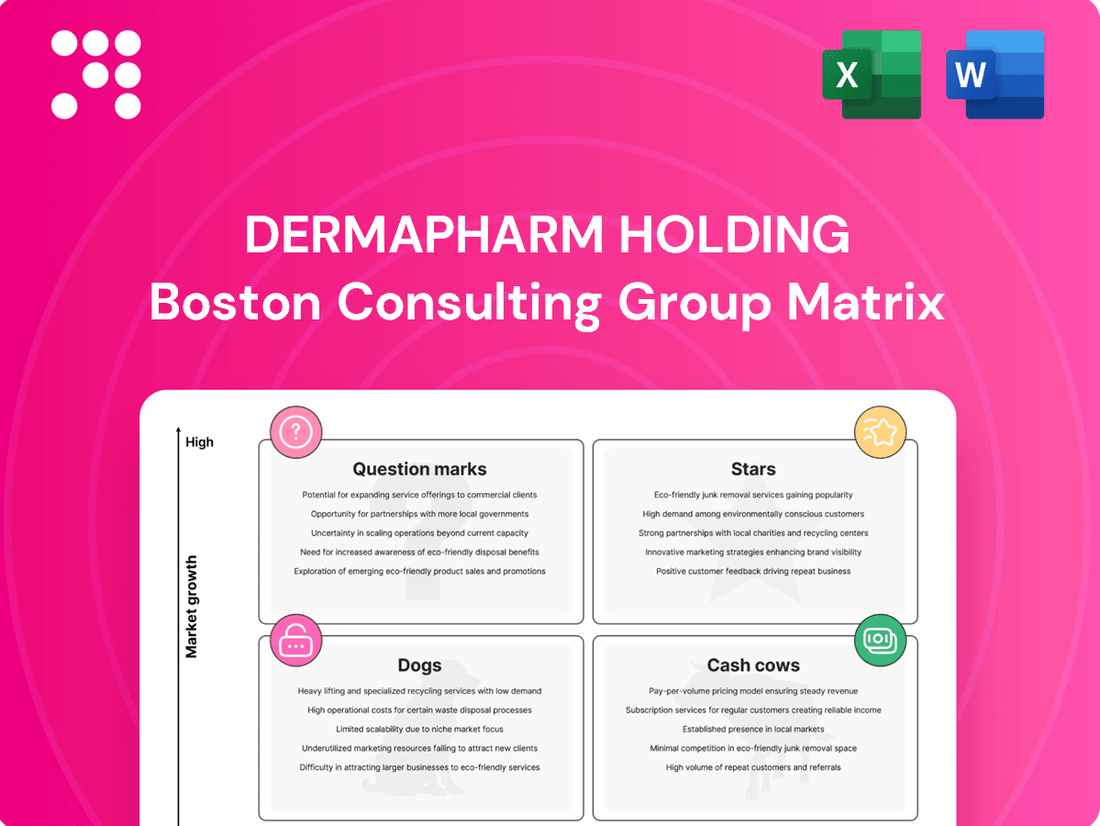

Dermapharm Holding Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Dermapharm Holding Bundle

Curious about Dermapharm Holding's product portfolio performance? This glimpse into their BCG Matrix highlights key areas, but for a comprehensive understanding of their Stars, Cash Cows, Dogs, and Question Marks, you need the full picture.

Unlock the strategic advantage by purchasing the complete BCG Matrix report. It provides detailed quadrant placements, actionable insights, and a clear roadmap for optimizing Dermapharm's product investments and future growth.

Don't miss out on the crucial data that will empower your strategic decisions. Get the full BCG Matrix today and gain the competitive clarity you need to navigate Dermapharm's market position with confidence.

Stars

Dermapharm's branded pharmaceuticals represent a significant pillar of its business, demonstrating impressive performance. In 2024, this core segment experienced robust organic growth, with revenues climbing to EUR 585.1 million, marking a 9.8% increase. This strong showing underscores its importance as a primary growth engine for the company.

The profitability of the branded pharmaceuticals segment is particularly noteworthy, evidenced by a high adjusted EBITDA margin of 45.3%. This indicates exceptional efficiency and pricing power within this category. Dermapharm is strategically focusing on bolstering its major brands and expanding its product offerings in this high-growth area, both domestically in Germany and across international markets.

Myopridin®/Myditin®, Ketozolin®, and Prednisolut® are key drivers of Dermapharm's branded pharmaceuticals segment, particularly within the German market. These products have consistently shown robust sales growth, underscoring their strong market penetration and demand. For instance, in 2024, Dermapharm reported a significant increase in revenue for its branded pharmaceuticals, with these specific brands being major contributors. This sustained positive performance solidifies their role as market leaders in their respective therapeutic areas, contributing substantially to Dermapharm's overall market share and profitability.

Allergopharma, with its flagship product Allergovit®, is a significant revenue and earnings driver for Dermapharm Holding. This product plays a crucial role in Dermapharm's branded pharmaceuticals segment, demonstrating robust growth not only within Germany but also across international markets.

The success of Allergovit® underscores Dermapharm's strategic focus on leading in niche therapeutic areas, specifically allergology, which is experiencing consistent market expansion. This specialization allows Dermapharm to solidify its market position and leverage its expertise for sustained growth.

Internationalization Efforts in Branded Pharmaceuticals

Dermapharm's internationalization efforts are a cornerstone of its branded pharmaceuticals strategy, aiming to leverage successful domestic brands in new, high-growth markets. This expansion is crucial for unlocking new revenue streams and increasing market share across Europe and beyond.

The company is actively working to broaden the product portfolios of its European subsidiaries. This focus on European expansion highlights significant growth potential in these key markets, with a particular emphasis on countries where Dermapharm can establish a strong foothold.

- European Expansion: Dermapharm is prioritizing growth within its European subsidiaries, aiming to replicate the success of its branded pharmaceuticals in new territories.

- Portfolio Growth: The strategy involves expanding the product offerings at these European entities to capture a wider market share and cater to diverse healthcare needs.

- Market Capture: By entering new geographical markets, Dermapharm seeks to capitalize on the growth potential of its established brands, driving overall revenue and profitability.

Strategic Acquisitions (e.g., Montavit)

The full consolidation of Montavit throughout the 2024 financial year has significantly boosted Dermapharm's revenue and earnings through inorganic growth. This strategic move is central to Dermapharm's approach of refining its business operations and pursuing external expansion, thereby integrating promising, fast-growing products into its existing offerings.

These acquisitions are crucial for strengthening Dermapharm's market position, particularly in therapeutic segments that are experiencing substantial growth. For instance, Montavit's contribution is expected to bolster Dermapharm's presence in key European markets.

Dermapharm's strategy emphasizes acquiring companies that complement its portfolio and offer synergistic benefits. This approach is designed to ensure sustainable long-term growth and enhance overall competitiveness.

- Montavit's full-year consolidation in 2024 provided a significant positive impact on inorganic revenue and earnings.

- Dermapharm actively pursues targeted acquisitions to optimize business activities and secure external growth.

- These strategic acquisitions introduce new, high-growth products, strengthening Dermapharm's market share in expanding therapeutic areas.

Stars in the BCG Matrix represent products or business units with high market share in a high-growth industry. For Dermapharm, their branded pharmaceuticals, particularly key brands like Myopridin®/Myditin®, Ketozolin®, and Prednisolut®, fit this description. These products are experiencing robust growth, with the branded pharmaceuticals segment achieving EUR 585.1 million in revenue in 2024, a 9.8% increase. Their high adjusted EBITDA margin of 45.3% further indicates strong performance in a growing market.

Allergopharma, with its product Allergovit®, also exemplifies a Star. It's a significant revenue and earnings driver in the expanding field of allergology, showing strong growth both domestically and internationally. Dermapharm's strategic focus on these niche, high-growth areas positions these products as Stars, requiring continued investment to maintain their leading positions and capitalize on market expansion.

| Dermapharm Business Segment | BCG Category | Key Products/Brands | 2024 Performance Highlights | Strategic Focus |

|---|---|---|---|---|

| Branded Pharmaceuticals | Stars | Myopridin®/Myditin®, Ketozolin®, Prednisolut® | Revenue: EUR 585.1M (+9.8% organic growth) Adjusted EBITDA Margin: 45.3% |

Strengthening major brands, expanding product offerings domestically and internationally. |

| Branded Pharmaceuticals | Stars | Allergovit® (Allergopharma) | Significant revenue and earnings driver, robust growth in allergology. | Leading in niche therapeutic areas, leveraging market expansion. |

What is included in the product

Dermapharm Holding's BCG Matrix analyzes its product portfolio, identifying Stars for growth, Cash Cows for funding, Question Marks for potential, and Dogs for divestment.

A clear BCG Matrix visualizes Dermapharm's portfolio, easing strategic decision-making.

This BCG Matrix simplifies complex portfolio analysis, acting as a strategic pain reliever.

Cash Cows

Established branded pharmaceuticals within Dermapharm Holding's portfolio are true cash cows, consistently generating substantial cash flow and healthy profit margins. These mature products hold a commanding market share in their therapeutic areas, meaning they don't need heavy marketing spend to maintain their position.

This segment significantly bolsters the company's overall financial stability and contributes to its impressive adjusted EBITDA margin. For instance, in 2024, Dermapharm reported a robust adjusted EBITDA margin, a testament to the reliable earnings from these established brands.

Dermapharm's dedication to 'Made in Europe' manufacturing is a cornerstone of its supply chain, fostering robust security and operational efficiency. This integrated approach, a significant advantage in the competitive pharmaceutical landscape, allows for streamlined processes that directly contribute to strong profit margins.

The company's established product lines, benefiting from this localized production, are reliable generators of cash flow. This operational stability is crucial for Dermapharm's ability to consistently generate substantial cash, a defining characteristic of a cash cow.

Dermapharm's core DACH market presence in branded pharmaceuticals is a true cash cow. This segment consistently delivers robust revenue and earnings, demonstrating its stability and profitability. The company's strong market share and established customer trust in Germany, Austria, and Switzerland ensure a dependable demand for its products, even in these mature markets.

This reliable performance generates significant excess cash, which is crucial for funding Dermapharm's strategic growth initiatives and investments in other business areas. For instance, in the first half of 2024, Dermapharm reported a substantial increase in its adjusted EBITDA, partly driven by the strong performance of its branded products in these key European markets.

Broadly Diversified Product Portfolio

Dermapharm's strength lies in its broadly diversified product portfolio, particularly in branded pharmaceuticals. This wide range of products acts as a buffer against market volatility, ensuring consistent cash flow even when specific product lines experience slower growth.

This diversification strategy allows Dermapharm to maintain a robust market presence across multiple therapeutic areas. For instance, in 2024, the company continued to benefit from its established brands in segments like dermatology and allergies, contributing significantly to its overall revenue stability.

- Dermapharm's diversified portfolio minimizes reliance on any single product.

- Branded pharmaceuticals form a core part of this resilient cash-generating strategy.

- Market share stability across various therapeutic areas is a key outcome of this approach.

Consistent Dividend Distribution

Dermapharm Holding's consistent dividend distribution highlights its status as a cash cow. The Board of Management's intention to propose a dividend of 90 cents per share for the 2024 financial year is a clear indicator of this. This proposed payout represents a distribution ratio of approximately 43% of the consolidated net profit.

This level of payout signifies robust and reliable cash generation from the company's mature product lines. It suggests that the earnings generated by these established products are stable and sufficient to cover reinvestment needs, with surplus cash available for shareholder returns.

- Dividend per share proposed for 2024: 90 cents

- Distribution ratio of consolidated net profit: Approximately 43%

- Implication: Stable earnings and healthy cash flow exceeding reinvestment needs.

Dermapharm's established branded pharmaceuticals are its cash cows, consistently generating significant cash flow and profits. These products benefit from strong market positions and require minimal investment to maintain their sales, contributing heavily to the company's financial strength.

The company's adjusted EBITDA margin in 2024, bolstered by these reliable earners, demonstrates the financial stability provided by its cash cow segment. This segment's performance is key to funding Dermapharm's strategic growth and investments.

Dermapharm's commitment to 'Made in Europe' manufacturing enhances the profitability of these cash cows through efficient, secure supply chains. This operational advantage directly translates into strong profit margins for its mature product lines.

The company's proposed dividend of 90 cents per share for 2024, representing about 43% of net profit, underscores the substantial and stable cash generation from its cash cow products, allowing for significant shareholder returns.

| Segment | Role in BCG Matrix | Key Characteristics | 2024 Financial Impact Indicator |

|---|---|---|---|

| Established Branded Pharmaceuticals | Cash Cow | High market share, low investment needs, consistent cash generation | Strong contribution to adjusted EBITDA margin |

| Mature products, stable demand in core markets (DACH) | Supports dividend payouts (e.g., proposed 90 cents/share for 2024) | ||

| Diversified therapeutic areas, minimizing risk | Drives overall revenue stability |

Preview = Final Product

Dermapharm Holding BCG Matrix

The Dermapharm Holding BCG Matrix preview you are viewing is the exact, fully formatted document you will receive upon purchase. This comprehensive analysis, meticulously prepared, will be delivered directly to you without any watermarks or demo content, ensuring immediate strategic utility. You'll gain access to a ready-to-use report designed for insightful business planning and competitive evaluation. This is the professional-grade tool you need to understand Dermapharm's product portfolio and make informed strategic decisions.

Dogs

The parallel import business, operating under the axicorp brand, experienced a modest revenue uptick in 2024. However, this growth came at a cost, as profitability diminished, leading to a negative EBITDA of EUR -1.6 million for the segment.

This segment is currently grappling with considerable headwinds, including escalating statutory discounts and rising operational expenses. These factors combine to make it a cash drain with limited potential for future expansion and persistently poor earnings.

Dermapharm Holding is actively pursuing strategies to optimize its overall portfolio. This includes a focus on divesting or undertaking significant restructuring initiatives for underperforming segments like the parallel import business to improve financial health.

Dermapharm's vaccine business, formerly part of a pandemic preparedness initiative, is experiencing a strategic reduction. This segment has seen a notable decrease in revenue, signaling a market that is either stagnant or contracting for Dermapharm in this niche. The company is actively scaling back its involvement, a move consistent with a business unit that has moved into the 'dog' category of the BCG matrix.

The financial impact of this downsizing is significant. While historically this business enjoyed high margins, its diminishing scale now exerts downward pressure on Dermapharm's overall profitability. For instance, in 2023, the vaccine segment's contribution to group revenue continued to shrink, reflecting the ongoing divestment and reduced market activity.

Within Dermapharm Holding's portfolio, the Arkopharma Group, specifically its 'Other healthcare products' segment, has shown signs of being a potential dog. In 2024, this segment saw a downturn in both revenue and EBITDA. This decline is largely attributed to previous price hikes and an initial surge in sales that created a challenging comparison for the current year.

Despite plans for a reorganization, Arkopharma's recent performance indicates difficulties in maintaining market share and achieving growth. This struggle positions certain elements of its product range as potential dogs, especially until the planned restructuring demonstrates tangible positive results and a turnaround in market position.

Candoro ethics GmbH NM and THC Pharm GmbH Operations

Candoro Ethics GmbH and THC Pharm GmbH, situated within Dermapharm's 'Other healthcare products' segment, faced operational headwinds in 2024. Their performance was impacted by a strategic relocation and consolidation of production facilities. This resulted in a notable decline in revenue contribution from these entities.

The relocation and consolidation efforts, while aimed at long-term efficiency, incurred significant upfront costs during 2024. These adjustments suggest that the product lines associated with these operations might be considered low-growth, low-market share assets within the broader BCG matrix framework, as the immediate returns from these investments were not substantial.

- Candoro Ethics GmbH and THC Pharm GmbH contributed to the 'Other healthcare products' segment's revenue decline.

- Production relocation and consolidation were key factors affecting their 2024 performance.

- These operational changes likely represent ongoing costs with delayed revenue generation.

- The segment's performance indicates potential challenges in market share or growth for these specific operations.

Older, Less Competitive Product Formulations

Older, less competitive product formulations within Dermapharm's extensive portfolio, if not specifically targeted for growth or possessing high market share, are likely candidates for the 'dog' category in a BCG matrix analysis. These products typically yield minimal cash flow and consume resources for maintenance rather than generating substantial returns.

For instance, a legacy dermatological cream formulation that faces strong competition from newer, more effective alternatives might fall into this classification. Dermapharm, like many pharmaceutical companies, may maintain such products for a niche customer base or due to regulatory requirements, but without significant investment for expansion.

- Low Market Share: These products often hold a small percentage of their respective market segments.

- Minimal Cash Flow: They generate just enough revenue to cover their own costs, with little to no profit contribution.

- Limited Growth Potential: The market for these older formulations is usually stagnant or declining.

- Maintenance Focus: Resources are allocated to ensure continued availability rather than to drive innovation or market penetration.

The vaccine business represents a clear 'dog' for Dermapharm Holding. Revenue has significantly decreased, indicating a contracting market or loss of competitive edge. The company is actively reducing its involvement, a strategic move for a unit with low growth and low market share.

Similarly, certain products within the Arkopharma Group's 'Other healthcare products' segment, particularly those impacted by past price increases and challenging year-on-year comparisons, are showing 'dog' characteristics. Despite restructuring plans, their current performance suggests difficulties in maintaining market position and growth.

Legacy product formulations, if not actively invested in for growth or possessing substantial market share, also fit the 'dog' profile. These products typically generate minimal cash flow and require maintenance rather than driving returns, reflecting a low-growth, low-market share status.

The parallel import business, under the axicorp brand, also exhibits 'dog' traits. Despite a slight revenue increase in 2024, profitability declined, resulting in a negative EBITDA of EUR -1.6 million. Escalating discounts and operational costs further solidify its position as a cash drain with limited future potential.

| Segment | 2024 Revenue Change | 2024 EBITDA | BCG Classification |

|---|---|---|---|

| Vaccine Business | Notable Decrease | Not Specified (Scaling Back) | Dog |

| Arkopharma (Other Healthcare Products) | Downturn | Downturn | Potential Dog |

| Parallel Import (axicorp) | Modest Uptick | EUR -1.6 million | Dog |

Question Marks

Arkopharma Group's strategic shift to a B2B2C model, targeting pharmacists, positions it as a potential 'question mark' in the BCG matrix. This transition involves substantial upfront investment and a period of cash consumption for restructuring, with uncertain immediate returns.

The herbal food supplements market, valued at over $10 billion globally in 2024 and projected to grow, offers significant upside if Arkopharma successfully redefines its market share through this new strategy.

While currently a cash drain due to reorganization, the long-term growth potential in the expanding dietary supplements sector could eventually transform Arkopharma into a 'star' if the B2B2C model gains traction and market acceptance.

Dermapharm's in-house product development focuses on branded pharmaceuticals using off-patent formulations, positioning them in expanding markets. While these products show promise, they currently hold a modest market share, necessitating substantial marketing and sales efforts to build recognition and market penetration.

Dermapharm's expansion into new European subsidiaries, while leveraging established product strengths, represents a strategic move into developing markets. These ventures are akin to Question Marks in the BCG matrix, demanding significant investment to build market share in regions with high growth potential but uncertain immediate returns.

For instance, Dermapharm's reported revenue growth in 2023 reached 16.9%, with international business contributing significantly. This expansion into newer European markets, while not yet mature cash cows, positions the company for future growth, mirroring the characteristics of a Question Mark needing strategic nurturing.

Group-wide AI Strategy Development

Dermapharm Holding initiated the development of a Group-wide Artificial Intelligence strategy in 2024, aiming to enhance operational efficiency across its various business units. This strategic move positions the company to leverage advancements in a rapidly evolving technological landscape, anticipating significant long-term benefits for its core operations.

This AI initiative represents a strategic investment in a sector with considerable growth potential, expected to yield transformative impacts on efficiency and overall business processes. While the immediate market share or direct revenue contribution from this strategy is minimal, its long-term success hinges on robust implementation and widespread adoption throughout the organization.

- Strategic Focus: Dermapharm's 2024 AI strategy development targets process optimization.

- Growth Area: This is an investment in a high-growth technological domain with transformative potential.

- Current Impact: Immediate market share and direct revenue generation from AI are currently low.

- Success Factors: Effective implementation and organizational adoption are critical for realizing AI benefits.

Strategic Niche Market Entries via Acquisitions

Dermapharm actively pursues external growth through strategic acquisitions, focusing on specialized niche markets. These acquisitions, even if currently small, are positioned to capitalize on high growth potential within their specific segments.

For instance, while established acquisitions contribute robustly, newer ventures or those in emerging niches might initially exhibit low market share but possess significant growth prospects. This aligns with a strategy of identifying and nurturing potential future stars.

- Acquisition Strategy: Dermapharm prioritizes acquiring companies in niche markets to foster growth.

- Growth Potential: Newer or smaller acquisitions, even with low current market share, are selected for their high market growth potential.

- Investment Requirement: Strategic investment is crucial for scaling and integrating these niche market acquisitions to maximize their potential.

- Example: Acquisitions like Montavit demonstrate successful integration and contribution, serving as a model for future niche market entries.

Dermapharm's strategic investment in Artificial Intelligence development, initiated in 2024, represents a clear 'question mark' within the BCG matrix. While the company anticipates significant long-term efficiency gains and transformative impacts on its business processes, the immediate market share or direct revenue contribution from this initiative is currently minimal.

The success of this AI strategy is contingent upon robust implementation and widespread adoption across all business units, requiring substantial upfront investment and resource allocation. This positions it as a high-potential, but currently uncertain, growth area that demands careful nurturing to transition into a future 'star' performer.

Dermapharm's expansion into new European subsidiaries, driven by its established product portfolio, also falls into the 'question mark' category. These ventures target developing markets with high growth potential but require significant investment to build market share and navigate uncertain immediate returns.

The company's revenue growth of 16.9% in 2023, with international business playing a key role, underscores the potential of these market entries. However, the nascent stage of these subsidiaries means they are not yet established cash cows, mirroring the investment needs of a question mark.

| Initiative | BCG Category | Rationale | Investment Need | Potential Outcome |

| AI Strategy Development (2024) | Question Mark | High growth potential in technology, uncertain immediate returns, requires significant implementation investment. | Substantial | Enhanced operational efficiency, transformative business process impact. |

| Expansion into New European Subsidiaries | Question Mark | Targeting high-growth developing markets, requires investment to build market share, uncertain immediate returns. | Significant | Future market leadership, contribution to overall revenue growth. |

BCG Matrix Data Sources

Our BCG Matrix leverages comprehensive market data, including Dermapharm's financial reports, industry growth projections, and competitor analysis to accurately position each business unit.