Dermapharm Holding Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Dermapharm Holding Bundle

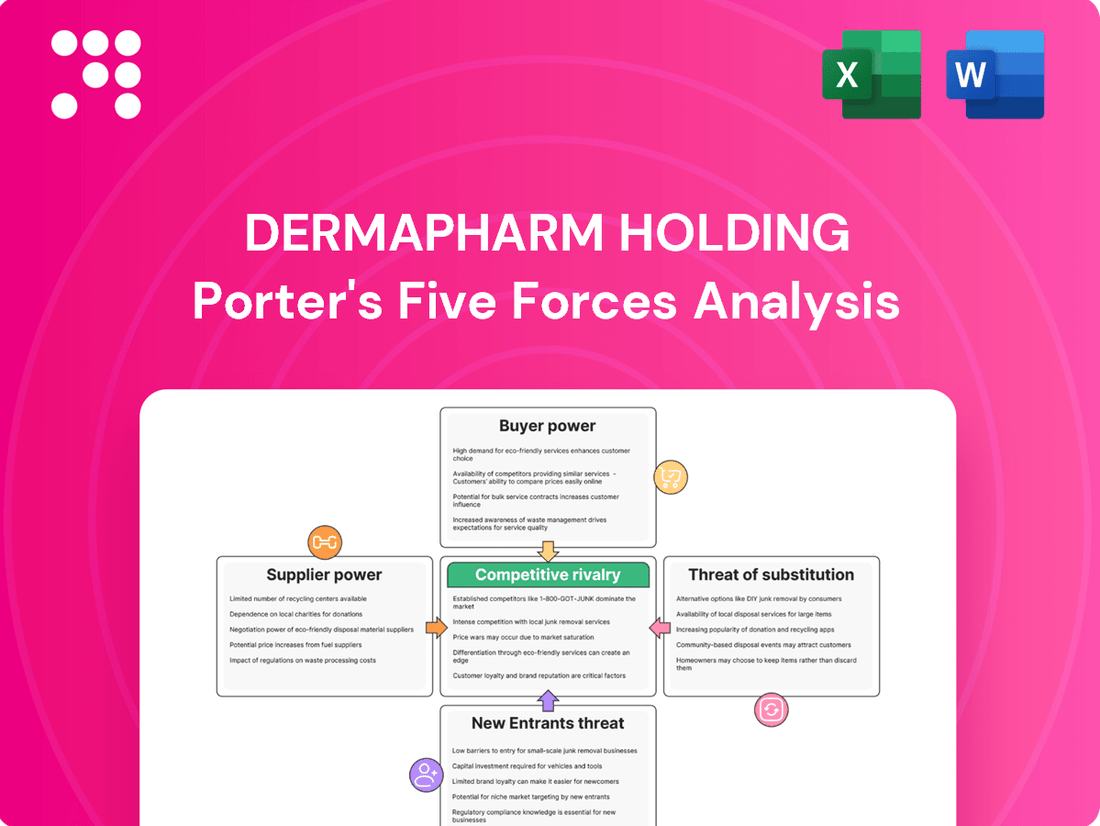

Dermapharm Holding navigates a competitive landscape shaped by moderate buyer power and the persistent threat of new entrants in the generic pharmaceutical sector. Understanding the intensity of these forces is crucial for strategic positioning.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Dermapharm Holding’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

The pharmaceutical sector, including companies like Dermapharm, is heavily dependent on Active Pharmaceutical Ingredients (APIs) and other essential raw materials. This reliance often means sourcing from a select group of specialized global suppliers, especially from China and India. When supply is concentrated or faces disruptions, these suppliers can wield considerable power, impacting pricing and availability for drug manufacturers.

As of 2025, the pharmaceutical supply chain faces a significant risk due to its over-reliance on a few foreign suppliers for APIs. It's estimated that between 65% and 70% of global API sourcing originates from China and India. This high concentration creates a vulnerability, as any issues in these regions, whether geopolitical, environmental, or logistical, can have a ripple effect across the entire industry.

Switching suppliers for critical pharmaceutical ingredients or specialized manufacturing equipment can be a significant hurdle for Dermapharm, directly impacting the bargaining power of its suppliers. If these transitions are expensive, time-consuming, or require navigating complex regulatory approvals, suppliers naturally gain leverage.

The pharmaceutical industry's stringent regulatory environment, demanding rigorous quality assurance and extensive validation processes for any supplier change, further amplifies these switching costs for Dermapharm. For instance, in 2023, the average cost for pharmaceutical companies to validate a new raw material supplier was estimated to be between €50,000 and €200,000, a substantial expense that bolsters supplier power.

Suppliers of highly specialized or patented ingredients, unique herbal extracts, or advanced manufacturing technologies hold significant sway. Dermapharm's commitment to branded pharmaceuticals and healthcare products often necessitates specific, high-quality inputs, thereby enhancing the leverage of suppliers providing these proprietary components.

Threat of Forward Integration by Suppliers

The threat of suppliers integrating forward into Dermapharm's pharmaceutical manufacturing operations could significantly bolster their bargaining power. This would mean suppliers, perhaps those providing active pharmaceutical ingredients (APIs) or specialized manufacturing services, starting to produce finished, branded drugs themselves, directly competing with Dermapharm.

However, this particular threat is generally mitigated by the substantial barriers to entry within the pharmaceutical industry. The immense capital required for setting up and maintaining compliant manufacturing facilities, coupled with the rigorous and lengthy regulatory approval processes overseen by bodies like the European Medicines Agency (EMA) or the U.S. Food and Drug Administration (FDA), makes forward integration a difficult and costly endeavor for most suppliers.

- High Capital Investment: Establishing pharmaceutical manufacturing plants requires billions of euros, including specialized equipment and sterile environments.

- Stringent Regulatory Hurdles: Obtaining Good Manufacturing Practice (GMP) certifications and product approvals involves extensive validation and compliance, a process that can take years and significant investment.

- Limited Supplier Capabilities: Most raw material or API suppliers lack the expertise, distribution networks, and marketing capabilities necessary to successfully launch and manage branded pharmaceutical products.

Impact of Supplier's Input on Dermapharm's Cost Structure

When the cost of a supplier's input represents a significant portion of Dermapharm's total production costs, suppliers can exert more pressure on pricing. This leverage allows them to dictate terms, potentially impacting Dermapharm's margins.

Rising costs for raw materials, transportation, and labor are currently straining pharmaceutical supply chains globally. For instance, the cost of active pharmaceutical ingredients (APIs) has seen an upward trend, with some reports indicating increases of 10-20% in 2023 for certain critical components, which directly impacts Dermapharm's profitability and grants suppliers greater leverage.

- Significant Input Costs: If key ingredients or packaging materials constitute a large percentage of Dermapharm's cost of goods sold, suppliers of these items gain considerable bargaining power.

- Supply Chain Disruptions: Global events and increased demand have led to shortages and price hikes for essential pharmaceutical inputs, strengthening supplier positions.

- Limited Supplier Alternatives: In cases where Dermapharm relies on specialized or few suppliers for critical components, these suppliers have increased ability to negotiate favorable terms.

- Impact on Profitability: Higher input costs passed on by suppliers directly squeeze Dermapharm's profit margins if the company cannot fully pass these increases to consumers.

The bargaining power of suppliers for Dermapharm is significantly influenced by the concentration of API sourcing, with an estimated 65-70% originating from China and India as of 2025. High switching costs, often between €50,000 and €200,000 per new raw material supplier in 2023, further empower these suppliers. Specialized or patented ingredients also grant suppliers considerable leverage, as Dermapharm often requires unique, high-quality inputs for its branded products. The threat of forward integration by suppliers is largely mitigated by the substantial capital investment (billions of euros) and stringent regulatory hurdles, including GMP certifications, required for pharmaceutical manufacturing.

| Factor | Impact on Dermapharm | Supplier Leverage |

|---|---|---|

| API Sourcing Concentration (2025) | High reliance on limited regions | High |

| Supplier Switching Costs (2023 Estimate) | Expensive and time-consuming validation | High |

| Specialized/Patented Inputs | Necessity for branded products | High |

| Forward Integration Threat | Mitigated by high barriers to entry | Low |

What is included in the product

This analysis dissects Dermapharm Holding's competitive environment, examining the intensity of rivalry, buyer and supplier power, threat of new entrants, and the impact of substitutes.

Understand the competitive landscape of the pharmaceutical industry with a clear, actionable analysis of Dermapharm Holding's Porter's Five Forces—perfect for strategic planning.

Customers Bargaining Power

Customer bargaining power is amplified when buyers are highly price-sensitive. This is a significant factor in the German pharmaceutical landscape, where statutory discounts and reimbursement regulations directly impact what companies can charge.

Dermapharm's experience highlights this. While its branded pharmaceuticals show robust growth, the parallel import business segment saw its EBITDA decline. This downturn was attributed to escalating statutory discounts and increased operational costs, directly reflecting the price sensitivity of customers or the regulatory environment.

Customers wield more influence when numerous substitute products or generic alternatives offer comparable therapeutic advantages. Dermapharm's diverse product range, encompassing both prescription and over-the-counter (OTC) medications, means customers can often opt for more budget-friendly choices due to the presence of generics and rival brands.

The concentration of customers significantly impacts Dermapharm's bargaining power. If Dermapharm primarily sells to a limited number of large pharmaceutical wholesalers or pharmacy chains in Germany, these major buyers can leverage their purchasing volume to negotiate more favorable terms, including lower prices and preferential payment conditions. This is a common dynamic in the German pharmaceutical market, where consolidation among distributors can create powerful buying groups.

Customer Information and Transparency

Customers, particularly in the German healthcare sector, benefit from significant information transparency. This allows them to readily compare pricing and quality across different pharmaceutical products and providers. For instance, the statutory health insurance system in Germany mandates price transparency for prescription drugs, directly impacting the bargaining power of pharmacies and healthcare providers who procure these medications.

This enhanced customer knowledge empowers them to negotiate better terms and seek out more cost-effective alternatives. The availability of detailed product information and clear pricing structures means customers are less reliant on single suppliers and can more easily switch if dissatisfied with terms or value. This dynamic is a key factor in the bargaining power of customers within the pharmaceutical industry, as exemplified by Dermapharm Holding's operating environment.

- Increased Information Access: Customers, especially in regulated markets like Germany, have access to extensive data on drug pricing and efficacy.

- Price Transparency in Healthcare: German healthcare regulations promote price transparency for pharmaceuticals, enabling informed purchasing decisions by pharmacies and healthcare providers.

- Impact on Negotiation: This transparency directly translates into greater leverage for customers when negotiating prices and terms with pharmaceutical manufacturers.

- Competitive Pressure: A well-informed customer base can drive down prices and increase competition among suppliers.

Low Switching Costs for Customers

When customers, such as pharmacies or end-consumers, face minimal costs and effort to switch from Dermapharm's offerings to those of a competitor, their bargaining power increases significantly. This ease of switching is particularly relevant in markets where products are not highly differentiated.

For many over-the-counter (OTC) medications and even certain prescription drugs, the barriers to switching are low. Patients can readily choose alternative brands, and pharmacies can easily stock competing products if they offer better terms or perceived value. This dynamic empowers customers by giving them more leverage in price negotiations and product selection.

- Low Switching Costs: For many of Dermapharm's products, particularly those in the over-the-counter segment, customers face minimal financial or operational hurdles when switching to a competitor.

- Price Sensitivity: This low switching cost often translates to higher price sensitivity among customers, as they can readily explore alternative options.

- Impact on Margins: Consequently, Dermapharm may face pressure to maintain competitive pricing to retain its customer base, potentially impacting profit margins.

The bargaining power of customers is a critical force affecting Dermapharm. In 2024, the pharmaceutical market, especially in Germany, continues to see strong customer influence due to price sensitivity and the availability of alternatives. Dermapharm's performance, particularly the decline in its parallel import business, underscores how escalating statutory discounts and operational costs can directly impact profitability when customers are highly price-aware.

Customers, including pharmacies and healthcare providers, benefit from significant information transparency regarding drug pricing and efficacy. This transparency, mandated by systems like Germany's statutory health insurance, empowers them to negotiate better terms, as they can readily compare offerings and switch to more cost-effective options. The low switching costs associated with many over-the-counter products further amplify this leverage, pressuring companies like Dermapharm to maintain competitive pricing to retain market share.

| Factor | Impact on Dermapharm | 2024 Context/Data |

|---|---|---|

| Price Sensitivity | High customer price sensitivity can lead to lower margins. | Statutory discounts in Germany directly affect pricing power. |

| Availability of Substitutes | Dermapharm faces competition from generics and rival brands. | The diverse OTC market allows consumers easy access to alternatives. |

| Switching Costs | Low switching costs empower customers to seek better deals. | Minimal barriers to switching for many products increase customer leverage. |

| Customer Concentration | Large wholesalers or pharmacy chains can negotiate better terms. | Consolidation in the German distribution market strengthens buyer power. |

Preview the Actual Deliverable

Dermapharm Holding Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. It details Dermapharm Holding's competitive landscape through a comprehensive Porter's Five Forces Analysis, examining threats from new entrants, the bargaining power of buyers and suppliers, the intensity of rivalry, and the threat of substitute products.

Rivalry Among Competitors

The German pharmaceutical market is a mature and intensely competitive landscape, populated by a diverse array of both domestic and international companies. This includes established multinational giants as well as nimble, specialized firms, creating a crowded field of players.

Dermapharm competes directly with formidable entities such as Bayer AG and Boehringer Ingelheim, both significant global pharmaceutical players with extensive product portfolios and R&D capabilities. Beyond these titans, a multitude of other pharmaceutical and biotechnology companies actively operate within Germany, further intensifying the competitive rivalry.

While the German pharmaceutical market shows promising growth, this expansion can paradoxically fuel intense rivalry. As the market is projected to grow at a compound annual growth rate of 5.3% from 2025 to 2030, companies like Dermapharm Holding will likely face increased competition as more players aim to capture a share of this expanding pie.

Dermapharm's strategy of focusing on branded pharmaceuticals and specialized therapeutic areas is designed to set its products apart. However, the availability of generic alternatives and the presence of well-established competing brands mean that the company still faces intense competition.

The company's strong organic growth in its existing branded products highlights successful differentiation in specific markets. For instance, in 2023, Dermapharm reported a significant increase in sales for its branded pharmaceuticals, underscoring its ability to carve out a distinct market position.

Despite these successes, Dermapharm encounters challenges. Declining revenues in certain segments, such as vaccines, and difficulties in others, like the Arkopharma business due to market shifts and competitive pressures, demonstrate that differentiation is an ongoing battle in the pharmaceutical landscape.

High Fixed Costs and Storage Costs

The pharmaceutical industry, including companies like Dermapharm, is characterized by substantial fixed costs. These include significant investments in research and development (R&D), state-of-the-art manufacturing facilities, and the stringent regulatory compliance required for drug production. For example, the cost of bringing a new drug to market can run into billions of dollars, with a large portion attributed to R&D and clinical trials.

This high fixed-cost structure often pressures companies to maintain high production volumes to spread these costs over a larger output. Consequently, this can fuel aggressive pricing strategies as firms strive to maximize capacity utilization and achieve economies of scale. Companies may engage in price competition to secure market share and ensure their fixed investments are efficiently employed.

Dermapharm's integrated business model, which encompasses in-house development, manufacturing, and distribution, inherently involves considerable fixed costs. This vertical integration means Dermapharm bears the full spectrum of these capital-intensive operations. Such a setup incentivizes competitive approaches aimed at sustaining and growing sales volumes to offset these substantial fixed expenditures.

- High R&D Investment: The pharmaceutical sector globally saw R&D spending reach approximately $240 billion in 2023, highlighting the significant upfront investment required.

- Manufacturing Capacity Utilization: Companies often aim for over 80% utilization of their manufacturing capacity to optimize cost per unit.

- Dermapharm's Integrated Model: Dermapharm reported €1.05 billion in revenue for 2023, with a significant portion of its operational costs tied to its integrated production and development capabilities.

- Price Sensitivity: In markets with high fixed costs, even small shifts in demand can lead to intensified price competition as firms seek to maintain profitability.

Exit Barriers

High exit barriers significantly influence competitive rivalry within the pharmaceutical sector, including for companies like Dermapharm. When it's difficult or costly for companies to leave the market, even those performing poorly may continue to operate, intensifying competition. This persistence can lead to overcapacity and downward pressure on prices.

- Specialized Assets: Pharmaceutical manufacturing often requires highly specialized and expensive equipment, such as sterile production lines and advanced research labs. The resale value of these assets outside the pharmaceutical industry is typically very low, making it challenging to divest them without substantial losses.

- Long-Term Contracts and Commitments: Companies in this industry often engage in long-term supply agreements with distributors, healthcare providers, and research partners. Breaking these contracts can incur significant penalties, acting as a deterrent to exiting the market.

- Regulatory Hurdles: The pharmaceutical industry is heavily regulated. Decommissioning manufacturing facilities or discontinuing product lines often involves complex and time-consuming regulatory approvals, adding another layer of difficulty to exiting.

- Product Life Cycles and R&D Investments: The lengthy development and approval processes for new drugs, coupled with substantial R&D investments, mean that companies are committed to their products for extended periods. Abandoning these investments prematurely is often not financially viable.

The competitive rivalry within the German pharmaceutical market is fierce, with Dermapharm facing off against global giants like Bayer AG and Boehringer Ingelheim, alongside numerous other specialized firms. This crowded landscape is further intensified by an anticipated market growth of 5.3% annually through 2030, which is expected to attract more competitors vying for market share.

Dermapharm's strategy of differentiating through branded pharmaceuticals and niche therapeutic areas aims to counter this intense competition. However, the presence of generics and established brands means differentiation is a continuous challenge, as evidenced by fluctuating revenues in segments like vaccines and the Arkopharma business in 2023.

High fixed costs associated with R&D, manufacturing, and regulatory compliance, estimated at billions for new drug development globally, pressure companies like Dermapharm to maintain high volumes and potentially engage in aggressive pricing to offset these expenditures. Dermapharm's integrated model, generating €1.05 billion in revenue in 2023, means it bears these costs across its operations, further driving the need for competitive sales strategies.

Exit barriers, such as specialized assets, long-term contracts, and regulatory hurdles, keep even underperforming companies in the market, intensifying rivalry. This dynamic, coupled with substantial R&D investments and product life cycles, makes exiting the pharmaceutical sector exceptionally difficult and costly.

SSubstitutes Threaten

The availability of generic drugs presents a substantial threat to Dermapharm's branded pharmaceutical business. Generic alternatives often provide comparable therapeutic benefits at a significantly reduced cost, directly eroding the market share and profitability of original branded products once patent protection lapses.

For instance, in 2024, the global generic drug market continued its robust growth, with estimates suggesting it accounts for a substantial portion of total prescription drug sales in many developed markets. This trend puts pressure on companies like Dermapharm that rely on branded products for revenue, especially as patent cliffs approach for several key medications.

Beyond traditional pharmaceuticals, alternative therapies and lifestyle changes present a significant threat to companies like Dermapharm. For instance, increasing consumer interest in holistic wellness means individuals might choose yoga, meditation, or specific diets over medications for certain conditions. In 2023, the global wellness market was valued at over $5.6 trillion, indicating a substantial shift in consumer spending towards non-pharmaceutical health solutions, directly impacting demand for some over-the-counter products and dietary supplements.

The growing focus on preventative healthcare and wellness, encompassing diet, exercise, and stress management, presents a significant threat of substitution for traditional pharmaceutical products. As consumers increasingly adopt healthier lifestyles, the demand for certain medications may decline, directly impacting companies like Dermapharm.

For instance, the rise in popularity of dietary supplements and natural remedies, a segment within Dermapharm's 'Other healthcare products,' directly substitutes for pharmacological treatments for various conditions. In 2024, the global wellness market was projected to reach trillions of dollars, indicating a substantial shift in consumer spending away from reactive medical care towards proactive health management.

Technological Advancements in Non-Pharmaceutical Treatments

Technological advancements are increasingly offering alternatives to traditional pharmaceutical treatments, presenting a significant threat of substitutes for companies like Dermapharm. For instance, the development of innovative medical devices or non-invasive therapeutic techniques can directly compete with drug-based solutions.

Dermapharm’s own involvement in developing and distributing medical devices means it must closely monitor these technological shifts. A notable trend is the rise of personalized medicine and gene therapies, which, while sometimes complementary, can also reduce reliance on broad-spectrum pharmaceuticals. In 2023, the global medical device market was valued at approximately $570 billion, with significant growth projected in areas like digital health and AI-driven diagnostics, indicating a strong pipeline of potential substitutes.

The threat is amplified as these new technologies often promise improved efficacy, fewer side effects, or more convenient administration. Consider the growing adoption of wearable health trackers and remote patient monitoring systems; these can reduce the need for frequent doctor visits and prescription refills, thereby impacting pharmaceutical sales. By 2024, the digital health market is expected to exceed $600 billion, showcasing the rapid expansion of technologically driven healthcare alternatives.

Key areas of technological advancement posing a threat include:

- Regenerative Medicine: Stem cell therapies and tissue engineering offer potential cures or long-term solutions for conditions currently managed with medication.

- Advanced Medical Devices: Innovations in implantable devices, smart prosthetics, and minimally invasive surgical robots can replace or augment drug treatments.

- Digital Therapeutics (DTx): Software-based interventions designed to prevent, manage, or treat medical disorders are gaining traction and regulatory approval.

- Biotechnology Innovations: CRISPR gene editing and other advanced biotechnologies could offer genetic fixes that eliminate the need for ongoing pharmaceutical intervention.

Parallel Imports and Biosimilars

The threat of substitutes for Dermapharm is significantly influenced by parallel imports and the growing biosimilar market. Parallel imports, where branded drugs are sourced from EU countries with lower prices, offer a direct cost-saving alternative to domestically supplied pharmaceuticals. This practice can put pressure on originator drug prices.

Furthermore, the increasing availability of biosimilars for complex biologic drugs presents another potent substitute. Biosimilars, which are highly similar to existing biologic medicines, often come at a substantially lower cost, thereby eroding the market share of the original biologic. This trend is particularly relevant for drugs with high price points.

Dermapharm actively participates in this competitive landscape through its Parallel import business segment, operating under the axicorp brand. This strategic involvement highlights the company's recognition of the impact these substitutes have on the pharmaceutical market and its efforts to leverage these dynamics.

- Parallel Imports: Sourcing branded drugs from cheaper EU markets.

- Biosimilars: Lower-cost alternatives to biologic drugs.

- Dermapharm's Involvement: Operates a parallel import business under the axicorp brand.

- Market Impact: Both parallel imports and biosimilars exert downward price pressure on originator products.

The availability of generic drugs, biosimilars, and parallel imports presents a significant threat of substitution for Dermapharm's branded products. These alternatives offer comparable efficacy at lower price points, directly impacting market share and profitability, especially as patents expire. For instance, in 2024, the global generic drug market continued its expansion, capturing a substantial share of prescription sales in major economies.

Beyond pharmaceuticals, the growing wellness industry and advancements in medical technology offer alternative health solutions. Consumers increasingly opt for lifestyle changes, natural remedies, and innovative medical devices over traditional drug treatments. The global wellness market, valued in trillions of dollars by 2023, underscores this shift towards proactive health management and alternative therapies.

Technological innovations like regenerative medicine, advanced medical devices, and digital therapeutics (DTx) are emerging as potent substitutes. These advancements can offer cures or more convenient management for conditions traditionally treated with pharmaceuticals. The digital health market, projected to exceed $600 billion by 2024, highlights the rapid growth of these technologically driven healthcare alternatives.

Dermapharm's own parallel import business, axicorp, demonstrates an awareness of these substitute pressures. By participating in this segment, Dermapharm acknowledges the downward price pressure exerted by lower-cost sourcing and the increasing prevalence of biosimilars, which directly compete with high-priced biologic drugs.

| Threat of Substitutes | Description | Impact on Dermapharm | 2024 Data/Trend | Example |

|---|---|---|---|---|

| Generic Drugs | Lower-cost versions of branded drugs after patent expiry. | Erodes market share and pricing power of originator brands. | Significant market share in developed countries. | Generic versions of blockbuster drugs. |

| Biosimilars | Highly similar versions of biologic drugs. | Reduces revenue from high-value biologic products. | Growing market, particularly for complex therapies. | Biosimilar versions of monoclonal antibodies. |

| Parallel Imports | Sourcing branded drugs from lower-priced markets. | Creates price competition and can reduce domestic sales. | Active business segment for Dermapharm (axicorp). | Importing pharmaceuticals from other EU countries. |

| Alternative Therapies & Wellness | Lifestyle changes, natural remedies, supplements. | Decreases demand for certain medications, especially OTC. | Global wellness market valued in trillions. | Increased use of supplements and yoga for health. |

| Medical Technology & DTx | Innovative devices, digital health solutions, gene therapies. | Offers non-pharmaceutical treatment options. | Digital health market projected to exceed $600B by 2024. | Wearable health trackers, AI diagnostics, regenerative medicine. |

Entrants Threaten

Entering the pharmaceutical manufacturing sector, particularly for branded drugs, demands considerable financial resources. This includes significant outlays for drug discovery and development, setting up state-of-the-art manufacturing plants, and extensive marketing campaigns to reach healthcare providers and patients.

Dermapharm's operational structure, which includes its own research and development capabilities alongside production, underscores the substantial capital investment necessary to establish a competitive presence. For instance, the global pharmaceutical market was valued at approximately USD 1.57 trillion in 2023, with significant portions dedicated to R&D and capital expenditures.

The pharmaceutical industry, including companies like Dermapharm, faces significant barriers to entry due to strict regulatory oversight. Obtaining approval for new drugs, medical devices, and even cosmetic products involves lengthy and expensive processes. For instance, in 2024, the average cost to bring a new drug to market remained in the billions of dollars, with clinical trial phases alone consuming a substantial portion of this.

While Germany's Medical Research Act, enacted to streamline clinical trials and approval pathways, aims to ease some burdens, the overall regulatory landscape remains a formidable challenge for potential new competitors. These stringent requirements necessitate substantial investment in research, development, and compliance, effectively limiting the number of new entities that can realistically enter the market and compete with established players.

Established brand loyalty and extensive distribution networks pose a significant barrier for new entrants in the pharmaceutical and healthcare sectors. Dermapharm Holding, for instance, has cultivated strong brand recognition and deep relationships within the pharmacy and healthcare professional communities. This loyalty is built on a broad product portfolio, including prescription drugs, over-the-counter medications, skincare, and supplements, all backed by a dedicated sales force. For example, in 2023, Dermapharm reported revenues of €1.05 billion, demonstrating the scale and market penetration achieved through these established channels, making it difficult for newcomers to replicate this level of access and trust.

Access to Key Raw Materials and Technologies

New entrants into the pharmaceutical sector, like Dermapharm, face significant hurdles in securing consistent access to critical raw materials and advanced manufacturing technologies. Established players often have long-standing relationships with specialized suppliers, making it difficult for newcomers to obtain high-quality inputs at competitive prices.

The pharmaceutical industry's reliance on specific Active Pharmaceutical Ingredients (APIs) from a limited number of global manufacturers presents a substantial barrier. For instance, in 2024, the market for certain APIs remained highly concentrated, with a few key suppliers dominating production, potentially limiting supply and increasing costs for new entrants.

Furthermore, proprietary manufacturing technologies, including specialized synthesis processes or advanced formulation techniques, are often protected by patents or trade secrets. Acquiring or licensing these technologies can be prohibitively expensive for nascent companies, hindering their ability to compete on product quality and efficiency.

- Limited Supplier Base: Concentration among API suppliers can restrict availability and inflate costs for new pharmaceutical manufacturers.

- Proprietary Technology: Access to advanced manufacturing processes and formulations is often guarded, creating a technological barrier to entry.

- Quality Control: Ensuring consistent quality of raw materials is paramount and can be challenging for new entrants without established supplier networks.

- Regulatory Hurdles: Sourcing materials and technologies must comply with stringent pharmaceutical regulations, adding complexity for those unfamiliar with the landscape.

Intellectual Property and Patents

The pharmaceutical industry, including companies like Dermapharm, is heavily influenced by intellectual property. Patents on active pharmaceutical ingredients and specific formulations act as a strong shield for established companies. This protection makes it incredibly difficult and expensive for new players to enter the market with comparable products without infringing on existing patents, which could lead to costly legal battles or substantial licensing fees.

Dermapharm itself benefits from this barrier, holding a significant portfolio of marketing authorizations for a wide array of active pharmaceutical ingredients. This extensive collection of intellectual property reinforces its position and acts as a deterrent to potential new entrants seeking to replicate its product offerings.

- Patent Protection: Patents on active pharmaceutical ingredients and formulations are a major barrier to entry in the pharmaceutical sector.

- Dermapharm's IP: Dermapharm possesses numerous marketing authorizations for various active pharmaceutical ingredients, strengthening its competitive moat.

- Deterrent to New Entrants: The high cost and legal risks associated with patent infringement discourage new companies from entering the market.

The threat of new entrants for Dermapharm Holding is generally low due to substantial capital requirements, stringent regulatory hurdles, and established brand loyalty. The pharmaceutical sector demands massive investments in research, development, and manufacturing, with the global pharmaceutical market valued at approximately USD 1.57 trillion in 2023.

Navigating complex regulatory pathways, such as gaining approval for new drugs which can cost billions of dollars in 2024, presents a significant barrier. Furthermore, Dermapharm's established distribution networks and strong brand recognition, evidenced by its 2023 revenue of €1.05 billion, make it difficult for newcomers to gain market access and trust.

Intellectual property, particularly patents on active pharmaceutical ingredients and formulations, further solidifies this barrier, making it costly and legally risky for new companies to enter with similar products.

| Barrier Type | Description | Impact on New Entrants | Dermapharm's Position |

| Capital Requirements | High costs for R&D, manufacturing, and marketing | Significant financial hurdle | Established infrastructure and funding |

| Regulatory Hurdles | Lengthy and expensive drug approval processes | Time-consuming and costly compliance | Expertise in navigating regulations |

| Brand Loyalty & Distribution | Strong customer relationships and market access | Difficulty in replicating market penetration | Extensive sales force and pharmacy networks |

| Intellectual Property | Patents on formulations and active ingredients | Risk of infringement and high licensing fees | Portfolio of marketing authorizations |

Porter's Five Forces Analysis Data Sources

Our Dermapharm Holding Porter's Five Forces analysis is built upon a robust foundation of data, incorporating information from annual reports, industry-specific market research, and regulatory filings to provide a comprehensive view of the competitive landscape.