Fabrinet Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Fabrinet Bundle

Fabrinet's marketing success hinges on a strategic interplay of its Product, Price, Place, and Promotion. This analysis delves into how their innovative optical components and robust supply chain create value, while their competitive pricing and targeted distribution channels ensure market reach. Discover the promotional tactics that solidify their brand leadership.

Ready to unlock the full picture of Fabrinet's marketing prowess? Get instant access to our comprehensive 4Ps analysis, packed with actionable insights and presented in an editable, professional format. Elevate your understanding and strategic planning today.

Product

Fabrinet's advanced optical packaging and precision manufacturing services are central to their Product strategy, offering specialized solutions for complex optical, electro-mechanical, and electronic products. This focus on high-performance components, critical for industries like telecommunications and data centers, underscores their commitment to precision and quality in intricate designs. For instance, in fiscal year 2023, Fabrinet reported approximately $2.4 billion in revenue, highlighting the significant demand for their specialized manufacturing capabilities.

Fabrinet's comprehensive lifecycle support is a cornerstone of their offering, providing Original Equipment Manufacturers (OEMs) with end-to-end services. This encompasses everything from initial design and process engineering to sophisticated supply chain management, manufacturing, advanced packaging, and stringent testing. This integrated approach ensures OEMs receive a seamless experience and high-quality products.

By partnering with OEMs throughout the entire product journey, Fabrinet demonstrates a commitment to robust quality control and efficient integration. For instance, in the optical communication sector, where product lifecycles can be intense, Fabrinet's ability to manage complex manufacturing processes, including advanced packaging for high-speed components, is critical. This deep involvement helps accelerate time-to-market for new technologies.

Fabrinet's marketing strategy heavily emphasizes focusing on high-growth market verticals. This allows them to concentrate their specialized optical and electro-mechanical manufacturing expertise where demand is strongest and innovation is rapid.

Key sectors include optical communications, vital for booming data center interconnects and evolving telecom infrastructure. For instance, the global optical communication market is projected to reach over $33 billion by 2024, highlighting the significant demand Fabrinet addresses.

Beyond optical communications, Fabrinet also targets sectors like automotive, particularly with the increasing adoption of LiDAR units for autonomous driving systems. They also serve the medical device industry and the industrial laser market, both experiencing substantial growth and technological advancements.

This targeted approach enables Fabrinet to build deep domain knowledge and offer tailored solutions, positioning them as a key partner in industries undergoing significant expansion and technological disruption.

High Complexity, Any Mix, Any Volume ion

Fabrinet's product strategy is defined by its capacity to manage exceptionally complex products, allowing for a wide variety of product mixes and production volumes. This flexibility is a key differentiator, attracting original equipment manufacturers (OEMs) who need bespoke, highly specialized solutions.

This ability to cater to custom needs, rather than mass-market demands, fosters a deep integration with their clients. For example, in fiscal year 2023, Fabrinet reported revenue of $2.4 billion, a testament to the significant demand for their specialized manufacturing services across various high-tech sectors.

- High Complexity: Fabrinet excels in manufacturing products with intricate designs and advanced technological requirements.

- Any Mix: The company supports a diverse range of product configurations within its production lines.

- Any Volume: Fabrinet can scale production efficiently from low-volume custom runs to higher-volume batches.

- OEM Partnership: This model positions Fabrinet as a strategic partner for OEMs seeking specialized, non-commoditized manufacturing solutions.

Continuous Innovation and Technology Enablement

Fabrinet's dedication to continuous innovation is evident in its pivotal role enabling next-generation technologies, especially within optical communications crucial for AI and expanding data centers. Their focus on high-speed components, such as 800 Gb/s products, directly supports the increasing demand for faster data transmission. This forward-thinking approach extends to collaborations on emerging technologies like LiDAR, which is integral to the advancement of autonomous driving systems.

This commitment to technological advancement is a key differentiator for Fabrinet. For instance, the significant growth in data center infrastructure and the rapid adoption of AI applications are driving demand for advanced optical networking solutions. Fabrinet's ability to manufacture these complex, high-performance components positions them as a critical partner for companies pushing the boundaries of what's possible.

Key aspects of Fabrinet's technology enablement include:

- Manufacturing advanced optical components for AI and data centers.

- Producing high-speed products like 800 Gb/s transceivers.

- Collaborating on cutting-edge technologies such as LiDAR for autonomous vehicles.

Fabrinet's product strategy centers on providing highly specialized, complex optical and electro-mechanical manufacturing services. They focus on enabling advanced technologies for key growth markets, ensuring high precision and quality in every component. This approach allows them to serve as a critical partner for Original Equipment Manufacturers (OEMs) in rapidly evolving sectors.

The company's ability to handle diverse product mixes and volumes, from low-volume custom builds to higher-volume production, is a significant advantage. This flexibility, coupled with deep expertise in advanced packaging and intricate designs, caters to the unique needs of clients in high-growth industries like optical communications and automotive.

Fabrinet's commitment to technological advancement is demonstrated by its role in manufacturing components for AI, data centers, and autonomous driving. For example, their work on 800 Gb/s products directly addresses the escalating demand for faster data transmission, a critical need in today's digital landscape.

| Product Focus | Key Technologies | Target Markets | Fiscal Year 2023 Revenue |

|---|---|---|---|

| Complex Optical & Electro-mechanical Components | Advanced Packaging, Precision Manufacturing, High-Speed Optics (e.g., 800 Gb/s) | Optical Communications, Data Centers, Automotive (LiDAR), Medical Devices, Industrial Lasers | Approximately $2.4 billion |

What is included in the product

This analysis provides a comprehensive examination of Fabrinet's Product, Price, Place, and Promotion strategies, offering insights into their market positioning and competitive advantages.

It's designed for professionals seeking a data-driven understanding of Fabrinet's marketing mix, enabling benchmarking and strategic planning.

Simplifies complex marketing strategies into actionable insights, addressing the pain point of information overload for busy executives.

Provides a clear, concise framework for understanding Fabrinet's market positioning, alleviating the difficulty of synthesizing diverse marketing efforts.

Place

Fabrinet's global manufacturing footprint is a cornerstone of its operational strategy, with key facilities strategically located in Thailand, the United States, China, and Israel. This widespread network allows for efficient production and proximity to major markets. For instance, Thailand remains a significant hub for optical component manufacturing, leveraging skilled labor and established infrastructure.

This global presence directly supports Fabrinet's ability to manage complex supply chains and cater to an international clientele. By diversifying manufacturing locations, the company mitigates risks associated with single-region reliance. In fiscal year 2023, Fabrinet reported revenue of $2.4 billion, underscoring the scale of its global operations and the importance of its distributed manufacturing capabilities in achieving this financial performance.

Fabrinet's direct-to-OEM distribution model is a cornerstone of its strategy, allowing for deep collaboration and customized solutions. This bypasses intermediaries, ensuring efficient and secure delivery of their high-value optical communication components and complex manufacturing services. For instance, in fiscal year 2023, Fabrinet reported revenue of $2.4 billion, a testament to the success of this focused approach in serving key industry players.

Fabrinet is strategically expanding its manufacturing capacity to meet the projected surge in demand, especially from rapidly growing industries. This proactive approach ensures they can capitalize on future market opportunities.

A key initiative is the construction of Building 10 at their Chonburi, Thailand facility. This substantial investment, part of their ongoing capital expenditure program, is specifically designed to house increased production volumes and support significant future growth.

For the fiscal year 2024, Fabrinet reported capital expenditures of $201.9 million, a significant portion of which is allocated to capacity enhancements like Building 10, underscoring their commitment to scalable operations.

Optimized Supply Chain Management

Fabrinet's place strategy heavily relies on its optimized supply chain management, a critical element for a leading provider of complex manufacturing services. They excel at procuring intricate components and raw materials, ensuring production remains timely, cost-effective, and of high quality for their OEM partners. This meticulous approach minimizes disruptions and reinforces their commitment to reliable delivery.

Consider these key aspects of their supply chain:

- Global Sourcing Network: Fabrinet maintains relationships with a diverse range of suppliers worldwide to secure specialized components, mitigating risks associated with single-source dependencies.

- Inventory Optimization: Through advanced forecasting and just-in-time principles, Fabrinet manages inventory levels to balance availability with carrying costs, a crucial factor in their operational efficiency. For instance, in fiscal year 2023, their inventory turnover ratio was approximately 7.5, indicating efficient management of their stock.

- Logistics and Distribution: Fabrinet strategically positions its manufacturing facilities and utilizes efficient logistics partners to ensure seamless flow of goods from suppliers to production and then to their customers, supporting their global OEM base.

- Risk Mitigation: Proactive identification and management of potential supply chain risks, such as geopolitical instability or component shortages, are embedded in their operations, ensuring business continuity.

Proximity to Key Customer Hubs

Fabrinet's manufacturing sites are strategically positioned to be near major customer hubs, a critical element for their success in serving Original Equipment Manufacturers (OEMs). While exact customer locations are confidential, their focus on optical communications, automotive, and medical device sectors implies proximity to key industry centers.

This close physical placement enables seamless integration with their clients' supply chains and fosters responsive collaboration, crucial for Fabrinet's role as a manufacturing partner. For instance, the optical communications industry has significant clusters in North America and Europe, areas where Fabrinet likely maintains operational advantages.

- Proximity to Optical Communications Hubs: Facilitates rapid prototyping and delivery for leading telecom equipment manufacturers.

- Automotive Sector Integration: Allows for efficient collaboration with major automotive OEMs and their Tier 1 suppliers, particularly in regions with strong automotive manufacturing bases.

- Medical Device Manufacturing Alignment: Ensures close ties with medical technology companies concentrated in innovation and production centers.

- Reduced Lead Times and Logistics Costs: Strategic site selection minimizes shipping times and expenses, enhancing overall customer service and cost-effectiveness.

Fabrinet's "Place" strategy centers on its strategically distributed global manufacturing footprint and its direct-to-OEM distribution model. This approach ensures proximity to key markets and facilitates close collaboration with clients, optimizing supply chains and enabling customized solutions. Their fiscal year 2023 revenue of $2.4 billion reflects the effectiveness of this geographically diverse and customer-centric placement strategy.

The company's commitment to expanding capacity, exemplified by the construction of Building 10 in Thailand, demonstrates a forward-looking placement strategy designed to meet escalating demand. This investment, supported by $201.9 million in capital expenditures for fiscal year 2024, reinforces their ability to serve a global clientele and capitalize on growth opportunities in sectors like optical communications and automotive.

| Manufacturing Location | Strategic Importance | Key Industries Served |

|---|---|---|

| Thailand | Primary optical component manufacturing hub, skilled labor | Optical Communications |

| United States | Proximity to North American markets, advanced manufacturing | Optical Communications, Medical Devices |

| China | Access to Asian markets, cost-effective production | Optical Communications, Automotive |

| Israel | Innovation hub, specialized technologies | Optical Communications, Defense |

What You Preview Is What You Download

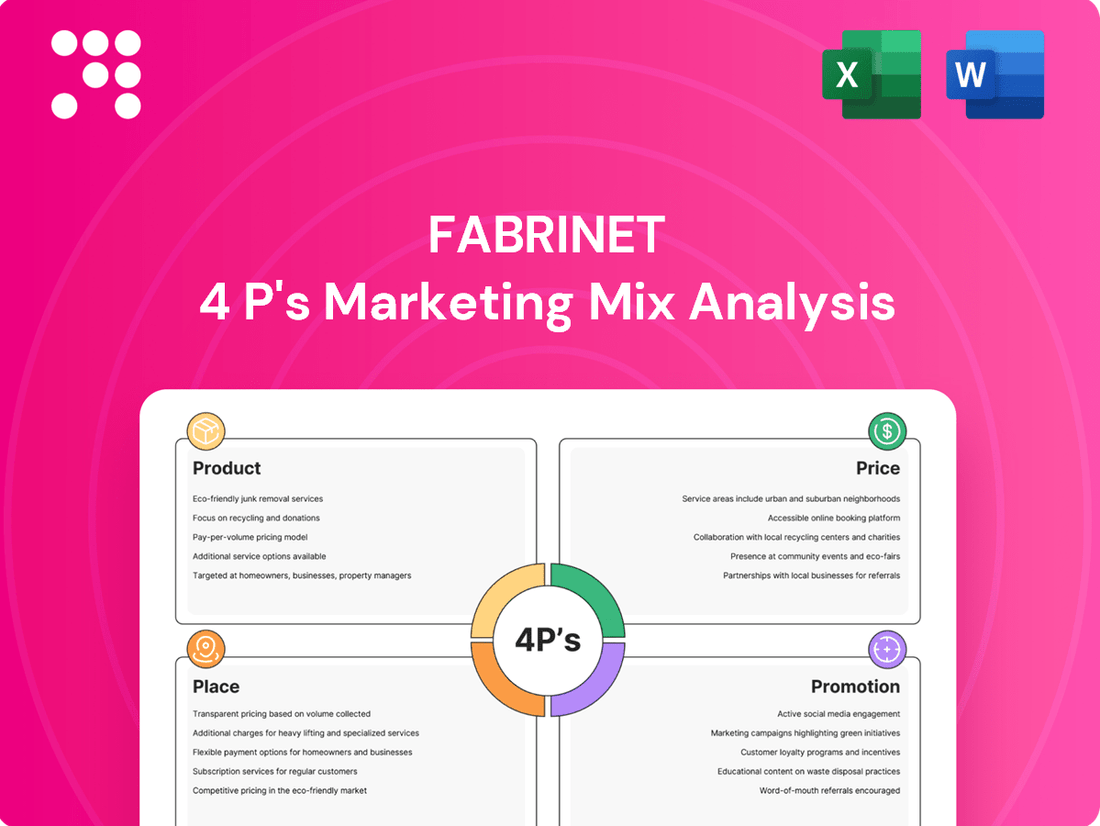

Fabrinet 4P's Marketing Mix Analysis

The preview you see here is the exact same comprehensive Fabrinet 4P's Marketing Mix Analysis you will receive instantly after purchase. You can be confident that the content and formatting are identical to the final document. This ensures you get precisely what you expect, ready for immediate use.

Promotion

Fabrinet prioritizes investor relations and financial communications as a key element of its marketing mix. This involves consistent engagement with the financial community through quarterly earnings calls, detailed financial reports, and investor presentations. For instance, in fiscal year 2023, Fabrinet reported revenue of $2.4 billion, demonstrating strong operational performance that is actively communicated to stakeholders.

Fabrinet's promotional strategy heavily relies on direct sales and forging strategic Original Equipment Manufacturer (OEM) partnerships. This B2B approach means they engage directly with key clients, building strong relationships to secure their business. For instance, in fiscal year 2023, Fabrinet reported that approximately 90% of its revenue came from its top 10 customers, underscoring the importance of these deep OEM collaborations.

Fabrinet actively participates in key industry gatherings like the Rosenblatt Securities Technology Summit and the J.P. Morgan Conference. These events are crucial for demonstrating their advanced manufacturing solutions and thought leadership.

In fiscal year 2023, Fabrinet reported revenue of $2.4 billion, underscoring their significant presence. Their engagement at these high-profile conferences allows them to connect with potential clients and partners, solidifying their reputation.

These presentations serve to highlight Fabrinet's expertise in optical packaging and advanced manufacturing, reinforcing their competitive edge. By sharing insights at these summits, they attract new business and strengthen relationships within the technology sector.

Corporate Responsibility Reporting

Fabrinet's commitment to Corporate Responsibility Reporting acts as a crucial promotional element within their marketing mix. Their annual report showcases sustainability efforts, talent development, and operational successes, directly addressing stakeholder interest in Environmental, Social, and Governance (ESG) performance.

This detailed reporting strategy enhances brand reputation and appeals to investors and customers increasingly prioritizing ethical and sustainable business practices. For instance, their 2023 report highlighted a 15% reduction in greenhouse gas emissions intensity year-over-year, demonstrating tangible progress in environmental stewardship.

- Sustainability Initiatives: Fabrinet details its progress in reducing environmental impact, such as energy efficiency improvements and waste reduction programs.

- Talent Development: The report outlines investments in employee training and well-being, showcasing programs designed to foster a skilled and motivated workforce.

- Operational Achievements: Key performance indicators related to quality, safety, and supply chain efficiency are featured, reinforcing operational excellence.

- ESG Focus: The report clearly articulates Fabrinet's dedication to ESG principles, providing transparency for stakeholders concerned with responsible corporate citizenship.

Emphasizing Expertise and Advanced Capabilities

Fabrinet's promotional strategy keenly emphasizes its deep expertise in advanced optical packaging and precision manufacturing. This focus targets OEMs who demand sophisticated, high-complexity solutions, often in lower volumes. For instance, their success in the photonics industry, a sector projected to grow significantly, underscores their advanced capabilities.

Their marketing highlights a unique ability to manage intricate, low-volume production runs, positioning them as a vital partner for companies needing specialized, cutting-edge technology. This approach appeals to clients requiring mission-critical components where precision and technical mastery are paramount. The company's financial performance, with revenue reaching $2.5 billion in fiscal year 2023, reflects the market's validation of their specialized offerings.

- Expertise in Advanced Optical Packaging: Fabrinet showcases its specialized knowledge in creating sophisticated optical components.

- Precision Manufacturing Capabilities: The company highlights its proficiency in high-precision manufacturing processes.

- High-Complexity, Low-Volume Production: Their promotional efforts focus on their ability to handle intricate, niche production needs.

- Mission-Critical Partner for OEMs: Fabrinet positions itself as an essential supplier for original equipment manufacturers requiring advanced technological solutions.

Fabrinet's promotional efforts center on showcasing its advanced optical packaging and precision manufacturing expertise, targeting OEMs requiring high-complexity, low-volume solutions. Their participation in industry events and strong investor relations further bolster their market presence.

The company's B2B strategy emphasizes direct sales and strategic OEM partnerships, with a significant portion of revenue, approximately 90% in fiscal year 2023, derived from their top 10 customers. This highlights the critical nature of these deep collaborations.

Fabrinet also leverages Corporate Responsibility Reporting to promote its commitment to ESG principles, demonstrating tangible progress in areas like emissions reduction, which was 15% year-over-year in 2023.

| Promotional Focus | Key Activities | Supporting Data (FY23) |

|---|---|---|

| Advanced Optical Packaging & Precision Manufacturing | Highlighting expertise in high-complexity, low-volume production. | Revenue: $2.5 billion |

| Investor Relations & Financial Communications | Quarterly earnings calls, financial reports, investor presentations. | Strong operational performance communicated. |

| Industry Engagement | Participation in key tech summits and conferences. | Strengthening reputation and client connections. |

| Corporate Responsibility Reporting | Showcasing ESG performance, sustainability, talent development. | 15% reduction in GHG emissions intensity YoY. |

Price

Fabrinet likely employs value-based pricing for its advanced optical packaging and precision manufacturing services. This approach aligns with the highly specialized and complex nature of their offerings, where the value delivered to clients is paramount.

Pricing is determined by the significant intellectual property, extensive engineering expertise, and cutting-edge technology integrated into their customized solutions. This means the cost reflects the advanced capabilities and problem-solving prowess Fabrinet provides, not just raw materials and labor.

For instance, Fabrinet's work in high-speed optical transceivers, critical for 5G and data centers, commands a premium due to the intricate design and manufacturing precision required. Their ability to produce these components reliably at scale directly translates to significant value for their customers in terms of performance and market competitiveness.

Fabrinet's business model heavily relies on long-term contractual agreements with major Original Equipment Manufacturers (OEMs). This strategy underpins a significant portion of its revenue, providing a foundation of stability and predictability. For instance, in fiscal year 2023, Fabrinet reported that over 80% of its revenue was generated from its top customers, many of whom operate under these extended contracts.

These agreements allow for structured pricing that reflects the extended timelines, complex manufacturing requirements, and the deep, integrated nature of the partnerships. This predictable revenue stream is crucial for Fabrinet's financial planning and its ability to invest in advanced manufacturing capabilities, supporting its position as a key player in the optical communication and advanced manufacturing sectors.

Fabrinet navigates competitive niche markets by employing a value-based pricing strategy. While offering specialized, high-value services, their pricing reflects a keen awareness of competitor offerings and overall market trends. This approach ensures they remain attractive to clients without compromising profitability, a key factor in maintaining their leadership. For instance, in the optical components sector, where Fabrinet is a significant player, pricing is often benchmarked against key competitors, with Fabrinet leveraging its technological edge and manufacturing scale to justify premium pricing where appropriate.

Cost Management and Operational Efficiency Impact

Fabrinet's commitment to cost management and operational efficiency is a cornerstone of its market strategy. This focus allows them to navigate economic complexities, including foreign exchange fluctuations, while consistently delivering strong operating margins. For instance, in their fiscal year 2023, Fabrinet reported an operating margin of 11.7%, demonstrating their ability to maintain profitability through disciplined cost controls and efficient operations.

This operational discipline directly translates into pricing power. By optimizing their production processes and supply chain, Fabrinet can offer competitive pricing to its clients in the optical communication and advanced packaging industries. This is crucial for securing long-term contracts and maintaining market share, especially when dealing with large, global customers who demand both quality and cost-effectiveness.

- Strong Operating Margins: Fabrinet achieved an 11.7% operating margin in FY2023, highlighting effective cost control.

- Pricing Flexibility: Efficient operations enable competitive pricing while ensuring healthy financial performance.

- Resilience to FX Pressures: Their cost management strategies help mitigate the impact of foreign exchange volatility.

- Customer Value Proposition: Competitive pricing, driven by efficiency, enhances their appeal to clients in demanding industries.

Strategic Investment in Capacity for Future Scaling

Fabrinet's strategic investment in new manufacturing capacity, exemplified by the ongoing construction of Building 10, signals a proactive pricing approach. This expansion anticipates heightened demand and greater production volumes, particularly for next-generation products.

By scaling its operational footprint, Fabrinet is positioned to leverage significant economies of scale. This could translate into more competitive pricing strategies for high-volume orders as production efficiencies are realized.

- Capacity Expansion: Building 10 construction underway, adding significant manufacturing space.

- Economies of Scale: Anticipated cost reductions through increased production volume.

- Future Pricing: Potential for more aggressive pricing on next-generation, high-volume products.

Fabrinet's pricing strategy is deeply intertwined with its value-based approach, reflecting the high-tech nature of its optical and electro-mechanical manufacturing. Their pricing reflects the significant R&D, intellectual property, and specialized engineering embedded in their solutions, rather than just material costs.

This strategy is supported by strong financial performance, with Fabrinet reporting an 11.7% operating margin in fiscal year 2023, demonstrating their ability to command premium pricing due to operational efficiency and technological expertise. Their long-term contracts with major OEMs further solidify this pricing structure, ensuring stability and allowing for investments in advanced capabilities.

| Metric | FY2023 Value | Significance for Pricing |

|---|---|---|

| Operating Margin | 11.7% | Indicates pricing power and efficient cost management. |

| Revenue from Top Customers | >80% | Highlights reliance on long-term, high-value contracts with structured pricing. |

| Investment in Capacity (Building 10) | Ongoing | Signals anticipation of demand and potential for economies of scale, influencing future pricing. |

4P's Marketing Mix Analysis Data Sources

Our Fabrinet 4P's Marketing Mix Analysis is grounded in comprehensive data, including official company filings, investor relations materials, and detailed product specifications. We also incorporate insights from industry research reports and competitive landscape analyses to ensure a holistic view.