Dermapharm Holding PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Dermapharm Holding Bundle

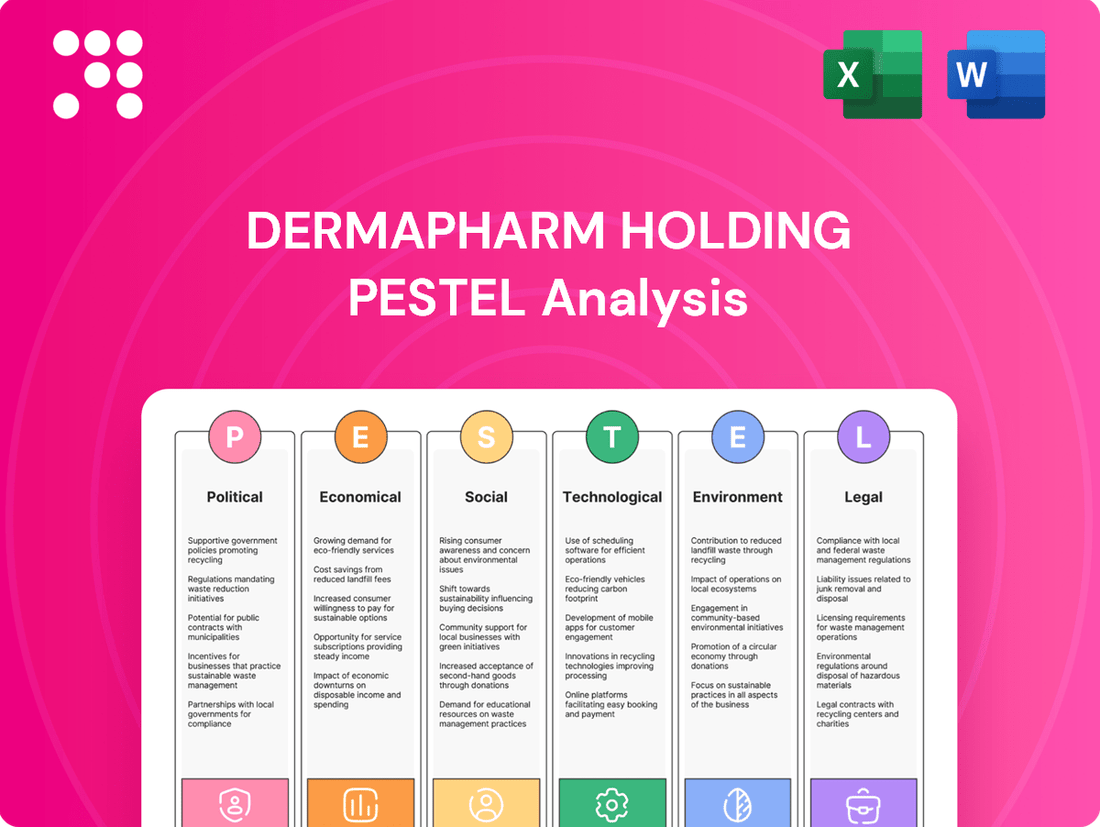

Navigating the complex landscape of the pharmaceutical industry requires a deep understanding of external forces. Our PESTLE analysis for Dermapharm Holding meticulously dissects the political, economic, social, technological, legal, and environmental factors shaping its strategic direction and future growth. Uncover critical insights into regulatory shifts, market dynamics, and emerging trends that could impact your investments or business strategies.

Gain a competitive advantage by leveraging our expert-crafted PESTLE analysis of Dermapharm Holding. This comprehensive report provides actionable intelligence on how global trends are influencing the company's operations and market position, empowering you to make informed decisions. Download the full version now to unlock a deeper understanding of Dermapharm Holding's external environment and identify opportunities for strategic advantage.

Political factors

German government initiatives like the Digital Act and Health Data Utilization Act are reshaping the healthcare landscape, impacting pharmaceutical companies such as Dermapharm. The mandatory implementation of e-prescriptions beginning January 2024 and the rollout of electronic patient files in early 2025 present both hurdles and avenues for growth.

These policy shifts aim to enhance efficiency and data utilization within the healthcare sector. For Dermapharm, adapting to these digital mandates, including the secure handling of electronic patient data, will be crucial for maintaining compliance and leveraging new operational efficiencies.

New regulations effective January 2025, stemming from the Medical Research Act, introduce a conditional framework for confidential drug pricing. This confidentiality is contingent upon pharmaceutical companies committing to local research and development activities and fulfilling specific reimbursement obligations, directly influencing market access and pricing strategies for companies like Dermapharm.

The ongoing AMNOG (Arzneimittelmarktneuordnungsgesetz) process remains a critical determinant for drug reimbursement in Germany. This established mechanism significantly impacts the profitability of new pharmaceutical products by setting price ceilings and assessing therapeutic benefits, a key consideration for Dermapharm's product pipeline and market entry strategies.

The Supply Chain Due Diligence Act (LkSG) significantly impacts companies operating in Germany. As of January 2024, its reach extended to include businesses with more than 1,000 employees, mandating rigorous due diligence concerning human rights and environmental standards throughout their global supply chains.

For Dermapharm, this means a critical need to verify ethical and sustainable practices across all its suppliers. While this compliance may lead to increased operational costs, it simultaneously offers a substantial opportunity to bolster its Environmental, Social, and Governance (ESG) profile, which is increasingly valued by investors and consumers alike.

Pharmaceutical Research and Development Incentives

The German government is actively promoting Germany as a center for pharmaceutical research and development. This includes efforts to simplify drug approval processes and offer incentives for conducting clinical trials within the country. These initiatives are designed to make Germany more competitive in the global pharmaceutical landscape.

The Medical Research Act, enacted in 2024, is a key component of this strategy. It seeks to expedite drug approval procedures and streamline contract negotiations, which could significantly benefit companies like Dermapharm by accelerating their product development timelines. For instance, the act aims to reduce the average approval time for new drugs.

- Streamlined Approvals: The Medical Research Act targets a reduction in drug approval times, potentially cutting months off the current process.

- Incentivized Trials: Financial and regulatory incentives are being introduced to encourage pharmaceutical companies to conduct clinical trials in Germany.

- Hub Development: The government's goal is to solidify Germany's position as a leading hub for pharmaceutical innovation and manufacturing.

International Trade and Geopolitical Stability

Dermapharm's position as a European manufacturer means its international trade and supply chain are significantly impacted by global geopolitical shifts. Trade agreements, like those within the EU and with other key markets, directly influence market access and import/export costs for raw materials and finished products. For instance, the EU's commitment to secure supply chains, particularly post-pandemic, reinforces the value of its 'Made in Europe' label, offering a degree of stability for Dermapharm by potentially reducing reliance on distant suppliers.

Navigating potential disruptions in global trade remains a key challenge. The ongoing trade tensions and evolving international relations can introduce tariffs, regulatory hurdles, and logistical complexities. In 2024, the pharmaceutical sector, like many others, continues to monitor developments such as potential trade disputes between major economic blocs and the impact of sanctions on global supply routes. Dermapharm’s strategy to maintain supply security through European manufacturing helps mitigate some of these risks, but it still requires careful management of cross-border operations and adherence to diverse international regulations.

- EU Trade Agreements: Dermapharm benefits from the EU's single market and its extensive network of free trade agreements, which facilitate smoother cross-border commerce for its products and components.

- Geopolitical Stability: Political stability in key manufacturing regions and transit countries is crucial for ensuring the uninterrupted flow of raw materials and the timely delivery of finished pharmaceutical goods.

- Supply Chain Resilience: The company's focus on European production aims to bolster supply chain resilience against international disruptions, a strategy that gained prominence following global events that highlighted vulnerabilities in extended supply networks.

The German government's commitment to digitalizing healthcare, with e-prescriptions mandated from January 2024 and electronic patient files rolling out in early 2025, directly impacts pharmaceutical operations. Furthermore, the Medical Research Act, effective January 2025, introduces conditional drug pricing tied to local R&D commitments, influencing market access and profitability for companies like Dermapharm.

The Supply Chain Due Diligence Act (LkSG), extended to companies with over 1,000 employees in January 2024, necessitates rigorous checks on human rights and environmental standards across global supply chains. This regulatory shift pushes Dermapharm to ensure ethical sourcing, potentially increasing costs but also enhancing its ESG standing, a factor increasingly scrutinized by investors.

Germany's strategic push to become a pharmaceutical R&D hub, supported by the 2024 Medical Research Act, aims to expedite drug approvals and clinical trial processes. This initiative, coupled with ongoing AMNOG negotiations that set drug reimbursement prices and assess therapeutic value, creates a dynamic regulatory environment for Dermapharm's product pipeline and market strategies.

What is included in the product

This PESTLE analysis examines the external macro-environmental factors impacting Dermapharm Holding, covering political, economic, social, technological, environmental, and legal influences.

It provides actionable insights into how these forces create both challenges and strategic opportunities for the company's growth and market positioning.

This Dermapharm Holding PESTLE analysis acts as a pain point reliever by providing a clear, summarized version of external factors for easy referencing during meetings and presentations.

It helps support discussions on external risks and market positioning during planning sessions, offering a valuable asset for strategic decision-making.

Economic factors

Germany's commitment to healthcare is evident in its consistently high expenditure, with per capita spending anticipated to climb through 2028. This upward trend, reaching an estimated €5,000 per capita by 2028, underscores a resilient and growing market for pharmaceutical products, directly supporting Dermapharm's operations.

The substantial and increasing healthcare spending in Germany, projected to represent over 12.8% of GDP in 2024, signifies a favorable environment for companies like Dermapharm that provide essential medicines and healthcare solutions.

Rising costs, including those for statutory discounts and general operational expenses, have noticeably impacted Dermapharm's profitability, especially within its parallel imports segment. For instance, in 2023, the company faced increased cost of goods sold, contributing to a slight compression in gross margins compared to the previous year.

Managing these persistent cost pressures is crucial for Dermapharm to sustain its financial performance and protect its profitability margins. The company's ability to navigate these challenges will be a key determinant of its success in the coming fiscal periods.

Consumer purchasing power directly affects demand for Dermapharm's products. While pharmacy sales to end-users remained robust, a notable trend in early 2024 saw pharmacies reducing their inventories, which in turn lowered immediate demand for Dermapharm's offerings.

Economic shifts significantly influence consumer spending on non-prescription items like skincare and supplements, key components of Dermapharm's 'Other Healthcare products' segment. For instance, during periods of economic uncertainty, consumers may become more price-sensitive, potentially opting for cheaper alternatives or delaying discretionary purchases.

Research and Development Investment

Dermapharm Holding's economic trajectory is significantly shaped by its commitment to research and development (R&D), which is intrinsically linked to its acquisition strategy. This dual approach is designed to foster innovation while simultaneously expanding its market reach and optimizing operational efficiencies. By investing in R&D, Dermapharm aims to bring novel products to market, thereby securing future revenue streams and enhancing its competitive edge.

The company's financial reports underscore this economic strategy. For the fiscal year 2023, Dermapharm reported R&D expenses of €76.1 million, a notable increase from €68.5 million in 2022, reflecting a clear prioritization of innovation. This investment is crucial for developing new pharmaceutical products and improving existing ones, directly impacting its long-term growth potential and market positioning.

- R&D Expenditure Growth: Dermapharm's R&D spending increased by approximately 11% from 2022 to 2023, reaching €76.1 million.

- Acquisition-Driven Expansion: The company has historically pursued strategic acquisitions to broaden its product portfolio and geographic presence, complementing internal R&D efforts.

- Market Share Enhancement: Investments in both R&D and acquisitions are geared towards increasing market share in key therapeutic areas and optimizing overall business activities.

- Future Revenue Streams: The focus on innovation through R&D is a critical economic factor for generating sustainable future revenue and maintaining profitability.

Exchange Rate Fluctuations and International Business

As Dermapharm continues its internationalization, exchange rate fluctuations present a significant challenge. For instance, if the Euro weakens against other currencies where Dermapharm operates, its reported revenue from those regions in Euros would decrease, even if sales volume remains constant. Conversely, a strengthening Euro could boost reported profits from foreign operations.

Dermapharm's strategic push into new international markets, particularly in 2024 and projected into 2025, directly increases its exposure to currency risks. The company must actively manage these exposures to protect its financial performance.

Consider the following impacts:

- Revenue Volatility: Changes in exchange rates can lead to unpredictable swings in the value of foreign earnings when translated back into Dermapharm's reporting currency.

- Cost of Goods Sold: If raw materials or intermediate goods are sourced from countries with different currencies, fluctuations can impact the cost of production.

- Competitive Pricing: Adverse currency movements can make Dermapharm's products more expensive in foreign markets, potentially affecting sales volumes and market share.

- Hedging Strategies: To mitigate these risks, Dermapharm may employ financial instruments like forward contracts or currency options, which have associated costs.

Germany's robust healthcare spending, projected to reach approximately €5,000 per capita by 2028, creates a stable and expanding market for pharmaceutical companies like Dermapharm. This high expenditure, representing over 12.8% of Germany's GDP in 2024, directly supports the demand for Dermapharm's products and services.

However, rising operational costs, including statutory discounts and increased cost of goods sold, have put pressure on Dermapharm's profitability, particularly in its parallel imports segment, as seen in 2023. Additionally, shifts in consumer purchasing power and inventory management by pharmacies can impact immediate demand for Dermapharm's offerings, especially for non-prescription items.

Dermapharm's strategic investment in research and development (R&D), with spending increasing to €76.1 million in 2023, is a key economic driver for future growth and innovation. This focus, coupled with strategic acquisitions, aims to enhance market share and secure long-term revenue streams.

Internationalization efforts expose Dermapharm to currency exchange rate fluctuations, which can impact reported revenue and the cost of goods sold. Managing these currency risks through hedging strategies is crucial for maintaining financial stability and competitive pricing in global markets.

| Economic Factor | Impact on Dermapharm | Data Point/Trend |

| Healthcare Spending (Germany) | Stable and growing market demand | Projected €5,000 per capita by 2028; 12.8% of GDP in 2024 |

| Operational Costs | Pressure on profitability, especially parallel imports | Increased cost of goods sold in 2023 |

| Consumer Purchasing Power | Influences demand for non-prescription items | Pharmacies reducing inventories in early 2024 |

| R&D Investment | Drives innovation and future revenue | €76.1 million R&D spend in 2023 (up from €68.5 million in 2022) |

| Currency Exchange Rates | Affects international revenue and costs | Exposure through internationalization efforts |

Same Document Delivered

Dermapharm Holding PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use, offering a comprehensive PESTLE analysis of Dermapharm Holding. This detailed breakdown covers Political, Economic, Social, Technological, Legal, and Environmental factors impacting the pharmaceutical company. You'll gain valuable insights into the strategic landscape and potential challenges and opportunities for Dermapharm.

Sociological factors

Germany's demographic landscape is rapidly evolving, with a notable increase in its aging population. This shift directly translates into a higher demand for healthcare services and specialized treatments for chronic conditions. For instance, by 2023, over 22 million people in Germany were aged 65 and over, a figure projected to continue rising.

This demographic trend presents a significant opportunity for companies like Dermapharm. As more individuals require ongoing care for chronic diseases, the market for branded pharmaceuticals and advanced therapeutics expands. Dermapharm’s focus on specific therapeutic areas aligns well with this growing need, positioning them to capitalize on increased healthcare spending.

Consumers are increasingly prioritizing their health and well-being, leading to a significant rise in demand for products that support preventative care. This growing health consciousness directly benefits companies like Dermapharm, whose portfolio includes over-the-counter (OTC) medications, skincare, and dietary supplements. For instance, the global dietary supplements market was valued at approximately USD 177.7 billion in 2023 and is projected to reach USD 326.7 billion by 2030, demonstrating a strong compound annual growth rate.

This societal shift towards a more proactive approach to health fuels the expansion of Dermapharm's 'Other Healthcare products' segment. As people seek to manage their health through accessible means, the appeal of readily available skincare solutions and nutritional aids grows, creating a favorable market environment for Dermapharm's offerings.

The growing acceptance of digital health tools like apps and electronic records by patients and doctors directly influences how Dermapharm's offerings reach consumers. For instance, in Germany, the e-prescription rollout saw over 200,000 prescriptions issued digitally by the end of 2023, a figure expected to climb significantly in 2024 and 2025.

This digital transformation means Dermapharm must adjust its sales and marketing approaches to integrate with these evolving healthcare pathways. Companies that can effectively navigate and leverage these digital channels will likely see improved product accessibility and patient engagement.

Lifestyle Changes and Preventative Healthcare

Consumers are increasingly prioritizing their well-being, leading to a greater demand for products that support healthier lifestyles and preventative healthcare. This trend directly benefits companies like Dermapharm whose product lines include dietary supplements and over-the-counter (OTC) medications. For instance, the global dietary supplements market was projected to reach over $230 billion by 2027, indicating significant growth driven by these societal shifts.

Dermapharm's strategic focus on these areas positions it well to capitalize on this evolving consumer behavior. The company's offerings in vitamins, minerals, and other health-focused supplements align perfectly with the growing consumer interest in proactive health management. This alignment suggests a positive outlook for Dermapharm as preventative care continues to gain traction.

- Growing Health Consciousness: A significant portion of the population, especially in developed nations, is actively seeking ways to improve their health and prevent illness.

- Dietary Supplement Market Expansion: The global market for dietary supplements is experiencing robust growth, with projections indicating continued upward trends through 2025 and beyond.

- OTC Product Demand: Increased awareness of minor ailments and a preference for self-treatment further boost the demand for accessible over-the-counter healthcare solutions.

Public Trust in Pharmaceutical Products

Public trust in pharmaceutical products is paramount, directly influencing patient adherence and market acceptance. Dermapharm's dedication to high-quality manufacturing, exemplified by its 'Made in Europe' ethos and rigorous adherence to Good Manufacturing Practice (GMP) standards, underpins this trust. For instance, in 2024, the company continued its focus on quality control, with its German manufacturing facilities subject to regular inspections by regulatory bodies, reinforcing its commitment to safety and efficacy.

Maintaining this confidence is vital for sustained growth. Negative publicity surrounding product recalls or safety concerns can severely damage a pharmaceutical company's reputation and financial performance. Dermapharm's proactive approach to quality assurance, including robust batch testing and traceability systems, aims to mitigate these risks and foster enduring public faith in its product portfolio.

The company's transparency in communicating product information and its responsiveness to regulatory updates further bolster public trust. By consistently meeting and exceeding industry standards, Dermapharm positions itself as a reliable provider of pharmaceutical solutions. This commitment is reflected in its ongoing investments in advanced manufacturing technologies and quality management systems throughout 2024 and into 2025.

Key aspects influencing public trust include:

- Product Quality and Safety: Ensuring efficacy and minimizing adverse events.

- Regulatory Compliance: Adherence to strict GMP and other pharmaceutical regulations.

- Transparency and Communication: Openly sharing product information and addressing concerns.

- Brand Reputation: Building a history of reliability and ethical practices.

Societal trends highlight a growing emphasis on preventative health and well-being, driving demand for Dermapharm's OTC products and supplements. The aging German population, with over 22 million individuals aged 65+ in 2023, also fuels a consistent need for specialized pharmaceuticals. Furthermore, the increasing adoption of digital health tools, evidenced by over 200,000 e-prescriptions in Germany by late 2023, necessitates adaptable market strategies.

| Societal Factor | Impact on Dermapharm | Supporting Data (2023-2025) |

| Aging Population | Increased demand for chronic condition treatments and healthcare services. | Germany: Over 22 million people aged 65+ in 2023; projected continued growth. |

| Health Consciousness & Preventative Care | Boosts demand for OTC products, skincare, and dietary supplements. | Global dietary supplements market valued at approx. USD 177.7 billion in 2023; projected to reach USD 326.7 billion by 2030. |

| Digital Health Adoption | Requires integration with digital sales and marketing channels for product accessibility. | Germany: Over 200,000 e-prescriptions issued by end of 2023; significant growth expected in 2024-2025. |

Technological factors

The ongoing digitalization of Germany's healthcare infrastructure, a trend accelerating into 2024 and 2025, presents both challenges and opportunities for Dermapharm. The widespread adoption of electronic patient records (ePA) and e-prescriptions demands that Dermapharm adapt its systems for seamless integration. This means ensuring their products and information can be easily accessed and managed within these new digital frameworks, facilitating smoother distribution and communication with healthcare providers.

Technological advancements in pharmaceutical manufacturing are significantly boosting efficiency and quality for companies like Dermapharm. New inspection and packaging systems for sterile products, for instance, are streamlining operations. Dermapharm's commitment to investing in modern production technologies, such as automated filling and sealing lines, is crucial for maintaining a competitive edge in the market.

Dermapharm's commitment to a Group-wide AI strategy highlights its proactive approach to leveraging artificial intelligence for operational efficiency. This strategy is crucial as AI is poised to revolutionize healthcare, with applications in diagnostics, drug discovery, and personalized treatment plans. For instance, AI algorithms are increasingly used to analyze medical images, potentially leading to earlier and more accurate diagnoses, which could impact the demand for certain pharmaceutical products.

The integration of AI in therapeutic support and personalized medicine presents significant opportunities for Dermapharm's future product development and market positioning. By 2025, the global AI in healthcare market is projected to reach substantial figures, with some estimates suggesting it could exceed $100 billion, underscoring the immense growth potential. This trend suggests that companies like Dermapharm that embrace AI will be better equipped to develop targeted therapies and adapt their market strategies to meet evolving patient needs and healthcare provider expectations.

Telemedicine and Digital Health Applications (DiGAs)

The growing adoption of telemedicine and digital health applications (DiGAs) offers Dermapharm significant opportunities to innovate its product delivery and patient interaction strategies. The German DiGA fast-track process, implemented in 2020, allows for a streamlined market entry for eligible digital health solutions, potentially accelerating the availability of new offerings for patients and healthcare providers.

This trend is supported by increasing patient demand for convenient and accessible healthcare. In Germany, for example, the number of telemedicine consultations surged significantly during the COVID-19 pandemic, with reports indicating millions of such consultations occurring annually. This digital shift underscores the importance of integrating virtual care models into the pharmaceutical sector.

Dermapharm can leverage these technological advancements to:

- Expand digital patient support programs: Offering online resources, remote monitoring, and virtual consultations to enhance patient adherence and outcomes.

- Develop or partner on DiGA-eligible solutions: Focusing on digital tools that complement existing pharmaceutical products, such as apps for chronic disease management or adherence tracking.

- Explore new revenue streams: Monetizing digital health services or data insights derived from patient engagement platforms, aligning with the evolving healthcare landscape.

Research and Development Technologies

Technological advancements in research and development are pivotal for Dermapharm. Innovations in drug discovery, such as AI-driven target identification and high-throughput screening, can significantly accelerate the development of new treatments. For instance, in 2024, pharmaceutical R&D spending globally was projected to exceed $250 billion, with a growing portion dedicated to digital health solutions and advanced analytics.

Dermapharm’s ability to leverage new formulation technologies, like advanced drug delivery systems, directly influences product efficacy and patient compliance. Similarly, the adoption of digital tools in clinical trials, including decentralized trials and real-world evidence collection, can streamline processes and reduce costs. Dermapharm's commitment to innovation is reflected in its investment in R&D, which remains a key driver for its pipeline.

- AI in Drug Discovery: Accelerating target identification and lead optimization.

- Advanced Formulation: Enhancing drug efficacy and patient experience.

- Digital Clinical Trials: Improving efficiency and data quality in testing.

- Biotechnology Integration: Incorporating novel biological approaches for therapeutic development.

Dermapharm is actively integrating artificial intelligence into its operations, aiming to boost efficiency and explore new avenues in healthcare by 2025. This strategic focus on AI is crucial as the global AI in healthcare market is expected to surpass $100 billion, offering significant growth potential for companies embracing these technologies.

Legal factors

Dermapharm navigates a complex web of regulations for drug approval and marketing. In Germany, this includes processes like the AMNOG benefit assessment, which directly impacts market access and pricing. For instance, the number of drugs undergoing this assessment can fluctuate annually, directly affecting the speed at which new treatments become available to patients and generate revenue for companies like Dermapharm.

The German Drug Pricing and Reimbursement Act (AMNOG) significantly influences how pharmaceutical companies, including Dermapharm, set prices and secure reimbursement for new medications from statutory health insurance funds. This regulatory framework is crucial for market access and revenue generation within Germany.

Recent legislative adjustments, such as those introduced by the Medical Research Act in 2024, have brought about changes, notably permitting confidential pricing agreements for certain innovative drugs. This development offers a degree of flexibility but also introduces new complexities for pricing strategies, requiring careful negotiation and adherence to specific criteria.

Dermapharm is subject to Germany's Supply Chain Due Diligence Act (LkSG), which mandates rigorous checks on human rights and environmental practices within its global supply chains. This law, effective from January 1, 2024, applies to companies with more than 1,000 employees, meaning Dermapharm must actively manage these risks. Failure to comply can result in significant penalties, including substantial fines.

Data Protection and Privacy Regulations (e.g., GDPR, ePA)

The ongoing digitalization of healthcare, notably with the introduction of the electronic patient file (ePA), places significant emphasis on robust data protection and patient privacy. Dermapharm must navigate these evolving requirements, ensuring strict compliance with regulations like the General Data Protection Regulation (GDPR) and other pertinent data privacy laws in its operations and product development.

Failure to adhere to these stringent regulations can result in substantial penalties, impacting not only financial performance but also brand reputation. For instance, GDPR fines can reach up to 4% of global annual turnover or €20 million, whichever is higher, underscoring the critical need for proactive compliance strategies. As of 2024, the European Union continues to refine its data protection frameworks, with ongoing discussions around the ePrivacy Regulation potentially introducing further obligations for companies handling sensitive health data.

- Increased scrutiny on data handling practices due to ePA implementation.

- Potential for significant financial penalties under GDPR for non-compliance.

- Need for continuous adaptation to evolving data protection legislation in the EU.

Intellectual Property and Patent Laws

Intellectual property and patent laws are foundational for Dermapharm, even as it concentrates on branded pharmaceuticals. These legal frameworks are crucial for safeguarding its unique product formulations and any novel advancements it develops. For instance, in 2023, the pharmaceutical industry globally saw significant investment in R&D, with companies filing thousands of new patents, underscoring the importance of IP protection for innovation.

Dermapharm's strategic approach, which heavily relies on acquiring existing products and companies, necessitates a thorough understanding and navigation of the intellectual property rights already in place. This due diligence ensures that acquired assets are legally sound and that Dermapharm can leverage them without infringing on existing patents. The company's ability to successfully integrate these acquisitions is directly tied to its proficiency in managing these complex IP landscapes.

- Patent Protection: Crucial for defending Dermapharm's proprietary drug formulations and new product innovations.

- IP Due Diligence: Essential for navigating existing intellectual property rights during company and product acquisitions.

- Market Exclusivity: Patents grant temporary monopolies, allowing companies like Dermapharm to recoup R&D investments and generate profits.

- Legal Challenges: Dermapharm must be prepared for potential patent disputes and litigation, which can be costly and time-consuming.

Dermapharm must navigate stringent German and EU pharmaceutical regulations, impacting drug approval, pricing, and market access. The AMNOG framework, for example, directly influences reimbursement and pricing strategies for new medications. Recent legislative changes, such as those in the 2024 Medical Research Act, have introduced provisions for confidential drug pricing, offering flexibility but demanding careful negotiation.

Environmental factors

Dermapharm's dedication to environmental stewardship is evident in its production facilities, which feature energy-efficient buildings and integrated solar power systems. These initiatives are becoming paramount as regulatory bodies and the public increasingly demand sustainable manufacturing practices.

Meeting stringent environmental standards is not just a matter of compliance but a core component of responsible corporate citizenship for Dermapharm. For instance, in 2023, their solar installations generated approximately 1.5 GWh of electricity, contributing to a reduction in their carbon footprint.

Pharmaceutical manufacturing, including Dermapharm's operations, inherently produces waste streams that necessitate rigorous management and pollution control. The company must adhere to stringent environmental regulations governing the disposal of chemical byproducts and the control of emissions, such as those mandated by the European Union's Industrial Emissions Directive.

In 2024, European pharmaceutical companies faced increasing scrutiny over their environmental impact, with a focus on reducing hazardous waste and greenhouse gas emissions. Dermapharm's commitment to sustainability likely involves significant investment in advanced waste treatment technologies and emission reduction strategies to meet these evolving compliance standards and minimize its ecological footprint.

The increasing emphasis on energy-efficient buildings and renewable energy sources, such as solar power, is a direct response to climate change concerns and the urgent need to reduce CO2 emissions. Germany, for instance, has ambitious targets, aiming for a nearly climate-neutral building stock by 2050, which will impact construction and renovation practices.

This trend aligns with broader German and European Union environmental goals, pushing for greater sustainability across all sectors. For example, the EU's Renewable Energy Directive sets targets for renewable energy consumption, encouraging investments in green technologies that Dermapharm might consider for its operations or supply chain.

Supply Chain Environmental Impact

The Supply Chain Due Diligence Act (LkSG) significantly impacts Dermapharm by extending environmental protection requirements across its entire value chain. This means Dermapharm must actively assess and mitigate environmental risks, from the sourcing of raw materials to the final delivery of its pharmaceutical products. This comprehensive approach is crucial for compliance and responsible operations.

Dermapharm's commitment to environmental stewardship within its supply chain is becoming increasingly critical. For instance, in 2023, the European Union's proposed Corporate Sustainability Due Diligence Directive (CSDDD) aims to further harmonize these obligations, potentially impacting companies like Dermapharm that operate across multiple member states. This directive underscores the growing regulatory pressure on businesses to demonstrate environmental accountability.

Key environmental considerations for Dermapharm's supply chain include:

- Resource Consumption: Managing water and energy usage in manufacturing and transportation.

- Waste Management: Implementing robust strategies for reducing and disposing of pharmaceutical waste and packaging materials, aiming for a circular economy model.

- Emissions Control: Monitoring and reducing greenhouse gas emissions from logistics and production processes, with a focus on achieving net-zero targets by 2050 as per broader industry trends.

- Biodiversity Impact: Assessing and minimizing the impact of raw material sourcing on ecosystems and biodiversity.

Resource Scarcity and Sustainable Sourcing

Dermapharm, as a pharmaceutical manufacturer, depends heavily on a consistent supply of various raw materials. The increasing global awareness of resource scarcity, particularly for certain active pharmaceutical ingredients (APIs) and excipients, poses a significant challenge. For instance, the supply chain for some botanical extracts, crucial for certain natural-based medicines, can be vulnerable to climate change impacts and over-harvesting.

This environmental pressure is driving a stronger demand for sustainable sourcing practices across the industry. Dermapharm must therefore adapt its procurement strategies to ensure long-term availability and ethical sourcing of its inputs. This may involve investing in or partnering with suppliers committed to regenerative agriculture or exploring the development of synthetic alternatives for naturally derived compounds.

The company's commitment to sustainability is also reflected in its operational choices. For example, in 2023, the pharmaceutical industry saw a growing emphasis on reducing water usage in manufacturing processes, with some companies setting targets to decrease consumption by 10-15% by 2025. Dermapharm's approach to resource management will be critical in navigating these evolving environmental expectations.

- Raw Material Dependency: Dermapharm relies on a diverse range of raw materials for its pharmaceutical products.

- Resource Scarcity Impact: Global concerns about the availability of specific raw materials can affect procurement costs and supply chain stability.

- Sustainable Sourcing Demand: Increasing pressure from consumers and regulators necessitates the adoption of environmentally responsible sourcing methods.

- Adaptation Strategies: Dermapharm may need to explore alternative materials and strengthen partnerships with sustainable suppliers to mitigate risks.

Environmental factors significantly shape Dermapharm's operational landscape, demanding a proactive approach to sustainability. Growing regulatory pressure, exemplified by the EU's proposed Corporate Sustainability Due Diligence Directive (CSDDD), mandates enhanced environmental accountability throughout the value chain.

Dermapharm's commitment to reducing its ecological footprint is evident in its investments in energy-efficient facilities and renewable energy sources, such as solar power, which generated approximately 1.5 GWh of electricity in 2023. This aligns with Germany's ambitious climate goals, aiming for a nearly climate-neutral building stock by 2050.

The company must also navigate challenges related to resource consumption and waste management, particularly concerning pharmaceutical byproducts and packaging. Adherence to directives like the European Union's Industrial Emissions Directive is critical for controlling emissions and managing waste streams responsibly.

Furthermore, Dermapharm faces increasing scrutiny over its supply chain's environmental impact, driven by legislation like the Supply Chain Due Diligence Act (LkSG). This necessitates a thorough assessment and mitigation of environmental risks, from raw material sourcing to product delivery, to ensure compliance and ethical operations.

PESTLE Analysis Data Sources

Our PESTLE analysis for Dermapharm Holding is built on a robust foundation of data from official government sources, leading economic institutions like the IMF and OECD, and reputable industry-specific market research firms. This ensures comprehensive coverage of political, economic, social, technological, legal, and environmental factors impacting the pharmaceutical sector.