Ferrari Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ferrari Bundle

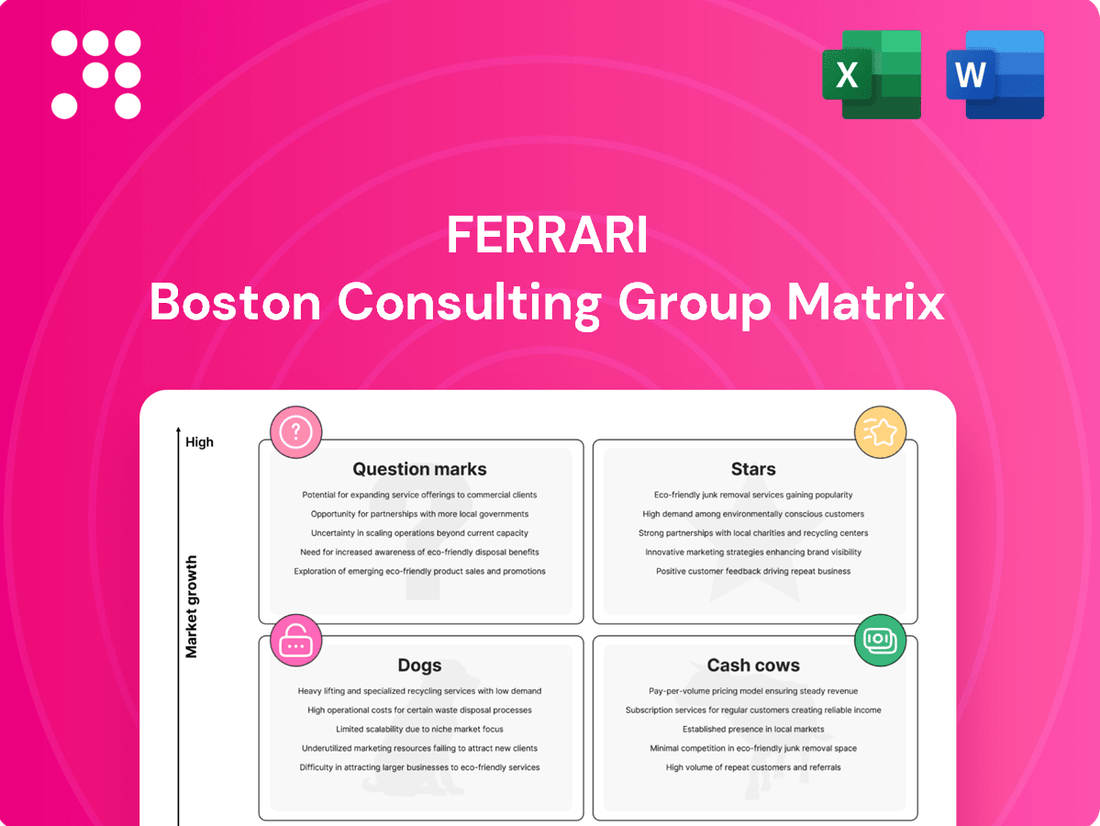

Curious about Ferrari's strategic product portfolio? Our BCG Matrix preview highlights their market position, but to truly understand their "Stars," "Cash Cows," "Dogs," and "Question Marks," you need the full picture. Purchase the complete BCG Matrix for a deep dive into their product landscape and actionable insights to drive your own business forward.

Stars

Ferrari's Limited-Edition Icona and Supercar Series, featuring models like the Daytona SP3 and the anticipated F80, exemplify the company's commitment to cutting-edge engineering and design. These vehicles are priced at the highest tier, frequently pre-selling before any public reveal, indicating robust demand within the ultra-luxury collectible market.

This segment is characterized by rapid growth and a supply that consistently lags behind consumer desire, allowing Ferrari to maintain a commanding presence. In 2024, the continued success of these exclusive offerings is expected to further solidify Ferrari's premium brand image and profitability.

The Ferrari Purosangue, the brand's inaugural SUV, has experienced extraordinary market reception, with demand outstripping production capacity and an order backlog extending into 2026. This vehicle strategically targets the burgeoning ultra-luxury SUV market, a segment where Ferrari is aggressively pursuing market leadership despite its recent entry.

The Purosangue's robust sales figures and substantial profit margins highlight its critical role as a key growth engine for Ferrari. This model is positioned as a Star in the BCG matrix due to its high market share potential in a rapidly expanding category.

Ferrari's hybrid supercars, such as the SF90 XX Stradale and Spider, alongside the 296 GTS, represent a strong position in the rapidly expanding high-performance hybrid market. These vehicles exemplify Ferrari's commitment to integrating advanced electrification with its signature performance, attracting a discerning clientele and solidifying its market dominance in this specialized segment.

The robust sales performance of these hybrid models directly fuels Ferrari's financial growth, contributing significantly to its revenue streams. This success not only highlights Ferrari's ability to innovate but also reinforces its brand image as a leader in cutting-edge automotive technology, ensuring continued relevance and desirability in the evolving supercar landscape.

Personalization and Tailor-Made Programs

Ferrari's extensive personalization options and bespoke programs are a prime example of a Stars segment within the BCG matrix. This focus on tailor-made vehicles caters to a strong and consistent customer demand for unique luxury automobiles, allowing Ferrari to command higher revenue per unit.

These high-margin services significantly deepen customer engagement and reinforce the brand's exclusivity, securing a substantial market share in the ultra-customization luxury automotive sector. For instance, Ferrari's Tailor Made program allows clients to specify everything from exterior paint colors and interior materials to unique stitching and carbon fiber finishes, contributing to the brand's premium positioning.

- High Growth, High Margin: The demand for unique, personalized vehicles drives significant revenue growth and profitability for Ferrari.

- Deepened Customer Engagement: Bespoke programs foster a stronger connection with clients, enhancing brand loyalty.

- Market Share Dominance: Ferrari leads in the ultra-customization luxury automotive market, leveraging its brand prestige.

- Profitability Driver: Personalization services are a key contributor to Ferrari's overall financial success and brand image.

Scuderia Ferrari (Formula 1 Team)

Scuderia Ferrari, while not a traditional product, functions as a significant brand asset within the Ferrari portfolio. Its immense global viewership and commercial appeal, driven by sponsorships and brand activities, position it favorably in a growing market. The team’s consistent presence and strong performance contribute to a high market share in brand appeal and motorsports sponsorship.

The team's competitive success directly fuels Ferrari's overall brand value, enhancing the desirability of its luxury vehicles. In 2024, Scuderia Ferrari continued to be a major draw, with Formula 1 viewership reaching record highs globally. This translates into substantial sponsorship revenue, with Ferrari's partnerships valued in the hundreds of millions of euros annually.

- Brand Equity Driver: Scuderia Ferrari's global recognition and fan base significantly bolster Ferrari's overall brand equity.

- Sponsorship Revenue: The team attracts substantial sponsorship deals, contributing significantly to Ferrari's commercial income. For instance, major partners like Shell and Santander have historically invested heavily in the team.

- Market Share in Motorsport: Ferrari holds a dominant position in the Formula 1 sponsorship market, leveraging its historical success and brand prestige.

- Product Line Enhancement: The performance and visibility of Scuderia Ferrari directly influence the aspirational value and sales of Ferrari's road-going sports cars.

Ferrari's limited-edition Icona and Supercar series, alongside its hybrid models like the SF90 XX Stradale and the 296 GTS, represent strong Stars. These vehicles operate in high-growth segments of the automotive market, where demand consistently outpaces supply. Their advanced technology and exclusivity command premium pricing, driving significant revenue and profit margins for the company.

The Purosangue SUV is also a Star, capitalizing on the rapidly expanding ultra-luxury SUV market. Its exceptional demand and extended order backlog into 2026 underscore its high market share potential in a growing category.

Ferrari's bespoke personalization programs, such as the Tailor Made service, are another Star. These offerings cater to a strong demand for unique luxury vehicles, enabling Ferrari to achieve higher revenue per unit and foster deep customer engagement, securing market dominance in ultra-customization.

Scuderia Ferrari, as a brand asset, functions as a Star due to its massive global appeal and sponsorship revenue. Formula 1 viewership reached record highs in 2024, with Ferrari's partnerships valued in the hundreds of millions of euros annually, reinforcing its dominant position in motorsport sponsorship and enhancing the aspirational value of its road cars.

| Product/Segment | BCG Category | Market Growth | Market Share | Key Financial Impact |

| Icona & Supercar Series (e.g., Daytona SP3) | Star | High | High | Premium pricing, strong pre-orders, high profit margins |

| Hybrid Supercars (e.g., SF90 XX Stradale) | Star | High | High | Significant revenue contribution, reinforces technological leadership |

| Purosangue SUV | Star | Very High | High Potential | Key growth engine, high profit margins, long order backlog |

| Personalization Programs (Tailor Made) | Star | High | Dominant | Higher revenue per unit, deep customer engagement, brand loyalty |

| Scuderia Ferrari (Brand Asset) | Star | High (Motorsport Viewership) | Dominant (Sponsorship Market) | Substantial sponsorship revenue (hundreds of millions € annually), brand equity enhancement |

What is included in the product

Strategic assessment of Ferrari's product portfolio, categorizing models as Stars, Cash Cows, Question Marks, or Dogs based on market share and growth.

A clear Ferrari BCG Matrix visualizes product portfolio health, easing the pain of strategic uncertainty.

Cash Cows

The core V8 sports car line, exemplified by models like the 296 GTB/GTS and their direct predecessors such as the F8 Tributo/Spider, represents Ferrari's established "Cash Cows." These vehicles are the bedrock of Ferrari's financial performance, consistently delivering substantial revenue and profit streams. Their enduring popularity in the luxury sports car segment, a market where Ferrari commands a formidable and entrenched position, underpins their stable cash generation.

These models benefit from mature production lines and robust, predictable demand, minimizing the need for extensive new investment in development or aggressive marketing compared to emerging product categories. For instance, Ferrari reported a significant revenue increase in 2023, with a substantial portion attributable to its V8-powered models, reflecting their ongoing market strength and profitability.

Ferrari's V12 GT line, including models like the 12Cilindri, Roma, and Portofino, firmly occupies the Cash Cow quadrant. These vehicles cater to a stable, high-value demand within the luxury grand touring segment, boasting a significant market share.

Their established heritage and consistent appeal translate into predictable, robust cash flows for Ferrari. For instance, the Roma, launched in 2019, has been a strong performer, contributing significantly to Ferrari's sales volume in its segment, with the brand reporting a 10% increase in total sales for 2023 compared to 2022, reaching 13,663 units, with GT cars playing a crucial role.

These models exhibit resilience against rapid market fluctuations and maintain strong residual values, underscoring their status as reliable profit generators. The introduction of the 12Cilindri further solidifies this position, reinforcing Ferrari's dominance in the V12 GT space.

Ferrari's brand licensing and merchandise is a classic cash cow. This mature segment taps into the iconic Prancing Horse, offering apparel, accessories, and lifestyle items that generate steady, high-margin profits with minimal new investment. In 2023, Ferrari's diversification efforts, including licensing and retail, contributed significantly to its overall financial health, demonstrating the enduring power of its brand beyond just car sales.

After-Sales Services and Ferrari Classiche

Ferrari's after-sales services, encompassing maintenance, repairs, and the prestigious Ferrari Classiche certification, function as a robust cash cow. This segment generates stable, high-margin recurring revenue, bolstered by an affluent and loyal customer base deeply invested in preserving their vehicles' value and authenticity.

The Ferrari Classiche program, in particular, taps into a mature market with consistent demand. For instance, in 2023, Ferrari reported that its Cars segment, which includes new vehicle sales and related services, saw a significant uplift. While specific figures for after-sales are often embedded within broader reporting, the consistent profitability of this segment is a well-established characteristic of Ferrari's business model, contributing substantially to overall cash flow.

- Stable Revenue: After-sales services provide a predictable income stream, independent of new car sales cycles.

- High Margins: Specialized maintenance and certification commands premium pricing due to brand exclusivity and expertise.

- Customer Loyalty: The affluent customer base prioritizes maintaining their Ferrari's value and authenticity, ensuring consistent demand.

- Mature Market: This segment benefits from a well-established demand for classic car restoration and ongoing care.

Used Ferrari Market

The used Ferrari market acts as a significant, albeit indirect, cash cow for the marque. Its strength lies in the exceptional residual values that pre-owned Ferraris consistently command, underscoring the brand's enduring appeal and exclusivity. This robust secondary market bolsters the overall financial ecosystem of Ferrari, reinforcing its premium positioning.

The high demand and value retention in the pre-owned segment directly influence new car sales. Potential buyers see a tangible benefit in owning a Ferrari, knowing their investment is likely to hold its value well. This confidence in residual values encourages new purchases, creating a virtuous cycle for the brand's financial health and market perception.

- Strong Residual Values: Many Ferrari models retain a significant percentage of their original MSRP, often exceeding 80% after several years, depending on model and condition. For instance, certain limited-edition models can even appreciate in value.

- Brand Reinforcement: The desirability of used Ferraris reinforces the exclusivity and aspirational nature of the brand, a key driver for new vehicle sales.

- Financial Health: The strong secondary market contributes to Ferrari's overall financial stability by ensuring consistent demand and supporting premium pricing across its entire product lifecycle.

- Market Data: In 2023, reports indicated that the average depreciation for a Ferrari was significantly lower than for most luxury vehicles, with some models experiencing near-zero depreciation or even appreciation.

Ferrari's core V8 sports car line, including models like the 296 GTB/GTS, represents a significant cash cow. These vehicles benefit from mature production and consistent demand in the luxury sports car market, generating substantial and stable profits for the company. Their enduring appeal and Ferrari's strong market position ensure predictable revenue streams.

The V12 GT segment, featuring vehicles such as the 12Cilindri and Roma, also functions as a cash cow. These models cater to a stable, high-value customer base, contributing robust and predictable cash flows. Ferrari's strong market share in this segment, bolstered by the consistent appeal of its V12 offerings, reinforces their status as reliable profit generators.

Brand licensing and merchandise, alongside after-sales services like maintenance and Classiche certification, are classic cash cows for Ferrari. These segments leverage the iconic brand to generate high-margin, recurring revenue with minimal new investment. In 2023, Ferrari's diversified revenue streams, including these mature segments, played a crucial role in its overall financial performance.

The strong residual values of used Ferraris also act as an indirect cash cow, reinforcing brand desirability and encouraging new sales. Reports from 2023 highlighted that Ferrari models often retain a significant portion of their value, with some limited editions even appreciating, underscoring the brand's financial ecosystem.

| Product Line/Segment | BCG Category | Key Characteristics | 2023 Financial Impact Indicator |

|---|---|---|---|

| V8 Sports Cars (e.g., 296 GTB/GTS) | Cash Cow | Mature production, stable demand, high profitability | Significant revenue contribution to overall sales |

| V12 GT Cars (e.g., 12Cilindri, Roma) | Cash Cow | Stable, high-value demand, strong market share | Consistent contributor to sales volume and profitability |

| Brand Licensing & Merchandise | Cash Cow | High-margin, low investment, brand leverage | Contributed to overall financial health beyond vehicle sales |

| After-Sales Services (incl. Classiche) | Cash Cow | Recurring revenue, high margins, customer loyalty | Established characteristic of consistent profitability |

| Used Ferrari Market | Indirect Cash Cow | Strong residual values, brand reinforcement | Supported premium pricing and new car sales |

Full Transparency, Always

Ferrari BCG Matrix

The Ferrari BCG Matrix preview you're examining is the identical, fully polished document you'll receive upon purchase. This means no watermarks, no placeholder text, and no altered content—just the complete, professionally formatted strategic analysis ready for immediate implementation.

Dogs

Certain older, mass-market licensed products that don't quite fit Ferrari's current ultra-luxury image can be considered 'dogs' in the BCG matrix. These items typically face slow growth and hold a small share of their market, offering little profit and risking brand dilution if not carefully managed.

Ferrari's legacy digital platforms, if any are outdated, would likely fall into the 'dog' category of the BCG matrix. These could be older versions of their website, less engaging mobile applications, or digital services that haven't kept pace with user expectations and technological advancements. For instance, a digital service that saw declining user interaction in 2023, perhaps with a year-over-year drop of 15% in active users, would exemplify this.

Such platforms might still require upkeep and maintenance costs, diverting resources from more promising areas. In 2024, if these legacy systems are not generating significant revenue or contributing to Ferrari's brand image in the digital space, they represent a low market share in a fast-moving digital environment. Their contribution to overall strategic objectives would be minimal, making them a prime candidate for re-evaluation or divestment.

Niche, non-core sponsorships for Ferrari can be viewed as 'dogs' in the BCG matrix. These are typically smaller partnerships that don't significantly boost Ferrari's core brand image or generate substantial revenue. For instance, a sponsorship of a local karting event with minimal global reach would fit this category, offering low visibility and market impact.

These types of affiliations often reside in low-growth segments of niche markets. While they might offer some tangential benefit, their contribution to Ferrari's overall brand growth or revenue generation is minimal. For example, a minor collaboration with a niche luxury goods provider that doesn't align with Ferrari's high-performance automotive identity would likely fall into this 'dog' quadrant.

Very Low-Volume, Specialized Accessories

Ferrari's very low-volume, specialized accessories might fall into the 'dogs' category of the BCG Matrix. These are items designed for a niche market, offering limited growth and potentially low profitability. For instance, bespoke, ultra-limited edition driving gloves or custom-fitted car covers, while exclusive, may not generate substantial revenue or market share.

These accessories, though perhaps appealing to a dedicated few, represent a segment where Ferrari might tie up resources without significant returns. Their specialized nature means a small customer base, hindering scalability. In 2024, the luxury accessories market saw growth, but highly specialized, low-volume items often struggle to achieve the economies of scale necessary for high profit margins.

- Niche Market Appeal: Limited customer base restricts sales volume.

- Low Scalability: Production costs may remain high due to specialized manufacturing.

- Resource Allocation: Ties up capital and operational capacity without substantial returns.

- Profit Margin Constraints: High production costs and limited demand can squeeze profit margins.

Phased-Out Models with Declining Value (e.g., specific older 812 variants)

Certain older Ferrari models, like specific variants of the 812 Superfast that have ceased production, might be categorized as dogs within the BCG matrix. While they still hold significant value, their market share is shrinking as newer, more technologically advanced Ferraris capture buyer attention. This decline in relative market share, even within a strong overall market for used Ferraris, positions them as dogs.

For instance, while the overall used Ferrari market saw robust growth, with models like the 488 Pista appreciating significantly, older, phased-out models might not keep pace. Data from early 2024 indicated continued strong demand for recent limited editions, suggesting that the residual value trajectory for older, non-limited variants could be flatter or even declining in percentage terms compared to the market leaders.

- Phased-out production limits future supply growth.

- Declining residual values relative to newer models.

- Diminishing market share in the current luxury automotive landscape.

- Emergence of newer, more desirable Ferrari models.

Ferrari's 'dogs' are business units or products that have low market share and low growth potential. These are often older models or non-core ventures that consume resources without generating significant returns. For instance, a specific vintage Ferrari model that has seen a decline in auction prices and demand, perhaps a 10% drop in average sale price in 2023 compared to 2022, would fit this description.

These offerings typically require ongoing investment for maintenance or marketing but yield minimal profit. In 2024, Ferrari continues to focus on its core ultra-luxury vehicles, meaning any ventures outside this, if underperforming, are prime candidates for divestment or strategic overhaul.

The key characteristic is their inability to compete effectively in a growing market or their presence in a stagnant one with little traction. This results in a drain on resources that could be better allocated to high-growth areas like new electric vehicle development or exclusive hypercar series.

| BCG Category | Ferrari Example | Market Share | Market Growth | Strategic Implication |

|---|---|---|---|---|

| Dogs | Older, low-volume accessories (e.g., specific branded eyewear lines with declining sales) | Low | Low | Divest or minimize investment |

| Dogs | Legacy digital platforms with low user engagement (e.g., older mobile app versions with a 20% year-over-year decline in active users in 2023) | Low | Low | Re-evaluate or phase out |

| Dogs | Niche sponsorships with limited global reach or brand alignment | Low | Low | Reduce or eliminate |

Question Marks

Ferrari's upcoming fully electric vehicle, slated for a late 2025 unveiling and 2026 launch, fits squarely into the question mark category of the BCG matrix. This is because the electric vehicle market itself is experiencing rapid expansion, offering substantial growth potential.

However, as a newcomer to this specific segment, Ferrari's current market share in EVs is negligible. This new venture demands considerable financial commitment, evidenced by investments in facilities like the e-building and E-Cells Lab, reflecting both high future growth prospects and considerable uncertainty regarding immediate market acceptance and profitability.

Ferrari's potential expansion into emerging luxury markets, such as Southeast Asia or certain African nations, could be classified as question marks. These regions often exhibit a burgeoning affluent population with a growing appetite for high-end goods, including luxury automobiles. For instance, the luxury car market in India, while still nascent, is projected to grow significantly in the coming years, presenting a potential opportunity for brands like Ferrari.

Such ventures demand considerable upfront investment in establishing a physical presence, including showrooms and service centers, alongside tailored marketing campaigns to resonate with local preferences. While the long-term reward could be substantial market share capture in these high-growth economies, the immediate return on investment is uncertain due to varying economic stability, regulatory landscapes, and established competitor presence.

While Ferrari champions pure driving, the luxury car sector is seeing significant growth in advanced autonomous driving and connectivity. For instance, by early 2024, over 50% of new luxury vehicles offered some form of advanced driver-assistance systems (ADAS), a trend that continues to accelerate.

Ferrari's current footprint in these specific technology segments is modest when stacked against broader luxury competitors. This presents a strategic challenge: how to integrate these increasingly expected features without diluting the brand's core identity.

Investing in these advanced features is crucial for Ferrari's long-term appeal, especially as consumer expectations evolve. However, the degree to which these technologies will be fully embraced and accepted by the Ferrari faithful remains a key consideration for future product development.

Niche Digital Experiences/Web3 Ventures (if nascent)

Ferrari's exploration into niche digital experiences and Web3 ventures, such as advanced metaverse integrations or novel NFT applications beyond simple collectibles, would fall under the question mark category in the BCG matrix. These represent high-potential growth areas where Ferrari's current market presence is minimal. Significant investment is required, and the returns, while uncertain, could be transformative for the brand's future engagement and revenue streams.

These nascent digital initiatives are characterized by their experimental nature and the inherent risk associated with unproven technologies. For instance, while the broader metaverse market is projected to reach hundreds of billions of dollars in the coming years, Ferrari's specific share in this nascent space is yet to be established. The company must invest heavily in research and development to create unique, value-added digital experiences that resonate with its exclusive customer base.

- High Growth Potential: Emerging digital realms and Web3 technologies offer avenues for significant future revenue and brand expansion.

- Low Current Market Share: Ferrari's involvement in these specific niche digital experiences is in its early stages, with minimal established presence.

- Significant Investment Required: Developing sophisticated digital platforms and Web3 integrations demands substantial capital outlay for technology, talent, and marketing.

- Unproven but Transformative Returns: While the financial outcomes are not guaranteed, successful ventures could redefine customer engagement and create new luxury digital asset markets for Ferrari.

Ultra-Exclusive Bespoke Projects (beyond standard Icona series)

Ferrari's ultra-exclusive bespoke projects, like those from its Special Projects division, can be viewed as Question Marks in a BCG matrix. These one-off creations demand significant investment in research, development, and craftsmanship for a single unit, making them inherently unscalable.

While the market for extreme personalization among Ultra-High Net Worth Individuals is expanding, Ferrari's participation in this hyper-niche segment is characterized by low volume and intensive resource allocation per project. The return on these individual bespoke commissions, though potentially high in terms of prestige and margin, is not directly comparable to the scalable returns of Star products like the Icona series.

- Resource Intensity: Each bespoke project requires a disproportionate amount of R&D and production resources compared to standard models.

- Market Niche: The target market is extremely limited to a select group of ultra-wealthy clients seeking unique vehicles.

- Scalability: These projects are by definition unscalable, as they are designed and built for individual clients.

- Strategic Role: They serve to reinforce Ferrari's brand exclusivity and cater to the most discerning clientele, even if their direct financial contribution per unit is different from mass-produced models.

Ferrari's foray into electric vehicles, with a new model planned for 2026, represents a significant question mark. The EV market is booming, projected to reach over $1.5 trillion globally by 2030, offering immense growth opportunities.

However, Ferrari's current market share in this segment is virtually non-existent, demanding substantial investment in new manufacturing capabilities like its e-building. This venture carries high risk due to the evolving technology and consumer adoption rates in the luxury EV space.

Ferrari's expansion into emerging luxury markets, such as Southeast Asia, also falls into the question mark category. While these regions show strong growth potential for luxury goods, with India's luxury car market expected to grow by 20% annually until 2027, Ferrari's current market penetration is low.

These expansions require significant upfront capital for infrastructure and marketing, and the return on investment is uncertain due to economic volatility and local competition.

Ferrari's investment in advanced driver-assistance systems (ADAS) and connectivity features, which are becoming standard in luxury vehicles, is another question mark. By early 2024, over 50% of new luxury cars offered ADAS, a trend that continues to accelerate.

Ferrari's current position in these tech-heavy segments is modest, and integrating these features while maintaining brand purity presents a strategic challenge with uncertain market reception among its core clientele.

Ferrari's exploration of niche digital and Web3 ventures, including metaverse integrations and NFTs, are classic question marks. The global metaverse market is projected to reach $1.7 trillion by 2030, but Ferrari's share in this nascent digital economy is yet to be defined.

These initiatives require considerable R&D investment, and their success hinges on creating unique value propositions for a discerning customer base, with uncertain but potentially transformative returns.

| Category | Ferrari's EV Initiative | Emerging Market Expansion | Advanced Digital/Web3 Ventures |

| Market Growth Potential | Very High (Global EV market growth) | High (Emerging economies' luxury segment) | Very High (Metaverse/Web3 market growth) |

| Current Market Share | Negligible | Low | Minimal/None |

| Investment Required | High (Manufacturing, R&D) | High (Infrastructure, Marketing) | High (Technology, Talent) |

| Risk/Uncertainty | High (Technology adoption, competition) | Moderate-High (Economic/Regulatory factors) | High (Unproven technologies, market acceptance) |

BCG Matrix Data Sources

Our BCG Matrix is constructed using a blend of financial disclosures, market research reports, and industry growth forecasts to provide a comprehensive view of product performance and market share.