Dermapharm Holding SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Dermapharm Holding Bundle

Dermapharm Holding boasts strong brand recognition and a diversified product portfolio, but faces challenges from increasing competition and regulatory hurdles. Understanding these dynamics is crucial for strategic decision-making.

Want the full story behind Dermapharm's market position, potential growth drivers, and inherent risks? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your strategic planning and investment decisions.

Strengths

Dermapharm Holding SE showcases a robust and varied product range, including prescription pharmaceuticals, readily available over-the-counter remedies, specialized skincare items, and nutritional supplements. This wide array of offerings spans multiple therapeutic segments, effectively minimizing the company's dependence on any single product line.

The company's integrated business approach is a significant strength, encompassing all stages from in-house research and development to manufacturing, stringent quality assurance, efficient logistics, and final distribution. This comprehensive control over its value chain allows Dermapharm to maintain high standards of product quality and operational efficiency.

Dermapharm's branded pharmaceuticals segment is a cornerstone of its success, consistently delivering robust organic growth and significantly boosting overall revenue. This segment's strength is evident in the impressive performance of key products.

Products such as Myopridin®/Myditin®, Ketozolin®, and Prednisolut® have experienced substantial growth, particularly within the German market. For instance, in the first half of 2024, branded pharmaceuticals saw a notable increase, contributing to Dermapharm's financial resilience.

This strategic emphasis on high-margin branded products not only solidifies Dermapharm's market standing but also serves as a primary driver of its profitability, showcasing a clear competitive advantage.

Dermapharm boasts a proven track record in strategic acquisitions and international expansion, evidenced by its successful integration of companies like Montavit. This capability allows for the swift broadening of its product portfolio and market reach.

The company's strategic approach to mergers and acquisitions, coupled with its internationalization efforts, has been a key driver of growth, enabling it to capture market share in new territories. For instance, the turnaround of Montavit from insolvency to profitability underscores Dermapharm's adeptness at integrating and revitalizing acquired businesses.

Robust Financial Performance and Positive Outlook

Dermapharm Holding has demonstrated a strong track record of financial performance, consistently meeting or surpassing its financial targets. In recent years, the company has reported year-over-year increases in both revenue and adjusted EBITDA, showcasing its operational efficiency and market positioning.

The company's Q1 2025 performance further solidified this trend, with continued revenue growth. Management has also provided an optimistic outlook for the full year 2025, projecting further expansion in both revenue and adjusted EBITDA, underscoring a stable financial base for future strategic initiatives.

- Consistent Financial Outperformance: Dermapharm has a history of achieving or exceeding its financial guidance in recent years.

- Q1 2025 Growth: The company reported continued revenue growth in the first quarter of 2025.

- Optimistic 2025 Guidance: Management has confirmed positive full-year guidance for 2025, anticipating further increases in revenue and adjusted EBITDA.

- Financial Stability: This robust financial health provides a solid foundation for future investments and expansion opportunities.

In-house R&D Competence and Product Pipeline

Dermapharm's in-house R&D competence is a significant strength, evidenced by its robust pipeline. The company actively manages over 50 development projects, focusing on niche markets. This dedication to innovation fuels a consistent flow of new branded pharmaceuticals and healthcare products, crucial for staying ahead in a dynamic market.

This strong R&D focus allows Dermapharm to adapt to evolving market needs and maintain its competitive position. The ongoing development efforts are key to future growth and revenue generation, ensuring the company remains relevant and can capitalize on emerging healthcare trends.

- Over 50 ongoing development projects

- Focus on niche markets for specialized products

- Continuous stream of new branded pharmaceuticals

- Adaptability to market demands through innovation

Dermapharm's diversified product portfolio, spanning prescription drugs, OTC remedies, skincare, and supplements, effectively mitigates reliance on any single product. Its integrated value chain, from R&D to distribution, ensures high quality and efficiency. The company's branded pharmaceuticals segment, driven by strong performers like Myopridin®/Myditin®, Ketozolin®, and Prednisolut®, consistently delivers robust organic growth and profitability.

Dermapharm excels in strategic acquisitions and international expansion, as demonstrated by the successful turnaround of Montavit. This capability allows for rapid portfolio enhancement and market penetration. The company consistently meets or exceeds financial targets, with Q1 2025 showing continued revenue growth and an optimistic full-year outlook for 2025, projecting further increases in revenue and adjusted EBITDA.

A significant strength lies in Dermapharm's in-house R&D, managing over 50 development projects, particularly in niche markets. This focus on innovation generates a steady stream of new products, ensuring market adaptability and future growth.

| Key Product Growth Drivers | Therapeutic Segments | Recent Performance (H1 2024) |

| Myopridin®/Myditin® | Muscle relaxants | Substantial growth, key contributor to branded segment |

| Ketozolin® | Antifungal | Significant increase in sales |

| Prednisolut® | Corticosteroid | Strong performance within the German market |

What is included in the product

Highlights Dermapharm Holding’s internal capabilities and market challenges, providing a comprehensive view of its strategic position.

Offers a clear breakdown of Dermapharm's competitive landscape, simplifying complex strategic challenges.

Weaknesses

Dermapharm's Q1 2025 results revealed a concerning trend: while revenue saw a modest uptick, profitability metrics like adjusted EBITDA and net income experienced a notable decline. This suggests that increased operating expenses or a less favorable product sales mix are impacting the company's bottom line.

Specifically, adjusted EBITDA fell by 15% year-over-year to €28.5 million, and earnings after tax dropped by 22% to €12.1 million in Q1 2025. This erosion of profitability, even with higher sales, signals potential challenges in cost management or pricing power.

The inability to translate revenue growth into proportional profit growth is a significant weakness for Dermapharm. Addressing these cost pressures and optimizing the product portfolio are crucial steps to restore investor confidence and ensure sustainable financial health.

The 'Other Healthcare Products' segment, notably Arkopharma, has faced revenue headwinds, with a reported revenue decline. This downturn is attributed to a combination of internal reorganization efforts and the impact of price adjustments, alongside the lapsing effect of early sales recorded in previous periods.

Furthermore, the segment's adjusted EBITDA has also seen a decrease, signaling profitability challenges. Successfully navigating these issues and revitalizing this segment is a key priority for Dermapharm's broader growth strategy, especially as it represents a significant part of their diversified portfolio.

Dermapharm Holding's parallel import business, despite revenue increases, is currently struggling with profitability, evidenced by a negative EBITDA. This financial strain stems from escalating statutory discounts and rising operational expenses within this segment.

The company is actively addressing this weakness by reviewing its product portfolio and refining the business model for parallel imports. This strategic adjustment highlights an ongoing effort to overcome the profitability challenges in this specific area.

Dependence on German Market Leadership

Dermapharm's strong position in the German market, particularly in areas like prescription generics, is a key strength, but it also creates a significant weakness. This heavy reliance on Germany means that any adverse economic shifts or policy changes within that single country could have a disproportionately large impact on the company's overall financial health.

For instance, if Germany were to implement stricter pricing regulations on pharmaceuticals or experience a significant economic slowdown, Dermapharm's revenue streams could be severely affected. This concentration risk highlights the need for broader geographic diversification to ensure stability and sustained growth.

- Over-reliance on Germany: Dermapharm's market leadership is heavily concentrated within Germany, exposing it to country-specific economic and regulatory risks.

- Vulnerability to German market shifts: Changes in German healthcare policies or economic downturns could disproportionately impact Dermapharm's revenue and profitability.

- Limited international diversification: A lack of robust market leadership in other key regions presents a weakness in mitigating risks associated with its primary market.

Impact of Vaccine Business Wind-Down

Dermapharm Holding has experienced a notable decline in revenue from its vaccine business as the pandemic phase of its cooperation agreements concluded. This wind-down, while anticipated, represents a significant shift from a previously substantial income source.

While the company's branded pharmaceuticals segment has shown robust growth, largely compensating for the vaccine revenue decrease, the strategic management of this transition is crucial. Ensuring that the expansion in other business areas effectively absorbs the impact of the vaccine business winding down is key to maintaining overall financial momentum.

- Revenue Impact: The cessation of pandemic-related vaccine cooperation has directly reduced revenue streams.

- Offsetting Growth: Expansion in branded pharmaceuticals has helped to mitigate the impact of the vaccine business decline.

- Strategic Management: Careful planning is required to ensure sustained overall growth as the company pivots from its vaccine operations.

Dermapharm's profitability is under pressure, with adjusted EBITDA declining 15% year-over-year to €28.5 million and net income dropping 22% to €12.1 million in Q1 2025, despite revenue growth. This indicates challenges in managing operating expenses or a less favorable product sales mix.

The parallel import business is a notable weakness, showing negative EBITDA due to escalating statutory discounts and rising operational costs. While Dermapharm is reviewing this segment, its current unprofitability strains overall financial performance.

The company's heavy reliance on the German market is a significant vulnerability. Adverse economic shifts or policy changes in Germany could disproportionately impact Dermapharm's financial health, highlighting a need for greater international diversification.

The wind-down of pandemic-related vaccine cooperation has reduced revenue streams. Although branded pharmaceuticals are growing, effectively absorbing this impact remains a key strategic challenge.

Preview Before You Purchase

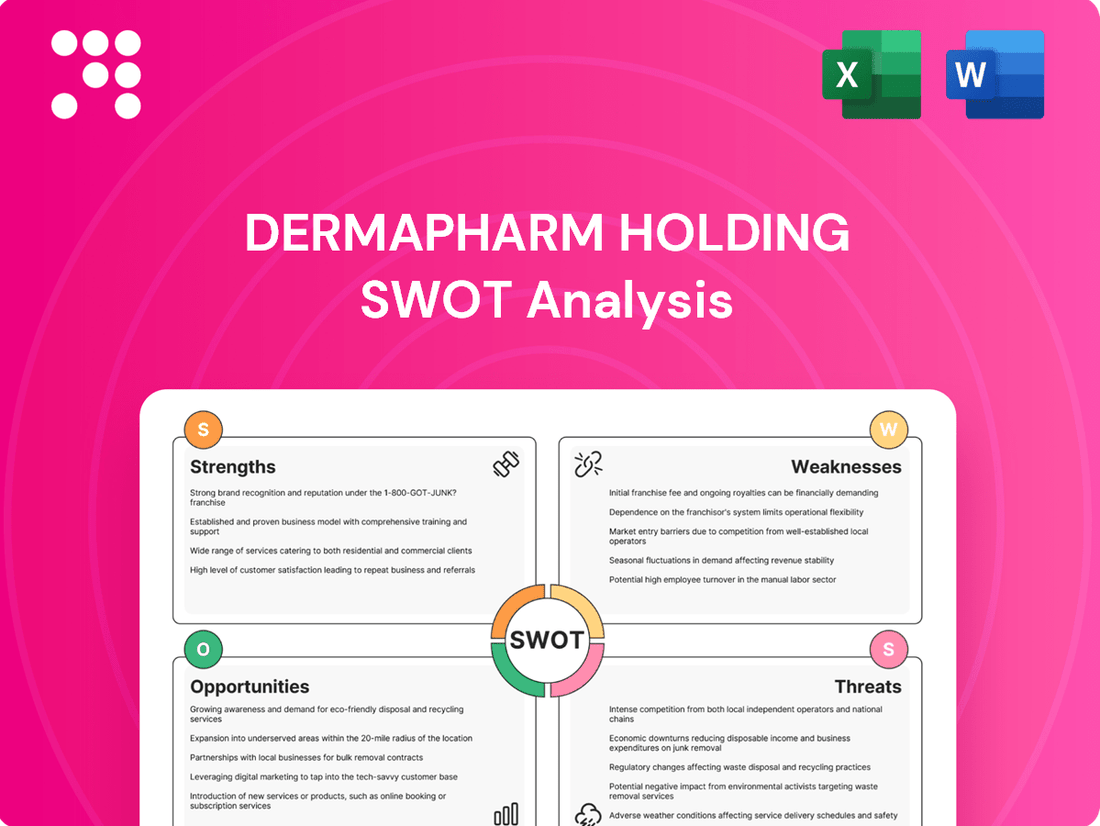

Dermapharm Holding SWOT Analysis

The preview below is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version, providing a comprehensive understanding of Dermapharm Holding's strategic positioning.

This is a real excerpt from the complete document. Once purchased, you’ll receive the full, editable version, allowing you to tailor the insights to your specific needs.

You’re viewing a live preview of the actual SWOT analysis file. The complete version becomes available after checkout, offering a detailed breakdown of Dermapharm Holding's Strengths, Weaknesses, Opportunities, and Threats.

Opportunities

Dermapharm's strategic focus on internationalization is a prime opportunity for expansion. By venturing into new markets beyond its strong German base, the company can significantly diversify its revenue streams and mitigate the risks associated with over-reliance on a single market. This global reach also allows Dermapharm to tap into previously unreached customer segments, fueling further growth.

The company has been actively pursuing this strategy, as evidenced by its acquisition of the Italian company Excelsior in 2023, a move that broadened its European footprint. This international expansion is a stated core pillar of Dermapharm's growth strategy, aiming to build a more resilient and geographically diverse business model.

Dermapharm has a proven history of successful acquisitions, a strategy they consider fundamental to their growth. For instance, in 2023, they completed the acquisition of a significant portion of Infectopharm, a move that bolstered their position in the pediatric market. This ongoing capability to identify and integrate new companies or product lines, particularly in burgeoning niche therapeutic areas, is a key opportunity. It allows Dermapharm to swiftly broaden its market reach and enhance its existing product portfolio, potentially accessing new patient segments and revenue streams.

Dermapharm's robust in-house Research and Development (R&D) is a significant opportunity. With over 50 development projects underway, the company possesses a strong pipeline, particularly in dermatology and allergy therapeutics. Successfully launching these new products is poised to fuel substantial future revenue growth and reinforce its reputation for innovation.

Optimization and Reorganization of Underperforming Segments

Dermapharm is strategically reorganizing its Arkopharma business, a key area for potential improvement. This restructuring aims to enhance operational efficiency and market responsiveness within this segment. By streamlining the parallel import business, Dermapharm is also addressing a less profitable area, signaling a commitment to boosting overall financial health.

The success of these organizational changes is crucial. For instance, if Arkopharma's revenue, which represented a significant portion of Dermapharm's sales in previous years, can be revitalized through this reorganization, it would directly impact the company's bottom line. This proactive management of underperforming units is a positive indicator of their strategic foresight.

- Revitalizing Arkopharma: Dermapharm's ongoing efforts to optimize the Arkopharma business model are designed to unlock greater potential and improve its contribution to the group's overall performance.

- Streamlining Parallel Imports: The company is actively working to make its parallel import business more efficient, aiming to reduce costs and increase profitability in this specific operational area.

- Boosting Financial Performance: Successful implementation of these reorganization strategies is expected to lead to improved profitability across these segments, positively influencing Dermapharm's consolidated financial results.

Potential in Medical Cannabis and Herbal Extracts

Dermapharm's bundling of medical cannabis and herbal extracts under its 'Other Healthcare Products' segment positions it to capitalize on burgeoning market trends. The increasing societal and regulatory acceptance of medical cannabis, coupled with Dermapharm's established expertise in herbal extracts, particularly through its subsidiary Euromed, creates a substantial avenue for growth.

The global medical cannabis market is projected to experience significant expansion. For instance, market research indicates a compound annual growth rate (CAGR) of approximately 15-20% for the medical cannabis sector leading up to 2025 and beyond. This upward trajectory is driven by factors such as evolving legalization policies and a growing understanding of therapeutic applications.

- Expanding Medical Cannabis Market: The global medical cannabis market was valued at over $15 billion in 2023 and is anticipated to reach upwards of $50 billion by 2028, demonstrating robust growth potential.

- Euromed's Herbal Expertise: Dermapharm's ownership of Euromed, a company with deep roots in developing and manufacturing herbal extracts, provides a strong foundation for innovation and product development in this area.

- Synergistic Opportunities: The combination of medical cannabis and herbal extracts allows for the development of diversified product portfolios addressing various health and wellness needs, potentially capturing a broader consumer base.

- Regulatory Tailwinds: Favorable shifts in regulatory landscapes across key markets are increasingly opening doors for both medical cannabis and standardized herbal medicinal products, presenting a conducive environment for market entry and expansion.

Dermapharm's strategic focus on international expansion presents a significant opportunity for growth, building on its successful acquisition of Excelsior in Italy during 2023. This global push diversifies revenue streams and taps into new customer bases, reinforcing its commitment to a more resilient business model.

The company's proven acquisition strategy, exemplified by the 2023 purchase of a substantial part of Infectopharm, allows it to effectively broaden its market reach and enhance its product portfolio, particularly in niche therapeutic areas. This capability to integrate new entities and product lines is a core driver for future revenue generation.

Dermapharm's strong in-house R&D pipeline, featuring over 50 development projects primarily in dermatology and allergy, represents a substantial opportunity. Successful launches from this pipeline are poised to drive future revenue and solidify its innovative reputation.

Capitalizing on the growing medical cannabis and herbal extracts markets, particularly through its subsidiary Euromed, offers another avenue for expansion. The global medical cannabis market, projected for strong growth with an estimated CAGR of 15-20% leading up to 2025, provides a fertile ground for product development and market penetration.

| Opportunity Area | Key Action/Driver | Market Potential/Data |

|---|---|---|

| International Expansion | Acquisition of Excelsior (2023) | Diversification of revenue, access to new markets |

| Acquisition Strategy | Acquisition of Infectopharm (2023) | Portfolio enhancement, entry into niche markets |

| R&D Pipeline | Over 50 development projects | Future revenue growth, innovation leadership |

| Medical Cannabis & Herbal Extracts | Euromed subsidiary, market growth | Global medical cannabis market projected to reach $50 billion by 2028 (from over $15 billion in 2023) |

Threats

The pharmaceutical sector is inherently competitive, with many companies striving for market dominance. Dermapharm faces this challenge directly, as increased competition, especially from generic drug producers or emerging players in its specialized therapeutic areas, could significantly impact its pricing power and overall profitability. For instance, the global pharmaceutical market, valued at approximately $1.5 trillion in 2023, is projected to grow, but this growth is accompanied by intense rivalry.

The pharmaceutical sector faces a constantly shifting regulatory landscape. For Dermapharm, this means potential impacts from altered drug approval pathways, new pricing controls, or heightened oversight on intellectual property and marketing practices. For instance, in 2024, the European Medicines Agency (EMA) continued to emphasize stricter data requirements for drug submissions, a trend likely to persist.

Increased scrutiny on pharmaceutical advertising and promotional activities, a consistent theme in 2024 and projected for 2025, could necessitate adjustments in Dermapharm's marketing strategies. Failure to adapt to these evolving compliance demands could affect market access and financial performance, underscoring the critical need for proactive regulatory engagement.

Persistent global uncertainties and economic turmoil, including inflation and supply chain disruptions, pose a significant threat to Dermapharm. These macroeconomic factors can dampen consumer spending on healthcare products and simultaneously inflate the company's operational costs. For instance, the ongoing inflationary pressures experienced globally in 2024, with some economies seeing inflation rates above 5%, directly impact raw material and energy expenses for pharmaceutical manufacturers like Dermapharm.

These external economic headwinds are largely outside of Dermapharm's direct control, yet they have the potential to materially affect its financial performance and profitability. The volatility in global markets and the potential for further economic slowdowns in key regions where Dermapharm operates create an environment of heightened risk that could impact sales volumes and margins throughout 2024 and into 2025.

Challenges in Integrating Acquisitions

While Dermapharm has a proven history of successful acquisitions, integrating new businesses inherently involves risks. Challenges can arise from differing corporate cultures, difficulties in realizing expected operational synergies, or the discovery of unforeseen liabilities, all of which could diminish the anticipated benefits and strain resources. For instance, in 2023, Dermapharm completed the acquisition of several smaller entities, and the success of these integrations will be a key factor in their 2024 performance.

Potential hurdles in merging operations and harmonizing distinct organizational cultures can slow down or even prevent the achievement of projected cost savings and revenue enhancements. Unforeseen issues, such as IT system incompatibilities or regulatory compliance gaps in acquired entities, can also emerge post-acquisition, requiring significant attention and investment. Dermapharm's commitment to rigorous due diligence and meticulous integration planning is therefore crucial to mitigate these potential threats.

- Cultural Misalignment: Differences in management styles and employee expectations can impede collaboration and productivity.

- Operational Synergies: Failure to achieve anticipated cost savings or revenue growth from combined operations.

- Unforeseen Liabilities: Discovery of undisclosed debts, legal issues, or environmental concerns within acquired companies.

- Integration Costs: Higher-than-expected expenses related to rebranding, system migration, and restructuring.

Dependence on Product Availability and Supply Chain Stability

Dermapharm Holding's parallel import business is particularly vulnerable to disruptions in product availability. For instance, if key pharmaceutical manufacturers face production delays or shortages in 2024 or 2025, it could directly impact Dermapharm's ability to source and sell these products. This reliance means that any instability in the global supply chain, whether due to geopolitical events, raw material scarcity, or logistical challenges, poses a significant threat to revenue streams from this segment.

The company's profitability in this area could also be squeezed if original manufacturers alter their distribution strategies or product launch timelines, limiting the availability of goods for parallel import. Such changes could force Dermapharm to seek alternative, potentially more expensive, sourcing options or face reduced sales volumes. For example, a sudden halt in production of a widely prescribed medication could leave Dermapharm's parallel import segment with insufficient stock to meet demand, directly impacting its financial performance.

- Vulnerability to Supply Chain Disruptions: Global supply chain issues, such as those experienced in 2021-2023 with shipping and manufacturing, could re-emerge, impacting product availability for Dermapharm's parallel import business.

- Manufacturer Dependency: Changes in product availability or distribution policies by original manufacturers directly affect Dermapharm's sourcing capabilities and profitability in this segment.

- Impact on Revenue and Profitability: Shortages or increased costs of sourced pharmaceuticals can lead to lower sales volumes and reduced profit margins for the parallel import division.

Intense competition from both established pharmaceutical giants and agile niche players presents a constant challenge for Dermapharm. This rivalry can erode pricing power and market share, particularly in therapeutic areas with high generic penetration. For instance, the global generics market is expected to continue its growth trajectory, reaching an estimated $250 billion by 2026, intensifying pressure on branded and specialized drug manufacturers.

Navigating the complex and evolving regulatory environment is a significant threat. Changes in drug approval processes, pricing regulations, or stricter marketing compliance requirements, as seen with the EMA's ongoing focus on data integrity in 2024, can increase operational costs and impact market access. Failure to adapt swiftly to these regulatory shifts can hinder product launches and reduce profitability.

Macroeconomic instability, including persistent inflation and potential supply chain disruptions, directly impacts Dermapharm's cost base and consumer demand. With global inflation rates remaining a concern in 2024, the cost of raw materials and energy continues to rise, squeezing profit margins. Economic slowdowns in key markets could also dampen healthcare spending, affecting sales volumes.

SWOT Analysis Data Sources

This Dermapharm Holding SWOT analysis is built upon a foundation of robust data, drawing from the company's official financial reports, comprehensive market research, and expert industry analyses to provide a well-rounded strategic perspective.