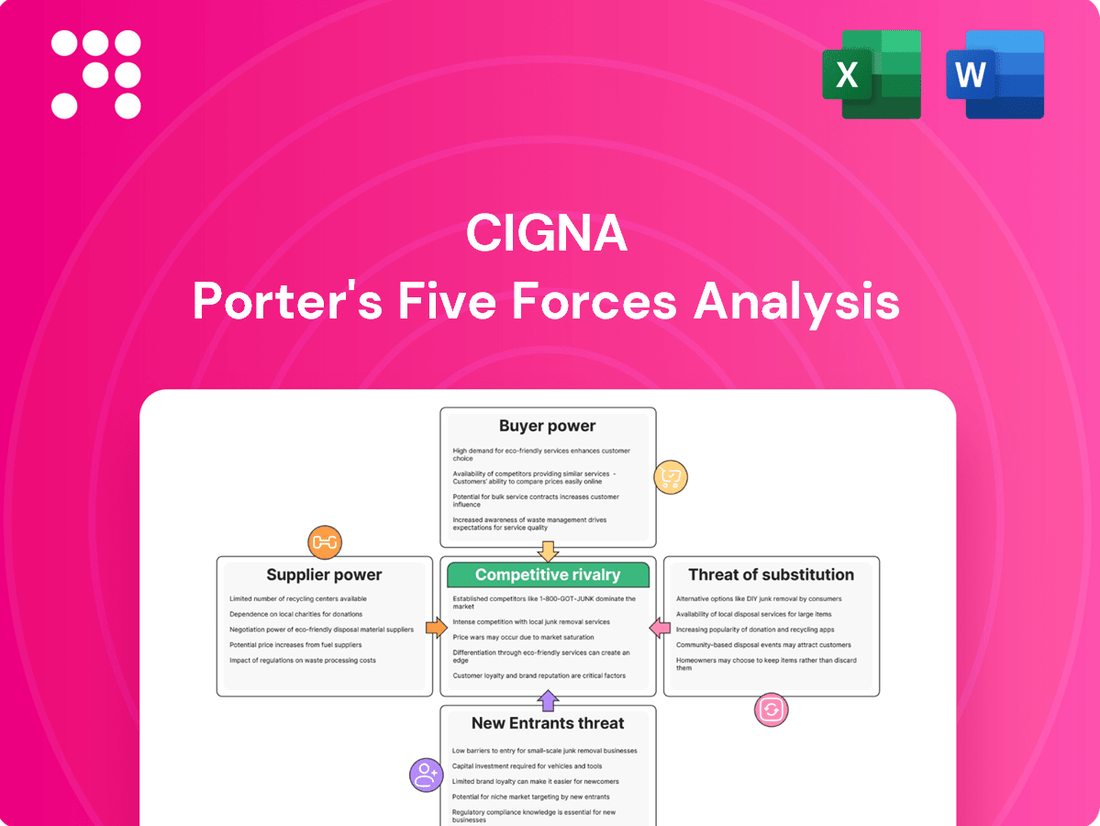

Cigna Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Cigna Bundle

Cigna navigates a complex healthcare landscape where buyer power, particularly from large employers and government programs, significantly influences pricing and plan design.

The threat of new entrants, while potentially high due to technological advancements, is somewhat mitigated by stringent regulatory hurdles and established brand loyalty.

The full analysis reveals the real forces shaping Cigna’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Cigna's reliance on a limited number of crucial suppliers, such as major pharmaceutical firms and medical device manufacturers, significantly impacts its bargaining power. This concentration means these suppliers, often holding substantial market share, can dictate terms and pricing more effectively.

For example, in the medical equipment sector, the top four suppliers command approximately 70% of the market. This dominance grants them considerable leverage, potentially increasing Cigna's procurement costs and limiting its negotiation flexibility.

Cigna faces significant supplier power due to high switching costs. Moving between major medical supply or pharmaceutical contracts involves substantial expenses and time commitments. For instance, estimated transition costs can amount to $3.2 million for medical equipment and $2.7 million for pharmaceutical supplies.

These considerable financial and operational hurdles make it economically unfeasible for Cigna to frequently change its suppliers. Consequently, this increased burden strengthens the bargaining position of existing suppliers, allowing them to potentially command more favorable terms.

Major pharmaceutical giants like Pfizer, Johnson & Johnson, and Merck wield considerable pricing power over health insurers such as Cigna. These influential suppliers were able to negotiate average price hikes between 5.9% and 7.2% in 2024, underscoring their ability to set terms.

Cigna's Evernorth business unit actively works to control drug expenditures, notably by incorporating newer biosimilar alternatives into its strategy to mitigate these supplier-driven cost increases.

Specialized Services and Regulatory Environment

Certain healthcare technology vendors and specialized service providers hold unique knowledge or certifications, making them hard to substitute. This exclusivity grants them significant leverage. For instance, vendors offering proprietary data analytics platforms or specialized claims processing software often have few direct competitors, increasing their pricing power.

The intricate and ever-changing healthcare regulatory landscape further constrains Cigna's options for switching suppliers. Companies possessing deep expertise in compliance, such as those managing HIPAA-compliant data storage or specific medical coding standards, become indispensable. This reliance on specialized compliance knowledge significantly amplifies the bargaining power of these niche suppliers.

- Niche Expertise: Healthcare tech firms with unique data analytics or claims processing platforms are difficult to replace due to proprietary technology.

- Regulatory Dependence: Suppliers with specialized knowledge of evolving healthcare regulations, like HIPAA compliance, limit Cigna's supplier flexibility.

- Limited Alternatives: The scarcity of providers offering similar specialized and compliant services directly enhances supplier bargaining power.

Provider Network Importance

The bargaining power of suppliers for Cigna is influenced by the critical role healthcare providers play in its network. Cigna manages a substantial global network, boasting approximately 1.5 million health professionals. However, the need for extensive and high-caliber provider networks in key regions grants certain provider groups a moderate degree of leverage.

Cigna actively manages its provider relationships by evaluating and tiering healthcare professionals based on their quality of care and cost-effectiveness. This strategic approach helps to mitigate supplier power by creating a tiered system that incentivizes performance and efficiency among providers.

- Provider Network Size: Cigna's global network includes around 1.5 million health professionals.

- Geographic Concentration: The necessity of strong networks in specific areas can increase the bargaining power of providers in those regions.

- Provider Tiering: Cigna categorizes providers based on quality and cost, influencing their standing and negotiation leverage within the network.

The bargaining power of suppliers for Cigna remains a significant factor, particularly with major pharmaceutical companies and medical device manufacturers. In 2024, leading pharmaceutical suppliers successfully negotiated price increases ranging from 5.9% to 7.2%. This pricing power is amplified by high switching costs, estimated at millions of dollars for transitioning medical equipment and pharmaceutical contracts, making it financially impractical for Cigna to frequently change vendors.

| Factor | Impact on Cigna | Example/Data |

| Supplier Concentration | High | Top 4 medical equipment suppliers hold ~70% market share. |

| Switching Costs | High | Estimated $3.2M (medical equipment), $2.7M (pharmaceuticals). |

| Pharmaceutical Pricing Power | Significant | 2024 price hikes of 5.9%-7.2% by major drug firms. |

| Niche Expertise/Regulation | Moderate to High | Specialized compliance (HIPAA) and proprietary tech vendors limit alternatives. |

| Provider Network Leverage | Moderate | ~1.5M global health professionals; regional concentration can increase provider power. |

What is included in the product

This analysis unpacks the competitive forces shaping Cigna's healthcare market, examining supplier and buyer power, the threat of new entrants and substitutes, and the intensity of rivalry among existing players.

Quickly identify and mitigate competitive threats with a visual breakdown of industry power dynamics.

Customers Bargaining Power

Cigna's large corporate clients wield significant bargaining power due to their substantial membership numbers. These employers, often representing a considerable portion of Cigna's business, can negotiate for tailored benefit plans, cost efficiencies, and specialized services. In 2022, these large employers constituted 37% of Cigna's total medical membership, underscoring their influence on pricing and service delivery.

Customers today have unprecedented access to information about health insurance plans and pricing thanks to digital tools and online resources. This transparency allows individuals and small businesses to easily compare Cigna's offerings with those of competitors, directly impacting their price sensitivity and negotiation power.

In 2024, the average consumer spent over 10 hours researching health insurance options online, highlighting the significant role of readily available information. This increased awareness means customers are more likely to seek out the best value, putting pressure on providers like Cigna to offer competitive and transparent pricing structures to retain market share.

The health insurance landscape is quite crowded, giving consumers plenty of choices. This means if a customer isn't happy with their current plan or service, they can often find another provider without too much trouble. Cigna needs to keep its offerings attractive and its service top-notch to hold onto its customers.

While switching insurance plans can be a bit of a hassle, the availability of numerous competitors means customers have real leverage. Cigna's focus on customer satisfaction is evident, with a recent survey showing that 85% of their members would recommend the company, indicating strong retention potential.

Government Entities as Powerful Buyers

Government entities, particularly those managing programs like Medicare and Medicaid, represent substantial buyers of healthcare services. Their sheer volume of covered individuals grants them significant leverage in negotiating prices and terms with healthcare providers and insurers like Cigna.

Cigna's strategic maneuvers, such as its announced divestiture of certain Medicare Advantage businesses in late 2023, underscore the impact of these government-backed segments. The profitability and operational complexities associated with serving these large, regulated populations are key considerations in such decisions.

- Government Program Membership: Medicare and Medicaid programs collectively cover tens of millions of Americans, making them colossal purchasing blocs.

- Price Sensitivity: Government payers often operate with strict budget constraints, leading to intense price negotiations.

- Regulatory Influence: Government entities set reimbursement rates and regulations that directly shape the financial landscape for health insurers.

- Market Share Impact: The ability to attract and retain members within these government programs is crucial for an insurer's overall market position.

Demand for Value-Based Care and Digital Solutions

Customers are increasingly prioritizing value-based care, seeking affordable access, and expecting convenient digital health solutions. This shift directly impacts the bargaining power of customers in the healthcare sector.

Cigna is actively responding to these demands through its Evernorth and myCigna platforms, focusing on virtual care, preventive services, and personalized health management. For instance, in 2024, Cigna reported a significant increase in the utilization of its digital health tools, reflecting customer adoption of these convenient solutions.

The ability to attract and retain financially-literate decision-makers hinges on Cigna's effectiveness in meeting these evolving expectations. This includes offering transparent pricing and demonstrating clear health outcomes.

- Customer Demand for Value: Healthcare consumers are scrutinizing costs and outcomes more than ever, driving demand for services that deliver tangible benefits at a reasonable price.

- Digital Health Adoption: In 2024, telehealth services saw continued strong growth, with patient satisfaction ratings often exceeding those of traditional in-person visits for certain types of care.

- Cigna's Strategic Response: Investments in platforms like Evernorth aim to consolidate services and provide a more integrated, patient-centric experience, directly addressing the call for convenience and personalized care.

Cigna's customers, especially large employers, possess considerable bargaining power due to their significant membership numbers. This influence allows them to negotiate for better pricing and customized benefit plans, impacting Cigna's revenue streams.

The increasing availability of online information empowers consumers to easily compare health insurance options, heightening price sensitivity and forcing providers like Cigna to offer competitive rates. In 2024, consumers spent an average of over 10 hours researching plans online, underscoring this trend.

The competitive nature of the health insurance market provides customers with ample choices, enabling them to switch providers if dissatisfied. Cigna's focus on customer satisfaction, evidenced by an 85% member recommendation rate in a recent survey, is crucial for retention.

Government programs like Medicare and Medicaid represent substantial purchasing blocs, granting them significant leverage in price negotiations with insurers such as Cigna. Cigna's strategic decisions, like divesting certain Medicare Advantage businesses in late 2023, reflect the impact of these large, regulated customer segments.

Preview Before You Purchase

Cigna Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase, offering a comprehensive Cigna Porter's Five Forces Analysis. You'll gain insights into the competitive landscape, including the threat of new entrants, the bargaining power of buyers and suppliers, the threat of substitute products or services, and the intensity of rivalry among existing competitors within the health insurance industry. This professionally formatted analysis is ready for your immediate use.

Rivalry Among Competitors

The U.S. health insurance landscape is a battleground with several giants. Cigna competes head-to-head with formidable rivals like UnitedHealth Group, Elevance Health (formerly Anthem), Aetna (now part of CVS Health), Humana, Kaiser Permanente, and Centene. This crowded market means Cigna must constantly innovate and find unique ways to stand out.

The health insurance sector is witnessing substantial consolidation, with major players actively pursuing mergers and acquisitions. This ongoing trend intensifies price competition as consolidated entities aim to capture larger market shares and leverage economies of scale. For instance, in 2023, the healthcare M&A landscape saw continued activity, with insurers seeking to bolster their positions and manage costs more effectively.

Cigna strategically navigates this environment by prioritizing operational efficiency and implementing measures to mitigate escalating medical costs. These efforts are crucial for maintaining competitiveness amidst the pricing pressures arising from industry consolidation. The company's focus on value-based care models and technology integration aims to improve outcomes while controlling expenditures.

Competitors like UnitedHealth Group are formidable due to their diversified business models, which extend beyond traditional insurance to include pharmacy benefit management (PBM) and direct care delivery. This integration allows them to capture value across the healthcare spectrum. For instance, in 2023, UnitedHealth Group's Optum segment, which houses its PBM and care delivery services, reported revenue of $225.9 billion, highlighting the significant financial impact of these diversified operations.

Kaiser Permanente differentiates itself with a fully integrated care model, directly owning hospitals and employing physicians. This approach aims to control costs and improve patient outcomes by managing the entire care journey. In 2023, Kaiser Permanente reported total operating revenue of $47.5 billion, showcasing the scale of its integrated operations.

Cigna actively competes by bolstering its Evernorth Health Services segment, which offers a comprehensive suite of pharmacy, specialty pharmacy, and care services. This strategic move allows Cigna to offer integrated solutions and compete with the broader capabilities of its rivals. Evernorth's performance is crucial for Cigna's overall market standing, contributing significantly to its revenue streams.

Customer Satisfaction and Retention as Key Differentiators

In the highly competitive health insurance landscape, where core offerings can appear quite similar, Cigna strategically leverages customer satisfaction and retention as significant differentiators. The company focuses on enhancing the overall customer experience, investing in digital health platforms, and developing innovative solutions to stand out from rivals.

This commitment to customer centricity directly impacts retention. For instance, Cigna reported an impressive 85% member recommendation rate in its 2024 disclosures, a testament to its success in fostering loyalty even when faced with intense competition from other major health insurers.

- Customer Experience Focus: Cigna prioritizes a seamless and supportive customer journey.

- Digital Health Investments: The company enhances engagement and access through digital tools.

- Innovation in Solutions: Cigna aims to offer unique value propositions beyond basic coverage.

- Retention Metric: An 85% recommendation rate in 2024 highlights strong member loyalty.

Dynamic Regulatory and Economic Environment

The health insurance sector faces constant shifts due to evolving regulations and economic forces. For instance, changes to Medicare Advantage rates directly impact revenue streams for companies like Cigna. In 2024, the Centers for Medicare & Medicaid Services (CMS) proposed a net payment increase of 0.57% for Medicare Advantage plans for 2024, a figure that significantly influences profitability and strategic planning across the industry.

Economic pressures also intensify competition. Rising medical utilization and escalating drug costs present ongoing challenges, forcing insurers to manage expenses more effectively. This dynamic environment necessitates agility, as companies must quickly adapt their strategies to maintain profitability and market share amidst these fluctuating conditions.

- Regulatory Volatility: Changes in government policies, such as Medicare Advantage rate adjustments, create uncertainty and necessitate rapid strategic adaptation.

- Economic Headwinds: Increasing medical utilization and rising pharmaceutical prices directly impact operational costs and profitability for all health insurers.

- Industry-Wide Impact: These dynamic environmental factors influence competitive strategies and financial performance for every player in the health insurance market, including Cigna.

Competitive rivalry within the health insurance sector is intense, with Cigna facing off against well-established giants like UnitedHealth Group and Elevance Health. This crowded market compels Cigna to differentiate through customer experience and innovative solutions. For example, Cigna's 2024 disclosures highlighted an 85% member recommendation rate, underscoring its focus on retention amidst fierce competition.

Consolidation further fuels competition, as larger entities leverage economies of scale. This trend pressures Cigna to maintain operational efficiency and control escalating medical costs. Competitors like UnitedHealth Group, with its diversified Optum segment reporting $225.9 billion in revenue in 2023, demonstrate the strategic advantage of integrated business models.

Cigna's strategy involves strengthening its Evernorth Health Services segment to offer comprehensive solutions, directly competing with rivals' broader capabilities. Companies like Kaiser Permanente, with its integrated care model and $47.5 billion in operating revenue for 2023, also present unique competitive challenges.

| Competitor | Key Differentiator/Strategy | 2023 Revenue (Approx.) |

| UnitedHealth Group | Diversified model (PBM, direct care) | $371.7 billion |

| Elevance Health | Market presence, integrated services | $171.9 billion |

| Aetna (CVS Health) | Pharmacy integration, broad network | Part of CVS Health's $207.1 billion revenue |

| Humana | Medicare Advantage focus, integrated care | $102.2 billion |

| Kaiser Permanente | Fully integrated care model | $47.5 billion |

SSubstitutes Threaten

The rise of Direct Primary Care (DPC) models presents a significant threat of substitutes for traditional health insurance providers like Cigna. These DPC practices offer a compelling alternative by charging a predictable monthly fee for comprehensive primary care, often eliminating co-pays and deductibles. This direct-to-consumer approach appeals to patients prioritizing affordability, accessibility, and a more personalized healthcare experience, effectively bypassing the complexities and costs associated with conventional insurance for routine medical needs.

A significant threat to Cigna's employer-sponsored health insurance business comes from the increasing adoption of self-insurance by large employers. These companies choose to manage their employees' healthcare expenses directly, bypassing traditional insurers.

This self-insurance model offers greater control over healthcare spending and plan design, making it a compelling alternative to fully insured products. For instance, in 2023, it's estimated that over 60% of American workers were covered by self-funded health plans, a trend that continues to grow.

This shift directly substitutes for the services Cigna provides, as employers absorb the financial risk and administrative burden themselves, reducing reliance on external insurance carriers.

Government healthcare programs, such as Medicare and Medicaid, present a significant threat of substitution for private health insurance. These programs cater to specific populations, including the elderly, disabled, and low-income individuals, offering an alternative to commercially available plans. While Cigna does participate in some government programs, changes or expansions to these can directly impact the demand for private insurance. For instance, Cigna's 2023 divestiture of its Medicare Advantage plans underscores the strategic challenges posed by these government alternatives.

Focus on Wellness and Preventive Care

The growing focus on wellness and preventive care presents a significant threat of substitutes for traditional health insurance models like Cigna's. As individuals increasingly adopt healthier lifestyles and utilize preventive services, the demand for extensive, reactive 'sick care' insurance may decline. This shift means that services and technologies promoting wellness, such as fitness trackers, personalized nutrition plans, and virtual health coaching, could become substitutes for comprehensive health insurance policies. For instance, a 2024 report indicated a 15% year-over-year increase in consumer spending on digital health and wellness platforms, suggesting a tangible move away from solely relying on insurance for health management.

This trend could impact Cigna by reducing the perceived value of its core insurance products if individuals feel they can manage their health more effectively and affordably through preventative measures. The market is seeing a rise in direct-to-consumer wellness solutions that bypass traditional insurance.

- Growing adoption of wearable health technology: Devices that monitor vital signs and activity levels empower individuals to proactively manage their health.

- Increased availability of personalized health coaching and nutrition services: These services offer tailored advice, reducing reliance on insurance for managing chronic conditions.

- Expansion of telehealth for minor ailments and preventative check-ups: Virtual consultations offer a convenient and often lower-cost alternative to in-person doctor visits covered by insurance.

- Employer-sponsored wellness programs: Companies are investing more in these programs, shifting the focus from treatment to prevention, which could reduce employees' need for extensive insurance coverage for preventable illnesses.

Emergence of Health Technology and Digital Health Solutions

The rise of health technology and digital health solutions presents a significant threat of substitutes for traditional health insurance offerings like those from Cigna. New platforms, including telemedicine and AI-powered diagnostics, are increasingly providing healthcare services directly to consumers, often bypassing established insurance networks.

These digital health services can offer more convenient and potentially lower-cost alternatives for specific health needs. For instance, a growing number of individuals are utilizing direct-to-consumer telehealth services for minor ailments or mental health support, which could reduce reliance on traditional insurance plans for these services. In 2024, the digital health market continued its robust expansion, with telehealth utilization remaining significantly higher than pre-pandemic levels, demonstrating a clear shift in consumer behavior.

- Telehealth Adoption: Reports indicate that telehealth visits in the US remained elevated in early 2024, with some studies showing a substantial percentage of healthcare providers offering virtual care as a primary option.

- AI in Diagnostics: AI-driven diagnostic tools are becoming more sophisticated, offering faster and more accessible preliminary assessments for various conditions, potentially reducing the need for immediate in-person physician visits facilitated by insurance.

- Direct-to-Consumer Models: The growth of direct-to-consumer health tech companies, offering services from prescription delivery to chronic disease management, provides viable alternatives that compete with services traditionally covered by insurance.

- Cost Sensitivity: As consumers become more cost-conscious, the perceived value of digital health solutions that offer transparent pricing and potentially lower out-of-pocket expenses will increase, posing a direct challenge to traditional insurance models.

The threat of substitutes for Cigna is significant, particularly from alternative healthcare delivery and payment models. Direct Primary Care (DPC) and self-insured employer plans are gaining traction, offering more direct and potentially cost-effective solutions that bypass traditional insurance structures.

Government programs like Medicare and Medicaid also act as substitutes, especially for specific demographics, and shifts in these programs can influence private insurance demand. Furthermore, the increasing consumer focus on wellness and the rise of digital health platforms offer preventive and convenient care options that may reduce reliance on comprehensive insurance for everyday health needs.

| Substitute Type | Description | Impact on Cigna | 2023/2024 Data Point |

|---|---|---|---|

| Direct Primary Care (DPC) | Monthly fee for comprehensive primary care, bypassing insurance. | Reduces reliance on insurance for primary care needs. | Growing patient interest in affordable, accessible primary care models. |

| Self-Insured Employer Plans | Employers manage healthcare costs directly. | Decreases demand for Cigna's employer-sponsored insurance products. | Over 60% of US workers covered by self-funded health plans in 2023. |

| Government Healthcare Programs | Medicare, Medicaid offer alternatives for specific populations. | Can reduce the market for private insurance, especially with program expansions. | Cigna's divestiture of Medicare Advantage plans highlights strategic challenges. |

| Wellness & Digital Health | Preventive care, telehealth, health tech bypass traditional insurance. | May lower demand for reactive 'sick care' insurance; shifts focus to prevention. | 15% year-over-year increase in consumer spending on digital health and wellness platforms (2024). |

Entrants Threaten

Entering the health insurance market, like Cigna operates in, requires immense financial backing. Think about the costs for setting up IT systems, building a network of healthcare providers, and holding adequate reserves to cover claims. For instance, in 2024, the average capital required for a new health insurer to be licensed and operational in a major state can easily run into tens of millions of dollars, sometimes exceeding $50 million, depending on the state's regulations and the scope of services offered.

This high initial investment acts as a significant barrier. It makes it incredibly tough for smaller companies or startups to even get a foothold. Established players like Cigna, with their existing infrastructure and deep pockets, are naturally protected from a flood of new, less-resourced competitors. This financial hurdle is a primary reason why the health insurance landscape tends to be dominated by a few large, well-capitalized organizations.

The health insurance industry is a minefield of regulations, demanding rigorous licensing, adherence to complex compliance frameworks, and constant oversight. For instance, the Affordable Care Act (ACA) introduced numerous requirements that new entrants must meticulously navigate, adding layers of complexity.

These intricate state and federal legal and policy landscapes, including evolving mandates around coverage and pricing, create a formidable barrier. New companies face substantial costs and expertise requirements to simply establish a compliant operational foundation, deterring many potential competitors.

The necessity of building extensive provider networks presents a significant barrier to entry for new health insurers. Establishing a robust network of hospitals, physicians, and specialists demands substantial investment in time, resources, and complex negotiations with healthcare providers. For instance, Cigna's global network boasts approximately 1.5 million health professionals, a scale that new competitors would struggle to replicate quickly or cost-effectively.

Strong Brand Recognition and Customer Trust

Established players like Cigna have cultivated significant brand recognition and deep customer trust over decades of operation. For any new entrant to the health insurance market, achieving a similar level of brand equity and fostering genuine customer loyalty would require immense time and a substantial marketing budget. This presents a formidable barrier, making it difficult to attract and retain members against a well-established and trusted incumbent.

The threat of new entrants is significantly mitigated by Cigna's strong brand recognition and established customer trust. For instance, in 2024, Cigna continued to invest heavily in brand building, which is crucial in the healthcare sector where trust is paramount. New companies entering the market would face the daunting task of overcoming this entrenched loyalty, a process that typically demands years of consistent service and extensive marketing campaigns.

- Brand Equity: Cigna's long-standing presence has fostered a reputation for reliability and comprehensive coverage, making it a preferred choice for many consumers and employers.

- Customer Loyalty: Existing members often renew their policies due to familiarity and satisfaction with Cigna's services, creating a sticky customer base.

- Marketing Investment: A new entrant would need to spend considerably on advertising and outreach to even begin to rival Cigna's established market presence.

- Trust Factor: In healthcare, where decisions impact well-being, trust is a non-negotiable factor that new, unproven entities struggle to build quickly.

Economies of Scale and Operational Expertise

Incumbent health insurers leverage substantial economies of scale, particularly in claims processing and administrative overhead. For instance, in 2024, major players like UnitedHealth Group reported operating revenues exceeding $370 billion, a scale that allows for significant cost efficiencies not easily replicable by newcomers.

This scale translates into considerable purchasing power for medical services and technology, further widening the cost gap. New entrants would find it challenging to achieve similar operational expertise and cost advantages, hindering their ability to compete on price with established insurers.

- Economies of Scale: Large insurers benefit from lower per-unit costs in claims processing and administration due to high volume.

- Operational Expertise: Decades of experience have honed efficient workflows and risk management strategies.

- Technological Infrastructure: Significant investments in IT systems support complex operations and data analytics.

- Purchasing Power: Established insurers negotiate better rates with healthcare providers, lowering overall costs.

The threat of new entrants into Cigna's health insurance market is generally low, primarily due to the substantial capital requirements and regulatory hurdles. For example, initial licensing and operational setup in 2024 can demand over $50 million in some states, a significant barrier for startups.

Furthermore, building a robust provider network and achieving brand recognition comparable to Cigna's established trust takes years and considerable investment. Regulatory complexities, including ACA compliance, add further layers of difficulty, making it challenging for new players to gain traction against incumbents with established economies of scale and operational expertise.

| Barrier Type | Description | Impact on New Entrants |

| Capital Requirements | High initial investment for licensing, IT, and reserves (e.g., $50M+ in 2024). | Significantly deters smaller or underfunded competitors. |

| Regulatory Compliance | Complex state and federal regulations (e.g., ACA). | Requires substantial legal and compliance resources, increasing costs. |

| Provider Networks | Need to establish vast networks of healthcare providers. | Time-consuming and resource-intensive to replicate Cigna's 1.5M+ global provider base. |

| Brand Recognition & Trust | Established customer loyalty and a trusted brand image. | New entrants face a long and costly process to build similar credibility. |

| Economies of Scale | Lower per-unit costs due to high volume operations. | New entrants struggle to match the cost efficiencies of large players like UnitedHealth Group (>$370B revenue in 2024). |

Porter's Five Forces Analysis Data Sources

Our Cigna Porter's Five Forces analysis is built upon a foundation of comprehensive data, including Cigna's annual reports, SEC filings, and industry-specific market research from sources like IBISWorld. We also leverage insights from macroeconomic databases and health insurance industry publications to provide a robust understanding of the competitive landscape.