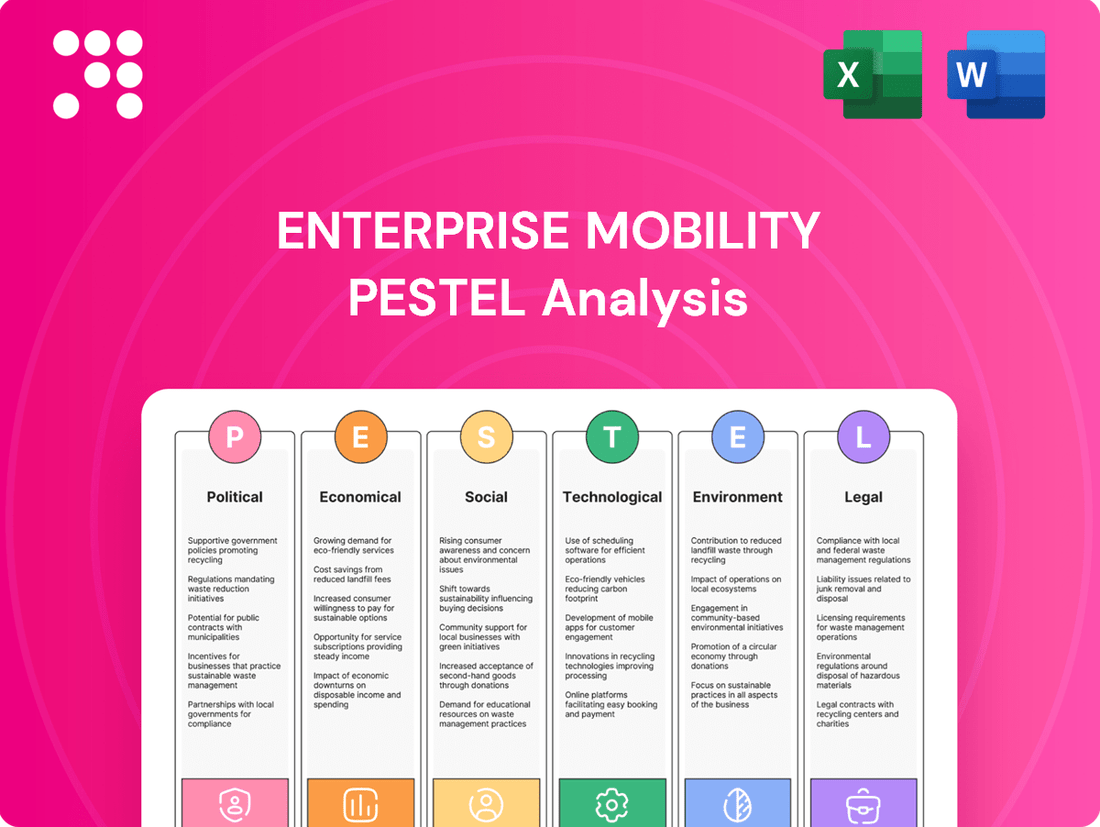

Enterprise Mobility PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Enterprise Mobility Bundle

Navigate the dynamic landscape of Enterprise Mobility with our comprehensive PESTLE analysis. Understand how political, economic, social, technological, legal, and environmental factors are shaping its future, offering you a critical advantage. Download the full version now to unlock actionable intelligence and refine your strategic approach.

Political factors

Government policies, such as upcoming Euro 7 emission standards in Europe, directly influence Enterprise Mobility's fleet composition and investment in cleaner vehicles. Shifts in tax credits for electric vehicles, like those seen in the US in 2024, can significantly alter the cost-effectiveness of transitioning to EV fleets. Navigating the varied regulatory environments across Enterprise's 90+ operating countries requires constant adaptation to local safety standards and urban mobility planning initiatives.

Global trade policies significantly impact Enterprise Mobility's fleet acquisition costs. For instance, the imposition of tariffs on imported vehicles, as seen in various trade disputes throughout 2024 and anticipated into 2025, directly increases the price of new additions to their rental fleet. These policy shifts necessitate careful financial planning and can influence sourcing strategies.

Geopolitical stability and international relations are crucial for Enterprise Mobility's demand. A stable global environment generally fosters increased tourism and business travel, both key revenue streams. Conversely, heightened international tensions or trade wars can deter travel, negatively impacting rental volumes. For example, in 2024, disruptions in certain regions due to political instability led to a noticeable dip in international business travel bookings for many rental companies.

Governments globally are pushing for greener transport, with many cities implementing zero-emission zones and offering incentives for electric vehicle (EV) purchases. For instance, by the end of 2023, the European Union saw a significant surge in EV registrations, with battery electric vehicles (BEVs) accounting for over 14% of new car sales, a notable increase from previous years.

Enterprise Mobility's strategy of electrifying its fleet directly supports these political objectives. This alignment can foster beneficial partnerships with government bodies and lead to more favorable regulatory conditions, potentially reducing operational costs and enhancing brand reputation. The company's stated ESG commitments explicitly champion this shift towards electrification.

Antitrust and Competition Laws

Antitrust and competition laws significantly shape Enterprise Mobility's operational landscape. As a major player, the company faces ongoing scrutiny from regulatory bodies like the U.S. Department of Justice and the European Commission, who monitor market concentration and prevent monopolistic practices. For instance, in 2024, global antitrust enforcement saw a notable increase, with regulators actively investigating large tech and transportation firms for potential anti-competitive behavior, impacting market access and pricing strategies.

Compliance is paramount to avoid substantial fines and operational disruptions. Failure to adhere to these regulations can lead to hefty penalties; for example, major tech companies have faced billions in fines for antitrust violations in recent years. Enterprise Mobility must navigate these complex legal frameworks to ensure its mergers, acquisitions, and pricing remain fair and competitive, safeguarding its market position and long-term growth prospects.

- Regulatory Oversight: Government agencies actively monitor market share and competitive practices in the transportation sector.

- Merger & Acquisition Scrutiny: Proposed deals by Enterprise Mobility are subject to antitrust review to ensure fair competition.

- Pricing Strategy Impact: Competition laws influence how Enterprise Mobility sets prices to avoid accusations of predatory or unfair pricing.

- Legal Compliance Costs: Significant resources are allocated to ensure adherence to evolving antitrust legislation globally.

Labor Laws and Employment Policies

National and regional labor laws, such as minimum wage requirements and regulations on working hours, directly influence Enterprise Mobility's operational expenses and how it manages its workforce. For instance, in 2024, the U.S. federal minimum wage remains at $7.25 per hour, but many states and cities have enacted significantly higher rates, impacting labor costs for companies with distributed workforces. Union regulations also play a crucial role, potentially affecting collective bargaining agreements and employee relations.

Policies concerning employee benefits, diversity, equity, and inclusion (DEI) are increasingly shaping corporate human resources strategies and public perception. Companies are focusing on comprehensive benefits packages to attract and retain talent, with many reporting increased investment in DEI initiatives to foster a more inclusive workplace culture. For example, a 2024 survey indicated that 75% of companies now have formal DEI programs, up from 50% in 2020.

- Minimum Wage Impact: In 2024, states like California and Washington have minimum wages exceeding $15 per hour, directly increasing labor costs for mobile workforces compared to states with lower mandates.

- Unionization Trends: As of early 2025, unionization efforts continue to be a significant factor in various sectors, potentially influencing Enterprise Mobility's employee contract negotiations and operational flexibility.

- DEI Investment: Companies are allocating an average of 5% of their HR budget to DEI programs in 2024, aiming to improve employee satisfaction and brand reputation.

- Employee Turnover: The technology and mobility sectors often experience annual employee turnover rates between 15-25%, necessitating proactive retention strategies and continuous recruitment efforts.

Government regulations on emissions and vehicle types, such as the Euro 7 standards impacting fleet choices, directly influence Enterprise Mobility's operational costs and investment strategies. Tax incentives for electric vehicles, like those adjusted in the US during 2024, can significantly alter the financial viability of fleet electrification. Navigating diverse international regulations requires constant adaptation to local safety and urban planning mandates across Enterprise's global operations.

What is included in the product

This Enterprise Mobility PESTLE Analysis comprehensively examines the external macro-environmental forces shaping the industry, offering a strategic roadmap for navigating its complexities.

It provides actionable insights into how political, economic, social, technological, environmental, and legal factors present both challenges and opportunities for businesses operating in the enterprise mobility space.

A PESTLE analysis for enterprise mobility acts as a pain point reliever by providing a structured framework to proactively identify and address external challenges, thereby mitigating risks and enabling more informed strategic decisions.

Economic factors

Global economic growth is a significant driver for Enterprise Mobility, as it directly impacts both consumer and business travel. When economies are expanding, people tend to travel more for leisure and business, boosting demand for car rentals and other mobility solutions. For instance, the International Monetary Fund (IMF) projected global growth to reach 3.2% in 2024, a slight slowdown from 2023 but still indicating a generally positive economic environment that supports travel spending.

Conversely, economic downturns can put a damper on travel budgets. During periods of recession or slower growth, consumers and businesses often cut back on discretionary spending, including travel. This can lead to reduced car rental volumes and potentially lower average rental prices as companies compete for a smaller pool of customers. The car rental market, however, has demonstrated notable resilience, adapting to changing economic conditions by offering flexible pricing and service options.

Consumer spending habits are intrinsically linked to economic health, and this directly affects Enterprise Mobility's revenue. As disposable incomes rise during economic upswings, consumers are more likely to engage in travel, whether for vacations or personal errands, increasing the need for rental vehicles. In 2024, consumer spending has shown continued strength in many developed economies, supporting the mobility sector despite inflationary pressures.

Rising inflation in 2024 continues to significantly impact the operating costs for enterprise mobility. Fuel prices, a major component of fleet expenses, have seen volatility, contributing to higher operational expenditures. Vehicle acquisition costs also remain elevated, with new vehicle prices still reflecting supply chain disruptions and increased manufacturing costs, impacting the total cost of ownership for businesses.

Maintenance expenses are also on the rise due to increased parts costs and labor shortages in the automotive repair sector. While rental prices for vehicles have shown some stabilization in early 2025, they generally persist above pre-pandemic benchmarks, signaling sustained cost pressures for companies relying on rental fleets. This necessitates a strong focus on efficient fleet management and stringent cost control measures to safeguard profitability.

Fluctuations in interest rates directly impact Enterprise Mobility's cost of financing its extensive vehicle fleet. For instance, if the Federal Reserve raises its benchmark interest rate, borrowing becomes more expensive for Enterprise. This means that acquiring new vehicles, especially for fleet expansion or upgrading to newer, more efficient models, will carry a higher financing cost.

Higher borrowing costs can significantly affect Enterprise Mobility's investment decisions. Consider the transition to electric vehicles (EVs), which often requires substantial upfront capital. If interest rates rise, the cost of financing these green fleet initiatives increases, potentially slowing down adoption rates or necessitating a re-evaluation of investment timelines. For example, a 1% increase in interest rates on a $100 million fleet financing deal could add $1 million annually in interest payments.

These interest rate dynamics can influence Enterprise Mobility's overall financial health and competitive positioning. When capital is more expensive, the company might delay capital expenditures, impacting its ability to offer the latest vehicle models or expand into new markets. This could put it at a disadvantage compared to competitors with lower debt burdens or access to cheaper financing, ultimately affecting its market share and profitability in the 2024-2025 period.

Tourism and Business Travel Trends

The post-pandemic resurgence in tourism and business travel is a significant tailwind for Enterprise Mobility. Leisure travel saw a robust recovery, with global international tourist arrivals reaching 88% of pre-pandemic levels by the end of 2023, according to the UN World Tourism Organization. This surge, coupled with the growing 'bleisure' trend where travelers extend business trips for leisure, directly boosts demand for rental vehicles.

Business travel is also on a strong rebound, though it's evolving. While some companies are opting for virtual meetings, many are returning to in-person interactions, driving corporate demand for Enterprise Mobility's fleet. For instance, the Global Business Travel Association (GBTA) projected business travel spending to reach $1.4 trillion globally in 2024, nearing 2019 levels.

Enterprise Mobility is well-positioned to capitalize on these shifts, serving both individual leisure travelers and corporate accounts. The increasing popularity of road trips and shorter, more frequent getaways also aligns with the flexibility offered by car rental services.

- Global international tourist arrivals reached 88% of pre-pandemic levels by end of 2023.

- Global business travel spending projected to reach $1.4 trillion in 2024.

- 'Bleisure' travel is a growing trend, blending business and leisure.

- Enterprise Mobility caters to both leisure and corporate travel segments.

Used Vehicle Market Dynamics

The wholesale used vehicle market is a critical factor for Enterprise Mobility, directly influencing how much their fleet vehicles are worth when they are sold (remarketing) and how much value they lose over time (depreciation). Following the significant price swings seen during the pandemic, the market is moving towards more stable pricing. This normalization impacts the predicted resale value of vehicles, which in turn affects the financial outcomes of Enterprise Mobility's vehicle sales operations.

Recent trends show a clear consumer preference shift, with demand increasingly leaning towards SUVs and trucks. This preference directly impacts the types of vehicles Enterprise Mobility might acquire for its fleet, as these models are likely to hold their value better in the resale market. For instance, in early 2024, the average price for used SUVs and trucks remained stronger compared to sedans, reflecting this ongoing demand. This strategic consideration is vital for optimizing fleet depreciation and remarketing profits.

- Used Vehicle Price Trends: While prices have stabilized from pandemic highs, the wholesale used vehicle market saw a slight year-over-year decrease in average prices in Q1 2024, with some segments like compact cars experiencing more pronounced declines than SUVs.

- Residual Value Impact: The residual value of Enterprise Mobility's fleet vehicles is directly tied to these wholesale market conditions, affecting profitability on remarketing efforts.

- Demand Shift: The continued strong demand for SUVs and trucks means these vehicle types are likely to retain a higher percentage of their original value compared to other segments.

- Fleet Management Strategy: Adapting fleet acquisition to align with consumer demand for SUVs and trucks can mitigate depreciation and enhance remarketing returns.

Global economic growth, projected at 3.2% for 2024 by the IMF, generally supports increased travel spending, benefiting Enterprise Mobility. However, rising inflation in 2024 continues to elevate operating costs, particularly fuel and vehicle acquisition prices, impacting overall profitability despite some rental price stabilization in early 2025.

Interest rate hikes directly increase financing costs for fleet acquisition. For example, a 1% rate increase on a $100 million deal adds $1 million annually, potentially slowing EV adoption and affecting competitive positioning.

The used vehicle market is stabilizing, but consumer demand for SUVs and trucks means these vehicles retain higher residual values, impacting Enterprise Mobility's remarketing profits and fleet depreciation strategies.

| Economic Factor | 2024/2025 Data Point | Impact on Enterprise Mobility |

|---|---|---|

| Global Economic Growth | IMF projects 3.2% in 2024 | Supports increased travel and rental demand. |

| Inflation | Elevated, impacting fuel and vehicle acquisition costs. | Increases operating expenses and total cost of ownership. |

| Interest Rates | Rising, increasing financing costs for fleet. | Higher borrowing costs for new vehicles and potential delay in EV adoption. |

| Used Vehicle Market | Stabilizing, with strong demand for SUVs/trucks. | Influences fleet depreciation and remarketing profitability. |

Preview the Actual Deliverable

Enterprise Mobility PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Enterprise Mobility PESTLE Analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors shaping the industry, providing critical insights for strategic planning.

Sociological factors

Consumers are increasingly favoring flexible, on-demand transportation over traditional car ownership. This shift is evident in the rising popularity of car-sharing services and vehicle subscription models, reflecting a desire for greater convenience and cost-effectiveness. For instance, the global car-sharing market was projected to reach over $15 billion by 2027, indicating a significant move away from personal vehicle dependence.

Enterprise Mobility, with its broad range of services that extend beyond simple rentals, is strategically positioned to capitalize on these evolving consumer preferences. By offering diverse mobility solutions, the company can cater to the growing demand for adaptable and user-friendly transportation options. This adaptability is crucial as consumers increasingly prioritize seamless digital interactions and personalized mobility experiences.

Global urbanization is accelerating, with the UN estimating that 68% of the world's population will live in urban areas by 2050. This surge in city dwellers intensifies the need for streamlined transportation, driving demand for shared mobility and Mobility-as-a-Service (MaaS) platforms. For instance, by the end of 2024, ride-sharing services are projected to see a 15% increase in usage in major metropolitan areas.

Higher population density in urban centers naturally leads to increased traffic congestion and a greater demand for efficient, shared transport options. This societal shift directly benefits enterprise mobility solutions that offer alternatives to individual car ownership, such as corporate shuttle services and integrated journey planning apps. In 2023, the global MaaS market was valued at over $120 billion, with projections indicating continued robust growth.

Growing public awareness of environmental issues is significantly shaping the transportation sector. Consumers are actively seeking greener alternatives, pushing companies like Enterprise Mobility to prioritize sustainable practices.

This trend is directly influencing fleet management decisions. For instance, by 2025, it's projected that electric vehicles (EVs) will represent a substantial portion of new car sales in many key markets, a shift Enterprise Mobility is actively addressing through investments in its EV fleet. This proactive approach supports their commitment to environmental, social, and governance (ESG) objectives, with a target to significantly reduce their fleet's carbon footprint by 2030.

Remote Work and Lifestyle Shifts

The widespread adoption of remote and hybrid work models has significantly reshaped travel behaviors. This shift has fueled a growing trend of digital nomads and bleisure travel, where business trips are extended for leisure. For mobility providers, this translates to a potential increase in demand for flexible, long-term car rental options and a need to cater to rentals in emerging non-traditional business hubs.

These lifestyle changes present new avenues for mobility service providers. For instance, companies are exploring subscription models for vehicles to cater to individuals who may not need a car daily but require one for extended periods or specific travel needs. This evolving landscape necessitates a more adaptable approach to fleet management and service offerings.

- Digital Nomadism: A 2024 report indicated that over 35 million people globally identify as digital nomads, a figure projected to grow.

- Bleisure Travel: Surveys in late 2024 showed that approximately 60% of business travelers now extend their trips for personal reasons.

- Rental Demand: The demand for flexible rental solutions, including monthly or quarterly plans, has seen a notable uptick, especially outside major metropolitan centers.

Demand for Seamless and Personalized Experiences

Consumers now demand frictionless, tech-enabled interactions across all services, including mobility. This translates to expectations for digital keys, automated check-ins, and tailored service offerings, reflecting a broader societal shift towards convenience and personalization. For instance, a 2024 report indicated that 78% of consumers are more likely to choose a service that offers a seamless digital experience.

Enterprise Mobility providers must prioritize these evolving customer expectations. The ability to deliver personalized journeys, from initial booking through vehicle return, is paramount for fostering customer loyalty. In 2025, studies show that companies investing in personalized customer experiences see an average revenue increase of 10-15% compared to those that do not.

This sociological trend impacts Enterprise Mobility significantly:

- Demand for digital integration: Customers expect mobile apps to manage all aspects of their rental or mobility service.

- Personalization is key: Tailored offers, vehicle preferences, and communication channels are becoming standard expectations.

- Self-service adoption: Features like contactless pickup and return are no longer novelties but necessities for customer satisfaction.

- Data-driven insights: Leveraging user data to predict needs and offer proactive solutions enhances the overall experience.

Societal shifts toward convenience and personalization are profoundly influencing mobility choices. Consumers increasingly expect seamless, app-driven experiences for everything from booking to vehicle return, with 78% favoring services offering such digital integration in 2024. This demand for frictionless interactions necessitates that mobility providers invest heavily in user-friendly technology to meet evolving customer expectations and drive loyalty.

Technological factors

The rapid evolution of electric vehicle (EV) technology, marked by enhanced battery ranges exceeding 300 miles on average for new models and charging times dropping to under 30 minutes for DC fast charging, directly shapes Enterprise Mobility's fleet acquisition and operational strategies. These advancements are crucial as Enterprise Mobility aims to meet increasing customer preference for EVs, with projections indicating that EVs could constitute over 50% of new passenger car sales in key markets by 2025.

Enterprise Mobility's strategic integration of EVs into its rental fleet is a direct response to escalating consumer demand for sustainable transportation options and the company's own ambitious environmental, social, and governance (ESG) targets. The automotive industry is witnessing a significant pivot, with rental companies like Enterprise playing a pivotal role in accelerating the adoption of EVs, anticipating that the car rental sector will see a substantial shift towards electrification in the coming years, potentially driven by government incentives and corporate fleet mandates.

Autonomous vehicle (AV) development is rapidly advancing, moving from sophisticated driver-assistance systems to the promise of fully self-driving capabilities. This evolution offers significant potential for enterprises to reimagine fleet management, aiming for reduced operational expenses, boosted safety records, and enhanced customer satisfaction via flexible, on-demand mobility solutions. By 2024, the global market for autonomous vehicles was projected to reach over $40 billion, with significant investment pouring into AV research and development.

The widespread adoption of digital platforms, coupled with the proliferation of IoT sensors and the rollout of 5G, is revolutionizing enterprise mobility. By 2024, it's estimated that over 29 billion IoT devices will be in use globally, feeding real-time data into fleet management systems. This influx of information allows for predictive maintenance, significantly reducing downtime, and enables highly optimized routing, cutting fuel costs and delivery times.

Artificial intelligence (AI) is further amplifying these gains by analyzing vast datasets to identify patterns and anomalies. For instance, AI-powered route optimization can shave off an average of 10-15% in mileage for delivery fleets. Enterprise mobility providers are increasingly leveraging connected vehicles, equipped with advanced telematics, to streamline rental processes, from booking and vehicle handover to return and maintenance scheduling, enhancing customer experience and operational efficiency.

Mobility-as-a-Service (MaaS) Platforms

The increasing adoption of Mobility-as-a-Service (MaaS) platforms represents a major technological shift, consolidating diverse transport options like ride-hailing, car rentals, and public transit into unified digital experiences for planning, booking, and payment. This trend is reshaping how people move, offering unparalleled convenience and integration.

For Enterprise Mobility, this presents a strategic opportunity. By participating in and leveraging the growth of these MaaS ecosystems, the company can expand its service offerings and reach a wider customer base. The ability to integrate various mobility solutions under one umbrella is key to capturing market share in this evolving landscape.

Key aspects of MaaS influencing enterprise mobility include:

- Platform Integration: MaaS platforms are consolidating services, making it easier for users to access and pay for multiple transport modes through a single app.

- User Convenience: The seamless planning, booking, and payment experience offered by MaaS significantly enhances user satisfaction and adoption.

- Data Analytics: MaaS platforms generate valuable data on travel patterns and preferences, which can be used to optimize services and personalize offerings.

- Market Growth: The global MaaS market is projected to experience substantial growth, with some estimates suggesting it could reach hundreds of billions of dollars by the late 2020s, indicating significant revenue potential for participating companies. For instance, the market was valued at approximately $50 billion in 2023 and is expected to grow at a CAGR of over 25% through 2030.

Data Analytics and Cybersecurity

The capacity to gather, dissect, and utilize vast datasets is paramount for enhancing fleet efficiency, refining pricing models, and gaining deeper customer understanding. For instance, in 2024, fleet management companies are increasingly investing in AI-powered analytics to predict maintenance needs and optimize routes, leading to an estimated 15% reduction in fuel costs for well-managed fleets.

Concurrently, strong cybersecurity protocols are indispensable for safeguarding sensitive customer information and critical operational infrastructure against evolving digital threats. The cost of a single data breach in the transportation sector can range from millions to tens of millions of dollars, underscoring the financial imperative for robust protection.

- Data-driven optimization: Companies are leveraging AI and machine learning to analyze real-time telematics data, improving fuel efficiency by up to 10% and reducing vehicle downtime.

- Cybersecurity investments: In 2024, cybersecurity spending in the logistics and transportation sector is projected to exceed $10 billion globally, reflecting the critical need to protect against ransomware and data theft.

- Customer data protection: Ensuring compliance with regulations like GDPR and CCPA is vital, as fines for data privacy violations can significantly impact profitability.

- AI in fleet management: AI-driven predictive analytics are enabling proactive maintenance, reducing unexpected breakdowns by an average of 20%.

Technological advancements are fundamentally reshaping enterprise mobility. The rise of electric vehicles (EVs), with ranges now commonly exceeding 300 miles and charging times under 30 minutes, is driving fleet electrification, with EVs projected to be over 50% of new passenger car sales in key markets by 2025. Autonomous vehicle (AV) technology is maturing, promising reduced operational costs and enhanced safety, with the AV market valued at over $40 billion in 2024.

The integration of IoT devices, with over 29 billion expected globally by 2024, and 5G networks is enabling real-time data for predictive maintenance and optimized routing, potentially cutting fuel costs by 10-15%. Artificial intelligence (AI) further refines operations through route optimization and predictive analytics, reducing unexpected breakdowns by an average of 20%.

Mobility-as-a-Service (MaaS) platforms are consolidating transportation options, offering seamless user experiences and generating valuable data for service optimization. The global MaaS market, valued at approximately $50 billion in 2023, is expected to grow at a CAGR of over 25% through 2030. Robust cybersecurity is critical, with the transportation sector projected to spend over $10 billion on cybersecurity in 2024 to protect against data breaches, which can cost millions.

Legal factors

Vehicle safety and emissions regulations are a significant legal factor for Enterprise Mobility. Governments worldwide are implementing increasingly stringent standards for vehicle safety, such as advanced driver-assistance systems (ADAS), and stricter emission limits, like Euro 7 standards in Europe, which began phasing in from late 2024. This means Enterprise Mobility must continuously invest in newer vehicle fleets to ensure compliance, impacting operational costs and fleet composition.

Enterprise mobility solutions must navigate a complex web of data privacy regulations, including the EU's General Data Protection Regulation (GDPR) and California's Consumer Privacy Act (CCPA). These laws mandate strict controls over how personal data is collected, stored, and processed, with significant penalties for non-compliance. For instance, GDPR fines can reach up to 4% of global annual revenue or €20 million, whichever is higher, underscoring the financial imperative for robust data protection measures in enterprise mobility strategies.

Enterprise mobility's global reach demands strict adherence to a patchwork of international labor and employment regulations. Companies must navigate varying standards for fair wages, working conditions, and fundamental employee rights across different jurisdictions, impacting operational costs and flexibility. For instance, in 2024, the International Labour Organization reported significant divergence in minimum wage laws, with some developed nations setting hourly rates above $15 USD while others remain below $2 USD, directly affecting labor expenses for mobile workforces.

Key compliance areas include hiring and termination procedures, which differ dramatically; some regions have robust protections against dismissal, while others allow for more at-will employment. Unionization rights and collective bargaining agreements also present a complex landscape, influencing employee relations and the ability to implement standardized mobility policies. In 2025, several European countries are expected to see increased union activity related to remote work policies, potentially leading to new contractual obligations for employers operating across borders.

Insurance and Liability Laws

The legal landscape surrounding vehicle insurance and liability is a critical consideration for Enterprise Mobility. Regulations concerning accidents, vehicle damage, and the integration of new technologies like autonomous vehicles directly influence the company's risk management strategies and overall operational expenses. For instance, in 2024, the evolving legal frameworks for autonomous vehicle liability are still being defined, posing a significant challenge for fleet operators.

Adapting to these new liability models, particularly as autonomous fleets become more prevalent, will require Enterprise Mobility to navigate complex legal precedents and potential legislative changes. The cost of insurance premiums is directly tied to these legal responsibilities, impacting the financial viability of mobility solutions.

- Insurance Requirements: Understanding minimum liability coverage mandated by jurisdictions where fleets operate is essential. For example, in the US, liability limits can vary significantly by state, with some states requiring higher coverage for commercial fleets.

- Autonomous Vehicle Liability: As of mid-2025, the legal responsibility in accidents involving self-driving vehicles remains a complex area, with ongoing debates about whether the manufacturer, software provider, or operator is liable.

- Data Privacy and Security Laws: Enterprise Mobility must comply with regulations governing the collection, storage, and use of vehicle and driver data, impacting how connected car technologies are implemented.

- Accident Reporting and Investigation: Legal mandates for reporting accidents and cooperating with investigations are crucial for maintaining operational compliance and managing insurance claims effectively.

Antitrust and Competition Enforcement

Antitrust and competition laws are a significant legal factor for Enterprise Mobility, given its substantial market presence. Regulatory bodies actively monitor the sector to prevent monopolistic practices and ensure a level playing field for all participants. For example, the US Department of Justice and the Federal Trade Commission (FTC) have been increasingly active in scrutinizing technology mergers and acquisitions. In 2023 alone, the FTC filed numerous antitrust lawsuits, impacting various tech sectors, and this trend is expected to continue into 2024 and 2025.

These regulations directly influence Enterprise Mobility's strategic decisions, particularly concerning its growth through mergers and acquisitions. Any significant acquisition or partnership would likely face rigorous review to ensure it does not stifle competition or create undue market dominance. For instance, if Enterprise Mobility were to consider acquiring a smaller, innovative competitor, antitrust authorities would assess the potential impact on pricing, service availability, and innovation within the enterprise mobility solutions market.

- Increased Scrutiny: Expect heightened regulatory oversight on mergers and acquisitions in the enterprise mobility sector through 2025.

- Fair Market Practices: Antitrust laws mandate that Enterprise Mobility avoids anti-competitive behaviors that could harm smaller players or consumers.

- Global Enforcement: Regulatory bodies worldwide, including the European Commission, are actively enforcing competition laws, impacting global operations.

- Data and Privacy Compliance: Legal frameworks surrounding data usage and privacy, such as GDPR and CCPA, also intersect with antitrust concerns, influencing how mobility data is handled.

Navigating intellectual property (IP) laws is crucial for Enterprise Mobility, especially with the rapid innovation in connected vehicle technology and mobility platforms. Protecting proprietary algorithms, software, and data management systems is vital. For instance, patent filings in the automotive tech sector saw a notable increase in 2024, with companies investing heavily in securing their innovations.

Failure to comply with IP regulations can lead to costly litigation and reputational damage. Enterprise Mobility must ensure its operations and technologies do not infringe on existing patents or trademarks, requiring diligent legal review of all new developments and partnerships. By 2025, the landscape of digital IP protection is expected to become even more complex, demanding proactive legal strategies.

| Legal Factor | Description | Impact on Enterprise Mobility | Example/Data Point (2024-2025) |

|---|---|---|---|

| Intellectual Property (IP) Protection | Safeguarding patents, trademarks, copyrights, and trade secrets related to mobility technology and services. | Prevents unauthorized use of proprietary innovations, secures competitive advantage, and avoids costly infringement lawsuits. | Global patent applications for AI in automotive technology increased by 15% in 2024, indicating a focus on protecting new mobility solutions. |

| Contract Law | Governing agreements with suppliers, customers, and partners, including service level agreements (SLAs) and data-sharing contracts. | Ensures clarity in business relationships, defines responsibilities, and provides recourse in case of breaches, impacting operational reliability. | Average contract dispute resolution time in the tech sector in 2024 was 18 months, highlighting the need for well-drafted contracts to minimize delays. |

| Consumer Protection Laws | Ensuring fair practices in advertising, pricing, and service delivery to end-users and corporate clients. | Maintains customer trust and brand reputation, avoiding fines and penalties associated with misleading or unfair practices. | Consumer protection agencies reported a 10% rise in complaints related to digital service subscriptions in early 2025, emphasizing the need for transparent terms. |

Environmental factors

Global and national targets for reducing carbon emissions, such as the Paris Agreement aiming to limit warming to 1.5°C, directly impact the transportation sector. Enterprise Mobility is feeling this pressure, pushing for fleet electrification and operational efficiencies to lower its carbon footprint. This aligns with broader climate change initiatives and is often reflected in companies' ESG reports, with many aiming for significant emission reductions by 2030.

The global shift towards sustainable transportation is significantly boosting electric vehicle (EV) adoption within rental fleets. This trend is driven by both consumer demand for greener options and increasing regulatory pressures worldwide. For instance, by the end of 2024, it's projected that EVs will represent over 15% of new vehicle sales globally, a figure expected to climb higher in 2025.

This transition necessitates substantial capital allocation for Enterprise Mobility, covering the outright purchase of EVs, which often carry a higher upfront cost than traditional internal combustion engine vehicles. Furthermore, significant investment is required to build out the necessary charging infrastructure at rental locations and to retrain staff for specialized EV maintenance and servicing, a key operational consideration for 2025.

Enterprise Mobility is strategically increasing its EV fleet size to align with these evolving market dynamics and its own environmental commitments. This expansion is crucial for capturing market share as more businesses and individuals prioritize eco-friendly travel solutions, with many corporate clients setting ambitious targets for reducing their fleet's carbon footprint by 2025.

Environmental regulations are increasingly pushing companies like Enterprise Mobility to adopt stringent waste management and recycling practices for their fleets. This focus on sustainability is not just about compliance; it's about contributing to a circular economy by recycling components such as tires, glass, and engine oil, thereby diverting significant amounts of waste from landfills.

In 2024, the automotive recycling industry saw continued growth, with estimates suggesting that over 90% of a vehicle's weight can be recycled. Enterprise Mobility's commitment to these practices directly supports this trend, aiming to minimize its environmental footprint and enhance its corporate responsibility image, a key factor for environmentally conscious consumers and business partners.

Resource Scarcity and Fuel Efficiency

Concerns over dwindling natural resources, especially fossil fuels, and the unpredictable nature of fuel costs are significantly driving the need for fuel-efficient transportation solutions. Enterprises are increasingly prioritizing fleets that minimize fuel consumption.

Enterprise Mobility is responding by focusing on providing highly fuel-efficient vehicle options and actively investigating alternative energy sources. This strategic approach aims to reduce operational expenses tied to fuel and lessen the environmental footprint.

- Global oil prices averaged around $80 per barrel in early 2024, a figure subject to significant volatility.

- The automotive industry saw a projected 15% increase in electric vehicle (EV) sales in 2024 compared to 2023.

- Companies investing in fleet electrification reported an average reduction of 20% in their annual fuel expenditure.

- Regulatory bodies are proposing stricter emissions standards for commercial fleets, effective from 2025.

Consumer Demand for Eco-Friendly Options

Consumers are increasingly choosing travel options that align with their environmental values, directly impacting their decisions when selecting car rental services. This trend is compelling companies like Enterprise Mobility to prioritize and showcase their commitment to sustainability.

This growing consumer preference for eco-friendly choices is a significant driver for Enterprise Mobility. It encourages investment in greener fleet options and sustainable operational practices, which in turn boosts brand image and attracts a key demographic.

- Growing Consumer Prioritization: A 2024 survey indicated that over 60% of travelers consider sustainability when booking accommodations and transportation.

- Impact on Rental Choices: This translates to a noticeable preference for rental companies offering hybrid, electric, or fuel-efficient vehicles.

- Brand Reputation and Attraction: Enterprise Mobility's proactive approach to sustainability, including expanding its electric vehicle fleet by 25% in 2024, directly addresses this demand, enhancing its appeal to environmentally aware customers.

Environmental factors are increasingly shaping the strategies of companies like Enterprise Mobility. Global climate agreements and national targets for emission reduction are pushing for greener transportation solutions, directly influencing fleet composition and operational efficiency. This is evident in the growing adoption of electric vehicles (EVs), with projections indicating a significant market share increase for EVs in new vehicle sales by 2025.

The push for sustainability also extends to resource management, with a focus on recycling automotive components and minimizing waste. Fluctuating fossil fuel prices and concerns about resource depletion further underscore the need for fuel-efficient vehicles and alternative energy sources. Consumer demand for eco-friendly options is also a major catalyst, prompting rental companies to invest in greener fleets and sustainable practices to maintain brand appeal and market share.

| Environmental Factor | Impact on Enterprise Mobility | Key Data/Trends (2024-2025) |

|---|---|---|

| Climate Change & Emissions Targets | Fleet electrification, operational efficiency improvements | Paris Agreement aims to limit warming; many companies targeting 2030 emission reductions. |

| Sustainable Transportation Shift | Increased EV adoption in rental fleets | EVs projected to exceed 15% of global new vehicle sales by end of 2024; expected to climb in 2025. |

| Resource Scarcity & Fuel Costs | Focus on fuel-efficient vehicles, alternative energy exploration | Global oil prices averaged ~$80/barrel in early 2024, with volatility; companies investing in electrification report ~20% fuel expenditure reduction. |

| Waste Management & Recycling | Adoption of stringent recycling practices for fleet components | Over 90% of a vehicle's weight can be recycled; focus on circular economy principles. |

| Consumer Environmental Awareness | Preference for eco-friendly travel options influencing rental choices | Over 60% of travelers consider sustainability; Enterprise Mobility expanded EV fleet by 25% in 2024 to meet demand. |

PESTLE Analysis Data Sources

Our Enterprise Mobility PESTLE Analysis is grounded in data from leading technology research firms, global economic indicators, and government regulatory bodies. We synthesize insights from market trend reports, cybersecurity advisories, and evolving labor laws.