Cigna Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Cigna Bundle

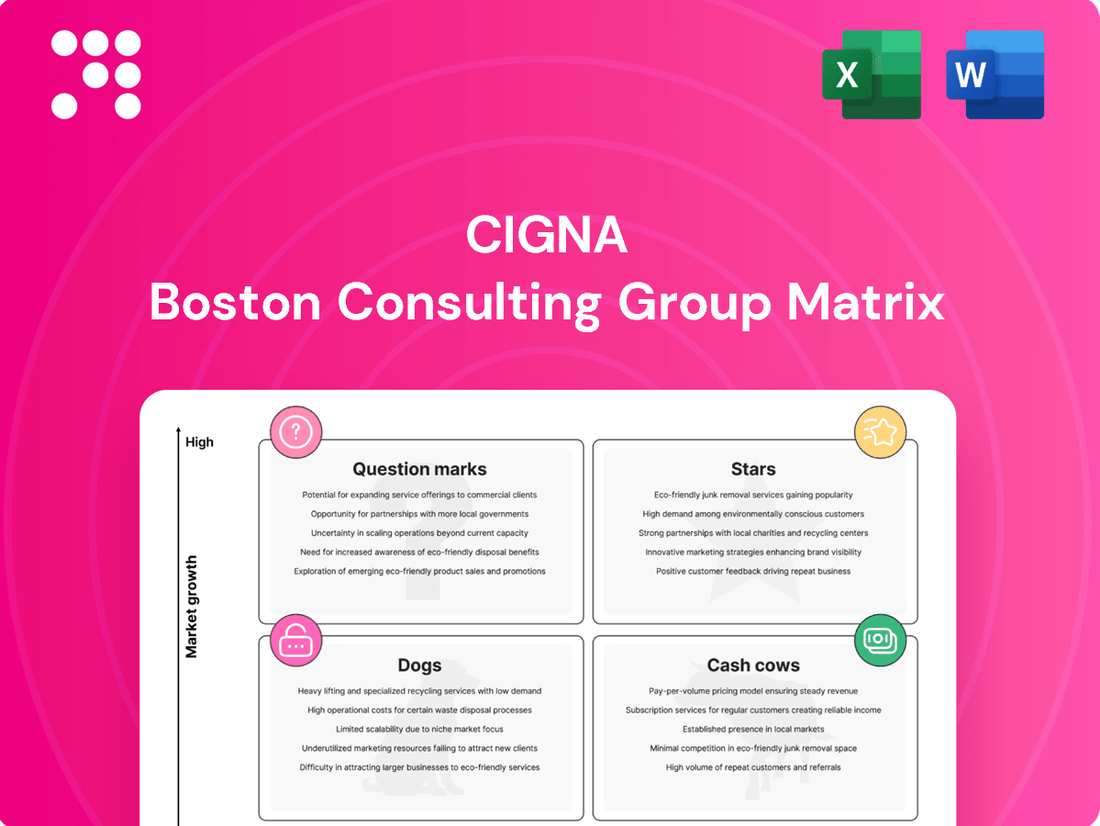

Curious about how Cigna strategically manages its diverse portfolio? This glimpse into their BCG Matrix highlights key product categories, revealing their market share and growth potential. Understand which Cigna offerings are driving growth and which require a closer look.

Unlock the full potential of this analysis by purchasing the complete Cigna BCG Matrix. Gain granular insights into each product's quadrant placement, enabling you to make informed decisions about resource allocation and future investments. Don't just see the overview; command the strategy.

Stars

Evernorth Pharmacy Benefit Management (PBM), particularly through its Express Scripts division, stands as a dominant force in the U.S. healthcare landscape. By 2024, it commanded an impressive 30% of all prescription claims, solidifying its position as the largest PBM by market share. This leadership is a testament to its robust capabilities within a rapidly expanding sector.

This market dominance was significantly bolstered by key strategic wins, including the management of pharmacy benefits for 20 million Centene members. Such substantial contracts underscore Evernorth's critical role and influence in a high-growth segment of the healthcare industry, demonstrating its capacity to secure and manage large-scale operations effectively.

Evernorth Specialty and Care Services is a significant growth engine for Cigna. In Q1 2025, its adjusted revenue surged by 19% to $23.9 billion, showcasing robust expansion.

This impressive growth is largely attributed to sustained demand for specialty medications and a notable increase in biosimilar utilization. Evernorth's strategic focus on biosimilars is yielding substantial cost savings for patients and payers.

By the close of 2024, nearly half of all eligible Humira prescriptions were being filled with biosimilar alternatives, demonstrating Evernorth's leadership in driving cost-effective healthcare solutions.

Evernorth Health Services stands out as a significant growth engine for Cigna, fueling its strong financial performance. In the first quarter of 2025, Cigna reported a 14% surge in total revenues, with Evernorth's expansion being a primary driver of this increase.

The company's deliberate strategy to broaden its client base and bolster its specialty pharmacy offerings through Evernorth highlights its considerable growth prospects. This consistent upward trend and strong underlying financial health firmly establish Evernorth as a leading Star within Cigna's portfolio.

Biosimilar Adoption Initiatives

Evernorth, Cigna's health services division, is significantly accelerating biosimilar adoption, a key strategy for cost containment and market growth. This focus directly addresses the increasing availability of biosimilar alternatives to high-cost biologic drugs.

By the close of 2024, a notable achievement was reached: nearly half of all eligible Humira prescriptions were being filled with biosimilar versions. This momentum is now extending to other critical interchangeable biosimilars, such as those for Stelara, demonstrating a sustained commitment to this segment.

- Biosimilar Market Expansion: Evernorth's efforts are capitalizing on the projected shift of over $100 billion in specialty drug spending towards biosimilar and generic competition within the next five years.

- Cost Savings and Access: The proactive push for biosimilar uptake directly translates to substantial savings for the healthcare system and improved access to more affordable treatments for patients.

- Strategic Positioning: By leading in biosimilar adoption, Cigna, through Evernorth, solidifies its position as a driver of drug affordability and a key player in managing healthcare costs.

- Growth Opportunity: This initiative represents a significant growth avenue for Evernorth, tapping into a rapidly expanding market segment with clear economic benefits.

Strategic Client Relationship Expansion

Strategic Client Relationship Expansion is crucial for Evernorth's Star position. Continued growth within existing client relationships and securing new business are key drivers. This organic growth, especially in pharmacy benefit services, highlights strong client loyalty and the ability to expand service offerings. For instance, in 2024, Evernorth's pharmacy benefit services saw continued strong performance, contributing to its overall market leadership.

These efforts directly translate into Evernorth's high market share and consistent revenue increases. Deepening these client ties is vital for maintaining a stable, yet growing, revenue stream in a highly competitive landscape. This focus ensures Evernorth remains a dominant player, leveraging its existing strengths to capture further market opportunities.

- Evernorth's organic growth strategy

- Pharmacy benefit services as a key growth area

- Impact on market share and revenue increases

- Importance of deepening client relationships for sustained growth

Evernorth's dominance in pharmacy benefit management, holding a 30% market share in 2024, positions it as a clear Star. Its robust growth, evidenced by a 19% adjusted revenue surge in Q1 2025 for its Specialty and Care Services, further solidifies this status. This expansion is driven by strategic wins, like managing Centene's pharmacy benefits, and a strong focus on biosimilar utilization, which is projected to capture significant market share from high-cost drugs.

| Evernorth Segment | 2024 Market Share / Key Metric | Q1 2025 Growth Metric | Key Growth Driver |

|---|---|---|---|

| Pharmacy Benefit Management (PBM) | 30% of U.S. prescription claims | Continued strong performance | Securing large client contracts (e.g., Centene) |

| Specialty and Care Services | N/A | 19% adjusted revenue surge | Biosimilar utilization, demand for specialty medications |

| Health Services (Overall) | N/A | 14% total revenue surge (Q1 2025) | Broadening client base, expanding specialty pharmacy offerings |

What is included in the product

The Cigna BCG Matrix analyzes its business units based on market share and growth to guide strategic decisions.

A clear BCG Matrix visualizes Cigna's portfolio, easing the pain of resource allocation by highlighting Stars and Cash Cows.

Cash Cows

Cigna Healthcare's U.S. commercial health plans are a cornerstone of its business, acting as a classic Cash Cow. This segment boasts a substantial market share, estimated at approximately 17% of the U.S. commercial health insurance market. These plans offer a wide array of medical and coordinated care solutions to employers and individuals alike.

Despite potentially moderate market growth, these established offerings consistently generate robust cash flow. This stability is driven by a large, loyal customer base and deeply entrenched, long-term relationships with employers, ensuring predictable revenue streams.

Cigna's International Health business, a key component of its global operations, acts as a reliable Cash Cow. This segment offers a broad range of health solutions to clients worldwide, contributing significantly to Cigna's diversified revenue streams.

Despite not experiencing rapid expansion, its long-standing presence in numerous international markets ensures a steady and consistent generation of cash flow. This stability is a hallmark of a Cash Cow, providing a solid financial foundation for the company.

In 2024, Cigna reported substantial international revenues, underscoring the segment's mature yet robust performance. For instance, Cigna's international health insurance premiums have consistently grown, reflecting sustained demand and market penetration.

Cigna's established group benefits, encompassing dental, vision, and behavioral health, represent significant cash cows. These offerings are staples for employers seeking comprehensive employee wellness programs, leading to high customer retention. For instance, in 2024, Cigna reported continued strength in its Evernorth Health Services segment, which includes many of these ancillary benefits, contributing to a stable and predictable revenue stream.

Health Management and Data Analytics Services

Cigna's Health Management and Data Analytics Services function as a Cash Cow within its BCG Matrix. These services, while not exhibiting rapid expansion, are crucial for generating consistent revenue and deepening client loyalty by offering valuable insights and support.

These offerings capitalize on Cigna's vast data reserves to enhance health outcomes and operational efficiency. For instance, in 2024, Cigna reported that its integrated health services, which heavily rely on data analytics, contributed significantly to its adjusted earnings per share, demonstrating their stable profitability.

- Stable Revenue Generation: These services provide a reliable income stream, underpinning Cigna's financial stability.

- Client Retention: The insights and support offered strengthen relationships with existing clients, reducing churn.

- Profitability Contribution: They play an integral role in Cigna's overall profitability, even without high growth rates.

- Data Leverage: Cigna's extensive data resources are effectively utilized to drive value and efficiency for clients.

Funding for Strategic Investments

Cigna's well-established health plan and benefit businesses act as significant Cash Cows, generating consistent and substantial cash flow. This financial strength is paramount for fueling the company's strategic investments in burgeoning, high-growth sectors.

The company's financial projections indicate a robust ability to self-fund expansion. Cigna is targeting over $10 billion in cash flow from operations for the year 2025. This substantial internal funding capacity enables Cigna to allocate capital towards innovation, cutting-edge technology, and the development of emerging healthcare solutions, thereby reducing reliance on external financing for growth initiatives.

- Cash Flow Generation: Cigna's mature health and benefits segments consistently produce strong, reliable cash flows.

- Strategic Investment Funding: These Cash Cows provide the necessary capital for Cigna to invest in new ventures and high-growth opportunities.

- 2025 Target: Cigna aims to achieve more than $10 billion in cash flow from operations in 2025.

- Reduced External Reliance: This internal funding capability allows for investment in innovation without being solely dependent on external capital markets.

Cigna's established U.S. commercial health plans and international health businesses are prime examples of Cash Cows. These mature segments, despite moderate growth, consistently generate substantial and predictable cash flow due to their large customer bases and strong market positions. For instance, in 2024, Cigna's international health insurance premiums showed sustained growth, highlighting the segment's reliable performance.

The company's ancillary benefits, like dental and vision, also function as Cash Cows, bolstered by high customer retention and the strong performance of its Evernorth Health Services segment in 2024. Furthermore, Cigna's data analytics services provide stable revenue and client loyalty, contributing significantly to adjusted earnings per share in 2024.

These Cash Cows are vital for Cigna, providing the financial muscle to invest in innovation and growth areas. The company's target of over $10 billion in cash flow from operations for 2025 underscores its ability to self-fund strategic initiatives, reducing reliance on external financing.

| Business Segment | BCG Category | Key Characteristics | 2024/2025 Data Point |

|---|---|---|---|

| U.S. Commercial Health Plans | Cash Cow | High market share, stable revenue, loyal customer base | Approx. 17% U.S. commercial health insurance market share |

| International Health Business | Cash Cow | Long-standing presence, consistent cash flow generation | Sustained growth in international health insurance premiums (2024) |

| Group Benefits (Dental, Vision, Behavioral Health) | Cash Cow | High customer retention, predictable revenue | Strong performance in Evernorth Health Services (2024) |

| Health Management & Data Analytics | Cash Cow | Leverages data, deepens client loyalty, stable profitability | Significant contribution to adjusted EPS from integrated health services (2024) |

| Overall Cash Flow Generation | N/A | Funding for strategic investments, reduced external reliance | Target >$10 billion cash flow from operations (2025) |

Full Transparency, Always

Cigna BCG Matrix

The Cigna BCG Matrix document you are currently previewing is the identical, fully formatted report you will receive immediately after purchase. This means no watermarks, no placeholder content, and no hidden surprises – just the complete strategic analysis ready for your immediate use. You can confidently use this preview as a direct representation of the professional, actionable insights that will be yours upon completion of your purchase. This ensures you know exactly what you're getting: a comprehensive tool designed to empower your strategic decision-making.

Dogs

Cigna’s Medicare Advantage (MA) business, which was divested to HCSC in March 2025 for $3.7 billion, would likely be classified as a Dog in the BCG Matrix. Despite operating in a growing market, this segment was marked by high operational costs for Cigna.

The MA segment exhibited a higher medical care ratio (MCR) than Cigna's other business lines. In 2024, for instance, the MA MCR was reported to be in the high 80s, significantly impacting profitability and acting as a financial burden on the company's overall performance.

Underperforming legacy products within Cigna's portfolio, though specific examples aren't publicly detailed, would represent offerings with shrinking market share and stagnant or negative growth. These could be older insurance plans or services that haven't adapted to evolving consumer needs or face intense competition from newer, more agile solutions. For instance, if a legacy health insurance plan saw its enrollment drop by 15% in 2023 compared to 2022, with minimal new customer acquisition, it would likely be considered a 'dog'.

Such products often require significant maintenance and support while generating minimal revenue, potentially acting as a drain on resources. Cigna's strategic reviews likely identify these areas, aiming to either revitalize them or divest them to focus on higher-growth, more profitable segments of the healthcare and insurance market. The company's emphasis on innovation and digital transformation suggests a proactive approach to phasing out or significantly overhauling offerings that no longer align with market demands or strategic objectives.

Cigna has strategically divested non-core assets to sharpen its focus. Beyond the significant Medicare Advantage divestiture, the company has also scaled back or sold smaller business units exhibiting low growth prospects or struggling to gain substantial market share.

These divestitures are a testament to Cigna's disciplined capital management, allowing for the reallocation of resources towards more promising and strategically aligned growth areas.

Segments with Persistent High Medical Costs

Cigna Healthcare has identified certain market segments experiencing persistently high stop-loss medical costs, directly affecting profitability. These areas exhibit a consistently elevated medical care ratio (MCR), proving resistant to turnaround efforts. This situation means a significant portion of revenue is being allocated to medical claims with insufficient returns.

For instance, in 2024, Cigna's employer-sponsored health insurance plans, particularly those catering to mid-sized businesses with complex health needs, have shown a trend of higher-than-average MCR. This is partly due to the increasing prevalence of chronic conditions and the associated high-cost treatments within these populations.

- Persistent High MCR Segments: Mid-sized employer plans in 2024 have demonstrated a concerning trend of elevated medical care ratios.

- Impact on Profitability: These segments consume a disproportionate amount of revenue for medical claims, hindering overall financial performance.

- Challenges in Mitigation: Despite ongoing strategies to control costs, these specific areas remain difficult to stabilize financially.

- Resource Allocation Strain: The sustained high medical costs in these segments place a strain on resources that could otherwise be allocated to growth initiatives or other profitable areas.

Inefficient or Outdated Operational Processes

Inefficient or outdated operational processes at Cigna can be categorized as 'dogs' within the BCG matrix framework, especially when they consume resources without fostering a competitive edge or generating significant revenue. These can include legacy IT systems or manual workflows that hinder agility and increase operational costs.

Cigna's commitment to investing in technology and workforce development, as evidenced by their ongoing digital transformation initiatives, aims to address these inefficiencies. For instance, in 2024, Cigna HealthCare continued to invest in enhancing its digital platforms to streamline member and provider experiences, a move that directly tackles potential 'dog' areas by modernizing core functions.

Failure to address these operational 'dogs' can lead to a substantial drain on financial and human capital. Without modernization, these processes risk becoming increasingly costly to maintain, diverting funds that could be allocated to more promising growth areas or innovative product development.

- Legacy Systems: Cigna's ongoing efforts to upgrade its core administrative and claims processing systems are crucial for eliminating 'dog' assets, aiming for greater automation and reduced manual intervention.

- Operational Inefficiencies: Areas like manual data entry or outdated customer service protocols represent operational 'dogs' that Cigna is actively seeking to improve through technology adoption and process re-engineering.

- Cost of Maintenance: Maintaining outdated technological infrastructure can be a significant financial burden, with estimates suggesting that a substantial portion of IT budgets are spent on keeping legacy systems operational rather than on innovation.

- Strategic Resource Allocation: By identifying and addressing these inefficient processes, Cigna can reallocate resources from these 'dog' areas to invest in high-growth segments or develop new, competitive offerings.

Cigna's Medicare Advantage business, divested in March 2025 for $3.7 billion, was a prime example of a 'dog' due to its high operational costs and a medical care ratio (MCR) in the high 80s during 2024. This segment struggled despite operating in a growing market, indicating a low market share and low growth potential relative to its costs.

Underperforming legacy products, characterized by shrinking market share and stagnant growth, also fit the 'dog' category. For instance, a health insurance plan experiencing a 15% enrollment drop in 2023 with minimal new acquisitions would be considered a 'dog'. These products drain resources without contributing significantly to revenue.

Inefficient operational processes, such as legacy IT systems or manual workflows, represent 'dogs' that consume resources without providing a competitive edge. Cigna's ongoing digital transformation, including platform enhancements in 2024, aims to modernize these functions and eliminate such drains.

These 'dog' segments, whether product lines or operational inefficiencies, require careful management or divestment to free up capital for more promising growth areas, reflecting Cigna's strategic resource allocation.

| Business Segment/Area | BCG Category | Key Characteristics | Financial Impact (Illustrative) |

|---|---|---|---|

| Medicare Advantage (Divested) | Dog | High operational costs, high MCR (high 80s in 2024), divested for $3.7B in March 2025. | Significant drag on profitability, resource drain. |

| Underperforming Legacy Products | Dog | Shrinking market share, stagnant/negative growth (e.g., 15% enrollment drop in 2023). | Low revenue generation, high maintenance costs. |

| Inefficient Operational Processes | Dog | Legacy IT systems, manual workflows, hinder agility, increase costs. | Consume resources without competitive edge, potential for significant cost savings through modernization. |

| Certain Employer-Sponsored Plans (Mid-size) | Dog | Persistently high stop-loss medical costs, resistant to turnaround efforts, high MCR in 2024. | Disproportionate revenue allocation to claims, hinders overall financial performance. |

Question Marks

Cigna Healthcare is investing $150 million in AI-powered digital tools to enhance customer experience. These include virtual assistants and personalized provider matching, aiming to innovate within a dynamic market. While these advancements show significant potential for growth, their market adoption and impact on Cigna's market share are still being evaluated.

Cigna is actively steering healthcare spending towards value-based reimbursement models, a significant shift from traditional fee-for-service. These models reward providers for the quality and efficiency of care delivered, rather than just the volume of services. This strategic pivot aims to improve patient outcomes while controlling costs.

While the potential for growth in value-based care is substantial, its widespread adoption and seamless implementation remain ongoing challenges. Cigna is making considerable investments to assist providers in navigating this transition, acknowledging that the market share derived from these newer models is still in its nascent stages of development.

In 2024, Cigna reported that a significant portion of its medical reimbursements were tied to value-based arrangements, indicating progress in this area. For instance, by the end of 2023, over 60% of their medical spend was under value-based contracts, a figure expected to continue growing as more providers embrace these payment structures.

Evernorth Behavioral Care Group, a new venture by Cigna, is positioned as a potential Star in the BCG Matrix. Its goal to guarantee appointments within 72 hours by 2025 taps into a rapidly expanding market for accessible mental health services.

While currently holding a low market share due to its recent launch, the group's ambitious scaling plans and focus on a critical need suggest substantial growth potential. If successful, it could capture significant market share and become a leading player.

New Digital Health Initiatives and Partnerships

Cigna is actively pursuing new digital health initiatives and partnerships, leveraging automation, analytics, and artificial intelligence to reshape healthcare delivery. Through Cigna Group Ventures, the company is investing in early-stage and growth-stage companies, signaling a commitment to innovation in this rapidly evolving sector.

These digital health efforts, encompassing virtual care and mobile health applications, represent high-growth potential. However, they are still in the process of solidifying their market position and demonstrating their full impact on Cigna's overall market share. Their ultimate success hinges on widespread market adoption and seamless integration into existing healthcare ecosystems.

- Investment Focus: Cigna Group Ventures is actively identifying and investing in promising digital health startups and growth-stage companies.

- Key Areas: Initiatives include virtual care platforms and mobile health applications, targeting high-growth segments of the digital health market.

- Market Position: While these ventures are in high-growth areas, they are still establishing their market presence and contribution to Cigna's overall market share.

- Success Factors: Market acceptance and effective integration of these digital health solutions are critical for their long-term success and impact.

EncircleRx Program for GLP-1 Management

Cigna's EncircleRx program is a key player in managing the increasing costs associated with GLP-1 medications, a rapidly expanding segment of pharmaceutical spending. This data-driven initiative, which covered approximately 8 million lives in 2024, offers solutions for cardiometabolic conditions, demonstrating Cigna's commitment to proactive health management.

While GLP-1 medications are a high-growth area, the precise market share of Cigna's management program within this dynamic market is still being established. This positions EncircleRx as a strategic investment with considerable potential for future growth and influence in the pharmaceutical cost management landscape.

- Data-Driven Management: EncircleRx leverages data analytics to optimize the use and cost-effectiveness of GLP-1 medications.

- Expanded Reach: The program's coverage grew to encompass roughly 8 million lives in 2024, highlighting its increasing adoption.

- Focus on Cardiometabolic Health: It addresses a critical area of healthcare need, linking medication management to broader health outcomes.

- Strategic Investment: EncircleRx represents a forward-looking strategy for Cigna to navigate and capitalize on the growing GLP-1 market.

Question Marks in Cigna's BCG Matrix represent initiatives with high growth potential but currently low market share. These are areas where Cigna is investing significantly, aiming to capture future market dominance. Their success is uncertain, requiring careful monitoring and strategic adjustments.

Cigna's digital health ventures, like those funded through Cigna Group Ventures, and the Evernorth Behavioral Care Group are prime examples of Question Marks. These are innovative efforts in rapidly expanding markets, such as digital health applications and accessible mental health services.

The EncircleRx program, managing GLP-1 medications, also fits this category. While the GLP-1 market is booming, Cigna's specific program share is still developing, making it a strategic bet on future market leadership in pharmaceutical cost management.

These initiatives are crucial for Cigna's long-term growth strategy, aiming to transform healthcare delivery and patient outcomes in dynamic sectors.

| Initiative | Market Growth Potential | Current Market Share | Strategic Significance |

|---|---|---|---|

| Evernorth Behavioral Care Group | High | Low | Addresses growing demand for mental health services, aiming for 72-hour appointment guarantees by 2025. |

| Digital Health Ventures (Cigna Group Ventures) | High | Low | Invests in AI, virtual care, and mobile health, targeting innovation in healthcare delivery. |

| EncircleRx Program (GLP-1 Management) | High | Developing | Manages high-cost GLP-1 medications, covering 8 million lives in 2024, with potential to lead in pharma cost management. |

BCG Matrix Data Sources

Our Cigna BCG Matrix leverages a robust data foundation, integrating financial performance metrics, market share data, and industry growth projections from reputable sources.