Credito Emiliano Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Credito Emiliano Bundle

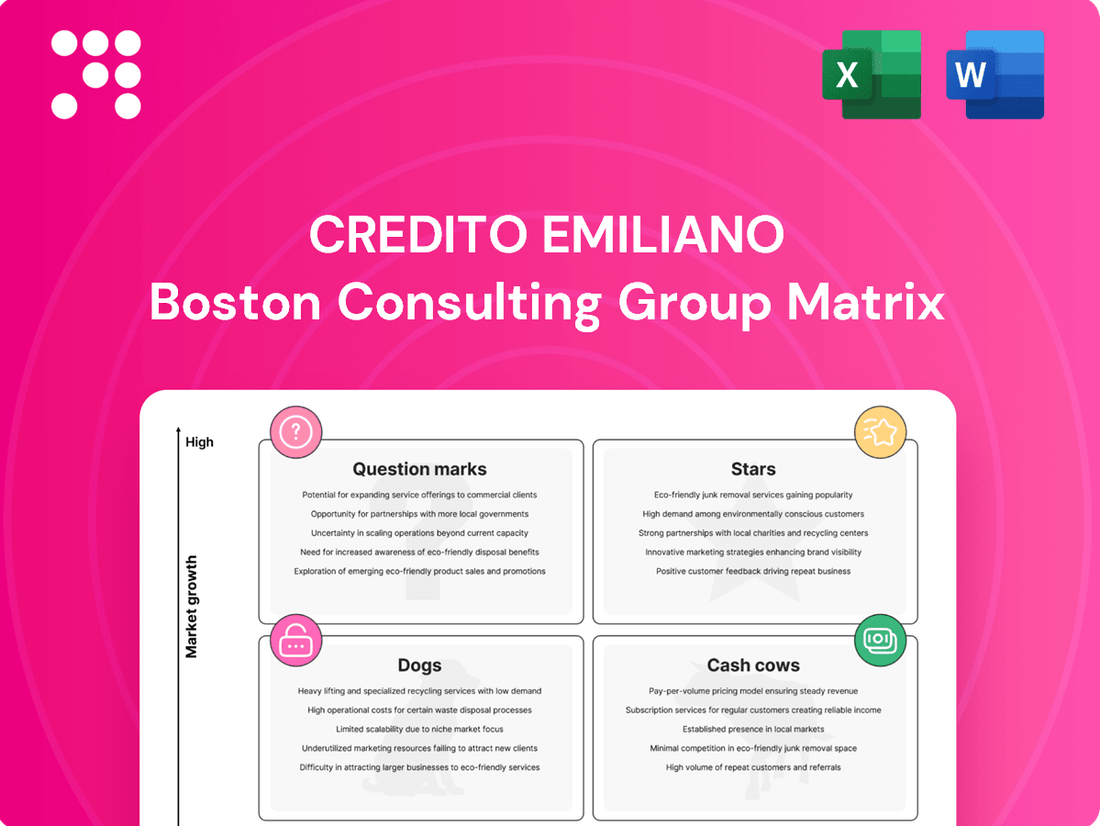

Unlock the strategic potential of Credito Emiliano with our in-depth BCG Matrix analysis. See precisely where its offerings fit – are they thriving Stars, reliable Cash Cows, underperforming Dogs, or promising Question Marks? This preview offers a glimpse into their market standing.

Don't miss out on the full picture! Purchase the complete BCG Matrix report to gain detailed quadrant placements and actionable insights that will guide your investment and product development decisions for Credito Emiliano.

Stars

Credito Emiliano is actively integrating artificial intelligence to bolster online security and personalize product offerings. This strategic move aligns with the booming digital banking sector, which is expected to grow at a compound annual growth rate of 10.9% through 2025. Credem's commitment to a digital-first approach, including its AI initiatives, positions these services as significant contributors to the bank's future growth.

Credito Emiliano's Wealth Management & Private Banking, spearheaded by Credem Euromobiliare Private Banking, is a significant player in the financial landscape. As of the close of 2024, this segment impressively managed total assets valued at €45.6 billion, demonstrating substantial client trust and market penetration. This robust asset base contributed to a healthy net profit of €78.7 million for the year.

The segment's excellence was further underscored by its recognition as Miglior Banca Private 2024. This award acknowledges its innovative and sustainable strategies, positioning it as a leader in a market segment that is seeing a surge in demand for tailored financial planning and advisory services.

Credito Emiliano, or Credem, is making significant strides in the burgeoning field of ESG and sustainable finance. By the close of 2024, the bank had amassed over €14 billion in Assets under Management specifically for sustainable products. This figure represents a substantial 46% of the Group's total managed assets, highlighting a strong focus on this growing market segment.

Credem's commitment is further demonstrated through its issuance of Green, Social, and Sustainability Bonds, alongside providing more than €480 million in ESG-related financing. These actions underscore Credem's position as a key participant in a financial sector experiencing robust growth and increasing investor interest in sustainability.

Credemtel (Technology Services for Businesses)

Credemtel, a key player in technology services for businesses, demonstrated impressive growth in 2024. The company's total revenues reached €43.7 million, a notable 14.3% increase compared to the previous year. This strong financial performance, which also includes a net profit of €6.5 million, highlights Credemtel's expanding market presence and the high demand for its specialized services.

Credemtel's significant revenue surge and profitability solidify its classification as a Star within the Credito Emiliano group. This classification is attributed to its high market share and rapid growth rate in the business technology services sector.

- Revenue Growth: €43.7 million in 2024, up 14.3% year-on-year.

- Net Profit: €6.5 million in 2024.

- Market Position: Strong market share and high growth in business technology services.

- BCG Matrix Classification: Star, indicating high growth and high market share.

New Customer Acquisition via Digital Channels

Credito Emiliano's strategic push into digital channels is clearly paying off, significantly boosting their new customer acquisition efforts. In 2024 alone, they welcomed around 29,000 new clients primarily through these online platforms. This highlights the considerable growth opportunities available by leveraging modern, user-friendly digital interfaces to reach a broader audience.

This success in attracting new customers digitally positions "New Customer Acquisition via Digital Channels" as a strong Star within Credem's operations. It reflects an efficient and scalable method for expanding their customer base, a critical factor for sustained growth and market share expansion in today's competitive banking landscape.

- Digital Onboarding Success: Approximately 29,000 new clients were acquired through digital channels in 2024.

- High Growth Potential: Demonstrates the significant capacity for customer growth via accessible online platforms.

- Star Category: Efficient digital customer acquisition solidifies this area as a key Star in the BCG Matrix.

- Strategic Importance: Underlines the value of investing in and optimizing digital engagement for future expansion.

Credemtel, with its robust revenue growth of 14.3% in 2024 to €43.7 million and a net profit of €6.5 million, clearly demonstrates high market share and rapid expansion in the business technology services sector. This performance firmly places Credemtel in the Star category of the BCG matrix, signifying a high-growth, high-market-share business unit.

Similarly, Credito Emiliano's digital customer acquisition strategy is a standout performer. In 2024, approximately 29,000 new clients were brought in through digital channels, indicating both high growth potential and a strong existing market position in this area. This success also warrants its classification as a Star.

| Business Unit | Market Growth | Market Share | BCG Classification |

|---|---|---|---|

| Credemtel (Tech Services) | High | High | Star |

| Digital Customer Acquisition | High | High | Star |

What is included in the product

This BCG Matrix analysis of Credito Emiliano offers strategic insights into its product portfolio, highlighting which units to invest in, hold, or divest.

Credito Emiliano's BCG Matrix offers a clear visual of business unit performance, relieving the pain of strategic uncertainty.

Cash Cows

Credem's core retail banking operations represent a significant cash cow, consistently generating stable revenue through its extensive branch network and large customer base. By the end of December 2024, customer deposits had climbed to €105.3 billion, underscoring the robust and dependable nature of its funding sources.

While loan growth within this traditional segment might be moderate, the substantial volume and inherent stability of deposits, coupled with established lending practices, guarantee sustained profitability for Credem.

Credem's established corporate banking services are a cornerstone of its operations, reflecting its deep roots as an Italian banking group. These offerings provide a full spectrum of financial solutions to businesses, leveraging long-standing client relationships and a significant presence in the mature corporate finance sector.

This segment consistently generates substantial profits and cash flow for Credem. In 2023, Credem reported a net profit of €535.5 million, with corporate banking playing a vital role in this performance. The mature nature of this market means that the need for aggressive expansion investments is lower, allowing these services to act as reliable cash generators.

Credem's insurance products are a cornerstone of its financial services, seamlessly integrated and frequently offered to its vast network of individual and family clients. This cross-selling strategy leverages existing client relationships to generate consistent fee income and recurring revenue, particularly within a well-established and mature market segment.

The company's strong distribution network and the deep-seated trust it has cultivated with its customer base translate into a significant market share for these insurance offerings among Credem's clientele. This allows the insurance segment to act as a reliable cash generator, contributing steadily to the bank's overall financial performance.

Factoring Services (Credemfactor)

Credemfactor, the factoring division of Credito Emiliano, is a prime example of a Cash Cow within the group's BCG Matrix. In 2024, it recorded impressive results, with €5.2 billion in gross flows of credits assigned by customers. This substantial volume points to a significant and stable market share in the factoring industry.

The net profit generated by Credemfactor in 2024 was €11.8 million, underscoring its consistent profitability. As a well-established financial service, factoring typically exhibits mature market characteristics, meaning it generates substantial cash flow with predictable, relatively low operational costs. This financial stability is the hallmark of a Cash Cow.

- Credemfactor's 2024 Performance: €5.2 billion in gross flows and €11.8 million in net profit.

- Market Position: Indicates a strong and high market share within the factoring sector.

- Cash Flow Generation: Factoring services consistently produce significant cash flow due to their mature nature.

- Operational Stability: Relatively stable operational costs contribute to its reliable profitability as a Cash Cow.

Leasing Services (Credemleasing)

Credemleasing stands as a robust Cash Cow within the Credito Emiliano group, demonstrating consistent profitability and a dominant market position. In 2024, this segment generated €1,196 million in total stipulated volumes and a healthy net profit of €39.2 million, underscoring its significant contribution to the group's overall financial health. The stable demand for leasing services in the Italian market, coupled with Credemleasing's operational efficiency, ensures a reliable and substantial cash flow generation.

The strength of Credemleasing as a Cash Cow is further evidenced by its ability to consistently deliver strong financial results. Its established presence and high market share in the Italian leasing sector mean that it requires minimal investment to maintain its position, allowing it to generate significant free cash flow. This consistent performance makes it a cornerstone of Credem Group's financial stability.

- 2024 Total Stipulated Volumes: €1,196 million

- 2024 Net Profit: €39.2 million

- Market Position: High market share in the Italian leasing market

- Cash Flow Contribution: Steady and significant contributor to Credem Group

Credem's core retail and corporate banking, alongside its factoring and leasing divisions, clearly exemplify Cash Cows within its BCG Matrix. These segments benefit from established market positions and stable revenue streams, requiring minimal new investment to maintain their strong performance.

The consistent profitability and substantial cash generation from these operations are vital for funding other business units and overall group growth. For instance, Credemfactor's €5.2 billion in gross flows and €11.8 million net profit in 2024, and Credemleasing's €1,196 million in stipulated volumes and €39.2 million net profit in the same year, highlight their reliable financial contributions.

| Segment | 2024 Net Profit | 2024 Key Metric | Market Position | Cash Flow Contribution |

|---|---|---|---|---|

| Credemfactor (Factoring) | €11.8 million | €5.2 billion (Gross Flows) | Strong/High Market Share | Significant & Stable |

| Credemleasing (Leasing) | €39.2 million | €1,196 million (Stipulated Volumes) | High Market Share | Steady & Substantial |

| Retail Banking | N/A (Part of overall results) | €105.3 billion (Customer Deposits) | Extensive Network | Dependable Funding & Profitability |

Preview = Final Product

Credito Emiliano BCG Matrix

The Credito Emiliano BCG Matrix preview you are viewing is the identical, fully formatted document you will receive immediately after purchase. This means no watermarks, no demo content, and no surprises – just a comprehensive strategic analysis ready for your immediate use. You are essentially getting a direct look at the final, polished report that will empower your decision-making. This preview guarantees that the quality and detail of the Credito Emiliano BCG Matrix are exactly as you see them now, ensuring you receive a professional and actionable resource.

Dogs

Credito Emiliano's merchant acquiring business, divested in January 2025, generated an extraordinary income of €95 million upon its transfer to Worldline. This strategic exit suggests the business operated with a low market share or within a low-growth sector for Credem, or was not deemed a core component of its future strategic direction. Such characteristics firmly place this segment within the 'Dog' category of the BCG matrix.

Certain legacy physical branches within Credito Emiliano's extensive network might be classified as Dogs in the BCG Matrix. These are branches situated in regions experiencing economic stagnation or decline, potentially struggling to attract new clients and retain existing ones.

If these locations aren't updated or strategically repurposed, they could become low-growth, low-market-share assets. Such branches may consume valuable resources without yielding commensurate returns, a common hurdle for traditional banking institutions.

Within Credito Emiliano's (Credem) diverse offerings, certain legacy niche financial products may be experiencing diminished customer engagement. These products, often lacking modern digital integration and failing to keep pace with evolving market demands, could represent declining assets with limited future growth potential.

If these older products have not been refreshed or are challenging to access through contemporary digital platforms, they might occupy a low market share. Such offerings could become cash traps, consuming resources without generating significant returns, particularly as customer preferences shift towards more agile and digitally accessible financial solutions.

Inefficient Manual Back-Office Processes

In Credito Emiliano's (Credem) back-office, manual processes represent a significant drag, classifying them as potential question marks in a BCG matrix context. These operations, often involving data entry, reconciliation, and document processing, are inherently slow to improve productivity. For instance, a 2024 report indicated that manual data handling in some European banks can increase processing times by up to 40% compared to automated systems.

These manual workflows consume substantial human capital and operational costs without directly fueling market share expansion or new revenue streams. This inefficiency means resources are diverted from growth-oriented activities. Credem's focus in 2024 has been on identifying and digitizing these areas to unlock efficiency gains.

- Manual Processing Costs: Inefficient manual back-office processes can represent a significant portion of operational expenses. For example, studies in 2024 have shown that manual invoice processing alone can cost banks between $10 and $30 per invoice, whereas automated solutions can reduce this to under $5.

- Limited Scalability: Manual operations inherently limit a bank's ability to scale its services efficiently. As transaction volumes increase, manual processes become bottlenecks, hindering growth and customer satisfaction.

- Risk of Errors: Human error is a significant concern in manual data handling. In 2024, financial institutions reported that manual data entry errors can lead to financial losses and regulatory compliance issues, impacting profitability and reputation.

Non-Performing Loan Management

Credito Emiliano's (Credem) non-performing loan (NPL) management, while crucial for maintaining asset quality, fits into the 'Cash Cows' quadrant of the BCG Matrix due to its low growth but significant cash generation potential through recovery. As of September 2024, Credem reported a Gross NPL Ratio of 1.91%, indicating effective management of troubled assets. However, the resources dedicated to NPL resolution, including specialized teams and recovery processes, represent a substantial operational cost and tie up capital that could otherwise be deployed in higher-growth areas.

These NPL management activities, while necessary, are inherently resource-intensive and yield relatively low direct returns compared to expanding core lending portfolios or investing in new, innovative financial products. This characteristic positions them as a cash trap within the BCG framework, as they consume capital and operational capacity without offering substantial growth prospects. The focus remains on efficient recovery to minimize losses and free up capital, rather than on expansion or market share gains in this specific segment.

- Low Growth Activity: NPL resolution is a mature and often declining market segment, offering limited opportunities for significant expansion.

- Resource Intensive: Managing NPLs requires dedicated staff, legal expertise, and operational infrastructure, consuming significant resources.

- Capital Tie-up: Funds allocated to NPL recovery are not available for investment in higher-return, growth-oriented business lines.

- Focus on Efficiency: The primary objective is to maximize recovery value and minimize losses, rather than to generate substantial profits from the NPL portfolio itself.

Within Credito Emiliano's portfolio, certain legacy physical branches in economically stagnant areas can be considered Dogs. These branches, often struggling with client acquisition and retention, represent low-growth, low-market-share assets. If not strategically repurposed, they consume resources without commensurate returns.

Similarly, some older, niche financial products with diminishing customer engagement and limited digital integration also fall into the Dog category. These offerings, characterized by low market share and potential cash-trap qualities, require careful management to avoid becoming a drain on resources.

The divested merchant acquiring business, sold for €95 million in January 2025, also fits the Dog profile due to its likely low market share or low-growth sector positioning for Credem. This strategic exit underscores its classification as a Dog in the BCG matrix.

| BCG Category | Credito Emiliano Examples | Characteristics | 2024 Data/Context |

|---|---|---|---|

| Dogs | Legacy physical branches in declining areas | Low market share, low growth, resource intensive | Economic stagnation in specific regions |

| Dogs | Outdated niche financial products | Diminishing customer engagement, low digital integration | Evolving customer preferences for digital solutions |

| Dogs | Divested merchant acquiring business | Low market share or low-growth sector | Sold in January 2025 for €95 million |

Question Marks

Credito Emiliano (Credem) is actively fostering fintech innovation by building strategic ecosystems. In 2024, Credem announced partnerships with several Italian universities and fintech startups, aiming to tap into the high-growth potential of emerging financial technologies. These ventures, though promising, are in their nascent stages, meaning Credem's current market share in these specific fintech niches is likely low, necessitating significant investment for expansion.

Advanced AI-powered customer solutions, such as personalized financial advisory tools, are currently in their early stages for Credito Emiliano. These innovations aim to tap into high-growth segments of customer experience and operational efficiency. Significant investment in marketing and user education will be crucial for their market penetration.

Credito Emiliano (Credem) is strategically positioning its 'wellness banking' initiatives within its digital transformation, aligning with a broader industry shift towards holistic financial and personal well-being. This focus on integrating financial health with overall wellness is a nascent but rapidly expanding area within financial services.

Given the emerging nature of 'wellness banking', Credem's offerings in this space are likely characterized by high growth potential due to unmet market demand. However, as a new entrant or early adopter, their current market penetration and customer adoption rates are probably modest, indicating a need for substantial investment to build market share and solidify a leading position.

Next-Generation Digital Onboarding Solutions

Credito Emiliano's focus on next-generation digital onboarding solutions aligns with the growing demand for remote and seamless customer acquisition in the digital banking sector. By investing in these cutting-edge capabilities, Credem aims to attract a larger segment of digitally native customers, a demographic increasingly prioritizing convenience and speed in their banking interactions.

The digital banking platform market is experiencing significant growth, driven by the need for efficient remote onboarding processes. While Credem's new digital onboarding solutions are designed to capitalize on this trend, their market share in this specific high-growth area is likely still developing as they optimize and scale their offerings to achieve market dominance.

Key aspects of Credito Emiliano's digital onboarding strategy include:

- Enhanced User Experience: Streamlining the account opening process to be intuitive and fully digital, reducing friction for new customers.

- Customer Acquisition Growth: Targeting a younger, digitally savvy customer base that expects seamless online interactions.

- Competitive Positioning: Differentiating Credem in a crowded digital banking market by offering superior onboarding technology.

- Market Share Expansion: Aiming to capture a more substantial portion of the rapidly expanding market for digital customer acquisition.

Niche Sustainable Finance Products (Beyond Core ESG)

While Credito Emiliano (Credem) has established a solid presence in broader ESG offerings, venturing into niche sustainable finance products presents significant untapped potential. These specialized areas, such as highly tailored green financing for emerging industries or intricate social impact bonds, represent high-growth opportunities that could differentiate Credem.

Currently, Credem's market share in these specialized segments is likely minimal, reflecting their nascent stage. This necessitates strategic investment to build expertise, develop innovative product structures, and scale operations effectively to capture these emerging markets.

- Niche Green Financing: Developing bespoke green loan facilities for sectors like circular economy startups or sustainable agriculture technology, which are currently underserved.

- Social Impact Bonds (SIBs): Creating or participating in SIBs focused on specific social outcomes, such as youth employment or affordable housing initiatives, potentially partnering with governmental or non-profit entities.

- Blue Bonds/Water Finance: Exploring opportunities in blue bonds, which finance marine and coastal conservation projects, or other water-related sustainable finance instruments.

- Biodiversity Credits/Finance: Investigating the emerging market for biodiversity credits or other financial instruments designed to fund conservation and ecosystem restoration efforts.

Credito Emiliano's "Question Marks" in the BCG Matrix likely encompass emerging fintech ventures and specialized sustainable finance products. These areas, while holding high growth potential, require substantial investment due to their nascent market penetration and ongoing development. Credem's strategic partnerships with universities and startups in 2024 highlight their commitment to these innovative, albeit early-stage, segments.

The bank's focus on advanced AI-powered customer solutions and 'wellness banking' also falls into this category. These initiatives are in their initial phases, necessitating significant marketing and user education to build market share. Similarly, next-generation digital onboarding solutions, while addressing a growing market need, are still being optimized for dominance.

Credem's ventures into niche sustainable finance, such as tailored green financing and social impact bonds, represent high-growth opportunities with currently minimal market share. The bank's investment in these specialized segments is crucial for developing expertise and scaling operations to capture these emerging markets effectively.

As of the first half of 2024, Credem reported a CET1 ratio of 16.3%, indicating a strong capital base to support these growth initiatives. The bank's digital transformation efforts, including investments in AI and onboarding, are key to unlocking future revenue streams in these "Question Mark" areas.

BCG Matrix Data Sources

Our Credito Emiliano BCG Matrix is built on robust financial disclosures, including annual reports and investor presentations, alongside comprehensive market research and industry growth forecasts.