Credito Emiliano PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Credito Emiliano Bundle

Unlock the strategic advantages Credito Emiliano holds by understanding the political, economic, social, technological, legal, and environmental forces at play. Our meticulously researched PESTLE analysis reveals how these external factors are shaping the bank's operations and future growth. Don't get left behind – download the full version now for actionable intelligence to inform your decisions.

Political factors

The stability of the Italian government is a crucial factor for Credito Emiliano (Credem), directly shaping the banking sector's regulatory landscape and economic policies. Frequent political changes or instability can introduce uncertainty regarding fiscal measures, financial regulations, and government support for financial institutions, thereby affecting Credem's strategic planning and operational framework.

For instance, the Italian government's approach to fiscal consolidation and banking sector reforms, often influenced by national elections and coalition dynamics, can significantly alter the economic climate in which Credem operates. The formation of new governments in 2023 and the ongoing political discourse around economic growth and public debt management are key elements to monitor for their potential impact on the banking sector's stability and profitability.

Credito Emiliano, as an Italian banking group, operates within the framework of the EU Banking Union, a system designed to create a more stable and integrated financial sector. This means Credem must adhere to regulations set at the European level, impacting everything from its capital reserves to how it manages risk.

Recent regulatory developments like CRR III (Capital Requirements Regulation III) and DORA (Digital Operational Resilience Act) are particularly significant. CRR III, for instance, will likely influence Credem's capital requirements, potentially demanding higher buffers to absorb potential losses, while DORA focuses on strengthening the digital operational resilience of financial institutions, requiring robust cybersecurity and IT risk management frameworks. As of early 2024, the implementation of these regulations is ongoing, with banks like Credem actively adapting their internal processes.

The European Central Bank's role in harmonizing banking policies across the Eurozone aims to foster a more uniform regulatory environment. While this harmonization intends to create a more level playing field, it also compels Credem to continuously adapt its strategies and operations to meet evolving European standards, ensuring compliance and maintaining its competitive position within the single market.

The European Union is strengthening its Anti-Money Laundering (AML) and Counter-Terrorist Financing (CFT) policies, with the new Anti-Money Laundering Authority (AMLA) set to begin operations in 2025. This development signals a move towards more rigorous compliance for financial institutions across the bloc.

For Credito Emiliano (Credem), this means an increased focus on robust AML/CFT frameworks, especially given its role in international finance. Non-compliance with these evolving regulations, which aim to safeguard the financial system, could lead to significant penalties and reputational damage.

Trade Policies and Geopolitical Tensions

Global trade tensions and geopolitical uncertainties continue to shape the economic landscape, directly influencing Italy's export-driven sectors. For instance, ongoing trade disputes, such as those involving tariffs between major economic blocs, can dampen demand for Italian goods. This slowdown can translate into reduced business activity, potentially impacting loan demand and the credit quality of Italian banks like Credito Emiliano (Credem).

Increased protectionism worldwide poses a significant risk. If key trading partners implement more restrictive trade policies, Italian companies reliant on exports may face higher costs or reduced market access. This economic pressure could lead to a rise in non-performing loans within the banking sector, as businesses struggle to service their debt. For example, a hypothetical 5% contraction in Italian exports due to tariffs could indirectly affect a substantial portion of the country's GDP, creating headwinds for financial institutions.

- Impact on Italian Exports: Global trade friction can directly reduce demand for Italian manufactured goods and agricultural products, a vital component of the Italian economy.

- Credit Quality Concerns: A downturn in export performance for Italian businesses could lead to increased defaults on loans, impacting banks' balance sheets.

- Geopolitical Risk Premium: Heightened geopolitical instability can increase the cost of capital for businesses and banks, affecting lending rates and investment decisions.

Government Support and Guarantees

Government guarantees on loans, especially those aimed at small and medium-sized enterprises (SMEs), play a significant role in shaping the credit risk landscape for financial institutions like Credito Emiliano. These guarantees can act as a buffer, mitigating the impact of potential credit losses, particularly during periods of economic instability. For instance, Italy's Fondo di Garanzia per le PMI, a state-backed loan guarantee fund, has been a crucial support mechanism. In 2023, this fund continued to provide significant coverage, with the Italian government allocating substantial resources to support SME financing and economic recovery.

However, the landscape of government support is dynamic. Any shifts or reductions in these support schemes could prompt banks to reassess their lending strategies and risk appetites. For example, a reduction in the coverage percentage of a government guarantee could lead Credito Emiliano to adopt more stringent credit assessment criteria or adjust its pricing for loans previously covered. The Italian government's approach to fiscal policy and its commitment to supporting the banking sector through various initiatives, including those for digitalization and green transition, will continue to influence the operational environment for banks in 2024 and 2025.

- Government guarantees can reduce the perceived risk of lending to SMEs, potentially increasing loan volumes.

- Changes in the availability or terms of government guarantees can directly impact a bank's provisioning for loan losses.

- Italy's commitment to supporting SMEs through initiatives like the Fondo di Garanzia per le PMI remains a key factor influencing the credit market.

- Future policy decisions regarding state aid and loan guarantees will be closely monitored by banks for their strategic implications.

Political stability in Italy directly impacts Credito Emiliano's operating environment through regulatory changes and economic policy. Shifts in government can alter fiscal measures and support for financial institutions, influencing Credem's strategic planning.

The Italian government's fiscal policies and approach to banking sector reforms, influenced by electoral cycles, shape the economic climate. For instance, ongoing discussions in 2024 regarding public debt management and economic growth strategies are key indicators for the banking sector's stability.

Credito Emiliano, as part of the EU Banking Union, must comply with European-level regulations such as CRR III and DORA, which affect capital requirements and digital resilience. These regulations, actively being implemented by banks in early 2024, underscore the need for continuous adaptation.

The European Union's strengthened AML/CFT policies, with the new AMLA commencing operations in 2025, will require more rigorous compliance from financial institutions like Credem. Non-compliance could result in penalties and reputational damage.

What is included in the product

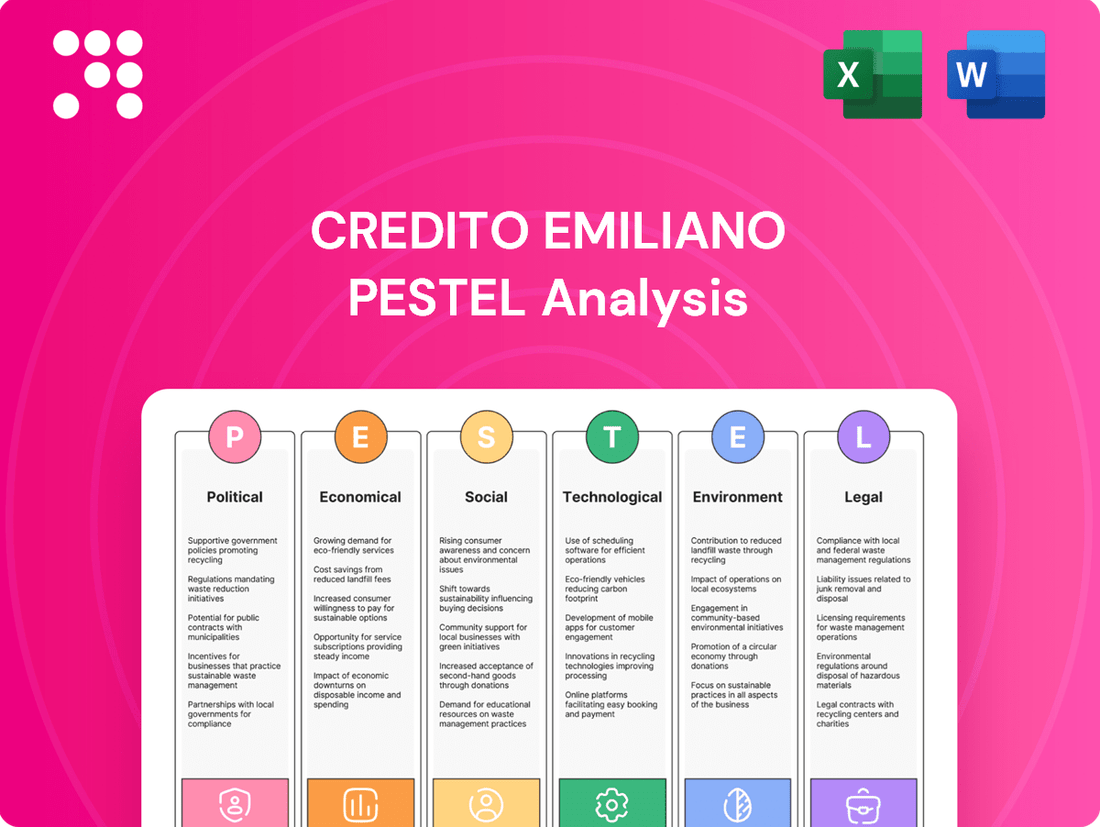

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors influencing Credito Emiliano, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights and forward-looking perspectives to help stakeholders navigate challenges and capitalize on opportunities within Credito Emiliano's operating landscape.

Credito Emiliano's PESTLE analysis offers a streamlined, easy-to-reference summary, acting as a pain point reliever by simplifying complex external factors for efficient meeting discussions and strategic planning.

Economic factors

The European Central Bank's (ECB) monetary policy, particularly its interest rate decisions, directly influences Credito Emiliano's (Credem) net interest income. A favorable differential between the interest earned on loans and the cost of funding is crucial for bank profitability. For instance, the Italian banking sector, including Credem, saw a positive impact in 2023 due to this widening gap.

Looking ahead, projections suggest potential ECB rate cuts in 2025. If these cuts materialize, it could lead to a moderation in net interest income from its 2024 high point. This shift would require banks like Credem to adapt their strategies to maintain profitability amidst a changing interest rate landscape.

Italy's GDP growth is a key indicator for Credito Emiliano, directly impacting its lending volumes and overall financial performance. Projections for 2024 and 2025 anticipate modest GDP expansion, largely fueled by resilient domestic demand and the strategic deployment of funds from the Recovery and Resilience Facility (RRF).

This anticipated economic uplift is expected to translate into a gradual increase in lending activity. Specifically, the financial sector, including banks like Credito Emiliano, could see a slight uptick in demand for both residential mortgages and corporate loans as businesses and individuals gain more confidence.

Inflation significantly impacts Credito Emiliano by influencing consumer spending and the cost of doing business. As inflation rates fluctuate, so does the purchasing power of individuals and the operational expenses for companies, directly affecting demand for banking services.

Looking ahead to 2025, projections indicate a decrease in headline inflation, largely attributed to stabilizing energy prices and a moderation in wage growth pressures. This economic shift is expected to support stable incomes, which in turn should boost household spending and create a more favorable environment for financial institutions like Credito Emiliano.

Non-Performing Loans (NPLs) and Asset Quality

The health of a bank's loan portfolio, specifically its non-performing loans (NPLs), is a crucial gauge of its asset quality. While Italy's banking sector has demonstrated improved resilience, evidenced by a notable decrease in Stage 2 loans, there's an anticipated uptick in default rates, especially among corporate borrowers. This trend suggests a need for continued vigilance in credit risk management.

Credito Emiliano (Credem) has consistently showcased robust asset quality. The bank has managed to maintain a commendably low net impaired loans ratio, a testament to its prudent lending practices and effective loan management strategies.

- Credem's Net Impaired Loans Ratio: Credem reported a net impaired loans ratio of approximately 1.1% as of the first quarter of 2024, a figure that remains among the lowest in the Italian banking sector. This reflects strong credit underwriting and a proactive approach to managing potential loan deterioration.

- Italian Banking Sector NPL Trends: The overall NPL ratio for the Italian banking system has seen a significant reduction, falling below 3% in early 2024. However, economic headwinds and rising interest rates could pressure this improvement, leading to a potential slight increase in defaults, particularly for small and medium-sized enterprises.

- Stage 2 Loan Performance: Stage 2 loans, which represent loans with increased credit risk but not yet in default, have also shown a downward trend across the Italian banking landscape. This indicates a general improvement in the creditworthiness of borrowers, although close monitoring is still advised.

Banking Sector Consolidation

The Italian banking sector is actively consolidating, with institutions aiming to achieve greater scale, optimize their capital structures, and accelerate technology adoption. This ongoing trend is significantly reshaping the competitive environment. For instance, by the end of 2023, the number of banks operating in Italy had continued its downward trajectory, a pattern observed over several years as smaller entities merge or are acquired by larger ones to enhance efficiency and market reach.

This consolidation could lead to the emergence of more robust banking players, potentially altering Credito Emiliano's (Credem) competitive positioning. It also opens avenues for strategic partnerships, mergers, or acquisitions, allowing Credem to expand its market share, diversify its offerings, or gain access to new technologies and customer segments. The drive for efficiency is a key motivator, as demonstrated by the cost-to-income ratios of many Italian banks, which are being scrutinized and improved through these strategic moves.

- Increased Scale: Banks merging gain larger asset bases and customer networks, enhancing their ability to compete.

- Capital Optimization: Consolidation allows for more efficient allocation of capital and improved regulatory ratios.

- Technology Integration: Merging entities often combine IT systems, leading to cost savings and better digital services.

- Competitive Landscape Shift: Fewer, larger banks could intensify competition or create opportunities for niche players like Credem.

Economic factors significantly shape Credito Emiliano's (Credem) operational environment. The European Central Bank's monetary policy, including its interest rate decisions, directly impacts the bank's net interest income, with potential rate cuts in 2025 signaling a need for strategic adaptation.

Italy's GDP growth, projected for modest expansion in 2024-2025, is expected to drive an increase in lending volumes for Credem, supported by domestic demand and RRF funds. Inflation is also forecast to decrease in 2025, which should boost household spending and create a more favorable climate for financial services.

The Italian banking sector's consolidation trend, continuing through 2023, presents both challenges and opportunities for Credem, potentially altering the competitive landscape and offering avenues for strategic growth.

Preview Before You Purchase

Credito Emiliano PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use, detailing Credito Emiliano's PESTLE analysis.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises, covering the Political, Economic, Social, Technological, Legal, and Environmental factors impacting Credito Emiliano.

The content and structure shown in the preview is the same document you’ll download after payment, offering a comprehensive PESTLE breakdown for Credito Emiliano.

Sociological factors

Italy's demographic landscape is characterized by a steadily aging population, with projections indicating a continued increase in the proportion of individuals over 65. This trend directly impacts the demand for financial services, particularly those focused on retirement planning, wealth preservation, and life insurance. Credito Emiliano (Credem) must actively adapt its product offerings to meet the growing needs of this segment, ensuring its services are tailored to support individuals and families navigating later life stages.

As of early 2024, Italy's old-age dependency ratio, which measures the number of elderly people relative to the working-age population, remains a significant concern. This demographic shift means a larger customer base will require specialized financial advice and products for managing pensions, investments for income generation, and long-term care insurance. Credem's ability to innovate and provide accessible, relevant solutions in these areas will be crucial for maintaining its market position and serving the evolving needs of its clientele.

Customers are increasingly demanding digital-first banking, expecting intuitive mobile apps and online platforms for all their financial needs. This shift is evident in the growing adoption of digital channels; for instance, by the end of 2023, over 70% of banking transactions in Italy were conducted digitally. Credito Emiliano's dual approach, maintaining a branch network while enhancing digital offerings, directly addresses this trend, necessitating ongoing investment in user experience and seamless integration between online and offline touchpoints.

The financial literacy of the Italian population directly influences how Credito Emiliano (Credem) can market its products. A population with lower financial literacy might be more hesitant to engage with sophisticated investment vehicles, preferring simpler savings accounts or traditional loans. Conversely, a financially savvy populace would likely seek out more complex offerings like wealth management services or structured products. In 2024, the OECD's Programme for the International Assessment of Adult Competencies (PIAAC) reported that while Italy shows some improvement, a significant portion of its adult population still struggles with basic financial numeracy, highlighting a key area for Credem to address through targeted educational initiatives and simplified product communication.

Trust and Reputation

Public trust is the bedrock of any financial institution, and Credito Emiliano (Credem) is no exception. Factors like ethical operations, clear communication, and a proactive approach to customer concerns directly shape a bank's reputation. For instance, Credem's consistent focus on strong corporate governance and its increasing emphasis on environmental, social, and governance (ESG) initiatives are key to building and maintaining stakeholder confidence.

Credem's reputation is further bolstered by its long-standing commitment to its community and its customers. In 2023, the bank reported a customer satisfaction score of 8.5 out of 10, a testament to its client-centric approach. This dedication to service excellence, coupled with its transparent dealings, solidifies its standing in the market.

The bank’s strategic investments in digital transformation, aiming to enhance user experience and operational efficiency, also play a significant role in its public perception. By adapting to evolving customer expectations and maintaining high standards of integrity, Credem reinforces its image as a reliable and forward-thinking financial partner.

- Customer Satisfaction: Credem achieved an 8.5/10 customer satisfaction rating in 2023.

- ESG Commitment: The bank's increasing focus on ESG principles enhances its stakeholder trust.

- Transparency: Open communication and ethical conduct are central to Credem's reputation management.

- Digital Investment: Investments in digital services aim to improve customer experience and operational trust.

Workforce Dynamics and Employee Engagement

Credito Emiliano's success hinges on its ability to attract and retain top talent in the highly competitive Italian financial services sector. In 2024, the demand for skilled professionals in areas like digital banking and data analytics continues to grow, making talent acquisition a key challenge. Ensuring high employee engagement is also crucial, as satisfied employees typically provide better customer service, directly impacting Credem's operational efficiency and reputation.

Sociological factors significantly influence Credem's performance. The bank's commitment to diversity and inclusion, alongside robust professional development programs, plays a vital role in fostering a positive work environment. For instance, Credem's ongoing investment in training programs aims to equip its workforce with the skills needed for evolving financial landscapes. By focusing on these areas, Credem can enhance employee satisfaction, which in turn boosts productivity and service quality.

- Talent Acquisition: The Italian banking sector faces a shortage of specialized skills, particularly in FinTech and cybersecurity, impacting recruitment efforts.

- Employee Engagement: High employee satisfaction correlates with lower staff turnover and improved customer service metrics, as observed in industry benchmarks.

- Diversity and Inclusion: Initiatives promoting gender equality and diverse representation in leadership positions are becoming increasingly important for corporate reputation and innovation.

- Professional Development: Credem's investment in continuous learning and upskilling programs is essential for adapting to technological advancements and regulatory changes.

Societal shifts, like the increasing demand for digital banking, directly impact Credito Emiliano's operations. By the end of 2023, over 70% of Italian banking transactions were digital, highlighting the need for robust online platforms. Credem's strategy of balancing its branch network with enhanced digital services addresses this trend, requiring continuous investment in user experience.

Financial literacy levels among Italians also shape product adoption. While some segments seek complex wealth management, others prefer simpler savings options. The 2024 PIAAC report indicated that a notable portion of Italy's adult population still struggles with basic financial numeracy, presenting an opportunity for Credem to offer targeted educational initiatives and simplified product communication.

Public trust, built on ethical operations and clear communication, is paramount for Credem. The bank's commitment to strong corporate governance and its growing focus on ESG principles in 2023 and 2024 are key to maintaining stakeholder confidence and a positive reputation. Credem's reported customer satisfaction score of 8.5 out of 10 in 2023 underscores its client-centric approach.

Attracting and retaining skilled talent, especially in digital banking and data analytics, is a significant challenge for Credem in 2024. High employee engagement is vital, as it correlates with better customer service and operational efficiency, with industry benchmarks showing lower staff turnover in banks with strong engagement programs.

| Sociological Factor | Impact on Credem | Supporting Data/Trend |

| Digital Adoption | Increased demand for online banking services | Over 70% of Italian banking transactions were digital by end of 2023. |

| Financial Literacy | Influences product uptake and need for financial education | Significant portion of Italian adults struggle with basic financial numeracy (PIAAC 2024). |

| Public Trust & Reputation | Crucial for customer loyalty and stakeholder confidence | Credem achieved 8.5/10 customer satisfaction in 2023; increasing ESG focus. |

| Talent Acquisition & Engagement | Key to operational efficiency and service quality | High demand for digital banking skills in Italy in 2024; engagement linked to lower turnover. |

Technological factors

Digital transformation is no longer optional for banks in 2025; it's a core strategy for boosting efficiency and finding new ways to earn. Credito Emiliano (Credem) is actively embracing this, particularly through its use of Artificial Intelligence. This focus on AI is helping Credem to not only strengthen its security measures but also to create more personalized product offerings for its customers and even anticipate potential software issues before they impact operations.

With the accelerating pace of digitalization, strong cybersecurity and data protection are no longer optional but essential for financial institutions like Credito Emiliano. The upcoming Digital Operational Resilience Act (DORA), taking effect in January 2025, will impose stringent requirements on banks, demanding comprehensive reporting on operational resilience, rigorous stress testing, and clear incident recovery timelines. This regulatory shift necessitates a significant investment in and enhancement of Credem's cyber defense capabilities to ensure compliance and safeguard sensitive customer information.

Artificial Intelligence (AI) and Machine Learning (ML) are pivotal to digital transformation, driving better decisions, streamlining operations, and cutting costs. Credito Emiliano (Credem) is leveraging these technologies for enhanced security measures and to craft more personalized customer offerings, showcasing a commitment to advanced tech for service improvement and internal efficiency.

In 2024, the global AI market was projected to reach over $200 billion, with significant growth expected in financial services. Credem's strategic adoption of AI for fraud detection and personalized financial advice directly addresses evolving customer expectations and the need for robust cybersecurity in the digital banking landscape.

Cloud Computing and Data Management

Credito Emiliano's operations are significantly enhanced by the adoption of cloud computing, offering unparalleled scalability and flexibility. This allows the bank to adapt swiftly to changing market demands and customer needs. For instance, by mid-2024, many leading European banks were reporting substantial investments in cloud infrastructure, with some aiming to migrate over 70% of their workloads to the cloud by 2025 to improve agility and reduce operational costs.

Effective data management is paramount for Credito Emiliano, especially with the increasing volume of financial transactions and customer interactions. The ability to manage and protect vast datasets directly impacts the development of innovative banking products and the generation of crucial customer insights. By the end of 2024, the global data management market was projected to exceed $100 billion, highlighting the critical importance of robust data handling capabilities for financial institutions.

- Scalability: Cloud platforms enable Credito Emiliano to easily scale its IT resources up or down based on demand, optimizing costs and performance.

- Data Analytics: Advanced cloud-based tools facilitate sophisticated analysis of customer data, leading to personalized product offerings and improved risk management.

- Security & Compliance: Robust cloud solutions are essential for safeguarding sensitive financial data and adhering to stringent regulatory requirements, a key concern for Italian banks.

Blockchain and Distributed Ledger Technology (DLT)

Blockchain and Distributed Ledger Technology (DLT) are poised to significantly reshape banking operations, impacting everything from transaction processing to secure data management for Credito Emiliano. The recent implementation of the Markets in Crypto Assets (MiCA) regulation across the EU, effective from December 2024, marks a pivotal moment as the first comprehensive European framework for DLT-based instruments. This regulatory shift underscores the growing importance and future integration of these technologies within the financial sector.

MiCA's introduction is expected to foster greater clarity and security for DLT applications, potentially lowering operational costs and enhancing efficiency for banks like Credito Emiliano. As of late 2024, the global blockchain market size was estimated to be over $12 billion, with projections indicating substantial growth in the coming years, particularly within financial services. This trend suggests a clear strategic imperative for financial institutions to explore and adopt DLT solutions.

- Regulatory Clarity: MiCA provides a foundational legal framework for DLT, enabling more predictable innovation.

- Operational Efficiency: Blockchain can streamline cross-border payments and back-office processes, reducing settlement times and costs.

- Market Growth: The expanding global DLT market, with significant investment in financial applications, signals a strong trend towards adoption.

Credito Emiliano is actively integrating advanced technologies to enhance its operations and customer experience. The bank's strategic focus on Artificial Intelligence (AI) and Machine Learning (ML) is evident in its efforts to bolster cybersecurity, personalize customer offerings, and proactively address potential system issues. The global AI market's projected growth to over $200 billion in 2024 highlights the significant opportunities these technologies present for financial services.

The bank's adoption of cloud computing provides crucial scalability and flexibility, allowing it to adapt to market dynamics and customer demands efficiently. Many European banks, by mid-2024, were significantly increasing cloud investments, with a goal to migrate substantial workloads by 2025 to improve agility and reduce costs.

Blockchain and Distributed Ledger Technology (DLT) are also key areas of focus, with the EU's Markets in Crypto Assets (MiCA) regulation, effective December 2024, providing a clear framework for DLT innovation. The expanding global DLT market, valued at over $12 billion in late 2024, signals a strong trend towards its adoption in financial services for improved efficiency and security.

Legal factors

Credito Emiliano (Credem) navigates a landscape shaped by stringent banking regulations, primarily overseen by the European Central Bank (ECB) and the Bank of Italy. These frameworks dictate operational standards and risk management practices.

The upcoming Capital Requirements Regulation III (CRR III), slated for implementation in January 2025, will elevate capital adequacy and risk management demands. This means Credem must bolster its capital buffers and refine its risk assessment processes to ensure compliance, potentially influencing its capital structure and strategic planning.

Consumer protection laws are a significant factor for Credito Emiliano, impacting everything from how they present financial products to ensuring fair lending. These regulations are crucial for building and maintaining customer trust in the banking sector.

The upcoming Payment Services Directive 3 (PSD3), expected in 2025, will further shape these interactions by pushing for enhanced open banking and strengthening consumer safeguards. This directive is designed to create a more competitive and secure financial landscape for all users.

The European Union is tightening its legal framework around Anti-Money Laundering (AML) and counter-terrorist financing, with new directives set to enhance scrutiny. A significant development is the establishment of the Anti-Money Laundering Authority (AMLA) in 2025, which will centralize supervision across member states.

Credito Emiliano, or Credem, must maintain and strengthen its compliance mechanisms to navigate these evolving regulations effectively. Failure to adhere to these stricter AML and sanctions rules could expose the bank to substantial financial penalties and reputational damage.

Data Privacy and Governance Regulations (e.g., GDPR, Data Act)

Credito Emiliano, like all businesses operating within the EU, faces evolving legal landscapes concerning data. The European Data Governance Act (DGA), already in effect, sets frameworks for data sharing and reuse. More critically, the upcoming enforcement of the Data Act in September 2025 will mandate new rules for data access and usage, directly impacting how Credem handles customer information and proprietary data.

Compliance with these regulations is paramount for maintaining customer trust and avoiding significant legal penalties. Credem must ensure its data management practices align with the DGA and prepare for the stricter requirements of the Data Act. This includes robust governance frameworks for data handling and security.

- Data Governance Act (DGA): Establishes rules for data sharing and reuse, fostering trust in data intermediaries.

- Data Act Enforcement: Beginning September 2025, this will introduce new obligations for data access and usage, impacting data management strategies.

- Customer Trust and Legal Compliance: Adherence is crucial to avoid fines and maintain a positive reputation with customers.

- Impact on Data Monetization: New regulations may influence how Credem can leverage its data assets.

Corporate Governance and Shareholder Rights

Credito Emiliano's corporate governance framework, including its board composition and shareholder approval processes, operates within strict Italian legal parameters. These regulations ensure transparency and accountability in decision-making. Recent shareholder approvals, such as the endorsement of the 2023 financial statements and a dividend payout of €0.40 per share in May 2024, underscore the adherence to these legal requirements.

The bank's commitment to shareholder rights is evident in its engagement through annual general meetings. These forums are crucial for legally binding decisions on financial performance and strategic direction. For instance, the approval of the 2023 financial year's results, which showed a net profit of €829 million, reflects this robust legal and procedural adherence.

- Board Composition: Credem's board structure is governed by Italian corporate law, requiring specific independence criteria and expertise.

- Shareholder Approvals: Legal frameworks mandate shareholder approval for key decisions like financial statement adoption and dividend distribution, as seen with the €0.40 per share dividend in 2024.

- Transparency: Adherence to legal reporting standards ensures transparency in financial disclosures and corporate actions.

- Regulatory Compliance: Ongoing compliance with banking regulations and corporate governance codes is essential for maintaining investor confidence and legal standing.

Credito Emiliano's operations are heavily influenced by evolving EU and Italian legal frameworks, particularly concerning capital requirements and consumer protection. The upcoming CRR III, effective January 2025, will necessitate strengthened capital buffers and risk management, impacting Credem's financial strategy. Similarly, PSD3, expected in 2025, will drive changes in open banking and consumer safeguards.

Data privacy and governance are also critical legal considerations, with the Data Act's enforcement in September 2025 imposing new rules on data access and usage. Credem must ensure robust compliance to maintain customer trust and avoid penalties.

The bank's corporate governance, including board structure and shareholder approvals, adheres to Italian legal standards, ensuring transparency. For example, the May 2024 approval of a €0.40 per share dividend for 2023 highlights this compliance.

These legal factors collectively shape Credem's operational landscape, demanding continuous adaptation and investment in compliance infrastructure to mitigate risks and maintain its market position.

Environmental factors

Climate change presents significant physical risks to Credito Emiliano (Credem) and the broader banking sector. Extreme weather events, such as floods, droughts, and heatwaves, can directly impact the value of assets Credem holds, particularly through its loan portfolios. For instance, mortgages on properties located in areas prone to severe weather face increased default risk, as damage to these assets can diminish their collateral value.

Credem must proactively assess and integrate the management of these physical climate risks into its core lending and investment strategies. This involves understanding the potential impact of climate-related events on borrowers' ability to repay loans and on the performance of its investment assets. For example, the European Environment Agency reported that in 2023, floods and storms caused billions of euros in damages across Europe, highlighting the tangible financial implications for institutions with exposure to affected regions.

Financial institutions like Credito Emiliano are facing growing regulatory demands to embed environmental, social, and governance (ESG) criteria into their business practices and disclosures. This shift is driven by a global push for more sustainable finance.

The European Union is at the forefront, with initiatives like the EU Omnibus Regulation designed to streamline existing ESG reporting requirements. This aims to make compliance less burdensome for companies operating within the EU.

A significant upcoming development is the EU Green Bonds Standard (EU GBS), expected to be a key framework in 2025. This standard will provide a unified approach to classifying and verifying green bonds, influencing how financial products are marketed and invested in.

Credito Emiliano, or Credem, has set an ambitious goal to achieve carbon neutrality by 2025. This involves a systematic approach, starting with a thorough assessment of their carbon footprint. They are actively developing plans to reduce their emissions directly.

To bridge any remaining gaps, Credem plans to purchase certified carbon credits. This commitment underscores the increasing importance of environmental stewardship within the banking industry, aligning with broader sustainability trends.

Sustainable Investment and Lending Practices

Credito Emiliano, or Credem, is actively engaging with sustainable bond frameworks and reporting, signaling a clear commitment to green, social, and sustainability bonds. This strategic direction aligns with a significant shift across the financial sector, aiming to channel investments into projects with positive environmental and social impacts and to offer a growing range of ESG-compliant financial products.

This focus on sustainability is not just a trend but a growing imperative. For instance, the global sustainable bond market reached a record $1.1 trillion in issuance in 2023, with projections suggesting continued robust growth through 2024 and into 2025. Credem's participation in this market reflects an understanding of evolving investor preferences and regulatory landscapes that increasingly favor environmentally and socially responsible investments.

- Green Bonds: Credem's involvement in frameworks for green bonds supports financing for projects with clear environmental benefits, such as renewable energy or energy efficiency initiatives.

- Social Bonds: The bank's engagement with social bond frameworks indicates a commitment to funding projects that address social issues, like affordable housing or access to essential services.

- Sustainability Bonds: By participating in sustainability bond frameworks, Credem is supporting a blend of green and social objectives, reflecting a holistic approach to responsible finance.

- ESG Integration: This move is part of a broader strategy to integrate Environmental, Social, and Governance (ESG) criteria into its lending and investment practices, meeting client demand for sustainable financial solutions.

Resource Scarcity and Environmental Footprint

Credito Emiliano, like many financial institutions, faces challenges related to resource scarcity and its environmental footprint. Operational aspects, such as the energy consumption within its numerous branches and offices, alongside waste generation, directly contribute to this footprint. For instance, in 2023, Credem reported a total energy consumption of approximately 15,000 MWh across its operations, with a significant portion attributed to its physical infrastructure.

The bank is actively engaged in optimizing resource usage and reducing waste as part of its broader environmental sustainability initiatives. These efforts are crucial for mitigating the impact of its operations on natural resources and aligning with increasing regulatory and stakeholder expectations regarding environmental responsibility.

Key areas of focus for Credem's environmental initiatives include:

- Energy Efficiency: Implementing measures to reduce electricity consumption in branches and data centers, such as LED lighting upgrades and smart building management systems.

- Waste Management: Enhancing recycling programs and reducing paper usage through digitalization of services and internal processes.

- Sustainable Procurement: Prioritizing suppliers with strong environmental credentials and sourcing eco-friendly materials for office supplies and operations.

Credito Emiliano is actively addressing climate change risks, with a focus on physical impacts like extreme weather events affecting its loan portfolios. The bank is also responding to growing regulatory demands for ESG integration, evidenced by its participation in sustainable bond frameworks and its goal of carbon neutrality by 2025.

The bank's commitment to sustainability is reflected in its engagement with green, social, and sustainability bonds, mirroring a broader financial sector trend. This strategic alignment is supported by the significant growth in the global sustainable bond market, which reached $1.1 trillion in issuance in 2023, with continued expansion anticipated through 2024 and 2025.

Credem is also working to reduce its operational environmental footprint, focusing on energy efficiency, waste management, and sustainable procurement. For example, in 2023, the bank consumed approximately 15,000 MWh of energy, underscoring the importance of these operational initiatives.

| Environmental Factor | Credem's Response/Initiative | Relevant Data/Context |

|---|---|---|

| Climate Change Risk | Assessing physical risks to loan portfolios from extreme weather. | Billions in damages from floods/storms in Europe in 2023. |

| Regulatory Demands | Integrating ESG criteria into business practices and disclosures. | EU Omnibus Regulation streamlining ESG reporting. |

| Carbon Neutrality Goal | Targeting carbon neutrality by 2025, including carbon credit purchases. | Credem's direct emission reduction plans. |

| Sustainable Finance | Engaging with green, social, and sustainability bond frameworks. | Global sustainable bond market reached $1.1 trillion in 2023. |

| Operational Footprint | Optimizing resource usage and reducing waste. | Credem's 2023 energy consumption: approx. 15,000 MWh. |

PESTLE Analysis Data Sources

Our Credito Emiliano PESTLE Analysis is built on a robust foundation of data from official sources, including the Bank of Italy, European Central Bank, and national statistical offices. We also incorporate insights from reputable financial news outlets, industry-specific reports, and economic forecasting agencies to ensure comprehensive and current information.