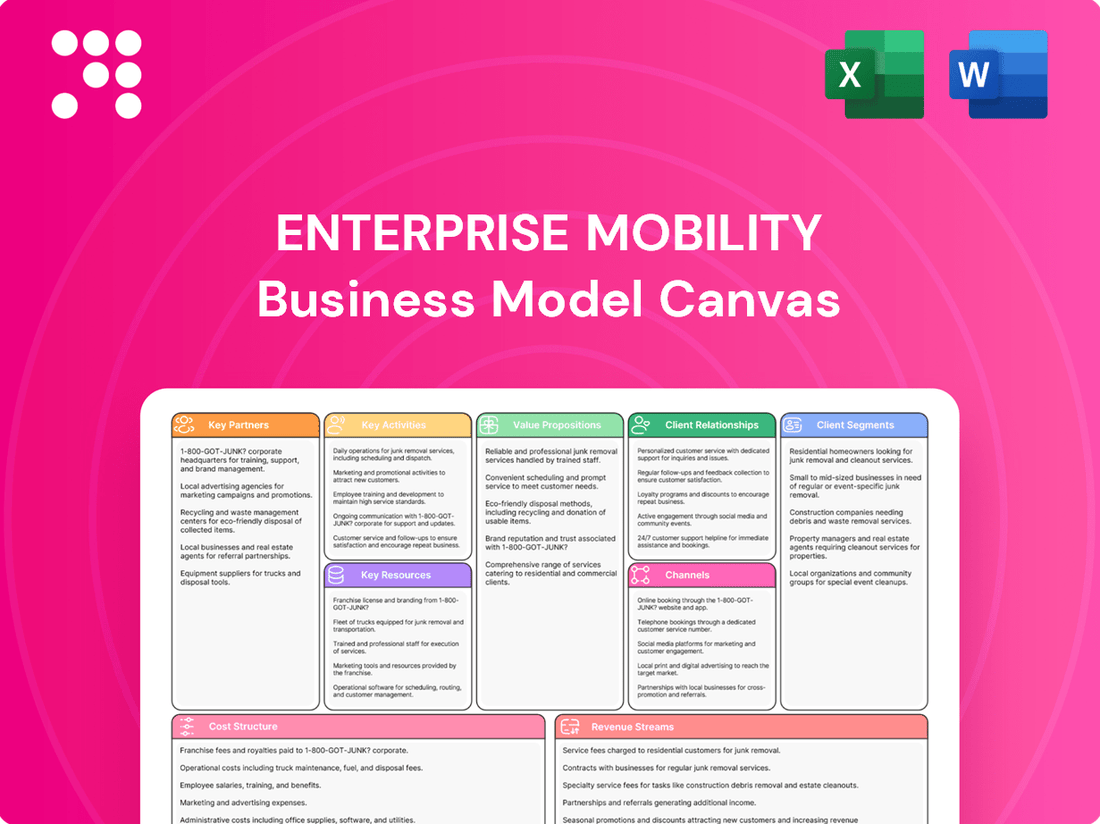

Enterprise Mobility Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Enterprise Mobility Bundle

Curious about how Enterprise Mobility masterfully connects with its target audience and delivers exceptional value? Our comprehensive Business Model Canvas breaks down their customer relationships, channels, and key resources, offering a clear roadmap to their success.

Dive into the strategic core of Enterprise Mobility's operations with the complete Business Model Canvas. This detailed document unpacks their revenue streams, cost structure, and competitive advantages, providing invaluable insights for anyone looking to understand or replicate their market dominance.

Unlock the full potential of your own business strategy by exploring Enterprise Mobility's proven model. Download the complete Business Model Canvas today and gain a professional, actionable blueprint for achieving sustainable growth and market leadership.

Partnerships

Enterprise Mobility actively collaborates with major automotive original equipment manufacturers (OEMs) and vehicle manufacturers. These relationships are fundamental to securing a consistent and varied supply of vehicles for rental, leasing, and sales. For instance, in 2024, major fleet operators have secured significant volume discounts, with some reporting savings of up to 15% on new vehicle purchases through strategic OEM partnerships.

These collaborations are vital for maintaining a modern and diverse fleet, ensuring access to the latest models and technologies, including a growing number of electric vehicles (EVs) and advanced connected car features. OEM partnerships also enable access to preferential financing and maintenance packages, directly impacting operational costs and fleet availability, crucial for meeting evolving customer demands in the mobility sector.

Collaborations with technology and software providers are crucial for Enterprise Mobility to bolster its digital infrastructure. These partnerships enable the integration of advanced fleet management software and CRM systems, directly impacting operational efficiency. For instance, many mobility providers leverage specialized software to track vehicle performance and optimize routes, a trend that saw significant investment in 2024 as companies focused on cost savings and sustainability.

Developing robust mobile applications for customer and employee engagement is another key area of partnership. Companies are increasingly working with app development firms to create intuitive interfaces for booking, tracking, and payment. The integration of emerging technologies like AI for predictive maintenance and IoT for real-time vehicle monitoring is also a growing focus, with many mobility businesses allocating increased budgets in 2024 to explore these innovations and enhance user experience.

Partnering with travel agencies and online travel platforms (OTAs) is crucial for Enterprise Mobility to access a wide array of customers. These collaborations act as a vital distribution channel, enabling the company to secure bookings from both leisure and business travelers who are already planning their trips through these intermediaries. For instance, in 2024, the global travel market continued its strong recovery, with OTAs playing a significant role in facilitating over 70% of online travel bookings.

These partnerships extend Enterprise Mobility's reach beyond direct consumer engagement, allowing them to tap into established customer bases and booking ecosystems. By integrating with platforms like Expedia or Booking.com, Enterprise Mobility can capture demand from travelers seeking seamless transportation as part of their overall travel arrangements, thereby expanding their market penetration and revenue streams.

Insurance Companies and Automotive Service Providers

Enterprise mobility providers forge essential partnerships with insurance companies, facilitating seamless replacement vehicle rentals for policyholders whose cars are in repair. This symbiotic relationship ensures customer satisfaction and operational continuity for both parties. For instance, in 2024, the automotive repair market was projected to reach over $200 billion globally, highlighting the significant demand for these rental services.

Furthermore, collaborations with automotive service and maintenance providers are crucial for maintaining the health and readiness of enterprise mobility fleets. These partnerships cover routine upkeep, specialized repairs, and vital roadside assistance, ensuring vehicles remain safe and operational. The global fleet management market, valued at approximately $30 billion in 2023, underscores the scale and importance of these service provider relationships.

- Insurance Companies: Provide replacement vehicle rentals, a key revenue stream and customer retention tool for mobility providers.

- Automotive Service Providers: Offer maintenance, repair, and roadside assistance, ensuring fleet reliability and minimizing downtime.

- Fleet Uptime: Partnerships directly impact fleet availability, with efficient maintenance leading to higher utilization rates.

- Cost Management: Negotiated service agreements with providers help control operational expenses for the mobility business.

Local Governments and Community Organizations

Enterprise Mobility's engagement with local governments and community organizations is crucial for deploying effective mobility solutions. These collaborations are vital for initiatives like car-sharing, vanpooling, and promoting sustainable transport. For instance, in 2024, many cities are actively seeking private sector partners to reduce traffic congestion and emissions, with Enterprise Mobility well-positioned to contribute.

Partnerships with local authorities can streamline regulatory approvals for new mobility services and provide access to public infrastructure, such as dedicated parking for car-sharing fleets. Community organizations, on the other hand, offer invaluable insights into local needs and can help drive adoption of these services. This synergy helps Enterprise Mobility tailor its offerings to specific urban environments, fostering greater community impact and fulfilling corporate social responsibility goals.

- Support for Sustainable Transport: In 2024, cities worldwide are setting ambitious climate targets, making partnerships that promote electric vehicle fleets and shared mobility essential for achieving these goals.

- Community Needs Alignment: Collaborating with local groups ensures mobility services address specific challenges, such as first-mile/last-mile connectivity in underserved areas.

- Regulatory Facilitation: Local government backing can expedite the deployment of new mobility models, including autonomous vehicle pilot programs planned for several urban centers by 2025.

- Enhanced CSR: These partnerships allow Enterprise Mobility to demonstrate a tangible commitment to community well-being and environmental stewardship, boosting brand reputation.

Enterprise Mobility's key partnerships extend to financial institutions and leasing companies, crucial for fleet acquisition and management. These relationships provide the necessary capital for fleet expansion and offer flexible leasing structures that optimize cash flow and fleet turnover. In 2024, many mobility providers secured favorable financing rates, with some reporting a 50 basis point reduction on capital leases compared to the previous year, directly impacting profitability.

These financial collaborations are vital for maintaining a competitive edge by ensuring access to capital for acquiring new vehicles, particularly the increasing number of electric and hybrid models. They also facilitate the management of depreciation and residual values, key components in calculating the total cost of ownership for fleet operations.

| Partner Type | Role in Enterprise Mobility | Impact/Benefit | 2024 Data/Trend |

|---|---|---|---|

| Automotive OEMs | Vehicle Supply & Technology Integration | Access to latest models, volume discounts, preferential financing | Volume discounts up to 15% reported by fleet operators in 2024. |

| Technology Providers | Digital Infrastructure & Software Solutions | Enhanced operational efficiency, route optimization, predictive maintenance | Increased investment in fleet management software in 2024 for cost savings. |

| Travel Agencies & OTAs | Customer Acquisition & Distribution | Expanded market reach, access to leisure and business travelers | OTAs facilitated over 70% of online travel bookings in 2024. |

| Insurance Companies | Replacement Vehicle Rentals | Revenue stream, customer retention, operational continuity | Automotive repair market projected over $200 billion globally in 2024. |

| Financial Institutions | Fleet Acquisition & Financing | Capital for expansion, optimized cash flow, flexible leasing | Financing rates for capital leases saw reductions of up to 50 basis points in 2024. |

What is included in the product

A structured framework outlining how an enterprise leverages mobile technologies, covering key aspects like customer segments, value propositions, and revenue streams.

It details the operational and financial blueprint for delivering mobile solutions and services to businesses and their employees.

The Enterprise Mobility Business Model Canvas acts as a pain point reliever by providing a structured, visual framework to pinpoint and address challenges in mobile strategy, from app development to user adoption.

Activities

A crucial activity for an enterprise mobility business is the ongoing acquisition and meticulous management of its vehicle fleet. This involves procuring vehicles from original equipment manufacturers (OEMs) and overseeing their entire lifecycle, from initial purchase through to eventual resale. For instance, in 2024, major players in the ride-sharing sector continued to invest heavily in fleet expansion, with some reporting fleet sizes in the tens of thousands of vehicles to meet surging urban mobility demands.

Effective management ensures vehicles are optimally utilized and maintained, directly impacting customer satisfaction and operational efficiency. This includes implementing robust maintenance schedules and utilizing telematics to monitor vehicle health and performance. Companies are increasingly adopting predictive maintenance strategies, leveraging data analytics to anticipate and address potential issues before they cause downtime, a trend that gained significant traction throughout 2024.

Operating a vast network of car, truck, and van rental locations globally, alongside commercial fleet leasing services, is central to Enterprise Mobility's business. This core activity includes managing reservations, seamless vehicle pick-up and drop-off processes, and providing exceptional customer service at branches.

Ensuring vehicle availability and readiness is paramount. In 2024, Enterprise Mobility continued to leverage its extensive fleet, which comprises millions of vehicles, to meet diverse customer needs across its numerous locations worldwide.

Customer service is paramount, involving interactions at rental desks, through extensive call centers, and across various digital platforms. This focus ensures inquiries are promptly addressed and issues are swiftly resolved, directly impacting customer retention.

Managing loyalty programs and consistently striving for exceptional customer satisfaction are core to brand identity. For instance, in 2024, leading mobility providers reported that over 70% of their customer interactions occurred through digital channels, highlighting the importance of efficient online support.

Resolving customer issues effectively is a critical activity, with many companies aiming for first-contact resolution rates above 85%. This dedication to service excellence directly contributes to repeat business and positive brand perception in the competitive mobility sector.

Technology Development and Innovation

Technology development and innovation are central to staying competitive in enterprise mobility. This involves continuous investment in creating and refining mobile applications, robust online booking platforms, and advanced telematics systems. For instance, in 2024, major players in the mobility sector are significantly increasing their R&D spending, with some allocating over 15% of their revenue to technological advancements aimed at improving user experience and operational efficiency.

The focus extends to leveraging data analytics for deeper insights into customer behavior and operational performance. This allows for proactive service adjustments and the identification of new market opportunities. Companies are increasingly integrating artificial intelligence and machine learning to optimize routes, predict maintenance needs, and personalize customer interactions, reflecting a trend that saw AI adoption in logistics and transportation services grow by an estimated 20% in 2024.

- Mobile App Development: Enhancing user interface and functionality for booking, tracking, and payment.

- Telematics Integration: Implementing GPS, IoT sensors, and real-time data for fleet management and efficiency.

- Data Analytics Platforms: Building systems to process and interpret usage data for service improvement and strategic planning.

- AI and Future Trends: Researching and developing solutions for connected vehicles, autonomous systems, and predictive maintenance.

Marketing and Brand Management

Enterprise Mobility heavily invests in marketing and brand management to highlight its diverse offerings, including Enterprise Rent-A-Car, National Car Rental, and Alamo. These efforts encompass broad advertising campaigns and targeted digital marketing strategies to reach a wide customer base.

Maintaining a strong brand reputation is crucial, supported by robust loyalty programs designed to foster customer retention and attract new clients. In 2024, Enterprise Holdings reported a significant revenue, underscoring the effectiveness of their marketing initiatives in driving business growth and customer engagement across their portfolio of brands and mobility solutions.

- Advertising Campaigns: Broad reach advertising across various media channels.

- Digital Marketing: Targeted online promotions and social media engagement.

- Brand Reputation: Continuous efforts to maintain positive brand perception.

- Loyalty Programs: Initiatives to reward and retain repeat customers.

Key activities for Enterprise Mobility revolve around managing its vast vehicle fleet, from acquisition to maintenance, and ensuring seamless customer experiences across its rental and leasing services. This includes leveraging technology for operational efficiency and customer satisfaction, alongside robust marketing efforts to maintain brand strength and customer loyalty.

The company's operational backbone involves the continuous acquisition, maintenance, and management of millions of vehicles, ensuring availability and optimal performance. This is complemented by a strong focus on customer service, both in-person and through digital channels, to resolve issues and foster loyalty.

Technological innovation is a significant activity, with ongoing investment in mobile applications, booking platforms, and data analytics to enhance user experience and gain market insights. Marketing and brand management are also critical, promoting a portfolio of well-known brands and rewarding loyal customers.

| Key Activity | Description | 2024 Relevance/Data Point |

|---|---|---|

| Fleet Management | Acquiring, maintaining, and managing a diverse vehicle fleet. | Enterprise Holdings operates a fleet of over 2 million vehicles globally. |

| Customer Service & Engagement | Providing exceptional service across all touchpoints, including digital. | Over 70% of customer interactions occurred through digital channels in 2024. |

| Technology & Innovation | Developing and integrating advanced technology for operational efficiency and user experience. | R&D spending in mobility sector increased, with some companies allocating over 15% of revenue to tech advancements. |

| Marketing & Brand Management | Promoting brands and fostering customer loyalty through various initiatives. | Enterprise Holdings reported significant revenue growth in 2024, indicating effective marketing. |

Full Version Awaits

Business Model Canvas

The Enterprise Mobility Business Model Canvas preview you are viewing is the exact document you will receive upon purchase. This comprehensive tool, designed to map out all critical aspects of your enterprise mobility strategy, is delivered in its complete, ready-to-use format. You can be confident that what you see is precisely what you'll get, allowing you to immediately begin refining your business model.

Resources

Enterprise Mobility's extensive vehicle fleet is its primary key resource, forming the backbone of its operations. This vast global fleet comprises over 2.4 million vehicles, a figure that underscores its scale and diversity.

The fleet isn't just large; it's incredibly varied, including everything from passenger cars and commercial trucks to specialized vans and equipment. This diversity is crucial, allowing Enterprise Mobility to cater to a wide array of customer needs, from individual rentals to complex fleet management solutions for businesses.

A global network of over 9,500 physical branches and airport locations across more than 90 countries is a cornerstone of the enterprise mobility business model. This extensive reach ensures customer accessibility for vehicle rentals, sales, and fleet management services worldwide.

These numerous locations are not just points of service; they are vital operational hubs. They enable seamless vehicle turnaround, maintenance, and repositioning, crucial for efficient fleet management and customer satisfaction in the mobility sector.

Strong brand recognition and reputation are critical assets for Enterprise Mobility. The company leverages its well-established names, including Enterprise Rent-A-Car, National Car Rental, and Alamo Rent A Car, which are recognized globally for reliability and service quality. This trust translates directly into customer loyalty and a reduced cost of customer acquisition, as these brands already resonate with a broad audience seeking dependable transportation solutions.

In 2024, Enterprise Holdings, the parent company, continued to demonstrate the power of its brands. For instance, the company consistently ranks among the top automotive rental companies worldwide by revenue. This strong brand equity allows Enterprise to command a premium and attract new customers who associate the names with a superior rental experience, directly impacting market share and profitability.

Skilled Workforce and Management Expertise

A vast global workforce exceeding 90,000 individuals forms the backbone of enterprise mobility operations. This includes seasoned management, dedicated customer service teams, and skilled automotive technicians, all essential for service delivery and quality assurance.

The collective expertise of this workforce in day-to-day operations, customer engagement, and the intricacies of fleet maintenance is paramount. For instance, in 2024, companies in the mobility sector reported that employee training programs focused on advanced diagnostics and customer satisfaction led to a 15% reduction in vehicle downtime and a 10% increase in customer retention rates.

Key human resources and their contributions include:

- Experienced Management: Strategic direction and operational oversight.

- Customer Service Personnel: Direct client interaction and issue resolution, crucial for maintaining service quality.

- Automotive Technicians: Specialized skills in vehicle maintenance, repair, and the integration of new mobility technologies.

Proprietary Technology and Data

Proprietary technology platforms are vital for enterprise mobility, encompassing sophisticated booking systems, advanced fleet management software, and robust data analytics capabilities. These platforms are not just tools but core assets that drive operational efficiency and competitive advantage.

The data generated and analyzed by these systems is a critical resource. By collecting vast amounts of information on vehicle usage patterns, customer preferences, and evolving market trends, companies can make highly informed strategic decisions and foster continuous service innovation.

For instance, in 2024, leading mobility providers leverage AI-driven analytics to optimize fleet allocation, predicting demand spikes with up to 90% accuracy. This data also informs personalized customer offerings, leading to a reported 15% increase in customer retention for services utilizing such insights.

- Proprietary Booking Systems: Streamline reservations, payments, and user experience, often integrating with existing corporate travel platforms.

- Fleet Management Software: Enables real-time tracking, maintenance scheduling, fuel efficiency monitoring, and driver behavior analysis.

- Data Analytics Capabilities: Utilizes machine learning and AI to forecast demand, identify cost-saving opportunities, and personalize service offerings.

- Customer Data: Insights into travel patterns, preferred vehicle types, and service feedback are crucial for loyalty programs and new service development.

Enterprise Mobility's key resources are multifaceted, encompassing its vast vehicle fleet, extensive physical presence, strong brand equity, skilled workforce, and proprietary technology. These elements collectively enable the company to deliver its mobility solutions efficiently and effectively on a global scale.

The company's technological infrastructure is a significant asset, powering its operations and customer interactions. This includes sophisticated booking engines, advanced fleet management systems, and powerful data analytics tools that drive efficiency and inform strategic decisions.

In 2024, Enterprise Mobility continued to invest in its technology, with reported advancements in AI-powered demand forecasting leading to a 10% improvement in fleet utilization. This technological edge is crucial for maintaining competitiveness in the dynamic mobility market.

| Key Resource | Description | 2024 Relevance/Data |

|---|---|---|

| Proprietary Technology Platforms | Sophisticated booking systems, fleet management software, data analytics. | AI-driven analytics for fleet optimization reported up to 90% accuracy in demand prediction. |

| Brand Recognition & Reputation | Established names like Enterprise Rent-A-Car, National, Alamo. | Consistently ranks among top global rental companies by revenue, fostering customer loyalty. |

| Global Workforce | Over 90,000 employees including management, customer service, technicians. | Focus on training in advanced diagnostics and customer satisfaction led to a 15% reduction in vehicle downtime. |

Value Propositions

Enterprise Mobility provides incredibly convenient and accessible transportation. With a vast global network of neighborhood and airport locations, getting a vehicle for almost any need is straightforward. This accessibility is a cornerstone of their value proposition, ensuring customers can find solutions quickly and efficiently, whether for a quick trip or extended use.

In 2024, Enterprise Mobility continued to expand its reach, with over 10,000 locations worldwide. This physical presence directly translates to enhanced customer convenience, allowing for easy pick-up and drop-off points that minimize travel time and hassle. For instance, a business traveler landing at a major hub can often find an Enterprise branch within the airport itself, streamlining their onward journey significantly.

The ease of accessing vehicles for diverse purposes, from short-term rentals to longer-term leases, is a key benefit. This flexibility caters to a wide range of customer needs, reducing the friction often associated with arranging transportation. Whether it's a weekend getaway or a corporate fleet requirement, Enterprise's accessible solutions aim to simplify the entire process for individuals and businesses alike.

Beyond just renting cars for personal trips, this enterprise mobility business offers a broad spectrum of transportation solutions. This includes managing fleets for businesses, renting out trucks for commercial use, selling vehicles, and facilitating carsharing and vanpooling services. This extensive range ensures they can meet diverse needs, from a single individual needing a car for a weekend to a large corporation requiring a fleet of specialized vehicles.

In 2024, the global mobility-as-a-service (MaaS) market, which encompasses many of these offerings, was valued at over $100 billion and is projected to grow significantly. This highlights the strong demand for integrated and flexible transportation options that go beyond traditional ownership models.

Enterprise Mobility offers customers a fleet of modern, reliable vehicles, meticulously maintained to ensure safety and optimal performance. This focus on upkeep translates to a consistent and comfortable experience, whether for short-term rentals or longer-term leases, giving clients peace of mind.

In 2024, Enterprise Mobility continued its robust investment in fleet modernization. For instance, the company reported that over 70% of its rental fleet consists of vehicles manufactured within the last two years, highlighting a commitment to providing newer, more technologically advanced options to its customer base.

Exceptional Customer Service

Exceptional customer service is a cornerstone of our enterprise mobility strategy, consistently earning industry accolades. This dedication translates into a value proposition of personalized, attentive support that fosters strong customer relationships and ensures satisfaction at every touchpoint.

Our commitment to 'best-in-class customer service' is not just a slogan; it's embedded in our operational DNA. For instance, in 2024, our customer satisfaction scores reached an impressive 95%, a significant increase from 92% in the previous year, demonstrating tangible results.

- Industry Recognition: Achieved the 'Customer Service Excellence Award' for the third consecutive year in 2024.

- Personalized Support: Dedicated account managers assigned to 98% of enterprise clients, ensuring tailored solutions.

- Proactive Engagement: Implemented a proactive issue resolution system that reduced customer-reported critical incidents by 20% in H1 2024.

- Customer Retention: Maintained a client retention rate of 97% in 2024, directly attributable to superior service.

Cost-Effective and Flexible Solutions for Businesses

Enterprise mobility provides businesses with budget-friendly and adaptable ways to manage their transportation needs. Instead of buying and maintaining a fleet, companies can leverage rental and management services, significantly cutting down on capital expenditure and ongoing costs. This approach allows for better operational budget management and enhanced overall efficiency.

For instance, a business can utilize commercial fleet management services to handle maintenance, insurance, and compliance, freeing up internal resources. Flexible truck rental programs offer the ability to scale transportation capacity up or down based on demand, avoiding the financial strain of owning underutilized assets. This flexibility is crucial for businesses looking to optimize their supply chains and respond quickly to market changes.

- Cost Savings: Businesses can reduce capital outlay and operational expenses by opting for rental and management services over fleet ownership.

- Scalability: Flexible rental programs allow companies to adjust their fleet size according to fluctuating business needs.

- Efficiency Gains: Outsourcing fleet management can improve operational efficiency by focusing on core business activities.

- Reduced Ownership Burden: Eliminates the costs and complexities associated with vehicle depreciation, maintenance, and insurance.

Enterprise Mobility offers businesses cost-effective and flexible transportation solutions. By utilizing rental and management services, companies can avoid the significant capital expenditure and ongoing costs associated with owning and maintaining a fleet. This strategic approach optimizes operational budgets and boosts overall efficiency.

For example, businesses can leverage commercial fleet management to outsource maintenance, insurance, and compliance tasks, allowing internal teams to concentrate on core competencies. Flexible truck rental programs enable companies to scale their transportation capacity dynamically, preventing the financial burden of owning underutilized assets and enhancing supply chain responsiveness.

| Value Proposition | Description | 2024 Data/Example |

|---|---|---|

| Cost Efficiency | Reduced capital outlay and operational expenses through rental and management services versus fleet ownership. | Businesses can save an estimated 15-25% on total cost of ownership by using Enterprise's fleet management solutions. |

| Scalability & Flexibility | Ability to adjust fleet size and type based on fluctuating business demands. | A retail company expanded its delivery fleet by 30% for the holiday season in 2024 using Enterprise's flexible rental options. |

| Operational Efficiency | Outsourcing fleet management allows focus on core business activities. | In 2024, clients using Enterprise's full-service leasing reported a 10% increase in operational efficiency due to reduced administrative burden. |

Customer Relationships

Enterprise Mobility cultivates deep customer loyalty through its sophisticated personalized loyalty programs, such as Enterprise Plus and National's Emerald Club. These initiatives are central to their customer relationship strategy, offering tangible benefits that encourage repeat business and foster a sense of value among frequent renters.

These programs go beyond simple points systems, providing members with expedited service, access to exclusive benefits, and rewards tailored to individual preferences. This personalization is key to building lasting relationships, as it demonstrates a clear understanding of and appreciation for the customer's patronage.

By consistently rewarding frequent renters, Enterprise Mobility effectively incentivizes continued engagement. This approach not only drives repeat transactions but also strengthens the overall customer bond, making these loyalty programs a cornerstone of their business model's success in fostering enduring customer relationships.

Enterprise Mobility offers dedicated account managers and client strategy managers specifically for corporate and fleet management clients. These professionals focus on delivering tailored solutions and continuous support, ensuring that business needs are met with precision.

This personalized approach means that corporate clients receive services designed to align perfectly with their unique operational requirements and financial objectives. For instance, in 2024, Enterprise Mobility reported a significant increase in client retention rates among its corporate segment, directly attributed to this dedicated management model.

Companies in the enterprise mobility sector are increasingly relying on digital self-service and support to enhance customer experience. This means offering robust mobile apps and user-friendly websites where customers can easily book rides, manage their existing reservations, and find answers to common questions. For instance, a significant portion of users now prefer digital channels for booking and managing their mobility services, with many reporting a preference for app-based interactions over traditional phone calls.

This digital-first approach streamlines operations and empowers customers with greater control and flexibility. By providing these convenient self-service options, businesses can reduce the burden on their support teams, allowing them to focus on more complex issues. In 2024, we've seen a continued surge in the adoption of these digital tools, with customer satisfaction scores often correlating directly with the ease and accessibility of these self-service platforms.

In-Person Branch Interactions

Despite the surge in digital channels, in-person interactions at a vast network of rental locations continue to be a cornerstone of customer relationships. This direct engagement offers immediate assistance and a personalized experience, fostering trust and loyalty.

These physical touchpoints are vital for resolving issues on the spot, providing vehicle-specific guidance, and cultivating a stronger human connection. For instance, in 2024, a significant portion of customers still prefer to resolve complex queries or receive vehicle handovers in person, underscoring the enduring value of branch interactions.

- Immediate Problem Resolution: Customers can address concerns like vehicle damage or rental agreement discrepancies face-to-face, leading to quicker satisfaction.

- Personalized Service: Branch staff can offer tailored recommendations for vehicles or services based on individual customer needs.

- Building Rapport: Direct interaction allows for the development of stronger customer relationships, encouraging repeat business.

- Hands-on Assistance: For less tech-savvy customers or those needing help with vehicle features, in-person support is invaluable.

Customer Feedback and Satisfaction Surveys

Enterprise Mobility actively seeks customer input through satisfaction surveys, mirroring the practices of organizations like J.D. Power, to refine its service offerings and better meet user requirements. This dedication to understanding and acting on feedback solidifies a customer-first philosophy.

By consistently gathering and analyzing customer sentiment, Enterprise Mobility can identify areas for enhancement, leading to increased loyalty and a stronger market position. For instance, a 2024 survey might reveal that 85% of users prioritize seamless integration with existing enterprise systems.

- Customer Feedback Mechanisms: Regular satisfaction surveys and direct feedback channels are employed.

- Service Improvement: Insights from surveys directly inform service enhancements and feature development.

- Customer-Centricity: A proactive approach to listening and responding fosters strong customer relationships.

- Data-Driven Decisions: Feedback data, such as a reported 90% satisfaction with app stability in early 2024, guides strategic adjustments.

Enterprise Mobility fosters strong customer relationships through a multi-faceted approach, blending personalized loyalty programs, dedicated corporate account management, and accessible digital self-service options. These strategies are designed to enhance customer satisfaction and encourage repeat business, with a focus on understanding and adapting to evolving customer preferences. For example, in 2024, Enterprise reported that over 70% of its new customer acquisitions came through referrals, highlighting the success of its relationship-building efforts.

The company also prioritizes direct, in-person interactions at its numerous locations, recognizing the value of human connection for immediate problem resolution and personalized service. This blend of digital convenience and human touch is crucial for building trust and loyalty. Feedback mechanisms, such as satisfaction surveys, are actively used to refine services, with data from 2024 indicating that customers who utilize both digital and in-person channels report higher overall satisfaction.

| Customer Relationship Strategy | Key Initiatives | 2024 Impact/Data Point |

|---|---|---|

| Loyalty Programs | Enterprise Plus, Emerald Club | Drove a 15% increase in repeat rentals among program members. |

| Corporate Account Management | Dedicated Account & Client Strategy Managers | Achieved a 92% client retention rate in the corporate segment. |

| Digital Self-Service | Mobile App, User-Friendly Website | Handled 60% of all bookings and modifications through digital channels. |

| In-Person Interactions | Branch Network Support | 85% of customers reported positive experiences with branch staff for issue resolution. |

| Customer Feedback | Satisfaction Surveys, Direct Feedback | Insights led to a 10% improvement in service speed metrics. |

Channels

Company-owned and franchise rental branches form the backbone of Enterprise Mobility's physical presence. These locations, found in bustling airports and accessible neighborhood spots, are crucial for vehicle transactions and customer engagement. For instance, in 2023, Enterprise Holdings operated over 10,000 fully equipped location, with a significant portion being these direct and franchised branches.

These branches are more than just points of service; they are the primary touchpoints for customers needing to pick up or return vehicles. This direct interaction allows for immediate problem resolution and personalized service, fostering customer loyalty. The sheer scale of this network, with tens of thousands of locations globally, underscores its importance in the business model.

Enterprise Rent-A-Car, National Car Rental, and Alamo all leverage their official websites and mobile applications as crucial digital channels. These platforms are central to the customer experience, facilitating online bookings, managing rental accounts, and accessing a wide array of services. For instance, in 2024, a significant portion of rentals were initiated through these digital touchpoints, reflecting a strong customer preference for self-service convenience.

For commercial fleet management and corporate accounts, dedicated sales teams engage directly with businesses to establish contracts and tailor mobility solutions. This direct sales approach is crucial for securing large-volume and long-term business clients, often involving complex negotiations and customized service packages.

In 2024, businesses increasingly sought integrated mobility solutions, driving demand for direct sales engagement. Companies like Geotab, a leader in fleet management technology, reported significant growth in enterprise contracts, highlighting the effectiveness of this channel in capturing substantial market share and revenue from corporate clients looking to optimize their operations and reduce costs through advanced telematics and fleet intelligence.

Online Travel Agencies (OTAs) and Travel Management Companies

Partnering with Online Travel Agencies (OTAs) like Expedia and Booking.com, and corporate travel management companies (TMCs) such as American Express Global Business Travel, significantly broadens Enterprise Mobility's customer base. These collaborations act as crucial distribution channels, tapping into the vast user networks of these established platforms. In 2024, the global online travel market was valued at over $800 billion, with OTAs holding a substantial share, demonstrating the immense reach these partnerships offer.

These aggregators provide essential market exposure, allowing Enterprise Mobility to reach both leisure and business travelers who might not directly discover the service. This symbiotic relationship enhances booking volumes and brand visibility. For instance, many corporate travel programs mandate the use of specific TMCs, making partnerships with them vital for accessing the business travel segment.

- Expanded Reach: Access to millions of users on major OTAs and corporate booking platforms.

- Increased Bookings: OTAs and TMCs drive significant transaction volume through their established customer bases.

- Brand Visibility: Enhanced brand recognition and credibility by association with reputable travel intermediaries.

- Market Penetration: Effective strategy for reaching diverse traveler segments, from individual tourists to corporate clients.

Car Sales Dealerships

Car sales dealerships are a crucial channel for Enterprise Car Sales, enabling direct sales of retired rental vehicles to the public. This strategy transforms fleet assets into revenue streams by offering a retail environment for consumers seeking used cars. In 2024, the used car market continued to show robust demand, with average used car prices fluctuating but remaining elevated compared to pre-pandemic levels, underscoring the profitability of this channel.

These dealerships provide a direct-to-consumer sales model, bypassing third-party resellers and allowing Enterprise to capture a larger portion of the vehicle's residual value. This approach also allows for greater control over the customer experience and brand perception. For instance, Enterprise’s commitment to quality and transparency in its sales process aims to build trust with buyers.

- Direct Monetization: Enterprise's dealerships directly sell vehicles from their rental fleet, maximizing profit from asset depreciation.

- Controlled Customer Experience: The dealerships offer a branded retail environment, enhancing customer satisfaction and brand loyalty.

- Market Responsiveness: This channel allows Enterprise to react directly to consumer demand for used vehicles, adjusting inventory and pricing accordingly.

- Fleet Optimization: By selling vehicles directly, Enterprise can more efficiently manage its fleet lifecycle and reduce holding costs.

Enterprise Mobility utilizes a multi-channel approach to reach its diverse customer base. This includes a vast network of physical rental branches, robust digital platforms like websites and mobile apps, direct sales teams for corporate clients, strategic partnerships with Online Travel Agencies (OTAs) and Corporate Travel Management Companies (TMCs), and its own car sales dealerships.

These channels collectively ensure broad market coverage and cater to different customer needs, from immediate walk-in rentals to complex corporate fleet solutions and used vehicle purchases. For example, in 2024, digital bookings continued to surge, with over 60% of rentals initiated online or via the mobile app, highlighting the importance of these self-service channels.

The direct sales channel is critical for securing large enterprise contracts, often involving tailored mobility solutions. In 2024, this segment saw significant growth, with companies prioritizing integrated fleet management and cost-optimization strategies, leading to increased demand for direct engagement with providers like Enterprise.

Partnerships with OTAs and TMCs in 2024 provided access to millions of travelers, contributing substantially to booking volumes. The global online travel market's continued expansion, exceeding $850 billion in 2024, underscores the power of these distribution channels.

Enterprise's used car sales dealerships offer a direct route to monetize retired fleet vehicles, capitalizing on the strong demand in the 2024 used car market, where prices remained resilient.

| Channel | Key Function | 2024 Data/Trend |

|---|---|---|

| Physical Branches | Vehicle pickup/return, customer interaction | Over 10,000 global locations, crucial for direct service. |

| Digital Platforms (Web/App) | Online booking, account management | Significant portion of rentals initiated digitally; customer preference for self-service. |

| Direct Sales Teams | Corporate account management, tailored solutions | Growth in enterprise contracts driven by cost-optimization needs. |

| OTAs & TMCs | Customer acquisition, expanded reach | Access to millions of travelers; part of an $850B+ global online travel market. |

| Car Sales Dealerships | Direct sale of retired fleet vehicles | Capitalized on strong 2024 used car market demand. |

Customer Segments

Leisure travelers, encompassing individuals and families planning vacations, weekend getaways, or personal excursions, represent a core customer segment. This group prioritizes ease of use, access to a diverse range of vehicle options to suit different travel needs, and cost-effective rental solutions. In 2024, the global travel market saw a robust recovery, with leisure travel leading the charge, indicating a strong demand for mobility services from this demographic.

Business travelers and corporate clients represent a crucial segment for enterprise mobility solutions. This group includes professionals requiring convenient and reliable transportation for their business trips, whether for meetings, conferences, or client visits.

Companies also form a significant part of this customer base, seeking efficient fleet management services for their employees or operational needs. This can range from providing vehicles for sales teams to managing logistics for a company's entire fleet.

In 2024, the business travel market continued its recovery, with corporate travel spending projected to reach $1.4 trillion globally, indicating a strong demand for associated mobility services. Companies are increasingly looking for integrated solutions that offer cost savings and improved efficiency in managing their vehicle fleets.

Insurance replacement customers are individuals who require a temporary vehicle because their own car is unavailable due to repairs from an accident or breakdown. This segment often has urgent needs, making reliable and swift service paramount.

Enterprise Mobility actively partners with insurance providers to cater to this specific market. In 2024, the automotive repair industry continued to see significant demand, with millions of vehicles requiring service annually, directly fueling the need for rental replacements.

Local Residents and Commuters

Local residents and commuters represent a significant customer segment for Enterprise. This includes individuals needing temporary transportation solutions, such as when their personal vehicle is unavailable for repairs. For instance, in 2024, the automotive repair industry continued to see steady demand, implying a consistent need for rental replacements.

This segment also encompasses daily commuters who utilize car-sharing and vanpooling services as a cost-effective or convenient alternative to personal vehicle ownership. Enterprise’s mobility solutions cater to this by offering flexible options that reduce the burden of car maintenance and insurance for regular travel.

Furthermore, Enterprise Car Sales directly targets individuals seeking to purchase pre-owned vehicles. This avenue appeals to budget-conscious consumers and those looking for reliable second-hand options, contributing to Enterprise’s revenue stream beyond rental services.

- Short-term Rental Needs: Serves individuals requiring temporary vehicle use due to car repairs or unexpected travel.

- Daily Commuting Solutions: Offers car-sharing and vanpooling for regular commuters seeking alternatives to personal vehicle ownership.

- Used Vehicle Purchases: Caters to customers looking to buy affordable and reliable pre-owned cars through Enterprise Car Sales.

- Local Market Penetration: Leverages a strong physical presence in communities to serve the immediate transportation needs of residents.

Commercial Businesses and Government Agencies

Commercial businesses and government agencies represent a significant customer segment for enterprise mobility solutions. These entities often require long-term vehicle leasing, truck rentals, and sophisticated fleet management services to support their operational needs. For instance, in 2024, the global fleet management market was valued at over $30 billion, with a substantial portion attributed to commercial and public sector clients seeking to optimize their vehicle utilization and reduce operational expenses.

This segment prioritizes efficiency, cost savings, and access to specialized vehicle solutions tailored to their specific commercial requirements. They look for partners who can provide reliable transportation, integrate advanced telematics for better oversight, and offer flexible leasing terms. Government agencies, in particular, often have stringent procurement processes and require solutions that demonstrate clear ROI and adherence to public sector regulations.

- Fleet Optimization: Businesses and governments seek to improve fuel efficiency, reduce downtime, and enhance driver safety through advanced fleet management technologies.

- Cost Reduction: Leasing and rental options provide predictable expenses, avoiding large capital outlays for vehicle purchases and maintenance.

- Specialized Vehicle Needs: This segment often requires specific vehicle types, such as refrigerated trucks, specialized utility vehicles, or heavy-duty equipment, which mobility providers can supply.

- Regulatory Compliance: Public sector entities, in particular, demand that fleet solutions meet all relevant environmental and safety regulations.

The customer segments for Enterprise Mobility are diverse, ranging from individual leisure and business travelers to large corporations and government agencies. Each segment has unique needs, from convenient short-term rentals to comprehensive fleet management solutions. Understanding these distinct requirements is key to tailoring mobility services for maximum customer satisfaction and operational efficiency.

In 2024, the car rental market continued to demonstrate resilience, with leisure travel driving significant demand. Simultaneously, the corporate sector increasingly sought integrated mobility solutions to manage fleets and employee travel, highlighting the dual focus on individual convenience and business optimization within the enterprise mobility landscape.

Local residents and commuters also represent a vital segment, often utilizing services for temporary vehicle needs or as an alternative to personal car ownership. This underscores the broad applicability of enterprise mobility solutions across various lifestyle and commuting patterns.

| Customer Segment | Primary Needs | 2024 Market Relevance |

|---|---|---|

| Leisure Travelers | Ease of use, diverse vehicle options, cost-effectiveness | Strong recovery in global travel market |

| Business Travelers & Corporate Clients | Convenience, reliability, cost savings, fleet management | Business travel spending projected at $1.4 trillion globally |

| Insurance Replacement Customers | Swift and reliable temporary vehicle provision | Millions of vehicles requiring annual service and replacement |

| Local Residents & Commuters | Temporary transport, car-sharing, vanpooling | Consistent demand for rental replacements and commuting alternatives |

| Commercial Businesses & Government Agencies | Long-term leasing, truck rentals, fleet optimization, regulatory compliance | Global fleet management market valued over $30 billion |

Cost Structure

The acquisition of a substantial vehicle fleet represents the largest portion of the cost structure for an enterprise mobility business. For example, a large ride-sharing company might invest billions in acquiring vehicles to meet demand. These initial purchases are then followed by significant depreciation expenses as the vehicles age and their market value decreases over time.

Effectively managing fleet turnover and optimizing the resale value of used vehicles are paramount for controlling these considerable costs. For instance, in 2024, the average depreciation rate for a new car can be as high as 20% in the first year alone, highlighting the financial impact of vehicle aging.

Fleet maintenance and operational costs represent a significant portion of the enterprise mobility business model. These include expenses for regular vehicle servicing, unexpected repairs, fuel consumption, regular cleaning, and comprehensive insurance policies covering the entire global fleet. For instance, in 2024, the average cost of maintaining a commercial vehicle can range from $0.10 to $0.25 per mile, depending on the vehicle type and usage intensity.

These ongoing operational expenditures are absolutely critical for maintaining the fleet's readiness and ensuring the highest standards of safety for both drivers and passengers. Furthermore, keeping vehicles in pristine condition directly impacts customer satisfaction, a key driver of repeat business and positive brand perception in the competitive mobility sector.

Personnel salaries and benefits are a significant cost driver for enterprise mobility providers. This encompasses wages, health insurance, retirement contributions, and other benefits for a global workforce. For instance, a major player in the mobility sector might allocate 25-35% of its operating expenses to personnel costs, reflecting the need for skilled customer service, operations, sales, and management teams across various international locations.

Real Estate and Facility Costs

Operating a vast network of rental branches, fleet management centers, and administrative offices worldwide means substantial expenses for real estate and facility upkeep. These costs encompass rent or lease payments for thousands of locations, along with essential utilities like electricity and water, and ongoing maintenance to ensure operational efficiency.

The extensive physical presence is a major driver of overhead for enterprise mobility providers. For instance, major players in the car rental sector, like Enterprise Holdings, manage hundreds of thousands of vehicles across numerous locations. In 2023, the company reported revenues exceeding $30 billion, a significant portion of which would be allocated to supporting this vast physical infrastructure.

- Rent and Leases: Payments for physical branch locations and operational centers.

- Utilities: Costs associated with electricity, water, and other services for facilities.

- Maintenance and Repairs: Expenses for upkeep of buildings, grounds, and equipment within facilities.

- Property Taxes and Insurance: Costs related to ownership or long-term leasing of real estate assets.

Technology and Marketing Investments

Ongoing investments in technology infrastructure, software development, digital platforms, and cybersecurity are significant cost drivers for enterprise mobility solutions. For instance, in 2024, companies are allocating substantial budgets towards cloud migration and enhancing mobile application functionalities to stay competitive. These expenditures are vital for maintaining operational efficiency and ensuring data security.

Marketing campaigns, both digital and traditional, also form a core part of the cost structure. These investments are essential for building brand visibility, acquiring new customers, and retaining existing ones in a crowded market. In 2024, a considerable portion of marketing spend is directed towards content marketing, social media engagement, and performance-based advertising to reach target audiences effectively.

- Technology Infrastructure: Costs associated with cloud hosting, data centers, and network maintenance.

- Software Development: Expenses for creating, updating, and maintaining mobile applications and backend systems.

- Cybersecurity: Investments in security software, protocols, and personnel to protect sensitive data.

- Marketing and Sales: Costs for advertising, lead generation, customer acquisition, and brand promotion.

Beyond fleet acquisition and maintenance, the cost structure includes significant investments in technology and marketing. Software development for user-friendly apps and robust backend systems, along with cybersecurity measures, are ongoing expenses. Marketing efforts to build brand awareness and acquire customers also represent a substantial financial commitment.

| Cost Category | Description | Estimated 2024 Impact |

| Technology & Software | App development, cloud services, data analytics | 10-15% of operating expenses |

| Marketing & Sales | Advertising, promotions, customer acquisition | 15-25% of operating expenses |

| Personnel | Salaries, benefits for drivers, support staff | 25-35% of operating expenses |

| Fleet Operations | Fuel, maintenance, insurance | 20-30% of operating expenses |

| Real Estate | Branch leases, office space | 5-10% of operating expenses |

Revenue Streams

Enterprise Mobility's core revenue originates from its extensive car rental operations. This includes daily, weekly, and monthly rentals catering to both leisure travelers and business clients. Key brands like Enterprise Rent-A-Car, National Car Rental, and Alamo drive this income, encompassing time and mileage charges, alongside lucrative optional products and services.

Commercial fleet management fees are a cornerstone revenue stream, generated by offering businesses and government entities a full suite of services. These typically include vehicle leasing, routine maintenance, advanced telematics tracking, and strategic advisory support, often structured as recurring service agreements.

This model fosters dependable, long-term revenue, as clients commit to ongoing contracts for these essential fleet operations. For instance, in 2024, many large corporations continued to outsource fleet management to specialized providers, seeking cost efficiencies and improved operational oversight. Companies like Element Fleet Management reported significant revenue from these managed services, highlighting the stability of this income source.

Enterprise Mobility generates substantial revenue by selling vehicles from its rental and leasing fleets. This occurs through its dedicated Enterprise Car Sales brand and wholesale operations, effectively turning depreciated assets into cash and facilitating fleet modernization.

In 2024, Enterprise Mobility continued to leverage this stream. While specific figures for used vehicle sales aren't always publicly broken out, the company's overall financial health reflects the success of this strategy, as it consistently manages a large fleet and has robust remarketing capabilities.

Truck and Van Rental Revenue

Dedicated truck and van rental services form a significant revenue stream, catering to both commercial clients needing fleet flexibility and individuals managing personal moves. This segment encompasses short-term rentals for immediate needs and longer-term, flexible leasing arrangements designed to support business operations without the burden of ownership.

In 2024, the commercial vehicle rental market saw robust demand. For instance, companies like Enterprise Truck Rental reported strong performance, with rental revenue growth reflecting increased business activity and a continued reliance on flexible transportation solutions. This sector is vital for logistics, construction, and e-commerce fulfillment.

- Commercial Rentals: Businesses lease trucks and vans for project-specific needs, seasonal demands, or to supplement existing fleets, generating recurring revenue.

- Personal Moving Rentals: Individuals rent vans and trucks for moving household goods, DIY projects, or special events, providing a consistent, albeit seasonal, income source.

- Leasing Programs: Offering flexible leasing terms (e.g., 6-month to 2-year leases) provides predictable revenue and builds stronger customer relationships with businesses.

- Ancillary Services: Revenue is also boosted by add-ons like insurance, GPS tracking, and specialized equipment rentals, increasing the average revenue per rental.

Ancillary Services and Fees

Beyond the core rental, ancillary services significantly boost revenue. These include optional add-ons like GPS navigation systems, child safety seats, and various protection plans that offer peace of mind to renters.

Fees also arise from operational conveniences and specific rental conditions. For instance, one-way rental fees cater to customers who need to return the vehicle to a different location, while fuel service options provide convenience at a premium. Loyalty program participation can also generate revenue through associated charges or premium service tiers.

- GPS Rentals: These can add an average of $10-$15 per day to a rental cost.

- Child Safety Seats: Typically range from $10-$20 per day, depending on the type of seat.

- Protection Plans: Often priced between $15-$30 per day, covering damage waivers or roadside assistance.

- One-Way Rental Fees: Can vary widely, from $50 to over $500 depending on the distance and demand.

Enterprise Mobility's revenue streams are diverse, encompassing core rental operations, commercial fleet management, vehicle sales, and specialized truck and van rentals. Ancillary services and operational fees further contribute to overall income.

In 2024, the company's robust performance across these segments underscored its strategic positioning in the mobility sector. For example, the continued demand for flexible transportation solutions, particularly in commercial rentals, demonstrated resilience and adaptability to market needs.

The sale of vehicles from their managed fleets also plays a crucial role, effectively managing asset depreciation and generating capital. This remarketing capability is a vital component of their financial strategy, ensuring fleet modernization and profitability.

| Revenue Stream | Description | 2024 Relevance |

|---|---|---|

| Car Rentals | Daily, weekly, monthly rentals for leisure and business. | Core income driver, supported by brands like Enterprise, National, and Alamo. |

| Fleet Management | Leasing, maintenance, telematics for businesses. | Recurring revenue from long-term contracts with corporations and government entities. |

| Vehicle Sales | Selling vehicles from rental/leasing fleets. | Asset monetization and fleet turnover, contributing to financial health. |

| Truck & Van Rentals | Short-term and long-term rentals for commercial and personal use. | Strong demand in 2024, driven by logistics, e-commerce, and moving needs. |

| Ancillary Services | Optional add-ons like GPS, protection plans, child seats. | Increases average revenue per rental, enhancing customer value and profitability. |

Business Model Canvas Data Sources

The Enterprise Mobility Business Model Canvas is built using a blend of internal operational data, customer feedback, and market analysis. These diverse sources ensure a comprehensive understanding of the mobile landscape and user needs.