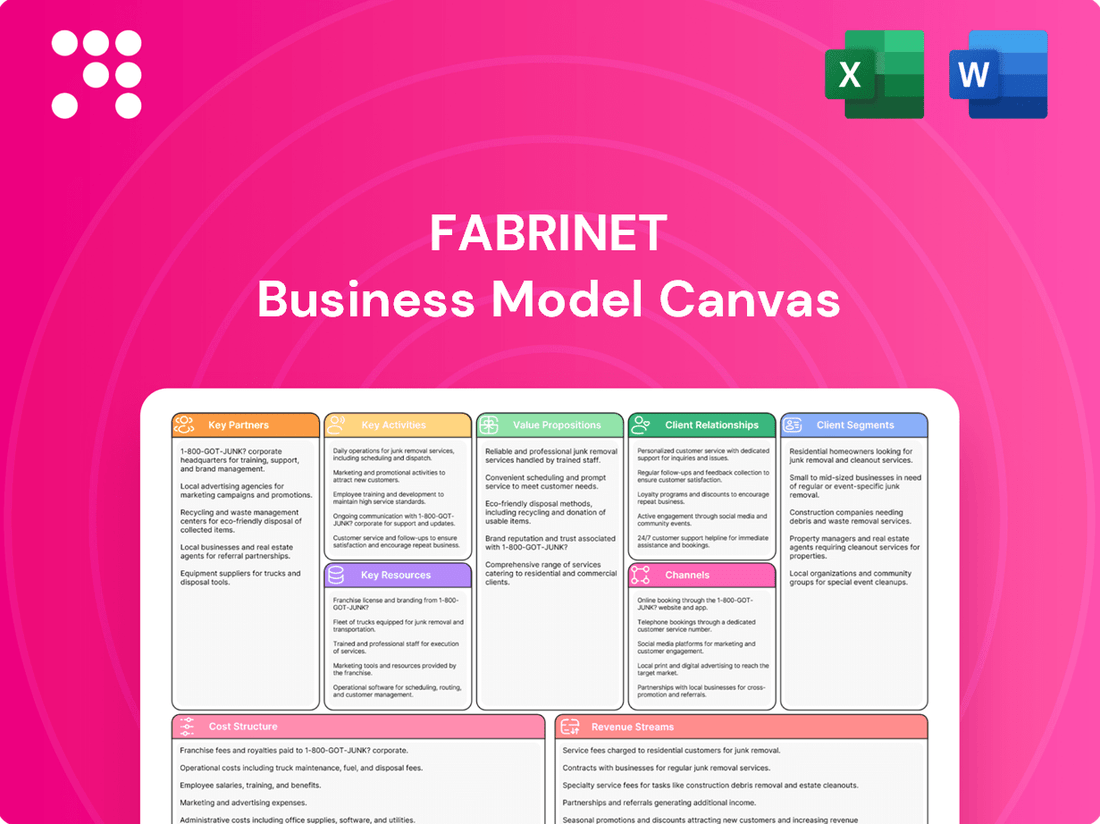

Fabrinet Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Fabrinet Bundle

Discover the strategic genius behind Fabrinet's operational excellence with our comprehensive Business Model Canvas. This detailed breakdown illuminates their customer relationships, revenue streams, and key resources, offering a powerful framework for understanding their success. Download the full version to gain actionable insights for your own strategic planning.

Partnerships

Fabrinet's key partnerships are predominantly with Original Equipment Manufacturers (OEMs) in sectors like optical communications, medical devices, and automotive. These collaborations are essential, as Fabrinet acts as a crucial manufacturing partner for complex, high-value products. For instance, in fiscal year 2023, Fabrinet reported that its top two customers accounted for approximately 34% of its total revenue, highlighting the deep integration and reliance on these OEM relationships.

Fabrinet actively pursues technology and R&D partnerships, collaborating with industry leaders on cutting-edge projects. These alliances are crucial for staying ahead in optical communication technology, enabling access to specialized expertise and co-development opportunities.

In 2024, Fabrinet continued to leverage these collaborations to drive innovation. For instance, their work with major telecommunications equipment manufacturers directly fuels the development of next-generation optical networking solutions, a key area for growth and market differentiation.

Fabrinet's supply chain alliances are foundational, as the company depends on a diverse network of suppliers for critical raw materials and components. These partnerships are not just about sourcing; they are integral to Fabrinet's core offering of effective supply chain management, which includes ensuring on-time delivery and optimized inventory for its clients.

For instance, in fiscal year 2023, Fabrinet reported a significant portion of its cost of revenue was directly tied to materials and components, underscoring the financial impact of these supplier relationships. Maintaining strong alliances helps Fabrinet navigate potential disruptions, such as those experienced globally in recent years, and manage overall costs effectively, directly impacting its competitive pricing and service reliability.

Strategic Customer Investments

Fabrinet cultivates deep relationships with major clients, treating them as strategic partners. A prime example is its collaboration with Amazon, supplying critical optical components for Amazon's burgeoning AI infrastructure. This isn't just about selling parts; it's about integrating into the supply chain for technologies like high-speed data centers and AI training, which are experiencing massive growth.

These strategic customer investments are crucial for Fabrinet's long-term stability. By becoming an indispensable supplier for rapidly expanding sectors, Fabrinet secures predictable revenue streams. This alignment ensures that as these technologies scale, Fabrinet's business scales with them, fostering a mutually beneficial growth trajectory.

- Amazon Partnership: Fabrinet is a key supplier for Amazon's optical networking needs, particularly for AI and data center expansion.

- AI Infrastructure Demand: The increasing demand for AI training and high-speed data centers directly benefits Fabrinet through these customer relationships.

- Revenue Security: These deep integrations provide long-term visibility and security for Fabrinet's revenue, reducing reliance on short-term contracts.

- Strategic Alignment: Fabrinet's focus on these partnerships ensures it remains at the forefront of technological advancements driven by its major customers.

Industry-Specific Manufacturing Partnerships

Fabrinet cultivates key partnerships focused on specialized, high-volume manufacturing within specific industries. A prime example is their collaboration with Blickfeld for the production of automotive-grade LiDAR, a critical component for advanced driver-assistance systems and autonomous vehicles.

These strategic alliances allow Fabrinet to effectively leverage its established expertise in precision opto-mechanical-electrical product manufacturing and its certified, high-capacity facilities. This synergy enables the company to efficiently supply specialized components to rapidly expanding and high-growth market sectors.

- Automotive LiDAR Production: Partnership with Blickfeld for automotive-grade LiDAR, a key growth area.

- Specialized Manufacturing: Leveraging Fabrinet's precision manufacturing capabilities for niche, high-volume needs.

- Market Expansion: Enabling entry into emerging sectors requiring specialized opto-electronic components.

Fabrinet's key partnerships are crucial for its manufacturing prowess, primarily with Original Equipment Manufacturers (OEMs) in optical communications, medical devices, and automotive sectors. These relationships are foundational, with the top two customers representing approximately 34% of total revenue in fiscal year 2023, underscoring their significance.

Fabrinet also engages in technology and R&D collaborations, working with industry leaders to drive innovation in areas like next-generation optical networking solutions, vital for staying competitive in the rapidly evolving telecommunications landscape.

Supply chain alliances are equally important, ensuring access to critical raw materials and components. These partnerships are vital for Fabrinet's ability to manage inventory effectively and maintain on-time delivery, directly impacting cost management and service reliability.

Strategic customer partnerships, such as the one with Amazon for AI infrastructure and data center expansion, provide long-term revenue security and align Fabrinet with high-growth technological advancements. Furthermore, collaborations like the one with Blickfeld for automotive-grade LiDAR production highlight Fabrinet's role in supplying specialized components for emerging high-growth markets.

What is included in the product

Fabrinet's Business Model Canvas showcases its role as a leading contract manufacturer for optical communication components, focusing on high-volume, complex production for major industry players.

It details customer segments like telecom equipment manufacturers, channels through direct sales and strategic partnerships, and value propositions centered on advanced manufacturing capabilities and cost-efficiency.

Fabrinet's Business Model Canvas acts as a pain point reliever by providing a clear, one-page snapshot of their complex optical technology manufacturing operations, simplifying understanding and strategic alignment.

It relieves the pain of information overload by condensing Fabrinet's intricate value chain into a digestible format, enabling faster decision-making and problem-solving.

Activities

Fabrinet's core activity revolves around providing advanced optical packaging and precision manufacturing services. This includes the intricate fabrication of optical components, modules, subassemblies, and complete systems, catering to high-complexity products across various volumes.

In 2024, Fabrinet continued to demonstrate its expertise in these advanced manufacturing services. The company's ability to handle a wide range of product mixes and volumes is a key differentiator in the market, allowing them to serve diverse customer needs efficiently.

Fabrinet's key activity in product lifecycle support is providing end-to-end services, encompassing everything from initial design and process engineering to manufacturing, advanced packaging, integration, assembly, and rigorous testing.

This comprehensive approach allows Fabrinet to offer complete, integrated solutions to its original equipment manufacturer (OEM) clients, streamlining the entire product development and production process.

By managing the product from its inception through final testing, Fabrinet ensures a high level of product quality and performance, a critical factor in the fast-paced technology sector.

For fiscal year 2023, Fabrinet reported revenue of $2.4 billion, underscoring the scale of their operations and their ability to manage complex product lifecycles for a diverse clientele.

Fabrinet's supply chain management is a cornerstone of its operations, focusing on the efficient procurement of optical components and the timely delivery of complex optical sub-assembly and module products. This involves meticulous inventory management to ensure availability while minimizing holding costs, a crucial balance for a company operating in a fast-paced technology sector.

In 2024, Fabrinet continued to emphasize robust supplier relationships and advanced logistics to navigate global supply chain complexities. Effective management here directly impacts Fabrinet's ability to meet the demanding production schedules of its clients in the telecommunications and data center industries, ultimately driving operational efficiency and cost control.

Research and Development

Fabrinet's commitment to Research and Development is a cornerstone of its strategy, ensuring it remains at the forefront of optical and electro-mechanical manufacturing innovation. This focus allows the company to design and produce highly customized optics and glass products, catering to specific client needs. Furthermore, their R&D efforts are directed towards creating advanced optical communication devices, crucial for the evolving telecommunications landscape.

This continuous investment in R&D is not just about staying current; it's about driving future growth. By developing next-generation technologies, Fabrinet expands its product portfolio and strengthens its market position. For instance, in fiscal year 2023, Fabrinet reported significant investments in R&D to support the development of new products and technologies, contributing to their overall revenue growth.

- Innovation in Optical Technologies: Fabrinet's R&D teams are dedicated to advancing optical component design and manufacturing processes.

- Customized Solutions: A key activity involves the research and development of bespoke optics and glass products tailored to unique customer specifications.

- Next-Generation Devices: The company actively pursues the creation of cutting-edge optical communication devices to meet future market demands.

- Maintaining Technological Edge: Continuous R&D investment is vital for Fabrinet to maintain its competitive advantage and expand its market reach.

Quality Assurance and Testing

Fabrinet's core operations hinge on ensuring the highest quality of manufactured products. This is achieved through stringent testing and comprehensive quality assurance processes implemented at every stage of production.

This meticulous approach covers everything from the validation of individual components to the final assembly checks, guaranteeing that each product meets exacting standards. Fabrinet's dedication to precision is a significant differentiator in the competitive optical communications and advanced solutions market.

- Component-Level Testing: Individual parts undergo rigorous inspection and testing to verify specifications and identify potential defects early in the manufacturing cycle.

- In-Process Quality Checks: Throughout the assembly process, quality control points are established to monitor workmanship and adherence to design parameters.

- Final Product Validation: Completed products are subjected to a battery of tests, including functional, performance, and reliability assessments, before shipment.

- Statistical Process Control (SPC): Fabrinet utilizes SPC methods to monitor and control production processes, aiming to reduce variability and improve product consistency. For instance, in the fiscal year 2023, Fabrinet reported a return rate of less than 0.1% for its manufactured optical components, underscoring its commitment to quality.

Fabrinet's key activities are centered on advanced optical packaging and precision manufacturing, encompassing the entire product lifecycle from design to testing. This involves meticulous supply chain management and continuous investment in research and development to maintain a technological edge. The company's commitment to stringent quality assurance ensures high-performance products for its clients.

| Key Activity | Description | Impact |

|---|---|---|

| Advanced Optical Packaging & Precision Manufacturing | Fabricating optical components, modules, subassemblies, and systems for high-complexity products. | Enables customized, high-quality solutions for diverse client needs. |

| Product Lifecycle Support | End-to-end services from design and engineering to manufacturing, integration, assembly, and testing. | Streamlines production for OEMs, ensuring product quality and performance. |

| Supply Chain Management | Efficient procurement of optical components and timely delivery of complex optical products. | Ensures product availability and meets demanding production schedules, driving efficiency. |

| Research & Development | Innovating optical technologies, developing customized optics, and creating next-generation optical communication devices. | Maintains technological leadership and expands product portfolio, driving future growth. |

| Quality Assurance | Rigorous testing and quality control at every production stage, including component-level and final product validation. | Guarantees product reliability and adherence to exacting standards, with a reported return rate of less than 0.1% in FY23. |

Full Version Awaits

Business Model Canvas

The Business Model Canvas preview you are viewing is the actual document you will receive upon purchase. This means the structure, content, and formatting are identical to the final deliverable, ensuring no surprises. You'll gain immediate access to this complete, ready-to-use Business Model Canvas, allowing you to start analyzing and strategizing for Fabrinet without delay.

Resources

Fabrinet's technological prowess is a cornerstone of its business model, evident in its advanced manufacturing processes and deep engineering talent. This expertise enables the creation of sophisticated optical and electro-mechanical products, crucial for industries like telecommunications and advanced manufacturing.

The company's ability to design and produce custom optical components, such as application-specific crystals and lenses, sets it apart. This specialization is vital for clients requiring highly tailored solutions, contributing to Fabrinet's competitive edge.

Patents further solidify Fabrinet's position, protecting its innovations and providing a barrier to entry for competitors. As of their latest reports, Fabrinet actively manages a portfolio of patents related to optical assembly and manufacturing techniques, underscoring their commitment to intellectual property.

Fabrinet's global manufacturing footprint is a cornerstone of its business model, featuring state-of-the-art facilities strategically positioned in Thailand, the United States (New Jersey), China (Fuzhou), and Israel. These locations are not just production hubs but vital links in a resilient supply chain designed for high-precision, high-volume output.

This geographical diversification is critical for serving Fabrinet's international clientele efficiently. For example, in fiscal year 2023, Fabrinet reported net sales of $2.4 billion, underscoring the scale of operations supported by these global facilities and their role in meeting diverse market demands.

Fabrinet's skilled workforce, especially its engineering talent, is a cornerstone of its operations. This expertise is crucial for producing intricate optical components and modules, demanding precision in every step from design to advanced packaging.

The company actively cultivates this talent through initiatives like its Temporary Technician Academy, ensuring a continuous supply of qualified personnel. This commitment to talent development directly supports Fabrinet's ability to meet the complex manufacturing needs of its clients.

Intellectual Property and Proprietary Processes

Fabrinet's intellectual property encompasses advanced optical packaging and manufacturing techniques. These proprietary processes are crucial for creating highly specialized components, giving them a distinct edge in the market.

This intellectual capital directly translates into their capacity to deliver tailored and innovative solutions to clients. For instance, their expertise in optical module assembly allows for the production of complex devices required by leading optical network equipment manufacturers.

The company's commitment to research and development, evident in their continuous refinement of these processes, ensures they remain at the forefront of optical technology. This focus on proprietary innovation is a cornerstone of their value proposition.

- Proprietary Optical Packaging: Advanced methods for assembling and protecting sensitive optical components.

- Manufacturing Process Innovation: Unique techniques for high-volume, high-precision production of optical modules.

- Design Expertise: In-house capabilities for designing and optimizing optical sub-assemblies.

- Intellectual Capital: Patents and trade secrets protecting their core technological advancements.

Strong Financial Capital

Fabrinet's strong financial capital is a cornerstone of its business model, providing the flexibility to invest in growth and return value to shareholders. This robust financial position is evidenced by significant cash reserves and marketable securities, allowing for strategic capital allocation. For instance, in fiscal year 2023, Fabrinet generated $2.4 billion in revenue and a net income of $223 million, underscoring its healthy financial performance.

This financial strength directly fuels key activities within Fabrinet's operations:

- Capacity Expansion: The company can readily fund the expansion of its manufacturing capabilities to meet growing customer demand, particularly in sectors like optical communications.

- Technology Upgrades: Significant financial resources enable ongoing investment in advanced manufacturing technologies and research and development to maintain a competitive edge.

- Share Repurchase Programs: Fabrinet has historically utilized its financial capital to buy back its own stock, enhancing shareholder value and demonstrating confidence in its future prospects.

- Strategic Initiatives: The financial stability supports mergers, acquisitions, or other strategic partnerships that could accelerate growth or expand market reach.

Fabrinet's key resources are a blend of proprietary technology, skilled human capital, and robust financial backing, all critical for its high-precision manufacturing operations. Their intellectual property, including patents on optical packaging and manufacturing processes, provides a significant competitive advantage. This technological edge is complemented by a dedicated workforce, particularly in engineering, ensuring the intricate production of optical components. The company's financial strength, evidenced by strong revenues and net income, enables continuous investment in capacity, technology, and strategic growth initiatives.

| Key Resource | Description | Impact |

|---|---|---|

| Proprietary Technology & IP | Patents on optical packaging, manufacturing techniques, design expertise. | Competitive advantage, barrier to entry, enables tailored solutions. |

| Skilled Workforce | Engineering talent, trained technicians. | High-precision manufacturing, complex optical component production. |

| Financial Capital | Strong revenue ($2.4B FY23), net income ($223M FY23), cash reserves. | Capacity expansion, technology upgrades, strategic investments, shareholder value. |

Value Propositions

Fabrinet's value proposition centers on delivering high-quality, precision-engineered optical components and manufacturing solutions. Their deep expertise in advanced optical packaging and complex electro-mechanical assembly ensures the creation of exceptionally reliable products for demanding applications.

This dedication to meticulous manufacturing processes is a key differentiator, allowing them to meet the stringent requirements of clients in sectors like telecommunications and data centers. For instance, in fiscal year 2023, Fabrinet reported revenue of $2.4 billion, underscoring the significant demand for their specialized manufacturing capabilities.

Fabrinet's value proposition centers on offering end-to-end product lifecycle services, a crucial advantage for Original Equipment Manufacturers (OEMs). This means they provide comprehensive support from the initial stages of design and process engineering all the way through manufacturing, advanced packaging, and rigorous testing.

By acting as a single, integrated partner, Fabrinet significantly simplifies complex product development and production for its clients. This consolidated approach is designed to reduce the operational burden on OEMs and, importantly, accelerate their time-to-market.

For instance, in fiscal year 2023, Fabrinet reported revenue of $2.4 billion, underscoring their capacity to handle substantial and complex manufacturing projects. This scale allows them to effectively manage the entire product lifecycle, delivering efficiency and speed to their OEM customers.

Fabrinet's mastery of high-complexity, low-volume production is a cornerstone of its value proposition. They excel at manufacturing intricate products, often in small batches, catering to clients with very specific and demanding requirements.

This specialization allows them to handle technically challenging projects that many other manufacturers cannot. For instance, in fiscal year 2023, Fabrinet reported revenue of $2.4 billion, demonstrating significant market traction for their specialized services.

Their ability to manage a high mix of products, even in low volumes, creates substantial switching costs for their customers. This deep integration into client supply chains, built on trust and proven capability, solidifies their market position.

Access to Advanced Technologies and Innovation

Fabrinet's value proposition centers on providing clients with unparalleled access to advanced optical and electro-mechanical capabilities. This includes state-of-the-art packaging and integration techniques, crucial for developing next-generation optical components. For instance, in 2024, the demand for sophisticated optical solutions in 5G infrastructure and data centers continued to drive innovation in these areas.

The company's unwavering commitment to research and development ensures clients consistently benefit from the latest technological breakthroughs. This forward-looking approach keeps their partners at the forefront of optical technology advancements, a critical advantage in rapidly evolving markets.

By leveraging Fabrinet's expertise, clients are positioned as leaders in emerging optical technologies, enabling them to capture market share and drive future growth.

- Advanced Capabilities: Clients access cutting-edge optical and electro-mechanical packaging and integration.

- Continuous Innovation: Fabrinet's R&D ensures clients benefit from the latest technological advancements.

- Market Leadership: This access positions clients as leaders in emerging optical technologies.

Reliable Supply Chain Management

Fabrinet provides dependable supply chain management, crucial for partners dealing with intricate components. This ensures that materials and finished goods arrive on time, keeping operations running smoothly. For instance, Fabrinet's expertise helps mitigate the complexities of global sourcing and logistics, a significant advantage in today's market.

Their robust supply chain directly translates to fewer disruptions and better inventory management. This operational efficiency is a key value proposition, minimizing risks for their clients. In 2024, Fabrinet continued to demonstrate its ability to manage complex global supply chains, contributing to its reputation for reliability.

- Timely Delivery: Ensuring components and products reach their destinations as scheduled.

- Efficient Inventory Control: Optimizing stock levels to reduce holding costs and prevent shortages.

- Risk Mitigation: Addressing potential disruptions in sourcing and logistics for complex parts.

- Enhanced Customer Satisfaction: Contributing to a seamless experience for Fabrinet's partners.

Fabrinet's value proposition is built on delivering high-quality, precision-engineered optical and electro-mechanical solutions, coupled with end-to-end product lifecycle services. They excel in managing complex, low-volume production and offer advanced capabilities that accelerate client time-to-market and reduce operational burdens.

Their expertise in advanced packaging and integration, supported by continuous R&D, positions clients as leaders in emerging optical technologies. Fabrinet also provides dependable supply chain management, ensuring timely delivery and mitigating risks for intricate components.

In fiscal year 2023, Fabrinet reported revenue of $2.4 billion, reflecting strong demand for their specialized manufacturing services. The company's ability to manage a high mix of products, even in low volumes, creates significant switching costs for customers, solidifying their market position through proven capability and trust.

| Value Proposition Area | Key Offering | Benefit to Customer |

|---|---|---|

| Manufacturing Expertise | Precision optical and electro-mechanical assembly | High-quality, reliable products for demanding applications |

| Lifecycle Services | Design, process engineering, manufacturing, testing | Simplified product development, accelerated time-to-market |

| Technological Advancement | Access to cutting-edge packaging and integration | Clients lead in emerging optical technologies |

| Supply Chain Reliability | Dependable sourcing and logistics management | Minimized disruptions, efficient operations, reduced risk |

Customer Relationships

Fabrinet's collaborative design and engineering approach with its Original Equipment Manufacturer (OEM) clients is a cornerstone of its customer relationships. This deep partnership ensures products are not only designed for optimal performance but also for efficient manufacturability, a critical factor in cost-effectiveness and speed to market.

By embedding their engineering teams with clients, Fabrinet gains invaluable insights into specific performance needs and potential production challenges. This proactive engagement allows for early identification and resolution of design issues, ultimately leading to highly customized solutions that precisely meet client specifications.

This level of integration fosters exceptional client loyalty. For instance, in 2024, Fabrinet continued to deepen these collaborations, with a significant portion of its revenue directly tied to ongoing, co-developed projects, highlighting the success and stickiness of this relationship model.

Fabrinet likely assigns dedicated account managers and technical specialists to its major Original Equipment Manufacturer (OEM) clients. This direct, personalized approach ensures that complex customer requirements are thoroughly understood and met with precisely tailored solutions, fostering deep trust and enduring partnerships.

Fabrinet solidifies customer relationships through long-term contracts, demonstrating a deep commitment and strategic integration with its clients. These agreements are crucial for ensuring predictable revenue streams and highlight Fabrinet's indispensable role as a manufacturing partner.

The strategic integration fostered by these contracts creates significant switching costs for customers. For instance, in fiscal year 2023, Fabrinet reported revenue of $2.4 billion, with a substantial portion likely secured through these multi-year arrangements, underscoring the stability and value derived from these deep client partnerships.

Transparency and Investor Engagement

Fabrinet prioritizes transparency with its investor base, a crucial element in its business-to-business model. This is achieved through consistent financial reporting and investor calls, fostering trust within the financial community.

For instance, in their fiscal year 2023 earnings, Fabrinet reported revenue of $2.4 billion, demonstrating robust performance that is communicated directly to stakeholders.

- Regular Financial Disclosures Fabrinet provides quarterly and annual financial results, ensuring investors have up-to-date information.

- Investor Conference Calls The company actively engages with investors through conference calls to discuss performance and future outlook.

- Commitment to Stakeholder Trust This open communication strategy is designed to build and maintain confidence among its financial partners.

After-Sales Support and Continuous Improvement

Fabrinet extends its commitment beyond manufacturing by offering crucial after-sales support, including rigorous testing and integration services. This ensures that the complex optical and electro-optic products function optimally in their intended environments.

The company actively pursues continuous improvement, likely incorporating customer feedback to refine both its manufacturing processes and product offerings. This iterative approach is vital for adapting to evolving technological demands and maintaining a competitive edge.

Fabrinet's dedication to ongoing support solidifies its position as a comprehensive partner throughout the product lifecycle. For instance, in fiscal year 2023, Fabrinet reported revenue of $2.4 billion, underscoring the scale of their operations and the importance of sustained customer relationships.

- Post-Manufacturing Services: Testing and integration to ensure product readiness.

- Customer Feedback Loop: Driving continuous improvement in products and processes.

- Lifecycle Partnership: Reinforcing long-term value and customer loyalty.

- Operational Scale: Supported by significant revenue, like $2.4 billion in FY2023, demonstrating the need for robust after-sales engagement.

Fabrinet's customer relationships are built on deep collaboration and long-term partnerships with Original Equipment Manufacturers (OEMs). This involves embedding engineering teams with clients to ensure products are designed for both performance and efficient manufacturing. This integration fosters loyalty, with a significant portion of their revenue in 2024 stemming from these co-developed projects.

Dedicated account managers and technical specialists provide personalized service, ensuring complex needs are met and building trust. Long-term contracts further solidify these relationships, creating predictable revenue streams and highlighting Fabrinet's role as an indispensable manufacturing partner. For example, in fiscal year 2023, Fabrinet reported $2.4 billion in revenue, much of which was likely secured through these multi-year agreements.

| Customer Relationship Element | Description | Impact/Example |

| Collaborative Design & Engineering | Embedding engineers with OEM clients to optimize product design for performance and manufacturability. | Ensures customized solutions and early issue resolution. |

| Dedicated Account Management | Assigning specialists to understand and meet complex client requirements. | Fosters deep trust and enduring partnerships. |

| Long-Term Contracts | Securing multi-year agreements for predictable revenue and strategic integration. | Demonstrates commitment and creates significant switching costs for clients. |

| After-Sales Support | Providing rigorous testing, integration, and continuous improvement based on feedback. | Ensures optimal product function and reinforces lifecycle partnership. |

Channels

Fabrinet relies heavily on its direct sales force and business development teams to forge strong relationships with Original Equipment Manufacturers (OEMs). This direct approach facilitates clear communication, enabling detailed discussions and the tailoring of manufacturing solutions to meet specific OEM needs. These teams are instrumental in navigating the complexities of securing substantial, multi-year manufacturing agreements.

In 2024, Fabrinet's focus on these direct channels proved vital for its performance. The company continued to secure significant contracts within the optical communications sector, a testament to the effectiveness of its dedicated sales and business development efforts. This strategy allows Fabrinet to maintain close partnerships, ensuring they remain aligned with evolving customer requirements and technological advancements.

Fabrinet's strategically positioned manufacturing and engineering facilities in Thailand, the United States, China, and Israel are crucial channels for its global operations. These hubs facilitate efficient production, localized customer support, and streamlined logistics, allowing Fabrinet to serve diverse markets effectively. For instance, Thailand remains a cornerstone for high-volume optical component manufacturing, while facilities in the US and Israel often focus on advanced engineering and specialized product lines, reflecting a diversified approach to global production capabilities.

Fabrinet actively participates in key industry conferences and trade shows, such as the Optical Fiber Communication Conference and Exposition (OFC) and SPIE Photonics West. These events are crucial for demonstrating their advanced optical and electro-mechanical manufacturing capabilities to a global audience of potential clients and partners.

In 2024, Fabrinet continued its engagement at these vital industry gatherings. For instance, OFC 2024 saw significant interest in next-generation optical networking solutions, a core area for Fabrinet's expertise. These platforms enable direct interaction, allowing Fabrinet to showcase its innovation and gather crucial market intelligence.

These channels not only serve as a showcase for Fabrinet's manufacturing prowess but also facilitate invaluable networking opportunities. By connecting with industry leaders and potential customers, Fabrinet strengthens its market position and identifies emerging trends, ensuring its offerings remain aligned with evolving demands in the photonics and optical technology sectors.

Online Investor Relations Portal

Fabrinet’s online investor relations portal acts as a central hub for all financial communications, ensuring transparency and easy access for stakeholders. This digital channel is crucial for disseminating timely information, including financial reports and strategic updates.

The portal offers a comprehensive suite of resources, such as quarterly earnings releases, SEC filings, and replays of investor calls, making it a vital tool for investors and analysts. For instance, during fiscal year 2023, Fabrinet reported net sales of $2.4 billion, with the investor relations portal playing a key role in communicating these financial results.

- Dedicated Website Section: Fabrinet maintains a specific investor relations area on its corporate website.

- Information Accessibility: This portal enhances transparency by providing easy access to financial news, presentations, and SEC filings.

- Key Resources: Investors can find earnings releases, webcast replays, and other essential financial documents.

- Stakeholder Engagement: It serves as a primary communication channel for investors, analysts, and the broader financial community.

Strategic Partnerships and Alliances

Fabrinet leverages strategic partnerships and alliances as crucial channels to extend its market reach and penetrate new customer segments. Collaborations with leading technology providers and key customers, such as Amazon for cloud infrastructure and Innoviz for automotive LiDAR, are central to this strategy.

These alliances often manifest as co-development initiatives or preferred supplier agreements, solidifying Fabrinet's position in high-growth markets. For instance, Fabrinet's involvement in supporting AI infrastructure and the burgeoning automotive LiDAR sector highlights the strategic importance of these relationships in driving future revenue streams.

- Technology Collaborations: Partnerships with companies like Innoviz for LiDAR solutions are key to accessing the automotive market.

- Customer Integration: Deep relationships with hyperscale cloud providers like Amazon ensure Fabrinet is integrated into critical AI infrastructure supply chains.

- Market Expansion: These alliances serve as direct channels to new geographical regions and emerging technological sectors.

- Preferred Supplier Status: Agreements often grant Fabrinet preferential access and visibility within partner ecosystems.

Fabrinet's channels are multifaceted, encompassing direct sales, strategic partnerships, industry events, and robust online investor relations. These avenues are critical for customer acquisition, market penetration, and transparent stakeholder communication.

The direct sales and business development teams are paramount, fostering deep relationships with OEMs and securing long-term manufacturing contracts. In 2024, this direct engagement was particularly effective in the optical communications sector, reinforcing Fabrinet's market standing.

Strategic alliances, such as those with Amazon for AI infrastructure and Innoviz for automotive LiDAR, are vital for expanding reach into high-growth markets and emerging technologies.

Industry conferences like OFC and SPIE Photonics West serve as key platforms for showcasing manufacturing capabilities and gathering market intelligence, demonstrating Fabrinet's commitment to innovation and customer engagement.

| Channel Type | Key Activities/Focus | 2024 Relevance/Example |

| Direct Sales & Business Development | OEM relationship building, contract negotiation | Securing optical communications contracts |

| Strategic Partnerships | Co-development, preferred supplier agreements | Amazon (AI infrastructure), Innoviz (Automotive LiDAR) |

| Industry Events | Capability showcasing, networking, market intelligence | OFC, SPIE Photonics West |

| Online Investor Relations | Financial communication, transparency | Disseminating quarterly earnings, SEC filings |

Customer Segments

Optical Communications OEMs represent Fabrinet's core customer base, encompassing manufacturers of critical optical components, modules, and subsystems. This segment spans both the telecommunications and data communications industries, driving demand for advanced solutions like 400ZR and 800-gig optical products.

Fabrinet's reliance on this segment is substantial, with optical communications accounting for a significant majority of its total revenue. For instance, in its fiscal year 2023, revenue from optical communications reached $2.18 billion, representing approximately 86% of its total revenue.

Fabrinet is a key supplier to automotive Original Equipment Manufacturers (OEMs), providing critical optical and electro-mechanical components. These components are essential for advanced vehicle systems, particularly for the burgeoning field of autonomous driving, where technologies like LiDAR are becoming standard. For instance, Fabrinet's collaboration with LiDAR pioneer Innoviz showcases their direct involvement in equipping the next generation of smart vehicles.

Fabrinet serves medical device manufacturers by offering high-precision manufacturing services. This segment is characterized by an unwavering demand for exceptional quality and reliability, a direct consequence of the critical applications these devices serve, often impacting patient health directly.

The company's proven expertise in intricate optical and electro-mechanical manufacturing aligns perfectly with the stringent requirements of the medical device market. For instance, in 2024, the global medical device market was valued at approximately $600 billion, with a significant portion relying on precision manufacturing partners like Fabrinet.

Industrial Lasers and Sensors Manufacturers

Fabrinet serves manufacturers of industrial lasers and a diverse array of sensors, leveraging its expertise in high-precision optical components. This segment is crucial for diversification, moving beyond the company's traditional optical communications focus.

These industrial applications demand exacting optical specifications, a perfect match for Fabrinet's manufacturing capabilities. For example, the demand for advanced sensors in automation and quality control continues to grow, with the global industrial sensors market projected to reach approximately $35 billion by 2028, according to some industry analyses.

- Target Market: Manufacturers of industrial lasers and various sensor types.

- Core Competency Alignment: High precision and specialized optical components.

- Strategic Benefit: Diversification beyond the optical communications sector.

Emerging High-Growth Technology Markets

Fabrinet is strategically targeting emerging high-growth technology markets, including semiconductor processing, biotechnology, and metrology. This expansion reflects a proactive approach to customer segmentation, aiming to capture new revenue streams in sectors poised for significant advancement.

This diversification is crucial for Fabrinet's long-term stability, mitigating dependence on any single industry. For instance, the semiconductor market, a key area of focus, saw global sales reach an estimated $583.5 billion in 2023, according to the Semiconductor Industry Association (SIA). By entering adjacent high-growth sectors, Fabrinet leverages its core competencies.

- Semiconductor Processing: Fabrinet's expertise in precision optics and advanced manufacturing is directly applicable to the intricate processes involved in semiconductor fabrication.

- Biotechnology: The company's capabilities in handling sensitive materials and maintaining high levels of accuracy are transferable to the manufacturing of medical devices and diagnostic equipment.

- Metrology: Precision measurement is fundamental to metrology, an area where Fabrinet's optical assembly and testing proficiency provides a strong foundation for growth.

Fabrinet's customer base is primarily composed of Optical Communications OEMs, who represent the largest segment of their business. This includes major players in telecommunications and data centers, driving demand for high-speed optical products.

Beyond optical communications, Fabrinet also serves the automotive industry, supplying critical components for advanced driver-assistance systems and autonomous driving technologies. They also cater to medical device manufacturers, requiring high-precision and reliable components for life-saving equipment.

Additionally, Fabrinet is expanding into industrial applications, manufacturing components for lasers and sensors, and is strategically targeting emerging high-growth sectors like semiconductor processing and biotechnology to diversify its revenue streams.

| Customer Segment | Key Products/Services | Fiscal Year 2023 Revenue Contribution (Approx.) |

| Optical Communications OEMs | Optical components, modules, subsystems (e.g., 400ZR, 800-gig) | 86% ($2.18 billion) |

| Automotive OEMs | Optical and electro-mechanical components (e.g., for LiDAR) | Significant growth area |

| Medical Device Manufacturers | High-precision optical and electro-mechanical manufacturing | Leveraging expertise in critical applications |

| Industrial Lasers & Sensors | High-precision optical components | Diversification focus |

| Emerging High-Growth Markets (Semiconductor, Biotech, Metrology) | Precision optics and advanced manufacturing | Strategic expansion into new sectors |

Cost Structure

Manufacturing and production costs represent a significant portion of Fabrinet's expenses. These include the direct costs associated with raw materials, essential components, and the labor required for assembly and rigorous testing of their high-precision optical products.

For instance, in fiscal year 2023, Fabrinet reported cost of revenue of $2.03 billion, highlighting the substantial investment in their manufacturing operations. Efficiently managing their supply chain is absolutely crucial for controlling these considerable expenses and maintaining competitive pricing.

Fabrinet dedicates significant resources to research and development, a crucial element for maintaining its edge in the fast-paced optical technology sector. These investments fuel innovation in manufacturing processes, the creation of novel product designs, and the exploration of advanced materials.

For the fiscal year ending June 30, 2023, Fabrinet reported Research and Development expenses of $125.4 million. This figure highlights the company's commitment to continuous improvement and the development of next-generation optical solutions, essential for staying ahead in competitive markets.

Capital Expenditures are a significant part of Fabrinet's business, involving substantial investments in property, plant, and equipment. For instance, the construction of new facilities, such as Building 10, is a key component of their strategy to expand production capacity. These outlays are crucial for enabling higher production volumes and integrating new manufacturing technologies.

These investments directly affect Fabrinet's free cash flow, as they represent cash spent on long-term assets rather than operational expenses. For the fiscal year 2023, Fabrinet reported capital expenditures of $150.9 million, a notable increase from $73.7 million in fiscal year 2022, reflecting their commitment to growth and capability enhancement.

Selling, General, and Administrative (SG&A) Expenses

Selling, General, and Administrative (SG&A) expenses are operational overheads crucial for running Fabrinet's global business, encompassing salaries for administrative staff, marketing, sales efforts, and general corporate costs. Despite Fabrinet's focus on achieving industry-leading operating margins, these expenditures are fundamental to its operations.

For the first quarter of fiscal year 2025, Fabrinet reported that its operating expenses, which include SG&A, were less than 2% of revenue. This efficiency highlights their commitment to cost management while supporting their extensive sales and administrative functions.

- Salaries for administrative and support staff

- Marketing and sales activities to drive customer acquisition and retention

- General corporate overheads, including legal and accounting services

- Costs associated with managing a global operational footprint

Supply Chain and Logistics Costs

Fabrinet’s global supply chain necessitates substantial expenditures in procurement, logistics, warehousing, and the transportation of components and finished products across diverse geographical locations. These costs are inherently sensitive to fluctuations in global economic conditions and the impact of supply chain disruptions, which have been a recurring theme in recent years.

Effective management of these complex supply chain operations is crucial for Fabrinet to maintain cost control and operational efficiency. For instance, in fiscal year 2023, Fabrinet reported cost of revenues of $2.17 billion, a significant portion of which is attributable to its supply chain and logistics activities.

- Procurement Costs: Expenses related to sourcing raw materials and components globally, influenced by supplier pricing and volume discounts.

- Logistics and Transportation: Costs associated with moving goods, including freight, customs duties, and insurance, which can fluctuate with fuel prices and geopolitical events.

- Warehousing and Inventory Management: Expenses for storing components and finished goods, optimizing inventory levels to meet demand while minimizing holding costs.

- Supply Chain Resilience: Investments in diversifying suppliers and building redundancy to mitigate the impact of disruptions, thereby safeguarding against unexpected cost increases.

Fabrinet's cost structure is dominated by manufacturing and production expenses, including raw materials, components, and labor, as evidenced by their $2.17 billion cost of revenue in fiscal year 2023. Significant investments in research and development, totaling $125.4 million in FY2023, are crucial for innovation. Capital expenditures for expanding production capacity, such as $150.9 million in FY2023, also represent a major cost. Furthermore, managing a global supply chain incurs substantial procurement, logistics, and warehousing costs.

| Cost Category | FY2023 (USD Millions) | Notes |

| Cost of Revenue | 2,170 | Includes manufacturing, components, and direct labor. |

| Research & Development | 125.4 | Investment in innovation and new product development. |

| Capital Expenditures | 150.9 | Investment in property, plant, and equipment for capacity expansion. |

| SG&A Expenses | < 2% of Revenue (Q1 FY25) | Operational overheads for sales, marketing, and administration. |

Revenue Streams

Fabrinet's primary revenue driver is the sale of optical communication products. These range from essential components to complex modules and subsystems, serving both the telecommunications and data communications sectors. This business line is crucial, as it directly addresses the escalating need for faster and more efficient data transmission.

The demand for high-speed optical components continues to fuel growth in this segment. For example, Fabrinet reported strong growth in its telecom revenue during the third quarter of fiscal year 2025, underscoring the market's appetite for their advanced optical solutions.

Fabrinet generates revenue from manufacturing services for non-optical communication products. This includes components for the automotive sector, medical devices, industrial lasers, and various sensors.

This diversification is a key strategy, helping to balance Fabrinet's revenue streams and lessen its dependence on any single market. It provides a more stable financial foundation.

In the second quarter of fiscal year 2025, Fabrinet reported that each of these non-optical product categories experienced both sequential and year-over-year growth, indicating a positive trend in this segment of their business.

Fabrinet's core revenue generation stems from offering extensive manufacturing services to Original Equipment Manufacturers (OEMs) through long-term agreements. This encompasses everything from initial process design and engineering to final assembly and rigorous testing.

These contractual arrangements are crucial, providing Fabrinet with a stable and predictable stream of income. For instance, in fiscal year 2023, Fabrinet reported total revenue of $2.4 billion, a significant portion of which is directly attributable to these manufacturing contracts.

Advanced Packaging and Integration Services

Fabrinet generates revenue through advanced packaging and integration services, which are crucial for complex optical products. These high-value services leverage their expertise in precision manufacturing and miniaturization, catering to the increasing demand for sophisticated components. For instance, in fiscal year 2023, Fabrinet reported significant growth in its optical business, driven by demand for advanced components used in data centers and telecommunications, directly reflecting the value of these specialized integration services.

The company's ability to handle intricate system integration and advanced optical packaging translates directly into substantial revenue streams. As the technology landscape evolves, requiring more integrated and compact solutions, Fabrinet’s specialized capabilities become even more critical. This specialization allows them to command premium pricing for their services, contributing significantly to their overall financial performance.

- Advanced Optical Packaging: Revenue from specialized optical component assembly and encapsulation.

- Complex System Integration: Income generated from combining multiple optical modules and subsystems into a cohesive unit.

- High-Value-Added Services: Reflects the premium pricing for expertise in precision manufacturing and miniaturization.

- Market Demand Alignment: Revenue growth is tied to the increasing complexity and integration needs of optical products in sectors like data centers and 5G infrastructure.

Design Support and Process Engineering Fees

Fabrinet generates revenue by offering crucial design support and process engineering services early in the product development cycle. This proactive involvement allows them to refine customer designs for manufacturing efficiency, directly contributing to their income through consulting and project-based fees.

These specialized services not only optimize product manufacturability but also significantly enhance the overall value proposition for their clients. By integrating so closely with customer product roadmaps, Fabrinet strengthens its client relationships, fostering loyalty and repeat business.

- Early-Stage Design Collaboration: Fabrinet engages with clients at the initial design phases, providing expertise to optimize product architecture for manufacturing.

- Process Engineering Expertise: They offer specialized process engineering to ensure designs are cost-effective and efficient to produce at scale.

- Consulting and Project Fees: Revenue is generated through direct fees for these design support and process engineering engagements.

- Enhanced Customer Value: These services add significant value for customers by improving product manufacturability and reducing time-to-market.

Fabrinet's revenue streams are primarily built upon the manufacturing of optical communication products, encompassing components, modules, and subsystems vital for telecommunications and data communications. This core business is augmented by manufacturing services for a diverse range of non-optical products, including those for the automotive and medical sectors, offering a strategic diversification. The company also generates significant income from advanced packaging and complex system integration services, leveraging its precision manufacturing capabilities to meet the growing demand for sophisticated, miniaturized optical solutions.

| Revenue Stream | Description | Key Drivers | Fiscal Year 2023 Revenue Contribution (Approximate) |

|---|---|---|---|

| Optical Communication Products | Manufacturing of components, modules, and subsystems for telecom and data comms. | Demand for high-speed data transmission, 5G deployment, data center growth. | ~70% |

| Non-Optical Manufacturing Services | Production of components for automotive, medical, industrial lasers, and sensors. | Market diversification, growth in specialized industries. | ~15% |

| Advanced Packaging & Integration | Specialized assembly, encapsulation, and system integration for complex optical products. | Increasing product complexity, demand for miniaturization and high-value services. | ~15% |

Business Model Canvas Data Sources

Fabrinet's Business Model Canvas is built upon a foundation of financial disclosures, comprehensive market research, and internal operational data. These sources ensure each component, from revenue streams to cost structures, is accurately represented and strategically sound.