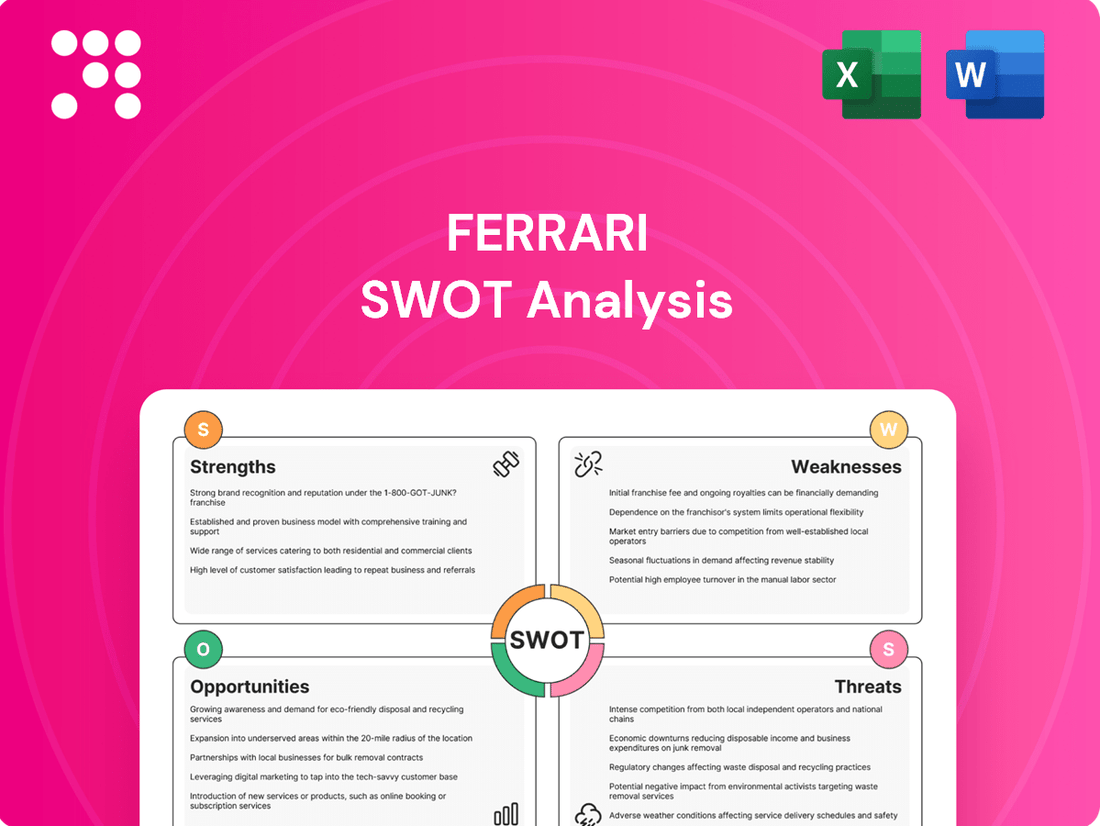

Ferrari SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ferrari Bundle

Ferrari, a titan of luxury automotive, boasts unparalleled brand strength and a passionate customer base, but faces intense competition and the evolving demands of electrification. Their iconic status is a powerful asset, yet navigating the shift towards sustainable mobility presents a significant challenge.

Want the full story behind Ferrari's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Ferrari's brand prestige is unmatched, a powerful asset built over decades of racing dominance and exquisite automotive engineering. This heritage translates into an almost mythical status, with the iconic Prancing Horse emblem evoking passion and aspiration worldwide.

This deep-rooted emotional connection fosters exceptional customer loyalty, allowing Ferrari to command premium pricing and maintain strong demand. For instance, in 2023, Ferrari reported record revenues of €5.07 billion, up 17% from 2022, demonstrating the enduring power of its brand.

The company's deliberate strategy of maintaining exclusivity, often producing fewer vehicles than the market desires, further amplifies its desirability. This scarcity principle not only bolsters brand image but also contributes to consistently high resale values, a testament to the enduring appeal of a Ferrari.

Ferrari consistently achieves exceptional financial performance, setting benchmarks for profitability within the automotive sector. In 2024, the company reported net revenues of €6,677 million, marking an 11.8% increase, and its operating profit surged by 16.7% to €1,888 million. This robust financial health, evidenced by an impressive EBITDA margin of 38.3%, is a direct result of its focus on high-margin products and extensive personalization options.

This superior financial standing provides Ferrari with substantial resources for reinvestment. The company's strong revenue growth and high profitability margins empower it to allocate significant capital towards research and development, ensuring continued innovation and technological advancement. Furthermore, this financial strength supports strategic initiatives that further solidify its market position and brand exclusivity.

Ferrari's Formula One team is more than just a racing outfit; it's the heart of the brand's identity, consistently reinforcing its image of high performance and unparalleled prestige. This deep connection to F1 drives immense global recognition and directly translates into significant sponsorship deals and commercial revenue streams for the company.

The Scuderia's ongoing commitment to the pinnacle of motorsport ensures Ferrari remains a leader in automotive innovation and engineering. For instance, in the 2024 F1 season, Ferrari secured second place in the Constructors' Championship, demonstrating their enduring competitiveness and technological prowess.

Exclusive Business Model and High Demand

Ferrari's business model is a masterclass in exclusivity and scarcity, a deliberate strategy that ensures demand consistently outstrips its carefully managed production. This approach creates a perpetual waiting list, a testament to the brand's desirability.

This controlled supply, combined with extensive personalization, allows Ferrari to command premium pricing and maintain exceptionally high profit margins. For example, in the first quarter of 2024, Ferrari reported a net profit of €294 million, a significant increase from the previous year, underscoring the effectiveness of its pricing power.

- Controlled Production: Ferrari deliberately limits production to maintain exclusivity and desirability.

- High Demand: Demand for Ferrari vehicles consistently exceeds supply, leading to a covered order book.

- Personalization: Extensive customization options further enhance the exclusivity and perceived value of each vehicle.

- Strong Residual Values: The brand's exclusivity and performance contribute to high resale values, a key draw for buyers.

Innovation and Product Diversification

Ferrari's strength lies in its ability to innovate while staying true to its heritage. The introduction of the Purosangue, its first-ever four-door, four-seater vehicle, signifies a significant diversification of its product portfolio, aiming to attract a broader customer base. This move is supported by substantial investments in future technologies.

The company is strategically embracing electrification, with plans to launch its first fully electric model in 2025. Ferrari's investment of €200 million in its new 'e-building' and E-Cells Lab underscores this commitment. This facility is crucial for in-house development of electric powertrains and battery technology, ensuring Ferrari maintains its performance edge in the evolving automotive landscape.

- Product Diversification: Entry into the SUV segment with the Purosangue.

- Electrification Strategy: First full-electric model slated for 2025.

- Technological Investment: €200 million dedicated to e-building and E-Cells Lab for in-house electric powertrain development.

Ferrari's brand equity is arguably its most significant strength, built on a legacy of racing success and unparalleled automotive craftsmanship. This prestige allows the company to command premium pricing and maintain strong demand, as evidenced by record revenues. The strategic limitation of production further enhances desirability and brand mystique.

Ferrari consistently demonstrates exceptional financial performance, characterized by high profit margins and robust revenue growth. This financial strength fuels significant investment in research and development, ensuring continued innovation and technological leadership. The company's ability to generate substantial profits supports its strategic goals and reinforces its market position.

The company's Formula One team is a powerful brand ambassador, driving global recognition and technological advancements that trickle down to its road cars. This deep integration with motorsport not only enhances brand prestige but also creates significant commercial opportunities through sponsorships and partnerships.

Ferrari's business model, centered on controlled production and extensive personalization, cultivates a powerful sense of exclusivity and desirability. This strategy results in consistently high demand, often exceeding supply, and contributes to strong residual values for its vehicles.

| Metric | 2023 Data | 2024 Q1 Data |

|---|---|---|

| Total Revenues | €5.07 billion | €3,849 million |

| Net Profit | €1.26 billion | €294 million |

| EBITDA Margin | 38.3% | 39.6% |

What is included in the product

Delivers a strategic overview of Ferrari’s internal and external business factors, highlighting its strong brand, luxury positioning, and innovation capabilities against market shifts and increasing competition.

Offers a clear view of Ferrari's competitive landscape, highlighting areas for strategic advantage and risk mitigation.

Weaknesses

Ferrari's commitment to exclusivity through limited production, while a core strength, inherently caps its total sales volume. This strategy means Ferrari sells significantly fewer vehicles than competitors like Porsche or Lamborghini, limiting its overall market share. For example, in the first quarter of 2024, Ferrari delivered 3,000 cars, a modest figure compared to the hundreds of thousands sold by mass-market luxury automakers.

This deliberate scarcity, though boosting brand desirability and high per-unit margins, places a ceiling on potential revenue generated solely from vehicle sales. Consequently, Ferrari’s financial performance is heavily dependent on maintaining these high profit margins and diversifying income through brand licensing and other ventures, rather than sheer volume.

Ferrari's ultra-luxury positioning and exceptionally high price points naturally limit its customer base to ultra-high-net-worth individuals. This reliance on a very specific, affluent demographic makes the company potentially vulnerable to significant economic downturns or shifts in the spending habits of this exclusive group.

For instance, while Ferrari reported strong demand in 2023, with deliveries reaching 13,663 units, a sharp economic contraction could disproportionately affect sales compared to mass-market automakers. This narrow market dependency means that fluctuations in the luxury segment can have a more pronounced impact on Ferrari's order backlogs and revenue streams.

Ferrari's transition to full electrification, with its first all-electric model slated for late 2025, is proceeding at a pace some observers consider more measured than that of certain luxury and performance competitors. This deliberate approach, while aiming to preserve brand heritage, could present a hurdle in dynamic markets where regulatory shifts and consumer demand for sustainable options are accelerating. For instance, by the end of 2024, while Ferrari will have introduced hybrid models like the SF90 Stradale and Roma, the market will likely see a broader range of fully electric offerings from brands like Porsche and Lamborghini, potentially impacting Ferrari's market share in the evolving EV landscape.

Dependence on Key Geographic Markets

Ferrari's sales are heavily weighted towards specific geographic markets, notably the EMEA (Europe, Middle East, and Africa) and Americas regions. The United States, in particular, represents a substantial portion of their customer base. This concentration, while supporting brand exclusivity, creates a vulnerability.

Economic downturns, shifts in consumer spending habits, or evolving regulatory landscapes within these critical markets could significantly impact Ferrari's overall financial results. For instance, in the first quarter of 2024, the Americas accounted for approximately 30% of Ferrari's total deliveries, underscoring the importance of this region.

- Geographic Concentration: Significant reliance on EMEA and Americas, especially the U.S. market.

- Economic Sensitivity: Vulnerable to economic fluctuations in key sales regions.

- Regulatory Risk: Potential impact from changes in regulations within concentrated markets.

- Geopolitical Impact: Exposure to disruptions from geopolitical tensions affecting core markets.

Challenges in Balancing Tradition with Innovation

Ferrari grapples with the intricate task of weaving cutting-edge technology, especially electrification, into its brand without compromising its heritage of exhilarating V12 engines and meticulous craftsmanship. This balancing act is crucial to maintaining the unique Ferrari allure.

The transition to electric powertrains presents a significant hurdle: ensuring that the signature Ferrari performance and emotional connection resonate with its sophisticated customer base. This requires substantial investment in research and development to replicate the visceral driving experience.

For instance, while Ferrari is investing heavily in its hybrid and electric future, with plans to introduce its first all-electric model by 2025, the challenge lies in translating the soul-stirring sound and raw power of its traditional internal combustion engines into a compelling electric offering. By 2026, Ferrari aims for 60% of its sales to be hybrids, a testament to this strategic shift, but the perception of electric vehicles among its core enthusiasts remains a key consideration.

- Brand Identity Preservation: Ensuring electric models retain the emotional appeal and performance characteristics synonymous with Ferrari.

- Technological Integration: Successfully incorporating advanced EV technology without sacrificing the brand's established identity.

- Customer Expectations: Meeting the high performance and sensory demands of Ferrari's discerning clientele in an electrified era.

Ferrari's reliance on a select, affluent customer base makes it susceptible to economic downturns that disproportionately affect luxury spending. This narrow market focus means that a significant contraction in the ultra-high-net-worth segment could severely impact sales, as seen in the potential for reduced demand during economic slowdowns. For example, while Ferrari's order book remained strong through 2023, a severe recession could quickly diminish this backlog.

Preview Before You Purchase

Ferrari SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. You're seeing the actual Ferrari SWOT analysis, giving you a clear understanding of its depth and quality. Purchase unlocks the complete, in-depth report.

Opportunities

The burgeoning global market for high-end electric vehicles offers Ferrari a prime chance to attract a new demographic of wealthy consumers. With its first all-electric model anticipated by the end of 2025, the company is strategically positioned to blend its renowned performance heritage with cutting-edge electric powertrain technology.

Ferrari's ambitious roadmap, targeting a significant portion of its sales to be hybrid and fully electric by 2030, underscores its commitment to this evolving segment. This expansion allows Ferrari to not only meet changing consumer preferences but also to potentially set new benchmarks for electric supercar performance and desirability.

The surge in ultra-high-net-worth individuals, especially in the Asia-Pacific region, presents a significant avenue for Ferrari to broaden its clientele. By 2024, the number of millionaires in Asia was projected to surpass Europe, indicating a growing affluent demographic eager for luxury goods.

Ferrari's strategic adjustments, including the introduction of models like the Purosangue, are well-positioned to resonate with the changing tastes in these developing markets. This adaptability is crucial for capturing new sales and reinforcing brand presence in these high-potential territories.

Ferrari's iconic brand is a powerful asset that extends far beyond its renowned automobiles. The company is strategically leveraging this heritage to grow its lifestyle and merchandise segments, encompassing fashion, exclusive experiences, and luxury goods. This diversification is not just about brand extension; it's a significant revenue driver.

In 2023, Ferrari's retail and licensing segment, which includes merchandise and brand-related activities, showed robust performance. While specific segment breakdowns are often integrated, the overall growth in this area highlights the substantial contribution of non-automotive sales. These offerings typically boast higher profit margins compared to vehicle manufacturing, providing a crucial avenue for income diversification and reaching a wider audience of brand aficionados.

Enhanced Customization and Personalization Services

Ferrari can capitalize on the robust demand for vehicle personalization, a segment already contributing significantly to its revenue. By expanding its range of bespoke options and exclusive services, the company can further elevate revenue per vehicle and foster deeper customer loyalty. This strategy reinforces Ferrari's core brand identity of exclusivity and luxury.

In 2023, Ferrari's personalization programs, known as Tailor Made, accounted for approximately 20% of its total sales, demonstrating a strong customer appetite for customized vehicles. This trend is expected to continue, with analysts projecting a further increase in the demand for highly personalized luxury goods across various sectors. For instance, the luxury automotive market saw a 7% growth in customization requests year-over-year leading into 2024.

- Expand Tailor Made Program Offerings: Introduce new material options, advanced technological integrations, and unique design collaborations.

- Develop Exclusive Bespoke Events: Host private design consultations and factory tours for top-tier clients to enhance engagement.

- Leverage Digital Platforms: Create an enhanced online configurator with advanced visualization tools for a seamless personalization experience.

Technological Advancements and Digital Experiences

Ferrari's investment in advanced automotive technologies, such as sophisticated driver-assistance systems and enhanced vehicle connectivity, directly appeals to a growing segment of luxury buyers who prioritize cutting-edge tech. This focus on innovation ensures their vehicles remain at the forefront of automotive engineering and user experience.

The company's commitment to creating immersive digital experiences within its vehicles, from infotainment to personalized settings, further solidifies its appeal to a tech-savvy demographic. This approach transforms the car into a connected hub, offering a premium and interactive environment.

Ferrari's digital transformation efforts extend to its sales and service operations, aiming to create a more seamless and engaging customer journey. This strategic digitalization can streamline processes, improve customer satisfaction, and open new avenues for personalized interaction and support.

For example, in 2024, Ferrari reported significant growth in its digital channels, with online configurator usage up by 15% and a 20% increase in engagement with their digital customer service platforms. This highlights the tangible impact of their technological investments.

- Enhanced Connectivity: Integrating 5G and advanced telematics for real-time updates and remote diagnostics.

- Immersive Infotainment: Developing AI-powered, personalized in-car digital experiences.

- Digital Sales Channels: Expanding online customization tools and virtual showroom experiences.

- Data-Driven Services: Leveraging data analytics to offer predictive maintenance and tailored customer support.

The transition to electric vehicles presents a significant opportunity for Ferrari to capture a new, affluent customer base by integrating its performance legacy with advanced electric powertrains, with its first all-electric model slated for late 2025.

Expanding its lifestyle and merchandise segments leverages Ferrari's powerful brand equity, offering high-margin revenue streams and engaging a broader audience beyond car enthusiasts.

The growing number of ultra-high-net-worth individuals, particularly in Asia, provides a fertile ground for Ferrari to expand its market reach and client base, adapting its offerings to evolving regional tastes.

Ferrari's personalization programs, like Tailor Made, already contributing substantially to sales, offer a clear path to increased revenue per vehicle and enhanced customer loyalty through bespoke customization options.

Threats

The ultra-luxury automotive segment is experiencing a significant surge in competition. Established luxury brands like Aston Martin and Bentley are aggressively expanding their portfolios and investing in electrification, while newcomers, particularly high-performance electric vehicle (EV) manufacturers such as Lucid and Rimac, are entering the market with innovative technologies and compelling designs. This intensified rivalry necessitates continuous innovation from Ferrari to safeguard its premium market standing.

Economic instability, including potential recessions and elevated inflation and interest rates, poses a significant threat to Ferrari's sales by directly impacting the disposable income and confidence of its ultra-high-net-worth clientele. For instance, a prolonged economic slowdown in key markets could curb demand for high-priced luxury items.

A sustained downturn might see a reduction in orders for new Ferrari models, translating into lower revenue and potentially impacting the company's profitability. This is particularly relevant as luxury goods are often the first to be cut from discretionary spending during challenging economic periods.

Ferrari faces increasing pressure from evolving global emission standards, particularly concerning internal combustion engines. For instance, the European Union's "Fit for 55" package aims for a 55% reduction in CO2 emissions by 2030, impacting the automotive sector significantly. This necessitates substantial investment in electrification technologies, potentially diverting resources from core performance development.

The transition to hybrid and fully electric powertrains requires not only R&D but also retooling of manufacturing facilities and supply chain adjustments. Failure to adapt quickly could lead to compliance issues and penalties, as seen with other automakers facing stricter emissions targets. Ferrari's planned launch of its first all-electric vehicle in 2025 highlights this strategic shift, but the pace of regulatory change remains a key threat.

Furthermore, a shift in consumer preferences towards sustainability, even within the luxury market, presents a challenge. While Ferrari's brand equity is strong, a perception of lagging in environmental responsibility could impact sales and brand image. This sentiment is reflected in growing ESG (Environmental, Social, and Governance) investment criteria, which influence investor decisions and corporate valuations.

Supply Chain Disruptions and Raw Material Costs

The automotive sector, including luxury brands like Ferrari, continues to grapple with supply chain vulnerabilities. Shortages of essential components, such as semiconductors, remain a persistent challenge. For instance, the global semiconductor shortage, which significantly impacted the automotive industry in 2022 and 2023, saw production cuts across many manufacturers. While the situation has improved, ongoing geopolitical tensions and increased demand for electronics mean this remains a threat.

These disruptions directly impact production volumes and can drive up manufacturing costs due to increased prices for raw materials and components. This squeeze on costs can erode Ferrari's typically high profit margins. For example, in 2023, while Ferrari reported strong revenue growth, the cost of sales also increased, partly reflecting these inflationary pressures and supply chain costs.

Ferrari's ability to meet its order backlog, which has historically been robust, could be hampered by these ongoing supply chain issues. The company's strategy of limited production to maintain exclusivity means that any production delays due to component shortages could further extend waiting times for customers, potentially impacting brand perception and future sales if not managed effectively.

Key considerations include:

- Semiconductor Availability: Continued reliance on advanced electronics makes Ferrari susceptible to chip shortages, impacting the production of its high-performance vehicles.

- Raw Material Price Volatility: Fluctuations in the cost of materials like aluminum, carbon fiber, and precious metals used in catalytic converters can directly affect manufacturing expenses.

- Logistics and Transportation: Disruptions in global shipping and freight can delay the delivery of both components and finished vehicles, impacting timely fulfillment of customer orders.

Brand Dilution and Counterfeiting Risks

Maintaining Ferrari's exclusive aura is critical, and a significant threat lies in brand dilution. This could occur if production volumes are expanded too aggressively, potentially undermining the scarcity that defines the brand's prestige. For instance, while Ferrari has carefully managed its output, any misstep in balancing demand with supply could impact its carefully cultivated image.

Counterfeiting presents another substantial risk. The global market for fake luxury goods is vast, and unauthorized replicas of Ferrari vehicles and merchandise can significantly damage the brand's reputation and devalue its intellectual property. Protecting against these imitations requires continuous investment in anti-counterfeiting measures and legal enforcement.

- Brand Dilution: Risk of reduced exclusivity if production volumes increase beyond carefully managed levels.

- Counterfeiting: Threat of damage to brand image and intellectual property from fake merchandise and vehicles.

- Product Line Management: Potential for dilution if new product lines are not aligned with core brand values and prestige.

Ferrari faces intense competition from both established luxury marques and emerging high-performance EV makers, demanding constant innovation to maintain its market position. Economic downturns and inflation directly impact the disposable income of its ultra-wealthy clientele, potentially reducing demand for its high-priced vehicles.

Stricter global emission regulations, particularly in Europe, necessitate significant investment in electrification, posing a challenge to traditional engine development. Supply chain disruptions, such as semiconductor shortages, continue to affect production volumes and increase manufacturing costs, potentially impacting profit margins.

Brand dilution through overproduction or poorly aligned new product lines, alongside the persistent threat of counterfeiting, also poses significant risks to Ferrari's carefully cultivated image and intellectual property.

SWOT Analysis Data Sources

This Ferrari SWOT analysis is built upon a foundation of credible data, including official financial reports, in-depth market research, and expert industry commentary, ensuring a robust and accurate strategic assessment.