Choppies SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Choppies Bundle

Choppies' strong brand recognition and extensive store network present significant strengths in the African retail landscape. However, understanding the full scope of their operational challenges and market vulnerabilities is crucial for informed decision-making.

Want the full story behind Choppies' strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Choppies' extensive and growing retail network is a significant strength, with over 287 stores across four Southern African countries as reported in their June 2024 annual report. This robust presence, coupled with plans for further expansion in 2024 and FY2025, allows Choppies to tap into a vast customer base and enhance its regional market dominance.

Choppies' core strength lies in its unwavering focus on affordability and delivering exceptional value. This strategy directly appeals to a significant customer base in its operating regions who are highly sensitive to price. By consistently offering competitive pricing, Choppies cultivates strong customer loyalty and drives substantial sales volumes.

This dedication to value is not just a claim; it’s backed by market data. For instance, in April 2025, Choppies was recognized as the most affordable retailer for a typical grocery basket in Namibia, underscoring its commitment to being a budget-friendly option for consumers.

Choppies has significantly broadened its retail and service scope by acquiring liquor and hardware stores from the Kamoso Group, moving beyond just groceries. This strategic expansion also includes ventures into milling and manufacturing, creating a more robust and varied business model.

Further strengthening its diversified offerings, Choppies is developing fintech solutions like the Payzana payment platform. The company also plans to introduce one-stop shops that will integrate value-added financial services, aiming to boost customer convenience and generate new revenue avenues.

Robust Sales Growth and Increased Footfall

Choppies has shown impressive sales growth, with retail sales climbing by a notable 19.3% during the six months leading up to December 2024. This strong performance is complemented by a healthy 15.5% increase in customer footfall across its operating regions. These figures highlight the company's ability to attract and serve more customers effectively.

The substantial rise in both sales volume and customer visits indicates successful strategies in place, likely stemming from enhanced in-store experiences and effective customer engagement initiatives. This robust performance points to a resilient business model capable of thriving even in dynamic market conditions.

- Sales Growth: 19.3% increase in retail sales for the six months ending December 2024.

- Footfall Increase: 15.5% growth in customer visits during the same period.

- Market Performance: Demonstrates strong customer attraction and sales generation across its markets.

- Operational Success: Reflects effective in-store execution and customer engagement strategies.

Established Brand and Optimized Operations

Choppies boasts significant brand recognition across Southern Africa, a testament to its long-standing presence. This established reputation translates into a loyal customer base, particularly in Botswana, where it holds a leading market position and is the largest private sector employer.

Operational efficiencies have been bolstered by an inventory optimization system, which has demonstrably improved stock availability. This focus on operational resilience is crucial for navigating dynamic market conditions and ensuring consistent customer service.

- Market Leadership: Choppies is a dominant player in Botswana, holding the largest market share in the grocery retail sector.

- Brand Loyalty: The company benefits from strong brand equity built over years of operation.

- Operational Efficiency: Implementation of an inventory optimization system enhances stock management and reduces waste.

Choppies' extensive store network, exceeding 287 locations across four Southern African nations as of June 2024, provides a substantial competitive advantage. This widespread physical presence, coupled with ongoing expansion plans for 2024 and FY2025, allows for deep market penetration and customer accessibility, solidifying its regional footprint.

The company's strategic focus on affordability resonates strongly with price-sensitive consumers, fostering significant customer loyalty and driving high sales volumes. This commitment to value is validated by market observations, such as being identified as the most affordable grocery option in Namibia in April 2025.

Choppies' diversification into liquor and hardware, alongside ventures into milling and manufacturing, broadens its revenue streams and strengthens its overall business model. Furthermore, the development of fintech solutions like Payzana and integrated financial services at one-stop shops aims to enhance customer convenience and unlock new growth opportunities.

| Metric | Value | Period |

|---|---|---|

| Retail Sales Growth | 19.3% | Six months ending December 2024 |

| Customer Footfall Increase | 15.5% | Six months ending December 2024 |

| Store Count | 287+ | June 2024 |

What is included in the product

Maps out Choppies’s market strengths, operational gaps, and risks, offering a comprehensive view of its internal capabilities and external market dynamics.

Offers a clear, actionable framework to address Choppies' identified weaknesses and threats, transforming challenges into strategic opportunities.

Weaknesses

Choppies' heavy reliance on Southern African markets exposes it to substantial regional economic volatility. High inflation rates and currency depreciation, such as the Kwacha's decline in Zambia, directly diminish consumer spending power and inflate operational expenses. This concentration amplifies the impact of any downturns, affecting profitability significantly.

Choppies operates in a fiercely competitive Southern African retail landscape, contending with a multitude of both local and global competitors. This intense rivalry, especially in product categories such as liquor, can lead to significant pressure on pricing strategies and, consequently, a dilution of gross profit margins.

The company's gross profit margin experienced a notable decline, falling to 17.6% in the fiscal year ending June 30, 2023, a decrease from 19.1% in the prior year. This contraction is partly attributed to the strategic integration of lower-margin businesses acquired, such as those from Kamoso, which has impacted overall profitability.

Choppies has struggled to maintain profitability in specific regions, exemplified by its exit from the Zimbabwean market in December 2024. This decision stemmed from a difficult operating climate, including a substantial move towards the informal economy and detrimental exchange rate policies.

These market exits underscore a recurring weakness in the company's ability to effectively navigate diverse economic landscapes and manage operations that are consistently underperforming, impacting overall financial health.

Integration Complexities of New Acquisitions

While Choppies' acquisition of the Kamoso Group in 2023 aimed to diversify its portfolio, it introduced significant integration challenges. The process of merging operations, systems, and cultures across these new entities demands substantial resources and management focus. This can strain existing operational capacities and require time for the newly acquired stores to achieve optimal performance and contribute positively to absorbing overheads.

The absorption of head office costs by new stores is a critical factor. Until these acquired locations reach their full revenue-generating potential, they may not adequately cover the increased administrative and operational expenses associated with their integration. This could lead to a temporary dilution of overall profitability metrics as the company works to fully realize the synergies from its recent expansion efforts.

- Integration Demands: Merging the Kamoso Group's operations into Choppies' existing structure requires significant investment in IT systems, supply chain alignment, and human capital management.

- Time to Profitability: New stores typically require a ramp-up period to reach optimal sales volumes and contribute to covering fixed head office costs, potentially impacting short-term earnings.

- Resource Strain: The integration process can divert financial and managerial resources from core business improvements or other strategic initiatives, potentially slowing overall growth.

Developing E-commerce and Digital Adaptation

Choppies' digital adaptation appears to be in its nascent stages when contrasted with prevailing global retail trends. While the company is exploring e-commerce and a digital path for paperless retail, its current digital footprint is relatively limited. This slower pace of digital transformation could be a significant weakness, particularly in capturing the expanding online retail market.

A nascent e-commerce presence directly impacts Choppies' ability to compete with more digitally sophisticated rivals. In 2024, global e-commerce sales are projected to reach over $6.3 trillion, highlighting the substantial revenue potential being missed. Choppies' current digital infrastructure may not be robust enough to effectively serve a growing online customer base or to offer the seamless digital experiences that consumers increasingly expect.

- Limited E-commerce Reach: Choppies' digital sales channels are not as developed as those of its competitors, potentially restricting market share capture.

- Slower Digital Transformation: The company's pace in adopting digital technologies lags behind global retail benchmarks, impacting its competitive positioning.

- Missed Online Market Opportunities: A less mature e-commerce platform hinders the ability to capitalize on the significant growth in online shopping, which is expected to continue its upward trajectory through 2025.

Choppies' financial performance has been hampered by a shrinking gross profit margin, which fell to 17.6% in FY2023 from 19.1% in FY2022. This decline is partly due to the integration of lower-margin businesses, impacting overall profitability and the ability to absorb rising operational costs.

The company's exit from Zimbabwe in December 2024 highlights a persistent weakness in adapting to challenging economic environments. This market withdrawal, driven by informalization and unfavorable exchange rates, underscores difficulties in managing operations in diverse and volatile regional markets.

Acquiring the Kamoso Group in 2023 presented integration challenges, straining resources and management capacity. Until these new stores achieve optimal revenue generation, they may not adequately cover increased head office costs, potentially diluting short-term profitability.

Choppies' digital presence is underdeveloped compared to global retail trends, with a limited e-commerce footprint. This slower digital transformation hinders its ability to compete with more advanced rivals and capture the growing online market, projected to exceed $6.3 trillion globally in 2024.

| Weakness | Description | Impact | Supporting Data |

|---|---|---|---|

| Declining Gross Profit Margin | Reduced profitability due to lower-margin acquisitions and competitive pricing pressures. | Erodes overall profitability and ability to invest in growth. | Gross profit margin decreased to 17.6% in FY2023 from 19.1% in FY2022. |

| Market Exit & Operational Challenges | Inability to effectively navigate difficult economic conditions in certain markets. | Loss of revenue streams and reputational damage. | Exit from the Zimbabwean market in December 2024 due to challenging operating climate. |

| Integration of Acquisitions | Difficulties in merging new entities, straining resources and delaying profitability. | Increased operational costs and potential dilution of short-term earnings. | Acquisition of Kamoso Group in 2023 introduced integration demands. |

| Limited Digital Transformation | Nascent e-commerce presence and slower adoption of digital technologies. | Missed opportunities in the growing online retail market and reduced competitiveness. | Global e-commerce sales projected to exceed $6.3 trillion in 2024. |

Full Version Awaits

Choppies SWOT Analysis

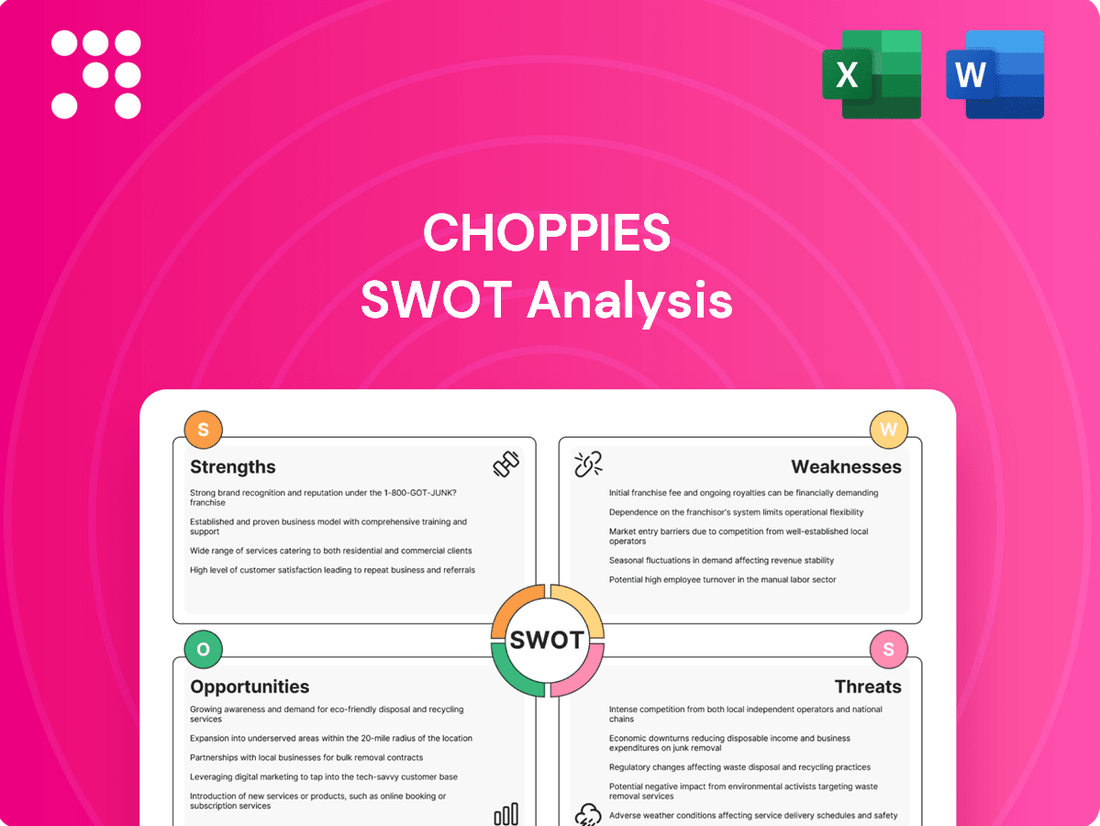

This is the actual SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. It details Choppies' internal strengths and weaknesses, alongside external opportunities and threats, providing a comprehensive strategic overview.

The preview below is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version, offering actionable insights for strategic planning.

This preview reflects the real document you'll receive—professional, structured, and ready to use. It highlights key factors influencing Choppies' market position and future growth.

Opportunities

Choppies can strategically expand by opening new stores in underserved areas within its existing markets, like Namibia, and potentially launching its Builders Mart brand in more African countries. This approach focuses on organic growth to boost market share and geographical presence.

For instance, in 2024, Choppies' expansion efforts in Botswana saw the opening of several new outlets, contributing to a 5% year-on-year revenue increase in that segment. This demonstrates a tangible opportunity to replicate such success in other regions.

The surge in e-commerce across Africa, with the market projected to reach $180 billion by 2025, offers Choppies a significant avenue for growth. By enhancing its digital and omnichannel capabilities, Choppies can tap into this expanding market and cater to the growing consumer demand for seamless online and in-store shopping experiences.

Further investment in a user-friendly e-commerce platform and streamlined digital payment options, potentially leveraging mobile money which is widely adopted in key African markets, will be crucial. This strategic move can attract a broader customer base and improve overall customer satisfaction by offering greater convenience and accessibility.

Choppies' acquisition of milling, tissue, and water bottling operations from Kamoso Group in 2023 presents a prime opportunity for backward integration. This strategic move allows Choppies to manufacture its own private label goods, directly impacting cost structures and pricing strategies.

By controlling these production processes, Choppies can achieve greater cost efficiencies, potentially leading to more competitive pricing for its private label range. This enhanced control over the supply chain also bolsters its ability to ensure product quality and availability, differentiating its offerings in the market.

This integration is expected to drive profitability by reducing reliance on external suppliers and capturing more of the value chain. For instance, private label penetration in the African grocery sector has been growing, with some markets seeing it reach over 20% by 2024, indicating a strong consumer acceptance and potential for Choppies to capitalize on this trend.

Diversification into Value-Added Financial Services

Choppies has a significant opportunity to enhance its revenue streams by expanding its fintech offerings. Beyond simple payment processing, they can integrate services like utility bill payments, airtime top-ups, and money transfer facilities directly at their numerous store locations. This strategy capitalizes on their existing physical footprint to offer greater convenience to their customer base.

This diversification into value-added financial services can unlock substantial non-traditional revenue. For instance, in 2023, the African fintech market saw significant growth, with mobile money transactions alone reaching hundreds of billions of dollars. By tapping into this, Choppies can create new income channels that complement their core retail operations.

- Expand fintech services: Integrate electricity and airtime sales, and money transfer services into the existing store network.

- Leverage infrastructure: Utilize the widespread store footprint to offer enhanced customer convenience and accessibility.

- Unlock new revenue: Generate non-traditional income streams by catering to the growing demand for digital financial services in the region.

Data-Driven Operations and Customer Personalization

Choppies can leverage advanced data analytics to deeply understand customer purchasing habits. This insight allows for significant optimization of inventory, ensuring popular items are always in stock and reducing waste on slow movers. For instance, by analyzing sales data from 2024, Choppies could identify regional preferences, leading to more efficient product assortment across its stores.

Tailoring product assortments based on this data is a key opportunity. By understanding what specific demographics or locations are buying, Choppies can curate shelves to better meet local demand, increasing customer satisfaction and driving sales. This also extends to personalizing promotional campaigns, making marketing efforts more effective and cost-efficient.

- Data-driven inventory management can reduce stockouts by up to 15% and decrease spoilage by 10% based on industry benchmarks.

- Personalized promotions have shown to increase customer engagement and conversion rates by an average of 20%.

- Analyzing customer data can lead to a 5-8% uplift in overall sales through improved product placement and targeted offers.

- Enhanced customer experience through personalization can boost customer loyalty and repeat purchase rates.

Choppies can capitalize on the growing African e-commerce market, projected to reach $180 billion by 2025, by enhancing its digital and omnichannel capabilities. This strategic move will allow the company to cater to increasing consumer demand for seamless online and in-store shopping experiences.

The acquisition of milling, tissue, and water bottling operations provides a significant opportunity for backward integration, enabling Choppies to manufacture its own private label goods. This control over production processes is expected to improve cost efficiencies and product quality, with private label penetration in African groceries reaching over 20% in some markets by 2024.

Expanding fintech services by integrating utility bill payments and money transfers at its stores can unlock substantial non-traditional revenue streams. The African fintech market saw significant growth in 2023, with mobile money transactions alone reaching hundreds of billions of dollars, highlighting the potential for Choppies to tap into this lucrative sector.

Leveraging data analytics to understand customer purchasing habits offers a chance to optimize inventory and tailor product assortments to local demand. Industry benchmarks suggest data-driven inventory management can reduce stockouts by up to 15%, while personalized promotions have shown to increase customer engagement by 20%.

Threats

Choppies continues to grapple with persistent macroeconomic headwinds across Southern Africa. High inflation rates, such as those seen in Zambia and Zimbabwe, erode consumer spending power, directly impacting sales volumes. For instance, Zambia's inflation reached over 10% in early 2024, a significant challenge for retailers.

Currency devaluations in key operating countries, including Botswana and South Africa, also present a substantial threat. These fluctuations increase the cost of imported goods, squeezing Choppies' profit margins and potentially forcing price hikes that further deter customers. Fluctuating commodity prices add another layer of uncertainty to operational costs and consumer demand.

The retail landscape is fiercely competitive, with both new players entering the market and established local and international companies aggressively expanding their reach. This intense rivalry puts constant pressure on Choppies to innovate and maintain its customer base.

The increasing prominence of global e-commerce platforms such as Shein and Temu presents a significant challenge. These online retailers offer a wide variety of goods, often at competitive prices, directly impacting Choppies' market share and forcing a re-evaluation of its traditional brick-and-mortar strategy.

Furthermore, a noticeable trend of consumers shifting towards informal retail sectors, perhaps due to price sensitivity or convenience, directly threatens Choppies' established business model. This shift means lost sales opportunities and a need to adapt to evolving consumer purchasing habits.

Choppies' extensive operations across Southern Africa, spanning countries like Botswana, South Africa, and Zimbabwe, inherently expose it to supply chain vulnerabilities. For instance, infrastructure deficits in some regions can lead to delays and increased logistics costs. The company's reliance on a broad network means it's susceptible to disruptions from political instability or trade policy changes in any of these operating markets.

Rising operational costs present a significant threat. In 2024, many Southern African economies experienced elevated inflation rates, impacting the cost of goods and services. Energy supply issues, particularly in South Africa, have led to increased reliance on more expensive backup power solutions, directly affecting Choppies' bottom line. Security concerns in certain operating areas also add to overheads, diverting resources from core business activities.

Evolving Consumer Preferences and Digital Lag

Choppies faces a significant threat from rapidly changing consumer preferences, particularly a growing demand for healthier and sustainably sourced products. Failure to align its product offerings with these evolving tastes could alienate a key demographic.

Furthermore, a digital lag presents a substantial risk. As of early 2025, many consumers expect a seamless online shopping experience, including efficient e-commerce platforms and digital loyalty programs. If Choppies' digital infrastructure and retail model aren't fully modernized, it risks losing market share to competitors who are more agile in their digital transformation.

- Shifting Demand: Growing consumer interest in organic and ethically produced goods.

- Digital Expectations: Increased reliance on online platforms for grocery shopping and personalized offers.

- Competitive Disadvantage: Competitors with robust e-commerce capabilities can capture market share more effectively.

Regulatory and Political Risks Across Operating Countries

Choppies faces significant threats from varying regulatory landscapes across its operating countries. Changes in government policies, trade barriers, and competition laws can create unpredictable challenges, impacting its ability to operate smoothly and profitably. For instance, shifts in import duties or local content requirements can directly affect supply chains and cost structures.

Political instability and unfavorable economic policies pose another critical risk. The company's past experience highlights this vulnerability; exchange rate policies were a contributing factor to its withdrawal from Zimbabwe. Such economic volatility can erode the value of earnings and disrupt financial planning.

- Regulatory Divergence: Choppies' presence in multiple African nations means navigating a patchwork of regulations, from food safety standards to labor laws, which can differ significantly and increase compliance costs.

- Political Volatility Impact: Political unrest or sudden policy changes in key markets, like Botswana or South Africa, could disrupt supply chains and deter consumer spending, directly impacting sales figures.

- Trade Policy Shifts: Changes in regional trade agreements or the imposition of new tariffs between countries where Choppies operates could create competitive disadvantages or increase the cost of goods sold.

- Compliance Costs: Adhering to diverse and evolving legal frameworks across different jurisdictions requires substantial investment in legal and compliance teams, adding to operational overhead.

Choppies faces intense competition from both established players and emerging online retailers like Shein and Temu, which are capturing market share with aggressive pricing and convenience. The shift towards informal retail channels also poses a threat as consumers prioritize affordability and accessibility. Furthermore, evolving consumer preferences for healthier and sustainably sourced products necessitate adaptation in product offerings to avoid alienating key demographics.

SWOT Analysis Data Sources

This Choppies SWOT analysis is built upon a robust foundation of data, including their latest financial statements, comprehensive market research reports, and expert opinions from industry analysts. This multi-faceted approach ensures a thorough and accurate assessment of their current strategic position.