Credito Emiliano Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Credito Emiliano Bundle

Credito Emiliano operates within a banking landscape shaped by intense rivalry, the significant bargaining power of its customers, and the constant threat of new entrants. Understanding these forces is crucial for navigating the competitive terrain.

The complete report reveals the real forces shaping Credito Emiliano’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Depositors hold significant bargaining power as they are the primary source of funding for banks like Credito Emiliano (Credem). This power is influenced by factors such as the availability of alternative banking solutions, the interest rates offered by competing institutions, and the depositor's perception of Credem's stability and trustworthiness.

If Credem finds itself needing to attract more deposits, it may be compelled to offer more competitive interest rates. This, in turn, would increase the bank's cost of funding, directly impacting its profitability. For instance, Credem saw its customer deposits grow by a healthy 9.0% year-on-year, reaching EUR105.3 billion by the close of December 2024, indicating a strong ability to attract and retain depositor funds.

Technology providers hold considerable sway over banks like Credito Emiliano (Credem) because of the sector's deep dependence on IT. Credem's strategic investments in AI and cloud computing, notably its partnership with Google Cloud, highlight this reliance. These specialized technology partners can command higher prices or dictate terms, especially when their solutions are critical for a bank's digital evolution and customer experience, and switching costs are substantial.

The banking industry, including Credito Emiliano (Credem), relies heavily on professionals with specialized skills in finance, risk management, IT, and cybersecurity. A scarcity of these highly qualified individuals can significantly impact operational costs and empower employees, especially those in critical technical or strategic positions.

For instance, reports from late 2023 and early 2024 highlighted persistent shortages in cybersecurity and data analytics roles across the financial sector, leading to salary increases of up to 15-20% for in-demand specialists. This trend directly translates to higher labor expenses for banks like Credem, potentially affecting their profitability and ability to invest in new technologies.

This general industry-wide challenge means Credem must contend with increased competition for talent, which can slow down innovation and hinder overall operational efficiency if key positions remain unfilled or if employee retention becomes difficult due to attractive offers elsewhere.

Regulatory Compliance Bodies

Regulatory compliance bodies, like the European Central Bank (ECB) and the Bank of Italy, wield significant influence over Credito Emiliano (Credem). These entities establish crucial capital requirements, operational standards, and adherence guidelines that Credem must follow. Failure to comply can result in substantial penalties, directly impacting the bank's expenses and strategic planning.

The bargaining power of these regulatory bodies is considerable, as their dictates can fundamentally shape a bank's operational landscape. For instance, capital adequacy ratios are a key area of focus. Credem has demonstrated strong performance in this regard, with its Pillar 2 requirement set at a robust 1% for 2025, positioning it favorably compared to many peers in both Italy and the broader European banking sector.

- Regulatory Oversight: Bodies like the ECB and Bank of Italy set the rules for banking operations, influencing everything from capital levels to compliance procedures.

- Enforcement Power: Non-compliance carries the risk of severe penalties, giving regulators substantial leverage over financial institutions like Credem.

- Capital Requirements: Credem's Pillar 2 requirement of 1% for 2025 highlights its strong capital position, a key metric scrutinized by regulators.

- Industry Benchmarking: Credem's ability to meet or exceed these requirements places it among the top-performing banks in Italy and Europe, mitigating regulatory risk.

Interbank Market Access

Interbank market access, while typically stable for established institutions like Credito Emiliano (Credem), can shift dramatically, granting significant power to suppliers during times of financial stress or liquidity shortages. Credem's capacity to tap into these wholesale funding avenues at competitive rates directly influences its cost of capital and, consequently, its profitability.

Credemholding's successful placement of a €200 million Tier 2 Subordinated Bond in May 2025 underscores its active participation in capital markets for securing diverse funding sources. This demonstrates a proactive approach to managing its funding needs, which can mitigate the bargaining power of traditional depositors and other funding providers.

- Interbank Market Influence: The ability of banks to access interbank lending and wholesale funding markets can be a crucial determinant of their operational stability, especially during periods of market uncertainty.

- Cost of Capital Impact: Credem's success in securing funding from these markets at favorable rates directly affects its overall cost of capital, influencing its lending margins and investment decisions.

- Diversified Funding Strategy: The issuance of a €200 million Tier 2 Subordinated Bond by Credemholding in May 2025 highlights a strategy to diversify its funding base beyond traditional retail deposits.

- Supplier Power Dynamics: While generally stable, the bargaining power of suppliers in the funding market can escalate significantly during liquidity crunches, making access to diverse funding channels vital for Credem.

Credito Emiliano (Credem) faces limited bargaining power from its suppliers, primarily due to the commoditized nature of many banking inputs and Credem's strong market position. While essential services like IT infrastructure and specialized consulting are necessary, the availability of multiple providers and Credem's scale generally prevent any single supplier from exerting excessive influence.

| Supplier Type | Credem's Position | Supplier Bargaining Power | Impact on Credem |

|---|---|---|---|

| IT Infrastructure & Software | Significant user, relies on specialized providers | Moderate to High (due to specialization and switching costs) | Potential for increased costs if providers dictate terms; essential for operations. |

| Professional Services (Legal, Audit) | Requires specialized expertise | Moderate (dependent on firm reputation and demand) | Costs can fluctuate based on market rates and regulatory changes. |

| Office Supplies & Utilities | Standard procurement | Low (highly commoditized, many vendors) | Minimal impact on overall profitability. |

What is included in the product

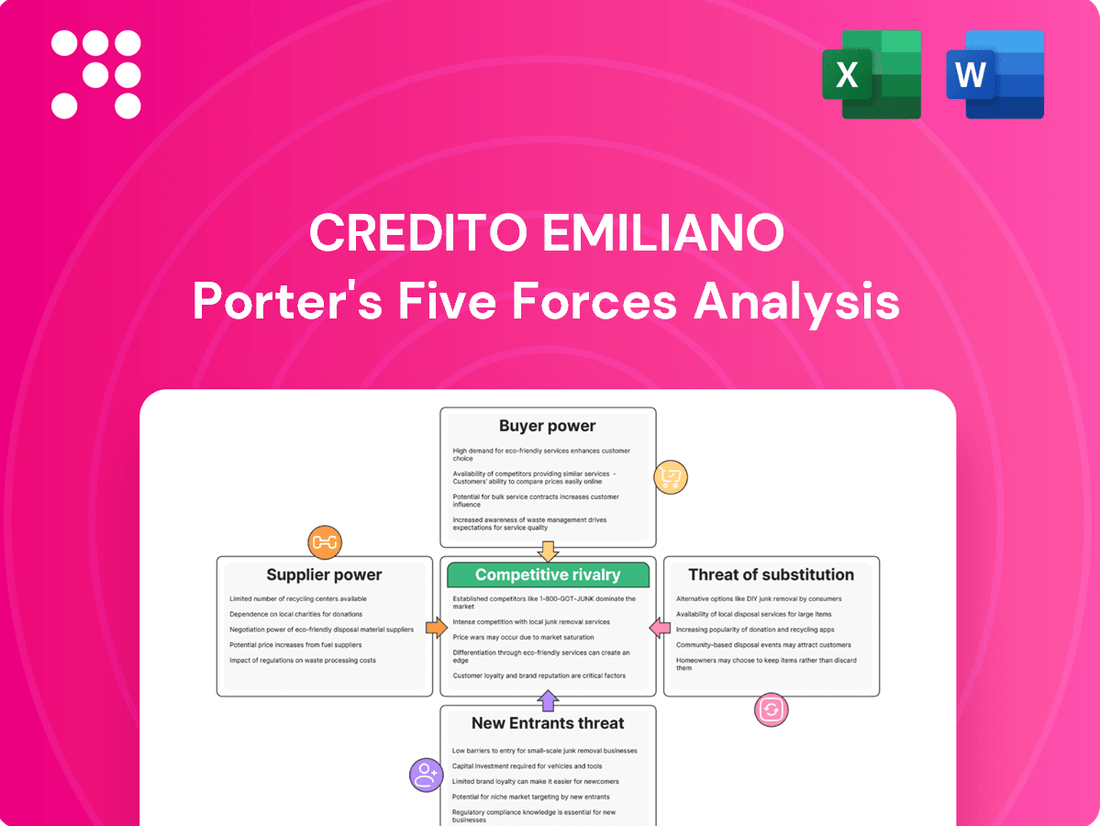

Tailored exclusively for Credito Emiliano, analyzing its position within its competitive landscape by examining the intensity of rivalry, bargaining power of customers and suppliers, threat of new entrants, and the availability of substitutes.

Effortlessly gauge competitive intensity by visualizing the impact of each Porter's Five Forces on Credito Emiliano, providing immediate clarity on strategic vulnerabilities.

Customers Bargaining Power

For fundamental retail banking needs, such as checking accounts, the effort for individual customers to switch providers is minimal, particularly as digital banking solutions simplify fund transfers. This ease of movement empowers customers to seek out more favorable terms or interest rates, thereby enhancing their leverage over financial institutions like Credito Emiliano (Credem).

Credem's recent performance highlights this dynamic, as the bank reported acquiring around 181,000 new clients in 2024, indicating a competitive environment where customer acquisition is a key focus, partly driven by customers' ability to switch services with relative ease.

Customers today have unprecedented access to information about banking products. They can easily compare interest rates, fees, and features offered by various institutions online. This transparency directly fuels price sensitivity, as consumers can pinpoint the best deals, thereby amplifying their bargaining power against banks like Credito Emiliano.

Corporate and business clients often present Credito Emiliano (Credem) with a wide array of financial requirements, encompassing areas like corporate lending, sophisticated treasury management, and tailored advisory services. These diverse needs mean Credem must offer a broad spectrum of solutions to remain competitive.

Larger enterprises, conducting significant financial transactions, possess considerable leverage to negotiate more favorable terms and bespoke financial packages. This bargaining power directly impacts Credem's corporate banking profit margins, as these clients can command better pricing and specialized offerings due to the substantial volume of business they represent.

Credem’s strategy includes serving both individual consumers with retail banking products and larger organizations with comprehensive corporate banking solutions. This dual focus means understanding and addressing the distinct bargaining power dynamics present in each segment.

Digital Platform Accessibility

The increasing accessibility of digital banking platforms significantly amplifies customer bargaining power. Customers can now easily compare offerings and switch providers, especially for straightforward transactions, reducing their reliance on any single institution. This shift means banks must compete not just on product, but on the quality and ease of their digital user experience.

Credito Emiliano (Credem) has been actively enhancing its digital service model, particularly for private individuals. By offering robust digital tools, Credem empowers customers to manage their finances more autonomously. For instance, in 2024, Credem reported a substantial increase in digital transactions, with over 70% of customer interactions occurring through digital channels, underscoring the growing customer preference and their enhanced ability to seek out the best digital solutions.

- Digital Channel Growth: Credem's digital channels are seeing increased adoption, with mobile banking app usage up by 15% year-over-year in early 2024.

- Customer Self-Service: The bank's investment in self-service digital tools allows customers to perform a wider array of banking operations without branch intervention.

- Competitive Landscape: Fintech competitors and other digital-first banks offer seamless user experiences, pressuring traditional banks like Credem to continuously innovate their digital offerings.

- Data-Driven Personalization: Leveraging customer data from digital interactions allows Credem to offer more personalized services, which can both increase loyalty and highlight areas where competitors might offer a superior digital experience.

Access to Alternative Funding for Businesses

Businesses, especially larger enterprises, increasingly tap into alternative funding avenues like corporate bonds, private equity, and direct lending from non-bank entities. This diversification lessens their dependence on traditional banks such as Credito Emiliano (Credem).

This reduced reliance significantly amplifies their bargaining power during loan negotiations with Credem. They can leverage these alternatives to secure more favorable terms.

Credem's extensive loan portfolio, reaching €36.4 billion in 2024, demonstrates its ongoing commitment to supporting businesses. However, the growing availability of alternative financing for these same businesses directly impacts their leverage in discussions with Credem.

- Alternative Funding Sources: Businesses can access corporate bonds, private equity, and direct lending, reducing reliance on traditional banks.

- Increased Bargaining Power: Access to these alternatives empowers businesses to negotiate better terms on loans from institutions like Credem.

- Credem's Loan Exposure: Credem's €36.4 billion in loans in 2024 highlights its significant role, yet customer alternatives challenge its pricing power.

Customers' ability to switch providers easily, especially with digital banking, gives them significant leverage over banks like Credito Emiliano (Credem). This ease of switching, coupled with readily available information on competing offers, makes customers more price-sensitive and assertive in negotiations. Credem's acquisition of 181,000 new clients in 2024 highlights the competitive environment where customer retention and attraction are paramount, driven by this customer power.

| Factor | Description | Impact on Credem |

| Ease of Switching | Minimal effort for retail customers to change banks, especially with digital transfers. | Increases customer leverage for better rates and terms. |

| Information Availability | Easy online comparison of rates, fees, and features. | Drives price sensitivity and amplifies customer bargaining power. |

| Digital Channel Adoption | Growing preference for digital banking enhances customer autonomy and comparison. | Pressures banks to offer superior digital experiences to retain customers. |

Same Document Delivered

Credito Emiliano Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. It details Credito Emiliano's Porter's Five Forces analysis, examining the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the threat of substitute products within its industry. This comprehensive analysis is professionally formatted and ready for your immediate use.

Rivalry Among Competitors

The Italian banking market, while historically fragmented, is actively consolidating. This trend means that while there might be many smaller banks, larger institutions are increasingly acquiring them. This consolidation is creating fewer, but more powerful, competitors, which naturally intensifies the rivalry for established players like Credito Emiliano (Credem).

Looking ahead, S&P Global Ratings anticipates that consolidation will remain a dominant theme in the Italian banking sector throughout 2025. This ongoing M&A activity suggests that the competitive landscape will continue to shift, with fewer, larger entities vying for market share, potentially increasing the pressure on all participants.

For standardized banking products like mortgages and basic current accounts, price is a major battleground. Customers frequently switch for even slightly better rates, which puts pressure on Credito Emiliano (Credem) to keep its pricing sharp. This intense price competition can squeeze profit margins for banks.

While the Italian banking sector experienced a boost in profitability in 2023, largely thanks to rising interest rates, the underlying competitive landscape remains. For instance, the average mortgage rate in Italy, while fluctuating, remained a key differentiator for customers in 2023 and early 2024, highlighting the ongoing importance of pricing strategies for banks like Credem.

While core banking products have largely become commodities, banks are increasingly differentiating themselves through enhanced digital platforms, tailored customer service, and specialized financial products. Credito Emiliano (Credem) is actively pursuing this strategy by bolstering its asset management and insurance offerings, alongside a significant push for digital innovation. This focus on unique value propositions is crucial for standing out in a crowded market.

Regulatory Landscape and Capital Requirements

The banking sector, including Credito Emiliano (Credem), operates under a rigorous regulatory framework, primarily overseen by the European Central Bank (ECB) for significant institutions. These regulations, such as the Capital Requirements Regulation (CRR) and Capital Requirements Directive (CRD), mandate specific capital ratios, liquidity coverage ratios, and leverage ratios. For instance, as of the first quarter of 2024, Credem maintained a robust Common Equity Tier 1 (CET1) ratio of 14.3%, significantly above regulatory minimums, demonstrating its strong capital position.

This stringent environment, while fostering stability and a level playing field, acts as a substantial barrier to entry for new players. New entrants must commit considerable capital to meet these requirements, limiting the number of potential competitors. Furthermore, the ongoing need for compliance necessitates significant investment in technology, personnel, and processes, diverting resources that might otherwise be used for aggressive pricing strategies.

- Stringent Capital Ratios: The ECB mandates high capital adequacy ratios, such as the CET1 ratio, requiring banks to hold a significant portion of their risk-weighted assets in high-quality capital.

- Compliance Costs: Banks must invest heavily in compliance infrastructure and expertise, impacting operational flexibility and potentially limiting price competition.

- Barriers to Entry: The substantial capital and regulatory hurdles create a high barrier for new banks seeking to enter the market, thus moderating competitive intensity.

- Credem's Capital Strength: Credem's strong capital ratios, such as its CET1 ratio of 14.3% in Q1 2024, position it favorably within this regulated landscape, highlighting its resilience and ability to meet evolving requirements.

Slowing Credit Growth and NPLs

The Italian banking sector has seen subdued credit growth, though recent indicators suggest a potential uptick. This slowdown, coupled with a long-term reduction in non-performing loans (NPLs), creates a more competitive landscape for banks like Credito Emiliano.

While overall NPLs have improved, there's a projected modest increase in default rates specifically for small and medium-sized enterprises (SMEs). This could intensify rivalry among financial institutions competing for the limited pool of creditworthy borrowers and attractive lending opportunities.

- Credit Growth: Italy's credit growth has been sluggish, with recent data from the Bank of Italy indicating a modest expansion in loans to households and businesses in late 2023 and early 2024.

- NPL Trends: The aggregate NPL ratio for Italian banks has fallen significantly, reaching multi-year lows by the end of 2023, yet the economic outlook presents potential headwinds.

- SME Default Expectations: Projections for 2024 and 2025 suggest a slight uptick in default rates for SMEs, influenced by persistent inflation and higher interest rates.

Competitive rivalry within the Italian banking sector is characterized by ongoing consolidation, with larger institutions acquiring smaller ones, intensifying competition for established players like Credito Emiliano (Credem). This trend is expected to continue through 2025, reshaping the market. Price competition on standardized products like mortgages remains fierce, pressuring profit margins, although banks are increasingly differentiating through digital services and specialized offerings.

Credem is actively enhancing its digital capabilities and expanding its asset management and insurance services to stand out. The sector's stringent regulatory environment, particularly high capital requirements like the Common Equity Tier 1 (CET1) ratio, acts as a significant barrier to entry, moderating overall rivalry. Credem's robust CET1 ratio of 14.3% in Q1 2024 demonstrates its strong capital position within this regulated landscape.

Despite a general improvement in non-performing loans (NPLs) by the end of 2023, a projected slight increase in SME defaults for 2024 and 2025 could heighten competition for creditworthy borrowers. Italy's credit growth has been subdued, with only modest expansion in loans to households and businesses observed in late 2023 and early 2024, further concentrating competition.

| Metric | Value (Q1 2024) | Source |

| Credem CET1 Ratio | 14.3% | Credito Emiliano Investor Relations |

| Italian Banking Sector NPL Ratio (End 2023) | Multi-year lows | Banca d'Italia |

| Italian Credit Growth (Late 2023/Early 2024) | Modest expansion | Banca d'Italia |

SSubstitutes Threaten

The rise of fintech and digital payment platforms presents a significant threat of substitution for traditional banking services like those offered by Credito Emiliano (Credem). These agile companies provide digital-first solutions for payments, lending, and budgeting, often bypassing established banking channels entirely. For instance, the global digital payment market was valued at over $2.5 trillion in 2023 and is projected to grow substantially, indicating a strong preference for these convenient alternatives.

Credem's strategic investment in digital transformation, including its 2023 agreement with Worldline for merchant acquiring services, demonstrates an awareness of this competitive pressure. This move aims to bolster its digital payment offerings and retain market share against non-traditional financial service providers.

The rise of peer-to-peer (P2P) lending and crowdfunding presents a significant threat of substitutes for Credito Emiliano (Credem). These platforms allow individuals and businesses to bypass traditional financial institutions for funding. For instance, by mid-2024, the global P2P lending market was projected to reach hundreds of billions of dollars, offering a direct alternative to bank loans.

These alternative finance channels empower both borrowers seeking capital and investors looking for returns, directly challenging Credem's core lending and deposit-taking businesses. The accessibility and often streamlined processes of P2P platforms can attract customers who might otherwise turn to Credem, thereby diminishing the bank's market share in certain segments.

The rise of direct investment and robo-advisory platforms presents a significant threat to traditional banking services like those offered by Credito Emiliano (Credem). These digital alternatives allow customers, especially those seeking asset management, to bypass intermediaries and invest directly. In 2024, the global robo-advisory market was valued at over $20 billion, demonstrating substantial customer adoption.

Credem's strategy to combat this involves emphasizing its comprehensive solutions and professional advisory services within its asset management and private banking divisions. By offering personalized guidance and a wider range of financial products, Credem aims to retain clients who might otherwise be drawn to the lower fees and perceived simplicity of robo-advisors.

Emergence of Neobanks and Challenger Banks

The rise of neobanks and challenger banks presents a significant threat of substitutes for traditional financial institutions like Credito Emiliano (Credem). These digital-first entities, such as Revolut and N26, operate with considerably lower overheads than brick-and-mortar banks, allowing them to offer competitive fee structures and user-friendly mobile applications. While their market share in Italy is still developing, their appeal to younger, digitally-native customers could divert business from established players.

Credem is actively addressing this by accelerating its digital transformation initiatives. This includes enhancing its online banking platforms and mobile app functionalities to meet evolving customer expectations. For instance, in 2023, Credem reported a 12.3% increase in digital transactions, signaling a growing customer preference for these channels.

- Neobanks offer lower operating costs, enabling competitive pricing.

- Digital-native customers are increasingly attracted to streamlined, app-based banking experiences.

- Credem's digital transaction volume grew by 12.3% in 2023, indicating a shift in customer behavior.

- Credem's digital transformation is crucial to retaining and attracting digitally-savvy customers.

Insurance Companies and Asset Managers

Non-bank financial institutions, such as insurance companies and independent asset managers, present a significant threat of substitutes to traditional banking services. These entities offer a range of products that directly compete with bank offerings like savings accounts, investment vehicles, and even certain lending facilities. For instance, life insurance policies with investment components or unit-linked plans can attract capital that might otherwise be deposited in a bank. In 2023, the global asset management industry saw assets under management (AUM) grow by approximately 10%, reaching over $130 trillion, highlighting the substantial pool of capital managed by these non-bank players.

Credito Emiliano (Credem) actively addresses this threat by engaging in bancassurance and asset management itself. This strategy allows Credem to capture a portion of the business that might otherwise go to external providers. By offering its own insurance and investment products, Credem not only diversifies its revenue streams but also strengthens its customer relationships by providing a more comprehensive financial service offering. As of the end of 2023, Credem's asset management division reported a notable increase in AUM, contributing positively to the group's overall financial performance.

- Insurance companies offer investment-linked products that compete with bank deposits and investment accounts.

- Independent asset managers attract significant capital, diverting funds from traditional banking services.

- The global asset management industry's AUM exceeded $130 trillion in 2023, demonstrating the scale of substitute offerings.

- Credem's bancassurance and asset management activities help mitigate this threat by internalizing customer demand.

The threat of substitutes for Credito Emiliano (Credem) is multifaceted, stemming from digital innovators and alternative finance providers. Fintech platforms, neobanks, and P2P lending services offer streamlined, often lower-cost alternatives to traditional banking. These substitutes directly challenge Credem's core services like payments, lending, and wealth management, forcing the bank to adapt through digital investment and enhanced customer service. The increasing adoption of these alternatives underscores the need for Credem to remain agile and customer-centric.

| Substitute Type | Key Offering | Credem's Response/Impact | 2023/2024 Data Point |

|---|---|---|---|

| Fintech & Digital Payments | Digital transactions, online payments | Digital transformation, merchant acquiring partnerships | Global digital payment market > $2.5 trillion (2023) |

| P2P Lending & Crowdfunding | Alternative funding for individuals/businesses | Potential reduction in loan origination | Global P2P lending market projected in hundreds of billions (mid-2024) |

| Robo-Advisory | Automated investment management | Emphasis on personalized advisory services | Global robo-advisory market valued at > $20 billion (2024) |

| Neobanks/Challenger Banks | Digital-first banking, lower fees | Accelerated digital platform enhancements | Credem digital transactions up 12.3% (2023) |

| Non-Bank Financial Institutions | Insurance products, independent asset management | Bancassurance, internal asset management growth | Global asset management AUM > $130 trillion (2023) |

Entrants Threaten

The banking sector, including institutions like Credito Emiliano (Credem), faces substantial regulatory hurdles that significantly deter new entrants. These include rigorous licensing processes, strict adherence to anti-money laundering (AML) and know-your-customer (KYC) mandates, and demanding capital adequacy requirements.

For instance, Credem's robust Common Equity Tier 1 (CET1) ratio, a key indicator of financial strength, alongside stringent Pillar 2 requirements, underscores the high capital investment necessary to operate within this environment. Such extensive compliance and capital demands create formidable barriers to entry for aspiring competitors.

Establishing a new bank necessitates enormous capital outlays to satisfy regulatory mandates, construct essential infrastructure, and cover early operational deficits. For instance, in 2024, typical initial capital requirements for a new banking license in many European jurisdictions could range from tens to hundreds of millions of euros, depending on the scope of operations.

This significant financial hurdle makes it exceedingly challenging for new entrants to enter the market at a scale that can effectively challenge established institutions like Credito Emiliano (Credem). Credem's robust capital position, often reflected in its strong Common Equity Tier 1 (CET1) ratios, which have consistently remained above regulatory minimums, serves as a critical competitive advantage, deterring potential new competitors.

The banking sector, including established players like Credito Emiliano (Credem), thrives on deeply ingrained customer trust and long-standing relationships. Credem, with its 114-year history, has cultivated a strong reputation that new entrants find difficult to replicate quickly. Building this level of confidence, particularly for intricate financial services, presents a significant barrier to entry.

Economies of Scale and Distribution Networks

Established banks like Credito Emiliano (Credem) leverage significant economies of scale, which are a major barrier to entry for new competitors. These scale advantages translate into lower per-unit costs for operations, technology investments, and marketing campaigns, enabling them to offer more competitive pricing and a wider array of financial products and services. For instance, in 2023, Credem reported total assets of €104.3 billion, reflecting its substantial operational footprint.

Furthermore, existing banks possess well-developed distribution networks, encompassing both physical branch presence and advanced digital platforms. Credem, with its extensive network of branches across Italy and robust online and mobile banking services, has cultivated strong customer relationships and brand loyalty. This established infrastructure makes it challenging and costly for new entrants to replicate the same level of accessibility and customer reach.

- Economies of Scale: Established banks benefit from lower operating costs per customer due to their size.

- Distribution Networks: Extensive branch and digital presence create a significant hurdle for new entrants.

- Credem's Financial Strength: Credem's €104.3 billion in total assets as of 2023 underscores its scale advantage.

- Brand Loyalty: Incumbents often enjoy greater customer trust and loyalty, built over years of operation.

Talent Acquisition and Retention

New entrants face a significant hurdle in attracting and retaining top talent, especially in the competitive financial sector. Established institutions like Credito Emiliano often boast stronger brand recognition and more attractive long-term career paths, making it difficult for newcomers to lure experienced professionals. For instance, in 2024, the average financial services firm in Italy reported an employee turnover rate of around 15%, highlighting the challenge of retention.

Building a team with the necessary expertise to navigate complex financial regulations and market dynamics is a considerable investment for any new banking entity. This requires not only competitive salaries but also robust training programs and a compelling organizational culture.

- Talent Competition: New banks must compete with established players for skilled professionals, often needing to offer premium compensation packages.

- Retention Challenges: Retaining experienced staff is difficult due to the allure of stability and comprehensive benefits offered by incumbent banks.

- Regulatory Expertise: Acquiring talent with deep understanding of financial regulations is crucial and costly for new entrants.

The threat of new entrants into the banking sector, particularly for an established player like Credito Emiliano (Credem), is significantly mitigated by substantial barriers. These include rigorous regulatory capital requirements, the immense cost of building customer trust and brand loyalty, and the need to establish extensive distribution networks. Newcomers also face intense competition for skilled talent.

For example, Credem's total assets stood at €104.3 billion in 2023, illustrating the scale advantage incumbents possess. In 2024, new banking licenses in Europe often require initial capital well into the tens or hundreds of millions of euros, a sum that deters many potential entrants. Furthermore, the sector's average employee turnover in Italy was around 15% in 2024, indicating the difficulty new firms face in attracting and retaining experienced personnel.

| Barrier | Description | Impact on New Entrants | Credem's Position |

| Regulatory Capital | High initial capital needed for licensing and solvency. | Significant financial hurdle, limits scale. | Strong CET1 ratios provide a buffer. |

| Customer Trust & Loyalty | Long-term relationship building is crucial. | Difficult and time-consuming to acquire. | 114-year history fosters deep trust. |

| Distribution Networks | Requires extensive physical and digital infrastructure. | Costly to replicate established reach. | Broad branch network and advanced digital services. |

| Talent Acquisition | Competition for experienced financial professionals. | Requires premium compensation and strong employer branding. | Established brand attracts and retains talent. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Credito Emiliano leverages data from its official annual reports, investor relations disclosures, and industry-specific banking publications. We also incorporate insights from financial news outlets and regulatory filings to provide a comprehensive view of the competitive landscape.