Choppies Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Choppies Bundle

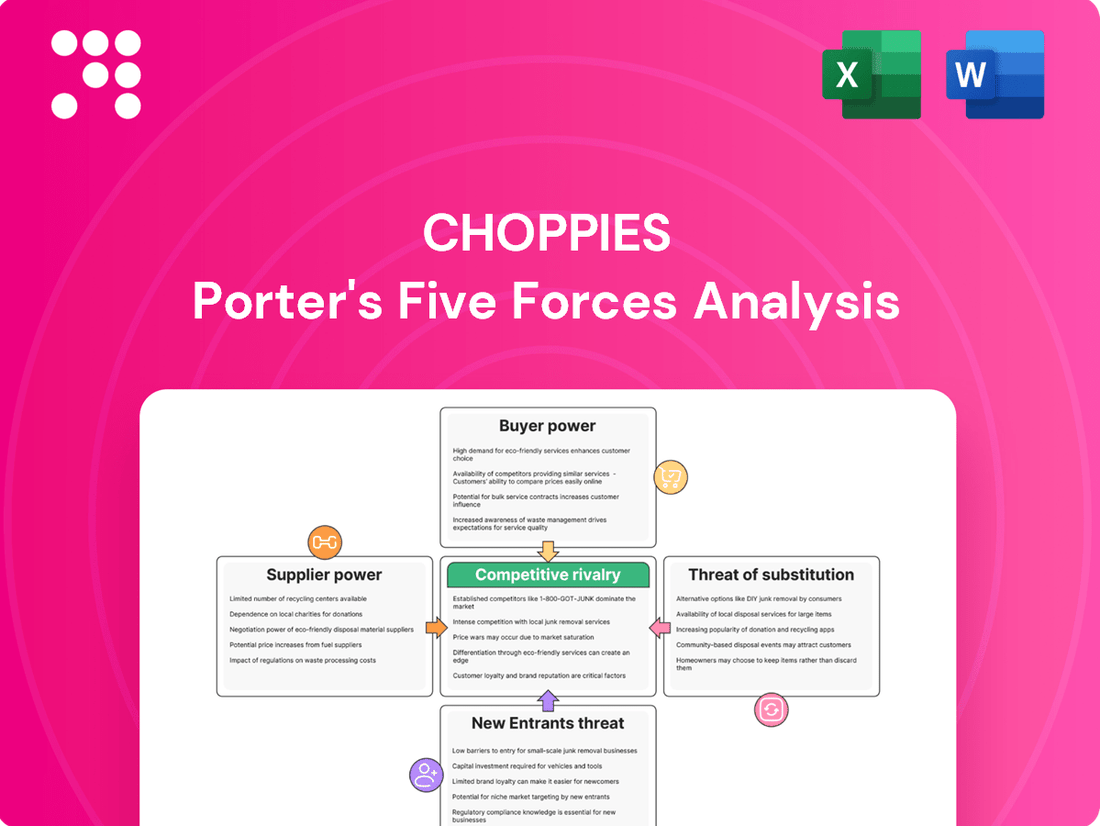

Choppies faces significant competitive pressure from rivals, with moderate bargaining power from both suppliers and buyers. The threat of new entrants is a key concern, while the availability of substitutes could impact its market share.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Choppies’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Choppies, operating as a substantial retail entity, leverages its significant purchasing volume to achieve economies of scale. This allows it to negotiate advantageous terms with a broad base of suppliers, thereby diminishing supplier bargaining power.

The Southern African grocery retail landscape is characterized by a degree of consolidation, with a few major players dominating. This market structure typically shifts leverage towards retailers like Choppies when dealing with individual suppliers, especially those who are less diversified.

The extent to which Choppies can dictate pricing or delivery terms is directly tied to a supplier's reliance on the retailer's order volume. For instance, if a supplier's revenue is heavily dependent on Choppies, their ability to exert pressure on pricing or terms is considerably weakened.

Choppies' commitment to quality supplier relationships is central to its sustainable food system strategy, aiming for stable supply chains. This focus suggests a proactive approach to mitigating supplier power.

However, the reality of the market can see suppliers leverage their position. For example, stockouts of popular items like beer in late 2024 demonstrate instances where suppliers, particularly for high-demand or niche products, can exert significant bargaining power over Choppies.

The bargaining power of suppliers is significantly influenced by product differentiation. When suppliers offer unique or highly specialized products with few viable alternatives, their leverage over a retailer like Choppies increases. This allows them to potentially dictate terms and pricing more aggressively.

For everyday items and general merchandise, Choppies likely benefits from lower supplier differentiation, which strengthens its own bargaining position. However, the situation shifts for branded goods or items with strong consumer loyalty; in these cases, suppliers can command more favorable terms due to established demand and limited substitutability, impacting Choppies' cost structure.

Backward Integration Potential

Choppies' acquisition of the Kamoso Group in 2023, encompassing milling, grain packaging, and tissue manufacturing, highlights its strategic move towards backward integration. This acquisition allows Choppies to potentially reduce its dependence on external suppliers for key private label items and essential goods, thereby enhancing its bargaining power.

By bringing certain production processes in-house, Choppies can effectively mitigate the influence of its suppliers. This vertical integration strategy can lead to cost savings and greater control over the supply chain, ultimately strengthening Choppies' competitive position against suppliers.

- Acquisition of Kamoso Group (2023): Included milling, grain packaging, and tissue manufacturing.

- Reduced Supplier Reliance: Potential to decrease dependence on external providers for private label and basic goods.

- Mitigation of Supplier Power: Internal production capabilities can lessen the impact of supplier price increases or supply disruptions.

Switching Costs for Choppies

For many everyday food and grocery items, Choppies faces low switching costs when moving between suppliers. This is because the market typically offers numerous alternative providers for similar products, meaning Choppies can easily find another source if a current supplier's terms become unfavorable. This generally keeps the bargaining power of these suppliers in check.

However, the situation shifts for more specialized items. For instance, if Choppies relies on a particular supplier for unique, high-quality fresh produce or specific branded goods that have strong consumer recognition, the costs and complexities associated with switching suppliers can increase. This might involve establishing new supply chains, adapting inventory, or even facing potential dips in consumer preference if the alternative isn't as well-received, thereby granting those specialized suppliers greater bargaining leverage.

- Low Switching Costs for Standard Goods: Facilitates supplier competition and limits individual supplier power.

- Higher Switching Costs for Specialized Items: Such as unique fresh produce or branded products, can increase supplier leverage.

- Impact on Procurement: Choppies' ability to negotiate favorable terms is influenced by the nature of the products sourced.

Choppies' substantial purchasing volume generally gives it considerable leverage over suppliers, particularly for common grocery items where numerous alternatives exist. This is further bolstered by low switching costs for these standard goods, allowing Choppies to easily shift between providers if terms become unfavorable.

However, suppliers of differentiated or branded products, where consumer loyalty is high and alternatives are limited, can exert significant bargaining power. For example, stockouts of popular items like beer in late 2024 illustrate instances where supplier constraints can impact availability and potentially dictate terms.

Choppies' 2023 acquisition of Kamoso Group, integrating milling and packaging, represents a strategic move to reduce reliance on external suppliers for key private label items, thereby strengthening its negotiating position and mitigating supplier power in those areas.

| Supplier Characteristic | Impact on Choppies | Example (Late 2024/Early 2025) |

|---|---|---|

| High Volume of Standard Goods | Low Supplier Bargaining Power | Numerous suppliers for basic produce, dairy, and packaged goods. |

| Product Differentiation/Branding | High Supplier Bargaining Power | Specific branded beverages, unique imported goods. |

| Supplier Dependence on Choppies | Low Supplier Bargaining Power | Smaller local producers relying heavily on Choppies' orders. |

| Choppies' Backward Integration | Low Supplier Bargaining Power | Internal production of private label items (e.g., Kamoso Group acquisition). |

What is included in the product

This analysis unpacks the competitive intensity within the grocery retail sector, specifically examining Choppies' position by evaluating the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the rivalry among existing competitors.

Instantly identify and mitigate competitive threats with a visually clear breakdown of Choppies' Porter's Five Forces, enabling swift strategic adjustments.

Customers Bargaining Power

Southern African consumers exhibit significant price sensitivity, a trend amplified by high inflation and strained disposable incomes throughout 2024 and into 2025. This economic pressure compels shoppers to scrutinize every purchase, making them more inclined to switch to retailers offering lower prices or better value propositions.

The growing preference for home cooking and essential goods further highlights this consumer behavior shift. Choppies, like its competitors, faces intense pressure to maintain competitive pricing strategies to retain its customer base amidst this heightened price consciousness.

The proliferation of digital channels and online grocery platforms in South Africa significantly boosts customer bargaining power. Consumers can now effortlessly compare prices across numerous retailers and readily identify alternative product options, often with just a few clicks.

This increased transparency means shoppers are highly informed about market pricing and actively hunt for deals, discounts, and loyalty rewards. For instance, by mid-2024, online grocery sales in South Africa were projected to grow by over 15% year-on-year, reflecting this heightened consumer engagement with digital comparison tools.

Consequently, retailers like Choppies face continuous pressure to refine their pricing strategies and enhance their value offerings to remain competitive. This dynamic forces a constant evaluation of product assortment, promotional activities, and customer service to attract and retain shoppers in a crowded marketplace.

For consumers, switching between different grocery retailers typically involves minimal costs. With a multitude of supermarkets and informal traders available, customers can easily shift their patronage. This ease of switching significantly amplifies customer bargaining power, enabling them to readily move to competitors offering superior deals or more convenient shopping experiences.

Choppies, like other players in the retail sector, faces this reality. In 2024, the grocery retail market remained highly competitive, with numerous brands vying for consumer attention. For instance, in South Africa, informal retail channels and a growing number of discount supermarkets offer consumers ample choice, putting pressure on established players to maintain competitive pricing and service levels to retain their customer base.

Customer Loyalty and Private Labels

Customer loyalty can be a powerful tool for businesses, and Choppies leverages this through its private label brands. By offering a wide selection of its own-brand products, the company aims to create a value proposition that encourages repeat purchases. This strategy is particularly effective in markets where consumers are mindful of their spending.

While price sensitivity is a significant factor for consumers, Choppies' focus on value for money, coupled with its private label offerings, can cultivate a degree of customer stickiness. For instance, in 2024, many retailers observed a continued consumer trend towards seeking out private label options, with market share for these products often growing in regions experiencing economic pressure. Choppies' commitment to this segment directly addresses this market dynamic.

However, it's crucial to acknowledge the broader market trend: brand loyalty is generally declining as consumers increasingly prioritize value. This makes it a persistent challenge for any retailer, including Choppies, to maintain customer allegiance solely through product offerings. The ability to adapt and continuously offer competitive value remains paramount.

- Choppies' Private Label Strategy: Extensive range of own-brand products designed to offer value for money.

- Consumer Behavior in 2024: Increasing price sensitivity and a shift towards private label brands across many markets.

- Loyalty vs. Value: While loyalty programs can help, the overarching trend shows a preference for value over traditional brand loyalty.

Footfall Growth and Value Proposition

Choppies' impressive footfall growth, a 15.5% increase in customer traffic across Botswana, Namibia, and Zambia for the six months ending December 2024, highlights a strong customer connection. This surge suggests that Choppies' value proposition and convenience are effectively meeting consumer needs, thereby managing customer bargaining power through superior offerings.

The ability of customers to drive down prices or demand higher quality is tempered by Choppies' demonstrated success in attracting and retaining shoppers. This growth indicates that while customers hold influence, Choppies is currently in a strong position to satisfy their demands, mitigating the direct impact of their bargaining power.

- Customer Acquisition: A 15.5% rise in footfall demonstrates Choppies' ability to attract new customers.

- Value Resonance: The growth signifies that Choppies' pricing and product mix appeal to a broad customer base.

- Competitive Positioning: Increased traffic suggests Choppies is successfully differentiating itself in the market.

- Demand Satisfaction: Meeting this higher demand effectively will be key to maintaining customer loyalty and managing bargaining power.

The bargaining power of customers for Choppies is significant, driven by high price sensitivity, especially evident in 2024 due to inflation and strained incomes across Southern Africa. Consumers actively compare prices, aided by digital platforms, making it easy to switch retailers for better deals. This forces Choppies to maintain competitive pricing and strong value propositions, including its private label brands, to retain shoppers.

| Factor | Impact on Choppies | Supporting Data (2024/2025 Trends) |

|---|---|---|

| Price Sensitivity | High | Consumers scrutinize purchases due to inflation; increased demand for discounts. |

| Ease of Switching | High | Minimal costs to switch retailers; proliferation of online comparison tools. |

| Information Availability | High | Digital channels provide easy price and product comparison. |

| Private Label Preference | Moderate (Mitigating Factor) | Choppies' private labels offer value, fostering some customer stickiness. Market share for private labels grew in 2024 in many regions. |

| Customer Footfall Growth | Mitigating Factor | 15.5% increase in footfall (H2 2024) suggests Choppies' value proposition is resonating, managing bargaining power. |

Full Version Awaits

Choppies Porter's Five Forces Analysis

This preview showcases the complete Choppies Porter's Five Forces Analysis, offering an in-depth examination of the competitive landscape for the retailer. The document you see here is the exact, professionally formatted analysis you will receive immediately after purchase, providing actionable insights without any placeholders or surprises. You can confidently expect to download this comprehensive report the moment your transaction is complete, ready for immediate use and strategic planning.

Rivalry Among Competitors

The formal grocery retail market in Southern Africa, especially South Africa, is heavily dominated by a few large companies. Major players such as Shoprite, Pick n Pay, Woolworths, and SPAR hold significant market share, creating a highly concentrated landscape. Choppies, being a substantial retailer outside of South Africa, contends directly with these established giants.

Competitive rivalry in the retail sector frequently involves aggressive pricing and frequent promotions. Choppies experienced this firsthand in late 2024, with its gross profit margin in Botswana and its liquor segment being negatively impacted by competitive discounting, highlighting the intensity of ongoing price wars.

Retailers continuously deploy discounts, loyalty programs, and special offers as key tactics to draw in and keep price-sensitive shoppers in this highly competitive environment.

Major retailers, including Choppies and its rivals, are aggressively broadening their store footprints and experimenting with different retail formats. For instance, Choppies reported opening eight net new stores across four countries in its recent fiscal year, while also assessing opportunities in e-commerce. This geographic and format expansion directly fuels competitive rivalry.

Competitors are not standing still; they are also pushing into less-served regions and building out their online capabilities. This dual-pronged approach intensifies the competition not only in traditional brick-and-mortar spaces but also across the increasingly important digital retail landscape.

Diversification of Offerings

Retailers are increasingly moving beyond just selling groceries to gain a competitive advantage. This means Choppies faces a broader range of rivals as companies expand into new product categories and services.

Choppies itself has actively pursued diversification. For instance, its acquisition of Kamoso brought liquor stores and hardware retailers into its portfolio, directly increasing the number of competitive fronts it operates on. This strategy intensifies rivalry with competitors who are also broadening their offerings.

- Increased Competitive Touchpoints: Diversification means Choppies now competes with specialized liquor stores, hardware chains, and other non-grocery retailers, not just traditional supermarkets.

- Broader Market Reach: By offering a wider array of products, retailers like Choppies aim to capture a larger share of consumer spending, directly impacting rivals' market share.

- Strategic Acquisitions: The Kamoso acquisition exemplifies how companies use mergers and acquisitions to expand their competitive scope and enter new market segments.

Innovation and Customer Experience

Competitive rivalry within the retail sector, particularly for companies like Choppies, is intensifying as businesses prioritize innovation and customer experience to stand out. This focus extends beyond just price, encompassing a strategic shift towards a 'people-before-products philosophy'. Retailers are investing in advanced inventory optimization systems and striving for flawless in-store execution to create seamless shopping journeys, including digital and paperless options.

The emphasis on personalized shopping experiences is a key driver of this non-price competition. For instance, by mid-2024, many leading retailers reported significant increases in customer loyalty programs and personalized marketing campaigns, directly correlating with improved sales figures. This indicates that how a retailer makes customers feel and the ease of their shopping journey are becoming as crucial as product availability and price.

- Inventory Optimization: Retailers are implementing AI-driven systems to reduce stockouts and overstocking, a trend that gained significant traction throughout 2023 and into 2024.

- Digital Transformation: The adoption of paperless transactions and mobile checkout options is accelerating, with some retailers reporting over 60% of transactions being digital by early 2024.

- Customer Centricity: A growing number of retailers are investing in staff training focused on customer engagement and problem-solving, aiming to build stronger emotional connections with shoppers.

- Personalization: Data analytics are being leveraged to offer tailored promotions and product recommendations, with early 2024 data showing a 15-20% uplift in conversion rates for personalized offers.

The competitive rivalry for Choppies is intense, driven by a few dominant players in Southern Africa and a constant battle over pricing and promotions. Choppies faced margin pressures in Botswana in late 2024 due to aggressive discounting by competitors.

Retailers are actively expanding their store networks and exploring new formats, with Choppies opening eight net new stores in its recent fiscal year. This expansion, alongside competitors' moves into underserved areas and e-commerce, heightens rivalry across both physical and digital retail spaces.

Beyond groceries, companies are diversifying into new product categories like liquor and hardware, as seen with Choppies' acquisition of Kamoso. This broadens the competitive landscape, forcing Choppies to contend with a wider array of specialized retailers.

Innovation in customer experience, including personalized offers and digital transactions, is a key battleground. By early 2024, many retailers saw improved sales from loyalty programs and personalized marketing, with some reporting over 60% of transactions being digital.

| Competitor | Market Share (South Africa, est. 2024) | Key Strategy | Recent Activity Example |

|---|---|---|---|

| Shoprite | ~35% | Price leadership, extensive store network | Continued expansion of Usave brand for value segment |

| Pick n Pay | ~25% | Customer loyalty, omnichannel approach | Investment in supply chain and digital platforms |

| SPAR | ~15% | Franchise model, strong regional presence | Focus on private label growth and convenience offerings |

| Woolworths | ~10% | Premium positioning, quality focus | Enhancing online shopping experience and food innovation |

SSubstitutes Threaten

The informal retail sector, including spaza shops and hawkers, poses a substantial threat of substitution for formal retailers like Choppies, especially in Southern African townships and rural areas. These informal businesses thrive on convenience, offering products within close proximity to consumers and often allowing for purchases in smaller, more affordable quantities. For instance, a significant portion of grocery spending in many African nations occurs through informal channels, reflecting their deep integration into local economies.

The burgeoning online grocery and food delivery sector presents a significant threat of substitution for traditional brick-and-mortar retailers like Choppies. In South Africa, the digital retail landscape is rapidly evolving, with platforms such as Takealot, Mr D Food, and Checkers Sixty60 experiencing substantial growth. These services offer unparalleled convenience, allowing consumers to order groceries and meals from their homes, directly competing with the need to visit physical stores.

While online grocery penetration in South Africa was estimated to be around 1.5% of total grocery sales in 2023, this figure is projected to climb significantly in the coming years, with some analysts forecasting it to reach 5% or more by 2027. This shift is driven by increasing internet and smartphone adoption, coupled with a growing consumer preference for time-saving solutions and competitive pricing often found online.

Specialty stores and local markets present a significant threat of substitution for supermarket chains like Choppies. Consumers increasingly seek out niche retailers for specific product categories such as premium cheeses, artisanal bread, or organic produce, bypassing the broader supermarket offering. For instance, the growth of dedicated organic food stores and butcher shops directly siphons off customers who prioritize specialized quality or sourcing.

Furthermore, the rise of farmers' markets and direct-to-consumer sales channels offers a compelling alternative, particularly for fresh produce and locally sourced goods. In 2024, the direct-to-consumer sales in the food sector saw a notable uptick, as consumers became more conscious of food miles and supporting local economies. This trend fragments the market, diverting sales from larger supermarket formats and forcing them to compete on price, convenience, and increasingly, on the perceived quality and provenance of their goods.

Home Cooking and Budget-Conscious Behavior

The increasing cost of living, amplified by persistent inflation, has significantly reshaped consumer habits, pushing many towards more economical choices. This economic pressure encourages more home cooking and a prioritization of essential grocery items, thereby decreasing discretionary spending on convenience foods and impulse purchases often available in supermarkets.

This behavioral shift directly impacts retailers like Choppies by diverting consumer spending away from potentially higher-margin prepared meals and impulse buys. For instance, in 2024, reports indicated that South African households were increasingly cutting back on non-essential spending, with grocery budgets being meticulously managed.

- Inflationary Pressures: Continued inflation in 2024 has made eating out and purchasing ready-made meals a less attractive option for many South African consumers.

- Home Cooking Trend: A notable increase in home cooking is observed as consumers seek to control costs and manage their food budgets more effectively.

- Reduced Discretionary Spending: Consumers are prioritizing essential groceries over impulse purchases and convenience foods, impacting supermarket sales of these items.

- Impact on Retailers: This trend presents a threat to retailers that rely on higher-margin convenience items, as consumers opt for more budget-friendly home-prepared meals.

Alternative Retail Formats

Consumers increasingly have access to a wider array of retail options beyond traditional supermarkets. These include discount retailers, bulk-buying warehouses, and even direct-to-consumer (DTC) channels for specific goods, offering greater price sensitivity and convenience.

The proliferation of these alternative formats intensifies competition for grocery retailers like Choppies. For instance, in 2024, discount grocers continued to gain market share in many African regions, putting pressure on established players to compete on price and efficiency.

- Discount Retailers: Offer lower prices through streamlined operations and private label brands, attracting budget-conscious shoppers.

- Bulk-Buy Warehouses: Appeal to consumers seeking volume discounts, reducing per-unit costs.

- Direct-to-Consumer (DTC) Models: Allow manufacturers to bypass intermediaries, potentially offering specialized products at competitive prices directly to consumers.

- Online Grocery Platforms: Provide convenient home delivery, further diversifying consumer choices and challenging traditional brick-and-mortar models.

The threat of substitutes for Choppies is multifaceted, encompassing informal retail, online platforms, specialty stores, and changing consumer spending habits driven by economic pressures. These alternatives offer convenience, price advantages, or specialized products that can divert customers from traditional supermarket formats.

The rise of discount retailers and bulk-buying options further intensifies this threat, as consumers actively seek more economical ways to purchase groceries. In 2024, the competitive landscape demonstrated a clear consumer preference for value, forcing established players to adapt their strategies.

| Substitute Type | Key Characteristics | Impact on Choppies | 2024 Trend Example |

|---|---|---|---|

| Informal Retail (Spaza Shops, Hawkers) | Proximity, smaller purchase quantities, convenience | Captures a significant share of grocery spending, especially in underserved areas | Continued dominance in townships and rural areas |

| Online Grocery Platforms (e.g., Checkers Sixty60) | Home delivery, convenience, potential for competitive pricing | Growing rapidly, appealing to time-poor consumers | Projected to increase market share significantly from its 2023 base |

| Specialty Stores & Local Markets | Niche products, perceived quality, direct sourcing | Siphons off customers seeking specific items or local provenance | Increased consumer interest in organic and artisanal products |

| Discount Retailers & Bulk Buyers | Lower prices, private labels, volume discounts | Attracts budget-conscious shoppers, pressures pricing strategies | Gained market share across various African regions |

Entrants Threaten

The grocery retail sector, particularly for large supermarket chains like Choppies, demands significant upfront capital. This includes the cost of establishing numerous physical stores, building robust logistics and distribution networks, stocking substantial inventory, and investing in essential technology. For instance, the average cost to open a new supermarket can range from several million to tens of millions of dollars, depending on size and location. This high financial barrier effectively deters many potential new competitors from entering the market.

Established retailers like Choppies leverage substantial economies of scale, particularly in bulk purchasing and sophisticated distribution networks. This allows them to negotiate better terms with suppliers and reduce per-unit costs, a significant advantage over newcomers. For instance, in 2024, Choppies' extensive store footprint across multiple African nations enabled optimized logistics, a feat difficult for a new entrant to replicate quickly.

Securing prime retail locations is a significant hurdle for new supermarkets. Established players often hold long-term leases in high-traffic areas, leaving limited desirable spots for potential competitors. For instance, in many African urban centers, the most sought-after mall spaces are already occupied by established grocery chains, making it difficult for newcomers to gain visibility and foot traffic.

Brand Loyalty and Customer Acquisition Costs

Established retailers like Choppies have built significant brand loyalty over time, making it difficult for new players to gain a foothold. This loyalty is often fostered through extensive marketing campaigns and customer retention programs, which can be costly for newcomers to replicate. For instance, in 2024, the average customer acquisition cost in the retail sector continued to be a significant barrier, with some estimates suggesting it can range from $50 to $200 per customer, depending on the market and product. Choppies' established reputation and focus on customer satisfaction further amplify this challenge for potential entrants.

New entrants must contend with substantial customer acquisition costs. To lure shoppers away from familiar brands, they need to invest heavily in advertising, promotions, and perhaps even price reductions. This financial outlay can be substantial, especially in competitive markets. For example, a new supermarket chain entering Botswana, Choppies' primary market, would likely need to allocate millions of dollars in its initial launch phase for marketing alone to build brand awareness and attract initial customer traffic. This investment hurdle is a key deterrent.

- Brand Recognition: Incumbent retailers benefit from years of consistent brand messaging and customer interaction.

- Customer Loyalty Programs: Established players often have mature loyalty schemes that reward repeat business, increasing switching costs for consumers.

- High Marketing Spend: New entrants face elevated marketing expenses to build awareness and persuade customers to try their offerings.

- Customer Acquisition Costs (CAC): In 2024, CAC in retail remained a significant barrier, with estimates often exceeding $100 per new customer acquired.

Regulatory Hurdles and Supply Chain Integration

New entrants face substantial regulatory hurdles, including obtaining various licenses and permits, which can be time-consuming and costly. For instance, in many African markets where Choppies operates, food retail licensing can involve multiple government agencies, potentially delaying market entry significantly.

Building a robust supply chain is another major barrier. New players must establish reliable procurement networks and efficient distribution channels, particularly for perishable goods, demanding considerable investment in logistics and infrastructure. Choppies, for example, has invested heavily in its own distribution centers to manage its supply chain effectively.

The dominance of established retailers often limits suppliers' options for new entrants. Suppliers may be hesitant to engage with newcomers due to existing contracts or the perceived risk, forcing new players to either accept less favorable terms or invest more in securing their supply base. By mid-2024, major retailers in key African markets continued to hold significant sway over supplier relationships.

- Regulatory Complexity: Navigating diverse and evolving retail regulations across different operating regions is a significant deterrent.

- Supply Chain Investment: The capital expenditure required for warehousing, transportation, and cold chain logistics is substantial.

- Supplier Power: Established players often secure preferential terms with suppliers, squeezing margins for new entrants.

The threat of new entrants into the grocery retail sector, particularly for a company like Choppies, is generally considered moderate to low. This is primarily due to the substantial capital requirements for establishing a physical presence, building efficient supply chains, and navigating complex regulatory landscapes. For instance, establishing a single supermarket can cost millions, and replicating the extensive network of an established player like Choppies requires immense financial backing.

| Barrier to Entry | Impact on New Entrants | Example for Choppies (2024 Context) |

|---|---|---|

| Capital Requirements | High | Opening a new store can cost millions; Choppies operates hundreds of stores. |

| Economies of Scale | Significant Advantage for Incumbents | Choppies' bulk purchasing power lowers per-unit costs significantly. |

| Brand Loyalty & CAC | Challenging to Overcome | Customer Acquisition Costs in 2024 often exceeded $100, making it expensive to attract shoppers. |

| Supply Chain & Logistics | Requires Massive Investment | Choppies' established distribution centers are a key asset that new entrants lack. |

Porter's Five Forces Analysis Data Sources

Our Choppies Porter's Five Forces analysis is built upon a robust foundation of data, including Choppies' annual reports, investor presentations, and publicly available financial statements.