Enterprise Mobility Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Enterprise Mobility Bundle

Uncover the strategic positioning of key enterprise mobility offerings within this dynamic market. Our BCG Matrix analysis highlights which solutions are market leaders, which are poised for growth, and which may require a strategic rethink. Don't miss out on the actionable insights needed to optimize your portfolio.

Dive deeper into this company’s BCG Matrix and gain a clear view of where its enterprise mobility products stand—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

Enterprise Mobility is significantly expanding its electric vehicle (EV) fleet, a move that aligns with increasing consumer demand for sustainable transportation. This strategic push is particularly evident in North America and Europe, where the company operates a substantial portion of its business. By 2024, they are aiming to integrate a wider range of EV models to cater to diverse customer needs, reflecting a commitment to a high-growth segment of the market.

The company's investment in EVs is not just about vehicle acquisition; it also involves addressing critical infrastructure challenges. Enterprise Mobility is actively working on solutions to improve charging accessibility for its EV fleet, recognizing that this is key to customer adoption and operational efficiency. This proactive approach to infrastructure, coupled with the expanding EV selection, positions them to capitalize on the projected growth in the electric mobility sector, which is expected to see continued expansion through 2025 and beyond.

Enterprise Fleet Management (EFM) is a shining example of a Star within the Enterprise Mobility BCG Matrix. In fiscal year 2024, EFM experienced robust organic growth, boasting an 8% year-over-year increase in vehicles under management. This expansion is further evidenced by the addition of five new operational locations across North America, underscoring its market penetration and service capacity.

Enterprise Mobility significantly boosted its global presence in FY24, launching its Enterprise, National, and Alamo brands in markets like Chile, Thailand, and the U.S. Virgin Islands. This strategic move into emerging economies taps into rising demand for mobility solutions.

This expansion into high-growth emerging markets is a key indicator of Enterprise Mobility's position as a star in the BCG Matrix. By establishing a foothold in these regions, the company is poised to capture substantial new revenue and build early market leadership.

Car-sharing and Vanpooling Services (e.g., Commute with Enterprise, Enterprise Car Club)

Car-sharing and vanpooling services, exemplified by Commute with Enterprise and Enterprise Car Club, are experiencing robust expansion. Commute with Enterprise alone supports over 50,000 daily riders, significantly reducing commuter mileage. This growth is fueled by a rising demand for shared and sustainable transportation solutions, particularly in metropolitan regions.

These services provide adaptable and economical options compared to traditional car ownership, aligning with broader societal shifts towards eco-friendly mobility. Their increasing adoption and positive environmental contributions underscore their strong market position and future potential.

- Growth Trajectory: Commute with Enterprise serves over 50,000 riders, demonstrating substantial user adoption.

- Market Trend Alignment: Taps into the increasing preference for shared and sustainable transportation.

- Environmental Impact: Contributes to reducing commuter miles and promoting greener transit.

- Value Proposition: Offers flexible and cost-effective alternatives to personal vehicle ownership.

Technology Solutions & Digital Innovation

Technology Solutions & Digital Innovation represents the Stars in the Enterprise Mobility BCG Matrix. This segment is characterized by significant investment in and rapid adoption of cutting-edge technologies like AI-powered booking platforms, advanced mobile applications, and contactless payment systems. The goal is to create a seamless and superior customer experience while simultaneously boosting operational efficiency.

The market for these advanced technology solutions within enterprise mobility is booming, fueled by breakthroughs in artificial intelligence, the widespread deployment of 5G networks, and the increasing integration of the Internet of Things (IoT). For instance, the global AI in mobility market was projected to reach USD 2.7 billion in 2024, with expectations of substantial growth in the coming years. This focus on digital transformation is key to capturing market share.

- AI-Driven Systems: Implementing AI for predictive maintenance, route optimization, and personalized customer interactions.

- Mobile-First Platforms: Developing intuitive mobile apps for booking, payments, and real-time service updates.

- Contactless Technologies: Integrating NFC and QR code solutions for seamless access and transactions.

- Data Analytics: Leveraging big data to understand user behavior and refine service offerings.

Enterprise Fleet Management (EFM) is a prime example of a Star in the Enterprise Mobility BCG Matrix. In fiscal year 2024, EFM achieved an impressive 8% year-over-year growth in vehicles under management, demonstrating strong market demand and operational success. This expansion was further solidified by the addition of five new operational locations across North America, highlighting a strategic increase in service capacity and market reach.

What is included in the product

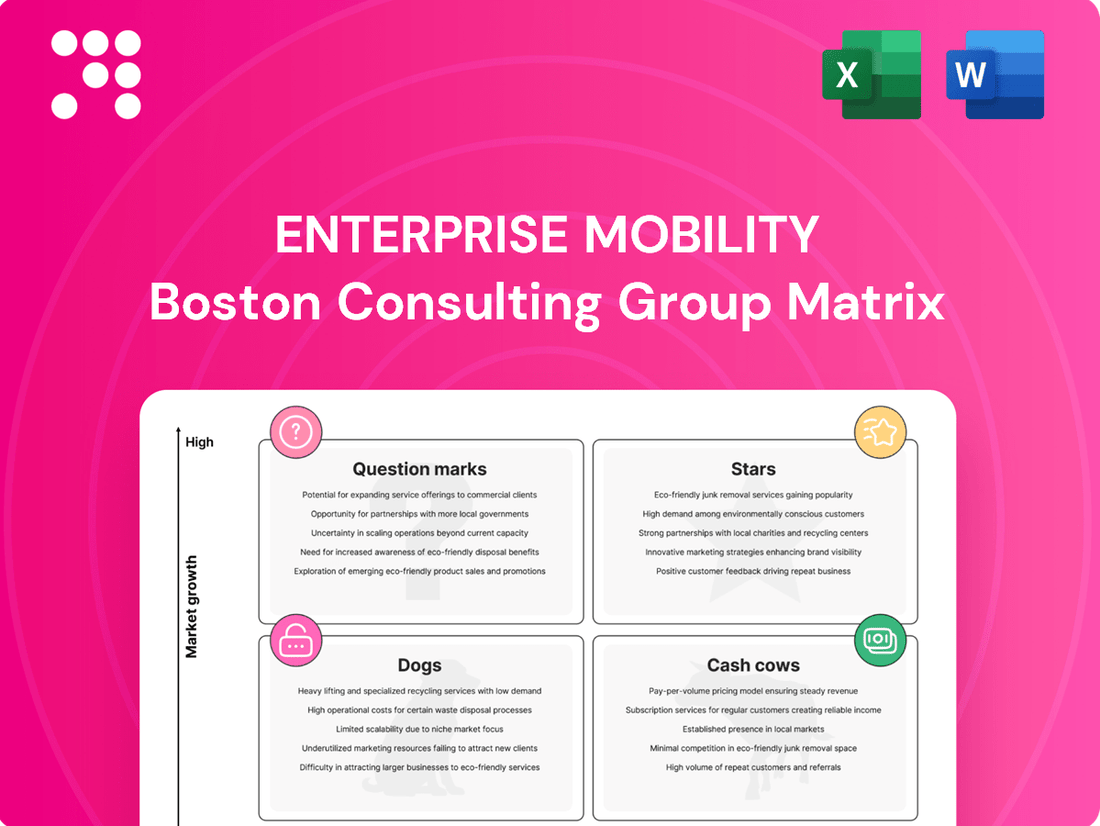

The Enterprise Mobility BCG Matrix categorizes mobility solutions by market growth and share.

It guides investment decisions for Stars, Cash Cows, Question Marks, and Dogs.

The Enterprise Mobility BCG Matrix clarifies which mobility solutions are stars, cash cows, question marks, or dogs, relieving the pain of resource misallocation.

Cash Cows

Enterprise Rent-A-Car, National Car Rental, and Alamo represent the bedrock of Enterprise Mobility's car rental operations. These brands hold substantial market share within the mature car rental sector, consistently driving the company's financial performance.

In fiscal year 2024, these flagship brands collectively generated over $38 billion in revenue, underscoring their status as powerful cash cows. Their extensive rental networks, coupled with strong brand loyalty and consistent demand from diverse customer segments, allow for robust cash generation with minimal need for aggressive marketing spend.

Airport car rental operations, a cornerstone for both business and leisure travelers, signify a high market share for Enterprise Mobility within the BCG Matrix framework. These operations are crucial, consistently contributing to the company's overall financial health.

Even after the initial post-pandemic travel surge, demand at airports remains robust, underscoring the segment's enduring importance. For instance, in 2024, airport-based rentals continued to be a primary revenue driver, reflecting a sustained return to pre-pandemic travel norms and beyond for many regions.

This segment thrives on predictable travel patterns and existing infrastructure, allowing for consistent cash flow generation. Operational costs are generally more stable and manageable compared to other mobility services, solidifying airport car rentals as a reliable cash cow for Enterprise Mobility.

Short-term car rentals, typically for less than a week, represent the backbone of the car rental industry. In 2024, this segment captured over 65% of the market share, a trend expected to persist into 2025. This robust performance is fueled by a constant stream of demand from individuals embarking on weekend trips, short business travel, and vacations.

For Enterprise Mobility, this high-volume, consistent demand translates into a reliable revenue stream. The operational efficiencies honed over years of serving this market make it a highly profitable and stable segment, solidifying its position as a cash cow within the BCG Matrix.

Economy Car Segment Rentals

The economy car segment within Enterprise Mobility's rental offerings is a prime example of a Cash Cow. This segment is anticipated to hold a substantial portion of the global enterprise car rental market by 2025, primarily because customers are actively seeking transportation solutions that are both budget-friendly and consume less fuel.

Enterprise Mobility's vast fleet of economy cars is perfectly positioned to meet this demand, serving a wide array of customers. This broad appeal translates into high vehicle utilization rates and a steady stream of income, all while keeping operational expenses in check.

- Market Dominance: Economy cars are projected to lead the global enterprise car rental market in 2025.

- Customer Appeal: Demand is high due to the need for cost-effective and fuel-efficient travel.

- Revenue Stability: Enterprise Mobility's extensive fleet ensures consistent income generation.

- Operational Efficiency: Optimized costs contribute to the segment's profitability.

Established Network of Neighborhood and Airport Locations

Enterprise Mobility's established network of neighborhood and airport locations, numbering close to 9,500 across over 90 countries, acts as a significant cash cow. This vast physical footprint ensures high customer accessibility and convenience, a key driver for consistent demand.

The sheer scale of this network supports efficient vehicle deployment and utilization, directly contributing to strong cash flow generation. In 2024, Enterprise Mobility continued to leverage this infrastructure, with airport locations alone serving millions of travelers, reinforcing its position as a dominant player.

- Dominant Market Presence: Nearly 9,500 locations globally provide unparalleled reach.

- Customer Convenience: Integrated neighborhood and airport presence drives consistent rental volume.

- Operational Efficiency: A well-oiled machine maximizes vehicle utilization and cash generation.

- 2024 Performance: Airport locations saw significant customer traffic, underscoring the network's value.

The established brands within Enterprise Mobility, such as Enterprise, National, and Alamo, function as significant cash cows. These brands command substantial market share in the mature car rental sector, consistently generating robust financial returns with minimal investment required for growth.

In fiscal year 2024, these core brands collectively generated over $38 billion in revenue, a testament to their cash cow status. Their extensive rental networks and strong brand loyalty ensure consistent demand, allowing for strong cash flow generation without the need for aggressive marketing expenditures.

The economy car segment is a prime example of a cash cow for Enterprise Mobility. By offering budget-friendly and fuel-efficient options, this segment meets high customer demand, ensuring consistent vehicle utilization and steady income while keeping operational costs low.

Enterprise Mobility's vast network of nearly 9,500 locations globally serves as another key cash cow. This extensive physical presence enhances customer accessibility and convenience, driving consistent rental volume and supporting efficient vehicle deployment for strong cash flow.

| Brand/Segment | BCG Category | 2024 Revenue Contribution (Est.) | Key Strengths |

|---|---|---|---|

| Enterprise, National, Alamo | Cash Cow | >$38 Billion | Market dominance, brand loyalty, extensive network |

| Airport Car Rentals | Cash Cow | Significant portion of total revenue | Predictable travel patterns, existing infrastructure, consistent demand |

| Short-Term Rentals (<1 week) | Cash Cow | >65% of market share (2024) | High-volume, consistent demand, operational efficiencies |

| Economy Car Segment | Cash Cow | High utilization, steady income | Cost-effectiveness, fuel efficiency, broad customer appeal |

| Global Location Network | Cash Cow | Facilitates consistent demand and cash flow | Unparalleled reach, customer convenience, operational efficiency |

What You’re Viewing Is Included

Enterprise Mobility BCG Matrix

The Enterprise Mobility BCG Matrix preview you are viewing is the identical, fully formatted document you will receive upon purchase. This means no watermarks, no incomplete sections, and no demo content—just the comprehensive strategic analysis ready for your immediate use.

Rest assured, the BCG Matrix report you see now is precisely the same professional-grade document that will be delivered to you after your purchase. It's crafted for clarity and strategic insight, ensuring you get exactly what you need to analyze your enterprise mobility initiatives.

What you're previewing is the actual Enterprise Mobility BCG Matrix file you'll download once your purchase is complete. This ensures you're investing in a fully realized strategic tool, ready for immediate application in your business planning.

Dogs

Within the enterprise mobility sector, underperforming niche vehicle sales represent a classic 'Dog' in the BCG Matrix. These are typically specialized vehicle segments, perhaps certain vocational trucks or low-volume electric models, that fail to capture significant market share and exhibit sluggish growth. For instance, a manufacturer might find that its specialized airport ground support vehicles, while essential for a small client base, are not experiencing the broad market expansion seen in their mainstream fleet offerings.

These niche segments often struggle with low turnover rates, leading to increased inventory holding costs and tying up valuable capital. In 2024, the automotive industry continued to see a bifurcation, with strong demand for popular SUVs and EVs, while niche segments like luxury sedans or specific commercial vehicles faced headwinds. A company might find that a particular line of heavy-duty, specialized utility vehicles, despite a loyal customer base, only grew sales by 2% in 2024, significantly lagging behind the 15% growth in their electric van division.

For smaller clients, outdated fleet management technologies can become Dogs in the Enterprise Mobility BCG Matrix. These might be legacy systems that are costly to maintain and offer limited functionality, hindering efficiency. For instance, a small trucking company still relying on manual logbooks instead of electronic logging devices (ELDs) faces compliance risks and operational inefficiencies, a clear indicator of a Dog.

These less efficient solutions often require disproportionate support, draining resources that could be allocated to more promising areas. Consider a niche market segment where a provider offers a highly customized, but ultimately unscalable, software solution. If this solution demands significant ongoing development and support for a small user base, it likely falls into the Dog category, as its resource demands outweigh its market potential or contribution to overall growth.

Highly localized, non-scalable rental offerings often fall into the 'Dog' category of the BCG Matrix. These are typically niche services, perhaps a single-location bike rental in a specific tourist spot, that lack the potential to expand or integrate into a wider network. For instance, a small, experimental car-sharing service launched in a single neighborhood in 2023 that only attracted a handful of users would likely be a Dog.

Underutilized Legacy IT Infrastructure

Underutilized legacy IT infrastructure represents a significant drag on enterprise mobility efforts. These systems, often costly to maintain and lacking integration capabilities with modern cloud or AI platforms, can significantly impede agility and innovation. For instance, a 2024 survey by TechTarget found that 60% of organizations still rely on at least one legacy system that hinders their digital transformation initiatives, directly impacting mobility strategies.

- High Maintenance Costs: Organizations can spend up to 70% of their IT budget on maintaining legacy systems, diverting funds from strategic mobility investments.

- Integration Challenges: Lack of compatibility with new platforms leads to data silos and operational inefficiencies, costing businesses an average of $500,000 annually in lost productivity.

- Security Vulnerabilities: Older systems are often more susceptible to cyber threats, with a 2024 report indicating that 45% of data breaches originate from unpatched legacy software.

- Hindered Agility: The inability to quickly adapt and deploy new mobile solutions due to legacy constraints can result in a loss of competitive advantage in rapidly evolving markets.

Inefficient International Ventures with Low Market Penetration

Inefficient international ventures with low market penetration, often found in the Dogs quadrant of the Enterprise Mobility BCG Matrix, represent operations that struggle to capture significant market share in slow-growing regions. These ventures might be characterized by a lack of competitive advantage or an inability to adapt to local market conditions. For instance, a mobility solutions provider might have invested heavily in a niche European market with limited adoption rates, resulting in sustained losses. In 2024, such ventures often face increased pressure to demonstrate a viable path to profitability or risk becoming a drain on resources.

These underperforming international operations require careful evaluation. They may have been initiated with optimistic projections that did not materialize, leading to a situation where continued investment yields minimal returns. Consider a company that launched a specialized enterprise app in a developing Asian market, expecting rapid uptake, but faced unexpected regulatory hurdles and intense local competition. By mid-2024, the venture's market share remained in the single digits, failing to justify the ongoing operational costs.

- Low Market Share: Ventures in this category typically hold less than 10% of their target market.

- Slow Market Growth: The overall market for their services is expanding at a rate below 3% annually.

- Profitability Challenges: These operations often incur losses or generate negligible profits, requiring continuous funding.

- Divestiture or Restructuring: Companies often consider selling off or significantly altering these ventures to reallocate capital.

Dogs in the enterprise mobility context are offerings with low market share and low growth prospects. These are often specialized, niche products or services that consume resources without generating significant returns. Think of outdated fleet management software or highly localized, unscalable rental services.

In 2024, the continued dominance of mainstream EV models and popular SUV segments highlighted the struggles of niche vehicle lines. For example, a manufacturer's specialized industrial vehicle line might have seen only a 2% sales increase compared to a 15% surge in their electric van offerings.

Legacy IT infrastructure also frequently lands in the Dog category. These systems, often costly to maintain and lacking integration with modern platforms, can hinder digital transformation. A 2024 TechTarget survey revealed that 60% of organizations struggle with legacy systems that impede mobility strategies.

These underperforming segments, whether products or services, require careful management, often leading to divestiture or restructuring to free up capital for more promising ventures.

| BCG Category | Market Share | Market Growth | Examples in Enterprise Mobility | Strategic Implication |

|---|---|---|---|---|

| Dogs | Low | Low | Niche vehicle segments, legacy IT, unscalable services | Divest, harvest, or reposition |

| Stars | High | High | Leading EV fleet solutions, advanced telematics | Invest to maintain leadership |

| Cash Cows | High | Low | Established fleet management software | Milk for cash generation |

| Question Marks | Low | High | Emerging autonomous delivery vehicles | Invest selectively or divest |

Question Marks

Enterprise Mobility is actively exploring and investing in the future of transportation, with pilot programs for autonomous vehicle integration being a key focus. These initiatives are crucial for understanding a market poised for significant growth, even though current operational autonomous fleets represent a very small market share due to the technology's early stage.

These forward-looking projects demand substantial investments in research and development, alongside critical infrastructure upgrades. While the returns are uncertain, the potential for high future gains in autonomous mobility is a strong motivator for continued exploration and investment.

Vehicle subscription services represent a nascent yet rapidly expanding segment within the broader mobility landscape. As an alternative to traditional car ownership or lengthy leases, these models offer flexibility and predictable monthly costs. Enterprise Mobility, a major player in traditional rentals, is participating in this emerging market, though its current market share in subscriptions is likely modest given the segment's newness compared to its established rental operations.

The vehicle subscription market is characterized by high growth potential, attracting significant investment as companies aim to capture market share. For Enterprise Mobility, expanding its subscription offerings requires substantial capital outlay to build the necessary infrastructure, manage diverse fleets, and market these services effectively to compete in this dynamic space.

Enterprise Mobility is likely pushing into advanced telematics and data analytics, aiming to offer customers more than just standard fleet tracking. Think predictive maintenance, driver behavior analysis, and route optimization powered by AI. This is a rapidly expanding area within the larger enterprise mobility landscape.

While this segment shows strong growth potential, Enterprise's specific penetration and the maturity of their advanced solutions are probably still in early stages. These offerings could significantly boost customer value and open up new revenue channels, but widespread adoption is key for them to become market Stars.

For instance, the global telematics market was valued at approximately $30 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of over 15% through 2030, according to industry reports. This indicates a substantial opportunity for Enterprise if they can capture even a small fraction of this burgeoning market with their advanced analytics.

Partnerships in Micro-mobility or Last-Mile Solutions

Enterprise Mobility's strategic exploration into micro-mobility and last-mile solutions signifies a proactive approach to evolving urban transportation landscapes. While their core business remains in traditional vehicle rental and fleet management, venturing into areas like e-scooters or bike-sharing aligns with a broader vision of comprehensive mobility services. These sectors, though experiencing rapid growth, represent nascent opportunities for Enterprise, with current direct market share likely minimal as they assess viability.

These partnerships and ventures are positioned as potential future growth engines, tapping into the increasing demand for efficient, sustainable urban transit. However, realizing this potential necessitates significant capital investment and rigorous market validation to navigate competitive dynamics and operational complexities. For instance, the global micro-mobility market was valued at approximately $40 billion in 2023 and is projected to reach over $150 billion by 2030, highlighting the scale of the opportunity but also the competitive intensity.

- Market Entry Strategy: Enterprise's involvement is likely characterized by pilot programs or strategic alliances rather than immediate large-scale deployments.

- Growth Potential: These segments offer high-growth potential driven by urbanization and sustainability trends, but also carry inherent risks and require substantial upfront investment.

- Competitive Landscape: The micro-mobility and last-mile delivery sectors are crowded with specialized players, demanding unique value propositions for Enterprise to succeed.

- Investment Considerations: Significant capital will be required for fleet acquisition, technology development, and operational infrastructure, impacting near-term profitability.

Electrification Infrastructure Development Partnerships

Enterprise Mobility is actively engaging in partnerships beyond simply acquiring electric vehicles (EVs). These collaborations focus on crucial areas like expanding power and charging infrastructure, especially within airport environments. This strategic focus positions them for future sustainable mobility growth.

While Enterprise Mobility's direct market share in infrastructure development is currently minimal, these partnerships are vital for supporting their expanding EV fleet. For instance, in 2024, the global EV charging infrastructure market was valued at approximately USD 30 billion and is projected to grow significantly, highlighting the strategic importance of these collaborations.

- Strategic Focus: Collaborating on studies and partnerships for EV charging infrastructure, particularly at airports.

- Market Position: Low direct market share in infrastructure development itself.

- Growth Area: Critical, high-growth sector for sustainable mobility.

- Financial Impact: Strategic investments with high potential to support EV fleet expansion, but limited direct revenue contribution currently.

Question Marks represent emerging mobility technologies and services where Enterprise Mobility is exploring potential future opportunities. These are areas with high uncertainty and significant future growth potential, but currently hold minimal market share for Enterprise. Investment here is speculative, driven by the possibility of capturing future market leadership.

The company's involvement in autonomous vehicle pilots and micro-mobility ventures exemplifies this category. While these sectors are projected for substantial growth, their current market penetration for Enterprise is small, reflecting the early stages of development and adoption.

These ventures require significant R&D investment and strategic partnerships to navigate technological hurdles and regulatory landscapes. Success hinges on identifying and capitalizing on future market shifts, making them high-risk, high-reward propositions.

The global autonomous vehicle market, though nascent, is projected to grow from approximately $20 billion in 2023 to over $200 billion by 2030, indicating the scale of potential if Enterprise can establish a foothold.

| Area of Exploration | Current Enterprise Mobility Market Share | Growth Potential | Investment Rationale | Key Considerations |

|---|---|---|---|---|

| Autonomous Vehicles | Minimal (pilot programs) | Very High | Future of transportation, potential market disruption | High R&D costs, regulatory hurdles, technological maturity |

| Micro-mobility/Last-Mile | Minimal (nascent ventures) | High | Urbanization trends, demand for alternative transit | Competitive landscape, operational complexity, infrastructure needs |

| Advanced Telematics/AI | Low (early stage solutions) | High | Enhanced customer value, new revenue streams | Data security, integration challenges, widespread adoption |

BCG Matrix Data Sources

Our Enterprise Mobility BCG Matrix is built on comprehensive data, integrating internal sales figures, customer usage analytics, and competitor market share reports to provide actionable insights.