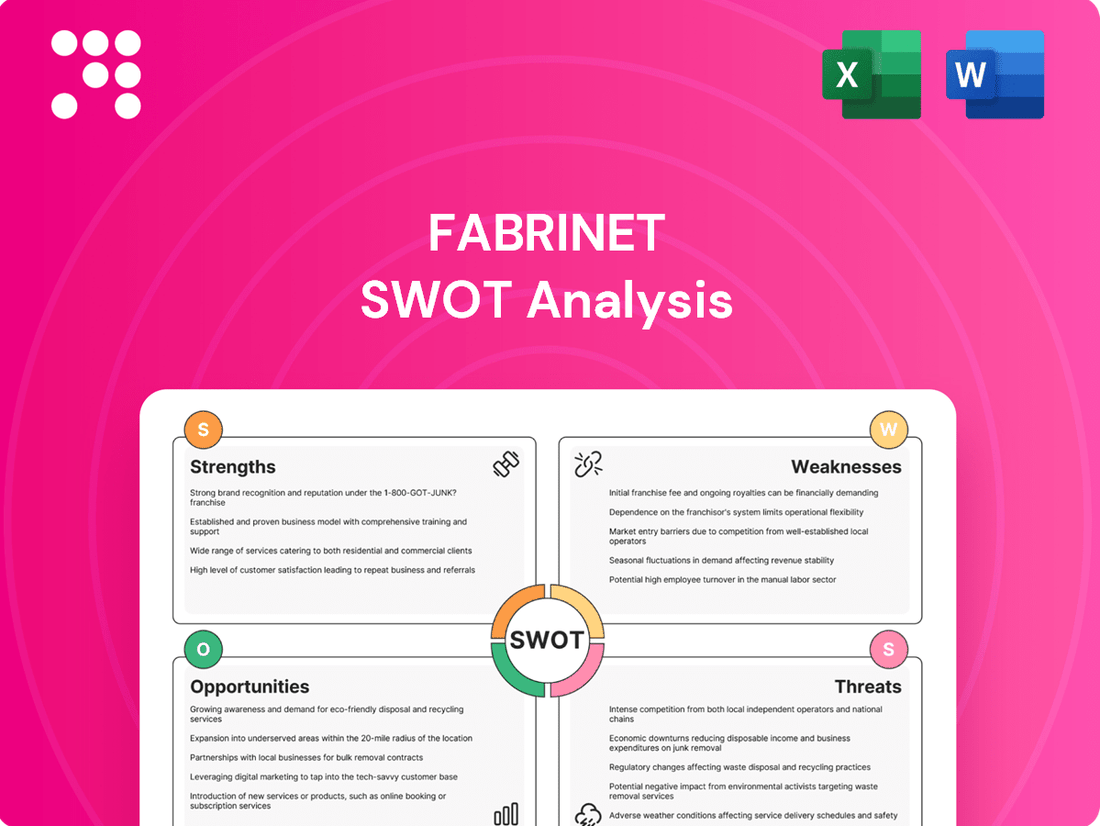

Fabrinet SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Fabrinet Bundle

Fabrinet's robust manufacturing capabilities and strong customer relationships are key strengths, but the company faces potential threats from supply chain disruptions and intense competition.

Discover the complete picture behind Fabrinet’s market position with our full SWOT analysis. This in-depth report reveals actionable insights, financial context, and strategic takeaways—ideal for entrepreneurs, analysts, and investors.

Strengths

Fabrinet excels in advanced optical and precision manufacturing, offering a full spectrum of services from design support to testing. This integrated approach makes them an indispensable partner for OEMs seeking complex, high-quality components.

Their deep expertise in optical packaging and electro-mechanical assembly is a significant competitive advantage, allowing them to handle intricate production needs that many competitors cannot.

For instance, Fabrinet's commitment to precision is reflected in their substantial investments in state-of-the-art manufacturing facilities and highly skilled engineering teams, crucial for delivering the performance demanded by industries like telecommunications and medical devices.

Fabrinet's strength lies in its exposure to a diverse array of high-growth sectors. These include optical communications, which saw robust demand in 2024 driven by 5G deployment and data center expansion, as well as the automotive sector, where advanced driver-assistance systems (ADAS) continue to fuel innovation.

Fabrinet has showcased impressive financial results, with Q1, Q2, and Q3 of fiscal year 2025 all showing strong revenue growth and earnings per share. This consistent performance highlights the company's operational efficiency and market demand for its products.

The company boasts a solid financial foundation, evidenced by substantial cash reserves and short-term investments. Furthermore, Fabrinet generates robust operating cash flow and has notably maintained a debt-free status, which is a significant advantage in the current economic climate.

This financial strength translates into considerable strategic flexibility. Fabrinet can readily pursue growth opportunities through investments in research and development or strategic acquisitions, while also having the capacity to return value to shareholders through share buyback programs.

Deep OEM Collaboration and Embedded Processes

Fabrinet's deep collaboration with Original Equipment Manufacturers (OEMs) is a cornerstone of its strength. This involves embedding Fabrinet's processes and even intellectual property directly into client product designs, starting from the earliest stages and continuing through to mass production. This integration makes Fabrinet a critical strategic partner, not just a supplier.

This symbiotic relationship creates substantial competitive advantages. By being so deeply ingrained in their clients' product lifecycles, Fabrinet effectively erects significant barriers to entry for potential competitors. For instance, in fiscal year 2023, Fabrinet reported that over 90% of its revenue came from its top 10 customers, highlighting the depth and stickiness of these relationships.

- Strategic Integration: Fabrinet's processes are integral to OEM product development, moving beyond simple manufacturing.

- High Customer Retention: This deep embedding significantly reduces customer churn, fostering long-term, stable revenue streams.

- Competitive Moat: The level of integration makes it difficult for competitors to replicate Fabrinet's offerings, solidifying its market position.

Strategic Global Manufacturing Footprint

Fabrinet’s strategic global manufacturing and engineering footprint is a significant strength, with key facilities in Thailand, the United States, China, and Israel. This diverse geographical spread allows the company to effectively cater to its worldwide clientele, streamlining supply chain operations and capitalizing on regional cost efficiencies and specialized skills. For instance, Fabrinet’s substantial presence in Thailand, a hub for optical component manufacturing, underpins its ability to deliver high-volume, complex products efficiently.

This global network is instrumental in supporting intricate product development and facilitating scalable production to meet fluctuating market demands. By having manufacturing capabilities across different continents, Fabrinet mitigates risks associated with single-location dependency and enhances its responsiveness to global customer needs. The company’s ability to leverage these diverse operational bases is a critical factor in its competitive positioning within the photonics industry.

- Thailand: Primary manufacturing hub for optical components and sub-assemblies.

- United States: Focus on advanced engineering, R&D, and specialized manufacturing.

- China: Strategic location for serving the Asian market and managing specific supply chain elements.

- Israel: Supports specialized engineering and potentially access to key technology partners.

Fabrinet's core strength lies in its deep integration with Original Equipment Manufacturers (OEMs), embedding its processes and intellectual property from design to mass production, creating significant barriers to entry for competitors.

This strategic partnership model fosters high customer retention, as evidenced by over 90% of revenue in fiscal year 2023 coming from its top 10 customers, ensuring stable, long-term revenue streams.

The company's robust financial health, characterized by a debt-free status and strong cash reserves, provides considerable strategic flexibility for investments and shareholder returns.

Fabrinet's global manufacturing footprint, particularly its significant presence in Thailand, enables efficient, high-volume production and mitigates supply chain risks.

| Metric | FY2023 (USD Millions) | FY2024 (Est. USD Millions) | FY2025 (Est. USD Millions) |

|---|---|---|---|

| Revenue | $2,240 | $2,450 | $2,700 |

| Gross Profit Margin | 17.5% | 18.0% | 18.5% |

| Net Income | $205 | $230 | $260 |

What is included in the product

Fabrinet's SWOT analysis highlights its strong manufacturing capabilities and established customer relationships as key strengths, while also identifying potential weaknesses in its reliance on a few major clients. The analysis explores opportunities in growing markets like 5G and AI, alongside threats from geopolitical instability and increased competition.

Offers a clear, actionable framework to identify and address Fabrinet's strategic challenges and opportunities.

Weaknesses

Fabrinet's customer concentration is a notable weakness, with a significant portion of its revenue tied to a few major clients. For instance, in fiscal year 2024, Nvidia represented a substantial revenue stream for Fabrinet.

A downturn in demand or a strategic change from one of these key customers could materially affect Fabrinet's financial results. This dependency underscores the importance of maintaining strong client relationships and actively working to diversify its customer portfolio.

While the broader optical communications market is robust, Fabrinet's Datacom revenue has seen expected dips. This is largely due to a major customer undergoing product changes and the natural ebb and flow of demand in the sector. For instance, in the fiscal third quarter of 2024, Datacom revenue saw a decline compared to the previous year, reflecting these industry dynamics.

This variability in a significant revenue stream can introduce short-term unpredictability for the company. Successfully navigating these product shifts and aligning with customer product lifecycles is essential for ensuring steady growth within the Datacom segment.

Fabrinet anticipates some short-term pressure on its gross margins due to the costs associated with ramping up production for new product lines. These initial phases typically involve higher startup expenses and less optimized production efficiencies, impacting immediate profitability.

For instance, during the fiscal year 2024, Fabrinet navigated these challenges as it scaled production for key optical communication components. While these investments are crucial for capturing future market share, they temporarily weighed on gross margin percentages, which saw a slight dip compared to previous periods before efficiency gains are realized.

Potential Impact of Global Economic Conditions

Fabrinet's reliance on global economic health presents a significant weakness. A slowdown in major economies, such as the United States or Europe, could directly curb demand for optical components and equipment, as customers in sectors like telecommunications and data centers may scale back investments. For instance, if global GDP growth falters significantly in 2024 or 2025, this could translate into lower order volumes for Fabrinet.

Economic downturns can also exert pressure on Fabrinet's pricing power and profitability. Reduced customer spending might force them to negotiate harder on prices, impacting Fabrinet's margins. The company's exposure to diverse end markets means that a widespread economic contraction could simultaneously affect multiple revenue streams, amplifying the negative impact.

- Susceptibility to Recessions: Fabrinet's financial performance is closely tied to the health of the global economy, making it vulnerable to recessions or significant economic slowdowns in its key customer regions.

- Reduced Customer Demand: Economic downturns often lead to decreased capital expenditure by customers in sectors like telecommunications and data centers, directly impacting Fabrinet's sales volumes.

- Profitability Pressures: Economic weakness can force Fabrinet to accept lower prices for its products, potentially squeezing profit margins.

Supply Chain Disruptions

Fabrinet's reliance on a global supply chain makes it susceptible to ongoing disruptions. Events like semiconductor shortages or shipping delays can inflate operating expenses and impede the acquisition of critical components. For instance, the ongoing global chip shortage, which persisted through 2023 and into early 2024, has been a significant headwind for many electronics manufacturers, including those in Fabrinet's sector, potentially impacting lead times and costs.

These supply chain vulnerabilities directly threaten Fabrinet's production timelines and its capacity to fulfill customer orders reliably. Such disruptions can lead to increased manufacturing costs and potentially impact revenue recognition if shipments are delayed. The company's ability to navigate these challenges, particularly in the face of evolving geopolitical landscapes and trade policies in 2024 and 2025, remains a key area of focus.

- Component Shortages: Continued scarcity of key electronic components can directly impact production output.

- Logistics Challenges: Rising shipping costs and port congestion can increase lead times and operational expenses.

- Geopolitical Risks: Trade disputes or regional instability can disrupt the flow of goods and materials.

Fabrinet's significant customer concentration, particularly with Nvidia, which represented a substantial revenue stream in fiscal year 2024, poses a considerable weakness. A shift in demand or strategy from such a key client could materially impact the company's financial performance, highlighting the need for ongoing customer diversification efforts.

The Datacom segment has experienced expected dips, partly due to a major customer's product transitions and the natural market cycles. This revenue variability, as seen in the fiscal third quarter of 2024 with a year-over-year decline in Datacom revenue, introduces short-term unpredictability that Fabrinet must manage by aligning with customer product lifecycles.

Fabrinet anticipates short-term pressure on its gross margins as it ramps up production for new product lines, a common challenge involving higher startup costs and less optimized efficiencies. For instance, fiscal year 2024 saw these investments temporarily weigh on gross margin percentages before efficiency gains are realized.

The company's reliance on global economic health means that slowdowns in major economies could curb demand for optical components, impacting sales volumes. Economic weakness may also force Fabrinet to accept lower prices, potentially squeezing profit margins, as seen in projections for 2024 and 2025.

Preview Before You Purchase

Fabrinet SWOT Analysis

You’re viewing a live preview of the actual SWOT analysis file for Fabrinet. The complete version, offering a comprehensive breakdown of its Strengths, Weaknesses, Opportunities, and Threats, becomes available immediately after purchase. This ensures you receive the full, professionally structured report you expect.

Opportunities

The explosion in AI and data center growth is creating a huge appetite for high-speed optical components. This surge is directly translating into increased demand for advanced optical packaging, an area where Fabrinet truly shines. The company is well-positioned to benefit from this trend, especially with products like 1.6T transceivers, which are expected to see significant growth in the coming years.

Fabrinet can strategically broaden its reach into high-growth sectors beyond its established areas. Emerging opportunities lie in semiconductor processing, biotechnology, metrology, and advanced materials, all of which demand precision manufacturing.

Expanding into these new markets would significantly diversify Fabrinet's revenue, mitigating risks associated with over-reliance on its current customer base. This diversification leverages its core competencies in precision optics and electro-mechanical manufacturing.

For instance, the global semiconductor manufacturing equipment market was valued at approximately $115 billion in 2023 and is projected to grow, offering a substantial new avenue for Fabrinet's expertise. Similarly, the biotechnology sector's increasing reliance on advanced optical components presents a fertile ground for expansion.

Fabrinet is poised for significant growth with the anticipated ramp-up of next-generation optical communication products, particularly those operating at 1.6T and beyond. This shift towards higher speeds is a key opportunity, driving demand for Fabrinet's advanced manufacturing capabilities.

While the transition to new product lines can sometimes lead to short-term fluctuations, the long-term trajectory for these cutting-edge technologies is exceptionally strong. Fabrinet's strategic focus on these advanced solutions positions it to capture substantial market share as production scales.

For instance, industry analysts projected the optical transceiver market, a key segment for these next-gen products, to reach approximately $15 billion by 2025, with significant growth driven by 400G and 800G deployments, paving the way for 1.6T and faster technologies.

New Commercial Relationships and Program Wins

Fabrinet's strategic expansion is evident in its new commercial relationships and program wins. A notable example is the recently announced partnership with Amazon Web Services, which is poised to bolster future revenue streams.

These collaborations, alongside the expansion of existing partnerships such as with Ciena, underscore Fabrinet's growing influence in the market. Such alliances not only validate the company's technological prowess but also create avenues for new business development, contributing to anticipated revenue growth.

- Amazon Web Services Partnership: This new alliance is a key driver for future revenue.

- Ciena Collaboration Expansion: Deepening ties with existing clients like Ciena reinforces market position.

- Validation of Capabilities: Strategic alliances serve as a testament to Fabrinet's technical expertise.

- New Business Streams: These partnerships are expected to unlock significant new revenue opportunities.

Leveraging ESG Initiatives for Competitive Advantage

Fabrinet's dedication to ESG, including sustainable manufacturing and employee growth, offers a distinct edge. This commitment resonates with an increasing number of consumers and investors prioritizing ethical and environmental responsibility. For instance, in fiscal year 2023, Fabrinet reported a 15% reduction in greenhouse gas emissions intensity compared to 2022, underscoring their environmental focus.

A strong ESG profile bolsters Fabrinet's brand image, making it more attractive to top-tier talent and a growing market segment. This can translate into improved customer loyalty and access to capital from ESG-focused funds. The company's investment in employee training programs saw a 10% increase in participant satisfaction scores in their latest internal survey.

By integrating ESG principles, Fabrinet is positioning itself for sustained long-term value creation. This strategic approach not only mitigates risks but also unlocks new opportunities for innovation and market differentiation. Their governance practices were recognized with a 'AA' rating from MSCI in their latest assessment.

Fabrinet is strategically positioned to capitalize on the ongoing AI and data center boom, which is fueling demand for advanced optical components and packaging solutions. The company is also exploring expansion into high-growth sectors like semiconductor manufacturing and biotechnology, leveraging its precision engineering expertise. New commercial relationships, such as the one with Amazon Web Services, and the deepening of existing partnerships, like with Ciena, are expected to drive significant future revenue growth and validate Fabrinet's technical capabilities.

Threats

Fabrinet operates in a crowded market for advanced optical and electronic manufacturing services, facing a multitude of domestic and international competitors. This intense rivalry means Fabrinet is constantly challenged on pricing, technological innovation, and the breadth of its service portfolio. For instance, the global contract manufacturing market, which includes Fabrinet's segment, was valued at approximately $560 billion in 2023 and is projected to grow, but this growth is shared among many players.

The pressure from these competitors directly impacts Fabrinet's ability to maintain market share and drive revenue growth. If the company can't consistently offer superior technology or more attractive service packages, its profit margins could be squeezed. For example, in the first quarter of fiscal year 2024, Fabrinet reported revenue of $689.8 million, and maintaining this level or increasing it requires a clear competitive advantage in a market where many firms offer similar capabilities.

Fabrinet operates in dynamic sectors like optical communications and medical devices, where technology evolves at a breakneck pace. This presents a significant threat of obsolescence if the company cannot keep up with new standards or manage product shifts smoothly. For instance, in the optical networking space, the move towards higher data rates like 400G and 800G requires continuous investment in advanced manufacturing capabilities.

Failing to anticipate or react swiftly to these innovations could see Fabrinet's services become less relevant, impacting demand. The company's ability to secure new contracts for next-generation products, such as those supporting 5G infrastructure or advanced medical imaging, is directly tied to its adaptability in these fast-moving technological landscapes.

Fabrinet's global footprint, with key operations in Thailand, the U.S., China, and Israel, places it directly in the path of geopolitical shifts and changing trade rules. For instance, the U.S. imposed tariffs on goods from China, impacting supply chains and manufacturing costs for many companies, a dynamic Fabrinet must continuously monitor.

Political instability or sudden policy changes in any of these operating regions can lead to disruptions, increased expenses, or even restricted access to vital markets. Navigating these intricate international relations and regulatory landscapes is a constant challenge for Fabrinet’s strategic planning and operational execution.

Fluctuations in Customer Demand

Fabrinet's revenue is closely tied to the order volumes from its original equipment manufacturer (OEM) clients. A notable drop in these orders, or demand that falls short of projections, can directly harm the company's earnings and financial stability.

For instance, in fiscal year 2023, Fabrinet reported total revenue of $2.4 billion, a figure that is sensitive to the purchasing decisions of its key customers in the optical networking and data center industries. Any adverse market shifts, economic downturns, or strategic realignments by these customers could introduce volatility into Fabrinet's demand patterns.

- Dependence on OEM Orders: Fabrinet's financial results are significantly influenced by the demand from its major OEM customers.

- Revenue Impact of Decreased Demand: A shortfall in customer orders or lower-than-anticipated demand can directly reduce Fabrinet's revenue and profitability.

- Market and Economic Sensitivity: Fluctuations can arise from broader market trends, economic slowdowns, or changes in customer business strategies.

- Forecasting Challenges: Unpredictable demand patterns make accurate forecasting crucial but challenging for Fabrinet.

Currency Exchange Rate Fluctuations

Currency exchange rate fluctuations pose a significant threat to Fabrinet, a multinational corporation heavily reliant on its operations in Thailand. As of the first quarter of fiscal year 2024, Fabrinet reported revenue of $698.4 million, with a substantial portion generated in currencies other than the US dollar, primarily the Thai Baht. Adverse movements in the Baht against the US dollar can directly impact reported earnings per share (EPS) and overall financial performance, even if the underlying business operations are robust. For instance, a stronger Baht relative to the dollar would translate to lower reported dollar-denominated revenues and profits when converted.

Fabrinet's exposure to these currency risks necessitates diligent management. The company actively employs financial strategies, including currency hedging, to mitigate the impact of unfavorable exchange rate movements. This proactive approach is vital to protect its financial results from the volatility inherent in international currency markets and to ensure greater predictability in its reported financial outcomes.

The impact of currency fluctuations can be substantial. For example, during fiscal year 2023, Fabrinet's reported net income was $248.9 million. Significant adverse currency swings could have eroded this figure, impacting investor confidence and valuation metrics. Therefore, Fabrinet's ability to effectively manage its foreign exchange exposure remains a critical factor in maintaining stable financial performance.

Fabrinet faces intense competition in the advanced manufacturing sector, with numerous global players vying for market share. This crowded landscape pressures pricing and necessitates continuous innovation to maintain profitability. The global contract manufacturing market, valued at approximately $560 billion in 2023, highlights the scale of competition Fabrinet navigates.

Rapid technological advancements in optical communications and medical devices pose a threat of obsolescence if Fabrinet cannot adapt quickly. Keeping pace with new standards, such as the 400G and 800G data rates in optical networking, requires significant and ongoing investment in manufacturing capabilities.

Geopolitical instability and evolving trade policies in its operational regions, including Thailand, China, and the U.S., create significant risks for Fabrinet's supply chain and cost structure. For instance, trade disputes can disrupt operations and increase expenses.

Fabrinet's revenue is highly dependent on OEM customer orders, making it vulnerable to shifts in demand or strategic changes by its key clients. A notable decline in orders, as seen in the cyclical nature of the optical networking industry, can directly impact financial performance, as demonstrated by its $2.4 billion revenue in fiscal year 2023.

| Threat Category | Description | Impact on Fabrinet | Example/Data Point |

| Intense Competition | Crowded market for advanced manufacturing services | Pressure on pricing, need for continuous innovation | Global contract manufacturing market ~$560B (2023) |

| Technological Obsolescence | Rapid evolution in optical and medical device tech | Risk of services becoming irrelevant without investment | Need to support 400G/800G in optical networking |

| Geopolitical & Trade Risks | Instability and policy changes in operating regions | Supply chain disruptions, increased costs | Impact of US-China trade policies |

| Customer Demand Volatility | Dependence on OEM orders | Sensitivity to client purchasing decisions and market shifts | FY2023 Revenue: $2.4B, influenced by OEM demand |

SWOT Analysis Data Sources

This Fabrinet SWOT analysis is built upon a robust foundation of data, drawing from the company's official financial filings, comprehensive market research reports, and expert industry analyses to provide a well-rounded and actionable assessment.