Choppies Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Choppies Bundle

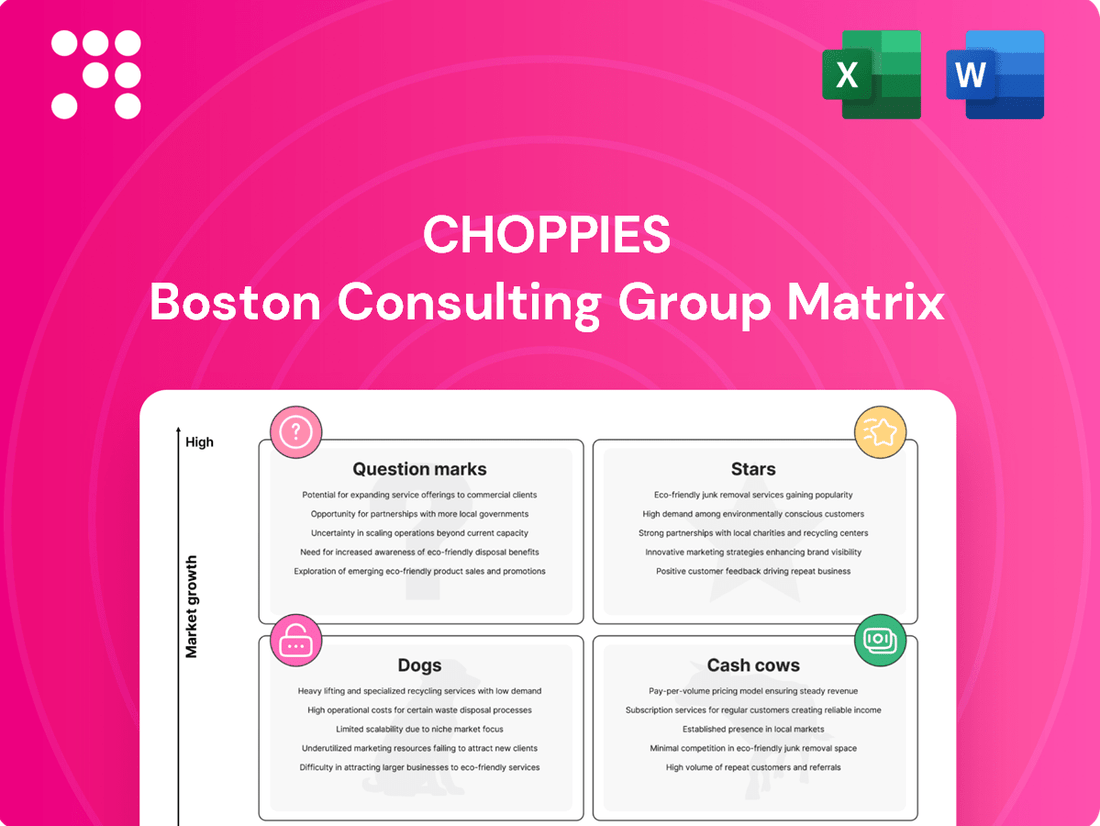

Curious about Choppies' product portfolio performance? This glimpse into their BCG Matrix highlights key areas of growth and potential challenges. Understand which products are driving revenue and which might need a strategic rethink.

To truly unlock the strategic potential of Choppies' business, dive into the full BCG Matrix. Gain a comprehensive understanding of their Stars, Cash Cows, Dogs, and Question Marks, and equip yourself with the insights needed to make informed decisions about resource allocation and future investments. Purchase the complete report for a detailed, actionable roadmap to optimizing Choppies' market position.

Stars

Choppies' Namibian operations are a shining example of a star in the company's portfolio. For the half-year ending December 2024, sales in Namibia surged by an impressive 51.0%, a dramatic turnaround from previous performance as the segment moved into profitability. This robust growth underscores a significant market opportunity and effective operational strategies.

The company's commitment to this market is further evidenced by its ambitious expansion plans. Choppies intends to launch seven new stores across Namibia during 2024, a clear signal of its intent to capture greater market share. This strategic investment is designed to capitalize on the burgeoning demand and solidify its presence in a key growth region.

This combination of rapid sales expansion and a move into profitability, coupled with aggressive store openings, firmly places Namibia in the star quadrant of Choppies' BCG Matrix. While this phase requires substantial investment, the potential for high future returns given the market's growth trajectory and Choppies' increasing market penetration is substantial.

Zambia Operations is a Star for Choppies, showing impressive growth. For the six months ending December 2024, sales grew by 12.4% in Pula and a significant 37.8% in Kwacha. This growth was fueled by the opening of six new stores, expanding their footprint in the region.

Despite facing headwinds such as currency devaluation and power supply issues, the Zambian segment achieved profitability at the EBITDA level. This turnaround highlights Choppies' effective strategy in navigating challenging economic conditions and capturing market share.

The strong performance in Zambia positions it as a key growth driver for Choppies. Continued investment is crucial to maintain this upward trajectory and capitalize on the expanding market opportunities.

Choppies' acquisition of Builders Mart in 2024 marked a significant diversification into the hardware retail sector. This move positions Builders Mart as a potential Star within Choppies' portfolio, especially with expansion plans into Namibia in FY2025 and other African markets.

The hardware segment is identified as a high-growth category in these new territories, where Choppies intends to capture substantial market share. While initial investments are necessary to build out this new offering, the strategic goal is for Builders Mart to evolve into a major revenue contributor, solidifying its Star status.

Liquorama (Stand-alone Liquor) Rollout

Choppies is strategically expanding its footprint with stand-alone liquor stores under the Liquorama brand. This move capitalizes on a growing consumer demand for dedicated liquor retail. The company is also set to launch the 'Chill' brand for stand-alone liquor stores in Namibia, aiming to capture a significant share of this expanding market.

This expansion into specialized liquor retail allows Choppies to diversify its offerings beyond traditional grocery formats. The investment is focused on establishing a strong market presence in a high-growth niche. For instance, in fiscal year 2024, Choppies reported a notable increase in sales from its liquor segments, indicating strong consumer uptake.

- Liquorama expansion targets a growing liquor market.

- 'Chill' brand launch planned for Namibia in 2024.

- Diversification into specialized retail to capture new market share.

- Investment aims to achieve market leadership in the liquor segment.

Strategic New Store Openings in Growth Regions

Choppies strategically expanded its footprint in FY2024 by opening eight net new stores across four countries. A significant portion of this growth, 26 new stores, was established between June and December 2024, with a clear emphasis on high-growth regions such as Namibia and Zambia.

These new openings are designed to drive increased footfall and volume growth, reflecting successful market penetration and gains in these expanding territories. This proactive organic expansion in promising markets aligns with the characteristics of Star products, necessitating continued investment to fully leverage these growth opportunities.

- FY2024 Net New Stores: 8

- New Stores (June-December 2024): 26

- Key Growth Regions: Namibia, Zambia

- Impact: Increased footfall, volume growth, market share gains

Choppies' Namibian operations are a prime example of a Star, exhibiting remarkable sales growth of 51.0% in the half-year ending December 2024, successfully transitioning into profitability. This strong performance is supported by plans to open seven new stores in Namibia during 2024, indicating a strategic push to capture more market share in a high-potential region.

Similarly, Zambia stands out as a Star, with sales growing 12.4% in Pula and 37.8% in Kwacha for the six months ending December 2024, driven by six new store openings. Despite economic challenges, the segment achieved EBITDA profitability, demonstrating effective strategy and market penetration.

The acquisition of Builders Mart in 2024 positions it as a potential Star, with expansion planned for Namibia and other African markets in FY2025, targeting the high-growth hardware sector. Choppies is also expanding its specialized liquor retail with Liquorama and the new 'Chill' brand in Namibia, capitalizing on growing consumer demand and aiming for market leadership in this niche.

| Segment | Growth Metric | Period | Key Developments | BCG Status |

| Namibia Operations | Sales Growth: 51.0% | H1 FY2025 (ending Dec 2024) | Turned profitable; 7 new stores planned for 2024 | Star |

| Zambia Operations | Sales Growth: 12.4% (Pula), 37.8% (Kwacha) | H1 FY2025 (ending Dec 2024) | Achieved EBITDA profitability; 6 new stores opened | Star |

| Builders Mart | N/A (Acquisition) | 2024 | Expansion into Namibia (FY2025) and other markets; targeting hardware sector | Potential Star |

| Liquor Retail (Liquorama, 'Chill') | Sales Increase | FY2024 | Expansion in Namibia ('Chill' brand); diversification into specialized retail | Star |

What is included in the product

Choppies' BCG Matrix categorizes its diverse retail operations, identifying high-growth, high-market-share Stars and stable Cash Cows, alongside nascent Question Marks needing investment and underperforming Dogs for divestment.

Choppies' BCG Matrix offers a clear, one-page overview of its business units, simplifying strategic decisions and alleviating the pain of complex portfolio analysis.

Cash Cows

The Botswana Core Supermarket Business within Choppies is a definitive Cash Cow. It boasts a commanding market-leading position and a deeply ingrained brand presence in its home market, Botswana, where it stands as the largest private sector employer.

This segment consistently delivers the lion's share of the company's revenue, exhibiting robust sales even within a mature market. New store openings are strategically managed to prevent cannibalization, underscoring the strength of existing locations.

With its substantial market share and consistent profitability, the Botswana operations serve as the primary engine for generating the cash flow necessary to support the entire Choppies Group. For instance, in the fiscal year ending June 30, 2024, Botswana's retail segment continued to be the largest contributor to the company's overall revenue, demonstrating its enduring Cash Cow status.

Choppies' established food and grocery retail operations in Botswana, Zambia, and Namibia are its quintessential Cash Cows. This segment, characterized by a high market share in mature, low-growth markets, consistently delivers strong, stable profits. In 2024, Choppies reported significant revenue from these core markets, underscoring their role as reliable profit generators.

These operations are the bedrock of Choppies' financial stability, generating substantial cash flow with minimal incremental investment. The company's entrenched market position means these outlets require less capital for expansion or aggressive marketing, allowing the generated profits to be reinvested in other ventures or distributed to shareholders. This consistent performance is vital for funding future growth strategies.

Choppies' optimized distribution infrastructure is a key strength, particularly in its established African markets. This efficiency allows for high-volume sales and consistent product availability.

The company's strong operational expertise in logistics translates into sustained profitability. This means the existing network reliably generates cash flow without needing substantial new investment for expansion.

Choppies Private Label Products

Choppies' private label products are a significant part of its strategy, offering a broad selection alongside established brands. These own-brand items generally yield higher profit margins and benefit from strong loyalty among their existing customers, particularly in Botswana.

The consistent sales and profitability of these private labels in a mature market position them as reliable cash cows for Choppies. They contribute a steady stream of income to the company’s overall financial performance.

- Higher Profit Margins: Private label goods typically offer better profit margins compared to branded products.

- Strong Brand Recognition: Choppies private labels have built significant brand loyalty within their core markets.

- Consistent Revenue: These products provide a stable and predictable revenue stream, crucial for financial stability.

- Market Dominance: Especially in Botswana, Choppies private labels hold a strong market position, ensuring continued sales.

Mature Value-Added Financial Services

Choppies' mature value-added financial services, including pre-paid utilities, mobile top-ups, and bill payments, function as significant cash cows. In its dominant markets, such as Botswana, these services benefit from an established customer base, consistently generating transaction-based revenue. For instance, in 2024, these ancillary services continued to represent a stable revenue stream, requiring minimal incremental investment to maintain or grow their contribution.

These services are crucial for Choppies' financial stability. They demand low capital expenditure for continued operation and expansion, allowing them to generate substantial and consistent cash flow. This surplus cash can then be strategically allocated to other business units within the company, such as funding growth initiatives or supporting less mature ventures.

- Dominant Market Presence: Established customer base in key markets like Botswana.

- Steady Revenue Generation: Consistent income from transaction-based financial services.

- Low Investment Requirement: Minimal additional capital needed for growth or maintenance.

- Cash Flow Contribution: Provides stable cash flow to support overall company finances.

Choppies' core supermarket operations in Botswana, Zambia, and Namibia are its prime cash cows. These segments, characterized by high market share in mature, low-growth environments, consistently deliver strong, stable profits. In the fiscal year ending June 30, 2024, these established markets continued to be the largest contributors to Choppies' overall revenue, reinforcing their role as reliable profit generators.

These operations are the financial bedrock of Choppies, generating substantial cash flow with minimal incremental investment. The company's entrenched market position means these outlets require less capital for expansion or aggressive marketing, allowing the generated profits to be reinvested in other ventures or distributed to shareholders. This consistent performance is vital for funding future growth strategies.

Choppies' private label products and value-added financial services, such as utility payments and mobile top-ups, also function as significant cash cows. These offerings benefit from an established customer base in dominant markets like Botswana, consistently generating transaction-based revenue with low capital expenditure requirements. In 2024, these ancillary services continued to represent a stable revenue stream, requiring minimal incremental investment to maintain or grow their contribution.

| Business Segment | Market Position | Growth Rate | Profitability | Cash Flow Generation |

|---|---|---|---|---|

| Botswana Supermarkets | Market Leader | Low | High | Very High |

| Zambia & Namibia Supermarkets | Strong Market Share | Low | High | High |

| Private Label Products | Strong Loyalty | Low | High Margins | Consistent |

| Financial Services | Established User Base | Low | Steady Transaction Fees | Stable |

Delivered as Shown

Choppies BCG Matrix

The Choppies BCG Matrix you see here is the complete, unwatermarked document you'll receive immediately after purchase. This comprehensive analysis, detailing Choppies' product portfolio across market share and growth, is ready for your strategic planning. You'll gain access to the full report, enabling informed decision-making for optimizing Choppies' business units.

Dogs

Choppies' operations in Zimbabwe presented a significant hurdle, characterized by persistent losses stemming from the nation's volatile economic climate and unstable currency. This segment demanded substantial resources but failed to deliver adequate returns, prompting a strategic decision to exit.

In a decisive move, Choppies announced its intention to cease operations in Zimbabwe, culminating in the sale of its assets in December 2024. This divestment clearly signals a strategic withdrawal from a market that proved consistently unprofitable, aligning with a focus on more viable business units.

Choppies strategically closed 15 underperforming stores in the financial year ending June 2024. This included 10 locations within its Kamoso segment, a move designed to streamline operations.

These closures represent units with limited market share and growth prospects, often referred to as cash traps. By exiting these locations, Choppies aimed to cut losses and redirect capital towards more promising opportunities.

The Kamoso general merchandise business was discontinued by Choppies during the June 2024 financial year. This strategic move indicates that Kamoso likely represented a low market share and low growth segment within Choppies' portfolio, failing to contribute meaningfully to the overall business.

By discontinuing Kamoso, Choppies was able to divest itself of an underperforming asset. This action would have freed up valuable capital and allowed management to redirect its focus towards more promising and synergistic business areas.

Kamoso South African Liquor Business (Discontinued)

The Kamoso South African liquor business, much like other segments, was discontinued in the June 2024 financial year. This strategic move suggests the operation was not meeting performance expectations, likely characterized by a limited market share and minimal growth prospects in South Africa's robust liquor market.

Divesting from underperforming units like Kamoso is a common business strategy aimed at concentrating resources on more profitable and core operations. This allows companies to improve overall financial health and focus on areas with higher potential for returns.

- Discontinuation: Kamoso South African liquor business ceased operations in FY2024.

- Market Position: Likely held a low market share in a competitive South African liquor sector.

- Strategic Rationale: Divestment supports a focus on core, profitable business areas.

- Financial Impact: Removal of an underperforming asset can improve overall company profitability.

Mediland Business (Sold)

Choppies' sale of its Mediland business in 2024 generated a profit, signaling a strategic move to divest a non-core asset. This action aligns with the Business Portfolio Matrix's classification of 'Dogs' – businesses with low market share and low growth potential – which are often sold to reallocate resources to more promising ventures.

While detailed financial performance data for Mediland prior to its sale is not widely available, the decision to sell suggests it was not a strategic fit for Choppies' future direction or was underperforming. The profit realized on the sale indicates a successful exit, contributing positively to Choppies' overall financial health.

- Strategic Divestment: The sale of Mediland represents Choppies' strategic decision to exit a business unit deemed a 'Dog' in its portfolio.

- Profit Realization: Choppies reported a profit from the sale, demonstrating an effective divestment strategy.

- Resource Reallocation: By selling Mediland, Choppies can redirect capital and management focus towards higher-growth or more synergistic business areas.

- Improved Financial Health: The divestment of underperforming assets like Mediland can lead to a leaner, more efficient, and financially stronger organization.

Choppies' strategic decisions in 2024, including the sale of its Mediland business, highlight its approach to managing 'Dogs' within its BCG Matrix. These are typically units with low market share and low growth potential, often divested to optimize resource allocation.

The sale of Mediland in 2024 generated a profit, indicating a successful exit from a non-core asset that likely did not meet performance expectations or strategic fit criteria. This move aligns with shedding underperforming segments to focus on more lucrative opportunities.

By discontinuing operations like the Kamoso general merchandise and South African liquor businesses in FY2024, Choppies further streamlined its portfolio. These actions collectively demonstrate a deliberate strategy to exit low-performing segments, thereby improving overall business efficiency and financial health.

These divestments and closures, such as the 15 store closures in FY2024, are characteristic of managing 'Dog' business units. They represent a commitment to shedding assets that consume resources without generating sufficient returns, thereby enabling a sharper focus on core competencies and growth areas.

Question Marks

Builders Mart's foray into new African territories, such as Namibia in fiscal year 2025, positions these ventures as Question Marks within the Choppies portfolio. Although the hardware sector generally exhibits strong growth, Builders Mart begins with a modest market share in these emerging markets.

Significant capital infusion is anticipated to be necessary to cultivate brand recognition and build a substantial customer base in these nascent regions. The objective is to transform these initial investments into Stars, capitalizing on the high-growth potential of the hardware market.

Choppies' planned expansion into stand-alone liquor stores under the 'Chill' brand in Namibia positions these outlets as Stars or Question Marks within the BCG Matrix. Initially, with a low market share in this new format, they represent a significant investment in a potentially high-growth sector.

The Namibian liquor market shows promise for growth, but the 'Chill' brand's success hinges on substantial initial marketing and operational capital to build a customer base. This venture is a high-growth potential area with an uncertain market penetration, requiring careful strategic management.

Choppies' planned cash and carry wholesale store in Lobatse, slated for the first half of FY2025, represents a strategic diversification into a new business model. This venture is expected to launch with a modest market share within the wholesale sector, positioning it as a potential Question Mark in the BCG Matrix.

The wholesale market presents significant growth opportunities, but Choppies' entry into this segment will necessitate considerable investment and meticulous strategic planning. Success in this high-growth, low-market-share category is crucial for the Lobatse store to eventually transition into a Star, requiring efficient operations and aggressive market penetration strategies.

Full-Scale E-commerce Implementation

Choppies' full-scale e-commerce implementation positions it as a potential star in the BCG matrix. The company aims to become a one-stop shop, extending its reach beyond Botswana to cater to a broader customer base.

This strategic move targets a high-growth digital market where Choppies currently holds a minimal share against established online players. The projected growth of the global e-commerce market, which was valued at over $5.7 trillion in 2023 and is expected to continue its upward trajectory, underscores the opportunity.

Successful execution requires significant capital outlay for:

- Technology Infrastructure: Building robust online platforms and mobile applications.

- Logistics and Supply Chain: Establishing efficient delivery networks across operating regions.

- Marketing and Customer Acquisition: Driving online traffic and converting it into sales.

This investment is crucial for achieving substantial market penetration and competing effectively in the digital retail space.

Entry into New Unspecified African Markets

Entry into new, unspecified African markets for Choppies would initially place these ventures in the Question Marks category of the BCG Matrix. This is because Choppies aims to replicate its successful model, meaning these new markets are likely high-growth environments where the company begins with a minimal market share. For instance, in 2024, many African economies are projected to experience robust GDP growth, offering fertile ground for retail expansion.

These new market entries require substantial investment and careful strategic planning. The objective is to nurture them into Stars, achieving high market share in a high-growth sector, or they risk becoming Dogs if they fail to gain traction and become profitable. Choppies' expansion strategy hinges on identifying and developing these emerging markets effectively.

- High Growth Potential: New African markets offer significant growth prospects, aligning with the high-growth characteristic of Question Marks.

- Low Market Share: Choppies entering these markets will start with a low relative market share, a defining trait of this BCG quadrant.

- Capital Intensive: Significant investment is needed to establish a presence and gain market share in these new territories.

- Strategic Uncertainty: The success of these ventures is uncertain, requiring strategic decisions to either invest further or divest.

Choppies' new ventures, like Builders Mart in Namibia and the 'Chill' liquor stores, are positioned as Question Marks due to their low initial market share in high-growth sectors. The planned cash and carry wholesale store in Lobatse also fits this category, requiring significant investment to gain traction.

These Question Marks represent opportunities for future growth, but their success is uncertain and dependent on substantial capital and strategic execution. The goal is to convert these into Stars by capturing market share in expanding markets, as seen with the e-commerce initiative targeting a global market valued over $5.7 trillion in 2023.

Africa's projected economic growth in 2024 provides a favorable backdrop for Choppies' expansion, but these new market entries demand careful management to avoid becoming Dogs.

The core characteristics of these Question Marks include high growth potential, low market share, capital intensity, and strategic uncertainty, necessitating focused investment to achieve market leadership.

BCG Matrix Data Sources

Our Choppies BCG Matrix leverages comprehensive financial statements, internal sales data, and market share reports to accurately assess product performance and growth potential.