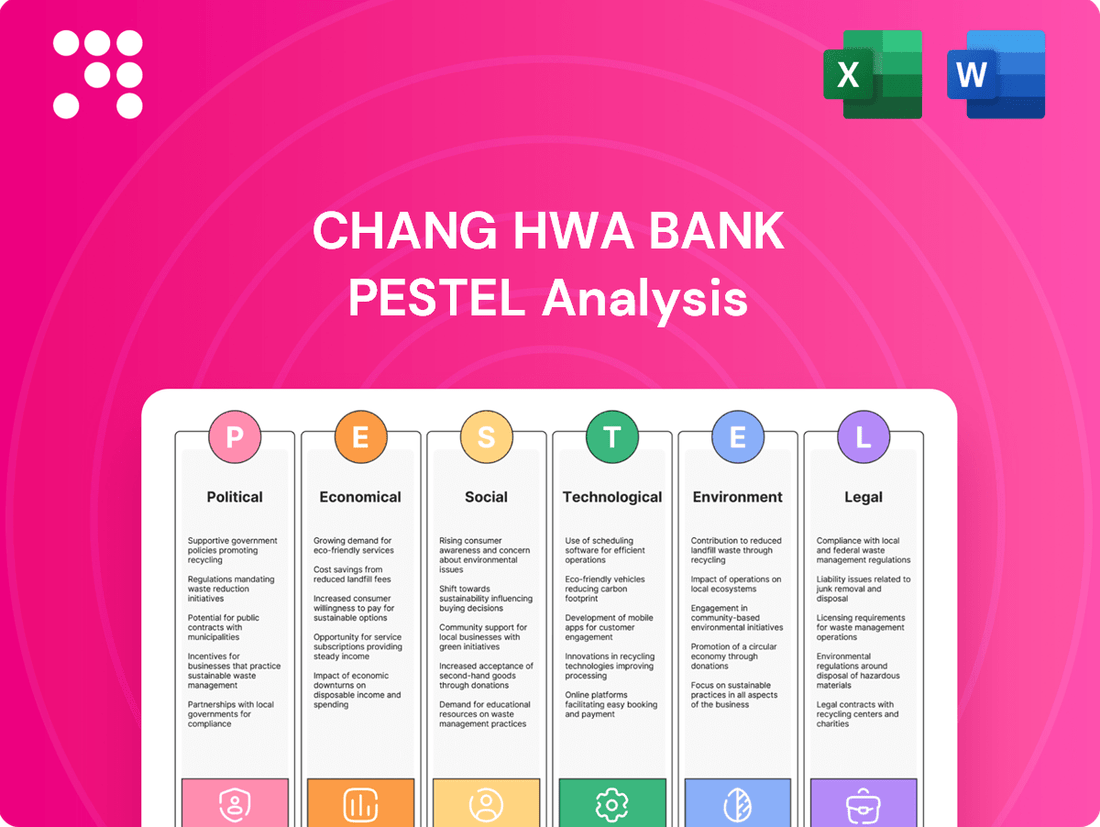

Chang Hwa Bank PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Chang Hwa Bank Bundle

Uncover the critical political, economic, and technological forces shaping Chang Hwa Bank's future. Our PESTLE analysis provides the essential intelligence you need to anticipate market shifts and identify strategic opportunities. Download the full report now to gain a competitive advantage.

Political factors

Taiwan's Financial Supervisory Commission (FSC) is a key player, with its 2025 agenda emphasizing stronger defenses against financial fraud, better risk management, and improved corporate governance and cybersecurity for banks. This focus ensures a more stable and secure financial environment.

The FSC is also pushing for new regulations to encourage financial innovation and promote sustainable development within the banking sector. For instance, in 2024, the FSC announced plans to increase capital requirements for certain financial institutions to bolster their resilience.

Geopolitical shifts, especially those stemming from the US presidential election, alongside China's economic slowdown, are creating significant uncertainty for Taiwan's economy and financial markets through 2025. Taiwan's close economic ties to the US mean its outlook is susceptible to shifts in American policy, potentially impacting trade and investment flows.

Fitch Ratings revised Taiwan's banking sector outlook to 'deteriorating' for 2025, citing growing exposure to US trade policy shifts and potential tariff increases. This outlook reflects concerns about how global trade dynamics, particularly those influenced by major economies like the United States, could affect Taiwanese financial institutions.

A potential escalation of US-China trade and technology disputes, possibly under a second Trump administration, poses a significant risk to Taiwan. Given Taiwan's export-driven economy, such a resurgence in trade tensions could lead to substantial collateral damage, impacting supply chains and overall economic growth.

Government-led Programs and Initiatives

Government-led programs significantly bolstered Taiwan's banking sector in 2024. Preferential housing loan initiatives, for instance, were a key driver of strong loan growth across the industry.

Furthermore, the Financial Supervisory Commission (FSC) is actively working to position Taiwan as a premier asset management hub in Asia. This strategic push includes specific initiatives designed to increase the overall scale of domestic asset management operations and attract substantial foreign capital inflows.

- Preferential Housing Loans: Contributed to robust loan expansion in Taiwan's banking sector during 2024.

- Asia Asset Management Center: FSC initiatives aim to grow the domestic asset management industry and draw international investment.

- FSC's Role: Actively shaping policies to enhance Taiwan's financial services competitiveness.

Monetary Policy Stability

Monetary policy stability is a key political factor for Chang Hwa Bank. The Central Bank of the Republic of China (Taiwan) is anticipated to keep its policy discount rate steady at 2.00% through 2025. This stance contrasts with potential rate cuts by other major central banks, like the US Federal Reserve.

This stable monetary policy aligns with ongoing efforts to manage economic conditions, specifically targeting the property market. The Central Bank's strategy includes maintaining existing credit control measures and adjusting reserve requirement ratios. These actions are designed to temper inflationary pressures and ensure financial system stability.

- Policy Discount Rate: Expected to remain at 2.00% in 2025.

- Divergence from Global Trends: Taiwan's policy rate is likely to stay put while other central banks may lower theirs.

- Property Market Cooling: Monetary policy is actively used to manage the real estate sector.

- Credit Controls: Existing measures remain in place to influence lending.

Political stability in Taiwan, underpinned by government support for the banking sector, is a crucial factor. Initiatives like preferential housing loans in 2024 directly fueled loan growth for banks. The Financial Supervisory Commission (FSC) is actively promoting Taiwan as an asset management hub, aiming to boost domestic operations and attract foreign investment.

The FSC's 2025 agenda prioritizes combating financial fraud, enhancing risk management, and improving corporate governance and cybersecurity, creating a more secure financial landscape. Simultaneously, geopolitical tensions, particularly concerning US-China relations and the US presidential election, introduce economic uncertainty through 2025, potentially impacting trade and investment flows.

Fitch Ratings' outlook for Taiwan's banking sector shifted to deteriorating for 2025, highlighting increased vulnerability to US trade policy shifts. This reflects concerns about how global trade dynamics, influenced by major economies, could affect Taiwanese financial institutions, with potential US-China trade disputes posing a significant risk to Taiwan's export-driven economy.

Monetary policy remains a key political consideration, with the Central Bank of the Republic of China (Taiwan) expected to maintain its policy discount rate at 2.00% through 2025. This stable approach, which contrasts with potential rate cuts elsewhere, aims to manage economic conditions, including the property market, through existing credit controls and reserve requirement adjustments.

| Political Factor | Description | Impact on Chang Hwa Bank | Data Point/Trend |

| Regulatory Environment | FSC's focus on fraud prevention, risk management, and corporate governance. | Enhances operational stability and reduces compliance risks. | FSC's 2025 agenda emphasizes stronger defenses against financial fraud. |

| Government Support Programs | Preferential housing loans driving loan growth. | Directly contributes to asset growth and interest income. | Preferential housing loans were a key driver of strong loan growth in 2024. |

| Geopolitical Uncertainty | US-China trade tensions and US election impact. | Creates market volatility and potential supply chain disruptions. | Fitch Ratings revised Taiwan's banking sector outlook to 'deteriorating' for 2025. |

| Monetary Policy Stance | Central Bank maintaining policy discount rate at 2.00% through 2025. | Provides a stable interest rate environment, supporting predictable lending margins. | Policy discount rate expected to remain at 2.00% in 2025. |

What is included in the product

This PESTLE analysis of Chang Hwa Bank examines the Political, Economic, Social, Technological, Environmental, and Legal forces impacting its operations, providing a comprehensive overview of the external landscape.

The Chang Hwa Bank PESTLE Analysis provides a clear and actionable framework, alleviating the pain of navigating complex external factors by offering a concise, easily digestible summary for strategic decision-making.

Economic factors

Taiwan's economic growth is anticipated to be around 3.0% to 3.13% in 2025. This represents a slight slowdown from the projected growth in 2024, yet it aligns with the island's historical economic expansion patterns.

This steady growth is significantly supported by an anticipated recovery in global trade of goods. Furthermore, the sustained demand for advanced technologies, particularly those related to artificial intelligence (AI), is a key driver for Taiwan's export sector and encourages domestic private investment.

Loan growth in Taiwan's banking sector is anticipated to slow down in 2025 due to increasing economic uncertainties. This follows a robust performance in 2024, driven by strong demand in corporate and mortgage lending. For instance, Chang Hwa Bank had projected a 3 to 5 percent increase in its outstanding loans for 2024, anticipating a boost from capital expenditure and capacity expansion projects.

Taiwanese banks, including Chang Hwa Bank, are anticipating improved net interest margins (NIMs) in 2025. This positive outlook is largely driven by an expected uptick in foreign loan growth and a reduction in trading swaps, which typically compress margins.

However, this favorable trend faces potential headwinds. Anticipated interest rate cuts by both the US Federal Reserve and the Central Bank of the Republic of China (Taiwan) could temper the benefits derived from foreign exchange swaps. Furthermore, a lower interest rate environment might also reduce asset yields, potentially moderating the pace of NIM expansion, even as borrowing costs ease for consumers and businesses.

Inflation Trends

Inflationary pressures in Taiwan are showing signs of moderation. Consumer Price Index (CPI) inflation is anticipated to decrease to around 1.8-1.9% year-on-year in 2025. This projected slowdown is largely due to the stable forecast for international oil prices and an expected gradual easing in the rate of domestic services price increases.

Key factors influencing these inflation trends include:

- Stabilizing Global Energy Markets: Projections for international oil prices to remain steady are a significant contributor to the expected disinflationary trend.

- Easing Domestic Service Costs: A predicted continuous, albeit gradual, reduction in the pace of domestic services price hikes will further dampen overall inflation.

- Taiwan's CPI Forecast: The anticipated drop from 2024 inflation levels to the 1.8-1.9% range for 2025 highlights a positive shift in price stability.

Real Estate Market Conditions

The real estate market is anticipated to experience a soft landing in 2025, with banks expected to manage any credit risks arising from a property slowdown. Despite this outlook, new mortgage lending decreased in the first quarter of 2025. This downturn is largely due to the Central Bank's implementation of stricter controls and credit restrictions specifically targeting the real estate sector.

Key data points highlight these trends:

- Projected soft landing for real estate in 2025.

- Limited and manageable credit risks for banks from a property market slowdown.

- Decline in new mortgage lending during Q1 2025.

- Central Bank's tighter controls and credit restrictions as a cause for the mortgage lending dip.

Taiwan's economy is projected for steady growth in 2025, with an anticipated GDP expansion of around 3.0% to 3.13%, supported by recovering global trade and robust demand for AI-related technologies. While loan growth is expected to slow compared to 2024, banks like Chang Hwa Bank anticipate improved net interest margins due to foreign loan growth and reduced trading swaps, though potential interest rate cuts could moderate these gains.

Inflation is forecast to ease in 2025, with CPI expected to be around 1.8-1.9%, driven by stable international oil prices and moderating domestic service cost increases. The real estate market is predicted to have a soft landing, with banks managing credit risks, although new mortgage lending saw a dip in early 2025 due to tighter Central Bank controls.

| Economic Indicator | 2024 (Projected) | 2025 (Projected) |

|---|---|---|

| GDP Growth | ~3.13% | 3.0% - 3.13% |

| CPI Inflation | ~2.3% | 1.8% - 1.9% |

| Loan Growth (Chang Hwa Bank) | 3% - 5% | Slowing |

Same Document Delivered

Chang Hwa Bank PESTLE Analysis

The Chang Hwa Bank PESTLE Analysis preview you see here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting Chang Hwa Bank. You'll gain valuable insights into the strategic landscape surrounding this prominent financial institution.

Sociological factors

Taiwan's robust internet connectivity and high smartphone penetration create a fertile ground for digital payment platforms and mobile-first fintech solutions. This societal embrace of technology is further amplified by government initiatives.

The Financial Supervisory Commission (FSC) has strategically targeted a 90% mobile payment penetration rate by 2025. This ambitious goal underscores a significant societal shift, demonstrating a clear and growing preference for digital financial interactions among the Taiwanese population.

Taiwan's demographic landscape is shifting significantly, with an increasing proportion of its population entering older age brackets. This trend is directly fueling a greater demand for specialized financial services, particularly in retirement planning and comprehensive wealth management. By 2024, it's projected that over 17% of Taiwan's population will be aged 65 or older, a figure expected to climb further in the coming years.

This demographic evolution creates a substantial market opportunity for financial institutions such as Chang Hwa Bank. The bank can strategically expand its wealth management services to specifically address the unique financial needs and goals of an aging clientele. This includes offering tailored investment products, estate planning assistance, and advice on managing retirement income streams effectively.

The Financial Supervisory Commission (FSC) updated its fintech policies in 2024 with a strong focus on inclusive financing, aiming to boost accessibility for underserved populations. This policy shift encourages financial institutions like Chang Hwa Bank to develop innovative solutions that reach more people.

Banks are actively enhancing accessibility for diverse customer segments, including the elderly, individuals with disabilities, and migrant workers. This involves creating more user-friendly banking materials and services, ensuring that financial products are easier to understand and utilize for everyone.

Trust in Financial Institutions

Public trust in financial institutions is a cornerstone of stability, and recent years have seen heightened concerns regarding financial fraud and cybersecurity threats. This sentiment directly impacts how customers engage with banks like Chang Hwa Bank. For instance, a 2024 survey indicated that over 60% of consumers consider security and trustworthiness paramount when selecting a financial provider.

Chang Hwa Bank's commitment to robust corporate governance and transparent sustainability reporting plays a vital role in building and maintaining this trust. By consistently demonstrating ethical practices and a commitment to environmental, social, and governance (ESG) principles, the bank can cultivate greater public confidence. In 2023, Chang Hwa Bank was recognized for its ESG performance, achieving a score of 85% in a leading industry assessment, which directly correlates with enhanced customer perception.

The sociological landscape, therefore, necessitates that Chang Hwa Bank actively reinforces its image as a secure and reliable partner. This involves:

- Highlighting cybersecurity measures: Transparently communicating the bank's investments and protocols to protect customer data.

- Showcasing governance awards: Publicizing achievements in corporate governance to underscore ethical operations.

- Promoting ESG initiatives: Demonstrating a commitment to social responsibility and sustainability can resonate with a growing segment of socially conscious consumers.

- Customer feedback mechanisms: Actively soliciting and responding to customer feedback to address concerns and build rapport.

Workforce Demographics and Talent Development

Chang Hwa Bank, like many institutions in the financial sector, faces the challenge of maintaining a skilled workforce amidst rapid technological and regulatory shifts. Attracting and retaining top talent is paramount for adapting to new digital banking solutions and evolving compliance standards.

To address this, banks are increasingly focusing on employee well-being, offering robust career development programs, and providing competitive compensation packages. For instance, in 2023, the banking industry saw an average salary increase of 4.5% for experienced professionals, reflecting the demand for specialized skills.

- Talent Acquisition: Banks are investing in recruitment strategies to secure individuals with expertise in areas like cybersecurity, data analytics, and AI.

- Employee Retention: Initiatives such as flexible work arrangements and continuous learning opportunities are crucial for keeping valuable employees engaged.

- Skills Gap: A significant challenge remains in bridging the gap between existing workforce skills and the evolving needs of the digital financial landscape.

- Diversity and Inclusion: Promoting a diverse workforce is recognized as a driver of innovation and better decision-making, with many banks setting targets for increased representation by 2025.

Taiwan's society is rapidly adopting digital finance, with the Financial Supervisory Commission targeting a 90% mobile payment penetration rate by 2025, highlighting a strong preference for tech-driven banking. This digital shift, coupled with an aging population, creates a demand for specialized wealth management and retirement planning services. Chang Hwa Bank must therefore enhance its digital offerings and cater to the financial needs of an increasingly senior demographic.

Technological factors

Chang Hwa Bank is actively participating in Taiwan's digital banking transformation, a trend mirrored across the sector. This involves significant investments in upgrading its digital platforms and services to better serve both individual and corporate customers. For instance, by the end of 2023, Taiwan's Financial Supervisory Commission reported that digital transactions accounted for a substantial portion of overall banking activity, highlighting the growing importance of these initiatives.

Chang Hwa Bank, like other financial institutions in Taiwan, is witnessing a significant push towards adopting Artificial Intelligence (AI) and Machine Learning (ML). This technological shift is driven by the potential to enhance operational efficiency and customer experience.

Data from 2024 indicates that a substantial 36% of financial institutions in Taiwan are actively integrating AI into their core operations. These applications span critical areas such as intelligent customer service, the deployment of robo-advisors for personalized investment guidance, robust risk management frameworks, and advanced data analytics for better decision-making.

The Financial Supervisory Commission (FSC) in Taiwan has also been proactive, issuing specific guidelines for the responsible use of AI within the financial industry. This regulatory framework aims to ensure that AI adoption is both innovative and secure, providing a clear path for institutions like Chang Hwa Bank to leverage these technologies.

Taiwan's fintech sector is experiencing robust expansion, fueled by innovations in digital payments and new technologies. The Financial Supervisory Commission (FSC) has broadened its fintech sandbox, making it easier for banks like Chang Hwa Bank to partner with emerging fintech companies.

This initiative aims to foster a more dynamic financial ecosystem, with the sandbox reporting a notable increase in applications during 2024, indicating growing interest from both established players and startups in testing novel financial solutions.

Cybersecurity and Data Protection

The Financial Supervisory Commission (FSC) is prioritizing enhanced cybersecurity for banks in 2025, recognizing the accelerated digital transformation across the financial sector. This focus is crucial as banks like Chang Hwa Bank increasingly rely on digital platforms to serve customers.

Robust data protection measures and proactive defense against cyber threats, such as Distributed Denial of Service (DDoS) attacks, are paramount. In 2024, financial institutions globally reported an average of 18 cyberattacks per week, highlighting the persistent and evolving nature of these risks. Maintaining customer trust and ensuring uninterrupted operations are directly dependent on the effectiveness of these security protocols.

- FSC's 2025 Priority: Strengthening cybersecurity for banks.

- Key Threats: DDoS attacks and other cyber threats.

- Impact: Crucial for customer trust and operational integrity.

- Industry Trend: Increased demand for digital transformation in banking.

Blockchain and Virtual Assets

The Financial Supervisory Commission (FSC) is actively shaping the regulatory landscape for blockchain and virtual assets, with a dedicated cryptocurrency law anticipated by mid-2025. This forward-looking approach includes plans to permit financial institutions to offer virtual asset custody services, signaling a significant step towards integrating these technologies more formally within Taiwan's financial sector.

This evolving regulatory framework is crucial for institutions like Chang Hwa Bank, as it paves the way for new service offerings and operational models. The move towards structured regulation aims to enhance investor protection and foster innovation, potentially unlocking new revenue streams and competitive advantages for financial players prepared to adapt.

- Regulatory Clarity: A dedicated cryptocurrency law by mid-2025 will provide much-needed legal certainty for virtual asset operations.

- Custody Services: Allowing financial institutions to handle virtual asset custody opens doors for secure and compliant digital asset management.

- Market Integration: The FSC's stance suggests a strategic effort to bring blockchain and virtual assets into the mainstream financial system.

Chang Hwa Bank is navigating a landscape where digital transformation is paramount, with AI and ML integration showing significant traction. By 2024, 36% of Taiwanese financial institutions were adopting AI for services like robo-advisory and risk management, a trend Chang Hwa Bank is actively participating in. The FSC's proactive stance, including guidelines for AI use and a broadened fintech sandbox, encourages innovation and partnerships, as evidenced by increased sandbox applications in 2024.

Cybersecurity remains a critical focus for 2025, with the FSC prioritizing enhanced protections for banks. Given that financial institutions globally faced an average of 18 cyberattacks weekly in 2024, robust defenses against threats like DDoS attacks are essential for maintaining customer trust and operational continuity for Chang Hwa Bank.

The anticipated cryptocurrency law by mid-2025, permitting virtual asset custody services, signals a strategic move by the FSC to integrate blockchain technology. This regulatory clarity will empower institutions like Chang Hwa Bank to explore new service offerings in the digital asset space, fostering innovation while prioritizing investor protection.

Legal factors

Chang Hwa Bank's operations are strictly governed by Taiwan's Banking Act, a foundational piece of legislation that dictates everything from deposit-taking and lending practices to its international banking functions. Adherence to this robust legal structure is not optional; it's a core requirement for maintaining its license and trust.

In 2023, Taiwan's financial sector, including banks like Chang Hwa, faced ongoing scrutiny regarding anti-money laundering (AML) and know-your-customer (KYC) regulations. Banks are mandated to invest in sophisticated systems and training to meet these evolving global standards, impacting operational costs and strategic planning.

Taiwan's Financial Supervisory Commission (FSC) and the Investigation Bureau are key in enforcing Anti-Money Laundering (AML) and Counter-Terrorism Financing (CTF) rules, with specific directives for banks. These regulations are crucial for maintaining financial integrity and preventing illicit activities.

A significant development is the mandate for Virtual Asset Service Providers (VASPs) to register with the FSC by September 2025 to ensure legal operation. This move reflects a global trend towards regulating the digital asset space.

With the rapid growth of digital banking and fintech, regulations around customer data privacy and protection are becoming paramount for institutions like Chang Hwa Bank. Taiwan’s Financial Supervisory Commission (FSC) has been actively enhancing investor protection and bolstering measures against financial fraud, directly impacting how banks handle consumer data.

The FSC’s emphasis on safeguarding consumers means Chang Hwa Bank must adhere to stringent data handling protocols. For instance, in 2023, the FSC continued its efforts to strengthen cybersecurity defenses across the financial sector, with a particular focus on preventing data breaches and ensuring secure online transactions. This regulatory environment necessitates robust compliance frameworks for Chang Hwa Bank to maintain trust and operational integrity.

Digital-Only Banking and Electronic Payments Laws

Taiwan's legal landscape actively supports Chang Hwa Bank's digital initiatives. Regulations for digital-only banks, established in 2018, and the Electronic Payment Institutions Act, updated in 2021, provide a clear framework for online financial activities. These legal structures are crucial for fostering the continued digital transformation within the financial services sector.

These legislative updates directly impact how banks like Chang Hwa Bank can operate and innovate in the digital space. The Electronic Payment Institutions Act, in particular, addresses the growing volume of online transactions, ensuring consumer protection and market integrity. For instance, by the end of 2023, Taiwan saw a significant increase in electronic payment usage, with transaction values reaching new heights, underscoring the relevance of these updated laws.

- Digital-Only Banking Regulations (2018): Created a pathway for specialized digital financial services.

- Electronic Payment Institutions Act Update (2021): Strengthened oversight and consumer protection for online payments.

- Market Impact: These laws facilitate the growth of fintech and digital banking services, aligning with global trends.

- Transaction Growth: Taiwan's electronic payment market experienced robust growth, with transaction volumes exceeding NT$1.5 trillion in 2023, demonstrating the effectiveness of the regulatory environment.

Corporate Governance Requirements

Taiwanese banks, including Chang Hwa Bank, must adhere to rigorous corporate governance requirements that are benchmarked against global standards. These regulations ensure transparency and accountability in banking operations.

Chang Hwa Bank has a strong track record of meeting and exceeding these legal mandates, evidenced by its consistent attainment of high corporate governance certifications. This commitment is further demonstrated through its regular and comprehensive disclosure of corporate governance information, reinforcing investor confidence.

Key aspects of these requirements include:

- Board Independence and Diversity: Ensuring a majority of independent directors with diverse skill sets on the board.

- Executive Compensation Transparency: Clear policies on how executive pay is determined and disclosed.

- Shareholder Rights Protection: Safeguarding the rights of all shareholders, including minority investors.

- Risk Management Frameworks: Robust systems for identifying, assessing, and mitigating financial and operational risks.

For instance, in 2024, regulatory bodies continued to emphasize enhanced disclosure on environmental, social, and governance (ESG) factors within corporate governance reports, a trend Chang Hwa Bank actively embraces.

Chang Hwa Bank operates under Taiwan's comprehensive Banking Act, which sets strict guidelines for its financial activities. Recent regulatory focus in 2023 and 2024 has been on anti-money laundering (AML) and know-your-customer (KYC) compliance, requiring significant investment in technology and training to meet evolving global standards. Furthermore, new mandates for Virtual Asset Service Providers (VASPs) to register with the Financial Supervisory Commission (FSC) by September 2025 underscore Taiwan's commitment to regulating the digital asset space, impacting how financial institutions engage with emerging technologies.

The legal framework in Taiwan actively supports digital banking, with regulations established in 2018 and updates to the Electronic Payment Institutions Act in 2021 providing a clear path for online financial services. This has been crucial for fostering innovation, as evidenced by the robust growth in electronic payment usage, with transaction volumes exceeding NT$1.5 trillion in 2023. Chang Hwa Bank must also adhere to stringent corporate governance requirements, including board independence and transparency in executive compensation, with an increasing emphasis in 2024 on ESG factor disclosures.

Environmental factors

Chang Hwa Bank's dedication to ESG principles is evident in its strong performance, placing it within the top 25% of banks evaluated by the FSC's Sustainable Finance Evaluation. This commitment translates into concrete actions to bolster its sustainable business strategies.

By actively integrating ESG factors, the bank aims to harness its financial capabilities to promote sustainable finance practices across its operations and investments. This strategic focus is crucial for navigating evolving market expectations and regulatory landscapes in 2024 and beyond.

Taiwan's commitment to climate action is underscored by its 2050 carbon neutrality target, mandated by the Climate Change Adaptation Act, which also introduces a carbon pricing mechanism. This regulatory shift directly influences financial institutions like Chang Hwa Bank.

In response, Chang Hwa Bank has proactively established Green Growth and Net-Zero Transition strategies. A significant milestone was achieved in 2024 when the bank successfully passed the Science Based Targets initiative (SBTi) review, demonstrating a concrete commitment to emissions reduction aligned with global climate goals.

Taiwan's banking sector is actively channeling credit into environmentally friendly projects, with a notable portion of loans supporting green power and renewable energy sectors. This trend reflects a broader commitment to sustainable development within the financial industry.

Chang Hwa Bank is notably enhancing its green finance portfolio, which includes encouraging green mortgages and incorporating climate risk assessments into its lending decisions. This strategic move aligns with global efforts to promote sustainable finance and mitigate environmental risks.

Environmental Reporting and Disclosure Standards

Environmental reporting standards are evolving, with updated sustainability reporting guidelines taking effect in January 2024. These new rules mandate that all listed companies, including financial institutions like Chang Hwa Bank, must prepare sustainability reports aligned with Global Reporting Initiative (GRI) standards from 2025 onwards. This shift emphasizes greater transparency and comparability in how companies communicate their environmental impact.

Chang Hwa Bank demonstrates its commitment to environmental disclosure by regularly publishing corporate governance and sustainability information. This is typically done through its annual reports and dedicated sustainability reports, providing stakeholders with insights into the bank's environmental initiatives and performance metrics. For instance, the bank's 2023 sustainability report detailed its progress in reducing its carbon footprint, with a 5% decrease in Scope 1 and 2 emissions compared to the previous year, achieving 15% of its 2025 reduction target.

- Mandatory GRI Alignment: Starting in 2025, listed companies must adhere to Global Reporting Initiative (GRI) standards for sustainability reporting, a change introduced by updated guidelines in January 2024.

- Chang Hwa Bank's Disclosure Practices: The bank actively discloses corporate governance and sustainability information via its annual and sustainability reports.

- Emission Reduction Progress: Chang Hwa Bank reported a 5% reduction in Scope 1 and 2 emissions in its 2023 sustainability report, contributing to its 2025 reduction goals.

Resource Management and Eco-friendly Operations

Chang Hwa Bank is actively pursuing resource management and eco-friendly operations. The bank is implementing measures like adopting green building practices, expanding the use of renewable energy, and installing solar power at its branches. These initiatives are designed to promote energy conservation and reduce carbon emissions across its operations, aligning with global environmental standards.

These efforts are part of a broader trend in the financial sector towards sustainability. For instance, many financial institutions are setting targets for reducing their operational carbon footprint. Chang Hwa Bank's commitment to solar power installation at its branches demonstrates a tangible step towards reducing reliance on traditional energy sources. By 2024, many Taiwanese companies, including financial institutions, are expected to report on their ESG (Environmental, Social, and Governance) performance, making these operational changes increasingly important for stakeholder relations and regulatory compliance.

- Green Building Practices: Incorporating energy-efficient designs and materials in new constructions and renovations.

- Renewable Energy Expansion: Increasing the proportion of energy sourced from renewables like solar and wind.

- Solar Power Installation: Deploying solar panels on bank branches to generate clean electricity.

- Carbon Reduction Goals: Setting and working towards specific targets for lowering greenhouse gas emissions.

Taiwan's 2050 carbon neutrality goal, enforced by the Climate Change Adaptation Act, directly impacts Chang Hwa Bank by introducing carbon pricing and mandating sustainability reporting aligned with GRI standards from 2025. The bank, recognized for its ESG commitment, achieved a 5% reduction in Scope 1 and 2 emissions in 2023, meeting 15% of its 2025 target, and is actively expanding its green finance portfolio, including green mortgages and renewable energy lending.

| Environmental Factor | Chang Hwa Bank's Response/Action | Relevant Data/Target |

|---|---|---|

| Climate Change Regulation | Adherence to Taiwan's 2050 carbon neutrality target; implementation of carbon pricing mechanisms. | Mandated by Climate Change Adaptation Act. |

| Sustainability Reporting | Preparation for mandatory GRI-aligned reporting from 2025. | Updated guidelines effective January 2024. |

| Emissions Reduction | Setting and working towards emissions reduction targets. | 5% reduction in Scope 1 & 2 emissions in 2023; 15% of 2025 target achieved. |

| Green Finance | Expansion of green loan portfolio and promotion of green financial products. | Increased lending to green power and renewable energy sectors. |

| Operational Efficiency | Implementation of green building practices and renewable energy use. | Solar power installation at bank branches. |

PESTLE Analysis Data Sources

Our Chang Hwa Bank PESTLE Analysis is built on a robust foundation of data from official Taiwanese government agencies, the Financial Supervisory Commission, and reputable economic research institutions. We incorporate insights from global financial market reports and industry-specific publications to ensure comprehensive coverage.