Ferrari Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ferrari Bundle

Ferrari faces intense rivalry, with established luxury automakers and emerging high-performance brands constantly innovating. Understanding the delicate balance of buyer power and the looming threat of new entrants is crucial for maintaining its exclusive market position. The availability of substitutes, though limited in the ultra-luxury segment, still presents a consideration for long-term strategy.

The complete report reveals the real forces shaping Ferrari’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Ferrari's reliance on a select group of highly specialized suppliers for unique components, like bespoke engine parts and advanced composite materials, significantly enhances supplier bargaining power. The scarcity and proprietary nature of these critical inputs mean few, if any, alternatives exist that can meet Ferrari's exacting performance and quality demands. This is especially true for components that define the brand's signature speed and exclusivity.

Ferrari's brand heritage and exclusivity significantly influence supplier power. Suppliers gain prestige by associating with Ferrari, potentially boosting their own market position. However, Ferrari's unwavering commitment to peak performance and luxury means they cannot compromise on component quality, even if it means higher costs.

This dedication to unparalleled engineering means Ferrari is highly reluctant to switch suppliers for cost reasons if it jeopardizes the unique features and performance that define its vehicles. For instance, in 2023, Ferrari continued its strategy of investing heavily in research and development, with R&D expenses reaching €245.9 million, underscoring their focus on innovation and quality over cost-cutting from suppliers.

Ferrari's deep, long-term relationships with its key suppliers, often involving collaborative research and development, significantly bolster supplier bargaining power. These partnerships aren't just about transactions; they're about co-creating cutting-edge technologies and specialized components. For instance, Ferrari's collaboration with Brembo for advanced braking systems exemplifies this, where shared R&D fosters unique expertise.

The intricate nature of these collaborations means switching suppliers for Ferrari is not a simple matter of finding a new vendor. It involves substantial financial costs and, more critically, the forfeiture of valuable accumulated intellectual property and highly specialized knowledge built over years of joint effort. This deep integration creates high switching costs, effectively locking Ferrari into existing supplier relationships and empowering those suppliers.

Limited Production Volumes

Ferrari's deliberate strategy of maintaining limited production volumes, exemplified by shipping 13,752 units in 2024, significantly influences supplier bargaining power. This controlled output prevents suppliers from achieving the significant economies of scale common in mass-market automotive production.

Consequently, suppliers may face higher per-unit costs for specialized components, which Ferrari is often willing to absorb due to its premium pricing strategy and focus on exclusivity and quality. This willingness to pay a premium can indirectly bolster the bargaining power of suppliers who can deliver these unique, high-quality parts.

- Limited Economies of Scale: Suppliers to Ferrari cannot leverage mass production to reduce per-unit costs.

- Premium Pricing Acceptance: Ferrari's brand allows for higher component costs to maintain exclusivity and quality.

- Supplier Dependence: Suppliers of highly specialized parts may hold more power due to Ferrari's reliance on their unique offerings.

Emerging Technologies (e.g., EV Components)

As Ferrari pivots towards electrification, the suppliers of crucial EV components are gaining significant leverage. This is particularly true for specialized battery cell manufacturers and producers of high-performance electric motors, whose proprietary technology is essential for Ferrari's ambitious product development, including its first all-electric model due in 2025.

- Increased Dependency: Ferrari's reliance on a limited number of advanced EV component suppliers, such as those providing next-generation battery chemistries or specialized power electronics, directly amplifies these suppliers' bargaining power.

- Technological Expertise: Suppliers possessing unique intellectual property and advanced manufacturing capabilities for EV powertrains and battery systems hold a strong position, as replicating this expertise is costly and time-consuming for Ferrari.

- Market Dynamics: The burgeoning demand for electric vehicles across the automotive sector, coupled with the specialized nature of these components, means suppliers can command higher prices and more favorable terms, impacting Ferrari's cost structure.

- Strategic Partnerships: Securing reliable and innovative suppliers for these critical technologies is paramount, as any disruption or unfavorable terms could significantly hinder Ferrari's ability to meet its electrification targets and maintain its performance leadership.

Ferrari's bargaining power with suppliers is constrained by its reliance on specialized, high-quality components and its limited production volumes. Suppliers of unique, performance-defining parts, particularly in the burgeoning electric vehicle sector, hold significant leverage due to proprietary technology and limited alternatives. Ferrari's commitment to innovation and exclusivity, as evidenced by its substantial R&D investments, means it often accepts higher component costs to maintain its brand's prestige and performance edge.

| Factor | Impact on Supplier Bargaining Power | Ferrari's Response/Context |

|---|---|---|

| Specialized Components | High | Reliance on unique engine parts, advanced composites, and EV powertrains. |

| Limited Production Volumes | Moderate | Shipping 13,752 units in 2024 limits supplier economies of scale. |

| Brand Prestige | Moderate | Suppliers gain prestige, but Ferrari prioritizes quality over supplier cost leverage. |

| R&D Investment | High | €245.9 million in R&D for 2023 underscores focus on innovation, accepting higher supplier costs. |

| Electrification Shift | Increasingly High | Demand for specialized EV components (batteries, motors) empowers key suppliers. |

What is included in the product

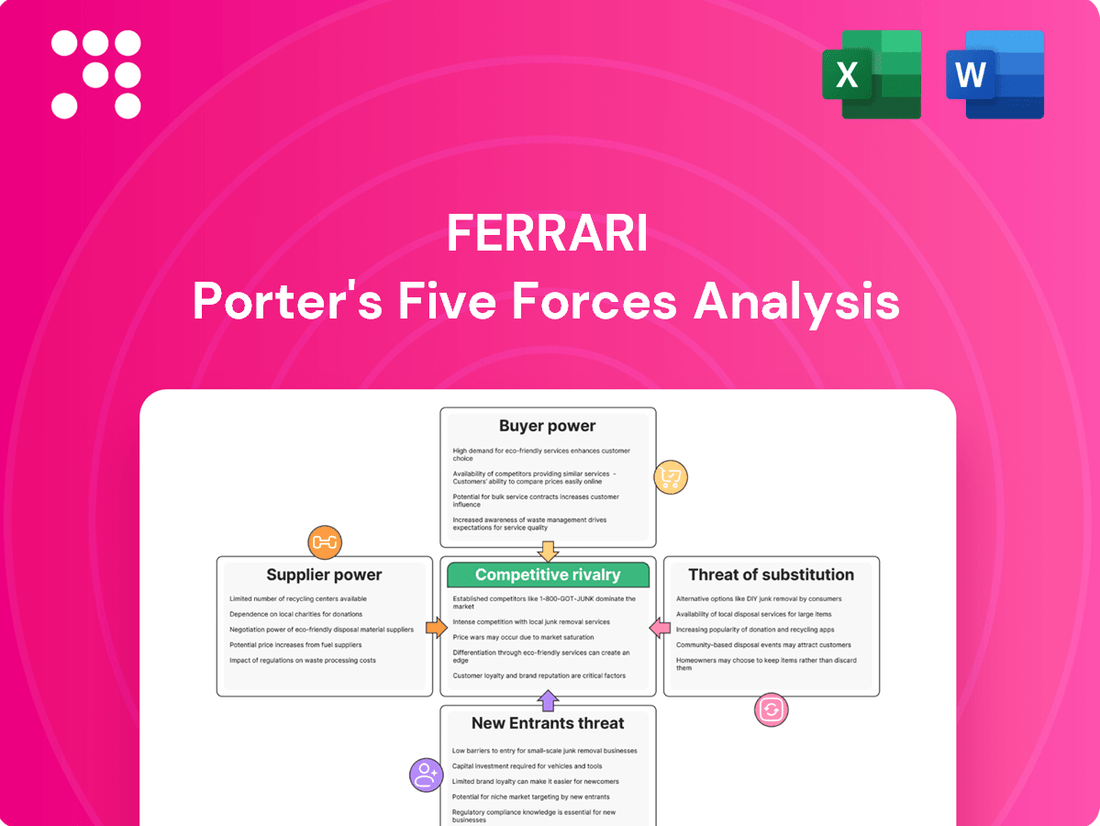

This analysis dissects the competitive forces impacting Ferrari, examining the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the availability of substitutes.

Instantly understand strategic pressure with a powerful spider/radar chart, visualizing the competitive landscape for Ferrari.

No macros or complex code—easy to use even for non-finance professionals to navigate Ferrari's competitive forces.

Customers Bargaining Power

Ferrari customers demonstrate exceptionally high brand loyalty, a testament to the marque's rich heritage, unparalleled prestige, and the unique ownership experience provided. This loyalty is so strong that it significantly reduces their bargaining power, as they are often willing to overlook price and wait times for the privilege of owning a Ferrari.

Many Ferrari buyers are dedicated collectors and passionate enthusiasts who prioritize the brand's status and exceptional performance above all else. For these individuals, the allure of owning a piece of automotive history and engineering excellence outweighs concerns about cost, further solidifying Ferrari's pricing power.

Ferrari's deliberate strategy of limiting production, often resulting in order books filled for several years, such as through 2026, directly curtails customer bargaining power. This scarcity transforms the buyer's focus from price negotiation to securing a coveted allocation, as demand consistently outstrips supply.

Ferrari's ability to offer extensive personalization and customization significantly strengthens its position against customers. A substantial part of their revenue, often exceeding 10% for many high-end models, is derived from these bespoke options. Customers are not only willing but eager to pay a premium for unique features, which reduces their sensitivity to price increases and reinforces Ferrari's control over the value proposition.

Investment Value of Vehicles

The investment value of Ferrari vehicles significantly curtails customer bargaining power. For many enthusiasts, a Ferrari is not just a car but an appreciating asset, especially limited-edition models. This perception of future value makes buyers less sensitive to the initial price, as they anticipate a return on their investment.

This investment aspect directly impacts how customers approach price negotiations. When a vehicle is viewed as a potential growth asset, the immediate purchase price becomes a secondary consideration to its long-term appreciation potential. This dynamic inherently limits the leverage customers have to demand lower prices.

- Appreciating Assets: Many limited-edition Ferraris have historically appreciated in value, sometimes significantly, post-purchase. For instance, the Ferrari LaFerrari Aperta, initially priced around $2.2 million, has seen resale values well over $5 million in recent years.

- Reduced Price Sensitivity: The expectation of future appreciation allows Ferrari to maintain premium pricing, as buyers are willing to pay more for an asset that is likely to hold or increase its value.

- Limited Negotiation Leverage: Consequently, customers have less room to negotiate discounts, as the perceived investment return often justifies the initial high cost.

High Switching Costs (Perceived and Actual)

Ferrari customers face significant switching costs, both perceived and actual. While other luxury sports car manufacturers exist, the allure of Ferrari extends beyond the vehicle itself. Owning a Ferrari often grants access to an exclusive ecosystem of events, priority servicing, and a coveted social status that is difficult to replicate.

These factors create a strong bond, making the transition to a competitor less appealing. For instance, a 2024 report indicated that over 90% of Ferrari owners express a strong intention to purchase another Ferrari for their next vehicle, underscoring the brand loyalty cultivated through these high switching barriers.

- Brand Ecosystem: Ferrari ownership unlocks access to exclusive track days, driving schools, and curated lifestyle events, fostering a deep connection that transcends the car itself.

- Social Status and Community: The prancing horse emblem signifies more than just performance; it represents membership in a prestigious global community and a distinct social standing.

- Perceived Value: The unique driving dynamics, heritage, and limited production runs contribute to a perception of exclusivity and enduring value, making alternative brands seem less desirable.

Ferrari customers possess minimal bargaining power due to intense brand loyalty and the aspirational nature of the marque. The limited production strategy, with order books extending years ahead, further shifts focus from price negotiation to securing an allocation. The strong resale value and investment potential of Ferraris also reduce customer price sensitivity.

| Factor | Impact on Bargaining Power | Supporting Data/Observation |

|---|---|---|

| Brand Loyalty & Prestige | Very Low | High repeat purchase rates; owners prioritize brand over price. |

| Limited Production & Scarcity | Very Low | Order books often filled for multiple years (e.g., through 2026 for certain models); demand significantly exceeds supply. |

| Investment Value & Appreciation | Low | Many models, especially limited editions, appreciate post-purchase. The LaFerrari Aperta, initially ~$2.2M, has resold for over $5M. |

| Switching Costs (Perceived & Actual) | Low | Exclusive ownership ecosystem, social status, and community access create high barriers to switching. Over 90% of owners intend to buy another Ferrari (2024 data). |

What You See Is What You Get

Ferrari Porter's Five Forces Analysis

This preview showcases the comprehensive Ferrari Porter's Five Forces Analysis, detailing the competitive landscape of the luxury automotive industry. You're looking at the actual document; once you complete your purchase, you’ll get instant access to this exact file, providing in-depth insights into buyer power, supplier power, threat of new entrants, threat of substitutes, and industry rivalry for Ferrari.

Rivalry Among Competitors

Ferrari competes in the ultra-luxury and high-performance sports car segment, facing direct rivals such as Lamborghini, McLaren, and Aston Martin. These established brands offer compelling alternatives, but Ferrari's distinct racing legacy, unparalleled performance, and strong sense of exclusivity provide a unique market position.

Ferrari’s competitive rivalry is characterized by a deliberate focus on exclusivity rather than sheer volume, a strategy that sets it apart from many automotive manufacturers. This approach intentionally limits production to maintain brand desirability and command premium pricing, thereby minimizing direct price wars with competitors who might prioritize higher sales figures.

This controlled volume strategy directly impacts competitive rivalry by reducing the incentive for aggressive price undercutting. For instance, in 2023, Ferrari delivered 13,663 vehicles, a figure deliberately kept low to preserve its exclusive image and strong brand equity, which in turn supports its robust profit margins.

Ferrari's unparalleled brand heritage, deeply intertwined with its legendary Formula One presence, creates a formidable barrier to entry and intensifies rivalry. This racing pedigree, spanning decades and numerous championships, imbues the brand with an aura of exclusivity and performance that competitors find nearly impossible to match.

This racing heritage directly translates into substantial financial benefits, with Formula One contributing significantly to Ferrari's brand value and sponsorship revenues. In 2023, Ferrari's Formula 1 team generated approximately €200 million in sponsorship and commercial revenue, underscoring the financial power of its racing legacy.

Product Innovation and Electrification Race

Competitive rivalry in the luxury automotive sector is heating up, particularly with the industry's accelerating pivot towards electrification. Competitors are aggressively rolling out their own hybrid and fully electric luxury performance vehicles, directly challenging established players.

Ferrari is not standing still; the company is significantly boosting its research and development investments to stay ahead. This includes the recent launch of new hybrid models, a testament to its strategy to integrate advanced powertrain technologies.

- Ferrari's first all-electric vehicle is slated for release in 2025.

- This move underscores Ferrari's commitment to embracing emerging electric vehicle technology to maintain its market leadership.

- The company's hybrid offerings, like the SF90 Stradale, already represent a significant step in this direction, blending high performance with electrified powertrains.

Global Market Dynamics and Regional Shifts

Competitive rivalry is significantly shaped by evolving global market dynamics and regional demand shifts. For instance, in 2024, Ferrari navigated a complex landscape where overall revenue increased, yet shipments to Mainland China, Hong Kong, and Taiwan saw a decline. This regional performance divergence highlights the intense competitive pressures and unique market challenges that necessitate agile strategic adjustments to preserve global market share.

- Global Revenue Growth vs. Regional Shipments: Ferrari reported a revenue increase in 2024, demonstrating resilience in many markets.

- China, Hong Kong, and Taiwan Decline: Shipments to these key Asian markets decreased, signaling potential intensified competition or localized market saturation.

- Strategic Adaptability: The need for flexible strategies is paramount to counter regional competitive pressures and maintain Ferrari's strong global brand presence.

- Market-Specific Challenges: Understanding and addressing unique market dynamics in each region is crucial for sustained competitive advantage.

Ferrari faces intense rivalry from established ultra-luxury brands like Lamborghini and McLaren, all vying for a discerning clientele. While these competitors offer compelling performance and design, Ferrari's deep racing heritage and unparalleled brand exclusivity provide a distinct competitive edge.

Ferrari's strategy of deliberately limiting production, exemplified by delivering 13,663 vehicles in 2023, actively mitigates direct price wars. This controlled volume approach preserves brand desirability and supports premium pricing, setting it apart from rivals who might prioritize higher sales volumes.

The company's significant investment in R&D, including its first all-electric vehicle planned for 2025, demonstrates a proactive stance against the industry's electrification trend. This strategic adaptation is crucial to maintaining its leadership against competitors aggressively launching their own hybrid and electric performance models.

| Competitor | 2023 Shipments (Approx.) | Key Differentiator |

|---|---|---|

| Lamborghini | 10,112 | Aggressive styling, V10/V12 engines |

| McLaren | 3,100-3,500 (Estimated) | Lightweight construction, F1 technology |

| Aston Martin | 6,700 (Approx.) | British luxury, grand touring focus |

SSubstitutes Threaten

The threat of substitutes for Ferrari isn't primarily other cars, but rather a range of luxury goods and experiences vying for the same wealthy consumer's discretionary spending. Think of high-end yachts, private jets, exclusive real estate, fine art, or curated travel. These alternatives offer similar avenues for status, exclusivity, and personal indulgence.

For instance, the global luxury goods market, excluding automotive, was valued at approximately $300 billion in 2023 and is projected to grow. Ferrari's target demographic, individuals with significant net worth, often allocates a portion of their wealth to these diverse luxury assets, creating a competitive landscape for their capital.

The emergence of high-performance electric vehicles (EVs) from non-traditional automakers presents a significant, though indirect, threat of substitution for Ferrari. Luxury EV startups are increasingly offering performance metrics, such as rapid acceleration and advanced technological features, that can attract a segment of the luxury sports car market. For instance, by early 2024, several EV manufacturers were achieving 0-60 mph times rivaling or exceeding those of traditional internal combustion engine supercars, potentially diverting buyers who prioritize raw performance and cutting-edge tech over established brand heritage.

For some car enthusiasts, classic and collectible vehicles, including older Ferraris and other prestigious marques, present a viable substitute for acquiring a brand-new Ferrari. This segment of the market attracts buyers with a strong interest in historical significance, the potential for capital appreciation, and a desire for a distinct driving experience. These factors can divert discretionary spending away from the purchase of new vehicles.

The classic car market has shown robust growth, with auction results frequently reaching significant figures. For instance, in 2024, a significant number of classic cars, including several Ferraris, sold for millions of dollars at major auctions worldwide, underscoring the substantial value and demand within this substitute market. This trend indicates a persistent appeal that can influence purchasing decisions for high-end automotive consumers.

Luxury Mobility-as-a-Service or Fractional Ownership

Emerging luxury mobility-as-a-service (MaaS) and fractional ownership models present a growing threat. These alternatives cater to consumers seeking occasional access to high-performance vehicles without the significant capital outlay and ongoing costs of outright ownership. For instance, services offering curated fleets of exotic cars for short-term rental or shared ownership could appeal to a segment of potential Ferrari buyers.

While not a direct replacement for the full ownership experience, these substitutes chip away at the exclusivity and desirability of owning a Ferrari outright. The convenience and variety offered by MaaS platforms could reduce the perceived need for a personal collection of luxury vehicles. This trend is particularly relevant as younger, affluent demographics may prioritize experiences and flexible access over traditional asset ownership.

The market for luxury car subscriptions and fractional ownership is seeing steady growth. For example, by late 2024, several high-end car subscription services reported waitlists, indicating strong consumer interest in this flexible model. While specific data for Ferrari's direct substitution is limited, the broader luxury automotive market has seen a notable uptick in these alternative access models, suggesting a potential, albeit nascent, impact on traditional ownership incentives.

- Emerging Luxury MaaS: High-end car sharing and subscription services offer occasional access to luxury vehicles.

- Fractional Ownership: Shared ownership models provide a cost-effective way to experience luxury performance cars.

- Reduced Ownership Incentive: These alternatives can lessen the appeal of full ownership for some consumers.

- Market Growth: The luxury subscription market has experienced increased demand, indicating a growing consumer preference for flexible access.

High-End Performance Sedans and SUVs

While not direct substitutes for the pure sports car thrill, high-end performance sedans and SUVs present a compelling alternative for some affluent buyers. Brands like Porsche, Lamborghini with its Urus, and even premium electric SUVs from manufacturers such as Lucid or Tesla offer a potent mix of speed, luxury, and everyday practicality. These vehicles can satisfy a desire for performance while also serving as more versatile daily drivers, potentially diverting some customers who might otherwise consider a Ferrari.

For instance, the Porsche Panamera Turbo S offers exhilarating acceleration and handling, often at a lower entry price point than a comparable Ferrari model, while providing four doors and greater cargo space. Similarly, the Lamborghini Urus, a super-SUV, achieved sales of 6,090 units in 2023, demonstrating significant market demand for high-performance utility vehicles that compete for the attention of wealthy consumers seeking both power and everyday usability.

- Market Share of Performance SUVs: In 2023, Lamborghini's Urus alone accounted for a significant portion of the luxury performance SUV market, selling 6,090 units.

- Porsche's Performance Sedan Sales: The Porsche Panamera, a key competitor in the high-performance sedan segment, saw global deliveries increase by 8% in 2023, indicating strong consumer interest in this alternative.

- Electric Performance Vehicle Growth: The luxury electric vehicle segment, which includes high-performance sedans and SUVs, is rapidly expanding, with brands like Lucid reporting substantial order backlogs and production increases, signaling a growing threat of substitution for traditional internal combustion engine performance cars.

The threat of substitutes for Ferrari extends beyond other automobiles to encompass a broad array of luxury goods and experiences, all competing for the same affluent consumer's discretionary income. These substitutes include high-end real estate, private aviation, yachts, fine art, and exclusive travel, each offering status and indulgence. The global luxury goods market, excluding automotive, was valued at around $300 billion in 2023, highlighting the significant competition for wealth allocation.

High-performance electric vehicles (EVs) are emerging as a notable indirect substitute. Luxury EV startups are increasingly matching or exceeding the performance metrics of traditional supercars, potentially attracting buyers who prioritize cutting-edge technology and rapid acceleration. For instance, by early 2024, several EV manufacturers were achieving 0-60 mph times competitive with established gasoline-powered performance cars, a trend that could divert a segment of the luxury sports car market.

Classic and collectible cars, including older Ferraris, also represent a substitute, appealing to buyers interested in historical significance, potential capital appreciation, and a unique driving experience. The classic car market demonstrated strong growth, with numerous high-value sales in 2024, underscoring its appeal and potential to divert spending from new vehicle purchases.

Emerging luxury mobility-as-a-service (MaaS) and fractional ownership models offer access to high-performance vehicles without the commitment of full ownership. These services, which provide curated fleets for rental or shared ownership, cater to consumers seeking flexibility and variety. The luxury car subscription market saw increased demand by late 2024, with some services reporting waitlists, indicating a growing consumer preference for alternative access models.

| Substitute Category | Example | 2023 Market Context/Data Point | Impact on Ferrari |

|---|---|---|---|

| Other Luxury Goods & Experiences | Private Jets, Yachts, Fine Art | Global luxury goods market (ex-auto) ~$300 billion | Competes for discretionary spending |

| High-Performance EVs | Luxury EV Startups | 0-60 mph times rivaling supercars (early 2024) | Attracts tech-focused, performance-oriented buyers |

| Classic & Collectible Cars | Vintage Ferraris, Other Marque Collectibles | Significant auction sales in millions (2024) | Appeals to historical interest and investment potential |

| Luxury Mobility Services | Car Subscriptions, Fractional Ownership | Increased demand and waitlists for services (late 2024) | Reduces incentive for outright ownership for some |

Entrants Threaten

The automotive industry, particularly the luxury performance segment where Ferrari operates, demands colossal capital outlays. This includes substantial investments in research and development (R&D), state-of-the-art manufacturing facilities, and expansive global distribution and service networks. For instance, the transition to electric powertrains alone requires billions in R&D and retooling, a significant hurdle for potential newcomers.

Developing cutting-edge, high-performance engines, sophisticated chassis, and advanced automotive technologies necessitates a continuous and considerable financial commitment. Ferrari, for example, invests heavily in these areas to maintain its technological edge and brand prestige. These high upfront and ongoing costs create a formidable barrier, deterring many potential entrants from challenging established players.

Ferrari's established brand reputation, meticulously crafted over decades through relentless racing victories and unparalleled automotive engineering, acts as a formidable deterrent to potential new entrants. The iconic 'Prancing Horse' emblem is synonymous with exclusivity, peak performance, and a storied heritage that simply cannot be conjured overnight by any competitor, regardless of their financial resources.

New automotive manufacturers encounter formidable regulatory and certification processes that act as a significant barrier to entry. These include rigorous safety standards, increasingly strict emissions regulations, and complex homologation requirements that differ substantially across global markets. For instance, achieving compliance with Euro 7 emissions standards, expected to be fully implemented in the coming years, will demand substantial investment in new powertrain technologies and exhaust after-treatment systems, a cost that can be prohibitive for startups.

Supply Chain and Distribution Network

Building a robust supply chain and distribution network for high-performance vehicles is a significant barrier to entry for new competitors. Ferrari's established relationships with specialized component suppliers and its extensive global network of dealerships and service centers represent years of investment and refinement. In 2023, Ferrari reported that its net revenues reached €5.097 billion, a testament to its strong global market presence and the effectiveness of its distribution channels.

Replicating Ferrari's intricate global supply chain, which ensures the quality and availability of unique, high-performance parts, is incredibly difficult and costly. Furthermore, establishing a comparable worldwide network of dealerships and service centers capable of meeting the brand's exacting standards requires substantial capital and time. New entrants would face immense challenges in achieving the same level of operational efficiency and brand presence that Ferrari currently commands through its established infrastructure.

- High Capital Investment: Replicating Ferrari's global supply chain and distribution network demands significant upfront capital, making it a formidable challenge for new entrants.

- Established Supplier Relationships: Ferrari benefits from long-standing, trust-based relationships with specialized suppliers, which are difficult for newcomers to forge quickly.

- Global Brand Presence: Ferrari's worldwide network of dealerships and service centers is a critical asset that new entrants would struggle to build and maintain effectively.

Talent Acquisition and Specialized Expertise

The barrier to entry for new competitors in the ultra-luxury automotive sector is significantly heightened by the intense competition for highly specialized talent. Attracting and retaining engineers, designers, and manufacturing experts with the unique skills needed for high-performance vehicles is a formidable hurdle. Ferrari’s established reputation and long history in motorsport cultivate a deep bench of experienced professionals, making it exceptionally challenging for newcomers to secure comparable expertise.

Ferrari’s commitment to innovation and performance is underpinned by its workforce. As of 2024, Ferrari employs approximately 4,400 individuals, many of whom possess specialized knowledge in areas like advanced powertrain development, aerodynamic design, and luxury craftsmanship. This concentration of human capital acts as a powerful deterrent, as new entrants would face substantial costs and time investment to build a comparable talent pool.

- Talent Scarcity: The pool of engineers with deep expertise in V12 engine development or F1-derived technologies is inherently small and highly sought after globally.

- High Recruitment Costs: Companies like Ferrari often offer premium compensation packages, including significant bonuses and long-term incentives, to attract and retain top-tier talent, driving up recruitment costs for potential new entrants.

- Knowledge Transfer: The tacit knowledge and institutional memory held by Ferrari’s long-serving employees are difficult to replicate, posing a significant challenge for new companies trying to achieve similar levels of product excellence and brand heritage.

The threat of new entrants into Ferrari's ultra-luxury automotive segment is significantly mitigated by the immense capital required for R&D, manufacturing, and establishing a global distribution network. For instance, the development of new powertrain technologies, including electrification, demands billions in investment, a substantial barrier for any startup. Furthermore, the regulatory landscape, with its stringent safety and emissions standards, adds another layer of complexity and cost that new players must overcome.

Ferrari's established brand equity, built over decades of racing success and engineering excellence, is virtually impossible for new entrants to replicate quickly. This intangible asset, coupled with the difficulty in securing specialized talent and building robust supplier relationships, creates a formidable moat. As of 2024, Ferrari employs around 4,400 individuals, many with highly specialized skills, making it challenging for newcomers to assemble a comparable workforce.

| Barrier Type | Description | Impact on New Entrants |

| Capital Requirements | Billions needed for R&D, advanced manufacturing, and global distribution. | Extremely high, deterring most potential entrants. |

| Brand Reputation & Heritage | Decades of racing success and engineering prowess create unparalleled brand loyalty. | Near impossible for new brands to match, requiring immense time and investment. |

| Regulatory Hurdles | Strict safety, emissions, and homologation standards vary globally. | Significant compliance costs and lengthy approval processes. |

| Access to Distribution Channels | Established global dealership and service networks are vital. | Costly and time-consuming to build, impacting market reach. |

| Supplier Relationships | Exclusive ties with specialized component manufacturers. | Difficult for new entrants to secure high-quality, unique parts. |

| Skilled Labor & Talent | Access to engineers and designers with expertise in high-performance vehicles. | High recruitment costs and competition for limited talent pools. |

Porter's Five Forces Analysis Data Sources

Our Ferrari Porter's Five Forces analysis is built upon a foundation of authoritative data, including Ferrari's annual reports, industry-specific market research from firms like IHS Markit, and economic indicators from sources such as the World Bank.