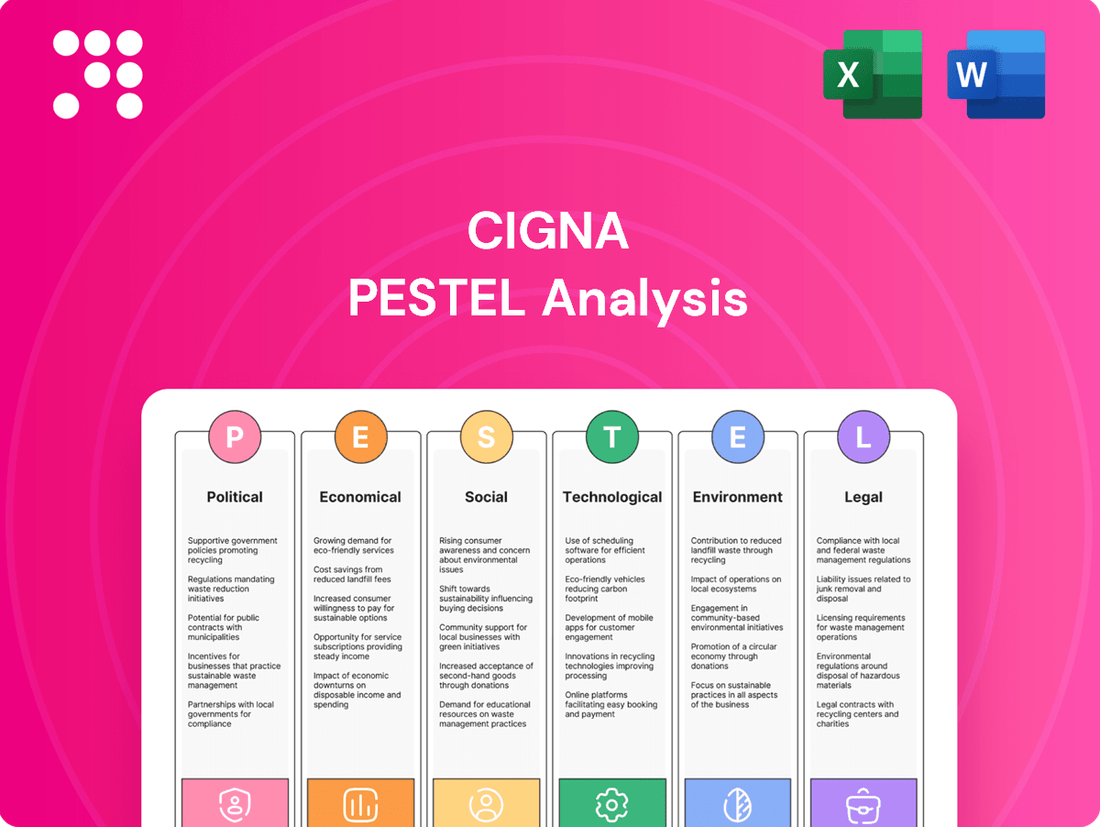

Cigna PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Cigna Bundle

Uncover the critical political, economic, social, technological, legal, and environmental factors shaping Cigna's strategic landscape. This comprehensive PESTLE analysis provides actionable intelligence to navigate market complexities and identify future opportunities. Empower your decision-making with expert insights—download the full version now.

Political factors

Government healthcare policies and regulations significantly shape Cigna's operational landscape. Changes in legislation, such as potential modifications to the Affordable Care Act (ACA) or the introduction of new healthcare proposals, directly influence Cigna's revenue, the types of products it can offer, and its overall business strategy. For instance, the expiration of federal premium subsidies for ACA members, scheduled for the end of 2025, could reduce the number of insured individuals, potentially impacting Cigna's health plan enrollment and profitability.

Political pressure on Pharmacy Benefit Managers (PBMs) is intensifying, impacting companies like Cigna, whose Evernorth segment is heavily involved in PBM services. This scrutiny stems from concerns over pricing practices and their effect on healthcare costs.

Proposed legislation, such as the proposed federal ban on certain rebate practices, could significantly alter PBM business models. For instance, the Inflation Reduction Act of 2022, while primarily focused on drug pricing negotiation for Medicare, signals a broader governmental intent to increase oversight in the pharmaceutical supply chain, potentially impacting PBM revenue streams derived from rebates.

Changes in government funding and reimbursement rates for Medicare Advantage (MA) and Medicaid programs directly impact Cigna's profitability in these crucial sectors. For instance, Cigna's MA earnings faced headwinds in 2024, partly due to pricing pressures and utilization trends, a situation anticipated to continue into 2025.

Regulatory shifts within these government-sponsored health plans also play a significant role. The ongoing Medicaid redeterminations process, which began in 2023 and is expected to extend through 2025, will affect Cigna's member enrollment and revenue streams in its Medicaid business.

Global Health Policy and Trade Agreements

Cigna, as a global health services provider, is significantly impacted by evolving international health policies and the dynamics of global trade agreements. Changes in these policies can directly influence Cigna's ability to operate and expand in different countries, affecting market access and the scope of services it can offer. For instance, shifts in World Health Organization (WHO) guidelines or bilateral trade deals can create new opportunities or impose new regulatory hurdles.

Geopolitical stability also plays a crucial role. In 2024, ongoing geopolitical tensions in various regions could disrupt Cigna's international supply chains for healthcare services and pharmaceuticals, potentially increasing operational costs and affecting the reliability of service delivery. The company must navigate these complexities to ensure consistent market presence and service continuity across its global footprint.

- Impact of WHO Guidelines: Cigna must adapt to updated WHO recommendations on disease management and public health, which can influence its product development and service offerings.

- Trade Agreement Revisions: Changes in trade pacts, such as those affecting cross-border data flow or the movement of healthcare professionals, can directly impact Cigna's operational efficiency and market penetration strategies. For example, the USMCA (United States-Mexico-Canada Agreement) continues to shape trade relations in North America, potentially affecting Cigna's operations in these markets.

- Geopolitical Risk Assessment: Cigna's financial performance can be vulnerable to political instability, which might lead to currency fluctuations or the imposition of sanctions, as seen in the ongoing global geopolitical landscape impacting various multinational corporations.

Healthcare Cost Containment Initiatives

Governments worldwide are prioritizing healthcare cost containment, directly impacting Cigna's operational landscape. For instance, in the United States, Medicare spending alone was projected to reach $1.3 trillion in 2024, a significant figure highlighting the scale of government concern. These initiatives often translate into stricter regulations on pricing, reimbursement rates, and the adoption of value-based care models, all of which Cigna must navigate.

Cigna's business model, which relies on managing health insurance plans and providing healthcare services, faces direct pressure from these cost-saving efforts. Policymakers are actively exploring ways to enhance efficiency and reduce waste in healthcare expenditure. This can manifest as increased scrutiny on administrative costs, negotiations for lower drug prices, and the promotion of preventative care to curb long-term expenses.

- Government Mandates: Expect more regulations aimed at controlling prescription drug costs and hospital fees, potentially impacting Cigna's profit margins.

- Value-Based Care: A continued push towards payment models that reward quality outcomes over service volume will require Cigna to adapt its provider contracts and patient management strategies.

- Efficiency Drives: Initiatives to streamline administrative processes and reduce unnecessary medical tests and procedures will be a key focus for payers and providers alike.

Government healthcare policies remain a dominant force shaping Cigna's trajectory, with ongoing debates and potential legislative changes influencing its core business. The political landscape's focus on healthcare affordability and access continues to drive regulatory shifts, impacting everything from drug pricing to insurance coverage mandates. For example, continued discussions around Medicare Advantage payment rates for 2025 are crucial for Cigna's substantial MA business.

What is included in the product

This Cigna PESTLE analysis provides a comprehensive examination of the external macro-environmental factors impacting the company, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights and forward-looking perspectives to guide strategic decision-making and identify potential opportunities and threats within Cigna's operating landscape.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, transforming complex external factors into actionable insights for Cigna's strategic decision-making.

Economic factors

Cigna's financial performance in 2024 and its outlook for 2025 are being significantly affected by a surge in medical costs and increased healthcare service utilization. This trend, initially observed in government programs, has now become widespread across the entire US healthcare landscape, impacting employer-sponsored health plans as well.

For instance, Cigna reported that its medical cost ratio for the first quarter of 2024 was 76.4%, a notable increase from the previous year, driven by higher-than-expected medical claims. This rise in utilization, particularly for services like hospital stays and specialty care, is putting pressure on insurers' profitability.

Average annual health insurance premiums saw a notable jump, rising by 7% for both single and family coverage in 2024. This trend directly impacts affordability for consumers and presents a significant challenge for health insurers.

For Cigna, navigating these rising premium costs is paramount to its financial health. The company's success hinges on its capacity to accurately price its diverse insurance plans and diligently manage its medical care ratio, which is the proportion of premiums paid out as claims.

Economic growth and employment rates are crucial for Cigna. In 2024, the U.S. economy is projected to grow moderately, with GDP expected to increase by around 2.5%. This growth directly impacts household incomes and business profitability, influencing their ability to afford health insurance premiums and services. A strong job market, with unemployment rates anticipated to remain low, around 3.8% in 2024, means more people are employed and thus more likely to have employer-sponsored health coverage, a key market for Cigna.

Inflationary Pressures and Wage Increases

Inflationary pressures within the healthcare sector are a significant concern for Cigna. Rising costs for medical supplies, pharmaceuticals, and services directly impact the company's operational expenses. For instance, the U.S. medical care inflation rate saw a notable increase, contributing to higher claims costs for insurers like Cigna.

Simultaneously, labor shortages across the healthcare industry are driving up wage demands. This means Cigna, like its competitors, faces increased costs for employing its workforce, from administrative staff to medical professionals. These combined pressures can indeed squeeze profit margins if Cigna cannot effectively manage pricing strategies and operational efficiencies to offset these rising expenses.

- Medical Care Inflation: In the U.S., medical care inflation has consistently outpaced general inflation in recent years, impacting healthcare provider costs and subsequently insurance premiums.

- Healthcare Workforce Shortages: Reports from 2024 and early 2025 continue to highlight critical shortages in nursing and specialized medical roles, leading to competitive wage environments.

- Impact on Margins: For health insurers, managing these escalating costs while maintaining competitive pricing is crucial for preserving profitability, with analysts closely watching expense ratios.

Interest Rate Fluctuations and Investment Income

Interest rate fluctuations directly influence Cigna's net investment income. As interest rates change, the returns on Cigna's extensive investment portfolio are affected, impacting its overall profitability. For instance, a sustained period of lower interest rates, as potentially observed in early 2025 compared to 2024, can lead to a decrease in this income stream.

This can have a tangible effect on the company's bottom line. A decline in net investment income, even if offset by other operational gains, can still present a headwind to earnings growth. Cigna's financial reports often detail the sensitivity of its investment income to interest rate movements.

For example, if we consider a hypothetical scenario where Cigna's investment portfolio yields 4% in a higher rate environment and this drops to 3.5% due to rate cuts, the impact on its net investment income could be significant, depending on the size of the portfolio. This highlights the importance of managing investment assets strategically in response to macroeconomic shifts.

- Interest Rate Impact: Changes in interest rates directly affect the yield Cigna earns on its investment portfolio.

- Profitability Link: Lower net investment income can reduce overall company profitability, as demonstrated by comparisons between Q1 2025 and Q1 2024 performance.

- Portfolio Sensitivity: Cigna's financial disclosures often quantify the sensitivity of its investment income to shifts in market interest rates.

Economic factors are significantly shaping Cigna's operating environment in 2024 and 2025. Persistent medical cost inflation, driven by increased utilization of healthcare services, is a primary concern. This trend, evident across the board, puts pressure on insurers' profitability, as seen in Cigna's Q1 2024 medical cost ratio of 76.4%. Furthermore, economic growth and employment figures directly influence Cigna's market penetration, with a projected U.S. GDP growth of 2.5% in 2024 and a low unemployment rate of 3.8% supporting demand for employer-sponsored health plans.

Rising healthcare workforce shortages are also contributing to increased operational costs for Cigna, as competitive wage environments drive up labor expenses. Simultaneously, fluctuations in interest rates directly impact Cigna's net investment income, a key component of its overall profitability. For instance, a hypothetical drop in portfolio yield from 4% to 3.5% due to rate changes could notably affect earnings.

| Economic Factor | 2024 Projection/Data | Impact on Cigna |

|---|---|---|

| Medical Cost Inflation | Elevated, impacting claims | Increased medical cost ratio, pressure on premiums |

| GDP Growth (US) | ~2.5% | Supports demand for health insurance |

| Unemployment Rate (US) | ~3.8% | Higher employer-sponsored coverage rates |

| Interest Rates | Fluctuating | Affects net investment income |

Same Document Delivered

Cigna PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Cigna delves into Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company.

What you’re previewing here is the actual file—fully formatted and professionally structured. You'll gain immediate access to detailed insights into Cigna's operational landscape and strategic considerations.

The content and structure shown in the preview is the same document you’ll download after payment. This allows you to confidently assess the depth and quality of the PESTLE analysis before making your purchase.

Sociological factors

The world's population is aging, with projections indicating that by 2050, one in six people will be over 65. This demographic shift, coupled with a rise in chronic diseases like diabetes and heart disease, significantly boosts the demand for healthcare services, pharmaceuticals, and long-term care solutions. For Cigna, this trend translates to a growing market for its insurance and health management offerings, but also necessitates a focus on managing the associated costs and developing tailored plans for managing chronic conditions.

Consumers now demand healthcare that feels as tailored and easy as their online shopping or streaming experiences. This shift means they expect proactive communication, convenient access to services, and solutions that fit their individual needs, not a one-size-fits-all approach.

Cigna is actively addressing this by channeling significant investment into digital platforms and personalized health programs. For instance, their digital health tools aim to provide members with convenient access to care and tailored wellness plans, reflecting a commitment to meeting these evolving expectations and boosting member engagement.

There's a significant and growing awareness of the mental and behavioral health challenges facing society, especially impacting younger demographics. This societal shift is a key factor influencing healthcare providers and insurers.

Cigna is actively responding to this crisis by increasing its investments in mental health programs and strategically embedding behavioral health services within routine primary care. This approach aims to make mental health support more accessible and integrated into overall wellness.

In 2024, Cigna reported a substantial increase in its utilization of virtual mental health services, with a reported 30% year-over-year growth, underscoring the demand and effectiveness of these expanded offerings.

Health Equity and Social Determinants of Health

Cigna's strategic direction is increasingly shaped by the growing emphasis on health equity and addressing social determinants of health (SDoH). This focus is evident as employers and health plans actively seek programs designed to reduce health disparities and the societal factors that impact well-being.

The demand for SDoH interventions is rising, with a significant portion of employers expressing interest in supporting these initiatives. For instance, a 2024 survey indicated that over 70% of large employers are exploring or implementing SDoH programs to improve employee health and reduce healthcare costs.

- Employer Investment: Many companies are allocating dedicated budgets towards SDoH initiatives, recognizing their long-term value in fostering a healthier workforce.

- Data-Driven Approach: Cigna leverages data analytics to identify populations most affected by SDoH and tailor interventions accordingly.

- Partnerships: Collaboration with community organizations is crucial for effectively addressing SDoH, by connecting members with resources for housing, food security, and transportation.

- Focus on Prevention: By tackling root causes of poor health, Cigna aims to shift from reactive care to proactive health management, potentially lowering overall healthcare expenditure by an estimated 15-20% in targeted populations by 2025.

Shifting Healthcare Delivery Preferences

People increasingly prefer healthcare that fits their lives, often a mix of seeing a doctor in person, getting care at home, and using remote monitoring tools. This shift means healthcare providers need to be more flexible. For instance, a 2024 survey indicated that over 60% of patients are open to or actively use telehealth services for routine check-ups and managing chronic conditions.

Cigna is responding by expanding its digital health offerings. They are investing in telehealth platforms and digital tools designed to make it easier for members to manage their health and engage with care. This approach supports the move towards value-based care, where outcomes are prioritized over the volume of services.

The adoption of these hybrid models is accelerating. By the end of 2024, it's estimated that telehealth visits will account for roughly 20% of all outpatient visits in the US, a significant jump from pre-pandemic levels. Cigna's strategy aligns with this by:

- Expanding virtual care options: Offering more ways for members to connect with healthcare professionals remotely.

- Integrating digital tools: Providing apps and platforms for health tracking, appointment scheduling, and communication.

- Supporting at-home care: Facilitating services that allow care to be delivered in the comfort of a patient's home.

- Focusing on engagement: Using technology to keep members actively involved in their health journey.

Societal expectations for healthcare are evolving, with a growing emphasis on personalized, accessible, and digitally-enabled services. This trend is highlighted by the increasing demand for telehealth and at-home care options. For example, a 2024 survey showed over 60% of patients were open to using telehealth for routine care, a sentiment Cigna is addressing through expanded digital health platforms and virtual care options.

Technological factors

The surge in digital health, particularly telehealth, is fundamentally reshaping how healthcare is delivered. Cigna is strategically embedding these technologies to boost accessibility, streamline operations, and improve patient involvement. For instance, the global telehealth market was valued at approximately $150 billion in 2023 and is anticipated to reach over $600 billion by 2030, showcasing substantial growth potential that Cigna is positioned to leverage.

Cigna is actively integrating AI and machine learning to streamline operations and enhance member experiences. For instance, AI-powered virtual assistants are being deployed to handle customer inquiries more efficiently, aiming to reduce wait times and improve satisfaction. This technological push is designed to personalize healthcare delivery, making it more responsive to individual needs.

The company is also utilizing predictive analytics to identify potential health risks and proactively intervene, which could lead to better health outcomes and cost savings. Furthermore, machine learning algorithms are being employed to bolster fraud detection capabilities, protecting both the company and its members from financial losses. In 2024, Cigna reported significant investments in digital transformation, including AI initiatives, to drive these operational improvements.

Cigna leverages advanced data analytics and predictive modeling to sift through extensive healthcare datasets. This capability allows them to pinpoint trends, forecast patient outcomes, and guide strategic decision-making, ultimately enhancing care management and enabling more tailored treatment approaches.

In 2024, the healthcare analytics market is projected to reach over $70 billion, highlighting the critical role of data in the industry. Cigna's investment in these technologies allows them to better anticipate health needs and optimize resource allocation, a crucial factor in a competitive landscape.

Cybersecurity and Data Protection

As healthcare increasingly moves online, cybersecurity and protecting sensitive data are paramount. Cigna needs to keep investing in strong security to keep patient information safe and follow all the privacy rules. This is a huge deal for trust and avoiding costly breaches.

The healthcare industry saw a significant rise in cyberattacks. For instance, in 2023, the number of reported healthcare data breaches in the US reached over 700, impacting millions of individuals. Cigna, like its peers, faces constant threats from ransomware and phishing attempts targeting personal health information (PHI).

- Increased Regulatory Scrutiny: Cigna must adhere to evolving data protection laws like HIPAA in the US and GDPR internationally, with significant fines for non-compliance.

- Rising Cybercrime Costs: The average cost of a healthcare data breach in 2023 was estimated to be around $10.93 million, a figure Cigna must actively work to mitigate.

- Technological Defense Investment: Continuous investment in advanced encryption, threat detection systems, and employee training is essential to counter sophisticated cyber threats.

Internet of Medical Things (IoMT) and Wearable Devices

The Internet of Medical Things (IoMT) and wearable devices are rapidly reshaping healthcare delivery, offering Cigna significant opportunities for enhanced patient engagement and proactive health management. These technologies enable continuous collection of vital health data, allowing for more personalized and timely interventions. For instance, remote patient monitoring systems can alert healthcare providers to potential issues before they become critical, reducing hospital readmissions and improving patient outcomes.

Cigna's strategic focus on IoMT aligns with the growing market for connected health solutions. The global IoMT market was valued at approximately $197 billion in 2023 and is projected to reach over $700 billion by 2030, demonstrating substantial growth potential. Wearable health trackers, a key component of IoMT, saw a significant increase in adoption, with shipments reaching over 100 million units in the first half of 2024 alone. This expansion provides Cigna with a wealth of real-time health information to inform its preventive medicine strategies and develop more effective health plans.

The integration of IoMT and wearables allows Cigna to:

- Enhance remote patient monitoring: Facilitating continuous tracking of chronic conditions, leading to earlier detection of adverse events.

- Promote preventive care: Utilizing real-time data to encourage healthier behaviors and identify individuals at risk for certain diseases.

- Improve care coordination: Providing seamless data flow between patients, providers, and payers for more integrated health management.

- Personalize health interventions: Leveraging granular health data to tailor treatment plans and wellness programs to individual needs.

Cigna is capitalizing on the rapid advancements in artificial intelligence and machine learning to refine its operational efficiencies and elevate member experiences. The company is deploying AI-powered tools, such as virtual assistants, to manage customer inquiries more swiftly and effectively, aiming to reduce wait times and boost overall satisfaction. These technological integrations are geared towards personalizing healthcare delivery, making it more attuned to individual patient requirements.

Furthermore, Cigna is leveraging predictive analytics to proactively identify potential health risks, paving the way for earlier interventions and potentially leading to improved health outcomes and cost reductions. Machine learning algorithms are also being utilized to strengthen fraud detection mechanisms, safeguarding both the company and its members from financial misconduct. In 2024, Cigna's commitment to digital transformation was evident through substantial investments in AI initiatives designed to drive these operational enhancements.

The company utilizes sophisticated data analytics and predictive modeling to analyze vast healthcare datasets, enabling it to identify emerging trends, forecast patient outcomes, and inform strategic decisions. This capability is crucial for enhancing care management and developing more personalized treatment strategies. The healthcare analytics market was projected to exceed $70 billion in 2024, underscoring the vital role of data in the sector. Cigna's investment in these technologies allows for better anticipation of health needs and optimized resource allocation, a key advantage in a competitive market.

The increasing reliance on digital platforms in healthcare necessitates robust cybersecurity measures to protect sensitive patient data. Cigna must continue to invest in advanced security protocols to ensure data privacy and compliance with regulations such as HIPAA. The healthcare sector experienced a notable increase in cyberattacks, with over 700 reported data breaches in the US in 2023 affecting millions of individuals, highlighting the persistent threats Cigna faces from ransomware and phishing attempts targeting personal health information.

| Technology Area | Cigna's Application | Market Data/Impact |

|---|---|---|

| Telehealth | Boosting accessibility, streamlining operations, improving patient engagement. | Global market valued at ~$150B in 2023, projected to exceed $600B by 2030. |

| AI & Machine Learning | Customer service (virtual assistants), fraud detection, personalized healthcare. | Significant investments in AI initiatives in 2024 for operational improvements. |

| Predictive Analytics | Proactive health risk identification, early intervention, cost savings. | Healthcare analytics market projected to exceed $70B in 2024. |

| Cybersecurity | Protecting sensitive patient data, ensuring regulatory compliance. | Average healthcare data breach cost in 2023 estimated at ~$10.93M; 700+ breaches in US in 2023. |

| IoMT & Wearables | Remote patient monitoring, preventive care, personalized interventions. | IoMT market valued at ~$197B in 2023, projected to exceed $700B by 2030. Wearable shipments exceeded 100M units in H1 2024. |

Legal factors

Cigna, as a major healthcare provider and insurer, operates under stringent legal frameworks. A critical component is the Health Insurance Portability and Accountability Act (HIPAA), which mandates robust protection for patient health information. Failure to comply can result in significant penalties; for instance, in 2023, HIPAA settlements and fines totaled over $3.5 million, highlighting the financial risks of non-compliance.

Beyond HIPAA, Cigna must navigate a complex web of state and international data privacy regulations. These laws, such as the California Consumer Privacy Act (CCPA) and the General Data Protection Regulation (GDPR) for international operations, dictate how personal data is collected, used, and secured. Staying abreast of these evolving legal requirements is paramount for maintaining trust and avoiding legal challenges.

Cigna, as a major player in the healthcare industry, faces rigorous antitrust oversight, particularly concerning its market share and any proposed mergers or acquisitions. For instance, its 2023 divestiture of its Medicare Advantage contracts to Health Care Service Corporation demonstrated the need for regulatory approval to ensure fair competition.

These regulations, enforced by bodies like the Federal Trade Commission (FTC) and the Department of Justice (DOJ), can significantly shape Cigna's strategic options. Approval processes for deals, especially those involving substantial market consolidation, can be lengthy and may impose conditions that alter the transaction's scope or Cigna's future operational flexibility.

The pharmaceutical benefits manager (PBM) sector faces increasing scrutiny, with potential legislation in 2024 and 2025 aiming to reshape drug pricing and potentially mandate the separation of PBMs from insurance operations. This regulatory uncertainty presents a significant legal risk for companies like Cigna.

Cigna's Evernorth Health Services, a major player encompassing Express Scripts, is directly exposed to these evolving legal frameworks. For instance, proposals in various states and at the federal level are exploring measures like banning spread pricing or requiring greater transparency in rebate negotiations, which could impact Evernorth's profitability and operational model.

Healthcare Reimbursement Policies and Coding Accuracy

Cigna's reimbursement policies, particularly concerning coding and billing accuracy, are critical legal factors. These policies are designed to align with guidelines from organizations like the American Medical Association (AMA) to ensure payment integrity and prevent fraud. Providers who fail to adhere to these stringent coding standards risk delayed or denied payments, directly impacting their revenue streams and Cigna's financial exposure.

The accuracy of medical coding is paramount, with significant financial implications. For instance, in 2024, the Centers for Medicare & Medicaid Services (CMS) proposed updates to the Medicare Physician Fee Schedule that could affect reimbursement rates for various services, underscoring the need for providers to stay abreast of evolving coding requirements. Cigna's internal policies often mirror or build upon these federal guidelines, making compliance a non-negotiable aspect of their provider network agreements.

- Coding Accuracy: Inaccurate coding can lead to claim denials, with studies indicating that claim denial rates can range from 10% to 50% for some specialties, directly impacting provider revenue.

- Reimbursement Audits: Cigna, like other major insurers, conducts regular audits to verify coding and billing practices, with penalties for non-compliance potentially including recoupment of overpayments.

- Regulatory Compliance: Adherence to HIPAA regulations regarding patient data privacy and accurate billing is a legal mandate that Cigna enforces through its provider contracts.

- AMA Guidelines: The AMA's Current Procedural Terminology (CPT) codes are the standard for medical billing, and changes or misinterpretations of these codes can lead to significant reimbursement discrepancies.

Litigation and Compliance with Corporate Integrity Agreements

Cigna's extensive operations necessitate rigorous adherence to legal frameworks, particularly concerning litigation and compliance with agreements such as the Corporate Integrity Agreement (CIA) with the U.S. Department of Health and Human Services. Failure to comply can result in significant financial penalties and reputational damage. For instance, in 2023, Cigna Health Management agreed to pay $1.7 million to resolve allegations related to improper billing practices, highlighting the ongoing scrutiny.

Maintaining robust ethical conduct and transparent reporting mechanisms are paramount for Cigna to mitigate legal risks and uphold its corporate integrity. This involves continuous monitoring of its practices against regulatory standards and the specific terms of its CIAs. The company's commitment to these principles directly impacts its ability to operate smoothly and avoid costly legal entanglements.

- Litigation Exposure: Cigna faces ongoing litigation risks across its various business segments, including health insurance and pharmacy benefit management.

- Corporate Integrity Agreements: Compliance with CIAs, often mandated after government investigations, requires strict adherence to operational and reporting standards.

- Regulatory Scrutiny: The healthcare industry is heavily regulated, making compliance with laws like the False Claims Act a continuous operational challenge.

- Financial Impact: Non-compliance can lead to substantial fines, settlements, and increased oversight, impacting profitability and shareholder value.

Cigna's legal landscape is shaped by data privacy mandates like HIPAA and GDPR, with non-compliance leading to substantial fines; for example, HIPAA settlements in 2023 exceeded $3.5 million. Antitrust regulations heavily influence mergers, as seen in Cigna's 2023 divestiture of Medicare Advantage contracts to ensure market competition, with oversight from bodies like the FTC. Increasing scrutiny on PBMs may lead to legislation in 2024-2025 impacting drug pricing and operational structures, posing a direct risk to Cigna's Evernorth Health Services. Furthermore, adherence to coding accuracy standards, influenced by entities like CMS and the AMA, is critical to avoid claim denials, which can affect 10-50% of claims in certain specialties, and potential recoupment of overpayments through audits.

| Legal Factor | Impact on Cigna | 2023-2025 Data/Trend |

|---|---|---|

| Data Privacy (HIPAA, GDPR) | Requires robust patient data protection; non-compliance incurs significant financial penalties. | HIPAA settlements in 2023 exceeded $3.5 million. |

| Antitrust Oversight | Regulates market share and M&A activity, potentially requiring divestitures for approval. | 2023 divestiture of Medicare Advantage contracts to Health Care Service Corporation. |

| PBM Regulation | Potential legislation in 2024-2025 could alter drug pricing and PBM operational models. | Focus on banning spread pricing and increasing rebate transparency. |

| Coding & Billing Compliance | Accurate coding is essential for reimbursement; errors lead to claim denials and audits. | Claim denial rates can range from 10-50% by specialty; CMS proposed Medicare Fee Schedule updates in 2024. |

Environmental factors

Cigna acknowledges the direct connection between a healthy environment and human well-being, aligning with global efforts to combat climate change. The company has formally committed to the Science Based Targets initiative (SBTi), a crucial step in demonstrating its dedication to sustainability.

As part of this commitment, Cigna intends to establish near-term greenhouse gas (GHG) reduction targets that are scientifically validated. Furthermore, the company has set an ambitious goal to source 100% of its electricity from renewable sources by the year 2030, a significant move towards decarbonizing its operations.

Cigna is actively enhancing its operational sustainability by focusing on building efficiency, responsible water management, and waste reduction. These initiatives are key to meeting its environmental targets and minimizing its ecological impact.

For instance, in 2023, Cigna reported a 15% reduction in energy consumption across its facilities compared to a 2020 baseline, directly contributing to lower operating expenses and a smaller carbon footprint.

The company's commitment to resource efficiency also translates into significant cost savings. In 2024, Cigna projected that its water conservation efforts would lead to an estimated 8% decrease in utility costs for its major office locations.

Environmental factors like air and water quality significantly impact public health, directly affecting the demand for healthcare services. For instance, the World Health Organization (WHO) reported in 2022 that air pollution alone causes an estimated 7 million premature deaths annually worldwide, underscoring the critical link between environment and health outcomes.

Cigna's commitment to improving health and vitality naturally extends to addressing these broader environmental determinants. By focusing on preventative care and wellness, Cigna can play a role in mitigating the health consequences of environmental degradation, such as respiratory illnesses and waterborne diseases, which are projected to increase in certain regions due to climate change impacts.

Sustainable Supply Chain Practices

Cigna is actively integrating sustainability into its supply chain, exemplified by initiatives such as adopting more eco-friendly packaging for its pharmacy operations. This move aligns with a growing industry trend and Cigna's commitment to environmental responsibility across its business. For instance, in 2023, the company reported a reduction in waste generation by 15% compared to its 2020 baseline, a testament to its ongoing efforts in sustainable procurement and logistics.

The company's focus extends to ensuring ethical sourcing and reducing the environmental impact of its logistics network. These practices are crucial for managing risks associated with climate change and resource scarcity, which can directly affect operational costs and business continuity. Cigna's 2024 sustainability report highlights a 10% decrease in carbon emissions from its transportation sector year-over-year, driven by optimized delivery routes and the exploration of lower-emission vehicles.

- Sustainable Packaging: Cigna is piloting compostable and recycled materials for its pharmacy packaging, aiming for a 25% increase in sustainable packaging use by the end of 2025.

- Ethical Sourcing: The company is enhancing its supplier code of conduct to include stricter environmental and social governance (ESG) criteria, with 80% of key suppliers now adhering to these updated standards as of early 2024.

- Logistics Optimization: Cigna is investing in route optimization software and exploring partnerships for electric vehicle delivery, targeting a further 5% reduction in transportation-related emissions in 2025.

- Waste Reduction: Continued focus on reducing operational waste, with a goal to achieve a 20% reduction in landfill waste by 2026 through improved recycling and waste management programs.

Investment in Virtual Care to Reduce Environmental Impact

Cigna sees its ongoing investment in virtual care as a way to help the environment. By allowing healthcare services to be delivered remotely, virtual care can cut down on the carbon emissions that come from people traveling to and from appointments.

This shift towards virtual care aligns with broader environmental goals, as reducing travel is a key strategy for lowering greenhouse gas emissions. For instance, a study by the American Medical Association in 2024 indicated that widespread adoption of telehealth could reduce patient travel by an estimated 20-30% annually, translating to millions of metric tons of CO2 equivalent saved.

- Reduced Travel Emissions: Virtual care minimizes the need for patients to travel, directly lowering carbon output from transportation.

- Lower Facility Footprint: Less reliance on physical locations can decrease energy consumption and waste associated with healthcare facilities.

- Digital Efficiency: The move to digital platforms for consultations and record-keeping reduces paper usage and associated environmental costs.

Cigna recognizes that environmental health directly impacts human health, driving its commitment to sustainability and climate action. The company's adherence to the Science Based Targets initiative (SBTi) and its goal to source 100% renewable electricity by 2030 underscore this dedication.

These environmental efforts translate into tangible operational efficiencies and cost savings, as seen in Cigna's 2023 report of a 15% reduction in energy consumption. Furthermore, its 2024 projections indicate an 8% decrease in utility costs due to water conservation measures.

By embracing virtual care and optimizing its supply chain, Cigna is actively reducing its carbon footprint. For example, a 2024 AMA study suggested telehealth could cut patient travel by 20-30%, directly lowering emissions.

| Environmental Initiative | Target/Status | Impact/Benefit | Year |

| Renewable Electricity Sourcing | 100% by 2030 | Decarbonization of operations | 2030 |

| Energy Consumption Reduction | 15% reduction vs 2020 | Lower operating expenses, reduced carbon footprint | 2023 |

| Water Conservation | Projected 8% utility cost decrease | Reduced operational costs | 2024 |

| Sustainable Packaging | 25% increase in use | Reduced waste, improved environmental impact | 2025 |

| Transportation Emissions Reduction | 5% further reduction targeted | Lower carbon output from logistics | 2025 |

PESTLE Analysis Data Sources

Our Cigna PESTLE Analysis is built on a robust foundation of data from reputable sources including government health agencies, international financial institutions, and leading market research firms. We meticulously gather insights on political stability, economic indicators, technological advancements, social trends, environmental regulations, and legal frameworks impacting the healthcare industry.