Choppies PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Choppies Bundle

Navigate the complex external landscape impacting Choppies with our comprehensive PESTLE analysis. Understand how political stability, economic fluctuations, and technological advancements are reshaping the retail sector across Africa. Gain a strategic advantage by identifying opportunities and mitigating risks before your competitors do. Download the full version now for actionable insights to fuel your business decisions.

Political factors

Choppies' extensive operations across Southern Africa mean its success is closely tied to the political stability of countries like South Africa, Botswana, and Zimbabwe. Stable governance fosters predictable regulatory frameworks and consistent economic policies, essential for a large retailer's long-term planning and investment. For instance, in 2023, South Africa, Choppies' largest market, experienced ongoing political discourse around coalition governments, which can influence business confidence and future policy direction.

Political instability, however, presents significant risks. The company has previously faced challenges in markets like Zimbabwe, where economic volatility linked to political factors has impacted operations. In 2022, Zimbabwe's inflation rate averaged over 250%, directly affecting consumer spending power and the cost of goods for retailers like Choppies, leading to strategic reviews of its presence in such volatile environments.

The retail sector in Southern Africa, where Choppies primarily operates, faces a patchwork of regulations. For instance, in Botswana, obtaining and renewing retail licenses can involve multiple government departments, potentially causing delays. In 2024, the average time for a new retail business to secure all necessary permits could extend several months, impacting operational timelines.

Complex licensing procedures and high compliance costs are significant hurdles. These can deter new entrants and make expansion difficult for existing players like Choppies. For example, in South Africa, specific regulations around food safety and product labeling add to operational expenses, with compliance costs potentially reaching 3-5% of a retailer's annual turnover.

Conversely, supportive regulatory environments can be a boon for growth. Countries that streamline licensing and offer incentives for retail development can see increased investment and market expansion. A move towards digital licensing platforms, as seen in some Namibian municipalities in late 2023, has begun to reduce administrative burdens and speed up market entry.

Government trade policies, particularly import duties and tariffs, significantly influence Choppies' cost of goods sold. For instance, in 2024, South Africa, a key market for Choppies, maintained various tariffs on imported agricultural products and consumer goods, impacting the landed cost of merchandise.

Favorable trade agreements within the Southern African Development Community (SADC) aim to reduce these barriers. These agreements can streamline Choppies' supply chain, potentially lowering operational expenses and allowing for more competitive pricing for consumers across its operating regions.

Conversely, any shift towards protectionist measures or an increase in tariffs, as seen in some African nations in recent years to support local industries, could directly escalate Choppies' operational costs. This would likely translate to higher prices for consumers, potentially affecting sales volume.

Consumer Protection Laws

Consumer protection laws are foundational for retailers like Choppies, governing everything from product quality and accurate labeling to fair pricing and transparent advertising. Adherence to these regulations is not just about avoiding hefty fines but also about cultivating vital consumer trust, a cornerstone of sustainable business in the retail sector.

For instance, in 2024, South Africa continued to emphasize stringent food safety standards. Regulations concerning food additives and contamination, as enforced by bodies like the Department of Health, necessitate rigorous compliance measures. These can directly impact Choppies' product sourcing, inventory management, and even the types of goods it can offer to consumers, potentially increasing operational costs but also enhancing product integrity.

- South Africa's Consumer Protection Act (CPA) mandates fair business practices, impacting pricing, advertising, and product information accuracy for retailers.

- Food safety regulations, particularly those concerning additives and contamination, require strict adherence, influencing product selection and supply chain audits in 2024.

- Compliance with consumer protection laws directly affects brand reputation and can mitigate risks of legal penalties, which could amount to significant financial losses for a company like Choppies.

Competition Law and Anti-Monopoly Measures

Governments across Southern Africa are actively enforcing competition laws to curb monopolistic practices and foster a level playing field in the retail industry. These regulations directly impact how companies like Choppies can grow, whether through acquiring other businesses or setting prices, ensuring fair consumer access to goods and services.

Choppies must navigate these legal frameworks diligently. For instance, the Competition and Consumer Authority in Botswana, a key market for Choppies, actively scrutinizes mergers and acquisitions to prevent market dominance. Failure to comply can result in significant penalties, impacting financial performance and market standing.

- Regulatory Scrutiny: Southern African competition authorities, such as the Competition Commission of South Africa, regularly review market concentration in the retail sector.

- Merger Control: Choppies' expansion plans, including potential acquisitions of smaller retail chains, are subject to approval processes designed to prevent undue market power.

- Pricing Regulations: Anti-monopoly measures can influence Choppies' pricing strategies, particularly in markets where it holds a significant share, aiming to protect consumers from potential price gouging.

- Compliance Costs: Adhering to these laws involves ongoing legal counsel and internal compliance mechanisms, representing a cost of doing business in the region.

Political stability is paramount for Choppies' operations across Southern Africa, influencing everything from regulatory consistency to consumer confidence. For example, in 2024, political developments in South Africa, Choppies' largest market, continue to shape the business environment, impacting investment decisions and strategic planning.

Conversely, political instability can introduce significant operational risks, as seen in markets like Zimbabwe where economic volatility, often linked to political factors, directly affects consumer spending and operational costs. In 2023, Zimbabwe's persistent inflation, exceeding 200%, underscored these challenges.

Navigating diverse regulatory landscapes, including licensing and compliance, presents ongoing challenges. In 2024, the complexity of obtaining retail permits in countries like Botswana can lead to operational delays, affecting expansion timelines and market entry strategies.

What is included in the product

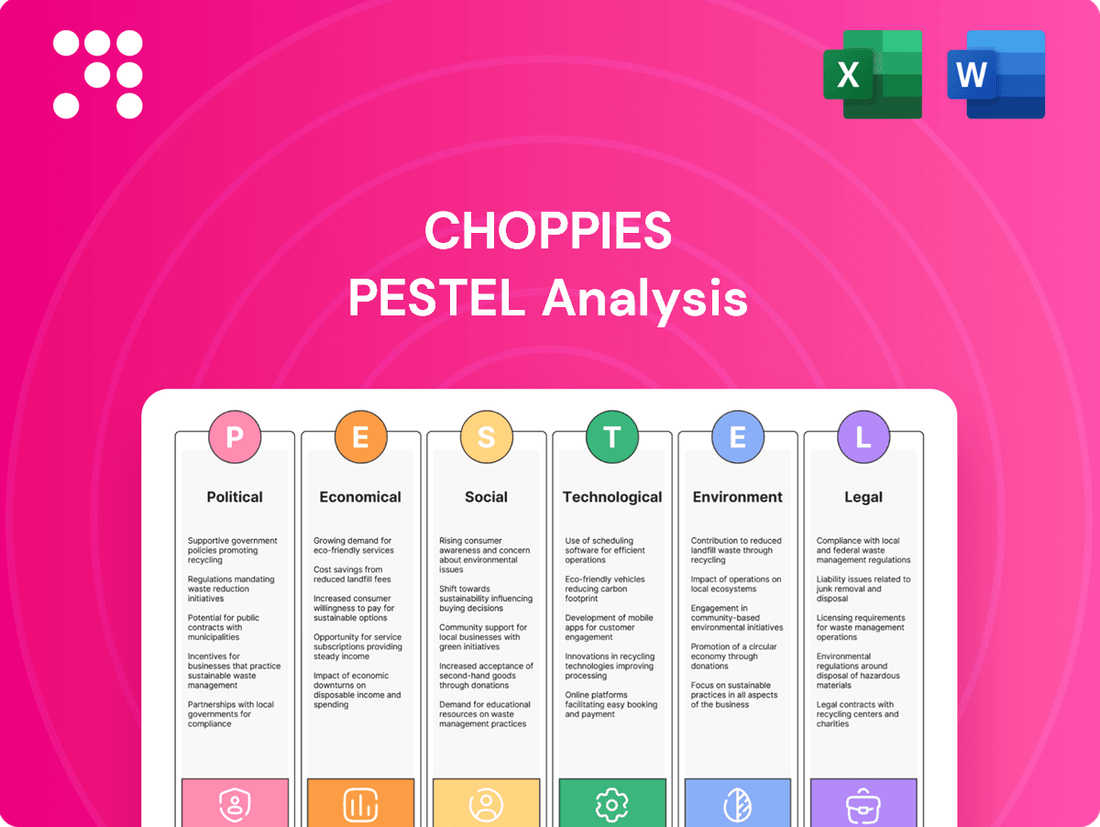

This Choppies PESTLE analysis examines the influence of external macro-environmental factors across Political, Economic, Social, Technological, Environmental, and Legal dimensions to identify strategic opportunities and threats.

A clean, summarized version of the Choppies PESTLE analysis provides easy referencing during meetings, highlighting key external factors that impact operations and offering actionable insights to mitigate risks and capitalize on opportunities.

Economic factors

Consumer purchasing power is a critical economic factor for Choppies, given its focus on affordability. In South Africa, for instance, inflation has remained a persistent concern. For example, the Consumer Price Index (CPI) in South Africa was recorded at 5.1% year-on-year in April 2024, impacting the real value of incomes.

Stagnant wage growth in key markets like Zimbabwe further compounds this issue. This economic reality means consumers have less discretionary income, pushing them towards essential goods and private label brands, which aligns with Choppies' value proposition but can pressure overall sales volumes.

High inflation rates significantly impact Choppies' operational costs, as the value of the South African Rand, its primary currency, depreciates. For instance, in early 2024, South Africa's inflation hovered around 5-6%, directly increasing the cost of imported goods and local supplies. This erosion of purchasing power affects consumer spending, forcing retailers like Choppies to manage tighter margins.

Exchange rate volatility, particularly concerning the Zimbabwean dollar in 2024, presents substantial challenges for Choppies. Zimbabwe's currency experienced significant fluctuations, with the exchange rate against the US dollar seeing considerable movement throughout the year. This volatility complicates pricing strategies, inventory valuation, and the repatriation of profits, making consistent financial forecasting difficult for operations in such markets.

Choppies' performance is closely tied to the economic growth of Southern Africa. For instance, Botswana, a key market, experienced a GDP growth of approximately 4.5% in 2023, indicating a healthy economic environment that supports consumer spending.

Conversely, South Africa, another significant market, saw its GDP growth moderate to around 0.6% in 2023. This slower growth can translate to more cautious consumer behavior, potentially impacting Choppies' sales volumes in that region.

Overall, robust GDP expansion in countries like Zimbabwe, which has shown signs of recovery, can boost consumer confidence and disposable income, directly benefiting retailers like Choppies by increasing demand for their products.

Interest Rates and Access to Credit

Interest rates significantly influence Choppies' financial landscape, impacting both consumer spending and the company's cost of capital. Higher rates can dampen consumer demand for goods, a key driver for retail businesses like Choppies, while also making it more expensive for the company to finance new projects or manage existing debt. For instance, if central banks in key operating regions like Botswana or South Africa were to raise benchmark rates in 2024 or 2025, this would directly increase the cost of borrowing for Choppies.

Conversely, lower interest rates can provide a dual benefit. They make it easier and cheaper for consumers to access credit, potentially boosting sales for Choppies. Simultaneously, a reduced cost of capital allows the company to invest more readily in expanding its store network, upgrading logistics, or managing inventory more efficiently. This was evident in periods of low rates globally, where businesses often saw improved access to funding.

The accessibility of credit is intrinsically linked to interest rates. When rates are low, lenders are often more willing to extend credit, which benefits Choppies through easier access to working capital and financing for capital expenditures. Conversely, in a high-interest-rate environment, credit markets can tighten, making it harder and more costly for Choppies to secure the necessary funds for its operations and growth strategies.

- Impact on Consumer Spending: Higher interest rates can reduce disposable income for consumers, leading to decreased spending on non-essential items, which directly affects Choppies' sales volumes.

- Cost of Capital: Fluctuations in interest rates directly alter the cost of borrowing for Choppies, impacting profitability and the feasibility of investment projects.

- Credit Availability: Interest rate policies influence the broader credit market, affecting how easily Choppies can access loans for inventory, expansion, or operational needs.

- Investment Decisions: The cost of financing influences Choppies' decisions on capital investments, such as opening new stores or upgrading existing infrastructure.

Unemployment Rates and Labor Costs

High unemployment rates significantly shrink the pool of consumers with discretionary spending power, directly impacting Choppies' sales volumes across its operating regions. For instance, in Botswana, the unemployment rate stood at approximately 22.4% as of the first quarter of 2024, a figure that limits the purchasing capacity of a substantial portion of the population.

Fluctuations in labor costs present another critical economic factor. Changes in labor legislation, such as the introduction or adjustment of minimum wage laws, can directly increase operational expenses for Choppies. For example, if Botswana were to implement a national living wage, it would likely raise payroll costs, potentially squeezing profit margins if these increased expenses cannot be offset by efficiency gains or price adjustments.

- Unemployment Impact: High unemployment, exemplified by Botswana's Q1 2024 rate of around 22.4%, reduces consumer spending, directly affecting Choppies' revenue.

- Labor Cost Pressures: Evolving labor laws and potential minimum wage hikes, like a living wage implementation in Botswana, can escalate operational costs for the company.

- Profitability Challenge: Increased labor expenses necessitate careful cost management and strategic pricing to maintain profitability in competitive markets.

Consumer purchasing power remains a key economic driver for Choppies. South Africa's inflation, recorded at 5.1% year-on-year in April 2024, erodes real incomes, pushing consumers toward essential goods. Stagnant wage growth in markets like Zimbabwe further limits discretionary spending, aligning with Choppies' value proposition but potentially impacting sales volumes.

Exchange rate volatility, particularly for the Zimbabwean dollar in 2024, complicates pricing and profit repatriation for Choppies. Botswana's GDP growth of approximately 4.5% in 2023 offers a positive economic environment, contrasting with South Africa's slower 0.6% growth in the same year, which may lead to more cautious consumer behavior.

Interest rates significantly influence Choppies' financial health. Higher rates increase borrowing costs for the company and can dampen consumer spending by reducing disposable income. Conversely, lower rates can boost sales through easier consumer credit access and reduce Choppies' cost of capital for investments.

High unemployment, such as Botswana's Q1 2024 rate of around 22.4%, directly reduces consumer spending power, impacting Choppies' revenue. Additionally, rising labor costs due to potential minimum wage increases, like a living wage in Botswana, can squeeze profit margins if not managed through efficiency or price adjustments.

| Economic Factor | Impact on Choppies | Relevant Data (2023-2024) |

|---|---|---|

| Inflation | Reduces consumer purchasing power, increases operational costs | South Africa CPI: 5.1% (April 2024) |

| GDP Growth | Influences consumer confidence and spending | Botswana GDP: ~4.5% (2023); South Africa GDP: ~0.6% (2023) |

| Interest Rates | Affects cost of capital and consumer credit access | Central bank rate decisions in key markets (e.g., Botswana, South Africa) |

| Unemployment Rate | Shrinks consumer spending pool | Botswana Unemployment: ~22.4% (Q1 2024) |

| Exchange Rates | Complicates pricing, profit repatriation | Zimbabwe Dollar volatility (2024) |

Full Version Awaits

Choppies PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Choppies delves into Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's operations and strategy.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. You'll gain valuable insights into the external forces shaping Choppies' business landscape, enabling informed decision-making.

The content and structure shown in the preview is the same document you’ll download after payment. It provides a detailed breakdown of each PESTLE element, offering a clear understanding of the challenges and opportunities Choppies faces.

Sociological factors

Southern Africa is witnessing a notable surge in urbanization, with populations increasingly moving to cities and their surrounding areas. This trend is expanding the potential customer base for retailers like Choppies. For instance, by 2025, it's projected that over 50% of Africa's population will reside in urban centers, a significant increase from previous decades.

Choppies' business model, which includes opening stores in smaller towns and catering to a wide range of income levels, positions it well to benefit from these demographic changes. This approach allows the company to tap into the growing demand in both established urban markets and developing peri-urban regions, effectively capturing a diverse customer segment.

Consumer lifestyles are shifting, with a growing desire for convenience and healthier food choices. This trend is particularly evident in emerging markets where Choppies operates, as busy schedules and increased health awareness drive purchasing decisions. For instance, in 2024, the global market for convenient food options was projected to reach over $200 billion, highlighting this significant shift.

Choppies is well-positioned to capitalize on these evolving preferences by focusing on its private label brands, which offer value and cater to budget-conscious shoppers. The company's strategy of providing a diverse product range, including ready-to-eat meals and healthier alternatives, directly aligns with these changing consumer demands, especially in price-sensitive regions.

Consumers are increasingly prioritizing health and wellness, driving demand for fresh, organic, and specialized dietary foods. This trend directly influences what shoppers look for in supermarkets.

Choppies must adapt its product selection to align with these growing health-conscious preferences. This means ensuring a robust supply of healthier options and providing clear, informative labeling to meet consumer expectations for transparency regarding ingredients and nutritional value.

In 2024, for instance, the global market for organic food was projected to reach over $370 billion, indicating a significant consumer shift. Similarly, the demand for plant-based alternatives and low-sugar products continues to surge, presenting both challenges and opportunities for retailers like Choppies to cater to evolving health needs.

Cultural and Regional Shopping Habits

Choppies' success hinges on recognizing that shopping habits are deeply ingrained in cultural and regional identities across Southern Africa. For instance, while urban centers might see a growing preference for modern supermarkets, rural areas often retain strong ties to traditional open-air markets, where bargaining and community interaction are key. This divergence means Choppies must adapt its offerings; a 2024 survey indicated that over 60% of consumers in Botswana still purchase a significant portion of their fresh produce from local markets, influencing how Choppies designs its store layouts and product sourcing strategies.

Tailoring merchandise and promotions to these diverse preferences is crucial. This includes stocking culturally significant food items and ensuring pricing strategies resonate with local economic realities. For example, in regions where extended family units are common, bulk purchasing options might be more appealing. Choppies’ 2025 strategic planning documents highlight a focus on regional product assortment, aiming to increase market share by 5-7% in specific territories by offering goods that align with local culinary traditions and consumer needs.

- Regional Preferences: Understanding that consumers in Zimbabwe might prioritize different staple foods compared to those in South Africa.

- Market Integration: Exploring opportunities to integrate with or complement existing traditional market ecosystems rather than solely competing.

- Promotional Adaptation: Developing marketing campaigns that speak to cultural values and local celebrations, potentially increasing customer engagement by 10-15%.

- Product Assortment: Ensuring a diverse product range that caters to both modern retail expectations and traditional consumption patterns.

Income Distribution and Inequality

Income distribution and inequality significantly shape consumer behavior in Southern Africa. For instance, in South Africa, a nation with substantial wealth disparities, a large portion of the population prioritizes value for money. Choppies' business model, which focuses on offering affordable goods, directly addresses this by appealing to a broad spectrum of income levels, from lower-income households seeking essential items to middle-income consumers looking for budget-friendly options.

This approach allows Choppies to remain relevant across diverse economic segments. The company's strategy of stocking a wide range of products, from basic necessities to slightly more aspirational items, caters to the varied purchasing power of its customer base. This is crucial in markets where disposable income can vary dramatically from one household to another, ensuring that Choppies can serve both those who need to stretch their budget and those who have a bit more to spend.

Consider the following points regarding income distribution and its impact on Choppies:

- Diverse Consumer Needs: High income inequality means a significant segment of the population prioritizes affordability and value in their purchases.

- Strategic Positioning: Choppies' focus on providing accessible price points allows it to capture market share across different income brackets.

- Market Penetration: By catering to all income groups, Choppies can achieve wider market penetration and build a loyal customer base, even amidst economic disparities.

- Resilience: This strategy helps the company remain resilient to economic downturns that might disproportionately affect higher-income consumers.

Sociological factors significantly influence Choppies' operations, particularly concerning urbanization and shifting consumer lifestyles. As more people move to cities, the potential customer base for retailers like Choppies expands, with projections indicating over 50% of Africa's population will be urban by 2025. This demographic shift, coupled with a growing demand for convenience and healthier food options, driven by busy schedules and increased health awareness, presents a clear opportunity for Choppies to adapt its product offerings and private label brands.

Consumer preferences are also deeply tied to cultural and regional identities, meaning shopping habits vary across Southern Africa. While urban areas may lean towards modern supermarkets, rural communities often favor traditional markets. Choppies must therefore tailor its merchandise and promotions to these diverse preferences, stocking culturally significant items and ensuring pricing aligns with local economic realities. For instance, a 2024 survey revealed that over 60% of consumers in Botswana still buy fresh produce from local markets, highlighting the need for adaptable strategies.

Income distribution and inequality play a crucial role in shaping consumer behavior. In regions with significant wealth disparities, like South Africa, a large segment of the population prioritizes value for money. Choppies' business model, which focuses on affordable goods, is well-suited to appeal to a broad spectrum of income levels, allowing for wider market penetration and customer loyalty across diverse economic segments.

Technological factors

The increasing penetration of internet and smartphones across Southern Africa, projected to reach over 60% by 2025, is fueling a significant surge in e-commerce adoption. This digital shift is particularly evident in the grocery sector, where consumers are increasingly opting for online purchasing convenience. Choppies is strategically evaluating its e-commerce capabilities to tap into this growing market, aiming to facilitate online ordering and better serve tech-savvy demographics.

This move is essential for Choppies to maintain its competitive edge in a rapidly evolving retail environment. By embracing online platforms, the company can expand its reach beyond physical stores, catering to a wider customer base that values digital accessibility and seamless shopping experiences. The company's investment in online infrastructure is a direct response to these changing consumer behaviors, ensuring relevance and future growth.

Choppies' operational efficiency hinges on advanced supply chain technologies. Systems like inventory optimization are crucial for managing stock effectively, minimizing waste, and ensuring products are consistently on shelves, a key factor in the high-volume retail sector where Choppies operates across its extensive store network.

By implementing these technologies, Choppies aims to enhance in-store execution and bolster product availability. For instance, in the fiscal year ending June 30, 2023, effective inventory management contributed to a reported 7.5% increase in group revenue, highlighting the direct impact of these technological investments on financial performance.

The proliferation of digital payment systems and mobile money across Africa is fundamentally reshaping how consumers transact. Services like M-Pesa, with over 60 million active users across East Africa as of late 2023, demonstrate the widespread adoption and trust in these platforms. This trend offers unparalleled convenience and better financial management tools for a significant portion of the population.

For Choppies, integrating these digital payment solutions is no longer optional but a strategic imperative. By embracing mobile money and digital wallets, Choppies can significantly streamline its point-of-sale operations, reducing cash handling complexities and potential errors. This also directly addresses the burgeoning consumer demand for cashless transactions, enhancing customer satisfaction and loyalty in a rapidly evolving retail landscape.

Data Analytics and Customer Relationship Management (CRM)

Choppies is increasingly leveraging data analytics to gain deeper insights into consumer behavior, purchasing patterns, and preferences. This allows for more personalized marketing campaigns and improved customer engagement. For instance, by analyzing sales data from its extensive network, Choppies can identify regional product demands and tailor promotions accordingly.

The implementation of robust Customer Relationship Management (CRM) systems is crucial for Choppies to enhance its retail strategy. These systems enable the company to tailor specific offers to customer segments, thereby boosting loyalty program effectiveness. In 2024, many retailers reported significant increases in customer retention rates after upgrading their CRM capabilities, with some seeing up to a 15% uplift in repeat purchases.

- Personalized Marketing: Data analytics helps Choppies understand individual customer preferences to create targeted promotions, increasing campaign ROI.

- Enhanced Loyalty Programs: CRM systems allow for the development of more attractive and personalized loyalty rewards, fostering greater customer retention.

- Optimized Retail Strategy: By analyzing customer data, Choppies can better manage inventory, optimize store layouts, and introduce products that align with evolving market demands.

- Competitive Advantage: In the fast-paced retail environment, effective use of data analytics and CRM provides a significant edge in understanding and responding to customer needs.

In-store Technology and Operational Efficiency

Choppies' adoption of in-store technology is crucial for boosting operational efficiency. Modern Point-of-Sale (POS) systems, for instance, can significantly speed up checkout times. Self-checkout kiosks offer customers more control and reduce labor costs for the retailer. These advancements directly impact customer satisfaction and streamline the overall shopping process.

Investments in technologies like energy-efficient refrigeration units are also key. Beyond cost savings on utilities, they contribute to a more sustainable operation. For example, upgrading to newer refrigeration systems can reduce energy consumption by 15-30% compared to older models, directly impacting Choppies' bottom line. This focus on efficiency translates to a better shopping experience and improved financial performance.

- Modern POS systems: Reduce transaction times and improve inventory management.

- Self-checkout kiosks: Enhance customer convenience and lower labor expenses.

- Energy-efficient refrigeration: Lower operational costs and support sustainability goals.

- Digital signage: Improve marketing and customer engagement within stores.

Technological advancements are reshaping how Choppies operates and interacts with customers. The increasing internet and smartphone penetration across Southern Africa, expected to exceed 60% by 2025, is driving e-commerce growth, prompting Choppies to enhance its online presence for greater accessibility and customer reach.

Digital payment systems, with services like M-Pesa serving over 60 million users in East Africa by late 2023, are becoming mainstream, making integration essential for Choppies to streamline transactions and meet consumer demand for cashless options.

Data analytics and CRM systems are vital for Choppies to understand consumer behavior, personalize marketing, and improve loyalty programs, with retailers seeing up to a 15% uplift in repeat purchases from CRM upgrades in 2024.

In-store technologies like modern POS systems and self-checkout kiosks improve efficiency and customer experience, while energy-efficient refrigeration can cut utility costs by 15-30%, boosting both sustainability and profitability.

| Technological Factor | Impact on Choppies | Supporting Data/Trend |

| E-commerce Growth | Expanded customer reach, new sales channels | Internet/smartphone penetration >60% by 2025 |

| Digital Payments | Streamlined transactions, enhanced customer convenience | M-Pesa: >60 million active users (late 2023) |

| Data Analytics & CRM | Personalized marketing, improved loyalty, better strategy | 15% uplift in repeat purchases from CRM upgrades (2024) |

| In-store Technology | Operational efficiency, cost savings, improved customer experience | Energy-efficient refrigeration: 15-30% energy reduction |

Legal factors

Choppies must navigate a complex web of food safety and health regulations. For instance, South Africa's recent updates to food additive regulations in 2024 impose stricter controls on what can be used in food products, requiring meticulous adherence from retailers.

Compliance with hygiene standards, accurate product labeling, and robust traceability systems are critical. Failure to meet these requirements, such as those outlined in the Foodstuffs, Cosmetics and Disinfectants Act in various operating countries, can lead to significant fines, product recalls, and severe damage to consumer confidence.

Labor laws, covering minimum wages, working conditions, and employee rights, directly impact Choppies' operational expenses and how it manages its workforce. For instance, in South Africa, the national minimum wage was R25.42 per hour as of March 2024, a figure that influences payroll costs significantly across its operations there.

Navigating and adhering to these diverse regulations in each country where Choppies operates is crucial. Failure to comply can lead to costly legal battles and damage the company's standing as an employer, affecting its ability to attract and retain talent.

Choppies' profitability is directly influenced by the corporate tax rates, Value Added Tax (VAT), and other levies across its operating countries. For instance, in South Africa, the corporate tax rate stands at 27%, while VAT is 15%. These varying tax structures necessitate robust financial planning to manage compliance and impact on margins.

Shifts in tax regulations, like Zimbabwe's introduction of an intermediated money transfer tax (IMTT) at 2% on certain transactions, can significantly alter pricing strategies and consumer spending power. This requires Choppies to adapt its financial models and ensure strict adherence to evolving compliance requirements to maintain competitiveness.

Land Use and Zoning Laws for Store Expansion

Land use and zoning regulations are critical for Choppies' expansion plans, dictating where new stores and distribution hubs can be established. Navigating these local ordinances is essential for ensuring projects proceed efficiently and within budget. For instance, in 2024, several African nations where Choppies operates, such as South Africa and Botswana, continued to refine their urban planning policies, potentially impacting development timelines and costs for new retail spaces.

Compliance with these legal frameworks is non-negotiable for Choppies to avoid costly delays or project cancellations. The process of obtaining construction permits can be lengthy, varying significantly by municipality. In 2025, Choppies will likely face ongoing scrutiny of its development proposals to ensure alignment with evolving environmental and urban development standards across its operating regions.

- Zoning Restrictions: Local zoning laws dictate commercial activity, potentially limiting store locations to specific districts.

- Permitting Processes: Obtaining building and operating permits can involve complex, time-consuming procedures.

- Land Use Planning: National and regional land use plans influence the availability and suitability of sites for retail development.

- Regulatory Changes: Evolving legal frameworks in 2024-2025 may introduce new compliance requirements for store construction and operation.

Intellectual Property and Brand Protection

Protecting Choppies' private label brands, trademarks, and other intellectual property is absolutely crucial in today's highly competitive retail landscape. These legal frameworks are the backbone that ensures the company's unique product offerings and distinct brand identity are shielded from unauthorized use and imitation by competitors.

For instance, in 2024, the global retail sector saw a significant increase in brand infringement cases, highlighting the ongoing need for robust IP protection strategies. Choppies' ability to legally defend its own brands, such as its private label food and household goods, directly impacts its market differentiation and customer trust.

- Brand Safeguarding: Choppies relies on trademark registration to prevent competitors from using similar names or logos on their products, thereby protecting its brand equity.

- Product Imitation Prevention: Design patents and copyrights can be used to safeguard the unique packaging and product designs of Choppies' private label items, deterring copycats.

- Legal Recourse: The existence of strong intellectual property laws provides Choppies with legal avenues to pursue action against infringers, recovering damages and halting unauthorized sales.

- Market Competitiveness: Effective IP protection allows Choppies to maintain a competitive edge by ensuring its innovations and brand identity remain exclusive and recognizable to consumers.

Choppies faces stringent legal requirements concerning food safety and product integrity across its operating markets. Adherence to regulations like South Africa's Consumer Protection Act ensures product quality and consumer trust, with non-compliance potentially leading to substantial penalties and recalls.

Labor legislation significantly impacts operational costs and workforce management, with minimum wage adjustments, such as the R25.42 per hour national minimum wage in South Africa as of March 2024, directly affecting payroll expenses.

Taxation laws, including corporate tax rates (e.g., 27% in South Africa) and VAT (15% in South Africa), along with transactional taxes like Zimbabwe's intermediated money transfer tax, necessitate careful financial planning and compliance to maintain profitability.

Intellectual property laws are vital for protecting Choppies' private label brands and trademarks against infringement, ensuring market differentiation and brand integrity in a competitive retail environment.

Environmental factors

Climate change poses a significant threat to Choppies' operations, particularly impacting agricultural supply chains. For instance, a severe drought in Southern Africa in 2023 led to a projected 20% reduction in maize yields, a staple for many of Choppies' customers. This scarcity can result in food shortages and increased prices, directly affecting consumer purchasing power and Choppies' inventory costs.

Water scarcity and unreliable energy supplies are critical environmental challenges, especially in regions where Choppies operates, such as Botswana and South Africa. Many areas in Southern Africa experienced significant load shedding in 2024, impacting refrigeration and store operations. Choppies must invest in resilient infrastructure and resource-efficient technologies to mitigate these risks and ensure business continuity.

Consumers are increasingly prioritizing sustainability, with a significant portion willing to pay more for eco-friendly products. This trend directly impacts retailers like Choppies, as shopper preferences shift towards businesses demonstrating genuine commitment to environmental responsibility.

Choppies' strategic focus on a circular economy, reducing plastic usage, and exploring renewable energy sources positions it favorably to capture this growing market segment. For instance, in 2024, reports indicated a 15% year-over-year increase in consumer spending on sustainable goods across key African markets where Choppies operates, highlighting the financial incentive for such initiatives.

Choppies, like other retailers, faces evolving waste management and recycling regulations. These rules, covering everything from packaging materials to disposal methods, can directly impact operational expenses and necessitate investments in compliance infrastructure. For instance, countries are increasingly implementing extended producer responsibility schemes, making retailers accountable for the end-of-life management of their products and packaging.

The growing consumer and governmental pressure for sustainable practices means retailers are expected to go beyond basic waste disposal. This includes actively promoting reusable shopping bags, a trend seen across many markets, and establishing in-store recycling facilities. In 2024, for example, several African nations strengthened their plastic bag bans, forcing retailers like Choppies to adapt their supply chains and customer interactions.

Carbon Footprint and Decarbonization Targets

Retailers like Choppies are increasingly scrutinized for their environmental impact, particularly their carbon footprint. This pressure stems from consumer demand, regulatory shifts, and investor expectations regarding sustainability. Choppies must actively manage its energy use in stores and distribution centers, optimize logistics to reduce transport emissions, and ensure its sourcing practices are environmentally responsible to meet evolving global standards.

Decarbonization targets are becoming a critical aspect of business strategy. For instance, many global retailers have set ambitious goals, such as reducing Scope 1 and 2 emissions by 50% by 2030. Choppies should monitor its own carbon emissions and develop clear strategies for reduction, potentially including investments in renewable energy sources and more efficient operational practices to align with these emerging benchmarks.

- Energy Consumption: Choppies' retail outlets and warehouses represent significant energy users. Improving insulation, adopting LED lighting, and exploring solar panel installations can directly reduce electricity consumption.

- Logistics Efficiency: The transportation of goods from suppliers to distribution centers and then to stores is a major source of emissions. Optimizing delivery routes, investing in fuel-efficient fleets, and exploring alternative transport modes are key areas for improvement.

- Sourcing Practices: Choppies' supply chain, from agriculture to manufacturing, contributes to its overall carbon footprint. Engaging with suppliers to promote sustainable farming methods and reduce waste throughout the value chain is crucial.

- Carbon Footprint Management: Implementing systems to accurately measure, report, and manage carbon emissions across all operations is essential for setting meaningful reduction targets and demonstrating progress.

Ethical Sourcing and Supply Chain Due Diligence

Choppies faces increasing pressure regarding ethical sourcing and supply chain integrity. Consumers and regulators are demanding greater transparency about labor practices and environmental impacts. For instance, by 2024, many international markets are implementing stricter regulations on supply chain due diligence, requiring companies to actively identify and mitigate human rights and environmental risks. This means Choppies must ensure its suppliers adhere to fair labor standards and environmentally sound practices to avoid reputational damage and potential penalties.

The company's commitment to responsible sourcing is vital for maintaining consumer trust and meeting evolving market expectations. A proactive approach to supply chain due diligence can differentiate Choppies in a competitive retail landscape.

- Ethical Sourcing Demands: Growing consumer awareness means products sourced unethically can lead to significant brand damage.

- Regulatory Compliance: Upcoming regulations, such as those focusing on forced labor in supply chains, necessitate robust due diligence processes.

- Reputational Risk: Failure to ensure responsible sourcing can result in negative publicity and loss of customer loyalty.

- Sustainability Goals: Aligning supply chain practices with sustainability objectives is becoming a key performance indicator for retailers.

Environmental challenges like climate change and water scarcity directly impact Choppies' supply chains and operational costs. For example, a 2023 drought in Southern Africa was projected to reduce maize yields by 20%, a key product for their customers. Load shedding in 2024 also disrupted store operations, highlighting the need for resilient infrastructure.

Consumer demand for sustainable products is rising, with shoppers willing to pay more for eco-friendly options. Choppies' focus on reducing plastic and exploring renewable energy, such as solar panels in stores, aligns with this trend. In 2024, spending on sustainable goods in key African markets increased by 15% year-over-year.

Evolving waste management and recycling regulations, including extended producer responsibility schemes, will increase Choppies' operational expenses. The company must adapt to stricter plastic bag bans, which were reinforced in several African nations in 2024, impacting supply chains and customer interactions.

Choppies faces scrutiny over its carbon footprint, necessitating efforts to manage energy use, optimize logistics for reduced transport emissions, and ensure environmentally responsible sourcing. Many global retailers aim to cut Scope 1 and 2 emissions by 50% by 2030, setting a benchmark for Choppies' own decarbonization strategies.

| Environmental Factor | Impact on Choppies | Data/Example |

|---|---|---|

| Climate Change & Water Scarcity | Supply chain disruption, increased costs | 2023 Southern Africa drought projected 20% maize yield reduction |

| Energy Supply Reliability | Operational disruptions | 2024 load shedding impacting refrigeration and store operations |

| Consumer Sustainability Preferences | Market opportunity for eco-friendly products | 15% YoY increase in sustainable goods spending in African markets (2024) |

| Waste Management Regulations | Increased operational expenses, need for compliance infrastructure | Strengthening of plastic bag bans in African nations (2024) |

| Carbon Footprint Pressure | Need for emissions reduction strategies | Global retail trend: 50% Scope 1 & 2 emission reduction target by 2030 |

PESTLE Analysis Data Sources

Our Choppies PESTLE Analysis is informed by a comprehensive blend of data sources, including official company reports, market research from leading firms like Euromonitor and Statista, and relevant government publications from the countries where Choppies operates. This ensures a robust understanding of the political, economic, social, technological, legal, and environmental factors impacting the business.