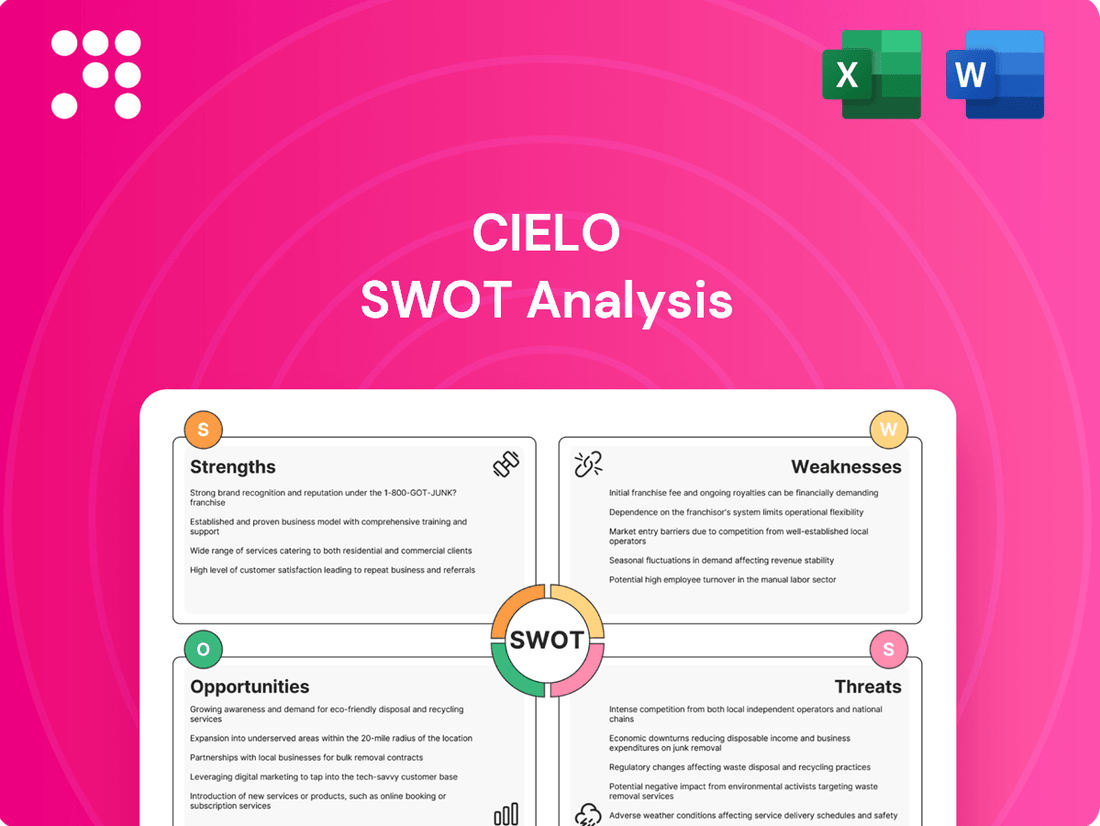

Cielo SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Cielo Bundle

Cielo's strengths lie in its established brand and customer loyalty, but its opportunities for expansion are tempered by potential market saturation. Our full SWOT analysis dives deep into these dynamics, revealing critical competitive advantages and potential threats.

Want the full story behind Cielo's market position and future growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your strategic planning and investment decisions.

Strengths

Cielo holds a commanding position in Brazil's payment processing sector, evidenced by its operations reaching 99% of the country's territory. This vast network ensures access to a broad merchant base, from micro-enterprises to major corporations, underpinning its market dominance.

Cielo boasts a comprehensive and continually expanding product line, encompassing essential services like credit and debit card processing, advanced point-of-sale (POS) systems, and a wide array of electronic payment solutions. This broad offering caters to diverse merchant needs.

The company's commitment to innovation is clear through its significant investments in technology and artificial intelligence. This focus fuels faster product development and the introduction of cutting-edge solutions, such as Cielo TAP, enhancing user experience and operational efficiency.

Cielo demonstrated a robust financial recovery, posting a substantial profit of R$2.1 billion in 2023. This figure represents the company's strongest performance since 2018, underscoring a significant rebound in its financial health.

Despite a dip in recurring net income during the second quarter of 2024, Cielo's overall financial results showed improvement. This was largely driven by successful asset management optimization and a reduction in funding costs, indicating effective operational efficiency and cost control measures.

Customer-Centric Innovation and Service Quality

Cielo's dedication to a customer-centric approach, fueled by data and advanced AI, significantly bolsters its service quality. This focus allows for greater agility in responding to customer needs, as seen in the 'Pra Cima Cielo' program. For instance, in 2024, Cielo reported a notable increase in customer satisfaction scores, directly linked to these personalized service enhancements and AI-driven support systems.

The company's strategic investments in urban mobility solutions further underscore its commitment to improving the customer experience. By leveraging technology, Cielo aims to provide seamless and efficient services, anticipating and meeting evolving consumer demands. This forward-thinking strategy is a key differentiator, positioning Cielo as a leader in customer-focused innovation within the financial services sector.

Key strengths in this area include:

- Customer-centric strategy: Prioritizing customer needs through data analysis and AI.

- Service agility: Rapid adaptation to market changes and customer feedback.

- Innovation in mobility: Developing solutions that enhance customer convenience and access.

- Operational efficiency: AI integration leading to improved service delivery and satisfaction.

Robust Corporate Governance and Sustainability Commitment

Cielo demonstrates strong corporate governance and a deep commitment to sustainability, evidenced by its inclusion in the Corporate Sustainability Index (ISE B3). This recognition underscores its dedication to responsible business operations and ethical practices.

The company's 2021-2025 Strategic Sustainability Planning provides a clear roadmap for its environmental, social, and governance (ESG) initiatives. This strategic focus ensures that sustainability is integrated into its core business model, driving long-term value creation and stakeholder trust.

- Recognition in ISE B3: Inclusion in the Corporate Sustainability Index highlights Cielo's leadership in sustainable business practices.

- Strategic ESG Framework: The 2021-2025 Strategic Sustainability Planning sets clear ESG targets, guiding responsible development.

- Commitment to Stakeholders: Adherence to high governance standards and sustainability efforts builds confidence among investors and the public.

Cielo's extensive operational reach across 99% of Brazil, coupled with a diverse and growing product portfolio, solidifies its market leadership. The company's significant financial rebound, marked by a R$2.1 billion profit in 2023, demonstrates robust recovery and effective operational management.

Innovation is a core strength, with substantial investments in AI driving product development and enhanced customer experiences, as highlighted by the 'Pra Cima Cielo' program which saw increased customer satisfaction in 2024. Furthermore, Cielo's commitment to sustainability, recognized by its inclusion in the ISE B3 index, reinforces its strong corporate governance and long-term value creation strategy.

| Metric | 2023 (R$ billions) | 2024 (Q2 - Recurring Net Income) | Key Initiatives |

|---|---|---|---|

| Profitability | 2.1 | Improvement driven by asset optimization | AI-powered product development, Customer satisfaction focus |

| Market Reach | 99% of Brazil | N/A | Comprehensive payment solutions |

| Sustainability | Included in ISE B3 | N/A | 2021-2025 Strategic Sustainability Planning |

What is included in the product

Analyzes Cielo’s competitive position through key internal and external factors, detailing its strengths, weaknesses, opportunities, and threats.

Offers a structured framework to identify and address strategic challenges, alleviating the pain of uncertainty.

Weaknesses

The Brazilian payments landscape has transformed dramatically, with the number of competitors soaring from a mere two in 2010 to 28 by 2023. This intense market saturation, fueled by the rise of agile fintechs, has significantly compressed profit margins.

Consequently, payment processing services are increasingly viewed as commodities, placing considerable pressure on Cielo's ability to maintain healthy profitability and competitive pricing strategies.

Cielo saw its recurring net income drop by 20.7% year-over-year in the second quarter of 2024. This significant decrease was largely due to a substantial reduction in its EBITDA, indicating persistent difficulties in sustaining profitability. The competitive and rapidly changing market environment continues to pressure Cielo's earnings.

Cielo's significant concentration within Brazil presents a notable weakness. Its business model is heavily anchored to the domestic economy, leaving it vulnerable to shifts in local economic conditions, changes in government regulations, and political uncertainties that can impact consumer spending and business operations. This deep reliance on a single market limits Cielo's capacity to spread risk and access broader growth opportunities.

Perception of Higher Fees

A significant weakness for Cielo is the perception of higher fees among some market participants and customers. This can be a deterrent, especially when compared to newer, more nimble competitors who may offer more aggressive pricing structures.

This perception of higher transaction fees could directly impact Cielo's market share. It might lead to existing merchants seeking out alternative payment processors and make it more challenging to onboard new businesses, particularly those operating in price-sensitive sectors of the economy. For instance, a small business owner evaluating payment processing options in 2024 might find that Cielo's fee structure, while potentially offering robust services, appears less competitive on a per-transaction basis than fintech startups.

Cielo's ability to retain customers and attract new ones is therefore directly linked to how effectively it can address this fee perception. If competitors continue to offer lower rates, Cielo risks losing ground in key market segments. Data from 2024 merchant surveys might indicate a correlation between fee sensitivity and processor choice, highlighting this as a critical area for Cielo to manage.

- Perceived High Fees: Market participants and customers often view Cielo's transaction fees as relatively higher than those of newer, more agile competitors.

- Customer Churn Risk: This perception can lead to existing customers switching to alternative payment providers, impacting revenue and market position.

- Barrier to New Merchant Acquisition: Higher fees can hinder Cielo's ability to attract new merchants, particularly in price-sensitive market segments.

- Competitive Pressure: The ongoing presence of lower-cost competitors intensifies the challenge for Cielo to maintain its customer base and expand its reach.

Potential Delisting from B3's Novo Mercado

Cielo's potential delisting from B3's Novo Mercado, triggered by a public acquisition offer, presents a significant weakness. This move could diminish its profile among investors and potentially hinder future capital raising efforts. For instance, if this delisting were to occur, it would remove Cielo from a segment specifically designed for companies with higher governance standards, potentially signaling a shift in its operational transparency.

The reduction in market visibility associated with delisting can erode investor confidence. This lack of visibility can make it harder for Cielo to attract new investment or maintain existing shareholder interest, impacting its ability to fund growth initiatives or manage its debt effectively. By November 2024, the market will be closely watching the outcome of the acquisition offer and its implications for Cielo's listing status.

Furthermore, a delisting could negatively affect Cielo's access to capital markets. Companies not listed on major exchanges often face higher borrowing costs and a more limited pool of potential investors. This could constrain Cielo's financial flexibility, especially in a competitive landscape where access to funding is crucial for maintaining market share and investing in new technologies.

The implications of this potential delisting are substantial:

- Reduced Market Visibility: Exiting the Novo Mercado could lead to a significant drop in public awareness and investor scrutiny.

- Impact on Investor Confidence: A delisting may be perceived negatively, potentially lowering investor trust and share price.

- Limited Capital Access: Difficulty in raising funds could constrain future operational and strategic development.

- Governance Perception: Moving away from a premium listing segment might raise questions about corporate governance standards.

Cielo's significant concentration within Brazil exposes it to the volatility of the domestic economy and regulatory changes, limiting its ability to diversify risk. The competitive pressure from a growing number of fintechs has intensified, leading to compressed profit margins and a commoditized perception of payment processing services. This market saturation, with the number of competitors rising from two in 2010 to 28 by 2023, directly impacts Cielo's ability to maintain profitability.

The company faces a perception of higher fees compared to agile competitors, which poses a risk to customer retention and new merchant acquisition. This fee sensitivity, evident in 2024 merchant evaluations, could lead to customer churn and hinder expansion into price-sensitive market segments. For instance, Cielo's recurring net income saw a 20.7% year-over-year drop in Q2 2024, partly due to reduced EBITDA, underscoring profitability challenges.

A potential delisting from B3's Novo Mercado, following a public acquisition offer, represents a significant weakness. This could reduce market visibility, erode investor confidence, and limit access to capital markets, impacting its ability to fund growth and manage debt. The market will be closely monitoring the outcome of the acquisition offer by November 2024.

| Weakness Category | Specific Weakness | Impact | Supporting Data/Context |

|---|---|---|---|

| Market Concentration | Over-reliance on the Brazilian market | Vulnerability to domestic economic downturns, regulatory shifts, and political instability. Limits risk diversification and broad growth opportunities. | Brazilian payments market saturation increased from 2 competitors in 2010 to 28 by 2023. |

| Competitive Landscape | Perception of higher transaction fees | Risk of customer churn and difficulty acquiring new merchants, especially in price-sensitive segments. | Recurring net income dropped 20.7% YoY in Q2 2024, partly due to EBITDA reduction. |

| Financial & Market Position | Potential delisting from Novo Mercado | Reduced market visibility, diminished investor confidence, and limited access to capital markets, hindering growth initiatives. | Market participants are observing the implications of a public acquisition offer on Cielo's listing status by November 2024. |

Preview Before You Purchase

Cielo SWOT Analysis

The preview you see is the actual Cielo SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. This allows you to assess the depth and structure of the analysis before committing. You're viewing a direct excerpt from the complete, ready-to-use file.

Opportunities

The digital payment market in Brazil is booming, with projections indicating a substantial compound annual growth rate of 18.586% from 2025 to 2035. This rapid expansion is largely driven by increased smartphone penetration across the population and a significant surge in e-commerce activities.

This robust market growth presents a prime opportunity for Cielo to further develop and promote its digital payment solutions. By capitalizing on these trends, Cielo can solidify its position and expand its reach within the increasingly digital Brazilian economy.

The widespread embrace of Pix, Brazil's instant payment system, offers a significant avenue for growth. By mid-2024, Pix transactions have consistently surpassed traditional debit and credit card volumes, demonstrating its dominance. Cielo can capitalize on this by seamlessly integrating Pix, including its newer contactless and recurring payment features, into its merchant offerings, aligning with consumer demand for speed and ease.

Small and Medium-sized Enterprises (SMEs) are increasingly adopting digital payment solutions, demonstrating a notable stabilization and enhancement in their commercial productivity. This trend positions SMEs as a crucial growth engine for payment providers.

Cielo's strategic emphasis on serving the SME segment, by offering specialized and adaptable payment solutions, presents a substantial opportunity to expand its market share. The company can leverage this by developing products that specifically address the unique needs of these businesses.

Advancements in AI and Mobile Technologies

The increasing integration of AI in payment security presents a significant opportunity for Cielo. For instance, AI-powered fraud detection systems saw a 30% increase in adoption by financial institutions globally in 2024, according to Juniper Research. This trend allows Cielo to bolster its security measures, making transactions safer for its clients and their customers.

Furthermore, the rapid expansion of mobile wallets and contactless payment methods offers a chance for Cielo to innovate its service offerings. By the end of 2025, it's projected that over 75% of all retail transactions in developed markets will be conducted via mobile devices, as per Statista data. Cielo can capitalize on this by enhancing its mobile payment infrastructure, leading to smoother and more convenient user experiences.

These technological advancements enable Cielo to:

- Enhance fraud detection capabilities: Implementing advanced AI algorithms can significantly reduce chargebacks and fraudulent activities.

- Streamline transaction processes: Optimizing for mobile and contactless payments can lead to faster checkout times and improved customer satisfaction.

- Develop innovative payment solutions: Leveraging AI and mobile tech can create new, user-friendly payment products and services.

- Improve user experience: A more intuitive and secure mobile payment interface can drive customer loyalty and adoption.

Strategic Partnerships and Diversification Initiatives

Strategic partnerships with established financial institutions and innovative fintech companies present a significant opportunity for Cielo to broaden its market presence and enhance its service portfolio. These collaborations can unlock access to new customer segments and complementary technologies, fostering growth.

Cielo's recent acquisition of a U.S. payment company, for instance, signals a clear intent to diversify its operations and explore international expansion. This move is projected to open up new revenue streams, moving beyond its traditional core markets and strengthening its competitive position globally.

- Market Expansion: Accessing new customer bases and geographic regions through partnerships.

- Service Enhancement: Integrating advanced fintech solutions to offer a wider range of services.

- Revenue Diversification: Developing new income sources beyond existing core business activities.

- International Growth: Leveraging acquisitions like the U.S. payment company for global market penetration.

The Brazilian digital payment market is experiencing rapid growth, projected to expand significantly between 2025 and 2035, driven by increased smartphone usage and e-commerce. Cielo can leverage this by enhancing its digital payment solutions to meet evolving consumer and business needs.

The widespread adoption of Pix, Brazil's instant payment system, presents a substantial opportunity for Cielo to integrate its features, including contactless and recurring payments, into its merchant services, aligning with demand for convenience.

The growing trend of Small and Medium-sized Enterprises (SMEs) adopting digital payment solutions offers Cielo a chance to expand its market share by providing tailored payment products that cater to their specific requirements.

The increasing integration of AI in payment security, with a global rise in adoption by financial institutions in 2024, allows Cielo to bolster its fraud detection capabilities, enhancing transaction safety.

The expansion of mobile wallets and contactless payments, with projections showing over 75% of retail transactions in developed markets by mobile devices by the end of 2025, provides an avenue for Cielo to innovate its service offerings for improved user experience.

Strategic partnerships with financial institutions and fintech companies offer Cielo opportunities for market expansion and service enhancement through access to new customer segments and technologies.

Cielo's international expansion, exemplified by its acquisition of a U.S. payment company, opens new revenue streams and strengthens its global competitive position.

Threats

The Brazilian payments landscape is intensely competitive, with fintechs like Stone and PagSeguro increasingly capturing market share by offering agile, digital-first solutions. These disruptors often present lower transaction fees and more user-friendly interfaces, directly challenging Cielo's established position. For instance, Stone reported processing R$387 billion in total payment volume in 2023, a significant increase that highlights the growing competitive pressure.

The evolving regulatory landscape presents a significant threat to Cielo. For instance, the mandated implementation of Open Finance in Brazil, alongside the growing adoption of low-cost instant payment solutions like Pix, directly challenges Cielo's established revenue streams from traditional card transactions. This regulatory shift, which gained considerable momentum throughout 2023 and is expected to continue shaping the market through 2024 and 2025, forces constant adaptation and strategic recalibration to maintain competitiveness and compliance.

Brazil's economic landscape remains a significant concern for Cielo, with persistent inflation impacting purchasing power. For instance, Brazil's inflation rate was around 4.62% in early 2024, a slight decrease but still a factor influencing consumer behavior.

Economic instability and elevated inflation can directly curb consumer spending, leading to lower transaction volumes for merchants. This slowdown in economic activity translates to reduced processed volumes and revenue streams for Cielo, as fewer transactions are processed through its payment networks.

Furthermore, potential economic downturns could exacerbate these issues, creating a challenging environment for payment processors like Cielo. The company's financial performance is closely tied to the overall health of the Brazilian economy and the spending habits of its consumers.

Rapid Technological Obsolescence and Innovation Demands

The payments sector is a hotbed of rapid technological change, with consumer demands for novel payment methods and stronger security constantly shifting. For Cielo, failing to keep pace with these innovations risks becoming outdated and losing its competitive edge.

Cielo's ability to integrate new technologies, such as advancements in tokenization and biometric authentication, will be crucial. For instance, the global digital payment market is projected to reach over $15 trillion by 2027, highlighting the immense pressure to innovate and capture market share through advanced solutions.

- Technological Obsolescence: Failure to invest in and adopt emerging payment technologies could render Cielo's current infrastructure and offerings obsolete.

- Innovation Gap: Competitors are likely to introduce more advanced and user-friendly payment solutions, potentially drawing customers away from Cielo if it lags.

- Security Demands: Evolving cyber threats necessitate continuous upgrades to security protocols, a costly but essential undertaking to maintain customer trust.

Increasing Cybersecurity Risks and Fraud

The increasing reliance on digital and real-time payment systems significantly elevates the risk of cyberattacks, data breaches, and sophisticated social engineering scams. As a leading payment processor, Cielo is under continuous pressure to allocate substantial resources towards advanced fraud prevention and robust security infrastructure to safeguard its operations and sensitive customer information, directly affecting operational expenditures and brand integrity.

For instance, the global average cost of a data breach reached $4.35 million in 2024, according to IBM's Cost of a Data Breach Report. This escalating threat landscape necessitates ongoing investment in cybersecurity, potentially impacting Cielo's profitability and competitive standing if not managed effectively.

- Cybersecurity Threats: Digital payment growth amplifies risks of data breaches and fraud.

- Investment Needs: Cielo must continually invest in advanced security to protect data.

- Cost Implications: High security spending can impact operational costs and profitability.

- Reputational Risk: Security failures can severely damage customer trust and brand image.

Intense competition from agile fintechs like Stone and PagSeguro, which processed R$387 billion in total payment volume in 2023, poses a significant threat by offering lower fees and user-friendly digital solutions. Regulatory shifts, including Open Finance and the rise of Pix, directly challenge Cielo's traditional revenue models, requiring constant adaptation through 2025. Furthermore, Brazil's economic instability, with inflation around 4.62% in early 2024, dampens consumer spending, reducing transaction volumes and impacting Cielo's revenue. The rapid pace of technological change necessitates continuous investment in innovations like tokenization to avoid obsolescence in a global digital payment market projected to exceed $15 trillion by 2027.

| Threat Category | Specific Threat | Impact on Cielo | Supporting Data/Trend |

|---|---|---|---|

| Competition | Fintech Disruption | Loss of market share and transaction volume | Stone processed R$387 billion in 2023 |

| Regulatory Changes | Open Finance & Pix | Erosion of traditional revenue streams | Pix adoption surged in 2023-2024 |

| Economic Factors | Inflation & Instability | Reduced consumer spending and transaction volumes | Brazil's inflation ~4.62% in early 2024 |

| Technological Evolution | Obsolescence Risk | Need for continuous investment in new payment tech | Global digital payments market projected >$15T by 2027 |

| Cybersecurity | Data Breaches & Fraud | Increased operational costs and reputational damage | Global average data breach cost $4.35M in 2024 |

SWOT Analysis Data Sources

This analysis is built upon a robust foundation of publicly available financial reports, comprehensive market research from leading industry analysts, and insights from expert commentary on the e-commerce landscape.