Ebix PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ebix Bundle

Navigate the complex external forces shaping Ebix's future with our comprehensive PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental factors that present both opportunities and challenges for the company. Gain a strategic advantage by leveraging these expert insights to refine your own market approach. Download the full version now for actionable intelligence that drives informed decisions.

Political factors

Ebix operates within highly regulated insurance and financial sectors, meaning government policies directly shape its operational environment. For instance, the ongoing evolution of data privacy laws, such as the California Consumer Privacy Act (CCPA) and its successor, the California Privacy Rights Act (CPRA), necessitates continuous adaptation of Ebix's software and services to ensure compliance.

Increased scrutiny on financial stability and consumer protection, particularly in the wake of economic shifts, can lead to new compliance burdens and reporting requirements for companies like Ebix. By mid-2024, many financial regulators were focusing on cybersecurity resilience, impacting how technology providers must secure client data and systems.

Cross-border regulatory convergence is a significant political factor. Major markets like the UK and US are increasingly aligning their regulations. For instance, the Financial Conduct Authority (FCA) in the UK and the National Association of Insurance Commissioners (NAIC) in the US are enhancing their collaborative frameworks. This push for harmonization is evident in initiatives like the development of Insurance Capital Standards (ICS).

This trend towards harmonized standards presents a dual-edged sword for a global company such as Ebix. On one hand, it can simplify compliance and reduce operational friction across different jurisdictions. For example, a unified approach to data privacy, like GDPR-inspired regulations spreading globally, can streamline how Ebix manages customer information across its international operations.

Conversely, this convergence can also introduce new compliance burdens or necessitate significant adjustments to existing business models if Ebix’s current practices don't align with the emerging global norms. Staying abreast of these evolving regulatory landscapes, such as potential changes in digital asset regulation or international tax treaties impacting cross-border transactions, is crucial for Ebix's strategic planning and risk management.

Governments globally are tightening data privacy regulations, with projections indicating that by 2024, 75% of the world's population will be under modern privacy laws. This surge in compliance requirements presents a significant challenge for software firms like Ebix.

Navigating this evolving landscape involves understanding and adhering to a multitude of regulations. In the US alone, states such as Utah, Texas, Oregon, Florida, and Montana have enacted their own distinct data privacy laws, adding layers of complexity for companies operating nationwide.

Internationally, Ebix must also contend with comprehensive frameworks like the European Union's General Data Protection Regulation (GDPR) and India's Digital Personal Data Protection Act (DPDPA). These regulations mandate strict data handling, consent, and security protocols, impacting how Ebix collects, processes, and stores user information.

Political Stability and Geopolitical Risks

Geopolitical tensions, such as ongoing conflicts and shifts in international relations, can create significant uncertainty for global markets. For Ebix, which operates in the insurance and financial technology sectors, these tensions can disrupt supply chains, impact investment flows, and alter regulatory landscapes across its various operating regions. For instance, the global defense spending was projected to reach $2.2 trillion in 2024, indicating a heightened level of geopolitical risk awareness and its economic implications.

Policy changes stemming from political instability or shifts in government priorities pose another critical risk. Unexpected regulatory overhauls or protectionist trade policies can directly affect Ebix's business model, particularly its international operations and data handling practices. The increasing trend of digital protectionism, where countries implement policies favoring domestic tech companies, is a growing concern for global fintech providers.

The rise in political polarization within key markets can lead to more volatile and unpredictable policy environments. This necessitates robust scenario planning and risk management strategies for companies like Ebix to navigate potential disruptions. A recent survey indicated that over 60% of global executives view political instability as a significant threat to their business growth in the coming years.

- Geopolitical Instability: Global defense spending projected to exceed $2.2 trillion in 2024 highlights elevated geopolitical risk.

- Policy Volatility: Increasing digital protectionism poses a direct threat to international fintech operations.

- Executive Concerns: Over 60% of global executives identify political instability as a major growth impediment for 2024-2025.

Government Initiatives in Digital Transformation

Governments worldwide are increasingly prioritizing digital transformation, creating a fertile ground for companies like Ebix. For instance, India's ambitious 'One Nation One Card' initiative, aimed at unifying public transit payments, is a prime example of this trend. Ebix Technologies is actively involved in supporting the implementation of such large-scale digital infrastructure projects.

These government-led digital drives translate directly into significant business opportunities. Ebix can leverage its technological expertise to partner with public sector entities, thereby expanding its market presence. The demand for integrated, technology-driven solutions in areas like financial services, insurance, and healthcare, spurred by these initiatives, is projected to grow substantially in the coming years.

- Digital India Initiative: Government focus on digitizing services and infrastructure.

- Smart City Projects: Urban development plans often incorporate digital solutions for efficiency.

- Financial Inclusion Programs: Government push for wider access to financial services through technology.

Governments globally are intensifying their focus on data privacy, with projections indicating that by 2024, a substantial 75% of the world's population will be covered by modern privacy laws, directly impacting how companies like Ebix manage sensitive information.

This regulatory push is evident in the US, where states like Utah, Texas, and Florida have enacted distinct data privacy laws, requiring Ebix to navigate a complex patchwork of compliance. Internationally, frameworks such as the EU's GDPR and India's DPDPA mandate strict data handling protocols, affecting Ebix's global operations.

Geopolitical instability, underscored by global defense spending projected to exceed $2.2 trillion in 2024, creates market uncertainty and can alter regulatory landscapes for Ebix. Furthermore, the rise of digital protectionism and increasing political polarization within key markets necessitate robust risk management strategies for companies operating internationally.

| Political Factor | Impact on Ebix | Supporting Data (2024-2025) |

|---|---|---|

| Data Privacy Regulations | Increased compliance burden and need for adaptable software solutions. | 75% of global population under modern privacy laws by 2024. |

| Geopolitical Instability | Market uncertainty, potential supply chain disruptions, and shifting regulatory environments. | Global defense spending projected to exceed $2.2 trillion in 2024. |

| Digital Protectionism | Challenges for international fintech operations and potential need to adapt business models. | Growing trend of countries favoring domestic tech companies. |

| Government Digital Initiatives | Opportunities for partnerships and expansion through government-led digital transformation projects. | India's 'One Nation One Card' initiative as an example of government digital drives. |

What is included in the product

This Ebix PESTLE analysis provides a comprehensive examination of how external macro-environmental factors, including Political, Economic, Social, Technological, Environmental, and Legal influences, shape the company's operating landscape.

It offers actionable insights for strategic decision-making by identifying potential threats and opportunities arising from these critical external forces.

Offers a clear, actionable framework to identify and mitigate external threats, transforming complex market dynamics into manageable strategic insights.

Economic factors

The global economy is anticipated to see steady, albeit modest, growth in 2025, with real GDP expansion projected to hover around 3.2%, consistent with the 2024 forecast.

Inflationary pressures are expected to moderate globally, though sticky wage growth and rising service costs might prompt varied monetary policy stances across different regions.

Potential fiscal uncertainties could contribute to an upward trend in long-term bond yields, adding another layer of complexity to the economic outlook.

The global primary insurance market is projected to expand at a robust pace, with an anticipated average annual growth rate of 2.6% in both 2025 and 2026. This upward trend is underpinned by sustained economic expansion, strong employment figures, and increasing real incomes, creating a favorable environment for insurance uptake.

Profitability within the non-life insurance sector is showing positive momentum. However, the industry continues to grapple with the financial impact of natural catastrophes, which remain a substantial challenge to overall profitability, necessitating careful risk management and pricing strategies.

The current economic climate features elevated long-term interest rates, a trend expected to bolster demand within the insurance sector. This environment is particularly beneficial for life insurers, as higher rates directly translate to improved investment yields, a key driver of profitability.

For companies like Ebix, which have significant exposure to life and annuity products, this sustained higher interest rate environment is projected to positively influence financial performance. For instance, as of early 2024, benchmark long-term Treasury yields have remained notably higher than historical averages, providing a more attractive return on insurance company investment portfolios.

Impact of Chapter 11 Restructuring on Financial Health

Ebix's emergence from Chapter 11 bankruptcy in August 2024 marks a significant turning point, leaving the company debt-free globally. This strategic move, bolstered by a $145 million investment from a consortium headed by Eraaya Lifespaces, is designed to create a more robust financial footing and streamline operations.

The restructuring is anticipated to foster long-term profitable growth by establishing a leaner operating model. This financial overhaul is crucial for enhancing Ebix's market position and investor confidence moving forward.

- Debt-Free Status: Ebix is now operating without any outstanding global debt following the August 2024 Chapter 11 emergence.

- Investment Influx: A $145 million investment from Eraaya Lifespaces and its partners provides substantial capital for future growth.

- Operational Streamlining: The restructuring aims to create a leaner operating model, improving efficiency and profitability.

- Foundation for Growth: The company is now positioned with a stronger financial foundation to pursue long-term, profitable expansion.

Investment and M&A Activity in Fintech and Insurtech

Fintech continues to draw substantial investment, particularly in embedded finance, Regtech, and AI applications. For instance, global fintech funding reached approximately $45 billion in the first half of 2024, indicating sustained investor confidence in these innovative areas.

While the insurance sector experienced a notable uptick in M&A activity around mid-2024, with deal volumes increasing by an estimated 15% compared to the previous year, the outlook for 2025 is tempered. Emerging geopolitical tensions and persistent economic uncertainties could potentially slow this momentum.

- Fintech Investment Focus: Embedded finance, Regtech, and AI remain key areas for venture capital and private equity funding in the fintech space.

- Insurtech M&A Trends: Mid-2024 saw a rise in insurance sector M&A, driven by consolidation and technology adoption.

- 2025 Outlook Caution: Geopolitical instability and economic volatility pose risks to continued M&A growth in insurtech through 2025.

- Market Dynamics: Investors are closely monitoring how macroeconomic factors will influence deal-making in both fintech and insurtech.

Global economic growth is expected to remain steady but modest in 2025, with projections around 3.2%. Inflation is anticipated to decrease, though regional monetary policies will vary due to persistent wage growth and service costs.

Higher long-term interest rates are a key economic factor, positively impacting the insurance sector, especially life insurers, by boosting investment yields. For Ebix, this environment is beneficial, building on its debt-free status post-Chapter 11 in August 2024, supported by a $145 million investment.

Fintech, particularly embedded finance, Regtech, and AI, continues to attract significant investment, with global funding around $45 billion in H1 2024. While insurance M&A saw a 15% increase mid-2024, future growth may be tempered by geopolitical and economic uncertainties.

| Economic Factor | 2024/2025 Outlook | Impact on Ebix |

|---|---|---|

| Global GDP Growth | Modest, ~3.2% | Supports insurance market expansion |

| Inflation | Moderating, but regional variations | Influences monetary policy and investment yields |

| Interest Rates | Elevated long-term rates | Boosts life insurance profitability and investment returns |

| Fintech Investment | Strong, ~$45B in H1 2024 | Opportunities in embedded finance, Regtech, AI |

| Insurance M&A | Increased mid-2024, potential slowdown | Market consolidation and technology adoption trends |

Preview Before You Purchase

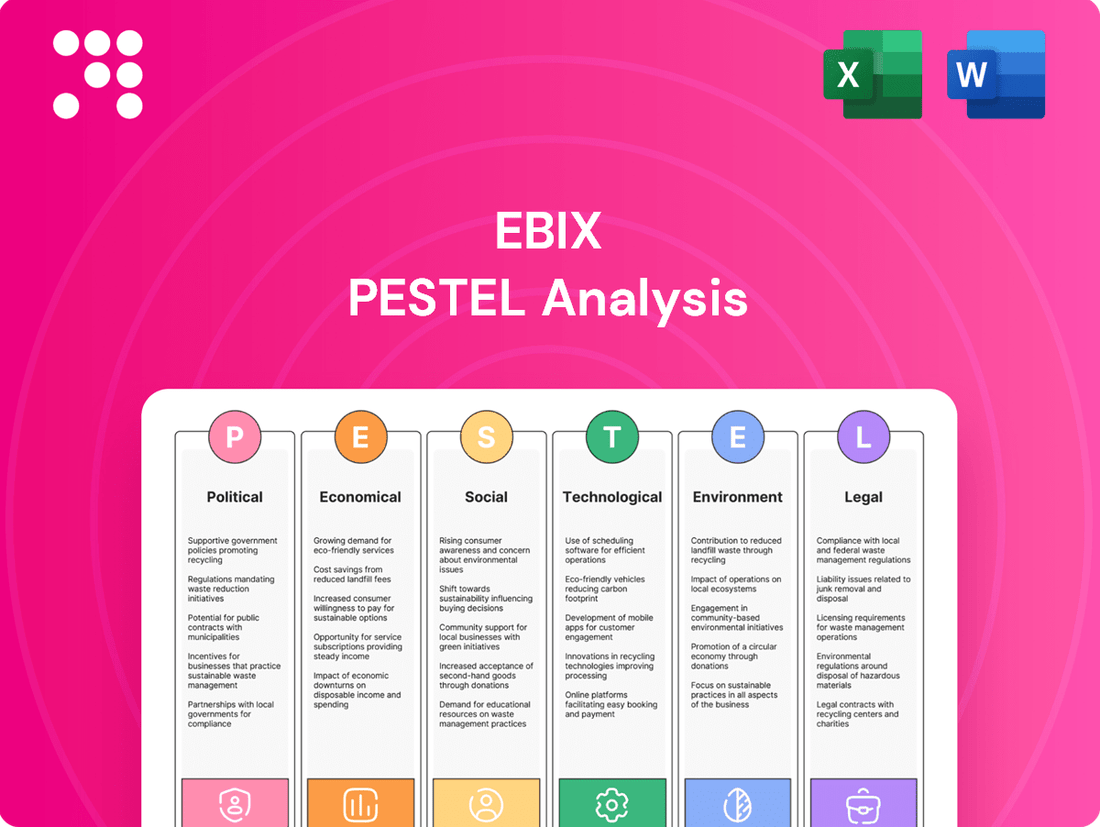

Ebix PESTLE Analysis

The preview shown here is the exact Ebix PESTLE Analysis document you’ll receive after purchase—fully formatted and ready to use.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. It provides a comprehensive overview of the Political, Economic, Social, Technological, Legal, and Environmental factors impacting Ebix.

The content and structure shown in the preview is the same Ebix PESTLE Analysis document you’ll download after payment, offering valuable insights for strategic planning.

Sociological factors

Customers increasingly expect digital interactions to be smooth, connected, and tailored to their individual needs, whether they are accessing financial services, healthcare, or educational platforms. This shift is evident in the widespread adoption of mobile banking and telehealth services, demonstrating a clear preference for convenience and personalization.

Ebix's strategic emphasis on on-demand software and e-commerce solutions directly addresses these evolving expectations. By automating and simplifying business operations, Ebix facilitates more direct and efficient relationships between its clients and their end-users, mirroring the seamless digital journeys consumers now anticipate.

For instance, a significant portion of consumers now prefer digital channels for customer service, with reports indicating that over 60% of customer service interactions are now handled digitally. This highlights the critical need for companies like Ebix to provide robust, user-friendly digital platforms that meet these heightened demands for accessibility and efficiency.

Global data privacy regulations, like GDPR and CCPA, are becoming more stringent, reflecting heightened consumer awareness. For instance, in 2024, the global data privacy management market was valued at approximately $1.5 billion and is projected to grow significantly, underscoring this trend.

Ebix must prioritize building and maintaining customer trust through transparent data usage and robust security. A breach or perceived misuse of data could lead to substantial reputational damage and financial penalties, impacting customer acquisition and retention efforts.

Maintaining strong data governance is critical for Ebix's operations in the insurance and financial technology sectors. As of early 2025, reports indicate that companies with strong data privacy practices often experience higher customer loyalty and a competitive advantage.

Societies increasingly expect readily available and cost-effective solutions, especially within healthcare and insurance sectors. This trend is particularly evident as individuals and businesses seek ways to manage rising costs and improve access to essential services.

Digital health strategies and tools are proving vital for overcoming financial hurdles and addressing workforce shortages in healthcare. For instance, the global digital health market was valued at approximately USD 211 billion in 2023 and is projected to grow significantly, highlighting the demand for such innovations, which aligns with Ebix's focus on technology-driven insurance and healthcare exchange solutions.

Workforce Transformation and Skill Development

The increasing integration of artificial intelligence and automation is fundamentally reshaping the workforce, demanding new skill sets across various sectors, including insurance. This technological wave requires a significant transformation in how employees are trained and developed to remain relevant and effective.

In response to this, many insurance companies are actively investing in AI training programs for their staff. For instance, a significant portion of the insurance workforce is expected to undergo reskilling or upskilling in areas like data analytics, AI interpretation, and digital customer service by 2025. This reflects a wider societal emphasis on continuous learning and adaptation to technological advancements.

- AI Adoption in Insurance: By the end of 2024, an estimated 40% of insurance companies are projected to have implemented AI-driven tools for at least one core business function, necessitating workforce adaptation.

- Upskilling Initiatives: Major insurers are reporting a 25% increase in investment in employee training programs focused on digital skills and AI literacy during 2024.

- Future Skill Demand: Projections for 2025 indicate a 15% rise in demand for roles requiring proficiency in AI, machine learning, and advanced data analytics within the financial services sector.

Impact of Demographic Shifts

Demographic shifts, particularly an aging global population and the projected rise in real incomes as inflation eases, are poised to significantly boost demand within the insurance market. For instance, the World Bank projects global life expectancy to continue its upward trend, reaching 73.4 years by 2025, indicating a larger pool of individuals requiring long-term financial planning and insurance products. This trend directly benefits companies like Ebix, whose insurance and financial solutions can be adapted to meet the specific needs of an older demographic, such as retirement planning and health coverage.

Ebix's strategic positioning in the insurance and financial technology sectors allows it to capitalize on these evolving consumer demographics. As real incomes increase, consumers are more likely to invest in financial products and insurance, especially those catering to later life stages. By tailoring its offerings, Ebix can address the growing demand for products that support financial security and healthcare needs among an aging populace, a demographic segment increasingly focused on wealth preservation and health management.

Key demographic trends influencing the insurance market include:

- Aging Population: Increased life expectancy leads to a greater demand for annuities, long-term care insurance, and health-related financial products.

- Rising Real Incomes: As inflation moderates, disposable income grows, enabling more individuals to afford and prioritize insurance and financial planning services.

- Shifting Consumer Needs: An aging demographic requires specialized insurance and financial solutions focused on retirement, healthcare, and legacy planning.

- Technological Adoption: An increasingly digitally-savvy older population creates opportunities for online platforms and digital solutions in insurance sales and service.

Societal expectations are increasingly centered on accessible, affordable services, particularly in healthcare and insurance. This demand is amplified by rising costs and workforce challenges, making digital solutions crucial. Ebix's focus on technology-driven insurance and healthcare exchanges directly addresses this need, aligning with the global digital health market's significant growth, which was valued at approximately USD 211 billion in 2023.

Technological factors

The rapid integration of Artificial Intelligence (AI) and Machine Learning (ML) is fundamentally reshaping key sectors like insurance, finance, and healthcare. These technologies are proving invaluable in areas such as improving diagnostic accuracy, optimizing treatment strategies, elevating customer service experiences, and bolstering fraud detection capabilities.

For Ebix, a prominent technology enabler in these domains, staying ahead necessitates ongoing adoption and strategic application of AI and ML. This commitment is crucial for maintaining a competitive edge and for developing sophisticated solutions across its core offerings, including agency management systems, Customer Relationship Management (CRM) platforms, and data interchange services.

In 2024, the global AI market is projected to reach over $200 billion, with significant growth expected in financial services and healthcare IT, areas where Ebix operates. For instance, AI-powered fraud detection systems in insurance are estimated to save the industry billions annually, a trend Ebix can leverage by enhancing its own platforms with such advanced analytics.

The global e-commerce market is projected to reach $8.1 trillion by 2024, a significant increase from previous years, underscoring the ongoing digital transformation. Ebix's business, deeply rooted in providing on-demand software and e-commerce solutions, is perfectly positioned to capitalize on this expansion. This trend facilitates greater connectivity and efficiency for businesses operating within its service ecosystems.

The healthcare sector's growing focus on data measurement and integrated ecosystems is a significant technological driver. Ebix's ability to harness advanced data analytics and ensure its platforms can seamlessly connect across insurance, financial, healthcare, and e-learning domains is paramount. This interoperability allows Ebix to offer richer insights and more cohesive solutions to its clients.

Emergence of Regtech Solutions

Regulatory technology, or Regtech, is rapidly becoming essential for businesses needing to keep pace with ever-changing financial regulations. These solutions offer real-time monitoring and proactive compliance, significantly reducing the risk of penalties and operational disruptions. For Ebix, a company deeply embedded in financial services technology, embracing or integrating Regtech presents a strategic advantage.

By incorporating Regtech, Ebix can enhance its existing platforms, providing clients with tools to navigate the complex and often costly regulatory environment more effectively. This not only strengthens Ebix's value proposition but also positions it as a key partner in ensuring client adherence to mandates. The global Regtech market is projected to grow substantially, with estimates suggesting it could reach over $30 billion by 2027, highlighting the increasing demand for such solutions.

- Real-time Compliance: Regtech automates monitoring and reporting, ensuring immediate alignment with new regulatory requirements.

- Efficiency Gains: Streamlining compliance processes reduces manual effort and associated costs for Ebix's clients.

- Market Growth: The expanding Regtech sector indicates a strong client need for advanced compliance tools.

- Competitive Edge: Integrating Regtech can differentiate Ebix's offerings in a crowded market.

Cybersecurity and Data Security Requirements

As digital transformation accelerates, cybersecurity threats are escalating. Ebix, operating in insurance, financial services, and healthcare, must prioritize robust security to protect sensitive client and customer data. This is particularly crucial given evolving cyber insurance standards and increasing mandates for reporting data breaches.

The financial services sector, a key area for Ebix, saw a 2023 increase in ransomware attacks by 74% compared to 2022, according to IBM's X-Force Threat Intelligence Index. This highlights the critical need for continuous investment in advanced cybersecurity infrastructure and protocols to mitigate risks and maintain trust. Failure to do so can lead to significant financial penalties and reputational damage.

- Increased regulatory scrutiny: Data privacy laws like GDPR and CCPA impose strict requirements on data handling and breach notification.

- Sophistication of threats: Cybercriminals are employing more advanced tactics, requiring constant vigilance and updated defense mechanisms.

- Impact of breaches: A single data breach can result in substantial financial losses, legal liabilities, and erosion of customer confidence.

- Cyber insurance landscape: The cost and availability of cyber insurance are directly tied to a company's demonstrated cybersecurity posture.

The increasing reliance on cloud computing and data analytics presents significant opportunities for Ebix to enhance its service delivery and operational efficiency. By leveraging these technologies, Ebix can offer more scalable, accessible, and data-driven solutions to its clients in the insurance, financial, and healthcare sectors.

The global cloud computing market is expected to exceed $1 trillion by 2025, indicating a strong market trend towards cloud-based services. For Ebix, this means greater potential for expanding its SaaS offerings and improving the performance of its existing platforms, like its insurance exchange and financial services platforms.

The integration of IoT devices, particularly in healthcare and insurance, is generating vast amounts of data that can be analyzed for risk assessment, personalized services, and improved operational insights. Ebix's role as a technology provider positions it to capitalize on this trend by developing platforms that can effectively ingest, process, and derive value from IoT data streams.

Legal factors

The global data privacy landscape is rapidly evolving, with significant new regulations taking effect in 2024 and 2025. This creates a complex compliance environment for companies like Ebix. For instance, the EU AI Act, finalized in 2024, introduces stringent rules for AI systems, which could affect how Ebix utilizes data in its software solutions.

In the United States, a growing number of states are enacting their own data privacy laws, adding to the compliance burden. India's Digital Personal Data Protection Act (DPDPA), which came into effect in 2023 and is seeing further implementation in 2024-2025, also imposes stricter requirements on data handling. These diverse regulations necessitate robust data governance and security measures for Ebix's e-commerce and software services.

The insurance sector is navigating a complex web of regulatory shifts in 2024 and 2025. Key among these are heightened expectations for insurers to disclose and manage climate-related financial risks, a trend underscored by increasing investor and governmental pressure. For instance, the Task Force on Climate-related Financial Disclosures (TCFD) recommendations are becoming more embedded in regulatory frameworks globally.

Furthermore, a stronger emphasis on consumer duty is mandating greater transparency and fairness in how insurance products are sold and managed. This includes clearer communication of policy terms and conditions, ensuring products meet customer needs. In parallel, the burgeoning cyber insurance market is facing new standards, driven by the escalating frequency and sophistication of cyber threats, with regulators seeking to ensure the solvency and fair treatment of policyholders in this volatile segment.

Ebix's software offerings, crucial for insurance operations, must therefore be agile enough to incorporate these evolving compliance mandates. Adapting to these new requirements, such as enhanced data reporting for climate risk or streamlined processes for consumer-facing interactions, will be vital for Ebix to continue providing value and support to its clients in the insurance industry.

Ebix successfully navigated its Chapter 11 restructuring, emerging debt-free in August 2024. This legal maneuver involved canceling existing equity, a common outcome in such proceedings to satisfy creditors, and secured a significant new investment to fuel future operations. The restructuring fundamentally reshaped Ebix's capital structure and ownership, positioning it for a new phase of growth.

Compliance with Financial Services Regulations

Ebix operates in financial services, a sector heavily governed by regulations. This includes strict rules for money remittance, foreign exchange, and wealth management. Failure to comply can result in significant fines and damage to its reputation. For instance, in 2024, the Financial Conduct Authority (FCA) in the UK imposed fines totaling over £500 million for various compliance breaches across the financial industry, highlighting the significant financial risks of non-adherence.

Navigating this complex legal landscape is crucial for Ebix's operations. The company must continuously monitor and adapt to evolving regulatory frameworks in every market it serves. This involves substantial investment in compliance departments and legal counsel to ensure all activities meet or exceed legal requirements.

Key regulatory areas impacting Ebix include:

- Data Privacy and Security: Adherence to regulations like GDPR and CCPA, which govern how customer data is handled and protected.

- Anti-Money Laundering (AML) and Know Your Customer (KYC): Implementing robust procedures to prevent financial crimes and verify customer identities.

- Consumer Protection: Ensuring fair treatment of customers, transparent product disclosures, and effective complaint handling mechanisms.

- Capital Adequacy and Solvency: Meeting financial strength requirements to ensure stability and protect policyholders and clients.

Intellectual Property Protection

Intellectual property (IP) protection is paramount for Ebix, given its core business as a software and e-commerce service provider. Navigating the complex landscape of global patent, copyright, and trademark laws is crucial to shield its proprietary technology and software solutions from unauthorized use or duplication. These legal safeguards are fundamental to maintaining Ebix's competitive advantage in the market.

The ability to enforce IP rights directly impacts Ebix's revenue streams and market position. For instance, in 2023, the global software market saw significant investment in IP protection, with companies allocating substantial budgets to legal defense and patent filings to secure their innovations. Ebix's reliance on its unique software platforms means that robust IP strategies are not just legal necessities but also critical business enablers.

- Global IP Enforcement: Ebix must actively monitor and enforce its IP rights across all operating jurisdictions to prevent infringement and protect its market share.

- Patent Strategy: Filing and maintaining patents for its innovative software solutions provides a barrier to entry for competitors and can be a source of licensing revenue.

- Copyright and Trademark: Protecting its software code through copyright and its brand identity through trademarks are essential for maintaining brand integrity and customer trust.

- Legal Compliance: Staying abreast of evolving IP laws and regulations worldwide ensures Ebix remains compliant and its IP assets are adequately secured.

Legal factors significantly shape Ebix's operational landscape, particularly concerning data privacy and financial services regulation. The company must navigate a patchwork of global and regional data protection laws, such as the EU AI Act and India's DPDPA, which demand robust data governance. Furthermore, the financial sector's stringent compliance requirements, including anti-money laundering and consumer protection mandates, necessitate continuous adaptation and investment in legal and compliance infrastructure to mitigate risks and maintain market access.

Environmental factors

The insurance sector, a core market for Ebix, is under mounting pressure from regulators to address climate change risks. For instance, by the end of 2024, the National Association of Insurance Commissioners (NAIC) in the US is expected to finalize its climate disclosure requirements, pushing insurers to quantify and report their exposure to physical and transition risks.

These evolving disclosure mandates mean Ebix's clients need enhanced capabilities to analyze and report on climate-related financial impacts. Failure to integrate climate considerations into underwriting and risk management, as mandated by frameworks like the Task Force on Climate-related Financial Disclosures (TCFD), could lead to increased capital requirements or penalties for insurers, directly affecting their demand for sophisticated data and analytics solutions from companies like Ebix.

The financial and insurance industries, including companies like Ebix, are experiencing a significant surge in the importance of Environmental, Social, and Governance (ESG) factors. Investors and stakeholders are increasingly scrutinizing companies' environmental impact and sustainability initiatives, even if specific details for Ebix aren't publicly itemized in this context.

This heightened focus on ESG reporting can directly influence investor sentiment, potentially impacting capital availability and valuation. For instance, a 2024 report indicated that over 70% of institutional investors consider ESG factors when making investment decisions, highlighting the tangible financial implications of a company's sustainability performance.

Furthermore, a strong ESG profile can foster more robust partnerships and improve a company's overall reputation. As regulatory frameworks around ESG continue to evolve globally, companies that proactively address these concerns are better positioned for long-term resilience and growth, a trend expected to accelerate through 2025.

Regulatory shifts, such as the Solvency UK reforms, are actively designed to free up capital specifically for 'green projects,' fostering innovation in sustainability. This presents a significant opportunity for Ebix to enhance its software offerings, enabling clients to more effectively manage and report on their environmental investments and broader sustainability efforts.

Natural Catastrophe Events and Risk Modeling

The escalating frequency and intensity of natural disasters, such as the record-breaking hurricane season in 2024 which saw five major hurricanes, are significantly impacting the insurance sector. This trend necessitates clearer policy language and robust notification protocols, particularly concerning cyber incidents that may be exacerbated by environmental disruptions. Ebix's advanced data exchange and analytical platforms are instrumental in assisting insurers with more accurate risk assessment and sophisticated modeling for these increasingly prevalent environmental events.

These tools enable insurers to better understand their exposure to climate-related risks, thereby improving their ability to price policies and manage capital effectively. For instance, Ebix's solutions can process vast datasets to identify patterns and correlations between environmental factors and potential claims, offering a more granular view of risk than traditional methods.

- Increased Insurer Exposure: The global insured losses from natural catastrophes in 2024 are projected to exceed $100 billion, a significant rise from previous years, putting pressure on insurer solvency.

- Data-Driven Risk Assessment: Ebix's analytical tools leverage AI and machine learning to process real-time weather data, historical loss data, and geographical information for precise risk modeling.

- Enhanced Policy Clarity: The need for clearer policy wording regarding natural catastrophe coverage is paramount, with regulators in several key markets pushing for standardized language by the end of 2025.

- Cyber-Environmental Interplay: The convergence of cyber threats and physical climate events, such as infrastructure damage impacting digital systems, requires integrated risk management approaches that Ebix's platforms can support.

Energy Consumption of Data Centers and IT Infrastructure

As a technology company reliant on extensive data centers and IT infrastructure, Ebix faces increasing scrutiny regarding its energy consumption and environmental footprint. The demand for on-demand software and e-commerce services directly translates into significant power usage for servers, cooling systems, and networking equipment. This environmental impact is a critical factor for Ebix, influencing operational costs and corporate social responsibility.

The global IT sector's energy consumption is substantial and growing. For instance, data centers alone accounted for approximately 1% of global electricity consumption in 2023, a figure projected to rise. This highlights the imperative for companies like Ebix to adopt energy-efficient technologies and sustainable operational practices to mitigate their environmental impact and manage escalating energy costs.

To address this, Ebix and similar companies are exploring several avenues:

- Investing in energy-efficient hardware: Upgrading to newer, more power-conscious servers and cooling systems can significantly reduce electricity usage.

- Optimizing data center design: Implementing advanced cooling techniques, such as free cooling and liquid cooling, can lower energy demands.

- Exploring renewable energy sources: Sourcing power from solar, wind, or other renewable providers helps reduce the carbon footprint of IT operations.

- Improving server utilization: Techniques like virtualization and workload consolidation minimize the number of active servers, thereby reducing energy consumption.

The insurance industry, a key market for Ebix, is increasingly focused on environmental factors due to regulatory pressures and the growing impact of climate change. For instance, by the end of 2024, the NAIC in the US is finalizing climate disclosure requirements, pushing insurers to quantify their exposure to physical and transition risks, which directly impacts their need for Ebix's analytical solutions.

The escalating frequency of natural disasters, with global insured losses from natural catastrophes in 2024 projected to exceed $100 billion, necessitates advanced risk assessment tools. Ebix's platforms, leveraging AI and real-time data, help insurers model these risks more accurately, improving policy pricing and capital management.

Ebix itself faces scrutiny over its environmental footprint as a technology company reliant on data centers. With IT sector energy consumption rising, Ebix is exploring energy-efficient hardware, renewable energy sources, and optimized data center designs to manage operational costs and its carbon impact, a trend expected to intensify through 2025.

| Environmental Factor | Impact on Insurance Sector | Implication for Ebix | Data Point (2024/2025 Projection) |

|---|---|---|---|

| Climate Change & Natural Disasters | Increased insured losses, demand for better risk modeling | Need for advanced analytics and risk assessment tools | Global insured losses from natural catastrophes projected to exceed $100 billion in 2024 |

| ESG Regulations & Investor Sentiment | Pressure for climate risk disclosure, focus on sustainability | Opportunity to enhance ESG reporting capabilities in software | Over 70% of institutional investors consider ESG factors in investment decisions (2024 report) |

| IT Energy Consumption | Rising operational costs, carbon footprint concerns | Drive for energy-efficient solutions and sustainable IT practices | Data centers alone accounted for ~1% of global electricity consumption in 2023, with projected growth |

PESTLE Analysis Data Sources

Our PESTLE analysis draws from a comprehensive range of data sources, including official government publications, leading economic indicators from institutions like the World Bank and IMF, and reputable industry-specific reports. This ensures that each aspect of the macro-environment is analyzed with accuracy and current relevance.