Ebix Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ebix Bundle

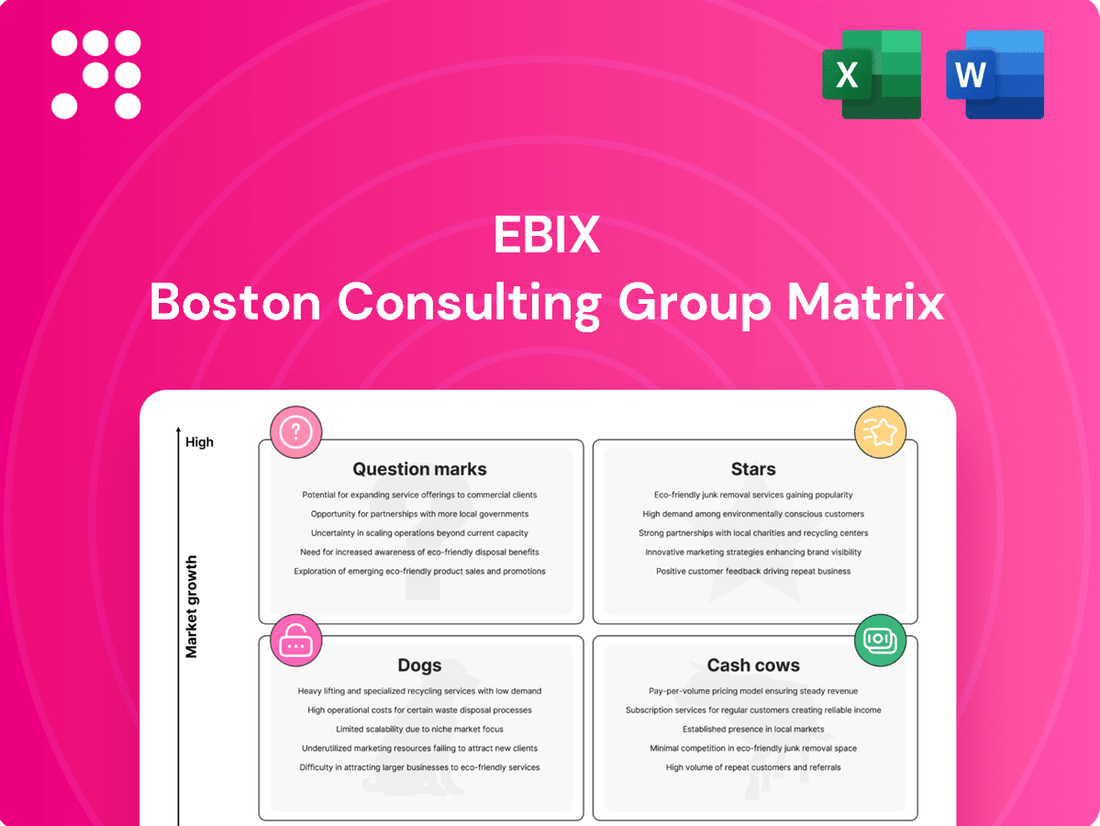

Curious about Ebix's strategic product positioning? This glimpse into their BCG Matrix reveals how their offerings stack up as Stars, Cash Cows, Dogs, or Question Marks. Don't miss out on the full picture; purchase the complete report for actionable insights and a clear path to optimizing Ebix's portfolio.

Stars

Ebix's core insurance software solutions, encompassing agency management, CRM, and data exchange, are positioned as Stars in its business portfolio. This segment benefits from a rapidly expanding market, projected to reach $15 billion by 2025 and maintain an 8% compound annual growth rate until 2033. This growth is fueled by the industry's increasing reliance on digitalization and the pursuit of operational efficiencies.

Ebix Technologies, formerly EbixCash, is making substantial strides in India's digital payments landscape, particularly through its involvement with the National Common Mobility Card (NCMC). This initiative is a key growth driver for the company.

The recent ₹140 crore contract secured with the Maharashtra State Road Transport Corporation (MSRTC) for the first statewide NCMC deployment underscores Ebix's leadership in this burgeoning sector. This contract is a significant win, positioning Ebix to revolutionize public transit payments across India with unified digital solutions.

EbixCash's ambitious 'phygital' strategy positions it as a Star within the Ebix BCG Matrix, leveraging its extensive network of over 650,000 physical distribution points across India and ASEAN. This robust physical presence is seamlessly integrated with a sophisticated omnichannel digital platform, facilitating a wide array of financial exchange services.

This integrated approach is particularly potent in a region experiencing rapid fintech growth, covering essential services like money remittance, forex, travel bookings, and various payment solutions. The company's ability to bridge the digital and physical divide caters to diverse customer needs, a critical factor in emerging markets.

For instance, in 2024, the digital payments market in India alone was projected to reach significant figures, highlighting the immense opportunity for platforms like EbixCash that can offer both online convenience and offline accessibility. The ASEAN region, with its burgeoning middle class and increasing digital adoption, further amplifies this growth potential.

Wealth Management and Lending Solutions

EbixCash's financial technologies segment, focusing on wealth management and lending solutions, serves a crucial role within the company's broader strategy. By providing sophisticated software for asset and wealth management, as well as trust companies across India, Southeast Asia, the Middle East, and Africa, EbixCash is tapping into a rapidly expanding market. The fintech sector in India alone is projected for substantial growth, with estimates suggesting it could reach $1 trillion by 2025, underscoring the significant opportunity for solutions that can capture a meaningful share of this burgeoning ecosystem.

These offerings position EbixCash's wealth management and lending solutions as potential stars in its portfolio. The demand for digital financial services is escalating, driven by increasing internet penetration and a growing young, tech-savvy population in these regions. For instance, India's digital payments market is expected to exceed $1 trillion in transaction value by 2026, indicating a strong appetite for the very technologies EbixCash provides.

- High Market Growth: The fintech market in India and other target regions is experiencing rapid expansion, creating a fertile ground for EbixCash's software solutions.

- Strategic Focus: EbixCash's emphasis on wealth and lending technologies aligns with global trends towards digital financial management and access to credit.

- Scalability: The software-based nature of these solutions allows for scalability across diverse geographical markets with varying regulatory landscapes.

- Revenue Potential: Capturing even a modest share of the projected trillion-dollar Indian fintech market represents significant revenue potential for EbixCash.

Emerging AI/ML Integration in Insurance Software

The insurance software market is rapidly evolving with AI and machine learning. Over 70% of property and casualty insurers plan to boost AI investments by 2025, highlighting a significant growth area.

If Ebix is effectively integrating advanced AI/ML for risk assessment, claims, and customer relationship management, its insurance software offerings would likely be classified as Stars in a BCG matrix. This strategic positioning reflects the company's participation in a high-growth segment driven by technological innovation.

- AI/ML integration in risk assessment

- Streamlined claims processing through AI

- Enhanced customer experiences via AI-powered CRM

- Significant insurer investment in AI technologies

Ebix's insurance software, enhanced by AI and machine learning for risk assessment and claims processing, is a clear Star. This segment is experiencing robust growth, with over 70% of P&C insurers planning increased AI investments by 2025. EbixCash's 'phygital' strategy, combining a vast physical network with digital platforms for financial services, also positions it as a Star, especially in the rapidly expanding fintech markets of India and ASEAN.

The company's involvement with India's National Common Mobility Card (NCMC), evidenced by a ₹140 crore contract with MSRTC, further solidifies its Star status in the transit payment sector. EbixCash's wealth management and lending solutions are also Stars, tapping into India's fintech market projected to reach $1 trillion by 2025.

| Business Segment | Market Growth | Ebix Position | Key Drivers |

|---|---|---|---|

| Insurance Software (AI/ML) | High (70%+ insurers increasing AI spend by 2025) | Star | Digitalization, AI adoption, efficiency |

| EbixCash (Phygital) | High (Fintech growth in India & ASEAN) | Star | Omnichannel strategy, diverse financial services |

| NCMC Solutions | High (Public transit digitalization) | Star | Unified digital payments, large-scale contracts (₹140 Cr MSRTC) |

| Wealth Management & Lending | Very High (India Fintech ~$1T by 2025) | Star | Digital financial services demand, young tech-savvy population |

What is included in the product

The Ebix BCG Matrix provides a strategic overview of Ebix's business units, categorizing them as Stars, Cash Cows, Question Marks, or Dogs based on market share and growth.

This framework highlights which Ebix units require investment, divestment, or harvesting to optimize the company's overall portfolio.

The Ebix BCG Matrix offers a clear, one-page overview, instantly relieving the pain of complex strategic analysis.

Cash Cows

Ebix's established insurance and reinsurance exchanges are prime examples of Cash Cows within the BCG matrix. These platforms facilitate over $100 billion in insurance premiums annually, demonstrating a significant market share in a mature industry segment.

Their entrenched position means they generate substantial and consistent cash flow with minimal need for aggressive marketing or expansion investments. This allows Ebix to leverage these established exchanges as reliable sources of capital for other business ventures.

Ebix's legacy agency management and CRM solutions are firmly entrenched as cash cows within its portfolio. These systems have been the backbone of operations for numerous insurance agencies for years, automating critical business processes and fostering strong client loyalty. This established market presence translates into predictable and substantial revenue generation.

In 2024, Ebix reported that its Software segment, which heavily features these legacy systems, continued to be a significant contributor to its overall financial performance. The recurring revenue model from these mature offerings provides a stable financial foundation, allowing Ebix to invest in other areas of its business.

Ebix's traditional healthcare BPO services, encompassing IT and call center operations, likely function as a Cash Cow within its portfolio. These mature services, while perhaps not experiencing rapid expansion, are crucial for generating consistent and predictable revenue streams for the company.

In 2024, the healthcare BPO market continued to demonstrate stability, with established players like Ebix leveraging their existing infrastructure and client relationships. While the digital health sector garners significant attention for its growth potential, the foundational BPO services remain indispensable for many healthcare organizations, providing a steady, albeit lower-growth, income source.

Mature e-Learning Solutions

Ebix's mature e-learning solutions, particularly those with a well-established client base, likely represent Cash Cows within its portfolio. These offerings, such as their corporate training platforms or specialized certification programs, are characterized by consistent revenue generation and a significant market share in their respective niches.

The e-learning market, while dynamic, sees segments mature as adoption rates stabilize. Ebix's established platforms benefit from this, requiring less investment for growth while yielding steady profits. For instance, in 2024, the global e-learning market was valued at over $250 billion, with corporate training accounting for a substantial portion.

- Stable Revenue Streams: Mature e-learning solutions often have recurring revenue models through subscriptions or long-term contracts.

- High Profitability: Lower investment needs compared to growth-stage products allow for higher profit margins.

- Established Market Position: A strong, loyal customer base in mature segments reduces customer acquisition costs.

- Cash Generation: These segments are prime generators of cash that can be reinvested in other areas of Ebix's business.

International Money Remittance and Forex Operations

EbixCash's international money remittance and foreign exchange (Forex) operations are prime examples of Cash Cows within the BCG matrix. These services are bolstered by an extensive network of retail branches, airport kiosks, and franchise partners spanning multiple countries, ensuring broad accessibility and customer reach.

These established financial exchange services operate within a mature market, generating steady, transaction-based revenue. For instance, the global remittance market is a significant sector, with projections indicating continued growth, underscoring the stable income potential of these operations.

- Mature Market Dominance: EbixCash leverages its established presence in the international money remittance and Forex sectors, which are characterized by consistent demand and predictable revenue streams.

- Extensive Network: A vast network of retail branches, airport kiosks, and franchise partners across numerous countries facilitates high transaction volumes and customer convenience.

- Transaction-Based Revenue: The business model relies on a high volume of transactions, providing a stable and reliable source of income, typical of Cash Cow business units.

- Market Stability: Operating in a mature financial exchange market, these services benefit from a degree of stability, requiring less investment for maintenance and yielding consistent returns.

Ebix's insurance and reinsurance exchanges are classic Cash Cows, facilitating over $100 billion in premiums annually within a mature market. Their entrenched position generates substantial, consistent cash flow with minimal investment, allowing Ebix to fund other ventures.

The company's legacy agency management and CRM solutions also serve as Cash Cows, forming the operational backbone for many insurance agencies and providing predictable, substantial revenue. This stable financial foundation, evident in Ebix's 2024 Software segment performance, allows for strategic reinvestment.

Ebix's traditional healthcare BPO services, including IT and call centers, are likely Cash Cows, generating consistent revenue despite not being high-growth areas. The 2024 healthcare BPO market stability, with established players like Ebix leveraging existing infrastructure, highlights the indispensable nature of these foundational services.

Mature e-learning solutions, such as corporate training platforms, are also considered Cash Cows. These benefit from consistent revenue and strong market share in their niches, requiring less investment for growth while yielding steady profits, as seen in the 2024 global e-learning market valued over $250 billion.

EbixCash's international money remittance and Forex operations are significant Cash Cows, supported by an extensive global network. These services generate steady, transaction-based revenue in a mature market, with the global remittance market showing continued growth potential.

| Ebix Business Segment | BCG Matrix Category | Key Characteristics | 2024 Relevance/Data |

|---|---|---|---|

| Insurance & Reinsurance Exchanges | Cash Cow | Mature market, high market share, consistent cash flow | Facilitate >$100 billion in premiums annually |

| Agency Management & CRM Solutions | Cash Cow | Established client base, recurring revenue, stable income | Significant contributor to 2024 Software segment revenue |

| Healthcare BPO Services | Cash Cow | Mature services, predictable revenue, leverages existing infrastructure | Stable income source in 2024 healthcare BPO market |

| E-learning Solutions (Mature) | Cash Cow | Consistent revenue, strong niche market share, lower investment needs | Benefit from 2024 global e-learning market (>$250 billion) |

| EbixCash (Remittance & Forex) | Cash Cow | Mature market, extensive network, transaction-based revenue | Stable income from international financial exchanges |

What You See Is What You Get

Ebix BCG Matrix

The Ebix BCG Matrix you are currently previewing is the exact, fully formatted document you will receive immediately after purchase. This comprehensive report is designed to provide actionable insights into your product portfolio's strategic positioning, ready for immediate integration into your business planning.

Dogs

Underperforming or obsolete legacy software modules within Ebix's offerings represent potential 'Dogs' in the BCG matrix. These are typically older systems or features that are no longer actively developed or are being phased out, indicating a low market share in mature or declining segments. For instance, if a specific legacy claims processing module, which once served a significant portion of the market, now sees minimal adoption due to newer, more efficient alternatives, it would fit this category. Such modules often generate minimal returns and can divert valuable resources from more promising growth areas.

Ebix's business units facing significant regulatory penalties or scrutiny, like past disclosure issues with the EbixCash IPO or concerns over gift card transactions, would likely be categorized as Dogs in a BCG Matrix. These challenges can directly impact revenue and inflate operational expenses. For instance, in 2023, Ebix faced scrutiny regarding its financial reporting, which can deter investors and partners.

Ebix's portfolio may include smaller, non-core acquisitions that haven't been effectively integrated or haven't achieved significant market traction. These units often represent low revenue generators with minimal growth potential, acting more as drains on resources than contributors to the company's expansion.

For instance, if Ebix acquired a niche software company in 2023 for $5 million that has since struggled to gain adoption, it would fit this category. Such an acquisition, if it continues to show negligible revenue growth and requires ongoing investment for maintenance, would be a prime candidate for the Dogs quadrant in a BCG analysis.

Segments Heavily Reliant on Outdated Technology

Segments of Ebix heavily reliant on outdated technology, failing to adopt cloud-native architectures or integrate advanced AI/ML capabilities, are likely positioned as Dogs in the BCG matrix. These areas face significant challenges in competitive markets where innovation and efficiency are paramount. For instance, if a core insurance processing platform still operates on legacy mainframe systems without a clear migration path to modern cloud infrastructure, its ability to offer competitive pricing, rapid feature deployment, or seamless integration with emerging InsurTech solutions would be severely hampered.

Such technologically stagnant segments struggle to attract new clients or retain existing ones who demand digital-first experiences and data-driven insights. This results in a shrinking market share and minimal revenue growth potential. By mid-2024, the broader financial services technology sector saw substantial investment in AI-powered claims processing and personalized customer engagement platforms, highlighting the competitive disadvantage for companies lagging in these areas.

- Technological Obsolescence: Core offerings not migrated to cloud-based or modern tech stacks.

- Competitive Disadvantage: Inability to match innovation and efficiency of tech-forward rivals.

- Low Market Share: Declining client base and difficulty attracting new customers.

- Limited Growth Prospects: Stagnant revenue due to outdated functionalities and poor user experience.

Businesses Impacted by Unresolved Financial Instability Concerns

Businesses within Ebix that are still grappling with the aftermath of its Chapter 11 restructuring, particularly those facing lingering financial instability, could be classified as Dogs in the BCG Matrix. This means they are likely experiencing low growth and hold a small market share.

These units might be characterized by ongoing delays in financial reporting or unresolved negotiations with creditors. Such persistent issues can significantly hinder their ability to attract new business and investment, thereby perpetuating their stagnant market position.

For instance, if Ebix's Q1 2024 earnings report, which was delayed due to ongoing restructuring complexities, directly impacted a specific business segment's ability to secure new contracts, that segment would exemplify a Dog. This lack of forward momentum and investor confidence is a hallmark of this category.

- Delayed Filings: Continued delays in regulatory filings beyond the initial restructuring period signal ongoing operational and financial challenges.

- Unresolved Creditor Negotiations: Ongoing disputes or protracted negotiations with creditors can tie up capital and management attention, preventing growth initiatives.

- Deterred Investment: The perception of instability discourages new capital infusion, limiting expansion opportunities and market share gains.

- Low Growth & Market Share: These combined factors result in business units that are not contributing significantly to overall company growth and are struggling to compete effectively.

Ebix's legacy software modules, like older claims processing systems with declining adoption, are prime examples of Dogs. These units operate in mature or shrinking markets, holding minimal market share and generating little revenue. Their continued existence can drain resources needed for more promising ventures.

Business units facing persistent regulatory issues or those from poorly integrated acquisitions, such as a niche software company acquired in 2023 that failed to gain traction, also fall into the Dog category. These segments struggle with low growth and often require ongoing investment without significant returns.

Technologically outdated operations, unable to adopt cloud or AI, are positioned as Dogs. These areas face a competitive disadvantage, leading to shrinking market share and limited growth prospects, as seen in the broader financial services tech sector's mid-2024 focus on AI-driven solutions.

Segments still impacted by Ebix's Chapter 11 restructuring, marked by financial instability and delayed reporting like the Q1 2024 earnings, are also considered Dogs. These units experience low growth and a small market share, often due to unresolved creditor negotiations and deterred investment.

Question Marks

EbixCash is actively exploring new digital payment frontiers beyond its established Indian market. For instance, in Southeast Asia, countries like Vietnam and the Philippines are experiencing a surge in digital payment adoption, with growth rates projected to exceed 20% annually through 2025. These markets, while currently having a lower initial share for Ebix, represent significant potential due to their rapidly expanding digital economies and increasing smartphone penetration, which reached over 70% in Vietnam by late 2024.

These new ventures into markets such as Brazil, where the Pix instant payment system has seen over 1.5 billion transactions in the first half of 2024 alone, demand substantial upfront investment. Ebix's strategy likely involves acquiring local players or building new infrastructure to compete effectively. The high growth potential, estimated at a compound annual growth rate of 15% for digital payments in Latin America up to 2027, justifies this investment, aiming to capture market share in these dynamic regions.

Emerging solutions in digital health and telehealth, such as AI-powered diagnostics or personalized remote patient monitoring platforms, would likely be classified as Question Marks within the Ebix BCG Matrix. These innovative offerings, while currently possessing a small market share, are poised for substantial growth, mirroring the broader digital health market's projected expansion from $387.8 billion in 2025 to $2.19 trillion by 2034, a compound annual growth rate of 21.2%.

Ebix is significantly investing in risk and compliance solutions, aiming to leverage advanced data analytics and artificial intelligence. This strategic push is creating new, innovative offerings within the established risk management market. For instance, by Q3 2024, Ebix reported a 15% year-over-year increase in its risk and regulatory solutions segment revenue, signaling strong market adoption of its existing capabilities.

The integration of AI and sophisticated analytics positions these new offerings in a high-growth segment. While the overall risk management market is mature, the specific niche for AI-driven compliance tools is still nascent. This creates a scenario where Ebix, by introducing these advanced capabilities, could be entering a market with substantial future potential, albeit starting with a relatively low initial market share for these specific AI-powered products.

Expansion into Niche E-learning Segments (e.g., Game-based Learning)

Expansion into niche e-learning segments like game-based learning positions Ebix as a potential 'Question Mark' in the BCG matrix. This segment is experiencing rapid growth, with projections indicating it will achieve the highest compound annual growth rate (CAGR) within the broader e-learning market.

For instance, the global game-based learning market was valued at approximately $10.2 billion in 2023 and is expected to reach $41.5 billion by 2030, exhibiting a CAGR of around 21.7% during this period. If Ebix is investing in or developing new offerings in this area where its current market share is minimal, these initiatives would fit the 'Question Mark' profile, requiring significant investment to capture a larger piece of this expanding pie.

- High Growth Potential: The game-based learning market is a rapidly expanding segment within e-learning.

- Low Current Market Share: Ebix's presence or market share in this specific niche is likely to be low, characteristic of a 'Question Mark'.

- Strategic Investment Required: Developing and marketing solutions in this area demands substantial investment to compete effectively.

- Future Star Potential: Successful penetration could transform these 'Question Marks' into future 'Stars' as the segment matures.

Blockchain-based Solutions for Insurance or Financial Services

Blockchain technology is making significant inroads into insurance and financial services, promising enhanced security and greater transparency for transactions and data management. This innovation is a key driver in the industry's evolution, offering new avenues for efficiency and trust.

For Ebix, developing or launching blockchain-based solutions would position them squarely in the Stars quadrant of the BCG Matrix. This is because the insurance and financial services sector is experiencing a high growth rate, fueled by the demand for more secure and efficient digital processes. While the market for these advanced solutions is expanding rapidly, Ebix's current market share in this specific niche is likely still developing, reflecting its early-stage investment in this innovative space.

- Market Growth: The global blockchain in financial services market was valued at approximately $1.5 billion in 2023 and is projected to reach over $10 billion by 2028, indicating a compound annual growth rate (CAGR) exceeding 45%. This robust growth trajectory highlights the potential for companies investing in this area.

- Ebix's Position: If Ebix has introduced blockchain solutions, they are tapping into this high-growth segment. For instance, their potential use of blockchain for claims processing or secure data sharing could capture a nascent but rapidly expanding market share.

- Innovation Focus: Companies like Ebix focusing on blockchain are addressing critical industry needs for fraud reduction and improved operational efficiency, which are key drivers of adoption in financial services.

- Strategic Advantage: Early adoption and development in blockchain can provide a significant competitive advantage, allowing Ebix to establish a strong foothold before the market matures and becomes more saturated.

Question Marks in Ebix's BCG Matrix represent business units or products with low market share in high-growth industries. These are typically new ventures or emerging technologies that require significant investment to gain traction and potentially become future Stars. Their success hinges on strategic resource allocation and market development, as seen with Ebix's exploration of new digital payment frontiers in Southeast Asia, where digital payment adoption is projected to grow over 20% annually through 2025.

Emerging solutions in areas like AI-powered diagnostics in digital health exemplify Question Marks. While the overall digital health market is expanding rapidly, projected to reach $2.19 trillion by 2034, specific AI diagnostic tools currently hold a small market share. Similarly, game-based learning, a niche within e-learning, is expected to grow at a CAGR of around 21.7% by 2030, representing a high-growth opportunity where Ebix's current share might be minimal.

These ventures demand substantial capital for research, development, and market penetration. For instance, Ebix's investment in new digital payment markets like Brazil, which saw over 1.5 billion Pix transactions in the first half of 2024, highlights the commitment needed. The success of these Question Marks is crucial for Ebix's future growth, as they have the potential to evolve into market leaders if managed effectively.

BCG Matrix Data Sources

Our BCG Matrix leverages comprehensive data, including Ebix's financial statements, market share reports, and industry growth projections, to accurately position business units.