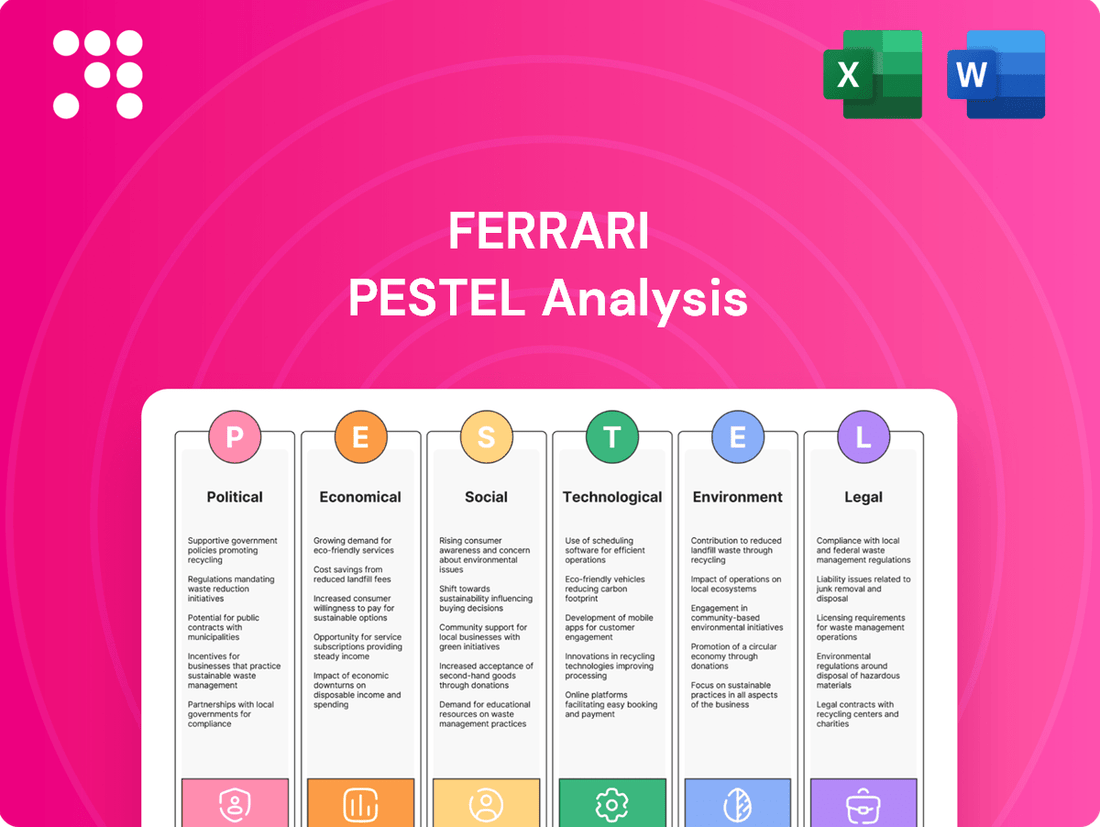

Ferrari PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ferrari Bundle

Ferrari operates in a dynamic global arena, constantly influenced by political shifts, economic fluctuations, and evolving societal preferences. Understanding these external forces is crucial for anticipating challenges and capitalizing on opportunities in the luxury automotive market. Our PESTLE analysis dives deep into these factors, offering a comprehensive view of what drives Ferrari's strategic decisions and future trajectory. Unlock these critical insights to refine your own market approach and gain a competitive edge. Download the full PESTLE analysis now!

Political factors

Governments worldwide are tightening emissions regulations, a significant factor for Ferrari. For instance, by 2025, the European Union aims for an average CO2 emission reduction of 55% for new cars, impacting manufacturers like Ferrari who must invest heavily in hybrid and electric powertrains to meet these targets and avoid substantial fines.

These policy shifts towards sustainability directly influence Ferrari's product development roadmap and market access. Failure to comply could lead to market restrictions or increased operational costs, forcing a strategic pivot towards greener technologies.

Ferrari's global operations are significantly influenced by international trade policies and tariffs. For instance, the European Union, Ferrari's home market, has various trade agreements that generally benefit its exports. However, potential shifts in these agreements, or the imposition of new tariffs by importing countries, could increase the cost of bringing its high-performance vehicles to customers in markets like the United States or China. In 2023, the EU's trade surplus with the US in goods was substantial, but specific sectors can face renewed scrutiny.

Political stability in Ferrari's core markets, particularly in Europe and North America, remains crucial. For instance, the ongoing geopolitical tensions in Eastern Europe and the Middle East, while not directly impacting Ferrari's primary sales, can create broader economic uncertainty that influences discretionary spending on luxury goods. Ferrari's sales in the Americas and Europe accounted for a significant portion of its revenue in 2023, underscoring the importance of stable political environments in these regions.

Luxury Goods Taxation Policies

Governments worldwide frequently impose elevated taxes on luxury goods, including high-performance automobiles like Ferraris, as a strategy to boost public revenue and mitigate wealth disparities. For instance, in 2023, the United Kingdom maintained its luxury car tax, which can add a significant percentage to the purchase price of vehicles exceeding certain thresholds, impacting affordability for some buyers.

Shifts in these tax structures, such as the introduction or escalation of luxury sales taxes or broader wealth taxes, can directly affect how desirable and accessible Ferrari vehicles are to their affluent customer base. This dynamic mandates that Ferrari continuously analyzes market conditions and refines its pricing strategies to remain competitive and appealing.

- Luxury Tax Impact: In 2024, several European nations are considering or have already implemented higher luxury taxes on vehicles, potentially increasing the effective price of a Ferrari by an additional 5-10% in certain markets.

- Wealth Tax Considerations: The potential for wealth taxes in key markets, while not universally applied to car ownership, could indirectly reduce disposable income available for ultra-luxury purchases.

- Revenue Generation vs. Market Demand: Governments aim to capture revenue from high-value transactions, but aggressive taxation risks dampening demand in an already niche market.

Government Support for Automotive Innovation

Governments worldwide are actively promoting automotive innovation, particularly in electrification and sustainable practices. For instance, the European Union's Horizon Europe program has allocated significant funding for research and development in green technologies, which could benefit high-performance vehicle manufacturers like Ferrari. These initiatives often include grants, tax credits, and R&D support, aiming to accelerate the transition to cleaner mobility solutions.

Ferrari can strategically leverage these government programs to reduce the substantial costs associated with developing cutting-edge technologies, such as advanced battery systems and lightweight materials. Accessing these financial and research resources can provide a crucial competitive advantage, enabling faster innovation cycles and potentially lowering the barrier to entry for new, sustainable powertrain technologies within their exclusive product lines.

- EU Green Deal funding: The European Union's commitment to climate neutrality by 2050, backed by substantial funding programs like Horizon Europe, directly supports R&D in sustainable automotive technologies.

- National R&D tax credits: Many countries, including Italy, offer tax incentives for companies investing in research and development, which Ferrari can utilize to offset innovation expenses.

- Government grants for electrification: Specific grants and subsidies are available in key markets for the development and production of electric vehicles and related infrastructure, potentially aiding Ferrari's electrification strategy.

Governments are increasingly focused on environmental regulations, pushing for lower emissions. For example, the EU's 2025 CO2 targets necessitate significant investment in hybrid and electric technology for manufacturers like Ferrari, impacting their product development and market access.

Trade policies and tariffs directly affect Ferrari's global sales. While EU trade agreements generally benefit exports, potential new tariffs in markets like the US or China could increase vehicle costs for consumers, influencing demand.

Political stability in key markets like Europe and North America is vital, as geopolitical uncertainties can dampen discretionary spending on luxury goods, impacting Ferrari's revenue streams.

Governments often impose luxury taxes to boost revenue. In 2024, some European countries are considering or implementing higher luxury vehicle taxes, potentially increasing Ferrari prices by 5-10% and affecting buyer affordability.

What is included in the product

This PESTLE analysis examines the external macro-environmental factors influencing Ferrari, dissecting the Political, Economic, Social, Technological, Environmental, and Legal landscapes relevant to its ultra-luxury automotive sector.

It provides a comprehensive framework for understanding how global trends and regulations create both challenges and strategic advantages for Ferrari's continued success.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, transforming complex external factors into actionable insights for Ferrari's strategic decision-making.

Helps support discussions on external risk and market positioning during planning sessions by clearly outlining the Political, Economic, Social, Technological, Environmental, and Legal impacts on Ferrari's operations.

Economic factors

The global economy's vitality directly influences Ferrari's performance. In 2024, projections suggest continued, albeit potentially moderate, global GDP growth, which bodes well for the luxury sector. A rising tide of high-net-worth individuals (HNWIs), a key demographic for Ferrari, is expected to persist, with the number of HNWIs globally projected to increase by approximately 5-7% annually through 2025, according to various wealth management reports.

Wealth distribution plays a crucial role; as wealth concentrates among fewer individuals, the demand for ultra-luxury goods like Ferraris can become even more pronounced. However, significant economic contractions or widespread recessions, which could see global GDP growth falter or turn negative as experienced in some periods, would likely dampen discretionary spending, impacting Ferrari's order books.

Ferrari's sales are intrinsically linked to the disposable income of its affluent clientele. Factors such as prevailing interest rates, inflation trends, and the performance of investment portfolios directly influence the purchasing power and overall confidence of ultra-high-net-worth individuals. For instance, in 2023, global wealth grew by 5.1% to $454.2 trillion, according to Credit Suisse, indicating a generally positive environment for luxury goods.

Sustained growth in the wealth of this demographic is paramount for Ferrari's ongoing success. As of the first quarter of 2024, Ferrari reported a 10% increase in net revenues compared to the same period in 2023, reaching €1.43 billion, which suggests a strong demand from its target market despite economic fluctuations.

Ferrari, as a global luxury automaker, is significantly impacted by exchange rate fluctuations. A strong Euro, for instance, can make its high-performance vehicles less affordable for buyers in countries using weaker currencies, potentially dampening demand in key markets like the United States or the United Kingdom.

Conversely, a weaker Euro could increase the cost of imported components and raw materials, affecting Ferrari's production expenses. For example, if Ferrari sources a significant portion of its advanced electronics from Asia, a depreciating Euro would directly translate to higher import costs, squeezing profit margins.

Ferrari actively manages this currency risk through hedging strategies to maintain financial stability. In late 2023 and early 2024, the Euro experienced some volatility against major currencies, highlighting the ongoing need for robust risk management.

Inflation and Cost of Materials

Rising inflation presents a significant challenge for Ferrari, directly impacting the cost of essential inputs. For instance, the price of specialty metals, advanced composites, and high-performance components, all crucial for their bespoke vehicles, has seen upward pressure. This inflationary environment can squeeze profit margins, especially considering Ferrari's commitment to premium quality and limited production runs.

Ferrari's operational costs are intrinsically linked to the global economic climate. Increased costs for skilled labor, essential for the meticulous craftsmanship involved in each car, add another layer of expense. Furthermore, energy prices, vital for manufacturing and logistics, have also been volatile. These combined cost pressures necessitate careful financial planning and strategic pricing adjustments.

- Material Costs: The cost of aluminum and carbon fiber, key materials for Ferrari's lightweight chassis, has seen increases. For example, aluminum prices experienced significant volatility throughout 2023 and into early 2024, impacting manufacturing budgets.

- Labor Expenses: Skilled labor is paramount for Ferrari's production. Wage inflation, particularly for specialized engineers and craftspeople, has been a growing concern in the automotive sector.

- Energy Prices: Fluctuations in oil and natural gas prices directly affect energy costs for Ferrari's manufacturing facilities and transportation logistics.

- Supply Chain Resilience: Ferrari's reliance on a global supply chain means that inflationary pressures in one region can have ripple effects across their production process.

Luxury Market Trends and Consumer Confidence

Ferrari's fortunes are closely tied to the broader luxury market, which in turn is heavily influenced by consumer confidence and spending power. When consumers feel financially secure, they are more likely to invest in high-value, discretionary purchases like luxury vehicles. For instance, in early 2024, despite some economic headwinds, the global luxury goods market was projected to grow by 8-10%, indicating robust consumer appetite for premium products.

Key trends shaping demand for luxury items like Ferraris include a growing emphasis on personalization, experiential luxury, and unique ownership propositions. Consumers are no longer just buying a product; they are seeking an experience and a sense of belonging. Ferrari's Tailor Made program, allowing extensive customization, directly addresses this, with a significant portion of its cars being personalized.

- Global luxury goods market growth projected at 8-10% in early 2024.

- Ferrari's Tailor Made program sees high customer engagement, reflecting demand for personalization.

- Experiential luxury, including exclusive driving events and brand experiences, is a key driver for high-net-worth individuals.

- Consumer confidence indices, particularly among affluent demographics, are critical indicators for Ferrari's sales performance.

Ferrari's performance is intrinsically linked to global economic health, with projected moderate GDP growth in 2024 supporting the luxury sector. The increasing number of high-net-worth individuals, expected to grow by 5-7% annually through 2025, provides a strong customer base. Ferrari's net revenues in Q1 2024 increased by 10% to €1.43 billion, underscoring robust demand from its affluent clientele.

| Economic Factor | 2023 Data/2024 Projection | Impact on Ferrari |

|---|---|---|

| Global GDP Growth | Projected moderate growth in 2024 | Positive for luxury spending |

| High-Net-Worth Individuals (HNWIs) | Expected 5-7% annual growth through 2025 | Expanded customer base |

| Global Wealth Growth | 5.1% growth in 2023 to $454.2 trillion | Increased purchasing power for luxury goods |

| Ferrari Net Revenues (Q1 2024) | €1.43 billion (10% increase YoY) | Demonstrates strong market demand |

Full Version Awaits

Ferrari PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Ferrari PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the luxury automotive giant. Understand the external forces shaping Ferrari's strategy and future success.

Sociological factors

The very idea of what constitutes luxury is changing. Consumers, particularly younger generations, are moving away from simply showing off wealth through flashy possessions. Instead, they're valuing experiences, authenticity, and increasingly, sustainability. This means brands like Ferrari need to think beyond just raw performance.

Ferrari's brand narrative needs to highlight its rich heritage, the meticulous craftsmanship that goes into each car, and the inherent exclusivity of owning one. Focusing on the unique ownership experience, perhaps through exclusive events or personalized services, will be crucial to connect with these evolving desires. For instance, in 2024, the demand for ultra-exclusive, limited-edition models continues to outstrip supply, demonstrating a clear appetite for rarity.

Societal expectations are shifting, pushing even luxury brands like Ferrari to prioritize environmental and social responsibility. Affluent consumers are more aware than ever of a brand's ethical footprint and commitment to sustainability.

This growing consciousness directly impacts purchasing decisions, with many wealthy buyers actively seeking out brands that align with their values. Ferrari's strategic investments in hybrid powertrains, such as the SF90 Stradale and the upcoming Purosangue, demonstrate a tangible response to this demand, showcasing a commitment to reducing emissions and embracing more sustainable manufacturing processes.

Social media and digital channels are pivotal in shaping Ferrari's brand image and engaging its passionate customer base. Ferrari actively uses platforms like Instagram, YouTube, and its own digital channels to share behind-the-scenes content, highlight its racing heritage, and showcase new models, fostering a strong sense of community among enthusiasts.

In 2023, Ferrari's Instagram account alone boasted over 65 million followers, demonstrating the immense reach and influence of its digital presence in connecting with a global audience and maintaining brand relevance across generations of potential buyers.

Demographic Shifts in Wealth Accumulation

Global wealth accumulation is undergoing a significant transformation, with emerging markets and younger demographics increasingly contributing to the pool of high-net-worth individuals. Ferrari must adapt its strategies to engage these evolving customer bases. For instance, by 2024, the number of millionaires in Asia was projected to surpass those in Europe, indicating a crucial shift in wealth concentration.

Understanding these demographic shifts is vital for Ferrari to effectively target new markets and attract the next generation of affluent buyers. This involves not only identifying where wealth is growing but also appreciating the diverse cultural nuances associated with these regions.

- Shifting Wealth Centers: Asia's wealth is rapidly expanding, with countries like China and India showing substantial growth in affluent populations.

- Generational Wealth Transfer: A significant portion of wealth is expected to be transferred to younger generations in the coming years, influencing luxury consumption patterns.

- Emergence of New Affluent Demographics: Entrepreneurs and tech innovators are becoming key drivers of wealth, often with different preferences and purchasing behaviors compared to traditional wealth holders.

- Regional Market Potential: Ferrari's market analysis for 2024/2025 should highlight the growing disposable incomes and luxury spending potential in regions like the Middle East and parts of Africa.

Shift Towards Experiential Consumption

The modern consumer is increasingly prioritizing unique experiences over mere product ownership. This shift is evident in how people spend their disposable income, with a growing demand for memorable events and personalized services. For Ferrari, this trend presents a significant opportunity to deepen customer engagement.

Ferrari's strategy already taps into this experiential economy. Their exclusive track days, driving schools, and bespoke personalization programs offer more than just a car; they provide access to a lifestyle and a community. For instance, the Ferrari Challenge series, a one-make racing championship, saw robust participation in 2024, with over 400 drivers competing globally, underscoring the demand for hands-on racing experiences.

- Experiential Value: Consumers seek memorable events and personalized services, moving beyond simple product possession.

- Ferrari's Alignment: Exclusive events, racing experiences, and customization options directly cater to this trend.

- Brand Loyalty: Expanding these experiential offerings can solidify brand loyalty and attract high-net-worth individuals seeking unique engagement.

- Market Growth: The luxury experiential market is projected to grow, with Ferrari well-positioned to capitalize on this expansion.

Societal values are evolving, with a growing emphasis on sustainability and ethical practices influencing consumer choices, even within the luxury segment. Ferrari's commitment to hybrid powertrains, exemplified by models like the SF90 Stradale, directly addresses this shift. Furthermore, the brand's robust digital presence, with over 65 million followers on Instagram in 2023, highlights its ability to connect with a global, digitally-native audience.

Technological factors

The automotive industry's technological landscape is rapidly evolving, with electric and hybrid powertrains at the forefront. Ferrari, a brand synonymous with high-performance combustion engines, faces a significant challenge and opportunity in adapting to this shift. The company has already begun its electrification journey, with its first hybrid model, the SF90 Stradale, launched in 2019, showcasing a blend of V8 power and electric motors.

Ferrari's commitment to electrification is further underscored by its 2026 target to have 60% of its lineup be hybrids. This strategic pivot is driven by both regulatory pressures and growing consumer interest in sustainable, yet powerful, vehicles. For instance, by 2035, the European Union plans to ban the sale of new internal combustion engine cars, making the transition to electric and hybrid powertrains imperative for market access and continued growth. This necessitates substantial investment in research and development for advanced battery technology, electric motor efficiency, and integrated powertrain management systems to maintain Ferrari's signature performance and driving dynamics.

Ferrari's commitment to innovation in lightweight materials is a cornerstone of its performance advantage. The company extensively utilizes carbon fiber composites, which are significantly lighter yet stronger than traditional aluminum or steel. This material choice directly contributes to improved acceleration, braking, and cornering capabilities, essential for maintaining its supercar pedigree.

Advanced manufacturing techniques, such as additive manufacturing or 3D printing, are also playing an increasingly vital role. Ferrari is exploring these technologies for creating complex, optimized components that are difficult or impossible to produce with conventional methods. For instance, in 2023, Ferrari announced advancements in 3D printing for engine parts, aiming to reduce weight and improve thermal efficiency, a key factor in high-performance vehicles.

Ferrari is increasingly integrating advanced digital technologies like sophisticated infotainment, robust connectivity, and advanced driver-assistance systems (ADAS) into its vehicles. For instance, the Ferrari Portofino M, introduced in late 2020, features a redesigned infotainment system with a larger touchscreen and enhanced connectivity options, reflecting this trend. This integration is crucial for meeting evolving customer expectations for safety and user experience.

The challenge for Ferrari lies in seamlessly incorporating these digital advancements without compromising its core identity: the pure, exhilarating driving experience. Balancing cutting-edge technology with the brand's heritage of performance and driver engagement is paramount. This means ensuring that digital features enhance, rather than distract from, the visceral connection between driver, car, and road.

Autonomous Driving Technology Development

While Ferrari remains committed to the pure driving experience, the relentless progress in autonomous driving technology presents a fascinating technological factor. These advancements could subtly reshape future vehicle designs and what consumers expect from their high-performance automobiles. For instance, by 2025, the automotive industry is projected to see significant strides in Level 3 and Level 4 autonomous systems, impacting how even enthusiast vehicles are conceived.

Ferrari's strategy likely involves a discerning integration of select autonomous features. Think of advanced driver-assistance systems (ADAS) that enhance safety or offer convenience during specific driving scenarios, rather than fully autonomous operation that would detract from the driver's engagement. This approach necessitates a careful balance, ensuring new capabilities complement, rather than compromise, the core thrill of piloting a Ferrari.

- ADAS Integration: Ferrari could adopt sophisticated ADAS, such as advanced adaptive cruise control and automated parking, by 2025, enhancing convenience without surrendering driver control.

- Software Development: Significant investment in proprietary software for managing these integrated systems will be crucial, ensuring a seamless and responsive user experience.

- Consumer Expectations: Evolving consumer demand for integrated digital experiences and safety features, even in performance cars, will shape Ferrari's technological roadmap.

Data Analytics and Artificial Intelligence in Design and Production

Ferrari is increasingly leveraging data analytics and artificial intelligence to refine its vehicle design and production processes. By analyzing vast datasets from simulations and real-world testing, AI algorithms can predict performance characteristics and identify areas for improvement with greater speed and accuracy than traditional methods. This technological integration is crucial for maintaining Ferrari's edge in high-performance automotive engineering.

The application of AI extends to optimizing Ferrari's complex supply chain and enhancing customer engagement. Predictive analytics can forecast demand for specific models and components, streamlining inventory management and reducing production lead times. Furthermore, AI-powered tools are being used to personalize the ownership experience, from bespoke configuration options to proactive maintenance scheduling, ensuring a premium customer journey.

In the realm of racing, AI plays a pivotal role in optimizing strategy and performance. Ferrari's Formula 1 team utilizes AI for real-time race analysis, predicting competitor actions, and fine-tuning car setups. For instance, in the 2024 season, advanced simulation tools powered by machine learning contributed to strategic decisions on tire management and pit stop timing, aiming to maximize on-track results.

Ferrari’s investment in these technological advancements is evident in its operational efficiency and product development cycles. By integrating AI and big data, the company aims to accelerate innovation, reduce costs, and deliver even more exceptional vehicles and experiences to its discerning clientele.

Ferrari is aggressively pursuing electrification, targeting 60% of its lineup to be hybrid by 2026, a move driven by regulations like the EU's 2035 ICE ban. This transition demands significant R&D in battery tech and electric powertrains to maintain performance. The company is also a leader in advanced materials, extensively using carbon fiber for weight reduction and performance enhancement, a key differentiator in the supercar segment.

The integration of digital technologies, including advanced infotainment and driver-assistance systems (ADAS), is a growing focus, as seen in models like the Portofino M. Ferrari aims to balance these digital enhancements with its core driving experience, ensuring they complement rather than detract from driver engagement. Furthermore, AI and data analytics are being deployed to optimize design, production, and customer experiences, with AI also playing a crucial role in Ferrari's Formula 1 racing strategies.

Legal factors

Ferrari must navigate a complex web of international vehicle safety standards, such as those set by the UNECE, NHTSA in the US, and Euro NCAP in Europe. These regulations dictate everything from crashworthiness to emissions, requiring significant investment in testing and engineering. For instance, meeting the latest Euro NCAP protocols often involves advanced driver-assistance systems (ADAS) that add substantial development costs.

Adapting designs and conducting rigorous testing for each target market, like the specific requirements for the Chinese market or the evolving safety mandates in North America, adds considerable complexity and expense to Ferrari's product development cycle. This can impact the timeline for new model introductions and necessitate region-specific production adjustments.

Non-compliance with these diverse safety standards can result in severe consequences, including costly recalls, such as those seen across the automotive industry for airbag or braking system issues, and outright bans from selling vehicles in key markets. This underscores the critical importance of proactive and meticulous adherence to global safety regulations for Ferrari's market access and brand reputation.

Ferrari must navigate increasingly stringent global emissions regulations, including evolving CO2 targets and stricter particulate matter limits. These legal frameworks directly influence the company's research and development for engine technology and the composition of its future vehicle lineup.

The imperative to reduce its carbon footprint presents a significant legal challenge, compelling Ferrari to accelerate its transition to hybrid and fully electric powertrain technologies. Failure to comply with these mandates could result in substantial financial penalties and potentially limit market access in key regions.

For instance, the European Union's 2035 ban on the sale of new internal combustion engine cars underscores the urgency of this shift. While Ferrari has a longer lead time for its ultra-luxury segment, the broader regulatory landscape necessitates proactive investment in electrification to ensure long-term viability and compliance.

Ferrari's iconic brand, designs, and technological innovations are fiercely protected through robust intellectual property rights. This legal framework is essential for combating counterfeiting and the unauthorized use of its distinctive logo, which is a cornerstone of its brand value. For instance, in 2023, Ferrari actively pursued legal actions against numerous entities for infringing on its trademarks and designs, underscoring the constant vigilance required to maintain brand exclusivity.

Safeguarding proprietary engine designs and cutting-edge racing technologies is paramount. Ferrari invests heavily in legal measures to prevent the illicit replication or appropriation of its engineering advancements, ensuring its competitive edge and the premium associated with its products. This commitment to legal protection directly translates into the sustained desirability and market value of its luxury automobiles.

Consumer Protection and Warranty Laws

Ferrari must navigate a complex web of consumer protection laws, which are particularly stringent for luxury goods. These regulations cover aspects like product quality guarantees, the duration and scope of warranties, and the expected standards for after-sales service. For instance, in the European Union, the Consumer Rights Directive sets out clear rules regarding faulty goods and the right to repair, replace, or refund, impacting how Ferrari handles customer claims across its key markets.

Adherence to these varying jurisdictional laws is crucial for maintaining brand reputation and avoiding costly legal battles. Ferrari’s commitment to quality is underscored by its warranty programs, which are designed to meet or exceed these legal requirements. A strong warranty framework not only builds customer trust but also mitigates the risk of disputes arising from potential manufacturing defects or performance issues, especially with high-performance vehicles.

- Warranty Compliance: Ferrari's new vehicle warranties typically extend for a significant period, often three years with unlimited mileage, aligning with consumer expectations and legal minimums in major markets like the EU and US.

- After-Sales Service Standards: Regulations often mandate reasonable timeframes for repairs and the availability of spare parts, influencing Ferrari's global service network operations.

- Consumer Rights: Laws such as the EU's Consumer Sales Directive provide consumers with rights concerning defective products, requiring manufacturers like Ferrari to address non-conformities.

- Dispute Resolution: Compliance helps Ferrari avoid penalties and reputational damage, as seen in cases where automotive manufacturers have faced fines for failing to meet consumer protection standards.

Labor Laws and Employment Regulations

Ferrari, as a global luxury automotive manufacturer, must meticulously adhere to diverse labor laws and employment regulations across its operating regions, including Italy, the United States, and China. These regulations govern everything from minimum wage requirements and working hours to employee benefits and termination procedures. For instance, Italy's labor laws, influenced by the EU framework, often mandate specific notice periods for dismissals and robust employee protections, while the US has a more at-will employment system in many states, though federal laws like the Fair Labor Standards Act (FLSA) still apply.

Navigating these legal landscapes is crucial for maintaining operational stability and brand reputation. Non-compliance can lead to significant financial penalties, reputational damage, and disruptions to production. For example, in 2023, companies operating in the EU faced increased scrutiny on fair wages and working conditions, with potential fines for violations. Ferrari's commitment to fair labor practices is not only a legal necessity but also a strategic imperative, influencing employee morale and productivity.

Key aspects of labor law compliance for Ferrari include:

- Compliance with National Minimum Wage Laws: Ensuring all employees are compensated at or above the legally mandated minimum wage in each country of operation.

- Adherence to Working Hour Regulations: Managing overtime, rest breaks, and maximum working hours as stipulated by local laws to prevent employee burnout and legal issues.

- Respect for Collective Bargaining Rights: Engaging with labor unions and employee representatives where applicable, in line with national legislation, to foster positive industrial relations.

- Implementation of Safe Working Conditions: Meeting stringent health and safety standards in manufacturing facilities, a critical component of labor law in most jurisdictions.

Ferrari operates under stringent international safety standards, requiring substantial investment in engineering and testing to meet regulations like Euro NCAP and NHTSA. These standards impact everything from crashworthiness to emissions, influencing product development timelines and costs.

The company must also comply with evolving global emissions regulations, including CO2 targets and particulate matter limits, which are accelerating its transition to hybrid and electric powertrains. Failure to meet these legal mandates can lead to significant financial penalties and market access restrictions, as exemplified by the EU's 2035 ban on new internal combustion engine vehicles.

Ferrari's intellectual property, including its iconic brand, designs, and technological innovations, is legally protected to combat counterfeiting and unauthorized use, crucial for maintaining brand exclusivity and value. In 2023, Ferrari actively pursued legal actions against numerous entities for trademark and design infringements.

Consumer protection laws mandate product quality, warranties, and after-sales service standards, requiring Ferrari to manage customer claims and potential disputes carefully. For instance, the EU's Consumer Rights Directive influences how Ferrari handles product non-conformities and customer guarantees.

Environmental factors

Ferrari is actively working to slash its carbon footprint across all operations. This includes a significant push towards renewable energy sources for its manufacturing facilities and optimizing supply chain logistics to minimize emissions. For instance, by the end of 2023, Ferrari reported that 70% of its energy consumption at its Maranello and Modena sites was covered by renewable sources, a figure it aims to increase further.

The company is also investing in sustainable production practices, such as using recycled materials and developing more eco-friendly manufacturing processes. This commitment is crucial not only for meeting evolving environmental regulations but also for maintaining its premium brand image, which is closely tied to innovation and forward-thinking design.

Ferrari's reliance on high-performance materials, including rare earth elements for advanced electronics and specialized alloys for engine components, makes resource scarcity a significant concern. The automotive sector, in general, saw a 5% increase in raw material costs in 2024, impacting luxury brands like Ferrari. Ensuring a stable and ethically sourced supply chain for these critical inputs is paramount for continued production and brand integrity.

Addressing potential scarcity, Ferrari is exploring the integration of recycled aluminum and carbon fiber composites in its vehicle construction, aiming to reduce reliance on virgin materials. The company's commitment to sustainability extends to responsible mineral sourcing, particularly for battery components in hybrid models, aligning with global efforts to mitigate the environmental impact of mining. This proactive approach is crucial for maintaining long-term supply chain resilience in an increasingly resource-constrained world.

Environmental regulations are tightening globally, pushing luxury automakers like Ferrari to adopt more rigorous waste management and recycling practices. These rules often mandate the responsible disposal and reuse of materials from both manufacturing processes and end-of-life vehicles, impacting operational costs and supply chain strategies.

Ferrari is investing in advanced recycling technologies and robust waste reduction programs across its Maranello facilities to comply with these evolving environmental standards. For instance, by 2024, the European Union's End-of-Life Vehicles (ELV) Directive continues to push for higher recycling rates, with targets for material recovery and a ban on certain hazardous substances.

Water Usage and Pollution Control

Ferrari's manufacturing, particularly its high-performance vehicle production, inherently involves processes that consume significant amounts of water, from cooling systems to parts cleaning. In 2023, the automotive sector globally faced increasing scrutiny regarding water footprint, with many manufacturers setting targets for reduction. Ferrari's commitment to environmental stewardship necessitates advanced water conservation strategies and sophisticated wastewater treatment to prevent the discharge of harmful pollutants into surrounding ecosystems, a critical factor for maintaining operational permits and brand reputation.

Adherence to increasingly stringent water quality regulations is paramount. For instance, the European Union's Water Framework Directive sets ambitious goals for water quality across member states, impacting industrial operations. Ferrari's proactive approach to managing its water usage and pollution control not only ensures compliance but also bolsters its image as a responsible corporate citizen, especially given the environmental consciousness of its luxury consumer base.

- Water Intensity: Ferrari's Maranello plant, like other advanced automotive facilities, utilizes water for various production stages, including paint shops and engine testing.

- Pollution Control: Investments in state-of-the-art wastewater treatment facilities are essential to remove chemicals and heavy metals before any discharge.

- Regulatory Compliance: Ferrari must align with Italian and EU environmental laws, which often include specific limits on chemical oxygen demand (COD) and suspended solids in discharged water.

- Sustainability Goals: Many leading automotive companies, including those in the luxury segment, are setting ambitious targets for water neutrality or significant reductions in water withdrawal by 2030.

Climate Change Impact and Extreme Weather Events

Climate change presents a significant environmental challenge, with increasing frequency of extreme weather events posing risks to Ferrari's operations. These disruptions can affect manufacturing facilities, the global supply chain, and logistics, necessitating adaptive strategies. For instance, strengthening infrastructure against floods or diversifying supply routes are crucial for business continuity.

Assessing climate risks across Ferrari's key sales regions is also paramount. For example, regions prone to heatwaves or severe storms might see impacts on consumer demand or event cancellations. Ferrari's commitment to sustainability, including reducing its carbon footprint, is also an environmental factor influencing its brand perception and market position.

- Increased risk of supply chain disruptions: Extreme weather events, such as floods or storms, can impact the availability and transport of critical components for Ferrari's luxury vehicles.

- Potential damage to manufacturing facilities: Ferrari's production plants, like its Maranello headquarters, could face physical damage from severe weather, leading to temporary shutdowns and production delays.

- Impact on global sales and events: Climate-related events can affect demand in certain regions or disrupt high-profile marketing events and product launches, impacting Ferrari's revenue streams.

- Need for climate-resilient infrastructure: Investments in making facilities and logistics more resilient to climate change are becoming an environmental imperative for long-term operational stability.

Ferrari is actively reducing its environmental impact by increasing its use of renewable energy, aiming for 70% renewable energy coverage at its Maranello and Modena sites by the end of 2023. The company is also focusing on sustainable manufacturing, incorporating recycled materials and eco-friendly processes to align with stricter environmental regulations and maintain its premium brand image.

Resource scarcity is a growing concern, particularly for high-performance materials like rare earth elements and specialized alloys. Raw material costs in the automotive sector saw a 5% increase in 2024, affecting luxury brands. Ferrari is addressing this by exploring recycled aluminum and carbon fiber, and ensuring ethical sourcing for hybrid vehicle battery components.

Tightening environmental regulations, such as the EU's End-of-Life Vehicles Directive, are pushing Ferrari towards enhanced waste management and recycling. The company is investing in advanced recycling technologies and waste reduction programs at its Maranello facilities to meet these evolving standards and improve material recovery rates.

Ferrari is implementing advanced water conservation and sophisticated wastewater treatment strategies to manage its water footprint and comply with regulations like the EU's Water Framework Directive. These efforts are crucial for operational permits, brand reputation, and meeting the environmental expectations of its discerning customer base.

PESTLE Analysis Data Sources

Our Ferrari PESTLE Analysis is meticulously constructed using data from reputable automotive industry publications, global economic indicators, and official regulatory bodies. We incorporate insights from market research firms, environmental agencies, and technological trend reports to ensure a comprehensive understanding of the macro-environment.