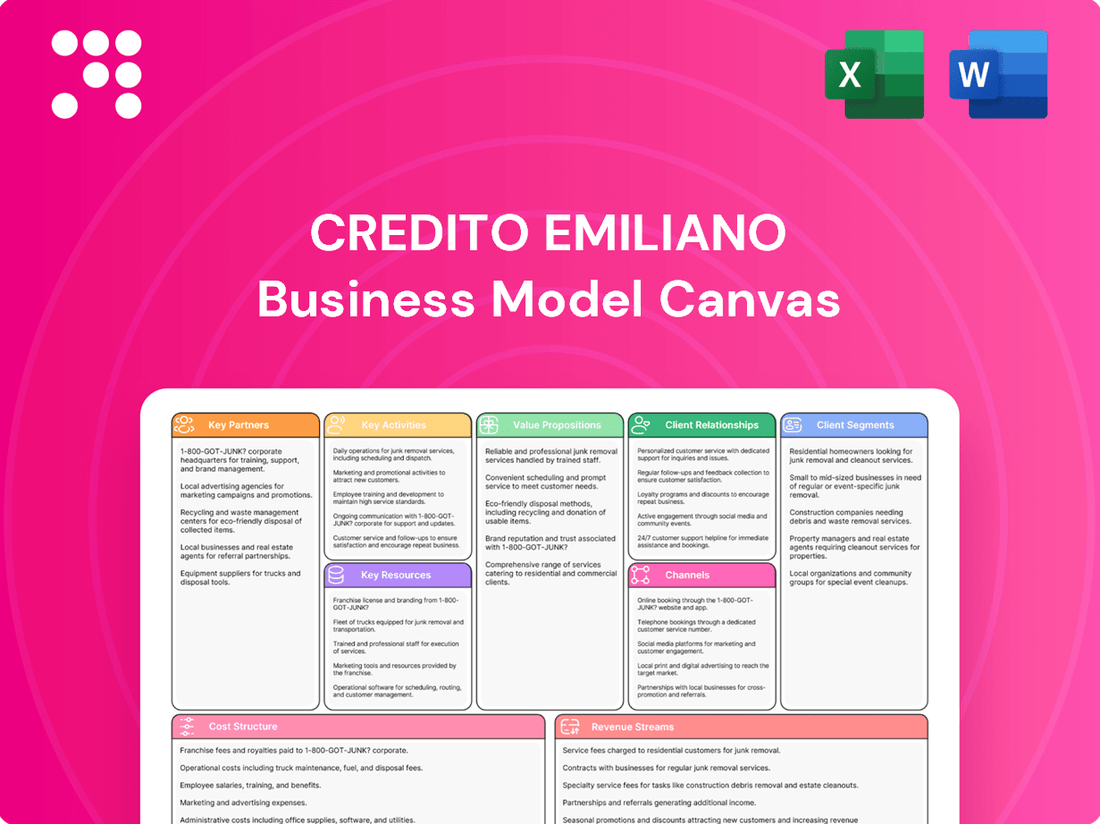

Credito Emiliano Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Credito Emiliano Bundle

Unlock the strategic blueprint of Credito Emiliano's success with our comprehensive Business Model Canvas. This detailed analysis reveals how they build customer loyalty, manage key resources, and generate revenue in the competitive banking sector. Perfect for anyone looking to understand and replicate effective business strategies.

Partnerships

Credem actively partners with major technology firms, such as Google Cloud, to accelerate its digital transformation. This collaboration allows Credem to harness advanced AI and cloud computing for improved security, innovative product creation, and streamlined operations.

In 2024, Credem continued to invest heavily in technology, with digital channels accounting for a significant portion of customer interactions. By integrating cutting-edge solutions from partners like Google Cloud, Credem aims to enhance its banking infrastructure, offering more secure and efficient services to its clients.

Credito Emiliano, or Credem, actively pursues key partnerships through joint ventures, notably with Credemassicurazioni, to bolster its bancassurance offerings. These collaborations are strategically formed with seasoned insurance providers, such as Reale Mutua Assicurazioni, a move designed to broaden the spectrum of insurance products available to Credem's clientele.

This partnership strategy directly addresses Credem's objective of expanding its product suite and diversifying its income sources, moving beyond the confines of conventional banking operations. For instance, in 2023, the bancassurance sector in Italy saw significant growth, with gross written premiums reaching approximately €140 billion, highlighting the lucrative potential of such ventures.

By combining Credem's extensive banking network and customer base with the specialized insurance knowledge of its partners, these joint ventures facilitate the delivery of cohesive and integrated financial solutions. This synergistic approach aims to enhance customer value and capture a larger share of the integrated financial services market.

Credito Emiliano's (Credem) relationship with its parent, Credemholding, is fundamental to its operational and strategic framework. Credemholding, as the principal shareholder, plays a pivotal role in capital allocation and the overarching strategic direction of the Credem banking group, ensuring a cohesive approach to financial management and growth initiatives across the entire entity.

Credemholding's substantial ownership stake in Credito Emiliano SpA directly impacts key financial decisions, including the consolidation of financial statements and the determination of dividend policies. This close alignment ensures that the group's financial reporting reflects a unified strategy and that capital is managed efficiently to support the bank's objectives.

This hierarchical structure, with Credemholding at the apex, provides a bedrock of stability and consistent strategic oversight for the banking group. It allows for centralized decision-making on critical matters, fostering a predictable and stable environment for both internal operations and external stakeholder confidence, particularly relevant in the dynamic financial landscape of 2024.

Collaborations with Fintech Start-ups and Academia

Credito Emiliano, or Credem, actively cultivates key partnerships with fintech start-ups and academic institutions through its dedicated Innovation Unit. This strategic focus on open innovation is designed to explore and integrate novel business models and cutting-edge technologies into the bank's operations.

By collaborating with universities and schools, Credem gains early access to emerging trends and methodologies, ensuring it stays ahead in the rapidly evolving financial landscape. These academic ties are crucial for researching and adopting new technologies, keeping the bank at the vanguard of financial innovation.

These collaborations are instrumental in building a comprehensive understanding of market innovation and serve as a powerful catalyst for internal development and growth within the organization. For example, in 2024, Credem's Innovation Unit participated in over 15 joint research projects with Italian universities focusing on AI in credit scoring and blockchain for secure transactions.

- Fintech Start-up Engagement: Credem partners with emerging fintechs to pilot new digital solutions and services.

- Academic Research Initiatives: Collaborations with universities explore advancements in financial technology and customer behavior.

- Open Innovation Ecosystem: Fostering a network that drives the adoption of new business models and technological advancements.

- Market Intelligence Gathering: Partnerships help map industry innovation and identify future growth opportunities.

Partnerships for Specific Financial Services

Credito Emiliano, or Credem, actively forms strategic alliances to enhance its specialized financial service portfolio. A prime example is their agreement to transfer merchant acquiring operations to Worldline. This move allows Credem to streamline its services and concentrate on its primary banking functions, while Worldline brings specialized expertise to the acquiring business.

These types of collaborations are crucial for optimizing service delivery and unlocking new revenue streams. By outsourcing non-core activities to specialists, banks like Credem can improve efficiency and customer experience. Furthermore, such partnerships can lead to significant one-off gains, as seen in asset transfers, bolstering the bank's financial performance.

For instance, in 2023, Credem reported a net profit of €537 million, with strategic operations like these contributing to its robust financial health. These partnerships enable Credem to adapt to market changes and leverage external capabilities, ensuring a competitive edge in the evolving financial landscape.

- Merchant Acquiring Transfer: Partnership with Worldline for specialized services.

- Focus on Core Competencies: Allows Credem to concentrate on primary banking activities.

- Leveraging External Expertise: Accessing specialized skills for non-core operations.

- Extraordinary Income Generation: Agreements contribute to overall profitability, supporting strong financial results like Credem's €537 million net profit in 2023.

Credito Emiliano's key partnerships are multifaceted, encompassing technology providers like Google Cloud for digital transformation, insurance companies such as Reale Mutua Assicurazioni through bancassurance ventures, and fintech start-ups for innovation. These alliances are crucial for expanding product offerings, diversifying revenue, and staying competitive.

The bank also strategically partners with specialized service providers, exemplified by the transfer of merchant acquiring operations to Worldline. This allows Credem to focus on its core banking strengths while leveraging external expertise for non-core functions, ultimately enhancing efficiency and customer experience.

Credem's relationship with its parent, Credemholding, is a fundamental partnership that ensures stable strategic direction and capital allocation. This hierarchical structure provides a consistent oversight, vital for navigating the dynamic financial environment of 2024.

In 2024, Credem's Innovation Unit actively engaged in over 15 joint research projects with Italian universities, focusing on areas like AI in credit scoring, demonstrating a commitment to open innovation and leveraging academic insights.

What is included in the product

A detailed breakdown of Credito Emiliano's banking operations, outlining its customer segments, value propositions, and revenue streams within the traditional 9 BMC blocks.

This model reflects Credito Emiliano's focus on community banking and strong customer relationships, detailing key partners and cost structures.

Credito Emiliano's Business Model Canvas acts as a pain point reliever by clearly mapping customer relationships and value propositions, enabling targeted solutions for common banking frustrations.

It provides a structured approach to identify and address inefficiencies in key partnerships and revenue streams, thereby alleviating operational pain points.

Activities

Credito Emiliano's core banking operations revolve around providing a comprehensive suite of retail and corporate banking services. This includes the crucial activities of accepting customer deposits and extending loans, which are the lifeblood of its financial intermediation. The bank actively pursues growth in both these areas, recognizing them as fundamental drivers of its profitability and market position.

In 2024, Credem continued to emphasize the expansion of its deposit base and loan portfolio as key strategic objectives. For instance, the bank reported a steady increase in customer deposits throughout the year, reflecting strong client trust and its ability to attract and retain funds. Similarly, its lending activities saw robust demand, particularly in business lending and mortgages, contributing significantly to its net interest income.

Credito Emiliano's asset management and wealth advisory activities are central to its business model, primarily driven by subsidiaries like Credemvita and Euromobiliare Asset Management SGR. These operations focus on managing investment portfolios and providing tailored financial guidance to a diverse clientele, including high-net-worth individuals and families.

These services are a significant contributor to the group's non-interest income, showcasing their importance in diversifying revenue streams beyond traditional lending. In 2023, Credem Euromobiliare reported a net profit of €320.6 million, a testament to the strength of its asset management and wealth advisory operations.

Credito Emiliano actively develops and distributes a wide array of insurance products, encompassing both life and non-life policies, primarily through its bancassurance channels. This strategic focus is exemplified by its subsidiaries, Credemvita and Credemassicurazioni, which have consistently demonstrated robust growth in their premium volumes.

In 2024, Credem's bancassurance segment continued to be a significant contributor, with insurance premiums for the group showing a positive trend, reflecting the success of cross-selling initiatives. This approach effectively utilizes the bank's extensive customer network to offer tailored insurance solutions, thereby increasing customer lifetime value and bolstering overall group profitability.

Digital Transformation and AI Integration

Credito Emiliano, or Credem, is making significant investments in digital transformation and the integration of Artificial Intelligence (AI) as a core part of its strategy. This focus is designed to modernize operations and enhance customer service.

The bank is actively establishing specialized AI divisions and developing AI-driven tools. These tools are crucial for improving fraud detection capabilities, optimizing IT infrastructure, and bolstering the security of online user interactions, reflecting a proactive approach to digital security.

Credem's objective is to make AI accessible throughout the entire organization. This democratization aims to unlock new efficiencies and elevate the overall customer experience, driving innovation across all touchpoints.

- AI-Powered Fraud Detection: Credem is leveraging AI to enhance its ability to identify and prevent fraudulent transactions, a critical function in modern banking.

- IT Optimization: The bank is using AI to streamline its IT operations, leading to greater efficiency and reduced operational costs.

- Enhanced Online Security: AI integration is key to strengthening the security measures for online banking users, protecting sensitive customer data.

- Democratizing AI: Credem's strategy includes making AI tools and capabilities available across the organization to foster widespread adoption and innovation.

Network Management and Customer Acquisition

Credito Emiliano's network management is crucial for acquiring and serving customers. They actively manage their branches, corporate offices, and financial advisor teams to ensure seamless service delivery, a key aspect of their customer acquisition strategy.

Expanding the customer base is a continuous effort, leveraging both digital channels and their established physical footprint. This dual approach ensures broad accessibility to Credem's financial products and services, driving new client acquisition.

- Branch Network Optimization: Credem's strategy involves optimizing its physical presence, with a significant number of branches across Italy, ensuring local market penetration and customer accessibility.

- Digital Channel Growth: The bank is heavily invested in digital platforms to attract and onboard new customers, reflecting a growing trend in the banking sector. In 2024, digital banking adoption continued to rise, with a substantial percentage of new accounts being opened online.

- Advisor-Led Acquisition: Their financial advisors play a vital role in building relationships and acquiring new clients, particularly for more complex financial needs, reinforcing the importance of personalized service in their acquisition model.

Credito Emiliano's key activities encompass core banking operations like deposit taking and lending, alongside strategic growth in asset management and wealth advisory services. The bank also actively distributes a wide range of insurance products through its bancassurance channels, leveraging subsidiaries like Credemvita and Euromobiliare Asset Management SGR. Furthermore, Credem is heavily invested in digital transformation and AI integration to enhance operations, customer service, and security.

The bank's network management is vital for customer acquisition and service, utilizing both physical branches and digital platforms. This dual approach, supported by a strong financial advisor network, ensures broad accessibility and personalized service, driving client acquisition and retention.

| Key Activity | Description | 2024 Data/Focus |

|---|---|---|

| Core Banking | Deposit taking and lending | Continued growth in customer deposits and robust demand for business lending and mortgages. |

| Asset Management & Wealth Advisory | Managing investment portfolios and providing financial guidance | Significant contributor to non-interest income; Credem Euromobiliare reported a net profit of €320.6 million in 2023. |

| Bancassurance | Distribution of life and non-life insurance products | Positive trend in insurance premiums, driven by cross-selling initiatives. |

| Digital Transformation & AI | Modernizing operations and enhancing customer service with AI | Developing AI tools for fraud detection, IT optimization, and online security; aiming to democratize AI across the organization. |

| Network Management & Customer Acquisition | Managing physical and digital channels for customer outreach | Optimizing branch network, growing digital channels (significant percentage of new accounts opened online in 2024), and leveraging financial advisors. |

Full Version Awaits

Business Model Canvas

The Credito Emiliano Business Model Canvas you're previewing is the actual document you will receive upon purchase. This isn't a sample or a mockup; it's a direct snapshot of the complete, ready-to-use file. You'll gain full access to this professionally structured and comprehensively detailed Business Model Canvas, exactly as presented here.

Resources

Credito Emiliano's financial capital and soundness are foundational. Its robust capital ratios, including a strong Common Equity Tier 1 (CET1) ratio, are critical resources. For instance, as of the first quarter of 2024, Credem reported a CET1 ratio of 15.2%, significantly above regulatory requirements, highlighting its financial resilience.

This financial strength enables Credem to absorb potential losses and fund strategic growth initiatives. Consistent net profit generation, such as the reported net profit of €314 million for the first quarter of 2024, further solidifies its position and maintains investor confidence in its stability and future prospects.

Credito Emiliano's human capital, including its dedicated employees, financial advisors, and Avvera agents, forms a cornerstone of its business model. Their collective expertise across diverse financial sectors is paramount in delivering superior service and tailored financial guidance.

The bank actively invests in continuous training and development programs for its workforce. This commitment ensures that their skills remain sharp and up-to-date, directly contributing to the high quality of services offered and fostering strong customer relationships.

In 2024, Credem continued to emphasize its skilled personnel as a key differentiator. The bank’s focus on building and retaining a knowledgeable team underpins its ability to navigate complex financial landscapes and maintain operational efficiency.

Credem's extensive physical footprint, encompassing over 800 branches and service points across Italy, is a cornerstone of its business model. This widespread network facilitates direct engagement with a broad customer base, from individual savers to large corporations. In 2024, this network continued to be a primary driver for customer acquisition and relationship management, offering personalized financial advice and support.

Beyond traditional branches, Credem also operates specialized corporate centers, private banking offices, and financial stores, catering to diverse client needs. This multi-faceted approach ensures accessibility and tailored service delivery, strengthening community ties and brand loyalty. The integration of these physical touchpoints with robust digital channels creates a powerful hybrid service model, enhancing customer convenience and reach.

Advanced Digital Platforms and Technology Infrastructure

Credito Emiliano’s advanced digital platforms, such as its intuitive mobile banking app and comprehensive internet banking services, are cornerstones of its operations. These technologies are powered by a robust IT and AI infrastructure, facilitating seamless online transactions and personalized customer interactions. For instance, in 2023, Credito Emiliano reported a significant increase in digital channel usage, with over 60% of customer transactions conducted online, highlighting the effectiveness of their technological investments.

The bank's commitment to continuous technological advancement is evident in its ongoing investments. These investments ensure that Credito Emiliano remains competitive in the evolving financial landscape, offering efficient service delivery and enabling data-driven strategic decisions. The bank allocated approximately €150 million in 2024 towards upgrading its IT systems and exploring new AI applications to further enhance customer experience and operational efficiency.

- Digital Channels: Mobile banking app and internet banking services provide customers with 24/7 access to financial management.

- IT & AI Infrastructure: The underlying technology stack supports secure, efficient, and scalable operations, leveraging AI for personalized services and risk management.

- Customer Experience: Investments in technology directly translate to a smoother, more convenient, and responsive banking experience for all users.

- Competitive Advantage: Staying at the forefront of technological innovation allows Credito Emiliano to differentiate itself and attract new customers in a crowded market.

Brand Reputation and Trust

Credito Emiliano, or Credem, leverages its robust brand reputation and the deep trust it has cultivated with its customer base as a core intangible resource. This strong standing is not merely a talking point; it directly translates into tangible business advantages.

Credem's reputation as one of Europe's most financially sound banks is a significant draw, attracting new customers and solidifying relationships with existing ones. In the financial industry, where security and reliability are paramount, this trust is a critical differentiator.

- Brand Strength: Credem consistently ranks high in customer satisfaction and trust surveys within the Italian banking sector.

- Customer Loyalty: The bank's reputation fosters strong customer loyalty, reducing churn and increasing the lifetime value of each client.

- Market Perception: A solid reputation enhances Credem's market perception, making it an attractive partner for businesses and individuals alike.

- Attracting Talent: A trusted brand also helps in attracting and retaining high-quality employees, further strengthening its operational capabilities.

Credito Emiliano's intellectual property, encompassing its proprietary IT systems, advanced risk management models, and unique service methodologies, represents a significant asset. These elements drive operational efficiency and provide a competitive edge.

The bank's ongoing investment in research and development, particularly in areas like AI-driven customer analytics and cybersecurity, is crucial for maintaining this intellectual capital. This focus ensures that Credem remains at the forefront of financial innovation, offering sophisticated solutions to its clients.

Credito Emiliano's intellectual property is a key enabler of its service delivery and strategic growth. The bank's ability to develop and adapt these internal tools allows for personalized customer experiences and efficient operational management, underpinning its long-term success.

Value Propositions

Credem provides a broad spectrum of financial services, encompassing retail and corporate banking, asset management, and insurance. This all-inclusive approach acts as a single point of contact for customers, addressing everything from everyday banking to significant investments and essential protection needs.

This diversified business model is crucial for Credem's resilience, allowing it to adjust effectively to shifts in the financial landscape. For instance, as of the first quarter of 2024, Credem reported a net profit of €178.3 million, demonstrating the strength derived from its varied revenue streams.

Credito Emiliano's commitment to financial stability is a cornerstone of its value proposition. The bank consistently highlights its robust capital ratios, which are significantly above regulatory requirements, offering clients a strong sense of security for their deposits and investments. For instance, as of the first quarter of 2024, Credito Emiliano maintained a CET1 ratio well in excess of 15%, a figure that underscores its financial resilience.

This financial strength is further reinforced by a remarkably low non-performing loan (NPL) ratio, consistently kept under 2% throughout 2023 and into early 2024. This low NPL ratio demonstrates effective risk management and a healthy loan portfolio, directly translating to greater security for clients.

Recognized as one of Europe's most solid banking institutions, Credito Emiliano's reputation for reliability and trustworthiness is a powerful differentiator. This established stability is crucial in a financial market where clients increasingly prioritize the safety and integrity of their financial partners.

Credem offers a robust digital experience through its advanced mobile banking app and internet banking services. These platforms allow customers to effortlessly manage accounts and conduct transactions anytime, anywhere, reflecting a commitment to convenience for its users.

The bank's strategic integration of Artificial Intelligence is designed to bolster digital security measures and personalize service offerings. This technological advancement aims to provide tailored banking solutions, enhancing both safety and user satisfaction for its increasingly digital customer base.

In 2023, Credem reported a significant increase in digital transactions, with over 70% of customer interactions occurring through digital channels. This trend underscores the value proposition of flexibility and accessibility for tech-savvy individuals and businesses.

Personalized Advice and Human-Centric Approach

Credem prioritizes a personalized touch, even with its digital offerings. Its extensive network of financial advisors and private bankers fosters strong, human-centric relationships, ensuring clients receive advice tailored to their unique circumstances.

This human element is crucial for addressing intricate financial planning and investment requirements. For instance, in 2024, Credem continued to invest in advisor training, aiming to enhance their ability to provide bespoke solutions.

The bank’s strategy successfully blends cutting-edge digital tools with the invaluable insight of human expertise. This synergy creates a banking experience that is both efficient and deeply supportive, catering to a wide range of client needs.

This approach is reflected in client satisfaction metrics. Reports from early 2024 indicated high levels of trust and engagement among customers who utilize both digital platforms and personal advisory services.

- Personalized Guidance: Financial advisors and private bankers offer tailored solutions.

- Human-Centricity: Strong emphasis on building and maintaining client relationships.

- Digital-Human Synergy: Integration of technology with personal expertise for a balanced experience.

- Addressing Complex Needs: Focus on sophisticated financial planning and investment strategies.

Sustainable Growth and Value Creation

Credem's core strategy centers on fostering sustainable growth and generating long-term value for all its stakeholders. This commitment is clearly demonstrated through its proactive engagement with Environmental, Social, and Governance (ESG) principles and a dedicated effort to accelerate the transition towards a more sustainable economy.

This focus resonates strongly with a growing segment of customers who actively seek out financial institutions that align with their values, prioritizing responsible banking practices and a secure, long-term financial future. For instance, in 2024, Credem continued to expand its range of ESG-linked financial products, offering solutions that support both client investment goals and broader environmental objectives.

- Sustainable Growth Strategy: Credem prioritizes long-term value creation through initiatives aligned with ESG principles.

- ESG Product Development: The bank actively develops and promotes financial products that support sustainable transitions.

- Customer Alignment: Attracts customers who value responsible banking and long-term financial well-being.

- Market Trend Responsiveness: Addresses the increasing demand for sustainable and ethical investment options in the financial market.

Credito Emiliano's value proposition is built on a foundation of comprehensive financial services, offering a one-stop shop for retail and corporate banking, asset management, and insurance. This integrated approach simplifies financial management for clients, ensuring all their banking and investment needs are met efficiently.

The bank's unwavering commitment to financial stability, evidenced by robust capital ratios exceeding regulatory requirements and a consistently low non-performing loan ratio below 2% as of Q1 2024, provides clients with exceptional security and peace of mind.

Credem excels in blending advanced digital capabilities with personalized human advice, creating a seamless and supportive banking experience. This synergy ensures both convenience through its user-friendly digital platforms and expert guidance for complex financial needs.

Furthermore, Credem's dedication to sustainable growth and ESG principles attracts clients who prioritize responsible financial practices, aligning their investments with ethical considerations and a vision for long-term prosperity.

| Value Proposition Component | Description | Supporting Data (as of Q1 2024) |

|---|---|---|

| Comprehensive Financial Services | All-inclusive banking, asset management, and insurance offerings. | Net profit of €178.3 million, demonstrating strength from diverse revenue streams. |

| Financial Stability & Security | High capital ratios and low NPLs ensure client asset safety. | CET1 ratio well over 15%; NPL ratio below 2%. |

| Digital-Human Synergy | Advanced digital platforms complemented by expert personal advice. | Over 70% of customer interactions via digital channels; ongoing investment in advisor training. |

| Commitment to Sustainability | Focus on ESG principles and sustainable financial products. | Expansion of ESG-linked financial product offerings. |

Customer Relationships

Credito Emiliano, or Credem, cultivates strong customer connections via its extensive network of financial advisors and private bankers. These professionals offer bespoke guidance on investments, wealth management, and insurance, ensuring clients' financial aspirations and risk tolerances are precisely addressed. This dedicated support builds enduring trust and loyalty.

Credito Emiliano significantly enhances customer relationships through digital self-service, offering a comprehensive mobile banking app and internet banking platform. These tools empower customers to manage accounts and conduct transactions independently, providing 24/7 convenience for digitally-inclined users.

In 2023, Credito Emiliano reported a substantial increase in digital transactions, with over 85% of customer interactions occurring through digital channels, highlighting the success of their self-service strategy.

The bank actively invests in its digital offerings, with recent updates to the mobile app in early 2024 introducing features like personalized financial planning tools and enhanced security protocols, further solidifying customer empowerment.

Credito Emiliano, or Credem, offers robust customer support through a variety of channels. This includes their extensive physical branch network, accessible digital platforms, and a dedicated virtual contact center.

This multi-channel strategy allows customers to engage with Credem using their most convenient method. Whether it's a quick question via the app or a more in-depth discussion at a branch, the aim is to provide a consistent and positive experience.

In 2024, Credem continued to invest in its digital infrastructure, with over 70% of customer transactions conducted through digital channels. This digital focus complements their strong branch presence, ensuring accessibility for all customer segments.

Proactive Communication and Tailored Offers

Credito Emiliano leverages data analysis and artificial intelligence to foster proactive communication and deliver tailored offers. This approach allows Credem to anticipate client needs, offering relevant financial solutions that enhance customer satisfaction and retention. For instance, in 2024, the bank continued to invest in its 'AI next' project, specifically designed to develop products that precisely match evolving customer requirements.

- Data-Driven Insights: Credem utilizes advanced analytics to understand individual customer behaviors and preferences, enabling personalized interactions.

- Anticipatory Service: By predicting future needs, the bank can proactively reach out with relevant financial products and advice, fostering loyalty.

- AI-Powered Personalization: The 'AI next' initiative is central to creating bespoke financial solutions, aiming to boost engagement and reduce churn.

- Enhanced Customer Experience: This focus on proactive and tailored communication directly contributes to a superior banking experience, a key differentiator in the competitive financial landscape.

Community and Stakeholder Engagement

Credem actively fosters community and stakeholder engagement, underscoring its commitment to creating value for families, businesses, and the wider community. This goes beyond typical banking services, reflecting a dedication to social responsibility and long-term prosperity for all involved.

The bank's strategy includes substantial support for social and community initiatives, aiming to generate lasting value for every stakeholder. This approach enhances Credem's standing and cultivates deeper customer loyalty.

- Community Investment: In 2024, Credem continued its tradition of investing in local projects, contributing to initiatives focused on social welfare and cultural development.

- Stakeholder Value: The bank's business model prioritizes long-term value creation, ensuring that families and businesses benefit from its operations beyond just financial transactions.

- Reputation Enhancement: By actively participating in and supporting community well-being, Credem strengthens its brand image and fosters a stronger connection with its customer base.

Credito Emiliano prioritizes a multi-faceted approach to customer relationships, blending personal advisory with robust digital self-service options. This dual strategy ensures accessibility and tailored support for a diverse clientele.

The bank actively uses data analytics and AI to anticipate customer needs, offering personalized financial solutions and proactive communication. This data-driven approach, exemplified by their 'AI next' project, aims to boost engagement and customer satisfaction.

Credem's commitment extends to community engagement, investing in social initiatives to build long-term value and enhance stakeholder relationships, which in turn strengthens customer loyalty.

| Customer Relationship Aspect | Description | 2024 Data/Initiatives |

|---|---|---|

| Personalized Advisory | Bespoke guidance from financial advisors and private bankers. | Continued focus on tailored wealth management and investment advice. |

| Digital Self-Service | Mobile and internet banking for convenient account management. | Over 70% of customer transactions via digital channels. |

| Data-Driven Personalization | AI and analytics for anticipating needs and offering tailored solutions. | Investment in 'AI next' project for precise product matching. |

| Community Engagement | Support for social and community initiatives. | Continued investment in local projects for social welfare and cultural development. |

Channels

Credem's extensive branch network, a key element of its business model, comprises over 600 physical locations throughout Italy. This robust network serves as the primary touchpoint for customers seeking personalized financial advice, account management, and the opening of new services. The branches are integral to Credem's strategy of offering a blend of traditional banking services with a strong local presence, fostering customer loyalty and trust.

The Credem Mobile Banking app is a cornerstone digital channel, providing customers with comprehensive tools to manage accounts, credit cards, payments, and investments. Its intuitive design, featuring biometric login and regular enhancements, ensures a seamless and secure on-the-go banking experience.

Credem's internet banking platform offers a robust digital gateway for customers to manage their finances. This channel facilitates account access, fund transfers, bill payments, and a wide array of other banking operations directly from a computer, emphasizing convenience and operational efficiency.

This online service acts as a comprehensive digital hub, complementing the mobile application with a more expansive interface for detailed financial management and strategic planning. As of the first quarter of 2024, Credem reported a significant increase in digital transaction volumes, underscoring the growing reliance on its internet banking services.

Network of Financial Advisors and Private Bankers

Credito Emiliano leverages a dedicated network of financial advisors and private bankers as a crucial channel for delivering its wealth management, investment advice, and private banking services. These highly trained professionals offer personalized, high-touch client interactions, often accommodating client schedules for meetings.

This specialized channel is particularly vital for attracting and serving high-net-worth individuals and clients requiring intricate financial planning. In 2024, Credito Emiliano continued to invest in its advisory force, recognizing that direct client relationships are key to retaining and growing its affluent customer base.

- Client Acquisition: Advisors actively identify and onboard new clients, particularly those with substantial assets seeking expert guidance.

- Relationship Management: Private bankers cultivate deep, long-term relationships, understanding individual client needs and financial goals.

- Service Delivery: This channel facilitates the delivery of tailored investment portfolios, estate planning, and other sophisticated financial solutions.

- Trust and Expertise: The personal touch of advisors builds trust, a cornerstone for managing significant wealth and complex financial matters.

Corporate Centers and Specialized Agencies

Credito Emiliano, or Credem, leverages specialized corporate centers and a network of Avvera agents and collaborators as key channels within its business model. These channels are specifically designed to serve the needs of businesses and to offer focused expertise on particular product lines, such as loans and mortgages. This approach ensures that corporate clients and those with specialized financial requirements receive dedicated attention and tailored solutions.

These specialized channels allow Credem to provide a higher level of service for complex business transactions and niche financial products. For instance, the Avvera network, comprising over 150 agencies and more than 3,000 professionals as of 2024, is instrumental in reaching and supporting small and medium-sized enterprises (SMEs) with their credit needs. This focused distribution strategy helps Credem to effectively manage its diverse customer base and product offerings.

- Specialized Expertise: Corporate centers and Avvera agents offer deep knowledge in areas like business finance and specialized lending.

- Tailored Solutions: This channel allows for customized financial products and advisory services for corporate clients.

- Network Reach: The Avvera network, with its extensive presence, facilitates access to a broad range of businesses across Italy.

- Efficient Service Delivery: By segmenting services through these specialized channels, Credem enhances the efficiency and effectiveness of its client support.

Credem's digital channels, including its mobile app and internet banking, are crucial for customer engagement and transaction processing. These platforms offer a comprehensive suite of services, from account management to investment tools, reflecting a strong push towards digital accessibility. As of the first quarter of 2024, Credem observed a notable uptick in digital transaction volumes, highlighting customer preference for these convenient and efficient methods.

The bank's physical branch network, numbering over 600 locations across Italy, remains a vital channel for personalized customer interaction and relationship building. This extensive presence supports Credem's strategy of blending traditional banking values with modern accessibility, fostering trust and loyalty among its diverse clientele.

Credem also utilizes a dedicated network of financial advisors and private bankers, a key channel for high-net-worth individuals and complex financial planning needs. These professionals provide tailored advice and relationship management, a strategy that Credito Emiliano continued to reinforce with investments in its advisory force throughout 2024.

Specialized channels, including corporate centers and the Avvera network of agents, cater to business clients and specific product lines like loans and mortgages. The Avvera network, with over 150 agencies and more than 3,000 professionals in 2024, is particularly effective in reaching and serving small and medium-sized enterprises with their credit requirements.

| Channel Type | Key Services | 2024 Focus/Data Point |

|---|---|---|

| Physical Branches | Personalized advice, account management, new service openings | Over 600 locations across Italy |

| Mobile Banking App | Account management, payments, investments, biometric login | Increased digital transaction volumes |

| Internet Banking | Account access, fund transfers, bill payments, financial management | Complements mobile app with expansive interface |

| Financial Advisors/Private Bankers | Wealth management, investment advice, private banking | Continued investment in advisory force for high-net-worth clients |

| Corporate Centers & Avvera Network | Business finance, specialized lending, mortgages for SMEs | Avvera: 150+ agencies, 3,000+ professionals |

Customer Segments

Credito Emiliano, or Credem, serves a wide range of individuals and families through its retail banking operations. This segment is crucial, forming a significant portion of the bank's overall customer base. They rely on Credem for essential everyday financial services.

The bank offers a comprehensive suite of products designed for personal financial management. This includes current accounts for daily transactions, savings accounts for accumulating wealth, mortgages for homeownership, and personal loans for various needs. Credem aims to make these services accessible and easy to use for its retail customers.

In 2024, Credem continued to emphasize its commitment to this segment, with retail deposits forming a substantial part of its funding structure. For instance, as of the first half of 2024, retail customer deposits remained a stable and significant funding source for the bank, underpinning its lending activities and overall financial stability.

Credito Emiliano, or Credem, offers robust corporate banking solutions tailored for small and medium-sized businesses (SMEs). These include essential services like business loans, efficient payment processing, and sophisticated treasury management designed to support daily operations and growth.

SMEs are a cornerstone of economic vitality, and Credem's commitment to this segment is evident in its focus on fostering their development. By providing targeted financial tools, the bank empowers these businesses to navigate their operational challenges and pursue expansion opportunities, contributing to broader economic progress.

In 2024, the Italian SME sector, representing over 99% of all businesses, continued to be a significant driver of employment and economic activity. Credem's financial support, including a reported increase in lending to SMEs in the first half of 2024, directly addresses their critical need for capital to invest and scale.

Credito Emiliano's private banking division caters to high net worth individuals, offering tailored wealth management, investment advice, and bespoke financial planning. This segment, often characterized by complex financial needs and a desire for long-term wealth preservation, benefits from dedicated relationship managers who provide exclusive and comprehensive financial stewardship.

Corporate Clients and Large Enterprises

Credem extends its financial expertise beyond small and medium-sized enterprises to cater to large corporate clients and enterprises. These sophisticated clients often require more than standard banking services, demanding complex financing arrangements, international banking capabilities, and specialized advisory support to navigate their extensive global operations and intricate financial structures. For instance, in 2024, Credem continued to facilitate significant corporate lending and structured finance deals, demonstrating its capacity to support the strategic objectives of major businesses.

The bank's commitment to these larger entities is reflected in its tailored solutions designed to meet their unique needs. This includes offering robust banking partnerships that can handle the scale and complexity of their operations, ensuring seamless international transactions and providing strategic financial guidance. Credem’s focus on building long-term relationships with corporate clients underscores its role as a key financial partner for growth and stability in the corporate landscape.

Key service areas for corporate clients include:

- Complex Financing Solutions: Structuring and providing large-scale loans, syndicated facilities, and project finance.

- International Banking Services: Facilitating cross-border transactions, trade finance, and foreign exchange management.

- Specialized Advisory: Offering strategic financial advice, M&A support, and risk management expertise.

- Treasury Management: Providing advanced tools and services for efficient cash and liquidity management.

Public Administration (Digital Services)

Credito Emiliano, through its subsidiary Credemtel, actively engages with the Public Administration sector, offering a suite of digital services and technological solutions. This strategic focus demonstrates the bank's capacity to deliver specialized digital infrastructure and services, extending its reach beyond conventional banking operations.

This diversification into public sector digital solutions is a key element of Credem's strategy to broaden its market presence. By providing essential technological support to government entities, Credem positions itself as a vital partner in the digital transformation of public services.

- Digital Transformation: Credemtel supports public administration in digitizing processes and improving citizen service delivery.

- Technological Infrastructure: The bank provides secure and scalable technological solutions tailored to the unique needs of government bodies.

- Market Expansion: This segment allows Credem to tap into a new revenue stream and build relationships within the public sector.

Credito Emiliano's customer base is diverse, encompassing individuals, families, small and medium-sized enterprises (SMEs), large corporations, and public administration entities. This broad reach allows the bank to offer a wide array of financial products and services tailored to the specific needs of each segment.

The bank's retail segment is a cornerstone, serving individuals and families with everyday banking needs like current accounts, savings, mortgages, and personal loans. For businesses, Credem provides crucial support to SMEs through loans, payment processing, and treasury management, recognizing their vital role in the Italian economy, which in 2024 continued to see SMEs as the backbone of employment.

Furthermore, Credem's private banking caters to high-net-worth individuals with specialized wealth management, while its corporate banking division supports large enterprises with complex financing, international services, and advisory. The bank also extends its reach into the public sector through Credemtel, offering digital transformation and technological infrastructure solutions.

| Customer Segment | Key Offerings | 2024 Relevance/Data Point |

|---|---|---|

| Individuals & Families (Retail) | Current accounts, savings, mortgages, personal loans | Retail deposits remained a significant funding source in H1 2024. |

| Small & Medium-sized Enterprises (SMEs) | Business loans, payment processing, treasury management | Italian SMEs, over 99% of businesses, are key employment drivers; Credem saw increased lending to SMEs in H1 2024. |

| High Net Worth Individuals (Private Banking) | Wealth management, investment advice, financial planning | Focus on long-term wealth preservation and tailored financial stewardship. |

| Large Corporations & Enterprises | Complex financing, international banking, specialized advisory | Facilitated significant corporate lending and structured finance deals in 2024. |

| Public Administration | Digital services, technological solutions (via Credemtel) | Support for public sector digital transformation and infrastructure. |

Cost Structure

Personnel costs represent a substantial part of Credito Emiliano's (Credem) expenses. These costs encompass salaries, benefits, and ongoing training for their extensive team of employees, financial advisors, and agents. This investment in human capital is vital for ensuring high-quality service and specialized expertise throughout Credem's varied business activities.

The banking and advisory sectors are inherently labor-intensive, and Credem's significant personnel expenses underscore this reality. For instance, in 2023, Credem reported personnel expenses amounting to €1.3 billion, reflecting the substantial investment in its workforce to deliver its comprehensive range of financial services.

Credem dedicates significant resources to its digital transformation, a crucial element of its business model. In 2024, these investments are expected to continue their upward trajectory, covering essential areas like upgrading IT infrastructure, developing advanced AI capabilities for customer service and risk management, and expanding cloud-based solutions. These outlays are fundamental to delivering competitive digital banking services and streamlining internal processes.

Cybersecurity is a paramount concern, and a substantial portion of Credem's technology budget is allocated to robust security measures. Protecting customer data and maintaining the integrity of digital platforms are non-negotiable. This focus ensures compliance with evolving regulations and builds trust in an increasingly digital financial landscape.

Credito Emiliano's branch network operating expenses represent a substantial portion of its cost structure. These costs encompass the upkeep of its physical locations, including rent, utilities, and essential security measures. For instance, in 2023, the bank reported operating expenses related to its branch network, reflecting the ongoing investment in maintaining this crucial customer touchpoint.

Staffing costs are another significant component within these operating expenses. Each branch requires personnel to manage customer interactions, provide financial advice, and handle daily transactions. The commitment to a physical presence means ongoing expenditure on salaries, benefits, and training for its branch employees, underscoring the importance of human capital in their service model.

While digital transformation is a strategic focus, the physical branch network continues to be a cornerstone of Credem's customer engagement strategy. These expenses, therefore, are not merely operational but are also tied to maintaining customer loyalty and accessibility, particularly for segments that prefer in-person banking services. This balance between physical and digital infrastructure shapes their overall cost base.

Regulatory Compliance and Contributions

As a regulated financial institution, Credito Emiliano (Credem) faces significant expenses tied to regulatory compliance. These costs are fundamental to maintaining financial system stability and safeguarding customer assets.

These mandatory payments include contributions to specific funds designed to support distressed banks and guarantee funds for life insurance policies, ensuring a safety net for policyholders. Adherence to these stringent regulatory frameworks is an essential and non-negotiable aspect of Credem's operational model.

For instance, in 2023, the Italian banking system, including institutions like Credem, contributed to the Deposit Guarantee Scheme (DGS). While specific figures for Credem's exact contribution to all such funds are proprietary, the broader Italian banking sector's DGS contributions are substantial, reflecting the commitment to systemic stability.

Key cost drivers within this category include:

- Regulatory Reporting and Supervision: Costs associated with fulfilling extensive reporting requirements to national and European authorities.

- Deposit Guarantee Scheme Contributions: Mandatory payments to protect depositors in case of bank failure.

- Insurance Policy Guarantee Funds: Contributions to funds that protect policyholders of life insurance products.

- Compliance Personnel and Technology: Investment in skilled staff and sophisticated systems to manage and monitor adherence to evolving regulations.

Marketing and Administrative Expenses

Credito Emiliano, or Credem, allocates significant resources to marketing and administrative expenses as a core part of its business model. These costs are essential for maintaining its market presence and operational efficiency. For instance, in 2024, a substantial portion of Credem's operating expenses would be dedicated to advertising campaigns aimed at attracting new clients and reinforcing its brand image as a reliable financial institution.

Customer acquisition efforts, including the costs associated with onboarding new accounts and providing initial support, also contribute to this category. Furthermore, general administrative overhead, encompassing salaries for management and support staff, rent for branches, and IT infrastructure, forms a critical component of Credem's cost structure. Efficient management of these expenses is paramount for ensuring profitability and sustained growth within the competitive banking sector.

- Marketing and advertising: Costs for brand promotion and customer outreach.

- Customer acquisition: Expenses related to bringing in new clients.

- Administrative overhead: Includes staff, facilities, and operational support.

- Profitability driver: Effective management of these costs directly impacts the bottom line.

Credito Emiliano's cost structure is heavily influenced by its extensive branch network and the personnel required to operate it. These physical locations incur ongoing expenses for maintenance, utilities, and security, representing a significant investment in customer accessibility and service delivery.

The bank's commitment to digital transformation also drives substantial costs, particularly in IT infrastructure upgrades, AI development, and cybersecurity. These investments are crucial for remaining competitive and ensuring the security of digital platforms.

Regulatory compliance is another major cost center, involving mandatory contributions to guarantee funds and expenses for reporting to authorities. These outlays are essential for maintaining financial stability and customer trust.

| Cost Category | Description | 2023 Data (EUR Billion) |

|---|---|---|

| Personnel Costs | Salaries, benefits, training for employees and advisors | 1.3 |

| Branch Network Operations | Rent, utilities, security, and upkeep of physical locations | Not specified separately, but a significant component of operating expenses |

| Digital Transformation & IT | Infrastructure upgrades, AI development, cloud solutions | Ongoing significant investment, expected to increase in 2024 |

| Cybersecurity | Measures to protect customer data and digital platforms | Substantial portion of technology budget |

| Regulatory Compliance | Contributions to guarantee funds, reporting costs | Significant, reflecting commitment to systemic stability (e.g., DGS contributions for Italian banks) |

| Marketing & Administrative | Advertising, customer acquisition, overheads | Substantial portion of operating expenses, crucial for market presence and efficiency |

Revenue Streams

Credito Emiliano's (Credem) principal revenue generator is Net Interest Income (NII). This income arises from the spread between the interest Credem earns on its loan portfolio and investments, and the interest it pays out on customer deposits and other borrowings. It’s the bedrock of their traditional banking operations.

In 2024, Credem demonstrated robust performance in this area. For the first nine months of 2024, Net Interest Income reached €1.33 billion, marking a substantial increase of 16.9% compared to the same period in 2023. This growth underscores the bank's effectiveness in managing its interest-earning assets and liabilities.

Credito Emiliano generates significant income through fees and commissions on its diverse financial services. This includes revenue from managing assets for clients, which is a key component of their non-interest income. For instance, in 2023, fees and commissions represented a substantial portion of their total operating income, underscoring the importance of this revenue stream.

Credito Emiliano, or Credem, generates significant revenue from insurance premiums collected via its subsidiaries Credemvita and Credemassicurazioni. These premiums stem from a diverse range of life and non-life insurance products, demonstrating a robust bancassurance strategy.

This revenue stream has experienced notable growth, a testament to Credem's effective integration of insurance offerings into its core banking services. For instance, in 2024, the group continued to see positive contributions from this segment, bolstering its overall financial performance.

Insurance premiums are a crucial element in diversifying Credem's income, offering a stable and expanding source of revenue that complements its traditional banking activities.

Income from Financial Activities

Credito Emiliano, or Credem, generates income from its financial activities, which encompass trading, hedging, and the disposition of financial assets. These income streams can include realized gains from their securities portfolios and other investment ventures.

These financial activities, while subject to market fluctuations, play a role in the group's overall operating income and bolster its financial adaptability. For instance, in the first quarter of 2024, Credem reported a net profit of €162.7 million, with a significant portion of its income derived from its diversified financial operations.

- Trading Gains: Income generated from actively buying and selling financial instruments.

- Hedging Activities: Revenue derived from strategies designed to mitigate financial risks.

- Sale of Financial Assets: Profits realized from selling investment holdings, such as securities.

- Investment Portfolio Performance: Contributions to income from the overall performance and management of the group's investment assets.

Digital Services Revenue

Credito Emiliano, through its subsidiary Credemtel, generates revenue by offering a suite of digital services tailored for businesses and public administration entities. This strategic move diversifies the group's income sources, moving beyond conventional banking activities into the burgeoning tech-focused service sector.

This digital services revenue stream is particularly significant as organizations increasingly embrace digital transformation. In 2023, Credemtel's contribution to the group's overall performance underscored this trend, with digital services becoming a key growth engine.

- Digital Services Growth: Credemtel's focus on digital solutions for businesses and public administration represents a forward-looking revenue stream for the Credito Emiliano group.

- Diversification Strategy: This segment highlights Credem's commitment to expanding its offerings beyond traditional banking into technology-driven services.

- Market Relevance: The increasing demand for digital transformation solutions makes this revenue stream a crucial area of income as the market evolves.

- 2023 Performance Indicators: Credemtel's performance in 2023 demonstrated the growing importance of digital services, contributing positively to the group's financial results.

Credito Emiliano's revenue streams are diverse, extending beyond traditional banking to encompass insurance and digital services. Net Interest Income remains the primary driver, with substantial growth observed in 2024. Fees and commissions from asset management and other financial services also contribute significantly, showcasing the bank's ability to monetize its service offerings.

The bancassurance model, through subsidiaries like Credemvita, generates consistent income from insurance premiums. Furthermore, Credemtel's digital services cater to the growing demand for tech-driven solutions, marking a strategic expansion into new markets and revenue channels.

| Revenue Stream | Description | 2024 (9M) | 2023 (Annual) |

|---|---|---|---|

| Net Interest Income | Interest earned on loans and investments minus interest paid on deposits. | €1.33 billion (+16.9% YoY) | N/A |

| Fees and Commissions | Revenue from asset management and other financial services. | N/A | Significant portion of operating income |

| Insurance Premiums | Income from life and non-life insurance products via subsidiaries. | Positive contribution | N/A |

| Trading Gains & Investment Income | Profits from trading, hedging, and sales of financial assets. | Contributed to net profit | N/A |

| Digital Services | Revenue from digital solutions offered by Credemtel. | Key growth engine | Demonstrated importance |

Business Model Canvas Data Sources

The Credito Emiliano Business Model Canvas is informed by a blend of internal financial statements, customer transaction data, and regulatory filings. These sources provide a comprehensive view of the bank's operational performance and market position.