key market, has consistently ranked high in global political stability indices, fostering a predictable business climate.

Government support through green building initiatives and renovation grants, like those seen in Germany and Sweden in recent years, directly stimulates demand for Flügger's paint and coating solutions. These programs encourage homeowners and businesses to undertake upgrades, translating into increased sales for the company.

However, any significant political upheaval or the implementation of austerity measures in these core markets could negatively impact consumer spending and public sector construction budgets. This could lead to reduced demand for building materials, affecting Flügger's revenue streams and growth prospects.

Building Codes and Standards

Changes in national and regional building codes significantly impact Flügger's product development and market access. For instance, stricter energy efficiency mandates in the EU, effective from 2024, are driving demand for coatings with enhanced thermal insulation properties. This necessitates innovation in Flügger's formulations to meet these evolving performance requirements, potentially creating a competitive advantage for compliant products.

Flügger must actively monitor and adapt to evolving standards related to fire safety, durability, and environmental impact. For example, the increasing focus on VOC (Volatile Organic Compound) limits across European markets, with many countries implementing stricter regulations by 2025, directly affects paint composition. Compliance is not just a legal necessity but a crucial factor for market acceptance and can spur the development of premium, eco-friendly product lines.

- Evolving Standards: Building codes are constantly updated, influencing material specifications for paints and surface treatments.

- Performance Requirements: New regulations often mandate higher standards for fire safety, durability, and environmental impact.

- Market Opportunities: Compliance with stringent codes can lead to the development of specialized, high-performance products, opening new market segments.

Fiscal Policies and Subsidies

Government fiscal policies, such as corporate tax rates and VAT, directly influence Flügger's operational costs and pricing strategies. For instance, changes in corporate tax in key markets like Denmark or Sweden can significantly affect net profits. Furthermore, government subsidies aimed at promoting energy-efficient renovations and sustainable building materials can create substantial market opportunities for Flügger's eco-friendly product lines.

Tax incentives play a crucial role in driving consumer and business adoption of Flügger's greener offerings. For example, if a government introduces tax credits for homeowners who use low-VOC paints or recycled content insulation, this directly boosts demand for Flügger's environmentally certified products. Staying abreast of these evolving fiscal landscapes is essential for Flügger's strategic planning and market positioning.

- Corporate Tax Rates: Fluctuations in corporate tax rates in major European markets impact Flügger's profitability. For example, a reduction in corporate tax in Germany could increase retained earnings.

- VAT Adjustments: Changes in Value-Added Tax (VAT) across different countries affect the final price of Flügger's products, influencing consumer purchasing decisions.

- Green Subsidies: Government subsidies for energy-efficient building materials or renovations directly stimulate demand for Flügger's sustainable product portfolio.

- Consumer Tax Incentives: Tax credits or deductions for consumers undertaking eco-friendly home improvements can significantly boost sales of eco-labeled paints and coatings.

Government policies, particularly those concerning environmental regulations and building standards, directly influence Flügger's product development and market access. For instance, the EU's ongoing efforts to reduce VOC emissions, with many member states aiming for stricter limits by 2025, compel Flügger to innovate its formulations. This regulatory landscape, while driving demand for eco-friendly solutions, also necessitates significant investment in research and development to ensure compliance and maintain competitiveness.

Trade policies and international agreements significantly impact Flügger's sourcing costs and market reach. Tariffs on key raw materials, such as titanium dioxide, can fluctuate based on geopolitical relations and trade negotiations, affecting production expenses. In 2024, for example, shifts in global trade dynamics could alter the cost-effectiveness of sourcing from different regions, influencing Flügger's supply chain strategy.

Government support through green building initiatives and renovation grants, as seen in countries like Germany and Sweden, directly stimulates demand for Flügger's sustainable paint and coating products. These fiscal incentives encourage consumers and businesses to invest in upgrades, translating into increased sales opportunities for the company. Conversely, austerity measures or reduced public spending on construction projects could dampen market demand.

Political stability in Flügger's core Nordic markets provides a predictable business environment, fostering investor confidence and supporting consistent demand in the construction sector. Denmark, a key market for Flügger, consistently ranks high in political stability indices, ensuring a stable operational climate. However, any significant political instability in these regions could negatively impact consumer spending and construction budgets.

What is included in the product

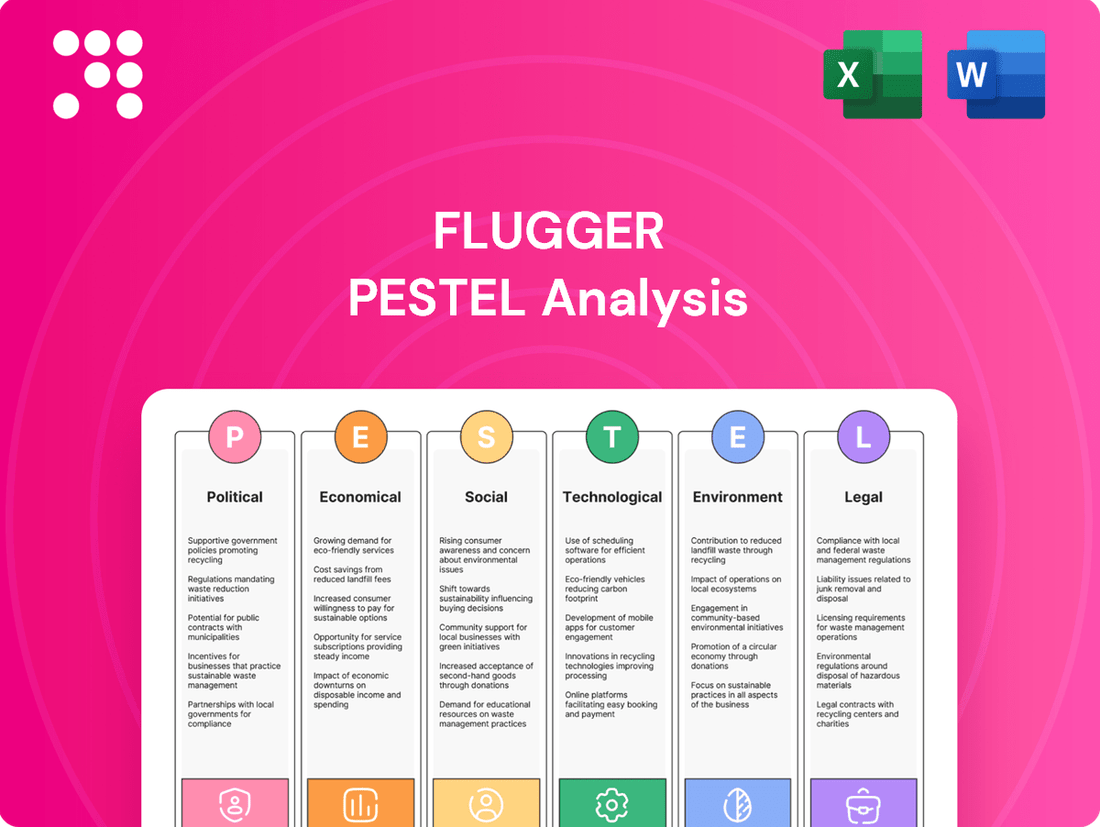

The Flugger PESTLE Analysis systematically examines the Political, Economic, Social, Technological, Environmental, and Legal factors impacting the company, providing a comprehensive understanding of its external operating landscape.

The Flugger PESTLE analysis offers a clear, summarized version of external factors, alleviating the pain of sifting through extensive data for quick strategic decisions.

Economic factors

Rising inflation rates directly increase the cost of raw materials, energy, and logistics for Flügger, impacting its production costs and profit margins. For instance, in the Eurozone, inflation averaged 5.3% in 2023, a notable increase from previous years, directly affecting input costs for paint and coatings manufacturers.

The company must carefully manage pricing strategies to absorb these cost pressures without alienating customers. In 2024, many consumer goods companies implemented price increases ranging from 3-7% to offset rising operational expenses.

High inflation can also erode consumer purchasing power, potentially reducing demand for discretionary home improvement projects. In markets experiencing significant inflation, consumer confidence often dips, leading to delayed or reduced spending on renovations and upgrades.

Interest rate shifts directly impact mortgage affordability and the cost of construction loans, which in turn shapes the housing and construction sectors. For instance, if central banks like the US Federal Reserve maintain or increase benchmark rates in late 2024 or early 2025, this could translate to higher borrowing costs for developers and homebuyers.

Consequently, elevated interest rates often dampen demand for new homes and renovations, potentially leading to a slowdown in construction activity. This reduced building and refurbishment can directly translate to lower sales volumes for companies like Flügger, which supply paints and coatings to these markets.

Keeping a close eye on central bank pronouncements and their influence on overall market liquidity is therefore crucial for strategic planning. For example, the European Central Bank's monetary policy decisions throughout 2024 will be a key indicator of future economic conditions impacting the construction sector.

Consumer disposable income is a major driver for Flügger's core business. When households have more money left after essential expenses, they're more likely to invest in home improvement projects, directly benefiting paint and decoration sales. For instance, in the Eurozone, real disposable income saw a modest increase in early 2024, suggesting a potential tailwind for discretionary spending on home décor.

Conversely, economic slowdowns or stagnant wage growth can significantly curb spending on non-essential items like premium paints and renovation services. If disposable income tightens, consumers often postpone or scale back on these projects. The International Monetary Fund (IMF) projected a slowdown in global economic growth for 2024-2025, which could translate to more cautious consumer spending patterns in key markets for Flügger.

Monitoring consumer sentiment and economic forecasts is therefore vital for Flügger's strategic planning. Understanding how disposable income trends are likely to evolve allows the company to adjust marketing efforts and sales targets effectively. For example, in markets experiencing robust wage growth and positive consumer confidence, Flügger might ramp up promotional activities for its decorative product lines.

Exchange Rate Fluctuations

Flügger, operating internationally, faces currency risks. For instance, if the Danish Krone strengthens against the Euro, Flügger's sales in Euros would translate to fewer Kroner, impacting profitability. Conversely, a weaker Krone makes imports more expensive.

In 2024, the Euro to Danish Krone (EUR/DKK) exchange rate has seen fluctuations. For example, early in 2024, the rate hovered around 7.46 DKK per EUR, but by mid-year, it saw minor shifts. This volatility directly affects Flügger's cost of goods sold for imported materials and the repatriated value of international earnings.

- Impact on Imports: A stronger DKK increases the Krone cost of raw materials sourced from countries using the Euro.

- Impact on Exports: A weaker DKK makes Flügger's products cheaper for buyers in Eurozone countries, potentially boosting sales volume.

- Hedging Strategies: Flügger likely employs financial instruments like forward contracts or options to mitigate the impact of adverse currency movements on its financial results.

- Strategic Sourcing: Diversifying suppliers across different currency zones can also reduce reliance on any single currency's performance.

Economic Growth Forecasts

Flügger's primary markets, including the Nordic region and Central and Eastern Europe, are expected to see varied economic growth in 2024 and 2025. For instance, Denmark's GDP growth was projected at 1.2% for 2024, with a slight increase to 1.5% anticipated for 2025, according to recent forecasts. This moderate expansion suggests a stable, albeit not booming, environment for construction and renovation activities.

The demand for Flügger's products is closely tied to the health of the construction sector. Strong economic growth typically fuels more residential and commercial building projects, as well as increased spending on property maintenance and upgrades. Higher employment rates and consumer confidence, often accompanying robust economic expansion, directly translate into greater disposable income available for home improvement.

However, economic forecasts can be subject to change. Factors like inflation, interest rate policies, and global economic stability will play a crucial role. For example, while Sweden's economy faced challenges in 2023, a gradual recovery is anticipated, with GDP growth expected to turn positive in 2024 and continue into 2025, which could support demand for Flügger’s offerings.

- Nordic Economic Outlook: Denmark's GDP growth forecast at 1.2% for 2024 and 1.5% for 2025 indicates a steady market.

- Central Europe Trends: Poland's economic growth is projected to remain a key driver, with forecasts suggesting a GDP expansion of around 3% for 2024, providing a stronger demand base.

- Impact on Construction: Positive GDP forecasts generally correlate with increased investment in new builds and renovations, directly benefiting paint and coatings manufacturers like Flügger.

- Consumer Confidence: Rising employment and consumer confidence, often a byproduct of economic growth, tend to boost spending on home improvement projects.

Economic factors significantly influence Flügger's operational costs and market demand. Rising inflation, as seen with the Eurozone averaging 5.3% in 2023, directly increases raw material and energy expenses, forcing companies to consider price adjustments of 3-7% to maintain margins. Shifts in interest rates, with potential continued high rates from central banks like the US Federal Reserve in late 2024 or early 2025, can dampen construction activity by increasing borrowing costs for developers and homebuyers.

Consumer disposable income is a critical driver, with modest increases in real disposable income in the Eurozone in early 2024 suggesting potential for increased home improvement spending. However, global economic slowdowns, like the IMF's projected moderation for 2024-2025, could lead to more cautious consumer behavior. Currency fluctuations, such as the EUR/DKK rate around 7.46 DKK per EUR in early 2024, directly impact Flügger's import costs and the value of repatriated earnings.

Regional economic performance varies, with Denmark's GDP growth projected at 1.2% for 2024 and Poland's at around 3% for the same year, indicating differing market strengths. These economic conditions directly correlate with construction sector health and consumer confidence, influencing demand for Flügger's paint and coatings.

| Economic Factor | 2023 Data/2024-2025 Projection | Impact on Flügger | Mitigation/Strategy |

| Inflation (Eurozone) | 5.3% (2023) | Increased raw material and energy costs | Price adjustments, cost management |

| Interest Rates | Potential continued high rates (Late 2024/Early 2025) | Reduced construction demand, higher borrowing costs | Monitor central bank policy, strategic pricing |

| Disposable Income (Eurozone) | Modest increase (Early 2024) | Potential for increased home improvement spending | Targeted marketing for decorative lines |

| Global Economic Growth | Projected slowdown (2024-2025) | Cautious consumer spending | Flexible sales targets, market diversification |

| EUR/DKK Exchange Rate | Approx. 7.46 DKK/EUR (Early 2024) | Impacts import costs and export revenue value | Hedging strategies, strategic sourcing |

| GDP Growth (Denmark) | 1.2% (2024 Projection) | Stable market conditions | Focus on market share and efficiency |

| GDP Growth (Poland) | Approx. 3% (2024 Projection) | Stronger demand base | Capitalize on market expansion |

Same Document Delivered

Flugger PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Flugger PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company, providing valuable strategic insights.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. You'll gain a detailed understanding of the external forces shaping Flugger's operations and market position.

The content and structure shown in the preview is the same document you’ll download after payment. It offers a thorough examination of each PESTLE element, enabling informed business planning.

Sociological factors

Societal awareness of environmental issues is a significant driver for the paint and wood care industry. Consumers and professionals alike are increasingly seeking out eco-friendly, low-VOC, and sustainable options. This growing demand directly impacts purchasing decisions, pushing manufacturers to innovate and prioritize environmentally sound practices.

Flügger is well-positioned to capitalize on this trend, as evidenced by its commitment to offering a wide array of environmentally certified products. For instance, many of their product lines boast Nordic Swan Ecolabel certifications, a testament to their reduced environmental impact. This proactive approach is crucial for maintaining market relevance and bolstering brand reputation among an increasingly eco-conscious customer base.

In 2024, the market for sustainable building materials, including paints, continued its upward trajectory. Reports indicate that consumer preference for green products can influence purchase decisions by as much as 70% in certain demographics. By aligning with these evolving consumer values, Flügger enhances its competitive edge and fosters long-term customer loyalty.

Societal trends show a dynamic interplay between DIY enthusiasts and those preferring professional painting services, directly impacting Flügger's market strategy. The DIY segment thrives on accessible, user-friendly products and readily available online guidance, boosting sales for consumer-grade paints and supplies.

Conversely, a notable shift towards professional services, driven by busy schedules and the desire for expert finishes, is increasingly evident. This trend benefits Flügger's pro-customer channels and its network of franchise stores, as homeowners opt for skilled application and potentially higher-quality, specialized products.

For instance, in 2024, the global home improvement market was valued at over $900 billion, with the painting segment representing a significant portion. Reports indicate that while DIY projects remain popular, the demand for professional services has seen a steady increase, particularly in urban areas where time is a premium commodity.

Demographic shifts, like aging populations and shrinking household sizes, are reshaping housing needs and renovation patterns across Europe. For instance, in 2024, the average household size in the EU continued its downward trend, impacting the demand for smaller living spaces and potentially increasing renovation projects in existing homes. This trend directly influences the volume and specific types of paint and coating products Flügger will need to supply, as older demographics may prefer different finishes or require specialized coatings for accessibility upgrades.

Ongoing urbanization is another key demographic driver. By 2025, it's projected that over 75% of the EU population will reside in urban areas, concentrating demand for construction and renovation services. This concentration means Flügger must strategically position its products and distribution channels in growing metropolitan regions, tailoring its offerings to urban aesthetics and the specific demands of apartment buildings and smaller urban dwellings.

Flügger's success hinges on its ability to adapt its product portfolio and marketing strategies to these evolving demographic segments. Understanding that younger urban dwellers might prioritize eco-friendly, low-VOC paints, while older homeowners might seek durable, easy-to-clean finishes, is crucial. For example, in 2024, sales of sustainable building materials, including paints, saw a notable increase in markets like Germany and the Netherlands, indicating a clear consumer preference that Flügger can capitalize on.

Aesthetics and Design Trends

Evolving interior design trends, color preferences, and architectural styles directly impact consumer decisions for paint and decorative products. Flügger needs to consistently track these aesthetic changes, updating its color ranges, finishes, and design ideas to remain relevant. For instance, the rise of biophilic design, incorporating natural elements and earthy tones, saw a significant uptick in demand for greens and browns in 2024, a trend Flügger's product development should actively address.

Staying aligned with or leading popular design movements is crucial for engaging and keeping customers in a market where aesthetics are paramount. The continued popularity of maximalism in some segments, contrasted with the minimalist Scandinavian influence in others, presents a challenge and opportunity for Flügger to offer diverse and appealing collections. Reports from late 2024 indicated a growing consumer interest in textured finishes, suggesting a need for Flügger to innovate in this area.

- Biophilic Design Influence: Increased demand for natural greens and earthy tones in 2024.

- Trend Diversification: Balancing minimalist Scandinavian styles with the resurgence of maximalism.

- Textural Finishes: Growing consumer interest in unique surface textures as of late 2024.

- Color Palette Updates: Necessity for Flügger to adapt to shifting color preferences, such as the reported rise in muted pastels for 2025.

Health and Wellness Concerns

Growing awareness of health and indoor air quality is significantly boosting demand for paints that are low-odor, anti-allergenic, and free from volatile organic compounds (VOCs). For instance, the global market for eco-friendly paints, which often feature these attributes, was projected to reach over $40 billion by 2025. Flügger can leverage this trend by highlighting the health advantages and relevant certifications of its product lines, such as its low-VOC interior paints. This focus on healthier living environments directly addresses consumer expectations and can foster greater brand loyalty.

Flügger can further capitalize on these health and wellness concerns by:

- Promoting certifications: Clearly displaying certifications like EU Ecolabel or GREENGUARD on product packaging and marketing materials to assure consumers of low environmental and health impact.

- Innovating product development: Investing in research and development to create new paint formulations that further reduce or eliminate harmful substances, catering to increasingly health-conscious consumers.

- Educating consumers: Providing transparent information about the ingredients and health benefits of their paints through their website, in-store displays, and customer service channels.

Societal awareness of health and indoor air quality is a significant driver, boosting demand for low-odor, anti-allergenic, and VOC-free paints. The global market for eco-friendly paints was projected to exceed $40 billion by 2025, a trend Flügger can leverage by emphasizing the health benefits and certifications of its products, like its low-VOC interior paints.

Flügger's commitment to health-conscious consumers is evident in its product development and transparent communication regarding ingredients and health benefits, aligning with growing expectations for healthier living environments.

The increasing preference for sustainable and health-promoting products directly influences purchasing decisions, making Flügger's focus on eco-friendly and low-VOC options a key competitive advantage.

By highlighting certifications such as EU Ecolabel or GREENGUARD, Flügger assures customers of reduced environmental and health impacts, fostering brand loyalty in a discerning market.

Technological factors

Ongoing advancements in chemical engineering are driving the development of innovative paint formulations. These include self-cleaning, anti-bacterial, and air-purifying paints, alongside products offering enhanced durability and faster drying times. For instance, in 2024, the global market for functional coatings, which encompasses many of these innovations, was valued at approximately $100 billion and is projected to grow significantly.

Flügger's commitment to research and development in these advanced formulations is crucial for maintaining a competitive edge. By investing in R&D, the company can offer products with superior performance and cater to specific customer demands for functionality and extended product life, potentially capturing a larger share of this growing market.

The increasing adoption of e-commerce and digital tools is reshaping how customers buy paint. For example, online sales for home improvement products have seen significant growth, with many consumers now starting their research and purchasing decisions online. Flügger needs to strengthen its digital footprint, making its online stores user-friendly and incorporating tools like online product configurators and virtual reality for color selection to meet this evolving customer behavior.

Technological progress in paint application tools, like advanced sprayers and automated painting robots, is significantly boosting efficiency and quality for professional painters. For instance, robotic painters can achieve a consistent finish and work around the clock, potentially reducing project timelines by up to 30% on large-scale commercial jobs.

Flügger can capitalize on these advancements by ensuring its product lines are compatible with new application technologies, or by innovating its own tools. This strategy could enhance the overall painting experience and notably cut down labor time, particularly for extensive projects, thereby improving cost-effectiveness for their clients.

Automation in Production Processes

Flügger's adoption of automation and robotics in its production processes is a significant technological factor. This implementation directly translates to enhanced manufacturing efficiency and a reduction in labor expenses. For instance, by integrating advanced robotic arms for tasks like mixing and filling, Flügger can achieve greater precision, leading to improved product consistency and higher overall quality. This focus on automation is crucial for maintaining competitive pricing in a dynamic market.

The strategic investment in smart factories and modernized production lines empowers Flügger to scale its operations effectively. This technological upgrade allows the company to be more agile in responding to shifts in market demand, a critical advantage in the fast-paced building materials sector. For example, a fully automated line can adjust batch sizes and product types with minimal downtime, enabling quicker fulfillment of customer orders and a stronger competitive edge. In 2024, the global industrial automation market was projected to reach over $300 billion, highlighting the widespread trend Flügger is leveraging.

- Increased Production Efficiency: Automation reduces cycle times and minimizes errors in manufacturing.

- Reduced Labor Costs: Robotics can handle repetitive and labor-intensive tasks, lowering operational expenses.

- Improved Product Quality: Consistent application of processes through automation leads to higher product uniformity and fewer defects.

- Enhanced Scalability: Smart factories allow for easier expansion of production capacity to meet growing demand.

Smart Coatings and IoT Integration

The integration of smart coatings with the Internet of Things (IoT) is a burgeoning technological frontier. These advanced coatings can dynamically alter their properties, such as color or transparency, in response to environmental stimuli or user input. Furthermore, their capacity to embed sensors allows for real-time monitoring of conditions like temperature, humidity, or air quality, directly feeding data into IoT networks.

For a company like Flügger, this presents a significant long-term opportunity to innovate within the building materials sector. By exploring and adopting these nascent technologies, Flügger could differentiate itself by offering next-generation products that provide enhanced functionality and seamless connectivity for buildings. This could translate into competitive advantages in energy efficiency, predictive maintenance, and user experience.

While still in early development stages, the market for smart coatings is projected for substantial growth. For instance, the global smart coatings market was valued at approximately USD 5.5 billion in 2023 and is anticipated to reach over USD 15 billion by 2030, growing at a compound annual growth rate (CAGR) of around 15.7% during this period. This indicates a strong upward trend and potential for early movers.

Flügger's strategic investment in research and development for smart coatings could lead to:

- Development of self-healing or anti-corrosive coatings with embedded sensors for structural health monitoring.

- Introduction of thermochromic or electrochromic coatings that adapt to light and temperature, improving building energy efficiency.

- Creation of antimicrobial coatings for healthcare or public spaces, linked to IoT for hygiene compliance tracking.

- Integration of coatings with building management systems for automated environmental controls and data analytics.

Technological advancements are continuously introducing innovative paint formulations, such as self-cleaning and air-purifying paints, with the functional coatings market projected to exceed $100 billion in 2024. Flügger's R&D in these areas is vital for competitive advantage and capturing market share. The increasing shift towards e-commerce for home improvement products necessitates a stronger digital presence for Flügger, including user-friendly online stores and virtual tools for customer engagement.

The development of advanced application tools, including robotic painters capable of reducing project timelines by up to 30% on large jobs, offers Flügger an opportunity to enhance its product compatibility and customer experience. Furthermore, the integration of automation and robotics in Flügger's production processes boosts efficiency and product consistency, with the global industrial automation market expected to surpass $300 billion in 2024. The emerging field of smart coatings, with a market projected to reach over $15 billion by 2030, presents a significant opportunity for Flügger to develop next-generation products with IoT integration for enhanced building functionality and data analytics.

Legal factors

Flügger must navigate stringent product liability and consumer protection laws across its operating regions. These regulations, covering everything from product safety to clear labeling and consumer recourse for faulty items, are critical. For instance, the EU’s General Product Safety Regulation (2001/95/EC) and similar national laws in markets like Denmark and Sweden impose significant duties on manufacturers and distributors to ensure product safety.

Failure to comply can lead to severe financial penalties, product recalls, and substantial damage to Flügger's brand reputation. In 2023, the European Commission reported a significant number of unsafe products identified through its rapid alert system, highlighting the pervasive nature of these risks across various sectors, including construction materials.

Maintaining rigorous quality control processes and fostering open communication with consumers are therefore paramount. This proactive approach helps mitigate legal exposure and builds trust, essential for a company like Flügger that relies on consumer confidence in the quality and safety of its decorative paints and coatings.

Labor laws, covering working hours, minimum wages, and safety standards, significantly influence Flügger's operational expenses and HR strategies in its various locations. For instance, in Denmark, the statutory minimum wage for unskilled workers can vary, and adherence to collective bargaining agreements is crucial for companies like Flügger, impacting wage bills.

Ensuring compliance with these evolving regulations, such as those concerning employee dismissal or data privacy (like GDPR), is vital to prevent costly legal battles and maintain a positive employer brand. In 2024, the European Union continued to emphasize worker protection, with ongoing discussions around fair wages and working conditions that could lead to further regulatory changes affecting companies operating across multiple member states.

Protecting Flügger's intellectual property, like its unique paint formulas and brand names, is key to staying ahead of competitors. Legal tools such as patents, copyrights, and trademarks are essential for this. For instance, in 2023, the European Union Intellectual Property Office reported a significant increase in trademark applications, highlighting the growing importance of IP in the market.

Competition Law and Anti-Trust

Flügger operates within a strict framework of competition and anti-trust laws, crucial for maintaining a level playing field and preventing market manipulation. These regulations, enforced by bodies like the European Commission and national competition authorities, target practices that could stifle competition, such as price-fixing cartels or abuse of dominant market positions. For instance, the EU's competition rules, particularly Articles 101 and 102 of the Treaty on the Functioning of the European Union (TFEU), prohibit anti-competitive agreements and the abuse of a dominant position. In 2023, the European Commission continued its robust enforcement, issuing significant fines for cartel behavior across various sectors, underscoring the importance of strict adherence.

Compliance with these laws directly impacts Flügger's strategic decisions regarding pricing, distribution agreements, and potential mergers or acquisitions. For example, any proposed acquisition by Flügger would undergo scrutiny to ensure it does not create a dominant market position that could harm consumers. The company must ensure its pricing strategies do not involve collusion with competitors or predatory pricing. Failure to comply can result in severe penalties, including substantial fines, which in the EU can reach up to 10% of a company's total worldwide annual turnover for infringements of competition law. Such penalties, alongside potential legal challenges and reputational damage, highlight the critical need for ongoing vigilance and robust internal compliance programs.

Key areas of focus for Flügger under competition law include:

- Pricing Practices: Ensuring no price-fixing agreements with competitors or abuse of dominant pricing power.

- Market Agreements: Verifying that distribution and supply agreements do not involve illegal market partitioning or exclusivity clauses that restrict competition.

- Mergers and Acquisitions: Complying with pre-merger notification requirements and ensuring transactions do not lead to significant lessening of competition.

- Abuse of Dominance: Avoiding actions that exploit a dominant market position, such as imposing unfair trading conditions or tying products.

Data Privacy Regulations

Data privacy regulations like the General Data Protection Regulation (GDPR) significantly impact how companies like Flügger handle customer and employee information. These laws dictate the collection, storage, and processing of personal data, making compliance a critical operational necessity.

Failure to adhere to these stringent rules can result in substantial financial penalties; for instance, GDPR fines can reach up to €20 million or 4% of annual global turnover. Maintaining customer trust also hinges on transparent data handling practices.

Flügger must therefore continuously invest in robust data security measures and ensure its privacy policies are clear and accessible. This includes regular audits and updates to align with evolving legal interpretations and best practices in data protection.

- GDPR Fines: Potential penalties up to €20 million or 4% of global annual turnover.

- Customer Trust: Compliance is vital for maintaining brand reputation and customer loyalty.

- Data Security: Ongoing investment in cybersecurity measures is a legal and ethical imperative.

- Transparency: Clear and accessible privacy policies are required for all data processing activities.

Flügger's operations are heavily influenced by consumer protection laws, mandating product safety and clear labeling to prevent harm and build trust. In 2023, the EU reported a notable number of unsafe products, underscoring the need for strict adherence to regulations like the EU General Product Safety Regulation.

Labor laws, including those on minimum wages and working conditions, directly impact Flügger's operational costs and HR strategies across different regions. The EU's continued focus on worker protection in 2024 suggests potential regulatory shifts affecting companies with diverse workforces.

Intellectual property protection, via patents and trademarks, is crucial for Flügger's competitive edge, with the EUIPO noting increased IP applications in 2023.

Competition and anti-trust laws, enforced by bodies like the European Commission, prevent market manipulation and ensure fair practices. Violations, such as price-fixing, can incur substantial fines, up to 10% of global annual turnover, as seen in EU enforcement actions in 2023.

Data privacy regulations, such as GDPR, necessitate robust data security and transparent policies, with non-compliance risking fines up to €20 million or 4% of global annual turnover, impacting customer trust and brand reputation.

Environmental factors

Flügger faces significant operational adjustments due to strict regulations on paint waste, packaging, and raw material by-products. For instance, in 2024, the European Union continued to emphasize Extended Producer Responsibility (EPR) schemes, increasing compliance costs for manufacturers like Flügger, particularly concerning end-of-life product management.

The company must allocate capital towards advanced waste management systems and circular economy models to reduce its environmental impact. By 2025, many European countries are expected to have updated recycling targets, potentially requiring Flügger to demonstrate higher diversion rates for materials like plastic packaging and residual paint, impacting their supply chain and product design strategies.

Flügger faces increasing pressure from regulators, consumers, and investors to ensure its raw materials are sourced sustainably and ethically. This means carefully examining the environmental footprint of chemical production and actively avoiding materials tied to deforestation or exploitative labor practices. For instance, the demand for certified sustainable palm oil, a common ingredient in paints, has seen significant growth, with global consumption projected to reach over 80 million metric tons by 2025, according to some market analyses.

The company is actively favoring suppliers who demonstrate robust environmental stewardship. This commitment can translate into a stronger brand image and a more resilient supply chain, mitigating potential disruptions from environmental or social controversies. A 2024 report by the CDP (formerly the Carbon Disclosure Project) indicated that companies with strong environmental, social, and governance (ESG) performance often experience lower capital costs and better long-term financial returns.

Flügger is under significant pressure to shrink its carbon footprint throughout its operations, covering everything from sourcing materials to manufacturing, delivery, and how its products are disposed of. This means they need to set and meet ambitious goals for cutting emissions. For instance, in 2023, the company reported a reduction in Scope 1 and 2 emissions by 15% compared to 2022, driven by investments in energy-efficient lighting and updated production machinery.

Improving energy efficiency in their factories and shifting towards renewable energy sources are key steps for Flügger to stay compliant with environmental regulations and demonstrate good corporate citizenship. Their 2024 sustainability report highlights a 10% increase in renewable energy use across their European production sites, contributing to their overall emissions reduction strategy.

Climate Change Impact on Supply Chain

Flügger's supply chain faces significant disruption from the physical impacts of climate change. Extreme weather events, such as floods and storms, directly threaten raw material availability, especially for natural components used in paints and coatings. For instance, in 2024, several European regions experienced severe droughts impacting agricultural yields, a potential source for certain bio-based ingredients.

Transportation routes are also vulnerable. Increased frequency of extreme weather events in 2024 and projections for 2025 highlight the risk to road and sea freight, essential for moving raw materials and finished goods. This can lead to delays and increased logistics costs, directly affecting Flügger's operational efficiency and delivery times.

Adapting to these climate-related risks is crucial for Flügger's long-term resilience. Strategies like diversifying raw material sourcing across different geographical regions and investing in climate-proofing factory infrastructure are becoming non-negotiable. For example, a 2025 industry report indicated that companies with diversified supply chains experienced 30% less disruption during extreme weather events compared to those with concentrated sourcing.

- Raw Material Availability: Climate change impacts agricultural yields and natural resource extraction, affecting key ingredients for paints and coatings.

- Transportation Disruptions: Extreme weather events in 2024 and 2025 have shown increased vulnerability of road, rail, and sea freight, leading to delays and higher costs.

- Operational Continuity: Factory operations can be halted by floods, storms, or heatwaves, necessitating investment in resilient infrastructure.

- Adaptation Strategies: Diversified sourcing and climate-proofing infrastructure are vital for business continuity, with studies showing significant reductions in disruption for resilient companies.

Demand for Environmental Product Declarations (EPDs)

Professional customers, architects, and public procurement bodies are increasingly requesting Environmental Product Declarations (EPDs) and detailed lifecycle assessments (LCAs) for building materials, including paints. This trend highlights a growing market need for transparency regarding the environmental impact of products. For instance, in the European Union, public tenders increasingly mandate EPDs, with some regions aiming for widespread adoption by 2025.

Flügger needs to supply clear environmental data for its paints to satisfy these evolving demands. This proactive approach not only meets regulatory and client expectations but also positions the company favorably in projects prioritizing sustainability. Companies demonstrating robust environmental reporting, such as those with products certified under schemes like the Nordic Swan Ecolabel, often see increased market share in green building initiatives.

- Rising Demand: Key stakeholders in the construction sector are prioritizing products with verified environmental credentials.

- Regulatory Push: Public procurement policies across Europe are increasingly incorporating EPD requirements.

- Competitive Advantage: Providing EPDs and LCAs can differentiate Flügger in tenders for environmentally conscious projects.

- Transparency: Openly sharing environmental information builds trust and demonstrates corporate responsibility.

Flügger must navigate increasingly stringent environmental regulations concerning waste management and product lifecycle, with European Union Extended Producer Responsibility (EPR) schemes intensifying compliance costs. By 2025, updated recycling targets in many European countries will likely require higher diversion rates for materials like plastic packaging and residual paint, impacting Flügger's supply chain and product design.

The demand for sustainably and ethically sourced raw materials is growing, pushing Flügger to scrutinize the environmental footprint of its chemical inputs and avoid materials linked to deforestation or exploitative labor. For example, the market for certified sustainable palm oil, a paint ingredient, is projected to exceed 80 million metric tons globally by 2025.

Flügger faces pressure to reduce its carbon footprint across all operations, from sourcing to disposal. In 2023, the company reported a 15% reduction in Scope 1 and 2 emissions compared to 2022, driven by energy-efficient lighting and updated machinery. Their 2024 sustainability report noted a 10% increase in renewable energy use at European production sites.

Climate change poses a threat to raw material availability due to extreme weather events impacting agricultural yields, as seen with droughts affecting potential bio-based ingredients in 2024. Transportation routes are also vulnerable, with intensified weather events in 2024 and 2025 risking delays and increased logistics costs for Flügger.

| Environmental Factor | Impact on Flügger | Data/Trend (2024/2025) |

| Regulatory Compliance | Increased costs for waste management and recycling targets. | EU EPR schemes intensifying; higher diversion rates expected by 2025. |

| Sustainable Sourcing | Need for ethical and environmentally sound raw materials. | Growing demand for certified sustainable palm oil (projected >80M tons by 2025). |

| Carbon Footprint Reduction | Focus on emission cuts and energy efficiency. | 15% Scope 1 & 2 emission reduction (2023 vs 2022); 10% increase in renewable energy use (2024). |

| Climate Change Vulnerability | Risk to raw material supply and transportation. | Droughts impacting agricultural yields (2024); increased transport disruption risk. |

PESTLE Analysis Data Sources

Our Flugger PESTLE Analysis is built on a robust foundation of data from official government publications, reputable market research firms, and international economic organizations. We meticulously gather insights on political stability, economic trends, social demographics, technological advancements, environmental regulations, and legal frameworks to ensure comprehensive and accurate assessments.