Cigna SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Cigna Bundle

Cigna's strengths lie in its diversified health services and strong brand recognition, while its opportunities include expanding into new markets and leveraging technology. However, it faces challenges from increasing competition and regulatory changes, and potential threats from economic downturns impacting healthcare spending.

Want the full story behind Cigna’s strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Cigna's diversified business portfolio is a significant strength, encompassing medical, dental, behavioral health, pharmacy, and vision care benefits. This broad range of services creates a resilient revenue stream, mitigating risks associated with over-reliance on any one sector.

The robust performance of Evernorth Health Services, in particular, underscores this diversification. In the first quarter of 2024, Evernorth's revenue grew by 4% year-over-year, reaching $34.4 billion, demonstrating its substantial contribution to Cigna's overall financial health.

Evernorth's pharmacy benefit management and specialty and care services divisions have been key drivers of this growth. For instance, the pharmacy services segment saw continued strength in the first quarter of 2024, reflecting Cigna's ability to leverage these integrated offerings.

Cigna has showcased robust financial performance, with total revenues climbing 27% to $247.1 billion in 2024. This upward trajectory is expected to continue, with the company projecting adjusted income from operations to be at least $29.60 per share for 2025, indicating a strong positive outlook.

The company's financial strength is further underscored by its commitment to shareholder returns, evidenced by consistent share repurchases and a recent increase in its quarterly dividend. These actions reflect management's confidence in Cigna's ongoing financial health and future growth potential.

Cigna's strategic divestiture of its Medicare Advantage business in 2023, a move impacting approximately 500,000 members, sharpens its focus on high-growth segments like Evernorth Health Services. This allows for a more concentrated allocation of capital and management attention toward areas with greater expansion potential and profitability.

By shedding the Medicare Advantage operations, Cigna is better positioned to invest in and capitalize on emerging trends, such as its significant investments in mental health solutions and employee well-being programs, which are experiencing robust demand in the current healthcare landscape.

Advanced Data and Technology Capabilities

Cigna's advanced data and technology capabilities are a significant strength, with the company actively investing in AI and digital solutions. This focus aims to enhance healthcare delivery, improve patient outcomes, and make administrative processes more efficient. For instance, Cigna reported a significant increase in its digital engagement metrics in 2024, with millions of members actively using its health apps and platforms for personalized care management.

The integration of vast data resources allows Cigna to offer evidence-based medical and pharmacy benefit management. This translates into actionable insights for healthcare providers and empowers individuals with more personalized care choices. By leveraging these insights, Cigna aims to drive better health decisions and manage costs effectively. Their digital transformation efforts are a core part of their competitive strategy, positioning them well in the evolving healthcare landscape.

Key aspects of Cigna's technological strengths include:

- AI-driven predictive analytics for identifying at-risk populations and proactively intervening.

- Digital health platforms offering members personalized wellness programs and care management tools.

- Streamlined administrative systems reducing operational costs and improving user experience.

- Data integration capabilities to provide a holistic view of member health and benefits.

Commitment to Affordability and Patient Experience

Cigna's dedication to affordability and a positive patient experience is a significant strength. The company is actively developing a healthcare model focused on transparency, robust support, and delivering tangible value to both patients and clients. This commitment is demonstrated through initiatives aimed at reducing patient costs and improving access to care, which in turn fosters strong customer loyalty and supports sustained growth.

Key initiatives underscore this commitment:

- Offering biosimilars at no cost: This directly addresses patient affordability for crucial medications.

- Expanding virtual care access: This provides convenient and often more cost-effective healthcare options.

- Diabetes assistance programs: These programs aim to lower out-of-pocket expenses for individuals managing chronic conditions.

These efforts not only enhance customer satisfaction but also build trust, positioning Cigna favorably in a competitive market. For example, in 2024, Cigna reported improved customer retention rates, partly attributed to these value-driven programs.

Cigna's diversified business model, encompassing medical, dental, behavioral, and pharmacy services, provides a stable foundation. The strong performance of Evernorth Health Services, which saw revenue growth of 4% to $34.4 billion in Q1 2024, highlights this resilience. This broad reach allows Cigna to mitigate risks and capitalize on various healthcare sectors.

The company's financial health is robust, with 2024 revenues reaching $247.1 billion, a 27% increase. Cigna projects adjusted income from operations to be at least $29.60 per share for 2025, signaling continued positive momentum. This financial strength is further supported by consistent shareholder returns through dividends and share repurchases.

Cigna's strategic divestiture of its Medicare Advantage business in 2023 sharpens its focus on high-growth areas like Evernorth. This move allows for concentrated investment in emerging trends such as mental health solutions and employee well-being programs, which are experiencing significant demand.

Advanced data and technology capabilities are a key strength, with substantial investments in AI and digital solutions enhancing healthcare delivery and patient engagement. Cigna reported increased digital engagement metrics in 2024, with millions of members actively using its health platforms.

| Strength | Description | Supporting Data (2024/2025) |

| Diversified Business Portfolio | Broad range of health services including medical, dental, behavioral, and pharmacy. | Evernorth Health Services revenue: $34.4 billion (Q1 2024), up 4% YoY. |

| Robust Financial Performance | Strong revenue growth and positive earnings outlook. | Total revenues: $247.1 billion (2024), up 27%. Projected adjusted income from operations: at least $29.60 per share (2025). |

| Strategic Focus | Divestiture of Medicare Advantage to concentrate on high-growth segments. | Divestiture completed in 2023, allowing for increased investment in areas like mental health. |

| Advanced Data & Technology | Investment in AI and digital solutions for improved healthcare delivery. | Increased digital engagement metrics in 2024; millions of members using health apps. |

What is included in the product

Analyzes Cigna’s competitive position through key internal and external factors, including its strong brand reputation and diversified product offerings, while also identifying potential threats from market competition and regulatory changes.

Identifies key Cigna strengths and weaknesses to inform targeted strategic adjustments.

Weaknesses

Cigna has experienced significant headwinds from higher-than-expected medical costs, especially within its stop-loss offerings in the Cigna Healthcare segment. This surge has directly elevated the medical care ratio (MCR), consequently squeezing profit margins and impacting overall earnings performance. For instance, in the first quarter of 2024, Cigna reported an MCR of 83.5% for its Health Services segment, up from 81.9% in the prior year's period, highlighting the persistent cost pressures.

The increasing trend in medical utilization across the broader U.S. healthcare system continues to pose a significant challenge. While Cigna is actively deploying various cost-mitigation strategies, the underlying upward pressure on healthcare expenses remains a persistent concern for the company's future profitability and financial stability.

Cigna's divestiture of its Medicare Advantage business, while strategically aimed at sharpening focus, has led to a noticeable decline in its overall medical customer base. This move, completed in early 2024, saw a significant portion of its senior customer segment transition to other providers.

The immediate impact of this divestiture is a reduction in total medical customers, which could affect revenue streams and market share in the short term. Managing this transition effectively is crucial to retain goodwill and prevent further customer attrition as Cigna reorients its strategy towards its core commercial and specialty businesses.

Cigna's Evernorth segment, encompassing Express Scripts, faces mounting regulatory pressure, especially concerning its role as a Pharmacy Benefit Manager (PBM). This intensified scrutiny, particularly in 2024 and anticipated into 2025, stems from concerns over pricing practices and the impact on drug costs.

Potential legislative actions, such as the proposed elimination of rebate and spread-based pricing models, could significantly affect Evernorth's profitability. For instance, proposals debated in the U.S. Congress in 2024 aimed to increase PBM transparency and curb their influence on drug pricing, directly threatening the revenue streams derived from these practices.

This regulatory uncertainty creates a considerable risk for a substantial part of Cigna's operations. The potential for adverse legislative outcomes introduces volatility into future earnings projections for the Evernorth business, a key growth driver for the company.

Dependence on Employer-Sponsored Plans

Cigna's significant presence in the employer-sponsored health insurance market, a core strength, also presents a notable weakness. This heavy reliance makes the company vulnerable to economic recessions that could lead employers to cut back on benefits or shift towards less comprehensive plans. For instance, a widespread economic downturn in 2024 could pressure employers to re-evaluate their healthcare spending, directly impacting Cigna's customer base.

Furthermore, changes in employer preferences, such as a move towards self-funded insurance models, pose a direct threat to Cigna's traditional business. If a substantial number of large employers decide to manage their own health benefits, Cigna could see a significant portion of its revenue stream diminish. This trend, if it accelerates, could erode market share in a critical segment.

- Market Concentration: Cigna's deep penetration in employer-sponsored plans, while a strength, creates a concentrated risk.

- Economic Sensitivity: A downturn in 2024 could force employers to reduce benefits, impacting Cigna's revenue.

- Shifting Employer Strategies: A rise in self-funded plans by employers could reduce demand for Cigna's core offerings.

- Benefit Reduction Risk: Employers might opt for leaner benefit packages, decreasing the value of Cigna's plans.

Execution Risks in Cost Management

Cigna faces significant execution risks in its cost management strategies. While the company has initiatives in place to control escalating medical expenses, the actual implementation of these plans is paramount for success. For instance, Cigna's goal to improve its adjusted earnings per share (EPS) by 13-17% in 2024, building on a 10% increase in 2023, hinges on disciplined execution of cost-saving measures.

The company's ability to recapture margins over the next two years depends heavily on its success in negotiating better rates with healthcare providers and effectively promoting preventative care programs. A misstep in these areas could derail financial recovery. For example, if negotiations for provider contracts don't yield expected savings, or if member engagement in wellness programs remains low, the projected margin improvements may not materialize.

Failure to effectively manage these rising costs can directly impact Cigna's financial performance, potentially hindering its ability to meet its profitability targets. In the competitive health insurance landscape, where medical cost inflation has been a persistent challenge, Cigna's operational efficiency in cost containment is a critical determinant of its financial health and market position.

Cigna's heavy reliance on employer-sponsored plans makes it susceptible to economic downturns, where businesses may reduce healthcare benefits. For instance, a recession in 2024 could lead employers to cut costs, impacting Cigna's customer base and revenue. Additionally, a growing trend of employers opting for self-funded insurance models directly threatens Cigna's core business, potentially eroding market share in this crucial segment.

What You See Is What You Get

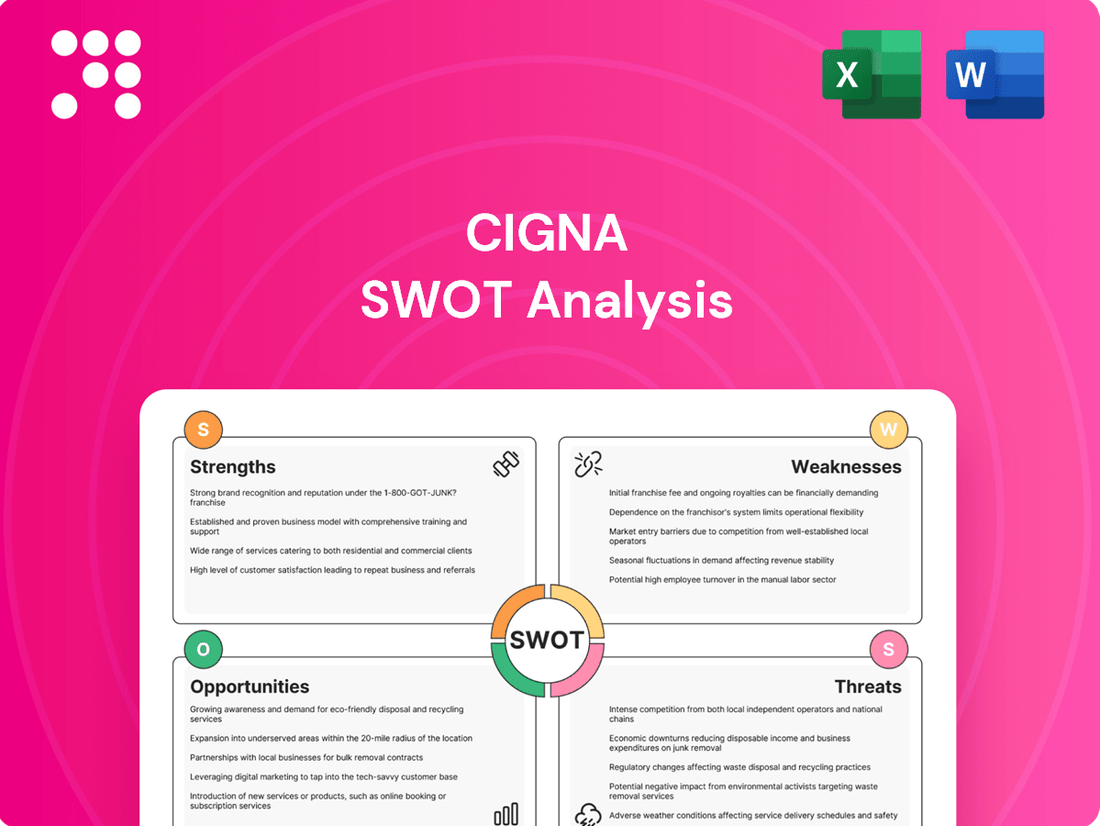

Cigna SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. You’re viewing a live preview of the actual SWOT analysis file, detailing Cigna's Strengths, Weaknesses, Opportunities, and Threats. The complete version becomes available after checkout, offering a comprehensive understanding of their market position.

Opportunities

Evernorth Health Services is a significant growth driver for Cigna, demonstrating robust performance, particularly in specialty pharmacy and care management. This segment offers substantial opportunities for further expansion, fueled by acquiring new clients and forging strategic partnerships.

The continued adoption of innovative solutions, such as programs managing GLP-1 drugs and the integration of biosimilars, presents a clear avenue for Evernorth to deepen its market penetration and service offerings. For instance, Cigna's 2024 first-quarter results highlighted Evernorth's contribution, with revenue growth reflecting the increasing demand for these specialized health services.

The healthcare sector's swift adoption of digital tools, including telehealth and AI for personalized care, presents a significant opportunity. Cigna can leverage this by increasing investments in its virtual care services, remote patient monitoring, and AI diagnostic capabilities. This expansion aims to improve healthcare accessibility, operational efficiency, and patient involvement.

Cigna's strategy of pursuing strategic partnerships and acquisitions remains a key opportunity for growth. By joining forces with other companies, Cigna can broaden its customer base and introduce new services. For instance, its collaboration with Aeroflow Health to offer enhanced nutrition support exemplifies how these alliances can lead to more tailored healthcare solutions, ultimately solidifying its standing in the market.

International Market Expansion

Cigna's established international presence provides a strong foundation for further global expansion. Emerging markets, in particular, present significant growth potential for health insurance and related services. In 2023, Cigna's international segment reported revenues of approximately $10.5 billion, demonstrating its existing global reach and revenue diversification capabilities.

Expanding into these growing economies allows Cigna to tap into new customer bases and reduce reliance on any single domestic market. This strategic move can lead to more robust and stable revenue streams.

- Geographic Diversification: Cigna can further penetrate high-growth regions like Asia-Pacific and Latin America, where healthcare spending is projected to increase significantly.

- Product Customization: Tailoring health solutions to meet the specific needs and regulatory environments of different countries can enhance market penetration.

- Partnership Opportunities: Collaborating with local healthcare providers and insurers can accelerate market entry and build trust.

- Digital Health Integration: Leveraging technology to offer telehealth and digital wellness programs can appeal to a broader demographic in international markets.

Focus on Value-Based Care Models

The healthcare industry's pivot towards value-based care, emphasizing patient outcomes and individualized health management, offers a significant avenue for Cigna. This shift rewards providers for quality of care rather than volume of services. For instance, by Q1 2024, Cigna's value-based care arrangements covered over 2.5 million people, demonstrating a commitment to this model.

Cigna can capitalize on this trend by innovating its product and service portfolio. Focusing on affordability, ease of access, and health equity will resonate with a growing segment of consumers and align with broader industry movements. This strategic alignment is crucial for capturing increased market share in the evolving healthcare landscape.

- Enhanced Patient Engagement: Developing digital tools and personalized programs that track patient-reported outcomes can improve engagement and satisfaction.

- Cost Containment Strategies: Implementing proactive health management and preventative care services can reduce overall healthcare costs, a key component of value-based care.

- Partnerships for Innovation: Collaborating with healthcare providers and technology companies to build integrated care solutions can accelerate the adoption of value-based models.

- Data Analytics for Outcomes: Leveraging advanced analytics to measure and demonstrate improved patient outcomes will be critical for success in value-based contracts.

Cigna's Evernorth Health Services is well-positioned for continued growth, particularly in specialty pharmacy and care management, as evidenced by its strong performance in Q1 2024. The company can further capitalize on this by expanding its client base and forging strategic partnerships, enhancing its market penetration with innovative solutions like GLP-1 drug management and biosimilar integration.

The increasing adoption of digital health technologies, including telehealth and AI, presents a significant opportunity for Cigna to boost its virtual care services and remote patient monitoring capabilities, thereby improving accessibility and efficiency. Strategic acquisitions and collaborations, such as the one with Aeroflow Health for nutrition support, are also key to broadening Cigna's customer reach and service offerings.

Cigna's established international presence, with 2023 international segment revenues of approximately $10.5 billion, offers a solid platform for global expansion, especially in high-growth emerging markets in Asia-Pacific and Latin America where healthcare spending is rising. Tailoring products to local needs and partnering with local providers will be crucial for success.

The shift towards value-based care, which Cigna is actively pursuing with over 2.5 million individuals covered by its value-based arrangements by Q1 2024, provides a strong opportunity to innovate and focus on patient outcomes and affordability, aligning with broader industry trends and enhancing market share.

Threats

Rising medical costs, fueled by factors like the increasing use of expensive specialty drugs and patients delaying care, are a major concern. This healthcare inflation directly impacts Cigna's bottom line, potentially widening the gap between what they pay for care and what they collect in premiums.

For instance, the Centers for Medicare & Medicaid Services (CMS) projected that national health expenditures grew by 5.1% in 2023, reaching $4.7 trillion. If this trend continues, Cigna's medical care ratio, a key profitability metric, could face upward pressure, squeezing profit margins unless offset by effective cost management and pricing adjustments.

Cigna, like other major players in the healthcare sector, faces significant threats from escalating regulatory and political scrutiny. This is particularly true for its managed care and Pharmacy Benefit Manager (PBM) operations.

Potential shifts in government policies, such as adjustments to Medicare Advantage reimbursement rates or new regulations targeting PBM business practices, could directly impact Cigna's profitability and its ability to operate with flexibility. For instance, proposed legislation in 2024 aimed to increase transparency and reduce costs within the PBM industry, which could affect Cigna's Evernorth Health Services segment.

Cigna faces intense competition from giants like UnitedHealth Group and CVS Health, which also operates Aetna. This crowded market means Cigna must constantly innovate and manage costs effectively to keep its customers and attract new ones.

The pressure from these major rivals is significant; for instance, UnitedHealth Group reported a revenue of $371.6 billion in 2023, highlighting the scale Cigna contends with. Any aggressive pricing strategies or groundbreaking new services introduced by competitors could directly impact Cigna's standing in the industry.

Cybersecurity Risks and Data Privacy Concerns

As Cigna's operations become more digitized, the threat of cyberattacks and data breaches escalates. A successful breach could expose sensitive patient information, leading to substantial regulatory fines and severe damage to customer trust. For instance, the healthcare sector experienced a 42% increase in cyberattacks in 2023 compared to the previous year, highlighting the pervasive nature of these threats.

The financial implications of a data breach can be immense. Beyond direct costs of remediation and legal fees, Cigna could face significant penalties under regulations like HIPAA. In 2024, the average cost of a healthcare data breach reached $10.93 million, a figure that underscores the potential financial strain.

- Increased Regulatory Scrutiny: Stricter data privacy laws globally mean higher penalties for non-compliance.

- Reputational Damage: Loss of patient confidence can lead to customer attrition and difficulty attracting new members.

- Operational Disruption: Cyberattacks can halt critical healthcare services, impacting patient care and revenue streams.

Changing Consumer Behavior and Expectations

Consumers increasingly expect healthcare to be as convenient and personalized as other services they use daily. This means Cigna must offer more accessible care options, like telehealth, and tailor solutions to individual needs. For instance, a 2024 survey indicated that over 70% of consumers prefer digital channels for managing their health, highlighting a significant shift in expectations.

The demand for affordability is also a major driver. As healthcare costs continue to rise, individuals and employers are seeking plans that provide value without compromising quality. Cigna's ability to offer competitive pricing and transparent cost information will be crucial in retaining and attracting customers in this environment. In 2025, we anticipate continued pressure on premium increases, making cost-effectiveness a paramount concern for plan members.

Failure to keep pace with these evolving consumer behaviors poses a significant threat. If Cigna does not effectively integrate digital health tools or provide the personalized, affordable experiences customers now demand, it risks losing market share. This could manifest as higher member churn and a diminished brand reputation, impacting its long-term growth prospects.

- Digital Health Adoption: Over 70% of consumers prefer digital health management tools as of 2024.

- Affordability Focus: Rising healthcare costs in 2025 will make cost-effectiveness a key differentiator.

- Personalization Demand: Consumers expect tailored healthcare solutions, mirroring experiences in other industries.

- Market Relevance: Inability to adapt to these changes could lead to customer dissatisfaction and reduced market standing.

Intensifying competition from major players like UnitedHealth Group, which reported $371.6 billion in revenue for 2023, presents a constant challenge. Cigna must continually innovate and manage costs to retain its customer base and attract new members amidst aggressive strategies from rivals.

The healthcare sector is experiencing a significant increase in cyberattacks, with a 42% rise noted in 2023. A data breach could expose sensitive patient information, leading to substantial fines, with the average healthcare data breach costing $10.93 million in 2024, and severe damage to Cigna's reputation.

Evolving consumer expectations for convenient, personalized, and affordable healthcare pose a threat. With over 70% of consumers preferring digital health management in 2024, Cigna's failure to adapt its digital offerings and cost structures could lead to customer attrition and a diminished market position.

SWOT Analysis Data Sources

This SWOT analysis is built upon a robust foundation of data, drawing from Cigna's official financial filings, comprehensive market research reports, and expert industry analyses to provide a well-rounded and insightful assessment.