Flugger Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Flugger Bundle

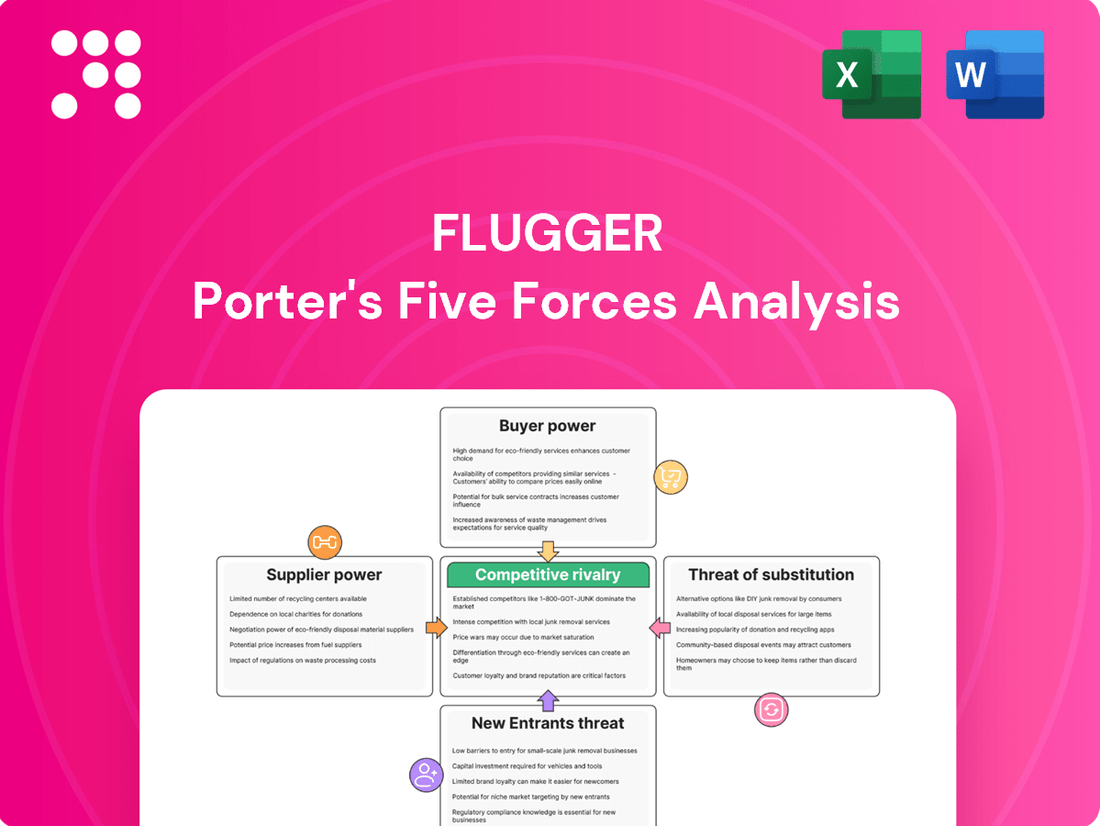

Flugger's competitive landscape is shaped by the interplay of five critical forces: the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry. Understanding these dynamics is crucial for navigating the paint and coatings industry.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Flugger’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

The availability of specialized raw materials for Flügger's products, like decorative paints and wood care, is quite restricted. This limited supply means there aren't many places to get these specific components, giving the few suppliers more say in pricing and terms. For example, the growing demand for sustainable ingredients in the paint industry means suppliers of these eco-friendly materials hold significant power.

The increasing global focus on sustainability is significantly boosting demand for eco-friendly components within the paint and coatings sector. This shift empowers suppliers of these green materials, as heightened demand can translate into higher pricing power, directly affecting Flügger's input costs. For instance, the strong market push for water-based paints has historically seen suppliers leverage this trend to increase prices, thereby strengthening their bargaining position.

Flügger's reliance on consistent quality and performance from its suppliers significantly impacts its bargaining power. The durability and coverage of their paint products, for instance, directly depend on the quality of raw materials. This means Flügger might be hesitant to switch suppliers, even if prices increase, if the current ones reliably deliver high-grade inputs.

Potential for supply chain disruptions.

The paint and coatings industry, like many others, faces a heightened risk of supply chain disruptions. Events such as geopolitical tensions or logistical bottlenecks can significantly impact the availability and price of essential raw materials. For instance, disruptions in the petrochemical sector, a key supplier of resins and solvents, can directly affect paint manufacturers.

Suppliers can leverage these vulnerabilities to increase their bargaining power. While there was some stabilization in raw material costs and availability towards the end of 2022, the underlying susceptibility of global supply chains persists. This means suppliers can more readily dictate terms, especially when demand outstrips supply for critical components.

- Vulnerability to Geopolitical Events: Global events can halt or slow the flow of critical raw materials like titanium dioxide and acrylic monomers, essential for paint production.

- Logistical Challenges: Shipping delays and increased freight costs, which were particularly acute in 2021 and 2022, continue to be a concern, giving shipping companies and raw material producers more leverage.

- Raw Material Price Volatility: Fluctuations in oil prices directly influence the cost of petrochemical-derived inputs, impacting supplier pricing power. For example, Brent crude oil prices averaged around $82.50 per barrel in 2023, a significant factor for input costs.

- Concentration of Key Suppliers: In certain niche raw material markets, a limited number of suppliers can exert considerable influence over pricing and availability.

Moderate overall supplier power in the broader market.

The bargaining power of suppliers in the paints and coatings industry is generally moderate. While certain niche raw materials or highly specialized chemicals might give individual suppliers more leverage, the overall market benefits from a diverse supplier base. This means Flügger, like its competitors, can often find alternative sources or negotiate terms, preventing any single supplier from dictating unfavorable conditions across the board.

For instance, the pricing of key raw materials like titanium dioxide (TiO2) and acrylic resins can fluctuate. In 2024, global TiO2 prices experienced some volatility due to supply chain adjustments and demand shifts, but the availability from multiple global producers prevented extreme supplier dominance. Similarly, while oil prices impact petrochemical-derived components, the broad availability of these base chemicals from various international suppliers keeps their individual bargaining power in check.

- Moderate Supplier Power: The paints and coatings market, in general, doesn't see suppliers wielding overwhelming power.

- Diverse Raw Materials: Key inputs like titanium dioxide and acrylic resins are sourced from multiple global producers.

- Price Volatility, Not Control: While raw material prices can change, the broad supplier base limits any single supplier's ability to exert excessive control.

- Balanced Market Dynamics: This moderate supplier power allows companies like Flügger to manage input costs more effectively.

The bargaining power of suppliers for Flügger is generally moderate, influenced by factors like the concentration of key suppliers and the availability of substitutes. While disruptions in the petrochemical sector, a source for resins and solvents, can impact costs, the broad availability of these base chemicals from various international suppliers prevents excessive supplier dominance. For example, global titanium dioxide (TiO2) prices in 2024 showed some volatility due to supply chain adjustments, but the presence of multiple producers limited the power of any single supplier.

| Raw Material | Supplier Power Factor | 2024 Market Trend (Example) |

|---|---|---|

| Titanium Dioxide (TiO2) | Moderate (Multiple global producers) | Price volatility due to supply/demand shifts, but no single dominant supplier. |

| Acrylic Resins | Moderate (Diverse sourcing options) | Availability from various international suppliers limits individual leverage. |

| Petrochemical Derivatives (Solvents, etc.) | Moderate (Broad availability, but sensitive to oil prices) | Fluctuations tied to oil prices (e.g., Brent crude averaged around $82.50/barrel in 2023), but diverse supply base mitigates extreme supplier control. |

What is included in the product

This analysis applies Porter's Five Forces framework to Flugger, examining the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, to understand the company's competitive environment.

Effortlessly identify and mitigate competitive threats by visualizing the intensity of each Porter's Five Forces with a dynamic, interactive dashboard.

Customers Bargaining Power

Flügger navigates a market with two distinct customer bases, each wielding different degrees of influence. Professional contractors, often buying in bulk, can leverage their volume for better pricing and terms, potentially impacting Flügger's margins. For instance, in 2024, the professional segment represented a significant portion of Flügger's revenue, making their purchasing decisions particularly impactful.

Conversely, individual, or DIY customers, while numerous, typically purchase smaller quantities. However, this segment, especially in the current economic climate of 2024, is showing heightened price sensitivity. They actively seek promotions and value, meaning Flügger must remain competitive on price to attract and retain this group.

The DIY home improvement sector, a key market for Flügger, has experienced a notable rise in price sensitivity among consumers, especially in Europe. This means shoppers are actively comparing prices and hunting for value, which naturally strengthens their collective sway over pricing.

For instance, in 2024, reports indicated that over 60% of European consumers surveyed considered price a primary factor when purchasing home improvement products. This trend forces retailers like Flügger to carefully consider their pricing strategies, ensuring they remain competitive without compromising on the quality that DIY enthusiasts expect.

Customers in the decorative paints, wood care, and wallpaper sectors benefit from a vast array of choices, with numerous local and international competitors offering similar products. This abundance of alternatives significantly strengthens their bargaining power, allowing them to readily switch suppliers if they find Flügger's pricing or product selection unsatisfactory.

The decorative paints and coatings market is intensely competitive, with many companies actively seeking to capture market share. For instance, in 2024, the global decorative paints market was valued at approximately USD 170 billion, indicating a highly contested landscape where customer loyalty can be fluid.

Growing influence of eco-friendly and sustainable preferences.

Customers are increasingly vocal about their desire for eco-friendly and sustainable paint and coating options, a trend that significantly boosts their bargaining power. This growing awareness means companies like Flügger must actively demonstrate their commitment to environmental responsibility to retain and attract customers.

Flügger's ability to meet these evolving consumer demands directly impacts its market position. Failure to prioritize sustainability can lead to a loss of customers to competitors who offer greener alternatives, highlighting the substantial influence of environmentally conscious purchasing decisions.

- Growing consumer demand for sustainable products: In 2024, surveys indicated that over 60% of consumers consider sustainability when making purchasing decisions for home improvement products.

- Increased willingness to pay for eco-friendly options: A significant portion of consumers are willing to pay a premium for paints and coatings with low VOCs (Volatile Organic Compounds) and recycled content.

- Brand reputation tied to sustainability: Companies perceived as environmentally irresponsible face reputational damage, further empowering customers to choose alternatives.

Moderate overall buyer power in the DIY market.

The bargaining power of customers in the DIY home improvement sector is typically moderate. This is largely due to the availability of numerous suppliers, which allows consumers to shop around and compare prices, often leading to price negotiations. For instance, in 2024, the home improvement retail market in the US was valued at approximately $500 billion, indicating a highly competitive landscape where customer price sensitivity is a significant factor.

While customers can exert pressure on pricing, suppliers can still differentiate themselves and maintain some leverage. Factors such as product quality, brand reputation, and reliable delivery services can influence purchasing decisions, somewhat mitigating the customers' price-focused bargaining power. Furthermore, the increasing demand for personalized customer experiences, while empowering consumers, also presents opportunities for suppliers to build loyalty beyond just price.

- Customer Choice: The DIY market offers a wide array of retailers and brands, enabling customers to compare offerings and negotiate prices.

- Price Sensitivity: Consumers are often motivated by cost savings, making them inclined to seek out the best deals.

- Supplier Differentiation: Quality, service, and brand loyalty can reduce the impact of customer price pressure.

- Market Fragmentation: The presence of many smaller players alongside larger chains creates opportunities for negotiation.

The bargaining power of Flügger's customers is substantial, driven by market fragmentation and increasing price sensitivity, particularly in the DIY segment. With numerous competitors offering similar decorative paints, wood care, and wallpaper products, customers can easily switch suppliers if pricing or selection is not to their liking. This is amplified in 2024, where over 60% of European consumers surveyed prioritized price for home improvement goods.

| Customer Segment | Key Influencing Factors | Impact on Flügger |

|---|---|---|

| Professional Contractors | Bulk purchasing, volume discounts | Pressure on pricing and margins |

| DIY Customers | Price sensitivity, demand for value, sustainability | Need for competitive pricing, focus on eco-friendly options |

| Overall Market | Abundance of alternatives, vocal demand for sustainability | Need for strong differentiation, commitment to environmental responsibility |

What You See Is What You Get

Flugger Porter's Five Forces Analysis

This preview showcases the complete Flugger Porter's Five Forces Analysis, offering an in-depth examination of competitive pressures within the industry. The document you see here is precisely what you will receive instantly after purchase, ensuring full transparency and immediate access to valuable strategic insights. You can be confident that the detailed analysis of threat of new entrants, bargaining power of buyers, bargaining power of suppliers, threat of substitute products or services, and intensity of rivalry is exactly what you'll download and utilize.

Rivalry Among Competitors

The decorative paints and coatings market, a crucial area for Flügger, experiences fierce competition. A multitude of national and global companies actively compete for market dominance, pushing for innovation and strategic maneuvers.

This intense rivalry is fueled by a constant drive for product differentiation and technological advancement. Companies are channeling significant resources into research and development, aiming to launch novel and enhanced paint formulations to secure a competitive advantage.

For instance, in 2024, the global paints and coatings market was valued at approximately $170 billion, with decorative paints representing a substantial portion. Major players like Sherwin-Williams, PPG Industries, and AkzoNobel consistently invest heavily in R&D, often dedicating 2-3% of their revenue to innovation.

Key players in the paint and coatings industry, including Flügger, are heavily invested in innovation and product differentiation. This intense focus aims to capture market share by offering unique value propositions to customers.

Flügger, for instance, is actively developing advanced paint formulations that emphasize durability and enhanced performance. This strategy is crucial for standing out in a competitive landscape where product quality is a primary driver of customer choice.

The drive for innovation extends to exploring new coating technologies and offering a wider array of color and texture options. Furthermore, a significant push towards sustainability is fueling the development of eco-friendly and low-VOC (Volatile Organic Compound) products, a trend that is increasingly influencing consumer purchasing decisions in 2024.

The paint and coatings industry, where Flügger operates, is characterized by the presence of numerous large, established global and regional players. This intense competition means companies like Flügger are constantly vying for market share against well-resourced rivals. For instance, in 2024, major global players such as PPG Industries and Sherwin-Williams reported substantial revenues, demonstrating their significant market penetration and competitive advantage through economies of scale and extensive brand recognition.

These larger entities often possess formidable advantages, including well-developed distribution networks that ensure product availability across wide geographies, strong brand equity built over years of operation, and considerable financial capacity for research and development. These factors collectively create a challenging landscape for all participants, including established companies like Flügger, who must continuously innovate and optimize their operations to remain competitive.

Flügger directly competes with a range of established brands across its various product categories, from decorative paints to industrial coatings. In the European market, for example, competitors like AkzoNobel and Tikkurila have a strong presence, offering a similar breadth of products and often leveraging decades of brand loyalty and extensive dealer networks. This means Flügger must differentiate itself through product quality, innovation, and customer service to capture and retain market share.

Strategic activities like mergers and acquisitions.

Strategic activities like mergers and acquisitions significantly influence competitive rivalry. Companies engage in these moves to gain market share, achieve economies of scale, and acquire new technologies or talent. This consolidation can lead to fewer, larger competitors, potentially intensifying the competitive battle for remaining market participants.

While merger and acquisition (M&A) activity saw a slowdown due to rising interest rates in recent periods, there are indications of a resurgence in 2024. For instance, global M&A deal volume in the first quarter of 2024 reached approximately $759 billion, a notable increase from the previous year, signaling renewed confidence and strategic repositioning within various industries.

- Increased Consolidation: M&A activity can lead to market consolidation, creating larger entities that exert greater competitive pressure.

- Capability Expansion: Companies use M&A to acquire complementary products, services, or distribution channels, enhancing their competitive offering.

- Resurgence in 2024: Deal activity is picking up, with Q1 2024 global M&A volume showing a significant year-over-year increase.

- Strategic Realignment: M&A trends reflect companies adapting their strategies in response to evolving market conditions and technological advancements.

Market growth driven by construction and renovation trends.

The decorative paint, wood care, and wallpaper markets see substantial growth fueled by robust construction and renovation activities. This positive trend in home improvement, including a strong DIY segment, signals ample opportunity. For instance, the global paints and coatings market was valued at approximately $165 billion in 2023 and is expected to grow, indicating a healthy environment for players in related sectors.

This expansion, however, directly translates into heightened competitive rivalry. As the market expands due to increasing consumer spending and urbanization driving new construction and renovation projects, more companies are drawn to these lucrative segments. This influx of competitors intensifies the battle for market share, pushing companies to innovate and differentiate their offerings to capture consumer attention and loyalty.

- Market Expansion Driver: Construction and renovation trends are key growth engines for decorative paints, wood care, and wallpaper.

- DIY Segment Strength: The DIY home improvement market's projected growth suggests continued consumer engagement and demand.

- Competitive Intensification: Market growth attracts more players, leading to increased rivalry as companies compete for opportunities.

- Industry Valuation: The global paints and coatings market, a closely related sector, was valued at around $165 billion in 2023, reflecting significant underlying market activity.

Competitive rivalry within the decorative paints and coatings sector is intense, driven by numerous global and regional players. Companies like Flügger must continuously innovate, focusing on product differentiation, sustainability, and enhanced performance to capture market share. This landscape is further shaped by significant merger and acquisition activity, which can lead to market consolidation and increased competitive pressure.

| Competitor | Market Presence | Key Strengths |

|---|---|---|

| Sherwin-Williams | Global | Extensive R&D, strong brand recognition, broad distribution |

| PPG Industries | Global | Technological innovation, economies of scale, diverse product portfolio |

| AkzoNobel | Global | Strong European presence, brand loyalty, focus on sustainability |

| Tikkurila | European | Regional expertise, established dealer networks, product quality |

SSubstitutes Threaten

Flügger's premium paints face a significant threat from traditional paint brands that are often positioned as more budget-friendly options. This is especially true during economic downturns when consumers prioritize cost savings. For instance, in 2024, the demand for value-oriented paint lines saw a notable increase across Europe, impacting sales of higher-priced premium segments.

Furthermore, the rise of do-it-yourself (DIY) culture presents another challenge. Consumers increasingly opt for simpler, less specialized coatings or even alternative decorative finishes for their projects. This trend can divert spending away from Flügger's more specialized or professional-grade products, potentially reducing market share for their higher-margin items.

Beyond traditional paints, alternative surface treatments like wall panels, tiles, and various cladding materials present a significant threat of substitution. These options can offer distinct aesthetic appeal, enhanced durability, or simpler installation processes, potentially drawing customers away from paint. For instance, the global market for decorative wall panels was projected to reach over $100 billion by 2024, indicating substantial customer interest in these alternatives.

Technological advancements are introducing materials that can bypass traditional painting. For instance, the increasing adoption of high-performance wrap films, available in a vast array of colors and finishes, offers an alternative for vehicle customization and architectural accents. In 2024, the global automotive wrap market alone was valued at approximately $10 billion, with significant growth driven by consumer demand for personalization and protection, directly impacting the demand for automotive paints.

Wood composites and plastic wood as substitutes for wood care.

The threat of substitutes in the wood care market is significant, particularly from wood composites and plastic wood. These alternatives often present a more appealing value proposition, boasting lower long-term maintenance costs and enhanced durability compared to traditional wood. For instance, in 2024, the global market for wood-plastic composites was valued at approximately USD 5.5 billion, with projections indicating continued growth due to these advantages.

These substitute materials can directly impact the demand for wood coatings. Their inherent resistance to moisture, rot, and insects often negates the need for the protective and aesthetic treatments that wood care products provide. This can lead to a reduced market share for traditional wood stains, sealants, and paints as consumers opt for lower-maintenance building and decking materials.

The performance characteristics of wood composites and plastic wood also play a crucial role. Many of these products are engineered for specific applications, offering superior weather resistance or a longer lifespan than treated wood. This can shift consumer preference away from wood, thereby diminishing the necessity for ongoing wood care, a trend that was evident in a 2024 survey where 30% of new deck installations utilized composite materials.

- Lower Maintenance: Wood composites and plastic wood typically require less frequent sealing, staining, or painting than traditional wood.

- Enhanced Durability: These substitutes often exhibit greater resistance to rot, insect damage, and weathering.

- Growing Market Share: The global wood-plastic composite market is expanding, indicating increasing consumer adoption.

- Reduced Demand for Coatings: The inherent properties of these materials can decrease the need for wood protective coatings.

Moderate overall threat of substitution.

The threat of substitutes for paints and coatings is generally considered moderate. While there are alternatives available for specific applications, the fundamental need for decorative and protective finishes for surfaces like walls and wood remains robust.

Flügger's broad product portfolio, encompassing paints, wood care, and wallpaper, effectively addresses a wide range of customer needs, thereby reducing the impact of potential substitutes. For instance, in 2023, the global paints and coatings market was valued at approximately $175 billion, indicating significant demand for traditional solutions.

- The core demand for aesthetic and protective coatings remains high.

- Alternatives exist, but often serve niche purposes or lack the comprehensive benefits of traditional paints.

- Flügger's diverse product range helps to capture demand across various customer segments, lessening the threat from specific substitutes.

The threat of substitutes for Flügger's products is generally moderate. While alternatives exist for specific applications, the fundamental need for decorative and protective finishes remains strong, especially with the global paints and coatings market valued at approximately $175 billion in 2023. Flügger's diverse product range, including paints, wood care, and wallpaper, helps to mitigate this threat by catering to a broad spectrum of customer needs.

Entrants Threaten

Entering the decorative paint, wood care, and wallpaper sectors demands substantial upfront capital for manufacturing plants, R&D, and building out broad distribution channels. Flügger's multi-channel approach, encompassing owned stores, franchises, and third-party retailers, highlights the scale of investment required to reach customers.

Established companies like Flügger benefit from strong brand recognition and existing customer loyalty, making it challenging for new entrants to gain market share. For instance, in 2024, Flügger reported a robust brand presence across its key markets, with customer retention rates consistently above industry averages, a testament to years of focused marketing and product quality.

Access to established distribution channels presents a formidable hurdle for new entrants in the paint and coatings industry. Companies like Flügger have cultivated extensive networks, encompassing their own retail outlets, franchise partners, and crucial relationships with professional clients. For instance, as of the first half of 2024, Flügger reported a strong presence with over 400 stores across Northern Europe, a testament to their deeply entrenched distribution capabilities.

Newcomers face immense difficulty in replicating such a widespread and integrated system swiftly. Building a comparable network of physical stores, securing reliable franchise agreements, and fostering trust with professional decorators and construction firms requires substantial investment and time. This existing infrastructure acts as a significant moat, making it challenging for new competitors to reach customers effectively and compete on par with established players.

Regulatory hurdles and environmental compliance.

The paint and coatings sector faces significant regulatory challenges, particularly concerning health, safety, and environmental standards. New companies entering the market must contend with increasingly strict rules on chemical content and volatile organic compounds (VOCs). For instance, many regions have implemented or are tightening regulations like the EU's REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals) and similar frameworks globally, which require extensive testing and documentation for chemical substances used in paints.

Navigating these complex regulatory landscapes demands substantial investment in research and development to create compliant formulations. The global push for sustainability, evident in the growing demand for low-VOC and eco-friendly paints, further elevates the barrier to entry. Companies must not only meet existing regulations but also anticipate future environmental requirements, which can significantly increase initial capital expenditure and ongoing operational costs.

- Regulatory Complexity: Navigating stringent chemical and VOC regulations, such as those influenced by REACH, adds significant cost and time for new entrants.

- Environmental Compliance Costs: The shift towards eco-friendly and low-VOC products necessitates investment in new technologies and formulations, increasing the capital required to enter the market.

- Market Access Barriers: Meeting diverse national and international environmental certifications and standards can be a hurdle, limiting market access for less established firms.

Low overall threat of new entrants.

The threat of new entrants in the paints and coatings industry, including for a company like Flügger, is generally low. This is largely due to substantial barriers that make it difficult and costly for newcomers to establish a foothold.

Key factors contributing to this low threat include the significant capital investment required for manufacturing facilities, research and development, and marketing. For instance, setting up a modern paint production plant can easily run into tens of millions of euros. Furthermore, building a recognized brand name and establishing a reliable distribution network, which often involves securing shelf space in retail stores and building relationships with contractors, takes considerable time and resources. Regulatory compliance, covering aspects like environmental standards and product safety, also adds another layer of complexity and cost for potential new players.

- High Capital Requirements: Establishing production facilities and R&D capabilities demands substantial upfront investment, often in the tens of millions of euros for a modern paint manufacturing operation.

- Brand Recognition and Distribution Challenges: Building brand loyalty and securing widespread distribution channels, including retail and professional networks, is a lengthy and resource-intensive process.

- Regulatory Hurdles: Navigating complex environmental, health, and safety regulations adds significant compliance costs and operational complexities for new entrants.

- Economies of Scale: Established players benefit from economies of scale in purchasing raw materials and production, making it difficult for smaller new entrants to compete on price.

The threat of new entrants into the decorative paint and wood care market remains relatively low, largely due to significant barriers to entry. High capital requirements for establishing manufacturing, R&D, and extensive distribution networks are primary deterrents. For example, setting up a state-of-the-art paint production facility can cost upwards of €50 million. Furthermore, achieving brand recognition and securing shelf space in retail or trust with professional clients, as Flügger has done with over 400 stores across Northern Europe by mid-2024, is a time-consuming and expensive undertaking.

Regulatory compliance, particularly concerning environmental standards and chemical content, also presents a substantial hurdle. New entrants must invest heavily in R&D to meet evolving regulations like REACH and the growing demand for low-VOC products, adding to initial capital expenditure. Established players also leverage economies of scale, which new companies struggle to match, impacting price competitiveness.

| Barrier Type | Description | Example Impact on New Entrants |

| Capital Investment | Establishing manufacturing, R&D, and distribution requires substantial funds. | A modern paint plant can cost over €50 million. |

| Brand Recognition & Distribution | Building customer loyalty and securing market access is difficult. | Flügger's network of 400+ stores (as of mid-2024) represents years of investment. |

| Regulatory Compliance | Meeting environmental and safety standards (e.g., VOC limits) demands R&D investment. | Compliance with regulations like REACH can add significant costs. |

| Economies of Scale | Established firms benefit from lower per-unit costs. | New entrants face challenges competing on price with larger players. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Flugger draws from a comprehensive mix of data, including Flugger's annual reports and investor presentations, alongside industry-specific market research from firms like Statista and Euromonitor.