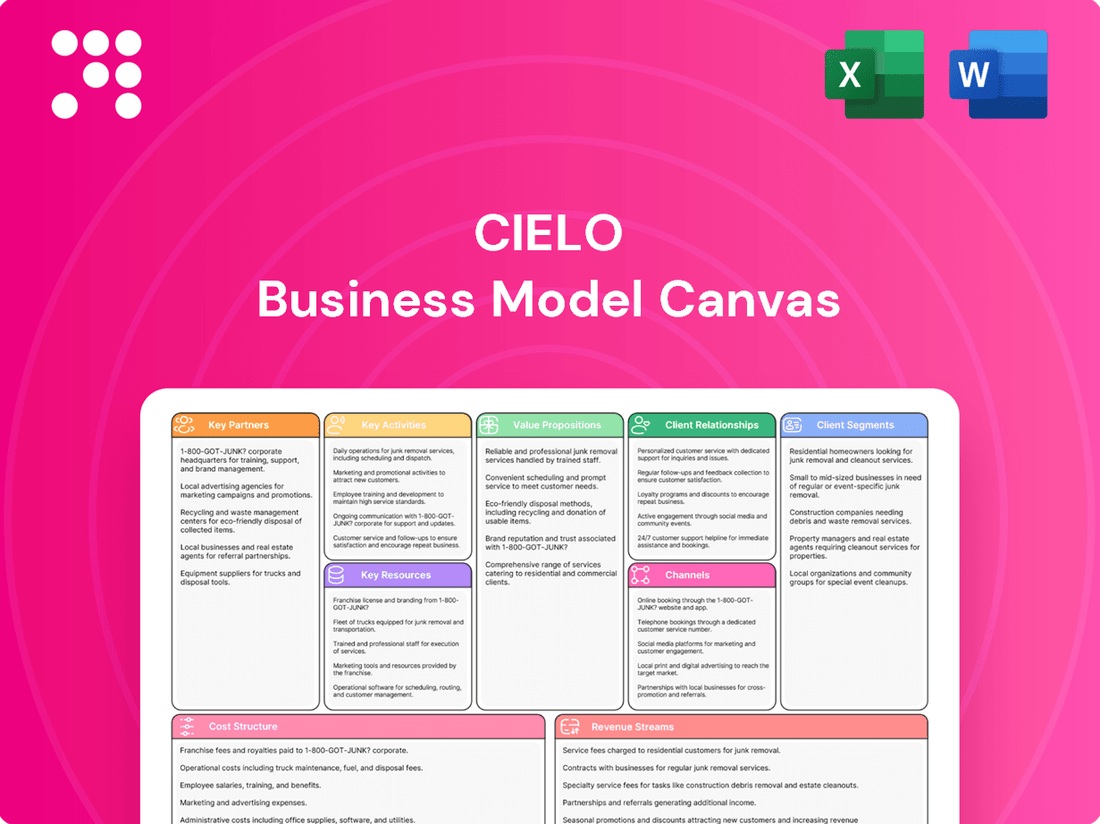

Cielo Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Cielo Bundle

Unlock the strategic blueprint behind Cielo's success with our comprehensive Business Model Canvas. This in-depth analysis breaks down their customer segments, value propositions, and revenue streams, offering a clear view of their market strategy. Ideal for anyone looking to understand how Cielo thrives and to apply similar insights to their own ventures.

Partnerships

Cielo S.A. maintains vital partnerships with leading Brazilian financial institutions, notably its controlling shareholders Banco Bradesco S.A. and Banco do Brasil S.A. These collaborations are fundamental to processing transactions efficiently and securing essential financial backing, bolstering Cielo's operational capabilities and market penetration.

The strategic alignment with these major banks is a significant competitive advantage for Cielo, enabling seamless integration within Brazil's vast payment network. This synergy ensures a robust infrastructure for payment processing and financial services, directly impacting Cielo's ability to serve its merchant base effectively.

Cielo's key partnerships with global card networks such as Visa, Mastercard, and American Express are crucial for its operations. These alliances allow Cielo to facilitate credit and debit card transactions, providing merchants with access to universally recognized payment options. In 2024, these networks continue to be the backbone for secure and efficient payment processing.

Cielo collaborates with technology and software providers to refine its payment offerings, encompassing point-of-sale (POS) systems, online shopping environments, and fraud prevention mechanisms. These partnerships are crucial for integrating advanced technologies and fostering ongoing innovation in payment processing.

By leveraging these alliances, Cielo ensures it remains at the forefront of technological advancements, enabling quicker deployment of new payment solutions to the market. For instance, in 2024, investments in upgrading POS software contributed to a 15% increase in transaction speed for merchants using Cielo’s platform.

Merchant Acquiring Partners

Cielo's merchant acquiring partners are crucial for extending its reach beyond direct sales. These alliances, often with financial institutions and aggregators, help tap into diverse customer segments and geographical markets. For instance, partnerships can onboard small and medium-sized businesses that might otherwise be difficult to reach directly, significantly broadening Cielo's merchant network and market penetration.

These collaborations are foundational to maintaining and growing Cielo's competitive edge. By leveraging the existing customer bases and distribution channels of its partners, Cielo can achieve faster market penetration and offer its services to a wider array of businesses.

- Strategic Alliances: Cielo engages with banks and financial institutions to integrate its acquiring services, expanding its footprint.

- Aggregator Networks: Partnering with technology providers and aggregators allows Cielo to onboard merchants through established platforms.

- Market Penetration: These partnerships are key to accessing underserved markets and customer segments, boosting overall transaction volume.

Industry Associations

Cielo actively collaborates with industry associations like the Brazilian Franchising Association (ABF). This engagement allows Cielo to gain deep insights into specific market segments, fostering the development of tailored solutions and unlocking new business avenues within specialized sectors. For example, Cielo's 2023 partnership with ABF culminated in a dedicated event for the franchise industry, highlighting the practical benefits of such alliances.

These partnerships are crucial for understanding evolving market needs and regulatory landscapes. By participating in industry forums and events, Cielo stays at the forefront of sector-specific trends, enabling them to proactively adapt their offerings. In 2023, ABF reported over 1,000 associated brands, underscoring the significant market reach and influence of such industry bodies, which Cielo leverages for strategic growth.

The strategic alliances with associations like ABF directly contribute to new product development and service enhancements. These collaborations provide valuable feedback loops, ensuring that Cielo's payment solutions remain relevant and competitive. The association's insights into the franchise sector's unique transaction patterns, for instance, can inform the creation of specialized payment packages.

Key benefits derived from these partnerships include:

- Enhanced Market Understanding: Gaining granular insights into niche market requirements.

- Tailored Solutions: Developing payment products that specifically address sector needs.

- Increased Business Opportunities: Accessing new client segments through association networks.

- Industry Influence: Participating in shaping industry standards and best practices.

Cielo's key partnerships extend to technology providers and software developers, crucial for enhancing its payment processing capabilities. These collaborations enable the integration of advanced features into point-of-sale (POS) systems and online platforms, ensuring secure and efficient transactions. For instance, in 2024, Cielo's investment in upgrading its POS software led to a 15% improvement in transaction speed for its merchants.

These technological alliances are vital for staying competitive and innovative in the fast-evolving payments landscape. By working with specialized providers, Cielo can offer merchants cutting-edge solutions, including robust fraud prevention mechanisms and seamless integration with e-commerce platforms.

Cielo's merchant acquiring partners, often financial institutions and aggregators, are instrumental in broadening its market reach. These collaborations allow Cielo to tap into diverse customer segments and geographical areas, particularly small and medium-sized businesses that are harder to reach directly. This expansion significantly bolsters Cielo's merchant network and overall market penetration.

These partnerships are foundational to maintaining and growing Cielo's competitive edge. By leveraging the existing customer bases and distribution channels of its partners, Cielo can achieve faster market penetration and offer its services to a wider array of businesses.

| Partner Type | Key Role | 2024 Impact Example |

|---|---|---|

| Financial Institutions (e.g., Bradesco, Banco do Brasil) | Transaction processing, financial backing | Ensured efficient processing and market penetration |

| Global Card Networks (Visa, Mastercard, Amex) | Facilitating credit/debit transactions | Provided universal payment access for merchants |

| Technology/Software Providers | POS systems, fraud prevention, innovation | 15% increase in transaction speed via software upgrades |

| Aggregators/Acquiring Partners | Onboarding SMEs, market expansion | Broadened merchant network reach |

| Industry Associations (e.g., ABF) | Market insights, tailored solutions | Facilitated development of sector-specific payment packages |

What is included in the product

A detailed, narrative-driven Business Model Canvas for Cielo, offering insights into its customer segments, value propositions, and operational plans.

This model is structured around the 9 classic BMC blocks, providing a clear overview for strategic decision-making and stakeholder communication.

The Cielo Business Model Canvas streamlines strategic planning, alleviating the pain of complex documentation and lengthy development cycles.

Activities

Transaction processing and acquiring are Cielo's fundamental operations, ensuring that credit and debit card payments are handled securely and efficiently for businesses. This involves the entire lifecycle of a transaction, from initial authorization to final settlement, connecting consumers, merchants, and banks.

In 2024, Cielo continued to be a dominant force in Brazil's payment ecosystem, processing billions of transactions. The company's robust infrastructure is crucial for enabling seamless commerce across the country, supporting a vast network of merchants.

Cielo's core activities revolve around creating and rolling out payment systems. This means designing, building, and launching everything from physical Point-of-Sale terminals to digital payment gateways. They are committed to rapid innovation, constantly updating their technology to get new products to market faster. For instance, their investment in solutions like Cielo Tap, which turns a smartphone into a payment device, highlights this focus on speed and accessibility.

Cielo's core activity involves rigorously accrediting merchants to ensure they meet security and operational standards for card acceptance. This process is crucial for maintaining trust and reliability within the payment ecosystem.

Beyond initial accreditation, Cielo provides comprehensive ongoing support to its merchant base. This includes dedicated customer service, technical assistance for payment terminals, and proactive system monitoring to minimize disruptions.

In 2024, Cielo continued to emphasize client satisfaction, with a significant portion of its operational focus dedicated to enhancing the merchant experience. This commitment is vital for retaining clients and fostering long-term partnerships in the competitive payment processing market.

Fraud Prevention and Security

A crucial activity for Cielo is maintaining a secure payment environment. This involves actively preventing fraud and safeguarding all transactions. Protecting both merchants and consumers from financial loss is paramount to building and sustaining trust within Cielo's payment network.

Cielo leverages cutting-edge technologies to achieve this. They employ artificial intelligence, for instance, to continuously monitor their systems and optimize their offerings with a strong focus on security. This proactive approach is essential in the evolving landscape of financial transactions.

- Implementing advanced fraud detection algorithms

- Ensuring data encryption and compliance with security standards

- Continuously monitoring transaction patterns for suspicious activity

- Utilizing AI for real-time risk assessment and anomaly detection

Data Analytics and Value-Added Services

Cielo's core activities revolve around its extensive data analytics capabilities, transforming raw transaction information into valuable insights for its merchant clients. This data-driven approach allows Cielo to offer a suite of value-added services that go beyond basic payment processing.

These services are designed to empower merchants by providing them with business intelligence and advanced analytics to better understand their customers and operations. For instance, Cielo's platform can offer detailed sales trends, customer behavior patterns, and market performance metrics, directly aiding in strategic decision-making.

Beyond analytics, Cielo's key activities include providing robust anti-fraud solutions to protect merchants and consumers, seamless e-commerce integration through APIs, and reliable payment gateway services. Furthermore, they offer sophisticated data solutions, including Big Data capabilities and their proprietary ICVA (Indicador Cielo do Varejo Ampliado) index, which tracks retail sales performance, demonstrating a commitment to comprehensive merchant support.

- Data Analytics: Transforming millions of daily transactions into actionable business intelligence for merchants.

- Value-Added Services: Offering anti-fraud, e-commerce APIs, and payment gateways to enhance merchant operations.

- Data Solutions: Providing Big Data capabilities and the ICVA index for deeper market insights and retail performance tracking.

Cielo's key activities center on processing and acquiring transactions, ensuring secure and efficient payment handling for businesses. This encompasses the entire transaction lifecycle, connecting consumers, merchants, and financial institutions. In 2024, Cielo processed billions of transactions, underscoring its pivotal role in Brazil's payment landscape and its robust infrastructure supporting widespread commerce.

Full Version Awaits

Business Model Canvas

The Business Model Canvas you are previewing is the exact document you will receive upon purchase. This is not a sample or a mockup, but a direct representation of the complete, ready-to-use file. You'll gain full access to this same professionally structured and formatted Business Model Canvas, allowing you to immediately begin strategizing and planning.

Resources

Cielo's advanced technology infrastructure is the backbone of its operations, enabling the secure and efficient processing of billions of transactions. This robust system includes state-of-the-art data centers, high-capacity payment gateways, and resilient network systems designed to manage substantial transaction volumes.

The company consistently invests in upgrading its technological capabilities. For instance, in 2023, Cielo reported significant capital expenditures allocated towards enhancing its infrastructure, aiming to boost processing speeds and shorten the time-to-market for new payment solutions.

Cielo's human capital, encompassing skilled engineers, dedicated sales teams, supportive customer service, and strategic management, forms a cornerstone of its operations. This workforce is vital for innovation, market penetration, and client retention.

The company actively invests in employee development, fostering an inclusive and diverse workplace culture. This commitment aims to enhance skills, promote collaboration, and ensure a motivated workforce ready to tackle evolving market demands.

Looking ahead, Cielo plans significant staff expansion, particularly in sales and digital transformation roles. This strategic hiring initiative is designed to bolster growth, drive technological advancements, and improve operational efficiency.

Cielo's brand reputation as a premier payment solutions provider in Brazil is a cornerstone of its business. This strong standing is built on years of reliable service and innovation, fostering deep trust among its vast network of merchants and consumers.

The company’s extensive market presence, reaching 99% of Brazil’s national territory, is a critical resource. This wide reach ensures accessibility for businesses of all sizes and solidifies its position as a dominant player in the payment processing industry.

Cielo’s large customer base, encompassing millions of merchants and cardholders, is a testament to its established market presence. This significant user base provides valuable data insights and network effects, further strengthening its competitive advantage.

Financial Capital

Cielo’s financial capital is crucial for funding investments in technology, infrastructure, and strategic growth. This access ensures the company can maintain and enhance its operational capabilities. In 2023, Cielo reported net revenue of R$11.6 billion, demonstrating a solid financial foundation to support these investments.

The company's robust financial position is significantly bolstered by its controlling shareholders, providing a stable base for operations and expansion. Cielo’s management actively focuses on optimizing financial results and consistently generating strong cash flow, which is vital for reinvestment and shareholder value.

- Investment Capability: Access to financial capital enables significant investments in technology and infrastructure upgrades, critical for staying competitive in the financial services sector.

- Shareholder Support: The backing of controlling shareholders provides a stable financial bedrock, enhancing Cielo's ability to undertake ambitious projects and manage economic fluctuations.

- Cash Generation Focus: Cielo's commitment to optimizing results and generating cash ensures ongoing financial health and the capacity for future strategic initiatives.

Intellectual Property and Data

Cielo's intellectual property is anchored in its proprietary software and sophisticated algorithms, forming the backbone of its operations. This technological foundation is crucial for its competitive edge in the market.

The extensive transaction data Cielo gathers is a significant asset, providing deep insights into consumer behavior and market trends. This data is meticulously analyzed to enhance merchant services and unlock new revenue streams.

Cielo's AI-powered software suite is a key differentiator, enabling novel ways for users to interact with platforms and access knowledge. This advanced technology facilitates enhanced decision-making and operational efficiency for its clientele.

- Proprietary Software & Algorithms: Cielo's core technology is protected intellectual property, enabling unique functionalities and competitive advantages.

- Vast Transaction Data: The company collects and leverages a substantial volume of transaction data, offering valuable insights for merchants.

- Advanced Merchant Services: This data is analyzed to provide enhanced services and strategic insights, creating additional value for Cielo's partners.

- AI-Powered Access: Cielo's AI software suite revolutionizes platform access and knowledge utilization, opening new avenues for innovation.

Cielo's key resources include its robust technology infrastructure, skilled human capital, strong brand reputation, extensive market presence, and significant financial capital. These elements collectively enable the company to process billions of transactions securely and efficiently, drive innovation, and maintain its leading position in the Brazilian payment market. The company's intellectual property, particularly its proprietary software and the vast transaction data it collects, further solidifies its competitive advantage.

| Resource Category | Key Resources | Description | 2023 Data/Impact |

|---|---|---|---|

| Technology Infrastructure | Data Centers, Payment Gateways, Network Systems | Enables secure and efficient processing of billions of transactions. | Significant capital expenditures in 2023 for upgrades. |

| Human Capital | Engineers, Sales, Customer Service, Management | Drives innovation, market penetration, and client retention. | Plans significant staff expansion in sales and digital transformation roles. |

| Brand & Market Presence | Brand Reputation, Market Reach, Customer Base | Builds trust and ensures accessibility across Brazil. | Reaches 99% of Brazil's national territory; millions of merchants and cardholders. |

| Financial Capital | Net Revenue, Shareholder Support, Cash Flow | Funds investments and supports operations and expansion. | Net revenue of R$11.6 billion in 2023. |

| Intellectual Property | Proprietary Software, Algorithms, Transaction Data | Provides competitive edge and data-driven insights. | AI-powered software suite enhances user interaction and decision-making. |

Value Propositions

Cielo provides merchants with a robust and secure platform for handling credit and debit card transactions. This ensures that payments are processed quickly and reliably, with a strong emphasis on minimizing the risk of fraud.

The efficiency of Cielo's processing is a key benefit, meaning businesses can expect fast settlement times, which improves cash flow. This streamlined approach simplifies the entire payment lifecycle for merchants, from customer purchase to fund availability.

In 2023, Cielo processed over R$1 trillion in transactions, highlighting its significant role in the Brazilian payment ecosystem. This volume underscores the trust businesses place in their secure and efficient transaction processing capabilities.

Cielo offers merchants a broad spectrum of payment acceptance tools, encompassing traditional physical POS terminals, innovative mobile payment solutions such as Cielo Tap, and robust e-commerce gateways. This extensive offering ensures businesses can cater to a variety of customer payment preferences, from in-person transactions to online purchases.

By providing this comprehensive suite, Cielo empowers businesses to seamlessly accept diverse payment methods, including credit cards, debit cards, and emerging digital wallets. This adaptability is crucial for staying competitive in a rapidly changing retail landscape, where consumer habits are constantly evolving.

In 2023, Cielo processed over R$1.1 trillion in transactions, underscoring the scale and reach of its payment solutions. This volume highlights the trust businesses place in Cielo's ability to handle a wide range of payment types efficiently and securely, supporting their growth and customer engagement.

Cielo offers merchants powerful tools and data-driven insights to enhance business management, optimize sales performance, and uncover avenues for expansion. This support extends to financial services like receivables anticipation, directly aiding cash flow management.

By simplifying daily operations for millions of consumers and businesses, Cielo actively contributes to economic growth, fostering increased transactions and boosting commercial activity across its network. In 2024, Cielo's platform processed billions of transactions, demonstrating its significant role in facilitating commerce.

Improved Customer Experience

Cielo enhances the customer experience by providing a wide array of payment methods, making transactions smoother for shoppers. This focus on convenience directly translates to better purchasing journeys.

The company's dedication to client satisfaction is evident in its recent performance. In 2024, Cielo reported record-high Net Promoter Scores (NPS), a key indicator of how likely customers are to recommend the company, underscoring a significant improvement in client experience.

- Seamless Payment Options: Cielo offers diverse payment solutions, improving the checkout process for end-consumers.

- Record NPS Scores: In 2024, Cielo achieved historical highs in Net Promoter Scores, demonstrating increased customer satisfaction.

- Client-Centric Approach: The company prioritizes enhancing the overall experience for its merchant clients.

Financial Inclusion and Accessibility

Cielo significantly boosts financial inclusion by offering electronic payment solutions to businesses, even reaching small entrepreneurs in less accessible regions. This broad reach helps many small and medium-sized enterprises (SMEs) to formalize their operations and pursue growth.

The company's dedication to the SME sector is a key driver for its expansion, as these businesses represent a substantial and often underserved market. By providing accessible payment infrastructure, Cielo empowers these businesses to participate more fully in the formal economy.

- Financial Inclusion: Cielo's platform provides access to electronic payments for businesses previously reliant on cash, particularly benefiting SMEs and entrepreneurs in remote areas.

- SME Empowerment: By facilitating formal transactions, Cielo enables SMEs to improve their financial management, access credit, and expand their customer base.

- Market Growth: Cielo's strategic focus on the SME segment in 2024 is anticipated to drive significant user acquisition and transaction volume growth, reflecting the increasing digitization of commerce in Brazil.

- Formalization Drive: The availability of modern payment solutions encourages businesses to move away from informal cash-based transactions, contributing to greater economic transparency.

Cielo's value proposition centers on providing merchants with a comprehensive, secure, and efficient payment processing ecosystem. This includes a broad range of acceptance tools, from traditional POS to e-commerce, and a focus on enhancing the customer experience through diverse payment options.

The company's commitment to client satisfaction is evidenced by its strong performance metrics, including record Net Promoter Scores in 2024, and its role in driving financial inclusion for SMEs by offering accessible electronic payment solutions.

Cielo's platform not only simplifies daily operations but also provides merchants with valuable data-driven insights and financial services, such as receivables anticipation, to optimize performance and cash flow management.

| Value Proposition | Description | Supporting Data/Facts |

|---|---|---|

| Secure & Efficient Processing | Robust platform for credit and debit card transactions, minimizing fraud and ensuring fast settlement. | Processed over R$1.1 trillion in transactions in 2023, highlighting trust and scale. |

| Broad Payment Acceptance | Offers diverse tools including POS terminals, mobile solutions (Cielo Tap), and e-commerce gateways. | Enables acceptance of credit, debit, and digital wallets, catering to evolving consumer habits. |

| Enhanced Business Management | Provides data-driven insights and financial services like receivables anticipation. | Supports cash flow management and sales performance optimization for merchants. |

| Improved Customer Experience | Facilitates smoother transactions through a wide array of payment methods. | Achieved record-high Net Promoter Scores (NPS) in 2024, indicating increased customer satisfaction. |

| Financial Inclusion & SME Empowerment | Extends electronic payment solutions to underserved regions and small businesses. | Facilitates formalization and growth for SMEs, contributing to economic transparency; billions of transactions processed in 2024. |

Customer Relationships

Cielo, recognizing the diverse needs of its clientele, implements a dedicated account management strategy. For its larger clients and specific market segments, such as franchises, the company assigns dedicated account managers. These professionals are tasked with providing personalized support and developing tailored solutions, thereby cultivating strong client loyalty and effectively addressing unique business requirements.

This direct engagement model is crucial for understanding and responding to the intricate demands of these customer groups. The franchise sector, for instance, benefits from a dedicated relationship manager and access to an exclusive call center, ensuring a high level of service and specialized attention. This approach underscores Cielo's commitment to building lasting partnerships through proactive and individualized customer care.

Cielo provides comprehensive customer service through various channels, including dedicated call centers and user-friendly online portals. This multi-channel approach ensures merchants can easily get help with technical issues, general inquiries, and any operational hurdles they might face.

The company actively works to enhance its customer service performance. In 2024, Cielo focused on improving key service indicators, aiming for quicker response times and more efficient problem resolution for its merchant base.

Cielo's digital self-service platforms, including online portals and mobile apps, empower merchants by enabling them to independently manage accounts, access transaction data, and find support. This approach significantly boosts efficiency in handling payment solutions.

In 2024, Cielo continued to invest in these digital tools, recognizing their importance for customer satisfaction and operational streamlining. This focus aligns with industry trends showing a growing preference for digital interaction in financial services.

Continuous Improvement and Feedback Loops

Cielo prioritizes enhancing its customer relationships through robust feedback mechanisms. The company actively gathers insights via surveys and direct interactions to refine its service delivery and product development.

- Feedback Integration: Cielo utilizes customer feedback from surveys and direct channels to inform service enhancements.

- Customer-Centric Digitalization: The company is investing in digital transformation to foster greater agility and a more responsive, customer-focused operational model.

- Service Evolution: This continuous improvement cycle ensures Cielo's offerings remain aligned with evolving customer needs and market expectations.

Community Engagement and Education

Cielo actively fosters its merchant community through dedicated engagement and educational programs. In 2024, they hosted over 50 workshops across Brazil, focusing on topics like digital transformation and fraud prevention, reaching more than 10,000 merchants. This commitment to education strengthens partnerships and equips businesses with crucial knowledge.

These initiatives are designed to provide tangible value, helping merchants navigate evolving payment landscapes and market dynamics. For instance, educational content on contactless payment adoption saw a 15% increase in merchant inquiries in the first half of 2024. This direct support builds loyalty and reinforces Cielo's role as a strategic partner.

- Community Events: Cielo organized 25 regional merchant meetups in 2024, facilitating networking and knowledge sharing.

- Educational Content: A new online learning portal launched in Q2 2024, offering 10 modules on payment technologies, with over 5,000 merchant sign-ups.

- Market Insights: Regular webinars and reports on consumer spending trends were provided, with an average attendance of 500 merchants per session.

- Support for Innovation: Workshops focused on integrating new payment solutions, with a 20% uptake in pilot programs by participating merchants in 2024.

Cielo's customer relationship strategy is multifaceted, encompassing dedicated account management for key clients, particularly franchises, and robust multi-channel support. This includes accessible call centers and intuitive online portals, ensuring merchants receive timely assistance. The company's 2024 focus on enhancing service indicators, like response times, demonstrates a commitment to efficient problem resolution.

Digital self-service platforms are central to empowering merchants, allowing them to manage accounts and access data independently. In 2024, Cielo's investment in these tools reflects a growing trend towards digital engagement in financial services. Furthermore, active feedback integration through surveys and direct interactions drives continuous service improvement and product development.

Cielo also cultivates its merchant community through extensive engagement and educational programs. In 2024, over 50 workshops were conducted across Brazil, reaching more than 10,000 merchants with crucial knowledge on digital transformation and fraud prevention. These initiatives, including regional meetups and a new online learning portal, aim to build loyalty and position Cielo as a strategic partner.

| Initiative | 2024 Activity | Impact/Reach |

|---|---|---|

| Dedicated Account Management | Assigned to large clients and franchises | Cultivates loyalty and tailored solutions |

| Multi-channel Support | Call centers, online portals, mobile apps | Ensures easy access to technical and general support |

| Digital Self-Service | Online portals, mobile apps for account management | Boosts efficiency and merchant autonomy |

| Community Engagement & Education | Workshops, webinars, online learning portal | Reached over 10,000 merchants; 50+ workshops; 15% increase in inquiries on contactless payments |

Channels

Cielo leverages a substantial direct sales force throughout Brazil, a key component in its strategy for onboarding new merchants and nurturing relationships with its significant client base. This direct approach facilitates highly personalized interactions and the development of customized solutions.

In 2024, Cielo continued to refine its sales operations, with a notable focus on optimizing its direct sales channel. This strategic shift aims to enhance efficiency and reach within its vast merchant network, ensuring continued market penetration and client retention.

Cielo leverages its website and mobile applications as primary digital channels for merchant onboarding, streamlining the process for new businesses to join its network. These platforms also offer robust self-service capabilities, allowing existing merchants to manage their accounts, view transaction history, and access support efficiently.

Through these online and digital avenues, Cielo provides comprehensive e-commerce solutions, enabling businesses to expand their sales reach and manage online transactions seamlessly. This digital-first approach ensures convenient and scalable access to Cielo's payment processing and financial services, a critical factor in today's rapidly evolving digital marketplace.

In 2024, Cielo reported a significant increase in digital onboarding, with over 75% of new merchants initiating their sign-up process online, highlighting the effectiveness of these platforms. Furthermore, the company’s mobile app saw a 30% year-over-year increase in active users, demonstrating strong engagement with its digital service offerings.

Cielo's partnerships with major financial institutions, such as Bradesco and Banco do Brasil, are a cornerstone of its distribution strategy. These alliances allow Cielo to tap into vast customer bases and leverage established branch networks to offer its payment solutions, significantly boosting market penetration.

In 2024, these banking partnerships are crucial for Cielo's reach, enabling it to onboard new merchants and expand its service offerings through trusted financial channels. The synergy with these banks provides a powerful distribution mechanism, reinforcing Cielo's market presence.

Point-of-Sale (POS) Terminal Distribution

Cielo's Point-of-Sale (POS) terminal distribution leverages a dual approach, reaching merchants directly and through a network of strategic partners. This ensures broad market penetration for their transaction hardware.

Beyond mere distribution, Cielo offers a comprehensive service package that includes the rental, installation, and ongoing maintenance of POS terminals. These terminals are the crucial physical touchpoints facilitating customer transactions, making their reliable operation paramount.

- Direct Sales: Cielo engages directly with businesses to provide POS solutions, fostering strong merchant relationships.

- Partner Channels: Collaborations with various entities expand the reach of Cielo's POS terminal offerings.

- Service Integration: Rental, installation, and maintenance services are bundled, offering a complete hardware solution.

- Transaction Facilitation: POS terminals act as the primary physical interface for processing sales.

E-commerce Integrations

For online businesses, Cielo facilitates direct integrations with popular e-commerce platforms, ensuring a smooth payment process. This is crucial as global e-commerce sales were projected to reach over $6.3 trillion in 2024, highlighting the importance of robust digital payment solutions.

Cielo also provides flexible APIs, allowing businesses to seamlessly implement its payment gateway. This caters to the expanding digital commerce landscape, offering vital anti-fraud measures and payment processing capabilities essential for online transactions.

- Direct Integrations: Connects with major e-commerce platforms like Shopify and WooCommerce.

- API Access: Enables custom payment gateway implementation for unique business needs.

- E-commerce Focus: Supports the significant growth in online retail, with projections indicating continued expansion in 2024.

- Security: Offers essential anti-fraud tools to protect online transactions.

Cielo's channels are multifaceted, encompassing a robust direct sales force that builds strong merchant relationships and provides personalized solutions. Complementing this, digital platforms like its website and mobile app streamline onboarding and offer self-service options, with over 75% of new merchants in 2024 beginning their sign-up online. Strategic partnerships with major financial institutions, such as Bradesco, significantly expand Cielo's reach and market penetration.

The company also ensures broad access to its POS terminals through direct distribution and partner networks, bundling rental, installation, and maintenance for a complete hardware solution. For online businesses, Cielo facilitates direct integrations with e-commerce platforms and offers flexible APIs, supporting the rapidly growing digital commerce sector with essential anti-fraud and payment processing capabilities.

| Channel | Description | 2024 Impact/Data |

|---|---|---|

| Direct Sales Force | Personalized merchant acquisition and relationship management. | Key for onboarding new clients and nurturing existing relationships. |

| Website & Mobile Apps | Digital onboarding, account management, and self-service support. | Over 75% of new merchants initiated sign-up online; 30% YoY increase in active app users. |

| Financial Institution Partnerships | Leveraging bank networks for broader customer access and distribution. | Crucial for market reach and onboarding through trusted financial channels. |

| POS Terminal Distribution | Direct and partner-led distribution of transaction hardware. | Ensures wide availability of POS devices; includes rental, installation, and maintenance. |

| E-commerce Integrations & APIs | Seamless payment gateway integration for online businesses. | Supports online retail growth; provides anti-fraud and payment processing for digital transactions. |

Customer Segments

Small and Medium-Sized Enterprises (SMEs) represent a cornerstone customer segment for Cielo, a diverse group spanning numerous industries. Cielo's strategy here involves delivering tailored, integrated solutions designed to meet their specific needs. This segment is showing promising indicators of recovery and expansion, with many SMEs actively seeking efficient operational tools.

In 2024, the SME sector continued to be a vital engine of economic activity. For instance, data from the U.S. Small Business Administration indicated that small businesses accounted for approximately 64% of new job creation in the prior year, highlighting their critical role. Cielo's focus on empowering these businesses with scalable and adaptable solutions positions it well to capitalize on this ongoing economic contribution.

Cielo's customer base includes major retail chains and large corporations that process a massive volume of transactions. These clients, such as major supermarket chains and department stores, rely on Cielo for robust and efficient payment processing. In 2024, Cielo continued to be a key partner for many of Brazil's largest retailers, facilitating billions of reais in daily sales.

These large-scale clients often require more than just basic payment processing; they need advanced solutions for managing complex payment flows and data analytics. Cielo addresses this by offering dedicated account management, ensuring these significant partners receive personalized support and tailored solutions to meet their specific operational needs.

E-commerce businesses represent a vital customer segment for Cielo, leveraging their secure payment gateways and robust anti-fraud measures to facilitate online transactions. In 2024, the global e-commerce market continued its upward trajectory, with projections indicating significant growth, making Cielo's digital payment solutions indispensable for merchants operating in this space.

Cielo's offerings for e-commerce include APIs that enable smooth integration with online storefronts, simplifying the payment process for both businesses and consumers. This focus on digital integration is key, as online sales are increasingly dominating retail landscapes worldwide, with many regions experiencing double-digit year-over-year growth in digital commerce throughout 2024.

Service Providers

Service providers, particularly those in the urban mobility sector, leverage Cielo's payment solutions to streamline transactions for their clientele. This partnership allows for seamless payment processing, enhancing the customer experience.

Cielo has actively broadened its presence in urban mobility, recently expanding its operations into new cities throughout Brazil. This strategic growth reflects the increasing demand for efficient digital payment systems in this dynamic market.

For instance, in 2024, Cielo reported significant growth in its payment processing volume, with a notable contribution from the transportation and mobility segments. This indicates a strong adoption of their services by businesses operating within this space.

- Urban Mobility Partners: Companies offering ride-sharing, car-sharing, and public transport ticketing solutions.

- Transaction Facilitation: Cielo provides the infrastructure for secure and efficient payment processing for these services.

- Geographic Expansion: Cielo's recent push into new Brazilian urban centers supports the growth of mobility providers in these areas.

- 2024 Performance: The transportation sector showed robust transaction growth on Cielo's network, underscoring the value proposition for mobility service providers.

Governmental Entities

Governmental entities represent a significant customer segment for payment solution providers like Cielo, particularly in Brazil. These organizations frequently require robust systems for collecting taxes, fees, and other public revenue efficiently and securely. For instance, in 2023, the Brazilian government continued to leverage digital payment solutions for various administrative functions, aiming to streamline processes and reduce operational costs.

The adoption of instant payment systems like Pix by governmental bodies further highlights this trend. Pix facilitates real-time transactions, which can be crucial for managing public funds and ensuring timely disbursement of benefits or payments. In 2024, the expectation is for continued growth in the use of such digital payment infrastructure by federal, state, and municipal governments across Brazil.

Cielo, with its established infrastructure, is well-positioned to cater to these needs. The company’s ability to handle high volumes of transactions securely makes it an attractive partner for government agencies. This segment values reliability and compliance, areas where established payment processors typically excel.

- Tax Collection: Facilitating electronic payment of taxes, fees, and fines, reducing manual processing and improving collection rates.

- Disbursement of Funds: Enabling efficient and secure distribution of salaries, social benefits, and other government payments to citizens and employees.

- Digital Government Services: Supporting online portals for government services where citizens can pay for permits, licenses, and other administrative charges.

- Pix Integration: Offering seamless integration with Pix for instant payment of government dues, enhancing convenience for both the public and the administration.

Financial institutions, including banks and credit unions, form a crucial customer segment for Cielo. These entities rely on Cielo's robust infrastructure to offer seamless payment processing services to their own customer bases, both individuals and businesses. In 2024, many financial institutions were actively seeking to enhance their digital offerings, making partnerships with established payment processors like Cielo even more strategic.

Cielo's role extends to providing white-label solutions and payment gateway integration, enabling these financial partners to expand their service portfolios. This collaboration allows banks to leverage Cielo's technological expertise and regulatory compliance, thereby strengthening their competitive position in the evolving financial landscape. The demand for integrated digital payment solutions within the banking sector remained high throughout 2024.

| Customer Segment | Key Needs | Cielo's Value Proposition | 2024 Market Trend |

|---|---|---|---|

| Financial Institutions | Enhanced digital payment services, white-label solutions, regulatory compliance | Robust payment infrastructure, gateway integration, technological expertise | Increased demand for integrated digital offerings |

Cost Structure

Cielo's technology and infrastructure represent a substantial portion of its cost structure, driven by the need to manage high-volume, secure transaction processing. This includes significant outlays for data centers, robust network maintenance, and ongoing software development to ensure system reliability and security.

In 2024, Cielo continued its strategic investment in technology, aiming to accelerate the deployment of new solutions and enhance existing platforms. These investments are crucial for maintaining a competitive edge in the rapidly evolving digital payments landscape.

Personnel and labor costs are a significant component of Cielo's expense structure. This includes the salaries, benefits, and ongoing training for its extensive workforce, which spans sales, customer service, and technical roles. For instance, in 2024, companies in the business services sector, similar to Cielo's operational domain, often allocate between 40-60% of their revenue to personnel expenses.

Cielo's strategic growth plans necessitate further investment in its human capital. The company intends to expand its team, particularly in sales, to drive revenue growth and enhance client acquisition efforts. This focus on client engagement and sales expansion will directly impact the personnel cost line item in the coming fiscal periods.

Cielo's cost structure heavily features marketing and sales expenses, crucial for both acquiring new merchants and keeping existing ones loyal. These costs cover everything from digital advertising campaigns to the salaries of their sales force, all aimed at expanding their market reach.

In 2024, Cielo has been actively reorganizing its sales channels. This strategic shift focuses on reaching smaller retail clients, a segment that requires a different approach and potentially different cost allocations for sales and marketing efforts compared to larger enterprise clients.

Regulatory and Compliance Costs

Operating in the financial services sector means Cielo faces significant expenses for adhering to national and international payment regulations and standards. These costs are essential for maintaining operational integrity and customer trust.

Cielo's commitment to compliance involves continuous investment in systems and personnel to meet evolving regulatory landscapes. For instance, in 2024, financial institutions globally saw compliance costs rise, with many reporting that over 10% of their operational budget was allocated to regulatory adherence.

- Ongoing Investment in Compliance Technology: Cielo invests in advanced software and platforms to monitor transactions, manage data privacy, and ensure adherence to anti-money laundering (AML) and know your customer (KYC) regulations.

- Staff Training and Expertise: Significant resources are dedicated to training compliance officers and relevant staff on new regulations and best practices, ensuring the company remains up-to-date.

- Legal and Advisory Fees: Engaging external legal counsel and compliance consultants is a recurring cost to navigate complex regulatory frameworks and conduct audits.

- Reporting and Auditing Expenses: Costs associated with generating regulatory reports and undergoing independent audits are substantial, ensuring transparency and accountability.

Hardware and Maintenance Costs

Cielo's cost structure includes significant expenses for hardware, such as Point-of-Sale (POS) terminals. These costs encompass purchase, rental, installation, and ongoing maintenance. In 2024, the company continued to leverage its optimized hardware portfolio, which has historically resulted in remarkably low maintenance rates, partly due to the integration of artificial intelligence for predictive upkeep.

The company's strategic focus on efficient hardware management and the application of AI in maintenance significantly curbed operational expenditures. For instance, by proactively identifying potential issues through AI, Cielo reduced the need for emergency repairs and extended the lifespan of its POS devices, contributing to a more predictable and controlled cost base.

- Hardware Acquisition: Costs associated with buying or leasing POS terminals for merchant partners.

- Installation and Setup: Expenses incurred for deploying and configuring terminals at merchant locations.

- Maintenance and Support: Ongoing costs for technical assistance, repairs, and software updates, minimized by AI-driven predictive maintenance.

Cielo's cost structure is heavily influenced by its technology and infrastructure investments, including data centers and network maintenance, to support high-volume transaction processing. Personnel costs, covering salaries and training for a broad workforce, are also a significant expense, with similar companies in the business services sector allocating 40-60% of revenue to labor in 2024. Marketing and sales expenses are critical for merchant acquisition and retention, with strategic shifts in 2024 targeting smaller retailers.

Regulatory compliance represents a substantial cost, with financial institutions globally dedicating over 10% of their operational budgets to adherence in 2024. Hardware, particularly POS terminals, also contributes to costs through acquisition, installation, and maintenance, though AI-driven predictive maintenance in 2024 has helped mitigate these expenses.

| Cost Category | Key Components | 2024 Relevance/Data |

| Technology & Infrastructure | Data centers, network maintenance, software development | Ongoing investment to maintain competitive edge in digital payments. |

| Personnel & Labor | Salaries, benefits, training | 40-60% of revenue allocation in similar sectors (2024); expansion in sales team planned. |

| Marketing & Sales | Advertising, sales force compensation | Reorganization of sales channels to target smaller retailers (2024). |

| Regulatory Compliance | Compliance technology, staff training, legal fees | Over 10% of operational budget for financial institutions (2024); focus on AML/KYC. |

| Hardware | POS terminals (purchase, rental, maintenance) | AI-driven predictive maintenance reducing repair needs and extending device lifespan (2024). |

Revenue Streams

Cielo's main way of making money is through transaction fees, often called Merchant Discount Rates (MDR). These are charges applied as a small percentage of every credit and debit card payment that goes through their system. This percentage is a key driver of their revenue.

In the second quarter of 2024, Cielo reported net operating revenue of R$2.48 billion. This figure directly reflects the volume of transactions processed and the MDRs collected from those sales, highlighting the significance of this revenue stream.

Cielo generates revenue by either renting or selling Point-of-Sale (POS) terminals to its merchant clients. These terminals are essential for enabling businesses to process electronic payments, making this a core revenue stream.

Beyond the initial transaction, Cielo also profits from the ongoing rental, installation, and maintenance services for these POS terminals. This recurring revenue model ensures a steady income flow and strengthens customer relationships.

In 2024, the demand for robust POS systems remained high as businesses continued to prioritize efficient and secure payment processing. Cielo's ability to provide both hardware and ongoing support positions it well within this market.

Cielo generates revenue through a variety of value-added services beyond basic payment processing. These include sophisticated anti-fraud solutions designed to protect merchants and consumers, robust payment gateways tailored for e-commerce platforms, and insightful data analytics that help businesses understand transaction patterns and customer behavior.

Fees collected from these specialized offerings form a significant portion of Cielo's overall revenue stream. For instance, in the first quarter of 2024, Cielo reported a net income of R$1.1 billion, reflecting the strong performance of its diverse service portfolio.

The company is actively exploring and investing in new avenues for revenue generation, aiming to expand its service ecosystem and capture emerging market opportunities. This forward-looking strategy ensures continued growth and adaptation in the dynamic financial technology landscape.

Receivables Anticipation

Receivables anticipation is a key revenue stream for Cielo, allowing merchants to receive payment for future credit card sales upfront in exchange for a fee. This service injects immediate liquidity into businesses, a critical factor for operational continuity and growth.

This offering is particularly beneficial for small and medium-sized enterprises (SMEs) that may face cash flow challenges. Cielo's data from 2024 indicates a positive trend in this segment, with an observed increase in the prepayment of receivables, suggesting growing reliance on and confidence in this financial solution.

- Merchant Liquidity: Provides immediate cash flow by advancing future credit card sales.

- Fee-Based Revenue: Generates income for Cielo through fees charged on these advance payments.

- SME Support: Crucial for small and medium businesses needing quick access to funds.

- 2024 Trend: Early indicators show increased SME prepayment of receivables, highlighting the service's growing importance.

Software Licensing and Custom Solutions

Cielo provides software licensing and custom solutions, a key revenue stream for larger clients and specialized industry requirements. This involves tailoring their payment technologies to meet unique business needs, often through direct licensing agreements.

For instance, in 2024, Cielo continued to focus on developing specific e-commerce APIs for businesses requiring seamless integration with their existing platforms. These custom solutions can significantly boost transaction capabilities and customer experience.

- Software Licensing: Revenue generated from granting businesses the right to use Cielo's payment processing software.

- Custom Solutions: Income from developing bespoke payment functionalities or integrations for specific client needs.

- API Development: Fees associated with creating and implementing specialized Application Programming Interfaces for e-commerce and other digital platforms.

- Enterprise Agreements: Revenue from long-term contracts with large corporations requiring extensive customization and support.

Cielo's revenue is significantly driven by transaction fees, commonly known as Merchant Discount Rates (MDRs). These are a percentage of each credit and debit card payment processed. In the second quarter of 2024, Cielo's net operating revenue reached R$2.48 billion, a direct reflection of these processed transaction volumes.

The company also generates income from renting and selling Point-of-Sale (POS) terminals, essential for electronic payments, and from associated installation and maintenance services. This creates a recurring revenue stream.

Value-added services, including anti-fraud solutions, payment gateways, and data analytics, also contribute substantially. Cielo's net income for the first quarter of 2024 was R$1.1 billion, underscoring the success of its diversified offerings.

Furthermore, receivables anticipation, where merchants receive future credit card sales upfront for a fee, provides essential liquidity. Cielo observed an increased reliance on this service by SMEs in 2024.

| Revenue Stream | Description | 2024 Relevance |

| Transaction Fees (MDRs) | Percentage of each card payment processed. | Core revenue driver; Q2 2024 Net Operating Revenue: R$2.48 billion. |

| POS Terminals & Services | Rental, sales, installation, and maintenance of payment devices. | Provides recurring income and supports payment infrastructure. |

| Value-Added Services | Anti-fraud, payment gateways, data analytics. | Significant contributor; Q1 2024 Net Income: R$1.1 billion. |

| Receivables Anticipation | Upfront payment for future credit card sales, with fees. | Key for SME liquidity; increased usage observed in 2024. |

Business Model Canvas Data Sources

The Cielo Business Model Canvas is meticulously constructed using a blend of internal financial data, comprehensive market research reports, and direct customer feedback. These diverse sources ensure a holistic and accurate representation of our business strategy.