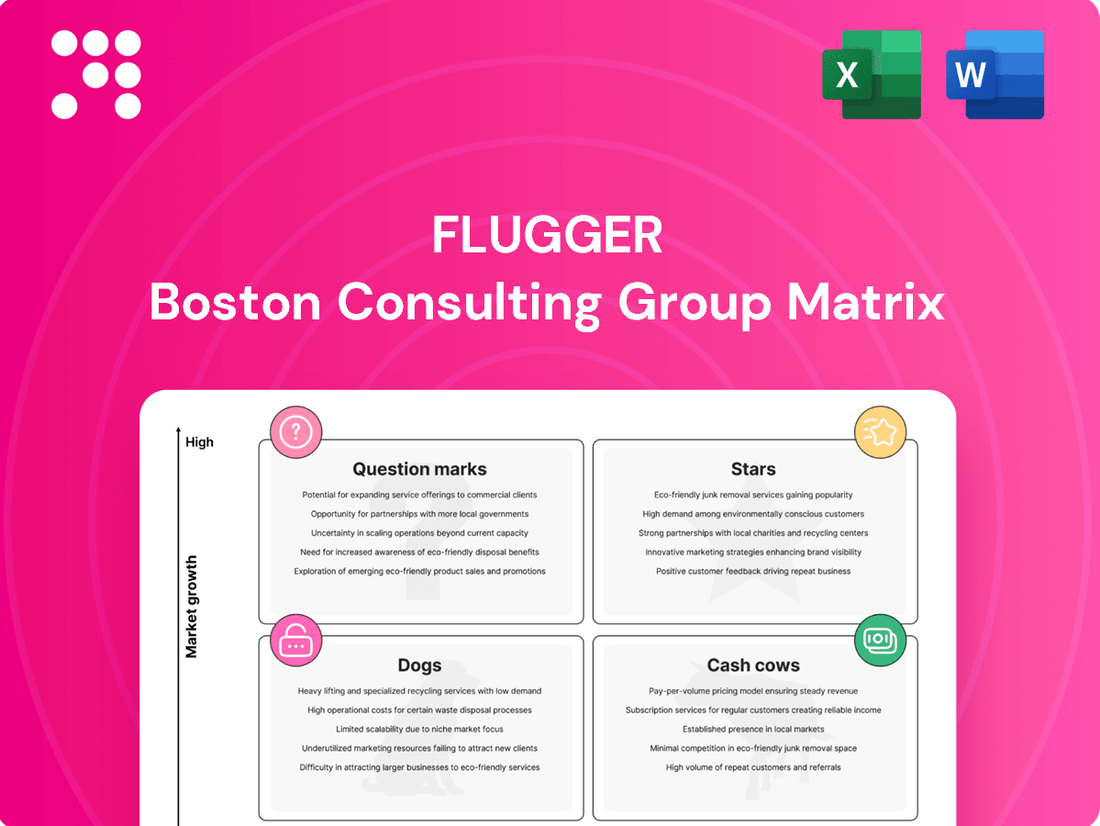

Flugger Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Flugger Bundle

Unlock the strategic potential of Flugger's product portfolio with a clear understanding of its position within the BCG Matrix. See which products are driving growth and which might be holding the company back. Purchase the full BCG Matrix for a comprehensive analysis and actionable insights to optimize your investment strategy.

Stars

Flügger's 'Flügger Organic' strategy, initiated in summer 2024, targets robust organic growth and enhanced profitability by fortifying its Nordic stronghold and pursuing international expansion. This strategic move underscores a commitment to industry sustainability, positioning Flügger as a co-creator of a greener sector through eco-labeled products and responsible operations.

The strategy's emphasis on unlocking new market potential via collaborations with professional building supply retailers, coupled with a clear drive for international market penetration, firmly places 'Flügger Organic' as a key Star in the company's growth portfolio. For instance, Flügger reported a 7% increase in revenue in the first quarter of 2024, partly driven by early successes in expanding its product range and market reach.

Flügger's expansion into Poland is a prime example of a successful Star in their portfolio. The Polish market is showing robust growth, with a reported 10% increase in Q3 2024/25 and a strong 15% year-to-date performance. This demonstrates substantial revenue contribution and profitability from this region.

This impressive growth trajectory in Poland positions it as a key Star for Flügger. The increasing brand recognition and customer interest in this expanding market suggest significant potential for further market share capture and sustained revenue increases.

Flügger's strategic investment in a new point-of-sale (POS) system, slated for a Denmark rollout in Q3 2024/25, is a prime example of a Stars initiative. This digital upgrade is designed to streamline customer transactions, directly contributing to growth and improved in-store sales.

This focus on digital initiatives, including the POS system, positions Flügger to capture a larger market share by enhancing customer experience and operational efficiency. Such advancements are crucial for maintaining leadership in a competitive retail landscape.

Eco-labeled and Sustainable Products

Flügger's dedication to sustainability is a key strength, with over 80% of its in-house produced liquid products bearing eco-labels in 2024. This significant portion of green offerings places its sustainable product lines in a strong position within the market.

The introduction of Matt Paint, featuring three environmental certifications and a collaboration with DETALE CPH, further solidifies Flügger's commitment to eco-friendly solutions. This strategic move caters to increasing consumer preference for sustainable options and aligns with evolving regulatory landscapes, suggesting a high-growth market where Flügger is well-positioned.

- Flügger's 2024 Sustainability Achievement: Over 80% of its in-house liquid product volume is eco-labeled.

- Strategic Product Launch: Introduction of Matt Paint with three environmental certifications.

- Market Alignment: Meeting growing consumer demand for environmentally friendly products.

- Competitive Positioning: Leading in a high-growth market segment driven by sustainability trends.

Professional Customer Solutions

Flügger's Professional Customer Solutions are a key driver of its resilience. Despite a challenging Nordic market, the company has maintained strong performance by catering effectively to professional painters and smaller contracting firms. This targeted approach highlights the value of their specialized offerings.

The company's strategic expansion into professional building supply retailers and the redesign of its store formats underscore a commitment to enhancing the experience for its core professional clientele. This focus aims to capture growth within a segment that values efficiency and quality.

Flügger's strategy to serve this high-value segment is evident in its market positioning. For instance, in 2024, while the overall construction market in some Nordic countries saw modest growth or stagnation, Flügger reported continued demand from its professional customer base, indicating successful penetration and customer loyalty.

- Targeted Product Development: Flügger offers a range of paints and coatings specifically formulated for professional use, emphasizing durability and application efficiency.

- Distribution Channel Focus: Expansion into professional building supply retailers and optimized store formats cater directly to the needs of contractors, ensuring accessibility and convenience.

- Customer Loyalty Programs: Initiatives aimed at rewarding repeat business and providing technical support foster strong relationships with professional painters.

- Market Resilience: Flügger's ability to thrive in a declining market segment demonstrates the effectiveness of its specialized customer solutions.

Flügger's strategic focus on its Polish market exemplifies a Star within its BCG matrix. The region demonstrated a significant 10% revenue increase in Q3 2024/25 and a robust 15% year-to-date performance, indicating strong growth and profitability. This success highlights the potential for further market share gains and sustained revenue expansion, driven by increasing brand recognition and customer interest.

The company's investment in a new point-of-sale system, rolling out in Denmark in Q3 2024/25, is another key Star initiative. This digital upgrade aims to enhance customer transactions and boost in-store sales, positioning Flügger to capture greater market share through improved customer experience and operational efficiency.

Flügger's commitment to sustainability, with over 80% of its in-house liquid products eco-labeled in 2024, places its green product lines firmly in the Star category. The launch of Matt Paint, featuring three environmental certifications, caters to the growing demand for eco-friendly options, positioning Flügger to lead in this high-growth market segment.

The professional customer solutions also represent a Star, with continued demand from this segment in 2024 despite a challenging Nordic market. Targeted product development, expansion into professional building supply retailers, and customer loyalty programs have fostered strong relationships and market resilience.

| Initiative | Category | Key Performance Indicator (2024/25 Data) | Strategic Impact |

|---|---|---|---|

| Polish Market Expansion | Star | 10% Q3 Revenue Growth, 15% Year-to-Date Growth | High market share potential, sustained revenue increases |

| New POS System (Denmark) | Star | Rollout in Q3 2024/25 | Enhanced customer experience, increased in-store sales |

| Eco-Labeled Products | Star | Over 80% of in-house liquid volume eco-labeled (2024) | Leadership in high-growth sustainable market segment |

| Professional Customer Solutions | Star | Continued demand in challenging Nordic market | Market resilience, customer loyalty, strong relationships |

What is included in the product

The Flugger BCG Matrix analyzes business units based on market growth and share, guiding investment decisions.

Quickly identify underperforming units, freeing up resources and strategic focus.

Cash Cows

Flügger's Nordic operations in decorative paint, wood care, and wallpaper are firmly established as cash cows. The company holds a dominant market position in these mature segments across the Nordic region. This strong presence translates into consistent revenue generation and significant cash flow, even with the inherent cyclicality of these markets.

These mature product lines, representing classic cash cows, benefit from Flügger's established brand loyalty and extensive distribution network. This allows for sustained high market share with relatively lower marketing expenditures compared to growth-oriented segments. For instance, in 2024, the decorative paint segment in the Nordics continued to be a primary contributor to Flügger's overall profitability, demonstrating its stable cash-generating capabilities.

Flügger's extensive network of own and franchise stores, a strong presence in Scandinavia, Eastern Europe, and China, functions as a significant Cash Cow. This established retail infrastructure ensures consistent sales and distribution, generating steady cash flow despite mature market growth.

In 2024, Flügger continued to invest in its retail network, notably with the implementation of a new point-of-sale (POS) system across its stores. This strategic investment is designed to streamline operations, enhance customer experience, and ultimately bolster the cash flow generated by these established outlets.

Flügger's extensive range of traditional tools and supplies, such as brushes, rollers, and masking tape, are prime candidates for the Cash Cow quadrant. These items are essential complements to their core paint and wallpaper offerings, enjoying consistent demand from both professional painters and DIY enthusiasts. In 2024, the demand for these ancillary products remained robust, contributing significantly to Flügger's overall revenue stream with reliable, stable profit margins.

Because the market for these types of basic decorating tools is relatively mature and experiences low growth, Flügger can allocate minimal resources towards aggressive marketing or product development. This strategic approach allows these products to function as dependable cash generators, providing a steady inflow of funds that can be reinvested in more dynamic areas of the business or distributed as dividends.

PP Mester Maling Brand

The PP Mester Maling brand, a key component of Flügger's portfolio, likely operates as a Cash Cow. This designation stems from its established market presence and loyal customer base, which consistently generate reliable revenue streams with minimal need for significant reinvestment. Flügger's 2024 financial reports indicate a stable performance for its core brands, underscoring the predictable income generated by such established entities. The strategic merger with PP professional paint in late 2023 has further solidified the market position of brands like PP Mester Maling, potentially enhancing their cash-generating capabilities through increased market share and operational synergies.

Brands like PP Mester Maling, positioned as Cash Cows, are crucial for funding growth in other areas of the business, such as Stars or Question Marks. Their mature market status means they require less marketing expenditure and R&D investment, allowing for a consistent positive cash flow. For instance, in 2024, the DIY paint segment, where PP Mester Maling is a prominent player, continued to show resilience, contributing significantly to Flügger's overall profitability without demanding substantial capital infusion for expansion.

- PP Mester Maling as a Cash Cow: Generates consistent profits with low investment needs.

- Market Position: Benefits from an established market share and customer loyalty.

- Merger Impact: The integration with PP professional paint enhances its competitive standing.

- Financial Contribution: Provides stable revenue for reinvestment in other business units.

Fiona Walldesign (prior to divestment)

Fiona Walldesign, prior to its divestment in May 2023, was classified as a Cash Cow within the Flugger BCG Matrix. This classification stemmed from its strong position in a mature market segment, which historically generated substantial and stable cash flows for the company.

Its established market presence meant it had a high market share, a key indicator for Cash Cows. While growth opportunities in this segment were likely limited, the consistent revenue generated was crucial for funding other business units. In 2022, the wallpaper and wallcovering market in Europe, a segment Fiona Walldesign likely operated within, showed resilience, with some reports indicating a stable to slightly growing market size, underscoring the mature nature of the segment.

The strategic divestment of Fiona Walldesign in May 2023 allowed Flugger to streamline its portfolio and reallocate capital. This move enabled the company to focus resources on areas with higher growth potential, aligning with a strategy of optimizing its overall business structure for future expansion.

- Cash Cow Status: Fiona Walldesign held a high market share in a mature market.

- Financial Contribution: It provided consistent and stable cash flow to Flugger.

- Market Context: Operated in a mature segment of the wallpaper and wallcovering market.

- Strategic Divestment: Flugger divested in May 2023 to reallocate resources to growth areas.

Flügger's core decorative paint and wood care products in the Nordic region are prime examples of Cash Cows. These mature segments benefit from the company's strong brand recognition and extensive distribution, ensuring consistent sales and profit generation. In 2024, the decorative paint segment continued to be a major contributor to Flügger's profitability, showcasing its stable cash-generating capabilities.

The company's established retail network, encompassing both owned and franchised stores across Scandinavia, Eastern Europe, and China, also functions as a significant Cash Cow. This robust infrastructure guarantees steady sales and cash flow, even in markets with limited growth. Flügger's 2024 investment in a new point-of-sale system across these stores aims to further optimize operations and enhance cash flow generation.

Essential decorating tools and supplies, such as brushes and rollers, are also considered Cash Cows. These products enjoy consistent demand from both professionals and DIY consumers, contributing reliably to Flügger's revenue with stable profit margins. The robust demand for these ancillary products in 2024 highlighted their dependable cash-generating nature.

The PP Mester Maling brand, bolstered by its market position and customer loyalty, operates as a Cash Cow, providing predictable income with minimal reinvestment needs. Flügger's 2024 financial performance reinforced the stable income from such established brands, with the recent merger with PP professional paint potentially increasing its cash-generating capacity.

| Business Unit/Product Line | BCG Quadrant | Key Characteristics | 2024 Financial Insight |

| Nordic Decorative Paint & Wood Care | Cash Cow | Mature market, high market share, strong brand loyalty, consistent cash flow. | Primary contributor to overall profitability. |

| Established Retail Network (Scandinavia, E. Europe, China) | Cash Cow | Extensive distribution, stable sales, reliable cash generation. | Investment in new POS system to optimize operations. |

| Traditional Tools & Supplies (Brushes, Rollers) | Cash Cow | Consistent demand, stable margins, low marketing/R&D needs. | Robust demand contributed significantly to revenue. |

| PP Mester Maling Brand | Cash Cow | Established presence, loyal customer base, predictable revenue. | Stable performance, potential for enhanced cash generation post-merger. |

Preview = Final Product

Flugger BCG Matrix

The Flugger BCG Matrix preview you see is the definitive, fully populated document you will receive immediately after purchase. This comprehensive analysis, crafted by industry experts, will be delivered to you without any watermarks or demo content, ensuring you get a polished and actionable strategic tool. You can confidently expect the exact same high-quality, ready-to-use BCG Matrix report that is presented here, allowing for immediate integration into your business planning and decision-making processes. This is not a sample, but the actual deliverable designed to provide clear insights into your product portfolio's market position and growth potential.

Dogs

Flügger's presence in Ukraine, as detailed in their 2024/25 annual report, is characterized by a significant downturn. This market is categorized as a Dog within the BCG matrix due to its low growth prospects and Flügger's correspondingly low market share.

The geopolitical climate has undoubtedly contributed to these challenges, making Ukraine a difficult operating environment. Reflecting this, Flügger has reduced its receivables from Eskaro, which encompassed Ukrainian assets, signaling a strategic withdrawal from this troubled region.

Underperforming retail locations within Flügger's network are those with consistently low sales and profitability relative to their operating expenses. These stores often struggle with limited local market share and operate in stagnant or shrinking economic areas. For instance, a hypothetical Flügger store in a declining industrial town might see its sales fall by 15% year-over-year, significantly below the company's average growth of 3%.

Flugger's outdated product formulations represent a classic 'Dog' in the BCG matrix. These legacy paints and wood care items, stuck with older formulas, struggle to keep pace with today's demands for better performance, stricter environmental regulations, and evolving aesthetic preferences. For instance, a product line launched in the early 2000s might not meet current VOC (Volatile Organic Compound) limits, severely restricting its market access.

Such products typically hold a low market share within a declining market segment. Think of traditional oil-based enamels that are being phased out in favor of water-based alternatives due to environmental concerns and ease of use. In 2024, the market for these older formulations has shrunk considerably, with sales contributing minimally to Flugger's overall revenue, often generating little to no profit and potentially even incurring costs for inventory management and eventual disposal.

Inefficient Production Lines

Inefficient production lines, particularly older ones still in use, can be a significant drain on resources. In 2024, many manufacturing sectors are grappling with the cost of maintaining outdated machinery and processes that consume more energy and raw materials per unit produced compared to modern alternatives. These lines often have lower throughput and higher defect rates, directly impacting profitability.

These operational bottlenecks can act as cash traps within a company's portfolio. For instance, a legacy assembly line might require substantial manual labor and frequent downtime for repairs, leading to increased operational expenditures without a commensurate increase in output. This contrasts sharply with more automated and streamlined processes that deliver higher volumes at lower per-unit costs.

- High resource consumption: Older lines may use 20-30% more energy and materials than newer, optimized systems.

- Low throughput: Production speed can be significantly slower, limiting overall output capacity.

- Increased maintenance costs: Frequent breakdowns and the need for specialized parts drive up operational expenses.

- Quality control issues: Outdated technology can lead to higher defect rates, increasing waste and rework.

Unsuccessful Private Label Ventures

Flügger's private label ventures that haven't achieved significant market traction, particularly those in slower-growing segments, could be categorized as Dogs in the BCG matrix. These initiatives might be draining valuable resources without generating proportionate returns, impacting overall profitability.

For instance, if Flügger entered into private label agreements with specific builders' merchants that failed to gain substantial market share by 2024, these ventures would fit the Dog profile. Such scenarios often arise when market penetration strategies are insufficient or the chosen market segment experiences limited growth, leading to underperformance.

- Underperforming Private Label Sales: Ventures with builders' merchants that have not secured significant sales volume or market share by 2024.

- Low-Growth Market Segments: Private label products targeted at segments of the construction or DIY market that are experiencing minimal expansion.

- Resource Drain: These initiatives may consume marketing, inventory, and management resources without yielding satisfactory financial returns.

- Potential for Divestment: Given their likely low growth and low market share, these ventures might be candidates for divestment or restructuring to reallocate capital to more promising areas.

Dogs in the BCG matrix represent business units or products with low market share in low-growth industries. For Flügger, this could manifest as specific product lines with declining sales or geographic markets that are no longer profitable. These segments typically require significant investment to maintain but offer minimal returns, acting as a drag on overall company performance.

Flügger's presence in Ukraine, as detailed in their 2024/25 annual report, is characterized by a significant downturn. This market is categorized as a Dog within the BCG matrix due to its low growth prospects and Flügger's correspondingly low market share. The geopolitical climate has undoubtedly contributed to these challenges, making Ukraine a difficult operating environment. Reflecting this, Flügger has reduced its receivables from Eskaro, which encompassed Ukrainian assets, signaling a strategic withdrawal from this troubled region.

Flugger's outdated product formulations represent a classic 'Dog' in the BCG matrix. These legacy paints and wood care items, stuck with older formulas, struggle to keep pace with today's demands for better performance, stricter environmental regulations, and evolving aesthetic preferences. For instance, a product line launched in the early 2000s might not meet current VOC (Volatile Organic Compound) limits, severely restricting its market access.

Inefficient production lines, particularly older ones still in use, can be a significant drain on resources. In 2024, many manufacturing sectors are grappling with the cost of maintaining outdated machinery and processes that consume more energy and raw materials per unit produced compared to modern alternatives. These lines often have lower throughput and higher defect rates, directly impacting profitability.

Flügger's private label ventures that haven't achieved significant market traction, particularly those in slower-growing segments, could be categorized as Dogs in the BCG matrix. These initiatives might be draining valuable resources without generating proportionate returns, impacting overall profitability.

| Category | Flügger Example | Market Growth | Market Share | Profitability Impact |

|---|---|---|---|---|

| Geographic Dog | Ukraine Operations | Low (due to geopolitical instability) | Low | Negative (reduced receivables, strategic withdrawal) |

| Product Dog | Outdated Paint Formulations | Low (declining demand for older tech) | Low | Minimal to Negative (low sales, potential inventory costs) |

| Operational Dog | Inefficient Production Lines | N/A (internal factor) | N/A (internal factor) | Negative (high resource consumption, increased costs) |

| Strategic Dog | Underperforming Private Labels | Low (specific segments) | Low | Negative (resource drain, low returns) |

Question Marks

Flügger's new environmentally certified Matt Paint, a collaboration with DETALE CPH, currently sits in the Question Mark quadrant of the BCG Matrix. This innovative product taps into the robust and expanding consumer demand for sustainable building materials, a market segment that saw significant growth in 2024, with reports indicating a 15% year-over-year increase in sales for eco-labeled paints in key European markets.

Despite its environmental credentials, the paint's market share is nascent, reflecting its recent introduction. To propel this product from a Question Mark to a potential Star, Flügger must strategically allocate substantial resources towards aggressive marketing campaigns and expanding its distribution network. This investment is crucial to build brand awareness and drive adoption, aiming to capture a larger slice of the burgeoning green building sector.

Flügger's e-commerce initiatives represent a classic Question Mark in the BCG matrix. While the digital market offers significant growth prospects, Flügger's current online market share is likely modest compared to its established physical store presence. This necessitates strategic investment to build a robust online platform and enhance digital marketing efforts.

The company is investing in its digital infrastructure to capture a larger share of the growing online market. This includes enhancing its website, optimizing for mobile, and potentially exploring new online sales channels. For instance, by mid-2024, many retailers saw online sales contribute between 15-25% of their total revenue, a figure Flügger aims to increase.

Expanding into new geographical markets for Flügger, beyond its current Nordic and Eastern European strongholds, would likely place it in the Question Marks category of the BCG Matrix. These are markets with high growth potential but where Flügger has minimal existing penetration, necessitating substantial upfront investment in research, branding, and distribution to establish a presence.

For instance, entering a rapidly developing Asian market, where the construction and renovation sectors are booming, would represent such a move. While the potential upside is significant, the initial capital outlay for understanding local consumer preferences, building a distribution network, and creating brand awareness could be considerable. Flügger's 2024 revenue of DKK 2.5 billion, while strong in its current markets, would need careful allocation to support such ambitious international ventures.

Innovative Surface Treatment Solutions

Flügger's commitment to developing novel surface treatment solutions places it in a dynamic position within the BCG matrix. These innovations, while not yet mainstream, target evolving market demands and specialized applications, suggesting a potential for future growth. For instance, their exploration into bio-based coatings or advanced antimicrobial surfaces aligns with increasing consumer and regulatory interest in sustainable and health-conscious building materials.

These forward-looking products represent a significant investment in research and development, requiring substantial marketing efforts to gain traction. The company's 2024 strategy likely includes targeted campaigns to educate specifiers and end-users about the unique benefits of these emerging treatments. The success of these ventures hinges on their ability to carve out niche markets and scale production efficiently.

- Innovation Focus: Flügger is actively developing new surface treatments for emerging needs and niche markets.

- Market Potential: These solutions are positioned in high-growth potential areas requiring significant R&D and marketing investment.

- Strategic Importance: Such innovations are crucial for maintaining a competitive edge and capturing future market share.

- Investment Rationale: The company is likely allocating resources to these ventures to drive future revenue streams and market leadership.

Partnerships with Building Supply Retailers

Flügger's strategy to partner with professional building supply retailers positions this initiative as a Question Mark in the BCG Matrix. This approach aims to unlock significant market potential by introducing and expanding the Flügger brand within these established distribution channels.

The success of this strategy hinges on several factors, including effective negotiation, seamless integration of Flügger products, and targeted marketing efforts. The objective is to capture substantial market share and drive considerable revenue growth from this new venture.

- High Growth Prospects: Building supply retailers often serve a large customer base, offering Flügger access to a market segment with considerable growth potential.

- Strategic Expansion: This partnership diversifies Flügger's distribution, moving beyond its traditional channels to reach professional contractors and builders more directly.

- Investment Required: Significant investment in marketing, sales support, and potentially inventory management will be necessary to establish a strong presence and gain traction.

- Market Uncertainty: The ultimate success in gaining market share and generating revenue is not guaranteed, reflecting the inherent risks associated with entering new distribution networks.

Question Marks represent products or business units with low market share in high-growth industries. Flügger's new eco-certified paint, for instance, is in a rapidly expanding sustainable materials market but has a small current market share. Similarly, their e-commerce ventures, while tapping into a growing digital landscape, are likely in their early stages with limited online penetration. Expanding into new geographical regions also fits this profile, offering high growth potential but requiring significant initial investment and facing uncertainty regarding market capture.

| Flügger Business Unit/Product | Market Growth Rate | Relative Market Share | BCG Classification |

|---|---|---|---|

| Eco-Certified Matt Paint | High (e.g., 15% YoY growth in eco-labeled paints in Europe in 2024) | Low (nascent market share) | Question Mark |

| E-commerce Initiatives | High (growing online retail sector, ~15-25% of total revenue for many retailers by mid-2024) | Low (modest current online share) | Question Mark |

| New Geographical Market Expansion | High (e.g., booming construction in certain Asian markets) | Low (minimal existing penetration) | Question Mark |

| Novel Surface Treatments (R&D) | High (emerging demand for specialized/sustainable solutions) | Low (not yet mainstream) | Question Mark |

| Partnerships with Retailers | High (potential to reach new customer segments) | Low (new distribution network) | Question Mark |

BCG Matrix Data Sources

Our BCG Matrix leverages comprehensive data, including Flugger's financial reports, market share data, and industry growth rates, to accurately position each business unit.