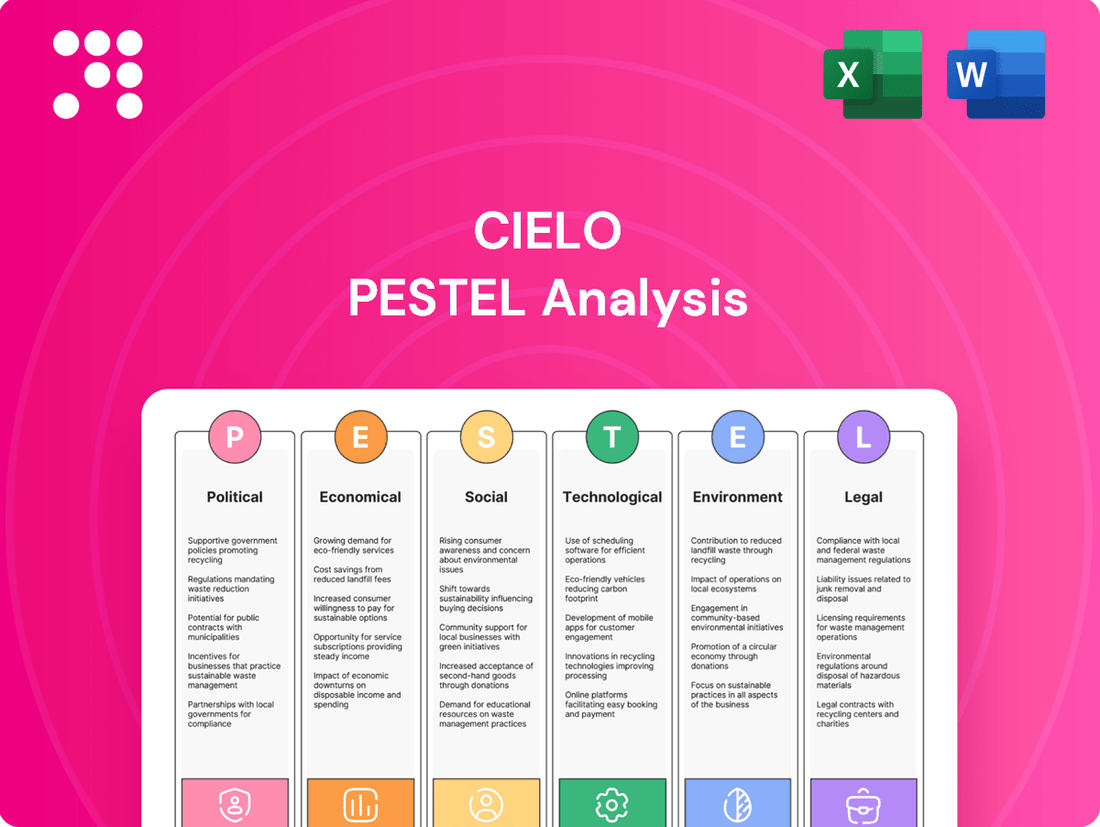

Cielo PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Cielo Bundle

Uncover the critical political, economic, social, technological, environmental, and legal forces shaping Cielo's path. This comprehensive PESTLE analysis provides the strategic intelligence you need to anticipate challenges and seize opportunities. Gain a competitive edge by understanding the external landscape. Download the full report now for actionable insights.

Political factors

The political landscape in Brazil, marked by a stable democratic framework since 1985, provides a foundation for business operations, though shifts in government can introduce policy uncertainty. For instance, the 2022 presidential election saw a change in administration, leading to a re-evaluation of economic priorities and potential regulatory adjustments within the financial sector.

Changes in government can directly impact Cielo's operating environment. A new administration might prioritize different fiscal policies or introduce new regulations on digital payments and financial services, as seen with past discussions around taxing digital transactions. Cielo's strategic planning must account for these potential policy evolutions to maintain its competitive edge and ensure regulatory adherence.

Investor confidence is closely tied to political stability and the predictability of economic policies. Brazil's commitment to fiscal responsibility and market-friendly reforms, as advocated by the current government, generally supports a positive investment climate. However, any perceived instability or significant policy reversals could deter foreign and domestic investment in companies like Cielo.

The Central Bank of Brazil (BCB) is a key regulator for Brazil's financial sector, significantly shaping Cielo's operating landscape. Recent BCB initiatives, like the ongoing evolution of Pix and open banking frameworks, directly influence transaction processing and competitive dynamics.

Cielo's business is sensitive to regulatory shifts, including potential changes in capital requirements or new directives on digital payment methods. For instance, the BCB's ongoing review of interchange fees for various transaction types could impact Cielo's revenue streams, a factor closely monitored by investors and analysts as of mid-2025.

Government initiatives, particularly the promotion of Pix, significantly reshape Brazil's digital payment ecosystem and consumer habits. These efforts to broaden financial inclusion and accelerate transaction digitization present both avenues for growth and competitive challenges for incumbent payment providers like Cielo. For instance, Pix adoption surged to over 130 million users by early 2024, demonstrating its rapid integration into daily financial life.

Antitrust and Competition Policies

Brazilian antitrust authorities, particularly the Administrative Council for Economic Defense (CADE), are actively involved in overseeing the payments sector. Their primary goal is to prevent monopolistic behaviors and encourage a more competitive landscape. As a significant player in this market, Cielo faces ongoing scrutiny regarding its substantial market share, its pricing structures, and any potential mergers or acquisitions it might pursue.

Cielo's compliance with these competition laws is not just about avoiding fines; it's essential for maintaining its operational freedom and continued access to the market. For instance, CADE has previously investigated and imposed conditions on large payment processors to ensure fair competition, impacting how companies like Cielo operate and expand. Staying ahead of these regulatory trends is paramount for sustained growth and market stability.

- CADE's Role: The Administrative Council for Economic Defense (CADE) actively regulates the Brazilian payments market to ensure fair competition.

- Market Scrutiny: Cielo, as a dominant payment processor, is under constant review for its market share, pricing, and M&A activities.

- Compliance Importance: Adherence to antitrust regulations is vital for Cielo to avoid penalties and secure its market position.

International Trade Relations and Sanctions

Cielo, while largely focused on the Brazilian market, can experience indirect impacts from Brazil's international trade dynamics. For example, trade disputes or sanctions involving Brazil could affect the broader economic climate, influencing consumer spending and business investment, which in turn impacts payment processing volumes. A notable instance is the US investigation into Brazil's Pix system, which, while not directly targeting Cielo, signals potential international scrutiny of digital payment infrastructures and could foreshadow future regulatory shifts or competitive pressures within the fintech landscape.

These international relations can also influence the availability and cost of technology and services that Cielo relies on, potentially impacting operational efficiency. For instance, if trade tensions lead to increased tariffs on imported technology components, it could raise operating costs for Cielo and its clients.

- US Investigation into Pix: The US Treasury Department's inquiry into Brazil's Pix instant payment system in late 2023 highlighted international interest and potential regulatory oversight on Brazil's financial infrastructure, indirectly affecting the competitive environment for payment providers like Cielo.

- Global Economic Slowdown: International trade slowdowns in 2024 and projected for 2025 could reduce cross-border transactions and impact overall economic activity in Brazil, thereby affecting the volume of payments processed by Cielo.

- Trade Agreements: Brazil's ongoing efforts to forge new trade agreements, such as those with the European Union or potential expansions of Mercosur, could open new markets or create new competitive dynamics for financial services, indirectly influencing Cielo's strategic outlook.

Political stability in Brazil, while generally consistent, can introduce policy shifts with new administrations. The 2022 presidential election, for example, brought about a change in economic priorities, potentially influencing financial sector regulations. Cielo's strategy must adapt to these evolving governmental stances and potential new rules, such as those concerning digital transaction taxation.

Government initiatives like Pix have dramatically reshaped Brazil's digital payment landscape, with over 130 million users by early 2024, presenting both growth opportunities and competitive challenges for Cielo. Regulatory bodies, including the Central Bank of Brazil and antitrust authorities like CADE, actively monitor and shape the payments sector, impacting Cielo's operational freedom and market position through scrutiny of market share and pricing.

International relations and trade dynamics can indirectly affect Cielo. For instance, the US Treasury's late 2023 inquiry into Brazil's Pix system highlights global interest and potential regulatory oversight. Global economic slowdowns projected for 2024-2025 could also impact cross-border transactions and overall economic activity, influencing Cielo's processed payment volumes.

What is included in the product

This Cielo PESTLE analysis examines how external macro-environmental factors influence the company across Political, Economic, Social, Technological, Environmental, and Legal dimensions, providing actionable insights for strategic decision-making.

Provides a clear, actionable framework to identify and mitigate external threats, turning potential market disruptions into strategic advantages.

Economic factors

High inflation rates and the Central Bank's corresponding interest rate policies, specifically the Selic rate, directly influence consumer spending power and the cost of credit for businesses like Cielo. For instance, if inflation remains elevated, the Selic rate might be kept high to curb it, making borrowing more expensive for merchants and potentially reducing transaction volumes.

Cielo's financial performance, especially its revenue streams from credit card transactions and the anticipation of receivables, is sensitive to these macroeconomic shifts. When interest rates are high, the cost of capital increases, impacting both consumer purchasing decisions and the profitability of Cielo's financial services.

Looking at recent data, Brazil's inflation has shown some moderation, with the IPCA (Brazil's benchmark inflation index) seeing a downward trend in early 2024, though remaining a key focus. Consequently, the Central Bank has been able to implement gradual reductions in the Selic rate, which stood at 10.50% as of May 2024. This easing of monetary policy generally creates a more favorable environment for economic activity, potentially boosting consumer spending and reducing financing costs for merchants, which bodes well for companies like Cielo.

Brazil's economic growth is a critical factor for Cielo, as robust GDP expansion directly fuels consumer spending and business activity. In 2023, Brazil's GDP grew by an estimated 2.9%, a solid performance that translates into higher transaction volumes for payment processors like Cielo. This growth signifies a more vibrant commercial landscape, leading to increased demand for payment services from merchants.

Conversely, an economic slowdown poses a direct challenge to Cielo's revenue streams. Should Brazil experience a contraction in GDP, as some forecasts suggested for early 2024 before revised upward, consumer spending typically tightens, and businesses may see reduced sales. This directly impacts the number of transactions processed, potentially dampening Cielo's profitability and growth prospects.

Consumer spending power is a critical driver for Cielo, as higher disposable income translates directly into more transactions processed. For instance, in Brazil, a key market for Cielo, personal disposable income saw an estimated growth of 3.5% in 2024, indicating a positive trend for transaction volumes.

A burgeoning middle class in Latin America, where Cielo operates extensively, fuels increased demand for goods and services, thereby boosting digital payment adoption. This growing purchasing power is expected to continue its upward trajectory through 2025, supporting Cielo's revenue streams.

Conversely, economic slowdowns or recessions can significantly dampen consumer confidence and reduce discretionary spending, directly impacting Cielo's transaction volumes and profitability. For example, if inflation outpaces wage growth, consumers tend to cut back on non-essential purchases, affecting payment processing businesses.

Competition Intensity in the Payment Processing Sector

The Brazilian payment processing landscape is a battleground, with established banks, agile fintechs, and emerging players vying for market share. This fierce competition directly impacts Cielo's profitability, forcing it to constantly innovate and offer competitive pricing to keep merchants on board.

Cielo's ability to maintain its market position hinges on its capacity to deliver efficient services and adapt to evolving customer demands amidst this crowded market. For instance, in Q1 2024, the total volume processed by Brazilian payment institutions reached R$2.4 trillion, highlighting the sheer scale and competitive nature of the industry.

- Intense Rivalry: Traditional banks, fintechs like Stone and PagSeguro, and even new entrants are actively competing for merchant accounts.

- Margin Pressure: The high number of competitors forces Cielo to keep its fees competitive, potentially squeezing profit margins.

- Innovation Imperative: Continuous investment in new technologies and services is crucial for Cielo to differentiate itself and retain its customer base.

- Service Efficiency: Streamlined onboarding processes and reliable transaction processing are key differentiators in a market where merchants have many choices.

Foreign Exchange Rate Fluctuations

While Cielo's core business is in Brazil, shifts in the Brazilian Real (BRL) against other currencies can significantly influence its financial performance. This is particularly true if the company holds debt or engages in partnerships denominated in foreign currencies. For instance, a weaker Real can increase the cost of servicing foreign debt.

A depreciating Real also has a direct impact on consumer spending, especially for imported goods. This can affect the volume of e-commerce transactions processed by Cielo, as consumers may curb spending on non-essential imported items. In early 2024, the BRL experienced volatility, trading around R$4.90 to R$5.20 against the US dollar, highlighting the ongoing sensitivity.

Key impacts of foreign exchange rate fluctuations for Cielo include:

- Increased cost of foreign-denominated debt servicing: A weaker BRL makes it more expensive to repay loans or other obligations in foreign currencies.

- Reduced consumer purchasing power for imports: This can dampen demand for goods sold online, affecting transaction volumes.

- Impact on international partnership profitability: Profits or expenses from partnerships with international entities can be revalued unfavorably when the BRL weakens.

- Exchange rate volatility: The BRL's performance against major currencies like the USD and EUR directly influences the company's reported earnings and balance sheet values.

Brazil's economic trajectory directly influences Cielo's transaction volumes and revenue. The nation's GDP growth, estimated at 2.9% for 2023, indicates a healthy commercial environment. Furthermore, personal disposable income saw an estimated growth of 3.5% in 2024, bolstering consumer spending and, consequently, transaction activity for payment processors.

The Central Bank's monetary policy, particularly the Selic rate, plays a crucial role. With inflation showing moderation and the Selic rate at 10.50% in May 2024, the easing of monetary policy generally supports economic expansion and reduces borrowing costs for merchants, which is beneficial for Cielo.

The competitive landscape within Brazil's payment processing sector is intense, with numerous players vying for market share. This competition can pressure profit margins, necessitating continuous innovation and efficient service delivery to retain customers. In Q1 2024, total payment volume processed reached R$2.4 trillion, underscoring the market's scale and competitive intensity.

| Economic Factor | 2023 Data | 2024 Forecast/Data (as of May) | Impact on Cielo |

|---|---|---|---|

| Brazil GDP Growth | 2.9% | Positive growth expected | Higher transaction volumes |

| Brazil Inflation (IPCA) | Moderating trend | Key focus, showing downward trend | Potential for lower interest rates, reduced borrowing costs |

| Selic Rate | Decreasing | 10.50% (May 2024) | Lower cost of capital, potentially boosting spending |

| Personal Disposable Income Growth | N/A | 3.5% (estimated) | Increased consumer spending, higher transaction activity |

| Total Payment Volume Processed (Brazil) | N/A | R$2.4 trillion (Q1 2024) | Indicates market size and competitive intensity |

Preview the Actual Deliverable

Cielo PESTLE Analysis

The Cielo PESTLE Analysis preview you see here is the exact document you’ll receive after purchase—fully formatted and ready to use.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises, providing a comprehensive look at Cielo's external environment.

The content and structure shown in the preview is the same document you’ll download after payment, offering a detailed breakdown of Political, Economic, Social, Technological, Legal, and Environmental factors impacting Cielo.

Sociological factors

Brazilians are increasingly embracing digital payment methods, with a notable shift away from cash. This trend is significantly boosted by the popularity of instant payment systems like Pix, which saw over 13.1 billion transactions in 2023, demonstrating a substantial move towards electronic alternatives.

This growing preference for credit/debit cards, mobile wallets, and instant payments directly expands the market for payment processors like Cielo. As more consumers opt for digital transactions, the demand for robust and convenient electronic payment infrastructure continues to rise, creating opportunities for service innovation.

Brazil's ongoing push for financial inclusion, particularly targeting its large unbanked and underbanked population, creates a fertile ground for companies like Cielo. Government programs and the rapid growth of fintechs are actively working to bring more Brazilians into the formal financial system. For instance, as of late 2023, the Central Bank of Brazil reported that Pix, the instant payment system, had reached over 130 million users, demonstrating a significant shift towards digital financial services.

Cielo is well-positioned to capitalize on this trend by providing accessible and intuitive payment processing solutions. By catering to these newly included consumers and small businesses, Cielo can significantly broaden its market reach. This expansion into previously underserved segments is crucial for sustained growth, especially as digital payment adoption continues to accelerate across the nation.

Brazil's urbanization continues, with over 87% of its population now residing in urban areas as of 2023, according to the World Bank. This trend fuels demand for digital payment solutions like those offered by Cielo, as urban dwellers often adopt new technologies more readily. The growing segment of tech-savvy youth, a key demographic for digital adoption, is particularly influential in shaping payment preferences.

Cielo must adapt its offerings to resonate with this evolving urban demographic. For instance, understanding that younger Brazilians, born after 1997, represent a significant portion of the population and are early adopters of mobile payment technologies is crucial. This necessitates developing user-friendly apps and digital-first marketing campaigns to capture this market share.

E-commerce Growth and Online Shopping Habits

The e-commerce landscape in Brazil has seen remarkable expansion, fueled by increasing internet access and widespread smartphone adoption. This trend directly boosts the need for dependable online payment solutions, making Cielo's role in facilitating secure transactions paramount for its ongoing growth.

In 2023, Brazil's e-commerce market was valued at approximately $60 billion, with projections indicating continued robust growth. This surge in online retail activity means more consumers are engaging in digital purchases, creating a greater reliance on efficient and secure payment gateways.

- E-commerce Penetration: Brazil's internet penetration reached over 80% in early 2024, with smartphone ownership exceeding 90% of the adult population.

- Online Spending Habits: The average Brazilian consumer spent an estimated $450 online in 2023, a figure expected to rise as digital commerce becomes more integrated into daily life.

- Demand for Secure Payments: Consumer trust in online transactions is heavily influenced by the security and ease of the payment process, highlighting the importance of advanced fraud prevention and diverse payment options.

- Cielo's Opportunity: Cielo's ability to offer seamless, secure, and varied payment methods for online businesses is critical to capturing market share in this expanding digital economy.

Financial Literacy and Digital Trust

The level of financial literacy in Brazil significantly influences how readily people embrace new payment technologies, like those offered by Cielo. A 2023 survey by the Brazilian Central Bank indicated that only 28% of Brazilians feel very confident in managing their finances, highlighting a need for clearer financial education. This directly impacts Cielo's strategy, as simpler, more intuitive platforms are crucial for broader adoption among a population still developing its digital financial confidence.

Building trust in digital financial systems is paramount for Cielo. Reports from 2024 show a growing concern about data security among Brazilian consumers, with a significant percentage expressing apprehension about online transactions. Cielo's investment in user-friendly interfaces and demonstrably robust security measures is therefore not just a feature, but a core requirement for fostering wider usage and loyalty to its payment solutions.

- Low Financial Literacy: Approximately 72% of Brazilians lack high confidence in financial management, impacting adoption of complex digital tools.

- Digital Trust Concerns: Consumer apprehension regarding online transaction security remains a key barrier for digital payment platforms.

- Cielo's Strategy: Focus on intuitive design and strong security is essential to overcome these sociological factors and drive platform usage.

Brazil's societal shift towards digital payments, exemplified by Pix's 13.1 billion transactions in 2023, directly benefits payment processors like Cielo by increasing demand for electronic infrastructure.

The nation's push for financial inclusion, with over 130 million Pix users by late 2023, opens new markets for Cielo to serve previously unbanked populations.

Urbanization, with over 87% of Brazilians living in cities as of 2023, accelerates digital payment adoption, making user-friendly digital solutions from companies like Cielo more critical.

Cielo's success hinges on adapting to evolving consumer preferences, particularly among younger, tech-savvy demographics, and addressing concerns about digital trust and financial literacy.

| Sociological Factor | 2023/2024 Data Point | Impact on Cielo |

|---|---|---|

| Digital Payment Adoption | Pix: 13.1 billion transactions (2023) | Increased demand for electronic payment infrastructure |

| Financial Inclusion | Pix users: 130 million+ (late 2023) | Expansion into new customer segments |

| Urbanization | 87%+ urban population (2023) | Accelerated adoption of digital payment solutions |

| Financial Literacy | 28% high confidence in finance management (2023) | Need for intuitive and simple payment platforms |

| Digital Trust | Growing concern over data security (2024) | Emphasis on robust security measures and user-friendly interfaces |

Technological factors

The rapid evolution of payment technologies, especially the widespread adoption of Pix in Brazil, is a major technological factor impacting Cielo. Pix, launched by the Central Bank of Brazil, has seen explosive growth, with over 1.7 billion transactions recorded in the first half of 2024 alone, demonstrating its significant market penetration and user preference.

Cielo must adapt to these advancements by continuously innovating and integrating new functionalities. This includes embracing contactless Pix options and developing solutions like Pix Automático to stay competitive and meet evolving consumer and business demands for faster, more convenient payment methods.

Cybersecurity remains a critical operational factor for Cielo, especially with the escalating volume of digital transactions. In 2024, global spending on cybersecurity solutions is projected to reach $221.7 billion, highlighting the industry's focus on mitigating risks. A data breach could severely damage customer trust and lead to substantial financial penalties, making robust security infrastructure and advanced fraud detection technologies essential investments for Cielo to safeguard sensitive payment information.

The market's hunger for advanced, connected point-of-sale (POS) systems and smooth online payment processing means Cielo must consistently enhance its hardware and software. This includes adapting to trends like contactless payments and mobile checkout solutions.

Introducing groundbreaking products, such as Cielo TAP, which turns smartphones into payment terminals, is crucial for Cielo to draw in and keep merchants. This innovation directly addresses the growing need for flexible and accessible payment options, particularly for small businesses and mobile vendors.

Adoption of AI and Machine Learning

Artificial intelligence (AI) and machine learning (ML) are rapidly transforming the payments industry, and Cielo is positioned to leverage these advancements. These technologies are crucial for bolstering fraud detection capabilities, a significant concern for payment processors. For instance, by analyzing vast datasets, AI can identify anomalous transaction patterns in real-time, significantly reducing losses. In 2024, financial institutions globally are investing heavily in AI for cybersecurity, with some reports suggesting AI-powered fraud detection can reduce false positives by up to 50%.

Furthermore, AI and ML enable hyper-personalization of customer experiences, a key differentiator in a competitive market. Cielo can utilize these tools to offer tailored financial products, loyalty programs, and customer support, thereby enhancing customer retention and satisfaction. The global AI in banking market was valued at over $10 billion in 2023 and is projected to grow substantially, indicating strong industry adoption. This personalization can lead to increased transaction volumes and higher customer lifetime value.

Operational efficiency is another critical area where AI and ML offer substantial benefits. From automating back-office processes like reconciliation and dispute resolution to optimizing resource allocation, these technologies can streamline operations and reduce costs. Companies that effectively integrate AI into their workflows are seeing significant improvements in processing times and a reduction in manual errors. For example, AI-driven process automation can cut operational costs by as much as 30% in certain financial services functions.

- Enhanced Fraud Detection: AI algorithms can identify and flag suspicious transactions with greater accuracy and speed than traditional methods.

- Personalized Customer Journeys: ML enables tailored product offerings and customer service, improving engagement and loyalty.

- Operational Streamlining: Automation of routine tasks through AI reduces costs and increases processing efficiency.

- Competitive Advantage: Strategic adoption of AI/ML provides a significant edge in security, service, and cost-effectiveness within the payments sector.

Digital Infrastructure and Connectivity

The availability and reliability of internet connectivity and mobile infrastructure across Brazil are crucial for Cielo's digital payment solutions. As of early 2024, Brazil boasts a growing internet penetration rate, with approximately 80% of the population having access, and mobile broadband coverage continues to expand, reaching more remote areas.

Improvements in this digital infrastructure directly benefit Cielo by enabling wider adoption of its services, particularly in regions previously underserved. This enhanced connectivity allows for more seamless transactions and opens up new market segments for the company.

Key advancements in Brazil's digital infrastructure include:

- Increased 5G deployment: The ongoing rollout of 5G technology promises faster speeds and lower latency, improving the experience for both merchants and consumers using digital payment platforms.

- Expansion of fiber optic networks: Investments in fiber optics are enhancing broadband reliability and capacity, supporting the growing demand for data-intensive digital services.

- Government initiatives for digital inclusion: Programs aimed at bridging the digital divide are bringing more Brazilians online, creating a larger potential customer base for digital payment solutions.

- Growth in mobile payment adoption: With over 150 million active mobile subscriptions in Brazil by late 2023, the mobile channel is a primary driver for digital payment growth, directly benefiting Cielo's reach.

The technological landscape for payment processors like Cielo is defined by rapid innovation and evolving consumer expectations. The widespread adoption of instant payment systems, such as Brazil's Pix, which facilitated over 1.7 billion transactions in the first half of 2024, necessitates continuous adaptation. Cielo's strategic response, including the development of contactless Pix and Pix Automático, underscores the need to integrate user-friendly and efficient payment methods.

Cybersecurity is paramount, with global spending on solutions projected to reach $221.7 billion in 2024. Cielo must invest in advanced fraud detection and robust security infrastructure to maintain customer trust and avoid significant financial repercussions from data breaches.

The trend towards connected point-of-sale systems and seamless online payment processing demands ongoing enhancements to both hardware and software. Innovations like Cielo TAP, which transforms smartphones into payment terminals, are vital for capturing market share, particularly among small and mobile businesses.

The integration of Artificial Intelligence (AI) and Machine Learning (ML) offers significant advantages in fraud detection, personalization, and operational efficiency. Financial institutions globally are increasing AI investments, with AI-powered fraud detection potentially reducing false positives by up to 50% in 2024, enhancing security and customer experience.

| Technological Factor | Impact on Cielo | Supporting Data/Trend (2024/2025) |

| Instant Payment Systems (e.g., Pix) | Increased transaction volume, need for real-time processing, competitive pressure for new features. | Pix: Over 1.7 billion transactions (H1 2024). |

| Cybersecurity Threats | Need for robust security measures, investment in fraud detection, risk of reputational damage. | Global cybersecurity spending projected at $221.7 billion (2024). |

| POS and Online Payment Evolution | Demand for contactless, mobile, and integrated payment solutions. | Growth in mobile payment adoption, over 150 million active mobile subscriptions in Brazil (late 2023). |

| AI and Machine Learning | Enhanced fraud detection, personalized customer experiences, operational efficiency gains. | AI in banking market valued over $10 billion (2023); AI fraud detection can reduce false positives by up to 50%. |

Legal factors

Brazil's Lei Geral de Proteção de Dados (LGPD), enacted in 2020, significantly impacts companies like Cielo by mandating stringent rules for handling personal data. As a leading payment processor, Cielo processes millions of sensitive customer transactions, making adherence to LGPD's principles on consent, purpose limitation, and data security paramount. Non-compliance can lead to substantial penalties, including fines of up to 2% of gross revenue in Brazil, capped at R$50 million per infraction, and could severely damage customer trust and market standing.

The Central Bank of Brazil (BCB) plays a pivotal role in shaping the landscape for payment instruments and institutions. Through resolutions and normative acts, the BCB sets the rules for operations, including those for innovative systems like Pix, and for the authorization and ongoing functioning of payment institutions. Cielo, as a major player, must remain vigilant, ensuring its practices align with these directives, which often involve adjustments to capital requirements and operational standards to maintain compliance.

Consumer protection laws in Brazil, such as the Consumer Defense Code (CDC), are robust and directly impact Cielo's operations. These regulations mandate transparency in pricing, clear contract terms, and prohibit misleading advertising, ensuring customers are well-informed about credit card processing services. Cielo's compliance is crucial for maintaining trust and avoiding penalties, especially as consumer complaints regarding financial services can lead to significant fines.

Antitrust and Competition Law Enforcement

Antitrust and competition law enforcement is a critical legal factor for Cielo, particularly given the concentrated nature of the payment processing market in Brazil. The Administrative Council for Economic Defense (CADE) actively monitors this sector, ensuring fair competition and preventing monopolistic practices. Cielo must adhere to stringent regulations concerning market dominance, mergers, acquisitions, and any behavior that could stifle competition.

For instance, CADE's scrutiny extends to pricing strategies and exclusive agreements that could disadvantage rivals. In 2023, CADE continued its robust enforcement actions across various sectors, and the financial services industry, including payments, remains a key focus area. The potential for fines and operational restrictions underscores the importance of proactive compliance for Cielo.

- CADE Oversight: Cielo operates under the watchful eye of CADE, Brazil's primary antitrust authority, ensuring compliance with competition laws.

- Market Concentration: The payment market's high concentration necessitates strict adherence to rules regarding market share and potential abuses of dominance.

- Merger Scrutiny: Any proposed mergers or acquisitions by Cielo face rigorous review by CADE to prevent undue market consolidation.

- Anti-Competitive Practices: Cielo must avoid practices such as price fixing, bid rigging, or exclusionary conduct that could harm competitors and consumers.

Taxation Policies on Financial and Digital Services

Changes in taxation policies, particularly concerning financial transactions and digital services, can significantly affect Cielo's operational costs and pricing strategies. For instance, if governments implement new taxes on digital payments or cross-border financial services, Cielo might need to adjust its fee structures or absorb these costs, impacting its profit margins.

Adapting to evolving fiscal landscapes is essential for Cielo's sustained profitability and market competitiveness. As of early 2024, many countries are actively reviewing or implementing digital services taxes and VAT on digital goods and services, a trend expected to continue through 2025. This necessitates close monitoring of legislative developments globally.

- Digital Services Taxes (DSTs): Several nations, including Brazil and Argentina in Latin America, have implemented or are considering DSTs that could apply to revenue generated from digital services, potentially impacting Cielo's revenue streams.

- VAT on Digital Transactions: The global trend of applying Value Added Tax (VAT) or similar consumption taxes to digital services and cross-border e-commerce continues, requiring businesses like Cielo to manage compliance in multiple jurisdictions.

- Payment Processing Fees: Taxation policies can also influence the cost of payment processing, affecting the overall cost structure for transactions facilitated by Cielo.

- Regulatory Compliance Costs: Increased tax scrutiny on digital and financial services necessitates investment in robust compliance systems and expertise, adding to operational expenses.

Cielo must navigate a complex web of Brazilian legislation, from data protection under LGPD to consumer rights enshrined in the CDC. The Central Bank of Brazil's directives heavily influence payment processing operations, requiring constant adaptation to new standards and capital requirements. Furthermore, antitrust regulations enforced by CADE are crucial, especially in a concentrated market, to prevent anti-competitive practices and ensure fair play for all participants.

Environmental factors

Investor and regulatory demands for robust Environmental, Social, and Governance (ESG) practices are intensifying for companies like Cielo. For instance, global sustainable investment assets reached an estimated $37.7 trillion in 2024, underscoring the financial community's focus on ESG performance.

Cielo's dedication to sustainability, encompassing its environmental impact and transparent ESG reporting, is increasingly crucial for maintaining a positive corporate image and securing access to capital. Failure to meet these evolving standards could impact borrowing costs and investor confidence.

Cielo's extensive payment processing infrastructure, encompassing data centers and Point-of-Sale (POS) terminals, is a significant energy consumer. This reliance on power, particularly for maintaining always-on operations and processing vast transaction volumes, places Cielo under environmental scrutiny.

As global environmental awareness intensifies, Cielo faces increasing pressure from regulators and stakeholders to demonstrably reduce its carbon footprint. This includes a growing expectation to implement and invest in energy-efficient technologies and operational practices across its entire network.

For instance, the global IT industry's energy consumption is projected to reach 6% of total electricity demand by 2025, a figure that highlights the scale of the challenge for companies like Cielo. Meeting these environmental goals will likely involve adopting renewable energy sources and optimizing data center cooling and hardware efficiency.

The physical point-of-sale (POS) terminals and other electronic hardware that Cielo utilizes have a finite lifespan, inevitably contributing to electronic waste. This lifecycle necessitates a robust waste management strategy. For instance, in 2024, the global generation of e-waste reached an estimated 62 million metric tons, a significant increase from previous years, highlighting the growing challenge.

Cielo must prioritize responsible waste management, focusing on recycling and the proper disposal of these electronic assets. This approach not only minimizes environmental harm but also ensures compliance with increasingly stringent environmental regulations. Many countries, including those in the EU, have specific directives like the Waste Electrical and Electronic Equipment (WEEE) Directive, which mandates producer responsibility for e-waste.

Climate Change Risks and Adaptability

While climate change might not directly impact Cielo's core business as a satellite communications provider, the increasing frequency of extreme weather events poses indirect risks. These events could disrupt critical physical infrastructure, including ground stations or data centers, or interrupt supply chains for necessary equipment, thereby affecting operational resilience. For instance, a severe hurricane in a region housing a key data center could lead to temporary service disruptions.

Cielo's proactive approach to its climate strategy and its alignment with frameworks like the Task Force on Climate-related Financial Disclosures (TCFD) are becoming crucial. These disclosures demonstrate the company's commitment to understanding and managing climate-related risks and opportunities. As of early 2025, companies are increasingly expected to report on their climate resilience, with investors closely scrutinizing these disclosures.

- Infrastructure Vulnerability: Extreme weather events like floods or wildfires could damage ground-based facilities essential for satellite operations.

- Supply Chain Disruptions: Climate-related impacts on manufacturing or transportation could delay the delivery of critical components for satellite maintenance or new deployments.

- TCFD Alignment: Cielo's adherence to TCFD recommendations enhances transparency regarding its climate risk management and strategic adaptability.

- Investor Scrutiny: Financial markets are placing greater emphasis on environmental, social, and governance (ESG) factors, making climate risk disclosure a key consideration for investment.

Demand for Eco-Friendly and Sustainable Business Practices

Consumers and businesses are increasingly prioritizing environmental responsibility, with a significant portion willing to pay more for sustainable products and services. For instance, a 2024 survey indicated that over 60% of consumers consider sustainability when making purchasing decisions, a figure that has steadily climbed year over year.

Cielo's commitment to sustainable solutions and transparent environmental reporting directly addresses this trend. By highlighting its eco-friendly practices, Cielo can bolster its brand image and attract a growing segment of environmentally conscious clients who seek partners aligned with their values. This focus can translate into a competitive advantage in the marketplace.

- Growing Consumer Preference: Over 60% of consumers consider sustainability in purchasing decisions (2024 data).

- Brand Enhancement: Demonstrating environmental responsibility improves brand perception.

- Client Attraction: Eco-conscious clients are more likely to engage with sustainable companies.

- Market Differentiation: Sustainable practices offer a competitive edge.

Cielo's operations, particularly its data centers and extensive network infrastructure, are significant energy consumers, placing it under scrutiny to reduce its carbon footprint. The global IT sector's energy demand is projected to reach 6% of total electricity by 2025, illustrating the scale of this challenge for companies like Cielo.

The company must address electronic waste generated by its physical POS terminals and other hardware. Global e-waste reached an estimated 62 million metric tons in 2024, emphasizing the need for robust recycling and disposal strategies, aligning with regulations like the EU's WEEE Directive.

Extreme weather events, while not directly impacting satellite communications, pose indirect risks to Cielo's ground infrastructure and supply chains, necessitating a focus on operational resilience and climate risk disclosure, as recommended by the TCFD.

Growing consumer and business demand for sustainability, with over 60% of consumers considering environmental factors in purchasing decisions in 2024, presents an opportunity for Cielo to enhance its brand image and attract environmentally conscious clients by highlighting its eco-friendly practices.

| Environmental Factor | Impact on Cielo | Data/Trend |

|---|---|---|

| Energy Consumption | Operational costs, carbon footprint | Global IT energy demand projected at 6% of total electricity by 2025 |

| Electronic Waste (E-waste) | Disposal costs, regulatory compliance, brand reputation | Global e-waste generation reached ~62 million metric tons in 2024 |

| Climate Change Risks | Infrastructure vulnerability, supply chain disruption | Increasing frequency of extreme weather events |

| Consumer & Business Preferences | Market share, brand loyalty, competitive advantage | Over 60% of consumers consider sustainability in purchasing (2024) |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Cielo is meticulously constructed using data from official government publications, reputable financial institutions, and leading market research firms. We incorporate economic indicators, regulatory updates, technological advancements, and social trends to provide a comprehensive overview.