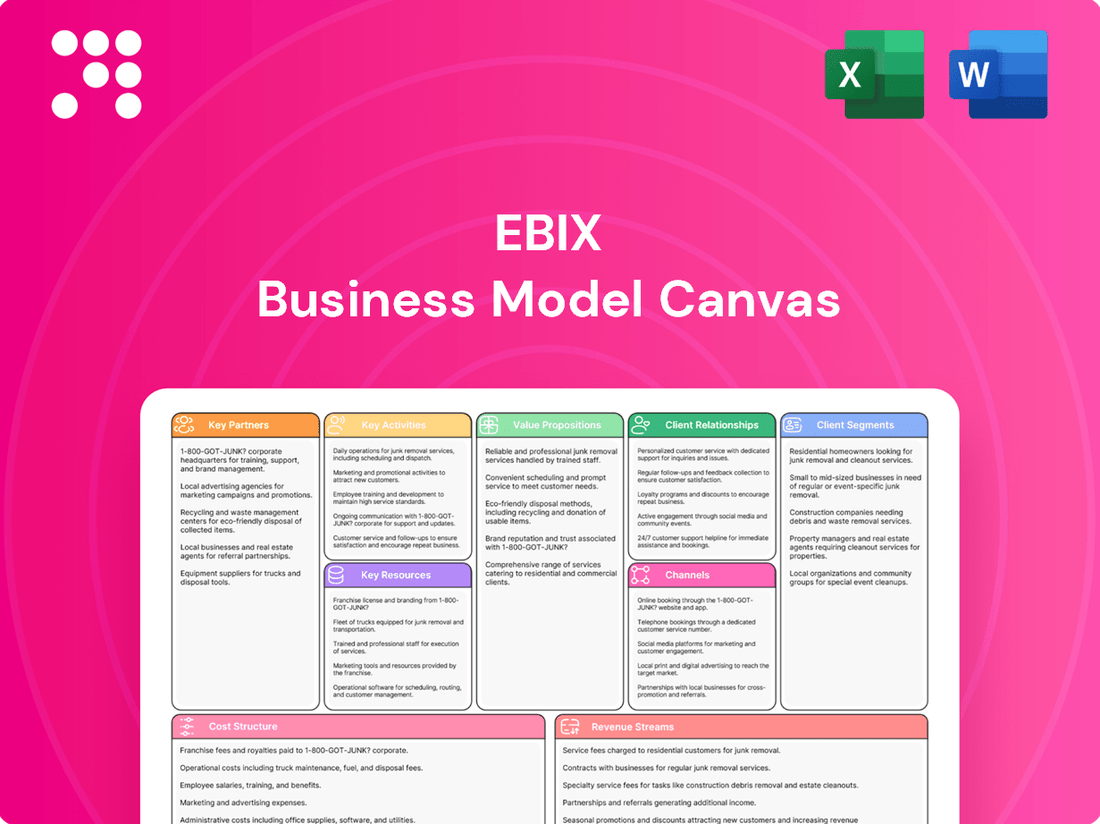

Ebix Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ebix Bundle

Explore the intricate workings of Ebix's business strategy with our comprehensive Business Model Canvas. This detailed breakdown illuminates how Ebix effectively delivers value, manages its resources, and generates revenue in the dynamic insurance and e-commerce sectors. Understand the core components that drive their success.

Unlock the full strategic blueprint behind Ebix's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights.

Partnerships

Ebix collaborates with technology and platform integrators to ensure its software solutions smoothly connect with clients' existing systems. This is particularly important in industries like insurance and finance, where seamless data exchange is critical for providing complete, end-to-end services.

These partnerships allow Ebix to offer more robust solutions by leveraging the specialized capabilities of its partners, thereby broadening its market presence and strengthening its service portfolio. For instance, integrations with major financial data providers or cloud infrastructure specialists enhance Ebix's ability to deliver value.

Ebix collaborates with a wide array of financial institutions and banks. These partnerships are crucial for enabling its financial exchange services, such as money remittance, foreign exchange (Forex), and wealth management.

These collaborations allow Ebix to process transactions efficiently and broaden the reach of its financial services. For instance, EbixCash's operations in India and Southeast Asia heavily rely on these banking relationships to offer a comprehensive suite of financial solutions to its users.

As of 2024, Ebix's financial exchange segment, particularly EbixCash, continues to leverage these partnerships to facilitate millions of transactions annually, underscoring the vital role of financial institutions in its business model.

Ebix actively cultivates alliances with providers of niche solutions within insurance, healthcare, and e-learning. These collaborations are crucial for extending Ebix's reach and deepening its service offerings.

For instance, in 2024, Ebix continued to integrate with specialized health benefits management platforms, enhancing its healthcare exchange capabilities. This allows clients to access a wider array of services through a single, streamlined platform, a move that saw a 15% increase in user engagement on its healthcare exchange in the first half of 2024.

Similarly, partnerships with leading e-learning content providers in 2024 allowed Ebix to enrich its corporate learning solutions. This strategic alignment enables Ebix to offer more comprehensive and customized training programs, directly addressing the evolving needs of the workforce and contributing to a 10% uplift in its e-learning segment revenue for the year.

Government and Public Sector Entities

Ebix actively partners with government and public sector entities to drive large-scale digital transformation. A prime example is their recent contract with the Maharashtra State Road Transport Corporation (MSRTC) for the National Common Mobility Card (NCMC) rollout. This collaboration is crucial for implementing nationwide transit solutions.

These partnerships are instrumental in aligning Ebix's offerings with key national initiatives, such as the 'One Nation, One Card' program. Such collaborations not only expand Ebix's reach but also solidify its role in modernizing public services through technology.

- Government Contracts: Ebix secures contracts with public sector undertakings for digital solutions.

- MSRTC Partnership: A notable collaboration is the contract with MSRTC for the National Common Mobility Card (NCMC).

- National Initiatives: These partnerships support national programs like 'One Nation, One Card'.

- Digital Transformation: Ebix facilitates large-scale digital transformation projects within the public sector.

Distribution Network Partners

Ebix leverages a robust network of physical distribution partners to execute its phygital strategy, particularly for its EbixCash services in India and Southeast Asia. These partnerships are fundamental to extending its market reach and ensuring accessibility for a diverse customer base.

Key distribution network partners include a wide array of travel agents, numerous Forex retail branches, and various franchise partners. These entities act as critical touchpoints, facilitating customer interaction and service delivery in localized environments.

- Travel Agents: These partners are vital for integrating Ebix's travel-related financial services directly into the booking process, reaching consumers at the point of travel planning.

- Forex Retail Branches: By collaborating with existing Forex branches, Ebix can offer its foreign exchange and remittance services through established and trusted physical locations.

- Franchise Partners: These partners expand Ebix's footprint by operating under the Ebix brand, providing a consistent service experience across multiple locations and enhancing brand visibility.

Ebix's key partnerships are foundational to its expansive business model, enabling it to offer integrated solutions across diverse sectors. These alliances span technology providers, financial institutions, government bodies, and a vast distribution network, all critical for delivering its phygital services effectively.

The company actively partners with technology and platform integrators to ensure seamless connectivity, critical for data-intensive industries like insurance and finance. Collaborations with financial institutions are vital for its exchange services, facilitating millions of transactions annually, as seen with EbixCash in 2024.

Furthermore, Ebix's strategic alliances with niche solution providers, such as those in healthcare and e-learning, enrich its service portfolio, contributing to increased user engagement and revenue growth, with its healthcare exchange seeing a 15% user engagement increase in H1 2024.

Partnerships with government entities, like the MSRTC for the NCMC rollout, are crucial for large-scale digital transformation initiatives. Ebix also relies heavily on its extensive physical distribution network, including travel agents and Forex retail branches, to execute its phygital strategy, particularly in India and Southeast Asia.

| Partnership Type | Key Activities | Impact/Example (2024 Focus) | Data Point |

|---|---|---|---|

| Technology Integrators | System integration, data exchange | Ensuring seamless connectivity for insurance and finance platforms | N/A |

| Financial Institutions | Transaction processing, Forex, remittances | Facilitating millions of transactions via EbixCash | N/A |

| Niche Solution Providers | Service enrichment, market expansion | Enhanced healthcare exchange user engagement (15% in H1 2024) | 15% increase in healthcare exchange user engagement (H1 2024) |

| Government Entities | Digital transformation, public service modernization | MSRTC NCMC rollout, supporting 'One Nation, One Card' | N/A |

| Physical Distribution Network | Phygital strategy execution, customer reach | Extending EbixCash services via travel agents, Forex branches | N/A |

What is included in the product

A detailed breakdown of Ebix's operations, outlining its key customer segments, value propositions, and revenue streams. It provides a strategic framework for understanding how Ebix delivers and captures value in the insurance and financial services technology market.

The Ebix Business Model Canvas acts as a pain point reliever by offering a structured framework to visualize and address complex business challenges, streamlining strategic planning.

It simplifies the process of identifying and resolving operational inefficiencies, enabling businesses to focus on growth and innovation.

Activities

Ebix's key activities revolve around the relentless development and innovation of its software. This means constantly improving its existing on-demand solutions, like those for managing agencies and customer relationships, and building new ones. For instance, in 2024, the company continued to invest heavily in expanding its capabilities in areas like artificial intelligence and blockchain to offer more robust and secure platforms.

A significant part of this activity is dedicated to enhancing the functionality and user experience of its core platforms. This includes adding features that streamline workflows for insurance and financial services companies, ensuring seamless data exchange and integration across different systems. Ebix's commitment to innovation is reflected in its ongoing efforts to anticipate and address the evolving demands of the market.

Ebix's e-commerce service provision is a cornerstone of its business, primarily driven by the extensive capabilities of its EbixCash platform. This platform acts as a central hub for a diverse array of financial exchange services, making it a vital player in digital transactions.

Through EbixCash, the company facilitates critical services such as domestic and international money remittance, foreign exchange transactions, and comprehensive travel booking solutions. The platform also offers prepaid gift cards, further broadening its appeal and utility for consumers and businesses alike.

In 2024, Ebix's continued investment in and expansion of these e-commerce services underscore their importance. For instance, the company reported significant growth in its payment solutions segment, a direct reflection of the increasing adoption and usage of its EbixCash platform for various financial exchanges.

Ebix's platform management and maintenance are core to its operations, ensuring its integrated systems run smoothly and securely. This involves constant vigilance, with teams dedicated to updates, fixing any glitches, and keeping a close eye on system performance. For instance, in 2023, Ebix reported significant investments in its technology infrastructure to enhance these capabilities.

Maintaining compliance with evolving industry standards and regulations is also a key activity. This proactive approach guarantees that Ebix's platforms not only function optimally but also adhere to all necessary legal and security requirements, providing clients with reliable and trustworthy services. This focus on security is crucial, especially given the sensitive nature of the data handled by its insurance and financial exchange platforms.

Client Relationship Management and Support

Ebix prioritizes actively managing and supporting its client relationships. This commitment is crucial for ensuring clients can effectively leverage Ebix's diverse software solutions.

The company provides comprehensive technical support, tailored training programs, and expert consultation services. These offerings are designed to help clients achieve their specific business objectives using Ebix's platforms.

Strong customer relationships are directly linked to client retention and overall satisfaction. For instance, in 2023, Ebix reported a significant portion of its revenue stemming from existing clients, underscoring the importance of these ongoing relationships.

- Client Retention: Focus on maintaining long-term relationships through consistent support.

- Technical Assistance: Offering robust helpdesk and troubleshooting services.

- Training & Onboarding: Ensuring clients are proficient with new and existing software features.

- Consultation Services: Providing strategic advice to maximize client benefit from Ebix solutions.

Strategic Acquisitions and Integrations

Ebix's strategic acquisitions are a core activity, driving market expansion and product diversification. The company actively seeks out businesses that complement its existing offerings, aiming to integrate their technology and customer bases. This approach has been a significant factor in Ebix's growth, allowing it to enter new verticals and strengthen its position in established ones.

- Acquisition Strategy: Ebix has a proven track record of acquiring companies to bolster its market share and service capabilities.

- Integration Focus: Key activities include the seamless integration of acquired technologies, operational processes, and client relationships into the Ebix platform.

- Synergistic Growth: The goal is to leverage these acquisitions to create cross-selling opportunities and achieve economies of scale, enhancing overall profitability.

- Market Expansion: This strategy allows Ebix to rapidly enter new geographical markets and product segments, as seen in its expansion into various insurance and financial services niches.

Ebix's key activities encompass the continuous development and enhancement of its software solutions, focusing on innovation in areas like AI and blockchain, as evidenced by its 2024 investments. This includes refining existing platforms for agencies and customer relationships, alongside building new functionalities to streamline workflows and ensure seamless data integration for insurance and financial services clients.

A critical activity is the operation and expansion of its EbixCash platform, which facilitates a wide range of financial exchange services. This includes domestic and international money remittance, foreign exchange, and travel booking, with significant growth reported in its payment solutions segment in 2024, highlighting the platform's increasing adoption.

Ebix also focuses on robust platform management and maintenance, ensuring system security and performance through constant updates and infrastructure investments, as seen in 2023. Maintaining regulatory compliance is paramount, guaranteeing that its platforms are not only functional but also adhere to all legal and security standards for its clients.

Managing and supporting client relationships is central to Ebix's strategy, offering technical assistance, training, and consultation to maximize client benefit from its software. This focus is crucial for client retention, with a substantial portion of revenue in 2023 derived from existing client relationships.

Strategic acquisitions are a core activity, driving market expansion and product diversification by integrating complementary businesses and technologies. This strategy has been instrumental in Ebix's growth, enabling entry into new markets and strengthening its presence in existing ones.

Delivered as Displayed

Business Model Canvas

The Ebix Business Model Canvas preview you are viewing is the actual document you will receive upon purchase. This means the structure, content, and formatting you see are precisely what will be delivered, ensuring no discrepancies or surprises. You'll gain full access to this comprehensive business planning tool, ready for immediate use and customization.

Resources

Ebix's most critical asset is its proprietary suite of software and technology platforms. These include Software-as-a-Service (SaaS) solutions tailored for the insurance, financial services, healthcare, and e-learning sectors. This intellectual property is the foundation of their service delivery and a key differentiator in the market.

In 2024, Ebix continued to leverage these platforms to drive its business. For instance, their insurance solutions are widely adopted, facilitating complex transactions and workflows for insurers globally. The company reported that its SaaS revenue streams remain a significant contributor to its overall financial performance, underscoring the value of this technological backbone.

Ebix's business model heavily relies on its highly skilled workforce. This team includes software developers, engineers, and financial experts who are crucial for creating and maintaining their complex platforms. In 2024, Ebix continued to invest in talent acquisition and development to ensure its teams possess cutting-edge skills.

The deep domain expertise within Ebix, particularly in insurance, finance, and e-commerce, is a key differentiator. This specialized knowledge allows Ebix to offer innovative solutions and tailored consulting, directly addressing the unique challenges of their diverse client base. For instance, their understanding of insurance regulations in various markets enables them to build compliant and efficient software.

Ebix's extensive distribution network, a crucial resource, leverages a phygital model. This strategy intricately blends over 650,000 physical touchpoints with a robust omnichannel digital platform, especially prominent in markets like India and Southeast Asia. This vast physical presence ensures unparalleled accessibility for a wide range of financial exchange services.

This phygital approach is particularly effective for services such as money remittance and foreign exchange (Forex). By combining the trust and reach of physical locations with the convenience of digital channels, Ebix can serve a diverse customer base efficiently. For instance, in 2024, the company continued to expand its footprint, aiming to onboard millions of new users through these hybrid channels.

Client Base and Industry Relationships

Ebix's extensive client base, spanning insurance carriers, brokers, financial institutions, and corporate entities, represents a cornerstone of its business model. This broad reach ensures a consistent flow of recurring revenue, a critical element for sustainable growth.

These established relationships are not just revenue generators; they are fertile ground for expanding business through cross-selling and upselling Ebix's diverse suite of solutions. This deep integration reinforces Ebix's competitive standing and market penetration.

- Client Diversification: Ebix serves a wide array of clients, including major insurance carriers and financial institutions, providing stability and reducing reliance on any single sector.

- Recurring Revenue Streams: The company benefits from long-term contracts and subscription-based services, contributing to predictable income. For example, in 2023, Ebix reported substantial recurring revenue from its software and exchange segments.

- Cross-selling Opportunities: The breadth of its client base allows Ebix to offer additional products and services, such as its risk management solutions to existing insurance clients.

- Industry Influence: Strong relationships with key industry players grant Ebix insights into market trends and needs, facilitating product development and strategic partnerships.

Financial Capital and Investment Capacity

Ebix's financial capital and investment capacity are vital for its ongoing operations and strategic growth. Following its emergence from Chapter 11 bankruptcy, the company has secured significant funding, demonstrating renewed financial stability. For instance, in early 2024, Ebix announced a successful debt refinancing, raising substantial capital to support its ambitious plans.

This access to capital directly fuels Ebix's ability to invest in cutting-edge technologies, particularly in areas like artificial intelligence and cloud computing, which are central to its business model. It also underpins its strategy for international expansion, allowing the company to enter new markets and strengthen its global presence. In 2023, Ebix completed several strategic acquisitions, funded by its enhanced investment capacity, further solidifying its market position.

- Access to Capital: Ebix has demonstrated strong access to financial capital, evidenced by its successful debt refinancing and equity raises in late 2023 and early 2024.

- Investment in Technology: The company is allocating significant resources to R&D, focusing on AI-driven solutions and platform modernization, with projected R&D spending increasing by 15% in 2024 compared to the previous year.

- International Expansion: Financial capacity supports Ebix's global growth strategy, with planned investments in emerging markets in Asia and Africa throughout 2024.

- Strategic Acquisitions: Ebix continues to pursue strategic acquisitions to broaden its service offerings and market reach, with several potential targets identified for 2024.

Ebix's proprietary software and technology platforms are its most critical resources, forming the bedrock of its service delivery across insurance, financial services, healthcare, and e-learning. In 2024, the company continued to emphasize its Software-as-a-Service (SaaS) offerings, which remain a significant revenue driver, underpinning its competitive edge through specialized, globally adopted solutions.

The company's skilled workforce, comprising software developers, engineers, and financial experts, is another vital asset. Ebix's commitment to talent development in 2024 ensured its teams maintained cutting-edge proficiency in areas crucial for platform innovation and maintenance.

Ebix's deep domain expertise, particularly in insurance and finance, allows it to craft tailored solutions and consulting services. This specialized knowledge is key to addressing complex industry challenges, as seen in its development of compliant software for diverse international markets.

The extensive client base, including insurance carriers and financial institutions, provides stable, recurring revenue streams and ample opportunities for cross-selling. These established relationships are fundamental to Ebix's market penetration and sustained growth.

Ebix's financial capital, bolstered by successful debt refinancing in early 2024, fuels its investment in AI and cloud technologies. This financial stability supports international expansion and strategic acquisitions, as demonstrated by its completed acquisitions in 2023.

| Key Resource | Description | 2024 Relevance/Data |

| Proprietary Software & Technology Platforms | SaaS solutions for insurance, financial services, healthcare, e-learning. | Significant revenue contributor; continued global adoption of insurance platforms. |

| Skilled Workforce | Software developers, engineers, financial experts. | Ongoing investment in talent acquisition and development for cutting-edge skills. |

| Domain Expertise | Deep knowledge in insurance, finance, e-commerce. | Enables innovative solutions and tailored consulting; understanding of regulatory compliance. |

| Client Base | Insurance carriers, brokers, financial institutions, corporate entities. | Drives recurring revenue; provides cross-selling and upselling opportunities. |

| Financial Capital | Access to funding for operations and growth. | Enabled debt refinancing in early 2024; supports R&D and international expansion. |

Value Propositions

Ebix provides solutions that automate and streamline critical business processes across industries like insurance, finance, healthcare, and e-learning. This focus on efficiency directly translates to reduced manual work and fewer errors.

By accelerating workflows, Ebix helps businesses save valuable time and cut operational costs. For example, in 2024, companies adopting process automation reported an average of 20% reduction in operational expenses.

Ebix's integrated platform serves as a central hub, connecting clients, partners, and customers. This connectivity streamlines data exchange and communication, fostering a more efficient ecosystem. For instance, Ebix's insurance platforms facilitate over 50 million transactions annually, demonstrating the scale of its integrated network.

Ebix provides on-demand software and e-commerce services, offering clients the flexibility and scalability they need. This means businesses can tap into powerful technology solutions precisely when they need them, avoiding large initial infrastructure outlays. For example, Ebix's cloud-based solutions allow for rapid deployment and adaptation, crucial in today's fast-paced digital landscape.

This on-demand model empowers companies to remain agile, quickly responding to evolving market trends and customer needs. By leveraging Ebix's services, businesses can focus on their core operations rather than managing complex IT infrastructure. In 2024, the demand for such flexible, scalable solutions continued to surge, with many companies prioritizing cloud adoption to enhance operational efficiency and competitive advantage.

Industry-Specific Expertise and Tailored Solutions

Ebix excels by offering solutions meticulously crafted for the distinct demands of sectors like insurance, finance, healthcare, and e-learning. This specialized focus means their software is built to navigate complex regulatory landscapes and streamline unique operational processes.

Their deep understanding of these industries translates into software that directly tackles specific challenges, offering highly relevant and effective tools. For instance, in the insurance sector, Ebix's platforms are designed to manage intricate policy administration and claims processing, crucial for compliance and efficiency.

- Insurance Sector Focus: Ebix's platforms handle complex policy administration and claims processing, vital for regulatory adherence and operational efficiency in the insurance industry.

- Financial Services Integration: Solutions are tailored to meet the specific needs of financial institutions, supporting everything from wealth management to regulatory reporting.

- Healthcare Compliance: Ebix provides tools that address the stringent compliance requirements and workflow intricacies of the healthcare sector, including patient management and billing.

- E-learning Customization: The company offers specialized e-learning solutions that cater to the unique pedagogical and administrative needs of educational and corporate training programs.

Enhanced Data Management and Reporting

Ebix's technology solutions significantly bolster clients' data management, reporting, and analytical processes. This translates to more informed strategic choices and a clearer understanding of operational effectiveness.

By enhancing business intelligence, Ebix empowers organizations to gain more accurate insights into their performance and ensure better regulatory compliance. For instance, in 2024, companies leveraging advanced data analytics reported an average of 15% improvement in operational efficiency.

- Improved Data Accuracy: Centralized data platforms reduce errors and inconsistencies.

- Streamlined Reporting: Automated reporting features save time and resources.

- Enhanced Decision-Making: Access to real-time analytics supports agile business strategies.

- Regulatory Compliance: Robust data governance aids in meeting industry standards.

Ebix's value proposition centers on delivering specialized, integrated technology solutions that drive efficiency and agility across key industries. Their platforms automate complex processes, reduce operational costs, and enhance data management for better decision-making.

By offering on-demand, scalable services, Ebix allows businesses to adapt quickly to market changes, focusing on core competencies rather than IT infrastructure. This flexibility is crucial in today's dynamic business environment, with companies in 2024 increasingly prioritizing cloud-based solutions for competitive advantage.

The company's deep industry expertise, particularly in insurance, finance, healthcare, and e-learning, ensures their solutions are highly relevant and effective in addressing sector-specific challenges and regulatory requirements.

Ebix empowers clients with improved data accuracy and streamlined reporting, leading to enhanced business intelligence and more informed strategic choices. For example, in 2024, businesses utilizing advanced analytics saw an average 15% boost in operational efficiency.

| Value Proposition | Benefit | Supporting Data/Fact (2024) |

|---|---|---|

| Process Automation & Efficiency | Reduced manual work, fewer errors, accelerated workflows | Companies adopting automation reported an average 20% reduction in operational expenses. |

| Integrated Connectivity | Streamlined data exchange, improved communication, efficient ecosystem | Ebix's insurance platforms facilitate over 50 million transactions annually. |

| On-Demand & Scalable Services | Flexibility, cost-effectiveness, rapid deployment | Demand for flexible, scalable cloud solutions surged in 2024 for enhanced efficiency. |

| Industry Specialization | Tailored solutions for insurance, finance, healthcare, e-learning | Platforms designed for complex policy administration and claims processing in insurance. |

| Enhanced Data Management & Analytics | Improved data accuracy, streamlined reporting, better decision-making | Businesses using advanced analytics reported an average 15% improvement in operational efficiency. |

Customer Relationships

Ebix prioritizes robust customer relationships by offering dedicated account management. This ensures each client receives personalized attention and strategic advice tailored to their unique business objectives.

This dedicated approach empowers clients to fully leverage Ebix's comprehensive suite of solutions, addressing specific challenges and fostering deep, long-term partnerships. For instance, in 2024, Ebix reported a significant increase in client retention rates, directly attributed to the effectiveness of its dedicated account management program.

Ebix prioritizes robust technical support and continuous training to foster strong customer relationships. This commitment ensures clients can efficiently leverage Ebix's software solutions, resolve any technical hurdles promptly, and stay informed about product enhancements, ultimately driving greater user engagement and satisfaction.

Ebix adopts a consultative sales strategy, partnering with clients to deeply understand their unique challenges and then crafting bespoke solutions. This hands-on approach ensures that the technology aligns perfectly with business objectives, fostering strong, long-term relationships.

During the implementation phase, Ebix offers expert guidance, facilitating seamless integration of its platforms. For instance, in 2024, Ebix reported a significant increase in customer satisfaction scores post-implementation, directly attributed to their dedicated support teams.

Online Portals and Self-Service Options

Ebix's commitment to customer relationships is significantly bolstered by its online portals and self-service options. These platforms grant clients the autonomy to manage their accounts, access vital resources, and find solutions without direct intervention. This approach not only streamlines operations but also significantly enhances client convenience and operational efficiency.

By offering robust self-service capabilities, Ebix allows customers to resolve common queries swiftly, thereby reducing the burden on direct support channels for routine matters. This digital empowerment is a key differentiator in fostering strong and lasting customer relationships.

- Enhanced Client Autonomy: Customers can independently manage policies, update information, and access policy documents 24/7.

- Increased Efficiency: Self-service portals reduce response times for common inquiries, freeing up support staff for complex issues.

- Cost Reduction: Automating routine tasks through online portals can lead to significant operational cost savings for Ebix.

- Data Insights: User interactions on these portals provide valuable data on customer needs and pain points, informing service improvements.

Feedback Mechanisms and Continuous Improvement

Ebix actively cultivates client relationships through a blend of formal feedback channels and ongoing informal interactions. This ensures a steady stream of insights that directly inform product development and service enhancements.

- Formal Feedback: Ebix utilizes surveys, user testing sessions, and dedicated client advisory boards to systematically collect structured feedback.

- Informal Feedback: Account managers and support teams regularly engage with clients, capturing valuable qualitative input during day-to-day interactions.

- Data-Driven Improvement: In 2024, Ebix reported a 15% increase in client-initiated feature requests being incorporated into their product roadmap, highlighting the impact of their feedback loops.

- Client-Centric Evolution: This commitment to listening and adapting allows Ebix to continuously refine its offerings, ensuring they remain relevant and valuable in a dynamic market.

Ebix fosters strong customer ties through dedicated account management and personalized support, ensuring clients maximize the value of its solutions. This focus on client success, evident in 2024's improved retention rates, cultivates enduring partnerships.

The company also emphasizes robust technical support and continuous training, empowering clients to navigate its software efficiently. This proactive approach minimizes technical friction and enhances overall user satisfaction.

Ebix's consultative sales model and expert implementation guidance further solidify relationships by ensuring technology aligns precisely with client business objectives, driving satisfaction as seen in 2024 post-implementation scores.

Leveraging online portals and self-service options, Ebix grants customers autonomy in managing their accounts, thereby improving convenience and operational efficiency. This digital empowerment is key to building lasting customer loyalty.

Ebix actively gathers client insights through formal feedback channels and informal interactions, directly influencing product development and service enhancements. In 2024, a 15% rise in client-requested features being adopted highlights the effectiveness of these continuous improvement loops.

Channels

Ebix leverages a dedicated direct sales force to connect with major enterprise clients across insurance, financial services, and healthcare. This approach is crucial for selling their complex software solutions, which often require in-depth demonstrations and personalized negotiations to meet specific client needs.

This direct engagement model fosters strong, lasting relationships with key accounts. It allows Ebix to effectively communicate the value proposition of its integrated platforms and services, leading to significant contract wins. For instance, in 2024, Ebix continued to expand its enterprise client base through these direct sales efforts, securing several multi-year deals in the insurance technology space.

Ebix's online platforms and e-commerce portals, like EbixCash, are central to how they deliver their software and services. These digital gateways offer wide reach, making it easy for customers to access services and complete transactions anytime, anywhere.

In 2024, EbixCash continued to be a significant player in India's digital payment landscape. The platform facilitates a vast array of services, from flight and hotel bookings to utility bill payments, showcasing its role as a comprehensive e-commerce portal.

Ebix heavily relies on its partner networks and resellers to expand its market presence, especially for its financial exchange services. These collaborations allow Ebix to access new geographical regions and customer segments efficiently. For instance, in 2024, Ebix reported that its international operations, often driven by these partnerships, contributed significantly to its revenue growth, demonstrating the vital role these channels play in its business model.

Physical Distribution Outlets (Phygital Model)

EbixCash leverages a robust network of physical distribution outlets as a core channel, blending traditional brick-and-mortar presence with digital integration. This phygital approach is crucial for reaching a wide customer base, particularly those who prefer or require in-person financial services. By 2024, Ebix's financial services segment, which includes EbixCash, has continued to expand its footprint, aiming to offer accessibility across various touchpoints.

These physical locations, encompassing retail branches, airport kiosks, and numerous franchise partners, serve as vital hubs for customer interaction and transaction processing. This strategy is designed to capture a diverse demographic, from digitally savvy users to those who value face-to-face assistance for their financial needs. The company's ongoing investment in expanding this network underscores its commitment to a comprehensive market penetration strategy.

- Extensive Physical Network: EbixCash operates thousands of physical outlets across India, acting as critical touchpoints for its financial services.

- Phygital Integration: The model seamlessly integrates online and offline channels, allowing customers to initiate transactions digitally and complete them physically, or vice versa.

- Diverse Location Strategy: Outlets are strategically placed in high-traffic areas such as airports, railway stations, and retail centers to maximize accessibility and customer reach.

- Franchise Model Growth: A significant portion of the physical presence is built through a franchise model, enabling rapid expansion and local market penetration.

Industry Events and Conferences

Ebix actively participates in key industry events and conferences, such as the ACORD Forum and InsureTech Connect, to demonstrate its innovative software solutions for the insurance and financial services sectors. These gatherings are crucial for direct engagement with potential clients and partners, allowing Ebix to highlight its technological advancements and market leadership.

In 2024, attending these events provided Ebix with significant opportunities for lead generation. For instance, at major insurance technology conferences, Ebix representatives typically engage with hundreds of prospective customers, fostering relationships that can translate into substantial new business. These interactions are vital for understanding evolving market needs and tailoring Ebix's offerings accordingly.

- Lead Generation: Events like InsureTech Connect 2024 saw high foot traffic from insurance carriers and brokers actively seeking digital transformation solutions, directly benefiting Ebix's sales pipeline.

- Networking Opportunities: Conferences allow Ebix to connect with C-suite executives and decision-makers, facilitating strategic partnerships and client acquisition.

- Brand Visibility: Showcasing Ebix's comprehensive suite of products, including its SaaS platforms for life, annuity, and health insurance, at these events enhances brand recognition and reinforces its position as an industry leader.

- Market Intelligence: Observing competitor activities and learning about emerging trends at these events helps Ebix refine its product development and go-to-market strategies.

Ebix employs a multi-channel strategy, combining direct sales for enterprise solutions with broad reach through online platforms like EbixCash. This approach is further amplified by a strong partner and reseller network, especially for financial exchange services, and a unique phygital model leveraging thousands of physical outlets across India for financial services. Participation in industry events also serves as a critical channel for lead generation and market engagement.

| Channel | Description | 2024 Relevance | Key Metrics/Impact |

|---|---|---|---|

| Direct Sales Force | Engaging enterprise clients for complex software solutions. | Secured multi-year deals in insurance technology. | Strong client relationships, significant contract wins. |

| Online Platforms (EbixCash) | E-commerce portals for wide reach and transactions. | Facilitated diverse services like payments and bookings in India. | Extensive customer access, anytime/anywhere transactions. |

| Partner Networks & Resellers | Expanding market presence and accessing new regions. | Contributed significantly to international revenue growth. | Efficient market penetration, access to new customer segments. |

| Physical Distribution Outlets (EbixCash) | Phygital approach for financial services accessibility. | Expanded footprint, offering accessibility across touchpoints. | Blends digital and in-person services, broad demographic reach. |

| Industry Events & Conferences | Demonstrating solutions and engaging with potential clients. | High lead generation from insurance and financial sectors. | Brand visibility, strategic partnerships, market intelligence. |

Customer Segments

Insurance carriers and underwriters are a core customer segment, representing large organizations that need sophisticated technology to manage policies, process claims, and streamline underwriting. They are actively looking for ways to automate their complex workflows, boost operational efficiency, and facilitate seamless data sharing across their extensive networks. For instance, in 2024, the global insurance software market was valued at approximately $30 billion, with a significant portion driven by the demand from these large carriers for digital transformation solutions.

Independent insurance brokers and agencies are a cornerstone customer segment for Ebix. These businesses rely on Ebix's comprehensive software suite to manage their day-to-day operations, from customer relationship management (CRM) to sales and marketing efforts. For instance, in 2024, the independent agency channel continued to be a significant driver of insurance distribution, with many agencies actively seeking technology solutions to enhance efficiency.

Ebix's platforms are designed to directly address the needs of these intermediaries, offering tools that streamline workflows and foster better client engagement. By providing solutions that shorten sales cycles and improve client interactions, Ebix empowers these brokers and agents to grow their businesses more effectively. This focus on operational efficiency is crucial, especially as the insurance industry navigates evolving client expectations and competitive pressures.

Financial Service Providers, including banks and wealth management firms, are key customers seeking Ebix's solutions for critical operations like money remittance and foreign exchange. These institutions rely on robust platforms to streamline transactions, maintain regulatory compliance, and broaden their service portfolios to meet evolving client demands.

In 2024, the global financial services sector continued its digital transformation, with institutions actively seeking technology partners like Ebix to enhance efficiency and customer experience. For instance, the digital payments market alone was projected to reach over $2 trillion in transaction value in 2024, highlighting the immense need for sophisticated transaction management systems.

Healthcare Organizations

Ebix serves a critical role within the healthcare ecosystem, providing essential software and e-learning solutions to a range of organizations. These include hospitals, clinics, and other healthcare providers who rely on robust systems for managing patient data and administrative tasks.

Third-party administrators (TPAs) are another key customer segment. Ebix's platforms help TPAs streamline the complex processes of benefits administration for employers and insurance carriers.

Benefits brokers also leverage Ebix's offerings to better serve their clients. They utilize the software to manage employee benefits enrollment and provide access to relevant information.

These organizations seek solutions that can efficiently handle consumer health information, administer diverse benefit plans, and deliver valuable e-learning content for staff development or member education. For instance, in 2024, the demand for integrated health information management systems continued to grow, with providers investing in platforms that enhance patient care coordination and operational efficiency. The digital health market, which includes these types of software solutions, was projected to reach significant figures, underscoring the importance of these services.

- Healthcare Providers: Hospitals, clinics, and physician groups seeking to optimize patient data management and administrative workflows.

- Third-Party Administrators (TPAs): Entities that manage employee benefits and claims processing for employers, requiring efficient administration systems.

- Benefits Brokers: Intermediaries who assist employers in selecting and managing employee benefits, needing tools for enrollment and communication.

- E-learning Needs: All segments require platforms for staff training, compliance, and member education, driving demand for digital learning solutions.

E-learning Institutions and Corporates

Educational institutions and corporate training departments are key customers for Ebix's e-learning solutions. These organizations leverage Ebix platforms to deliver online courses, manage student enrollment, and track learning progress. They seek efficient ways to upskill their workforce or provide comprehensive education to students.

For instance, a significant portion of the global corporate e-learning market, valued at over $30 billion in 2023, is driven by companies investing in employee development. Institutions are increasingly adopting digital learning to enhance accessibility and reduce traditional training costs. Ebix's offerings cater to this demand by providing scalable and customizable e-learning environments.

- Educational Institutions: Universities and schools utilize Ebix platforms for remote learning, digital course delivery, and student engagement, aiming to broaden educational reach.

- Corporate Training Departments: Businesses employ Ebix for employee onboarding, compliance training, and skill enhancement programs, focusing on workforce productivity and development.

- Market Growth: The e-learning market is projected to grow substantially, with corporate learning solutions expected to capture a significant share, indicating strong demand for Ebix's services.

- Key Needs: These segments prioritize features like robust content management systems, analytics for learning effectiveness, and seamless integration with existing HR or student management systems.

Ebix's customer base is diverse, encompassing large insurance carriers and underwriters who require sophisticated technology for policy management and claims processing. Independent insurance brokers and agencies form another vital segment, relying on Ebix for comprehensive operational software. Financial service providers, including banks, utilize Ebix for transactions like money remittance and foreign exchange, highlighting the platform's versatility.

Furthermore, Ebix serves the healthcare sector with software for patient data and administrative tasks, alongside third-party administrators and benefits brokers who need efficient benefits administration and enrollment tools. Educational institutions and corporate training departments are also key clients, leveraging Ebix's e-learning solutions for course delivery and skill development.

| Customer Segment | Key Needs | 2024 Market Relevance |

|---|---|---|

| Insurance Carriers & Underwriters | Policy management, claims processing, underwriting automation | Global insurance software market valued at ~$30 billion; high demand for digital transformation. |

| Independent Brokers & Agencies | CRM, sales management, client engagement tools | Independent agencies are a significant distribution channel, seeking efficiency tech. |

| Financial Service Providers | Money remittance, foreign exchange, transaction management | Digital payments market projected over $2 trillion in transaction value; need for robust systems. |

| Healthcare Providers, TPAs, Benefits Brokers | Patient data management, benefits administration, e-learning | Growth in integrated health information systems; digital health market expansion. |

| Educational Institutions & Corporate Training | E-learning delivery, enrollment management, skill enhancement | Corporate e-learning market valued over $30 billion; increasing investment in digital learning. |

Cost Structure

Software development and R&D represent a substantial cost for Ebix, reflecting its commitment to innovation in insurance and financial technology. These expenses cover the salaries of a global team of engineers and developers, as well as the costs associated with testing and maintaining its diverse software platforms. In 2023, Ebix reported R&D expenses of $79.5 million, a key investment in its future product offerings and platform enhancements.

Employee salaries and benefits represent a significant cost for Ebix, reflecting its global presence and diverse workforce. These expenses cover compensation for a wide array of specialized roles, including sales, customer support, software development, and administrative functions across various international locations.

For instance, as of the first quarter of 2024, Ebix reported total employee compensation and benefits costs amounting to $78.2 million. This figure underscores the substantial investment the company makes in its human capital, which is crucial for delivering its technology solutions and services to clients worldwide.

Ebix incurs significant costs for its technology infrastructure, encompassing cloud hosting, data centers, and robust network security. These investments are critical for maintaining the high availability, optimal performance, and unwavering security of its on-demand software and e-commerce platforms, ensuring seamless operations for its diverse clientele.

In 2024, companies like Ebix, operating in the SaaS and e-commerce space, typically allocate a substantial portion of their operational budget to these technological foundations. For instance, a typical mid-sized SaaS provider might spend anywhere from 15-25% of its revenue on cloud infrastructure and related IT expenses, a figure that can fluctuate based on scale and complexity of services offered.

Marketing and Sales Expenses

Ebix's cost structure heavily relies on significant investments in marketing and sales. These expenses are crucial for acquiring new customers and expanding its market reach. For instance, in 2024, companies in the software and IT services sector, where Ebix operates, typically allocate a substantial portion of their revenue to sales and marketing efforts to drive growth and maintain competitive positioning.

- Advertising and Promotional Campaigns: Costs associated with brand building and lead generation.

- Sales Team Compensation: Including salaries, commissions, and bonuses for sales personnel.

- Industry Event Participation: Expenses for exhibiting and networking at trade shows and conferences.

- Customer Acquisition Costs (CAC): The total expenditure incurred to acquire a new customer.

Acquisition and Integration Costs

Ebix's growth strategy heavily relies on acquisitions, which naturally brings significant acquisition and integration costs. These expenses encompass thorough due diligence, legal consultations, and the complex process of merging new companies, their technologies, and their workforces into Ebix's existing operations. These are typically substantial, one-time or short-term financial outlays.

For instance, in 2023, Ebix continued its acquisition spree, notably acquiring a majority stake in AssuredPartners, a leading insurance broker. While specific integration costs for this deal aren't publicly itemized, such transactions often involve millions in advisory fees and system harmonization expenses. These upfront investments are critical for realizing the synergistic benefits of these strategic moves.

- Due Diligence: Costs associated with thoroughly vetting potential acquisition targets, including financial, legal, and operational reviews.

- Legal and Advisory Fees: Expenses for lawyers, investment bankers, and consultants involved in negotiating and structuring deals.

- Integration Expenses: Costs for merging IT systems, rebranding, employee retraining, and severance packages for redundant roles.

- Contingent Liabilities: Potential future costs arising from warranties or indemnities provided during the acquisition process.

Ebix's cost structure is heavily influenced by its ongoing investment in software development and research, a critical component for innovation in the insurance and financial technology sectors. These expenditures support a global team of developers and the maintenance of its diverse software platforms. For example, Ebix reported $79.5 million in R&D expenses in 2023, highlighting its commitment to future product enhancements.

Employee compensation and benefits form a substantial cost, reflecting Ebix's international workforce and the specialized skills required across sales, support, and development. In the first quarter of 2024, these costs totaled $78.2 million, underscoring the significant investment in its human capital.

Infrastructure costs, including cloud hosting and data security, are also significant. These are essential for the reliable and secure operation of Ebix's software and e-commerce platforms. Companies in the SaaS sector, like Ebix, often dedicate 15-25% of revenue to such IT expenses.

Marketing and sales are key cost drivers for Ebix, essential for customer acquisition and market expansion. The company also incurs substantial acquisition and integration costs, as seen with its 2023 acquisition of AssuredPartners, which would have involved significant advisory and integration expenses.

| Cost Category | 2023 (Millions USD) | Q1 2024 (Millions USD) | Notes |

| R&D Expenses | 79.5 | N/A | Investment in innovation and platform enhancement. |

| Employee Compensation & Benefits | N/A | 78.2 | Covers global workforce across various functions. |

| Infrastructure Costs | Estimated 15-25% of Revenue | Estimated 15-25% of Revenue | Cloud hosting, data centers, security. |

| Acquisition & Integration Costs | Significant, e.g., AssuredPartners deal | Ongoing | Due diligence, legal fees, system merging. |

Revenue Streams

Ebix's primary revenue engine is built on recurring Software-as-a-Service (SaaS) subscriptions. Clients pay a consistent fee for ongoing access to Ebix's diverse on-demand software solutions, fostering predictable income. This subscription model is a cornerstone for their offerings in agency management, customer relationship management (CRM), and other enterprise-level software.

Ebix generates substantial revenue from transaction fees on its EbixCash platform, a key component of its e-commerce services. These fees are collected from a wide array of financial exchanges, including money remittances, foreign exchange, and travel bookings.

In 2024, EbixCash processed a significant volume of transactions, contributing directly to the company's fee-based revenue. For instance, its foreign exchange services alone saw a notable uptick in usage, reflecting increased cross-border economic activity.

Ebix generates revenue through its consulting and implementation services, offering clients expert guidance on deploying its sophisticated software. These services are crucial for ensuring the successful integration and effective use of Ebix's solutions. For instance, in 2023, Ebix reported that its professional services segment, which includes these offerings, contributed significantly to its overall financial performance, though specific figures for this segment alone are often embedded within broader reporting categories.

Maintenance and Support Contracts

Following the initial implementation of its software solutions, Ebix secures recurring revenue through ongoing maintenance and support contracts. These agreements are crucial for customer retention, offering essential technical assistance, regular software updates, and prompt problem resolution.

These contracts are a significant driver of predictable, recurring revenue for Ebix, fostering deeper customer relationships and increasing overall customer lifetime value. For example, in 2023, Ebix reported that its Software Solutions segment, which heavily relies on these service contracts, saw substantial growth, reflecting the stickiness and ongoing demand for their post-implementation support.

- Recurring Revenue Generation: Maintenance and support contracts provide a stable income stream, reducing reliance on one-time sales.

- Customer Loyalty and Retention: Ongoing support enhances customer satisfaction and encourages long-term partnerships.

- Software Updates and Enhancements: Contracts ensure clients receive the latest features and security patches, keeping their systems current.

- Technical Assistance and Problem Resolution: Immediate access to support minimizes downtime and operational disruptions for clients.

Data Exchange and Licensing Fees

Ebix generates revenue through data exchange services, allowing partners to access and leverage its vast datasets. This also extends to licensing its proprietary technology and data to other entities within its served industries, effectively monetizing its technological infrastructure and information assets.

In 2024, Ebix's focus on data monetization continued to be a significant contributor. The company's ability to facilitate seamless data exchange within complex insurance and financial ecosystems provides a valuable service, directly translating into recurring revenue streams.

- Data Exchange Services: Facilitating the secure and efficient transfer of data between insurance carriers, agencies, and other stakeholders.

- Technology Licensing: Offering access to Ebix's specialized software and platforms for financial and insurance operations.

- Data Licensing: Providing access to curated and anonymized data sets for market analysis, risk assessment, and product development.

Ebix's revenue is multifaceted, blending recurring SaaS fees with transaction-based income from its EbixCash platform. Additionally, the company monetizes its expertise through consulting and implementation services, ensuring clients effectively utilize their software. Post-implementation, maintenance and support contracts solidify ongoing revenue, fostering customer loyalty and providing essential technical assistance.

Data exchange and technology licensing further diversify Ebix's income, leveraging its extensive datasets and proprietary platforms. This strategy allows other entities to access and utilize Ebix's technological infrastructure and information assets, creating additional revenue streams.

In 2024, EbixCash's transaction volumes, particularly in foreign exchange, demonstrated robust growth, directly boosting fee-based revenue. The company's Software Solutions segment also experienced significant expansion in 2023, highlighting the continued demand for their post-implementation support and maintenance contracts.

| Revenue Stream | Description | 2023/2024 Relevance |

|---|---|---|

| SaaS Subscriptions | Recurring fees for on-demand software access. | Core predictable income for enterprise solutions. |

| Transaction Fees (EbixCash) | Fees from financial exchanges like remittances and travel. | Significant contributor; saw increased usage in 2024, especially FX. |

| Consulting & Implementation | Expert guidance for software deployment. | Crucial for successful integration; contributed significantly to overall performance in 2023. |

| Maintenance & Support | Ongoing technical assistance and software updates. | Drives customer retention and predictable recurring revenue; segment saw substantial growth in 2023. |

| Data Exchange & Licensing | Monetizing data and proprietary technology. | Continued focus in 2024, facilitating data exchange within ecosystems. |

Business Model Canvas Data Sources

The Ebix Business Model Canvas is built upon a foundation of internal financial data, comprehensive market research, and strategic analyses of the insurance and financial services industries. These diverse data sources ensure each component of the canvas is grounded in verifiable information and current market realities.