Fabrinet Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Fabrinet Bundle

Fabrinet operates in a dynamic market where understanding competitive forces is crucial. Our analysis reveals how buyer power, supplier leverage, and the threat of substitutes significantly shape its landscape. Discover the intensity of rivalry and the barriers to entry that define Fabrinet's strategic environment.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Fabrinet’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Fabrinet's reliance on a concentrated supplier base for critical optical, electro-mechanical, and electronic components significantly amplifies supplier bargaining power. When only a few providers can offer these specialized materials, they hold considerable sway over pricing and terms. For instance, in 2024, Fabrinet's dependence on a small number of high-precision component manufacturers meant that any price increase from these suppliers directly impacted Fabrinet's cost of goods sold.

Fabrinet's reliance on highly specialized and proprietary components for its advanced optical packaging and precision manufacturing services significantly enhances supplier bargaining power. When suppliers offer unique inputs with few viable alternatives, they gain considerable leverage. This situation can translate into increased costs or less favorable contract terms for Fabrinet, directly impacting its profitability and operational flexibility.

Switching suppliers in the precision manufacturing sector presents substantial hurdles for Fabrinet. These include the costs associated with re-qualifying new vendors, making necessary design modifications to accommodate different components, and the potential for disruptive production delays. These substantial switching costs inherently bolster the bargaining power of Fabrinet's current suppliers.

Fabrinet's operational model relies on a vast network of thousands of suppliers, a testament to the intricate and often long-term nature of these relationships. The sheer volume and established history with these partners indicate that severing these ties would be a costly and complex undertaking, further reinforcing supplier leverage.

Threat of Forward Integration by Suppliers

Suppliers possessing deep expertise in specialized components might consider integrating forward to directly compete with Fabrinet. This would involve them taking on manufacturing and assembly roles currently handled by Fabrinet. However, the extensive and intricate nature of Fabrinet's end-to-end services, covering everything from initial design and prototyping to final testing and logistics, presents a formidable barrier to entry for most component suppliers.

Fabrinet's specialization in high-complexity optical communication products further diminishes the likelihood of successful forward integration by its suppliers. These complex products require sophisticated manufacturing processes and deep industry knowledge, which are core competencies of Fabrinet but are typically outside the scope of component manufacturers. For instance, the precision required in manufacturing optical transceivers, a key product area for Fabrinet, demands specialized equipment and highly skilled labor.

- High Barrier to Entry: Forward integration by suppliers is challenging due to the comprehensive nature of Fabrinet's services, which span the entire product lifecycle.

- Fabrinet's Expertise: Fabrinet's deep knowledge in optical communication technologies and complex product manufacturing creates a significant competitive advantage.

- Limited Supplier Capability: Most component suppliers lack the capital, expertise, and infrastructure to replicate Fabrinet's broad service offering.

- Focus on Complexity: Fabrinet's concentration on high-complexity products naturally limits the pool of suppliers capable of forward integration.

Supplier's Importance to Fabrinet

Fabrinet's reliance on specialized components, such as optical transceivers and lasers, means that suppliers of these critical inputs hold significant bargaining power. The company's operational efficiency and ability to meet customer demand are directly tied to the consistent and timely delivery of these parts. For instance, disruptions in the supply of advanced optical components could severely impact Fabrinet's production schedules and its reputation for quality.

This interdependency grants essential suppliers considerable influence over pricing and delivery terms. Fabrinet's commitment to high-volume production for major customers like Cisco and Nokia necessitates strong supplier relationships, but also means that any fluctuations in supplier costs or availability can directly affect Fabrinet's profitability. In 2024, Fabrinet reported that its top customers accounted for a substantial portion of its revenue, underscoring the importance of maintaining smooth operations through reliable component sourcing.

- Supplier Dependence: Fabrinet depends on a select group of suppliers for highly specialized optical and electro-mechanical components.

- Quality and Timeliness: The quality and punctual delivery of these components are paramount for Fabrinet to meet its own production targets and customer commitments.

- Pricing Influence: Suppliers of unique or high-demand components can leverage their position to negotiate favorable pricing and terms, impacting Fabrinet's cost of goods sold.

- Market Dynamics: The limited number of qualified suppliers for certain advanced technologies further concentrates bargaining power within these suppliers.

Fabrinet's bargaining power with its suppliers is constrained by its reliance on a concentrated base for specialized optical and electro-mechanical components. Suppliers of these critical, often proprietary, inputs have significant leverage due to the high switching costs Fabrinet faces and the limited availability of alternative providers. This dynamic was evident in 2024, where Fabrinet's dependence on a few key component manufacturers directly influenced its cost structure.

The intricate nature of Fabrinet's manufacturing processes and its focus on high-complexity products mean that few suppliers can meet its stringent quality and technical requirements. This scarcity of qualified vendors amplifies their bargaining power, allowing them to command higher prices and dictate terms. For instance, the precision required for optical transceivers necessitates specialized suppliers whose expertise is difficult to replicate.

Fabrinet's relationships with its suppliers are often long-term and deeply integrated, further solidifying supplier influence. The substantial investments required for Fabrinet to qualify new suppliers and adapt its processes create significant barriers to changing vendors. This interdependence means suppliers can exert considerable pressure on pricing and delivery schedules, directly impacting Fabrinet's operational efficiency and profitability.

| Factor | Impact on Fabrinet | 2024 Data/Observation |

| Supplier Concentration | High | Fabrinet relies on a limited number of suppliers for critical components. |

| Switching Costs | High | Re-qualification, design changes, and potential production delays make supplier changes costly. |

| Component Uniqueness | High | Specialized and proprietary nature of components limits alternatives. |

| Supplier Forward Integration Risk | Low | Fabrinet's end-to-end services and complex product focus create barriers for suppliers. |

What is included in the product

Fabrinet's Porter's Five Forces Analysis dissects the competitive intensity within its optical communications and network equipment manufacturing sector. It evaluates the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the rivalry among existing competitors to understand Fabrinet's strategic positioning.

Instantly identify competitive threats and opportunities by visualizing the intensity of each Porter's Five Force, empowering strategic adjustments.

Customers Bargaining Power

Fabrinet's customer base is notably concentrated, with key original equipment manufacturers (OEMs) such as NVIDIA and Cisco being major revenue drivers. In fiscal year 2024, this concentration was starkly evident, as the top ten customers alone contributed a substantial 86% to the company's overall revenue.

This significant reliance on a few large clients bestows considerable bargaining power upon them. These dominant customers can leverage their substantial purchasing volume to negotiate favorable pricing and contractual terms, directly impacting Fabrinet's profitability and operational flexibility.

For Fabrinet's original equipment manufacturer (OEM) customers, the process of shifting to a different manufacturing service provider is often accompanied by significant expenses. These costs can stem from the need for re-designing components, undergoing rigorous re-qualification processes for new suppliers, and the potential for disruptions that could impact their crucial product launch timelines.

Fabrinet's strategy of offering a full suite of services, which includes valuable design support and advanced process engineering, is designed to integrate the company deeply into its customers' product development and manufacturing lifecycles. This deep integration effectively raises the barriers for customers looking to switch, thereby increasing their switching costs and consequently reducing their bargaining power.

Fabrinet's customers, many of whom are major original equipment manufacturers (OEMs), possess the substantial financial resources and technical expertise to potentially bring their manufacturing processes in-house. This inherent threat of backward integration grants these customers considerable bargaining power during price and contract negotiations.

However, the highly specialized nature of Fabrinet's manufacturing, coupled with its significant economies of scale and cost efficiencies, often renders in-house production less attractive for the intricate products its clients require. For instance, while a large telecom equipment manufacturer could theoretically build its own optical transceiver factory, the upfront investment and learning curve would likely outweigh the benefits compared to leveraging Fabrinet's established infrastructure and expertise.

Price Sensitivity of Customers

Customers in high-growth markets, especially those facing their own competitive pressures, tend to be very sensitive to price. This means that even for complex products like those Fabrinet produces, which typically allow for better margins, clients will actively look for the most economical options available.

This persistent drive for cost-effectiveness can put considerable pressure on Fabrinet's pricing strategies and, consequently, its overall profitability. For instance, in the fiercely competitive semiconductor manufacturing equipment sector, where Fabrinet operates, customers often leverage multiple supplier relationships to negotiate better terms.

- Price Sensitivity Impact: In 2023, Fabrinet reported revenues of $2.4 billion, highlighting the scale of their operations and the importance of managing pricing across a broad customer base.

- Competitive Landscape: The optical communication components market, a key area for Fabrinet, is characterized by numerous players, intensifying price competition.

- Customer Negotiation Power: Large telecommunications equipment manufacturers, who are significant customers for Fabrinet, often have substantial purchasing power, enabling them to demand lower prices.

- Margin Pressure: While Fabrinet specializes in advanced manufacturing, the need to remain competitive means that price concessions can directly affect their gross margins, which averaged around 19.5% in recent fiscal periods.

Volume of Purchases

Fabrinet's customers, particularly those in high-growth sectors like optical communications and automotive, often make substantial volume purchases. This sheer size of their orders grants them significant leverage. For instance, a large OEM's decision to consolidate suppliers or negotiate more favorable terms can directly impact Fabrinet's revenue streams.

The bargaining power derived from the volume of purchases is clearly demonstrated by shifts in Fabrinet's revenue. The company noted a change in its Datacom revenue in Q3 FY2025, directly attributable to a planned product transition by a major customer. This event underscores how a single, high-volume client's strategic moves can influence Fabrinet's financial performance, highlighting the customer's considerable power.

- High-Volume Orders: Fabrinet frequently secures large orders from key customers in growth markets.

- Customer Leverage: Substantial purchase volumes empower these customers to negotiate better pricing and terms.

- Q3 FY2025 Datacom Shift: A planned product transition by a major Datacom customer impacted revenue, illustrating the influence of large buyers.

Fabrinet's customer concentration, with top customers driving a significant portion of revenue, grants them considerable bargaining power. In fiscal year 2024, the top ten customers accounted for 86% of revenue, enabling them to negotiate favorable pricing and terms. While switching costs for customers exist due to re-design and qualification, the threat of backward integration and price sensitivity in high-growth markets still exerts pressure.

| Factor | Description | Impact on Fabrinet |

|---|---|---|

| Customer Concentration | Top 10 customers represented 86% of FY2024 revenue. | High leverage for major clients in negotiations. |

| Switching Costs | Re-design, re-qualification, and product launch disruption risks. | Mitigates some customer bargaining power. |

| Threat of Backward Integration | Customers' potential to bring manufacturing in-house. | Increases customer negotiation leverage. |

| Price Sensitivity | Customers in high-growth markets seek cost-effectiveness. | Puts pressure on Fabrinet's pricing and margins. |

What You See Is What You Get

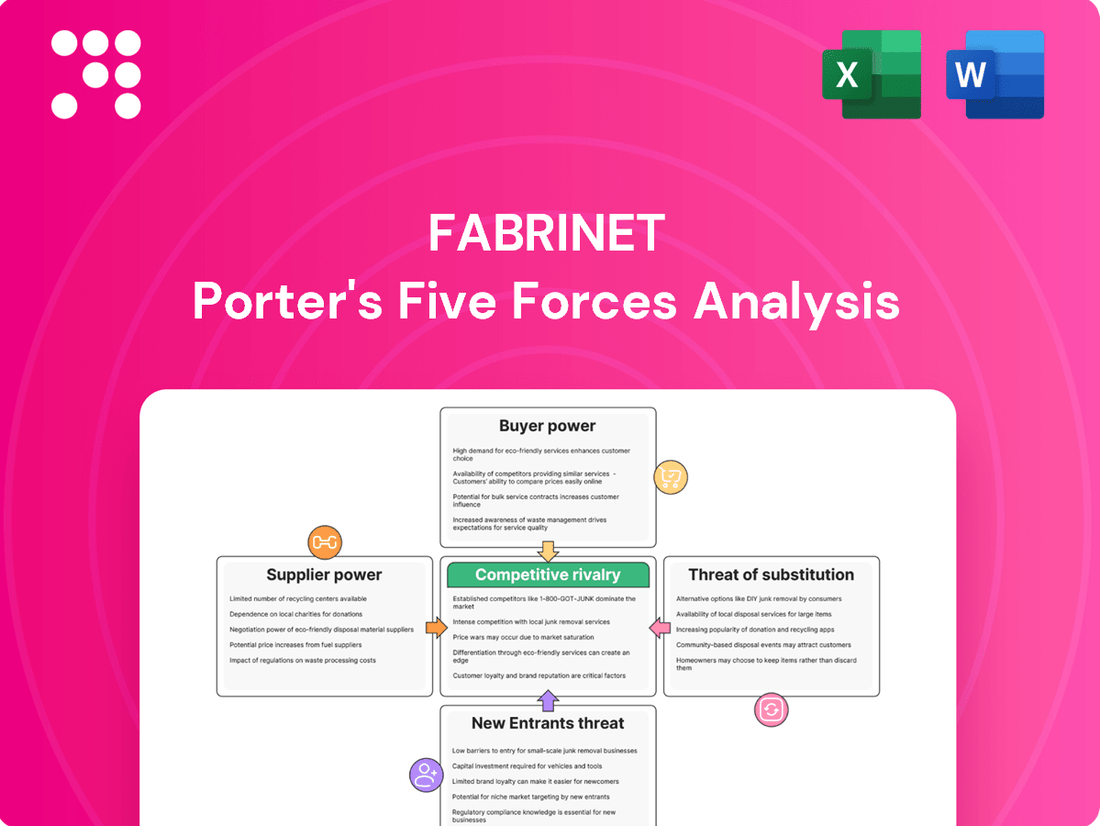

Fabrinet Porter's Five Forces Analysis

This preview showcases the comprehensive Fabrinet Porter's Five Forces Analysis, offering a detailed examination of competitive forces within the optical networking industry. The document displayed here is the part of the full version you’ll get—ready for download and use the moment you buy, providing actionable insights into Fabrinet's strategic positioning. You're looking at the actual document, which meticulously breaks down supplier power, buyer bargaining power, the threat of new entrants, the threat of substitutes, and the intensity of rivalry, all of which you'll receive instantly after purchase.

Rivalry Among Competitors

Fabrinet operates in a market characterized by significant competition, featuring numerous established players offering advanced optical packaging and precision manufacturing services. Key rivals include Benchmark Electronics, Celestica, Sanmina-SCI, Jabil Circuit, and Venture Corporation Limited. These companies possess substantial resources and market presence, intensifying the competitive landscape.

Fabrinet thrives in dynamic, high-growth sectors such as optical communications, automotive, medical devices, and industrial lasers. This robust market expansion generally softens competitive pressures by creating ample room for all participants to grow. However, the pursuit of market share within these expanding segments remains intensely competitive.

The company’s financial performance underscores this growth, with Fabrinet reporting a significant 19.2% year-over-year revenue increase in its third quarter of fiscal year 2025. This upward trajectory in revenue directly reflects the vibrant health and increasing demand within the markets Fabrinet serves.

Fabrinet stands out by specializing in intricate, high-complexity optical products and offering end-to-end services, from initial design to full-scale manufacturing. This deep integration and specialized knowledge create significant barriers for customers looking to switch, as their operations often become deeply entwined with Fabrinet's unique processes and engineering expertise.

The ability to handle any product mix and volume is a critical differentiator for Fabrinet, allowing them to cater to a wide range of customer needs. This flexibility, coupled with the embedded nature of their design and process engineering, contributes to substantial switching costs. For instance, in fiscal year 2023, Fabrinet reported revenue of $2.5 billion, demonstrating their significant market presence and the value customers place on their specialized capabilities.

Exit Barriers

Fabrinet operates in an industry characterized by substantial exit barriers, primarily due to the immense capital required for specialized manufacturing facilities and advanced equipment. These high upfront costs, coupled with the necessity of a highly skilled workforce, make it economically challenging for companies to simply shut down operations and leave the market. This situation can force even struggling firms to continue competing, potentially intensifying rivalry as they strive to recover their investments.

Fabrinet's own global network of manufacturing facilities represents significant fixed assets, creating a considerable commitment to the precision manufacturing sector. For example, in fiscal year 2023, Fabrinet reported total assets of $2.5 billion, a substantial portion of which is tied up in property, plant, and equipment. This financial entanglement discourages a swift exit, influencing competitive dynamics.

- High Capital Investment: Specialized manufacturing equipment and facilities represent a significant sunk cost for companies like Fabrinet.

- Skilled Workforce Dependency: The need for highly trained personnel further increases the cost and complexity of exiting the market.

- Asset Fixity: Fabrinet's global footprint of physical assets makes it difficult and costly to divest or repurpose upon exiting.

- Intensified Rivalry: High exit barriers compel companies to remain operational, potentially leading to prolonged competition even in less favorable market conditions.

Customer Concentration Impact

Customer concentration can significantly fuel competitive rivalry as providers aggressively pursue a limited pool of high-value clients. Fabrinet's reliance on a few major customers means competitors are keenly focused on winning or retaining these accounts, leading to intensified price competition and service innovation.

This dynamic is evident when considering Fabrinet's customer base. For instance, in fiscal year 2023, Fabrinet reported that its largest customer accounted for approximately 26% of its total revenue. This level of dependence on a few key clients naturally draws the attention of rivals who see these accounts as critical growth opportunities.

- Intensified Bidding Wars: When a significant contract comes up for renewal or a new large project is announced, multiple service providers, including Fabrinet's competitors, will likely engage in aggressive bidding, potentially driving down margins for all involved.

- Focus on Key Account Management: Competitors will invest heavily in building relationships and offering tailored solutions to these concentrated customers, directly challenging Fabrinet's existing partnerships.

- Strategic Partnerships and Acquisitions: To gain a foothold with these large clients, competitors might form strategic alliances or acquire smaller companies that already have established relationships, further increasing competitive pressure.

Fabrinet faces intense competition from established players like Benchmark Electronics and Celestica, who also offer advanced manufacturing services. This rivalry is fueled by market growth, with Fabrinet's revenue increasing by 19.2% year-over-year in Q3 FY2025, indicating ample opportunity but also a strong incentive for competitors to vie for market share. The company's specialization and high switching costs do provide some insulation, but the pursuit of key, concentrated customers, such as its largest client representing 26% of FY2023 revenue, intensifies competitive dynamics through aggressive bidding and relationship building.

| Competitor | Key Services | Market Focus |

|---|---|---|

| Benchmark Electronics | Electronics manufacturing services, design & engineering | Aerospace, defense, medical, industrial |

| Celestica | Advanced manufacturing services, supply chain solutions | Communications, enterprise, aerospace, defense, healthcare |

| Sanmina-SCI | Integrated manufacturing solutions, complex systems | Communications, defense, medical, industrial, automotive |

| Jabil Circuit | Diversified manufacturing services, supply chain | Healthcare, automotive, industrial, technology, aerospace |

| Venture Corporation Limited | Product realization services, advanced manufacturing | Medical, industrial, communications, lifestyle |

SSubstitutes Threaten

The primary substitute for Fabrinet's advanced optical packaging and precision manufacturing services is the decision by Original Equipment Manufacturers (OEMs) to bring these operations in-house. Many of the larger OEMs have the financial muscle and technical expertise to develop their own manufacturing capabilities. This trend is a constant consideration for Fabrinet as it assesses its competitive landscape.

While OEMs can indeed develop in-house capabilities, Fabrinet often points to significant barriers that make this a less attractive option for many. These include lengthy sales cycles for new product introductions and the immense complexity involved in precision manufacturing, requiring specialized equipment and highly skilled labor. For instance, the intricate nature of optical components demands extremely tight tolerances and advanced testing protocols that are costly and time-consuming to replicate internally.

For less complex components or products, original equipment manufacturers (OEMs) might indeed turn to more generic, lower-cost manufacturing service providers. This threat exists because some parts of the manufacturing process could potentially be outsourced to less specialized firms.

Fabrinet actively counters this by concentrating on high-complexity products and providing a comprehensive range of services, including crucial design support and advanced packaging solutions. This deliberate specialization creates a significant barrier for generic manufacturers attempting to offer direct substitutes for Fabrinet's core offerings.

Technological advancements pose a significant threat, as new integration methods could simplify manufacturing processes, potentially reducing the demand for Fabrinet's specialized optical and electro-mechanical packaging expertise. For instance, the emergence of novel architectures might bypass the need for current complex assembly techniques.

Fabrinet is actively mitigating this threat by investing in cutting-edge technologies, such as the development and manufacturing support for 1.6 Tb/s devices. This proactive approach ensures they remain at the forefront of industry needs and can adapt to evolving technological landscapes.

Customer Design Changes

Customer design changes pose a significant threat. If clients opt to simplify their product designs or integrate more off-the-shelf components, they might lessen their dependence on Fabrinet's specialized manufacturing and optical packaging expertise. This shift could reduce the need for Fabrinet's intricate engineering and process development services.

Fabrinet actively mitigates this threat by embedding itself early in the customer design process. Their involvement in design support and advanced process engineering helps them anticipate and adapt to evolving customer needs. For instance, Fabrinet's ability to handle complex, custom optical solutions remains a key differentiator, making it harder for customers to substitute these specialized capabilities with standardized alternatives.

- Threat of Substitutes: Customer Design Changes

- If customers redesign products to use simpler manufacturing or standardized components, their reliance on Fabrinet's specialized services decreases.

- Fabrinet's proactive engagement in design support and process engineering is crucial for staying ahead of these trends.

- The company's expertise in complex optical solutions acts as a barrier against substitution by standardized alternatives.

Cost-Performance Trade-offs

Customers may consider substitutes if the cost savings from lower-quality alternatives are significant enough to offset the performance advantages offered by Fabrinet's precision manufacturing. For instance, if a competitor offers a component at 20% less cost, but with a 5% lower reliability rate, a customer might evaluate this trade-off.

However, in demanding sectors like optical communications, automotive safety systems, and advanced medical devices, where failure can have severe consequences, performance and unwavering reliability are non-negotiable. This significantly diminishes the appeal of cheaper, less dependable substitutes for Fabrinet's clientele.

- High-Precision Demand: Industries like telecommunications, where Fabrinet operates, often require components with extremely tight tolerances, making lower-precision substitutes inadequate.

- Reliability Imperative: In automotive and medical sectors, product failures can lead to safety recalls or patient harm, making reliability a primary purchasing driver over minor cost differences.

- Value Proposition: Fabrinet's commitment to high-quality, intricate product manufacturing inherently builds a strong value proposition that is difficult for lower-cost, lower-performance substitutes to match.

The threat of substitutes for Fabrinet primarily stems from customers' potential to insource manufacturing or to opt for less complex, lower-cost alternatives. While larger Original Equipment Manufacturers (OEMs) possess the resources for in-house production, Fabrinet mitigates this by focusing on high-complexity, precision-intensive products that are difficult to replicate internally. For example, the intricate demands of optical packaging require specialized equipment and skilled labor, creating significant barriers to entry for potential in-house operations or generic manufacturers.

Technological advancements that simplify manufacturing processes also represent a substitute threat, potentially reducing the need for Fabrinet's specialized expertise. Fabrinet counters this by investing in cutting-edge technologies, such as supporting the development of 1.6 Tb/s devices, ensuring they remain at the forefront of industry innovation. Furthermore, customer design changes that favor simpler components can lessen reliance on Fabrinet's advanced capabilities, a risk the company addresses by actively participating in the early stages of customer design processes.

The cost-performance trade-off is a critical factor. While cheaper, lower-quality substitutes may exist, industries served by Fabrinet, such as telecommunications and medical devices, prioritize unwavering reliability and performance. In these sectors, the consequences of product failure—ranging from safety recalls to patient harm—make minor cost savings from inferior substitutes an unacceptable risk for customers. Fabrinet's value proposition is built on this high-precision, high-reliability manufacturing, making direct substitution challenging.

| Factor | Impact on Fabrinet | Mitigation Strategy | Example |

|---|---|---|---|

| In-house Manufacturing by OEMs | Potential loss of business if large OEMs bring production in-house. | Focus on high-complexity, specialized services that are difficult and costly for OEMs to replicate. | Fabrinet's expertise in advanced optical packaging for high-speed networking components. |

| Generic, Lower-Cost Manufacturers | Threat from providers offering less sophisticated solutions at lower prices. | Specialization in intricate, high-precision products and offering comprehensive design support. | Handling extremely tight tolerances for optical transceivers that generic manufacturers cannot meet. |

| Technological Advancements | New methods could simplify processes, reducing demand for current expertise. | Continuous investment in cutting-edge technologies and R&D. | Developing manufacturing capabilities for next-generation components like 1.6 Tb/s devices. |

| Customer Design Simplification | Reduced reliance on specialized services if customers use more off-the-shelf parts. | Early engagement in customer design processes and offering advanced process engineering. | Collaborating with clients to integrate complex optical sub-assemblies into their product designs. |

| Cost vs. Performance Trade-off | Customers might consider cheaper alternatives with lower quality. | Emphasizing superior reliability and performance crucial in target industries. | Ensuring components meet stringent reliability standards for automotive safety systems where failure is unacceptable. |

Entrants Threaten

The advanced optical packaging and precision manufacturing market demands significant capital for cutting-edge facilities, specialized machinery, and sophisticated testing equipment. This substantial upfront investment acts as a major deterrent for new companies looking to enter the industry, effectively raising the barrier to entry.

For instance, Fabrinet's continuous growth, exemplified by its new Building 10, underscores the capital-intensive nature of operations in this sector. This ongoing investment in infrastructure and technology is crucial for maintaining a competitive edge.

Fabrinet's significant technological expertise in optical, electro-mechanical, and electronic manufacturing, coupled with its proprietary processes and intellectual property, presents a formidable barrier to new entrants. Developing or acquiring comparable capabilities is a substantial investment in time and capital, making it difficult for newcomers to compete effectively. For instance, Fabrinet's ability to offer end-to-end solutions, from initial design to rigorous testing, underscores the depth of its accumulated knowledge and integrated operational efficiencies.

The threat of new entrants in the optical communication components and subsystems industry is somewhat mitigated by lengthy sales cycles. These cycles are often extended because customers, typically major original equipment manufacturers (OEMs), require extensive testing and validation for mission-critical products. Fabrinet, for instance, benefits from its deep, established relationships with these leading OEMs, built over years of reliable performance and trust.

For a new player, replicating this level of trust and navigating the complex qualification processes for high-volume, critical components would present a substantial hurdle. The time and resources required to secure initial contracts, especially with industry giants, can be prohibitive, effectively raising the barrier to entry.

Economies of Scale and Scope

Fabrinet benefits significantly from economies of scale, stemming from its high-volume production of intricate optical components and its expansive global manufacturing presence. For instance, in fiscal year 2023, Fabrinet reported revenue of $2.4 billion, underscoring its substantial operational capacity. Newcomers would face immense difficulty matching these cost efficiencies without substantial initial investment to reach comparable production volumes.

Furthermore, Fabrinet leverages economies of scope through its diverse service portfolio that spans multiple high-growth sectors, including optical communication, automotive, and medical devices. This diversification allows for shared resources and expertise, creating a competitive advantage. The company’s ability to serve these varied markets efficiently makes it challenging for a new entrant focused on a single niche to compete on cost and breadth of service.

- Economies of Scale: Fabrinet’s large-scale production, evidenced by its $2.4 billion in revenue for FY2023, creates significant cost advantages.

- Global Footprint: A worldwide manufacturing network allows Fabrinet to optimize production and logistics, a feat difficult for new entrants to replicate.

- Economies of Scope: Serving multiple high-growth markets like optical communication and automotive diversifies risk and enhances resource utilization.

- Barriers to Entry: The capital investment required to achieve similar scale and scope presents a substantial hurdle for potential new competitors.

Regulatory and Certification Hurdles

Manufacturing for critical sectors like medical devices and automotive demands rigorous adherence to regulatory standards and certifications. New players face significant challenges navigating these complex compliance landscapes, which are both time-consuming and expensive, thereby raising the barrier to entry. Fabrinet's established position indicates a proven track record of meeting these demanding industry requirements.

These regulatory hurdles can significantly deter potential new entrants. For instance, obtaining certifications like ISO 13485 for medical devices or IATF 16949 for automotive components requires substantial investment in quality management systems and process validation. Fabrinet's long-standing operations suggest they have already overcome these initial capital and operational expenditure barriers.

- Regulatory Compliance Costs: The cost of achieving and maintaining compliance with regulations such as FDA approvals or CE marking can run into millions of dollars for new entrants.

- Certification Lead Times: The process for obtaining critical certifications can take years, providing an incumbent advantage to established firms like Fabrinet.

- Industry-Specific Standards: Fabrinet's focus on optical communication, medical, and automotive industries means they must meet diverse and evolving technical specifications, which are difficult for newcomers to replicate quickly.

The threat of new entrants for Fabrinet is considerably low due to the substantial capital required for advanced manufacturing facilities and specialized equipment. Fabrinet's significant investments, such as its ongoing expansion projects, highlight the high barrier to entry. Furthermore, the company's deep technological expertise and proprietary processes are difficult and costly for newcomers to replicate.

Established customer relationships and lengthy qualification processes in critical sectors like optical communication and medical devices also deter new players. Fabrinet's proven track record and trust with major OEMs, built over years of reliable performance, provide a significant competitive advantage. The time and resources needed to gain similar customer confidence are substantial.

Economies of scale, exemplified by Fabrinet's $2.4 billion revenue in fiscal year 2023, and economies of scope across diverse markets, create cost efficiencies that new entrants struggle to match. Navigating complex regulatory landscapes and obtaining necessary certifications for industries like automotive and medical devices further increase the difficulty and cost for potential competitors.

| Barrier Type | Description | Fabrinet Advantage | New Entrant Challenge |

|---|---|---|---|

| Capital Requirements | High cost of advanced facilities, machinery, and testing equipment. | Established infrastructure and ongoing investment capacity. | Significant upfront investment needed to compete. |

| Technology & IP | Proprietary processes and deep expertise in optical, electro-mechanical, and electronic manufacturing. | Integrated end-to-end solutions and accumulated knowledge. | Time and capital intensive to develop or acquire comparable capabilities. |

| Customer Relationships & Qualification | Lengthy sales cycles and rigorous OEM validation for mission-critical products. | Deep, long-standing relationships with leading OEMs. | Prohibitive time and resources to secure initial contracts and build trust. |

| Economies of Scale | Cost advantages from high-volume production. | $2.4 billion revenue in FY2023 indicates substantial operational capacity. | Difficulty matching cost efficiencies without comparable production volumes. |

| Regulatory Compliance | Navigating complex certifications and standards (e.g., ISO 13485, IATF 16949). | Proven track record of meeting demanding industry requirements. | Expensive and time-consuming process to obtain and maintain certifications. |

Porter's Five Forces Analysis Data Sources

Our Fabrinet Porter's Five Forces analysis is built upon a foundation of robust data from annual reports, investor presentations, and reputable industry analyst reports. We also incorporate insights from market research firms specializing in the optical networking sector and relevant trade publications to capture current competitive dynamics.