Chang Hwa Bank Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Chang Hwa Bank Bundle

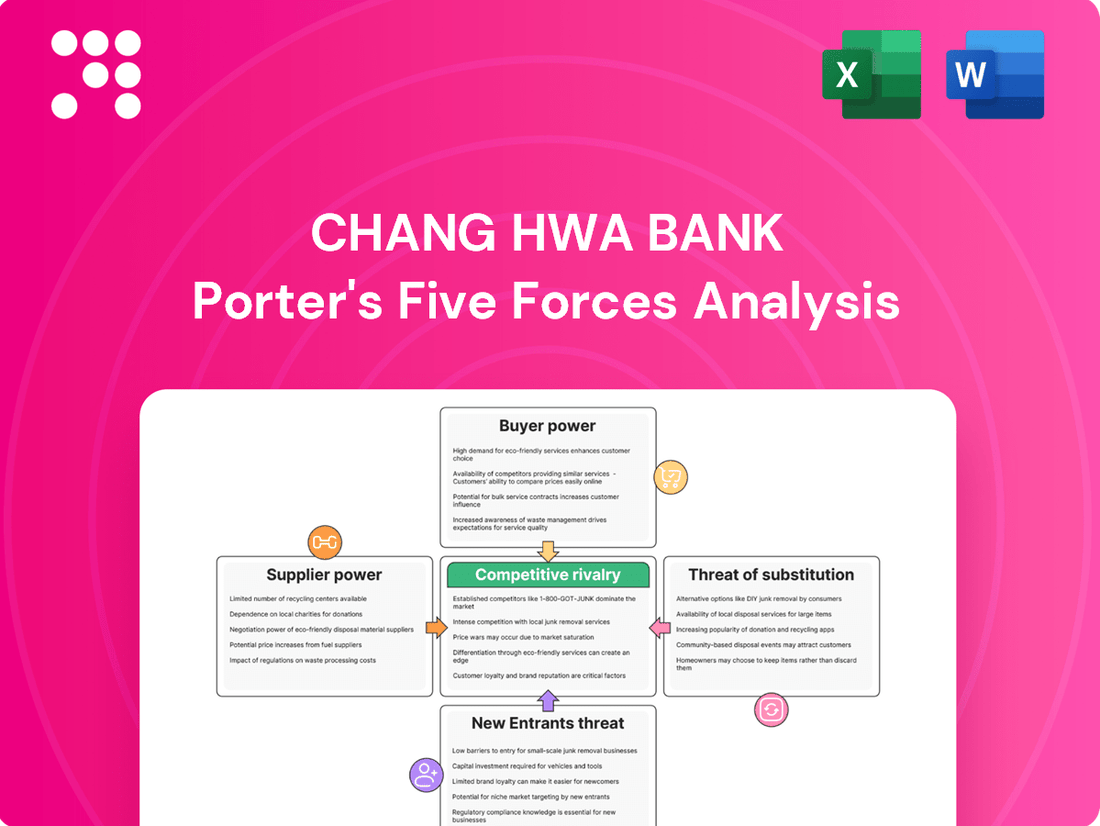

Chang Hwa Bank faces a dynamic competitive landscape, with moderate bargaining power from both suppliers and buyers influencing its operations. The threat of new entrants is a significant factor, requiring the bank to maintain strong customer loyalty and operational efficiency to counter potential disruptions.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Chang Hwa Bank’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Chang Hwa Bank's access to capital is significantly shaped by its reliance on customer deposits. The Central Bank of Taiwan's monetary policy, including its discount rate which stood at 2.0% in June 2025, directly impacts the cost of acquiring these funds. A strong retail deposit base is crucial for funding stability.

Competition for these deposits can drive up their cost, thereby influencing Chang Hwa Bank's overall funding expenses. This dynamic underscores the importance of maintaining a competitive edge in attracting and retaining customer deposits to manage its cost of capital effectively.

Chang Hwa Bank's digital transformation elevates its dependence on technology and digital platform providers for essential services like core banking, cybersecurity, AI, and cloud infrastructure. These specialized vendors can leverage their unique or critical solutions to exert significant bargaining power, particularly when these technologies are key to the bank's competitive edge.

While specialized providers can hold sway, the digital banking platform market is quite fragmented, presenting Chang Hwa Bank with a broad array of choices. For instance, in 2024, the global fintech market was valued at over $110 billion, indicating a competitive landscape with numerous players offering diverse solutions, which can help mitigate supplier power.

The banking sector's need for specialized skills, from traditional finance to emerging areas like fintech, data analytics, and cybersecurity, significantly impacts the bargaining power of suppliers, particularly human capital. This demand for expertise means employees with these in-demand skills can negotiate for higher salaries and better benefits. For instance, as of early 2024, the average salary for a cybersecurity analyst in Taiwan was approximately TWD 900,000 annually, reflecting the high value placed on these professionals.

Chang Hwa Bank's ability to attract and retain top talent in these critical fields is paramount, especially as it pursues digital transformation. A shortage of qualified personnel in areas like AI and machine learning, crucial for developing advanced banking solutions, can further empower these individuals. Reports from the first half of 2024 indicated a persistent talent gap in Taiwan's tech sector, with demand for AI specialists outstripping supply by a considerable margin.

Regulatory Bodies and Central Bank

The Central Bank of the Republic of China (Taiwan) and the Financial Supervisory Commission (FSC) wield considerable influence, acting as de facto suppliers by dictating the operational landscape for banks like Chang Hwa Bank. Their policy decisions, such as the Central Bank's decision to maintain the policy rate at 2.0% through late 2024 and into early 2025, directly affect borrowing costs and lending margins, thereby impacting the bank's profitability.

These regulatory bodies also impose compliance requirements that represent a cost of doing business. For instance, the 2024 amendments to the Money Laundering Control Act necessitate investments in enhanced systems and personnel, effectively increasing operational expenses and limiting flexibility.

- Regulatory Influence: The Central Bank and FSC set monetary policy and operational rules.

- Interest Rate Impact: A policy rate of 2.0% (late 2024/early 2025) influences Chang Hwa Bank's net interest margin.

- Compliance Costs: Amendments like the 2024 Money Laundering Control Act require significant investment in compliance.

- Supplier Power: These entities shape the banking environment, impacting costs and revenue potential.

Interbank Market and Wholesale Funding

While Chang Hwa Bank has a robust retail deposit base, its reliance on interbank markets and wholesale funding means its cost of funds can be influenced by external factors. In 2024, the stability of the Taiwanese banking sector, characterized by strong capitalization ratios, generally provided a favorable funding environment. However, global monetary policy shifts and economic uncertainties can still impact the availability and pricing of these wholesale funds.

The bargaining power of suppliers in this context relates to the institutions providing these wholesale funds. Factors influencing this power include:

- Interest Rate Environment: Central bank policies, such as interest rate hikes or cuts, directly affect the cost at which banks can borrow from each other or the wholesale market.

- Market Liquidity: Periods of tight liquidity in the financial markets can increase the bargaining power of lenders, as demand for funds outstrips supply.

- Counterparty Risk: The perceived financial health and creditworthiness of Chang Hwa Bank itself can influence the terms offered by wholesale funding providers.

Chang Hwa Bank's reliance on specialized technology providers for its digital transformation presents a key area of supplier bargaining power. While the fintech market is competitive, as evidenced by its over $110 billion valuation in 2024, the unique nature of core banking, cybersecurity, and AI solutions means certain vendors can command significant leverage.

The bank's need for specialized talent, particularly in AI and data analytics, also empowers suppliers of human capital. With a notable talent gap in Taiwan's tech sector in early 2024, professionals in these fields can negotiate higher compensation, impacting the bank's operational costs.

Regulatory bodies like the Central Bank and FSC act as powerful suppliers by setting the operational framework. Their policies, such as the maintained 2.0% policy rate through late 2024 and early 2025, directly influence funding costs and profitability. Furthermore, compliance mandates from regulations like the 2024 Money Laundering Control Act necessitate significant investments, increasing expenses.

| Supplier Type | Impact on Chang Hwa Bank | Key Factors Influencing Power | 2024/2025 Data Point |

|---|---|---|---|

| Technology Providers | Cost of essential digital services (core banking, AI, cybersecurity) | Uniqueness/criticality of solutions, market fragmentation | Global fintech market > $110 billion (2024) |

| Human Capital (Specialized Talent) | Labor costs for key roles (AI, cybersecurity) | Talent scarcity, demand for specific skills | Taiwanese cybersecurity analyst average salary ~TWD 900,000 (early 2024) |

| Regulators (Central Bank, FSC) | Cost of capital, compliance expenses, operational flexibility | Monetary policy, regulatory mandates | Central Bank policy rate 2.0% (late 2024/early 2025) |

What is included in the product

Uncovers key drivers of competition, customer influence, and market entry risks tailored to Chang Hwa Bank's position in Taiwan's banking sector.

Effortlessly identify and address competitive threats with a visual breakdown of each force, allowing for targeted strategic adjustments.

Customers Bargaining Power

Taiwan's banking landscape is exceptionally crowded, featuring 38 domestic banks alongside many other financial entities catering to a population of 23.5 million. This saturation creates an overbanked environment where customers hold considerable sway.

With so many choices available, customers, both individuals and businesses, possess substantial bargaining power. They can readily compare offerings and select the financial institution that provides the most appealing terms and services.

This ease of switching means banks must constantly strive to retain clients by offering competitive rates and superior customer experiences. A customer's ability to easily move their business to a competitor directly impacts a bank's profitability and market share.

Customers exhibit significant price sensitivity, particularly concerning loan interest rates and deposit yields. In 2023, the average interest rate on new mortgage loans in Taiwan hovered around 1.7%, a figure Chang Hwa Bank must consider when setting its own rates. Similarly, deposit rates are closely watched, with many customers actively seeking the best returns, further pressuring banks to offer competitive yields.

The proliferation of digital banking platforms and comparison websites has dramatically increased the ease with which customers can compare financial products. This transparency means Chang Hwa Bank faces intensified pressure to offer competitive pricing on services ranging from transaction fees to foreign exchange rates. This can directly impact the bank's net interest margins and overall fee-based revenue streams.

Digital empowerment significantly boosts customer bargaining power in Taiwan's banking sector. By July 2025, the widespread adoption of digital banking and mobile payment solutions means customers can easily compare offerings and switch providers, as seen with the increasing use of third-party payment apps. This accessibility reduces the effort and cost associated with changing banks, giving customers more leverage.

Sophistication of Corporate Clients

Large corporate clients of Chang Hwa Bank are highly sophisticated, often possessing deep financial expertise and substantial negotiating power. Their significant transaction volumes and strong credit ratings allow them to demand highly customized financial solutions and preferential terms on services like loans and trade finance. This sophistication intensifies competition among financial institutions vying for their business.

These major clients can effectively leverage their financial clout to secure more favorable pricing and tailored product offerings. For instance, in 2024, major corporations frequently negotiated lower interest rates on large credit facilities, directly impacting bank profitability. This bargaining power means banks must continuously innovate and offer competitive packages to retain these valuable relationships.

- Sophisticated Financial Expertise: Corporate clients often have dedicated treasury departments that understand complex financial instruments and market dynamics.

- Transaction Volume Leverage: The sheer scale of their banking needs gives them considerable weight in price and service negotiations.

- Creditworthiness Advantage: Strong financial health makes them attractive borrowers, enabling them to dictate terms.

- Demand for Bespoke Solutions: They require specialized services that larger banks are often willing to customize to win mandates.

Influence of Wealth Management Clients

The growing affluent and high-net-worth individual segments in Taiwan, a key market for Chang Hwa Bank, are increasingly dictating terms in wealth management. These clients, often with substantial assets, demand highly personalized service, bespoke investment products, and superior returns, thereby wielding considerable bargaining power.

For instance, by 2024, Taiwan's wealth management market is projected to continue its upward trajectory, with a significant portion of this growth driven by these very segments. Banks actively courting these profitable clients must therefore offer competitive fee structures and innovative solutions to retain their business.

- Growing Affluent Segments: Increased wealth in Taiwan fuels demand for sophisticated wealth management.

- High Client Expectations: Affluent clients expect personalized advice, tailored products, and competitive returns.

- Bargaining Power: These clients can negotiate terms due to their significant asset value and the competitive landscape.

- Bank Strategies: Banks like Chang Hwa Bank are incentivized to offer premium services and attractive rates to capture this market.

The bargaining power of customers in Taiwan's banking sector is amplified by market saturation and increasing digital accessibility, forcing Chang Hwa Bank to focus on competitive pricing and superior service. Customers can easily switch providers, especially with digital platforms making comparisons effortless, putting pressure on banks to offer attractive rates and fees. This dynamic is particularly evident with large corporate clients and the growing affluent segment, who leverage their financial sophistication and asset size to negotiate favorable terms.

| Factor | Impact on Chang Hwa Bank | Customer Leverage |

| Market Saturation | Intensified competition for customers | High; numerous banking options available |

| Digitalization & Comparison Tools | Pressure on pricing and fee structures | High; easy access to product and rate information |

| Corporate Client Sophistication | Need for tailored solutions and preferential rates | Very High; significant transaction volumes and expertise |

| Affluent Customer Demands | Focus on personalized wealth management services | High; substantial assets and demand for premium offerings |

Preview the Actual Deliverable

Chang Hwa Bank Porter's Five Forces Analysis

This preview showcases the comprehensive Porter's Five Forces Analysis for Chang Hwa Bank, detailing the competitive landscape and strategic implications. The document you see here is the exact, fully formatted report you will receive immediately after purchase, offering no surprises and no placeholders. You're looking at the actual, professionally written analysis, ready for your immediate use and strategic decision-making.

Rivalry Among Competitors

The Taiwanese banking sector is a crowded arena, with 38 domestic banks and 31 foreign bank branches operating by the end of 2024. This high degree of fragmentation means Chang Hwa Bank faces significant rivalry for customers and market share. The sheer number of institutions intensifies competition, pushing banks to offer competitive rates and services to stand out.

Many core banking products, like savings accounts and personal loans, are very similar across different institutions. This lack of unique features means competition often boils down to who offers the lowest interest rates or fees, squeezing profitability. For instance, in 2024, the average net interest margin for Taiwanese banks hovered around 1.1%, a figure susceptible to intense price-based competition.

The financial landscape is being reshaped by the rise of digital-only banks and the aggressive digital transformation of established players, significantly heightening competitive rivalry. Taiwan's market, for instance, has seen the emergence of pure-play digital banks like Line Bank, Next Bank, and Rakuten International Commercial Bank, directly challenging traditional institutions.

While these new entrants are still navigating the path to profitability, their presence is a powerful catalyst for innovation. They compel incumbent banks, including Chang Hwa Bank, to invest heavily in enhancing their digital platforms and customer service offerings to remain competitive and retain market share.

Government Influence and D-SIB Status

Government intervention significantly shapes the banking sector's competitive dynamics. In Taiwan, this includes direct ownership stakes in some institutions and the designation of Domestic Systemically Important Banks (D-SIBs). These classifications influence regulatory oversight and capital requirements, thereby affecting competitive pressures.

Chang Hwa Bank, as of November 2024, is not designated as one of the six D-SIBs in Taiwan. This status suggests a moderate level of systemic importance, potentially differentiating its competitive environment from that of the larger, more systemically critical banks. This distinction can impact its strategic positioning and the nature of its competitive rivalries.

- Government Ownership: The government's direct or indirect ownership in certain banks can create an uneven playing field, influencing lending practices and strategic decisions.

- D-SIB Designation: Being a D-SIB often entails stricter regulatory scrutiny and higher capital buffers, which can affect a bank's operational flexibility and competitive capacity.

- Competitive Landscape: Chang Hwa Bank's non-D-SIB status means it may face less intense regulatory pressure but also potentially fewer advantages associated with systemic importance compared to its D-SIB peers.

Slowing Loan Growth and Revenue Pressures

Competitive rivalry within the Taiwanese banking sector is intensifying as loan growth, while robust in 2024, is projected to slow down in 2025 due to prevailing economic uncertainties. This moderation in lending activity directly impacts revenue streams.

Furthermore, Taiwanese banks are bracing for a potential decline in revenue for 2025, largely attributed to anticipated lower gains from foreign exchange swap transactions. This revenue pressure forces banks to compete more aggressively for existing customer business.

- Slowing Loan Growth: While 2024 saw healthy loan expansion, forecasts for 2025 indicate a moderation due to increased economic uncertainty.

- Revenue Headwinds: Banks anticipate reduced revenue in 2025, particularly from foreign exchange swap gains, impacting overall profitability.

- Intensified Competition: The combination of slower loan growth and revenue pressures escalates competition for market share and existing client relationships.

- Profitability Challenges: Banks face the difficult task of maintaining profitability amidst these challenging market conditions, necessitating strategic adjustments.

Chang Hwa Bank operates in a highly competitive Taiwanese banking market, characterized by numerous domestic and foreign institutions. This intense rivalry forces banks to compete fiercely on price, particularly for standardized products like savings accounts and personal loans, as evidenced by the tight net interest margins seen in 2024. The emergence of digital-only banks further amplifies this competition, compelling traditional players to invest in digital innovation to retain customers.

Anticipated slower loan growth and potential revenue declines in 2025, especially from foreign exchange transactions, will likely intensify competition for existing business. Chang Hwa Bank's status as a non-D-SIB means it operates under different regulatory pressures compared to systemically important banks, influencing its strategic approach to rivalry.

| Metric | 2024 (Estimate) | 2025 (Projection) |

| Number of Domestic Banks | 38 | 38 |

| Number of Foreign Bank Branches | 31 | 31 |

| Average Net Interest Margin (Taiwanese Banks) | ~1.1% | Likely to remain under pressure |

| Loan Growth (Taiwanese Banks) | Robust | Projected to slow |

SSubstitutes Threaten

The rise of digital payment platforms and e-wallets like Taiwan Pay, Line Pay, and JKoPay presents a significant threat of substitution for Chang Hwa Bank. These services directly compete with traditional banking transactions, offering consumers a convenient alternative to cash, checks, and even credit cards for everyday purchases. In 2023, Taiwan Pay alone reported over 100 million transactions, highlighting the scale of this shift away from conventional banking methods.

Non-bank fintech companies are increasingly offering direct lending, peer-to-peer lending, and digital investment platforms that provide viable alternatives to traditional banking services. For instance, Taiwan's embedded finance market is expanding, with embedded lending solutions becoming more prevalent, directly challenging conventional bank loan offerings.

While not yet legal tender, cryptocurrencies and other digital assets present a growing threat to traditional banking services. Taiwan's evolving regulatory landscape for Virtual Asset Service Providers (VASPs), with stricter registration rules effective January 2025, acknowledges this shift. This regulatory movement suggests a future where digital assets could increasingly serve as alternative stores of value and transaction methods, potentially diminishing customer reliance on conventional bank deposits and payment systems.

Non-Bank Wealth Management Providers

Specialized wealth management firms, robo-advisors, and online brokerage platforms present a significant threat of substitutes to Chang Hwa Bank's traditional wealth management offerings. These alternatives often compete on price, with many robo-advisors charging annual management fees as low as 0.25% compared to traditional advisors who might charge 1% or more. Furthermore, their digital-first approach offers enhanced accessibility and convenience, attracting a growing segment of the market, particularly younger investors.

The Financial Supervisory Commission (FSC) in Taiwan has actively supported the growth of these fintech solutions, approving applications for robo-advisors within its regulatory sandbox. This regulatory environment fosters innovation and allows these substitute providers to refine their services, making them increasingly competitive. For instance, by mid-2024, several robo-advisory platforms had already amassed billions in assets under management, demonstrating their market traction.

- Lower Fees: Robo-advisors can offer management fees significantly below those charged by traditional bank advisors, potentially saving investors basis points annually.

- Increased Accessibility: Online platforms and robo-advisors provide 24/7 access to investment tools and financial planning, removing geographical and time-based barriers.

- Regulatory Support: The FSC's sandbox initiatives for robo-advisors indicate a favorable environment for these digital wealth management substitutes.

- Growing Market Share: The increasing adoption of digital financial services suggests a continued shift of assets away from traditional providers towards more agile, tech-driven alternatives.

Insurance and Hybrid Financial Products

Insurance companies are increasingly offering sophisticated financial products that directly compete with traditional banking services. For instance, annuities and investment-linked insurance policies can act as substitutes for savings accounts and mutual funds, attracting capital that might otherwise flow into banks. In 2024, the global life insurance market alone was valued at over $3 trillion, demonstrating the significant financial resources channeled through these alternative avenues.

Furthermore, the rise of hybrid financial products, which blend elements of both insurance and banking, presents a notable threat. These integrated solutions can offer customers a more streamlined approach to managing their finances, potentially diminishing their reliance on conventional banking relationships. This trend is particularly evident in wealth management and retirement planning, where combined offerings are gaining traction.

Chang Hwa Bank, like other traditional financial institutions, faces pressure from these evolving substitute products. The ability of insurance providers to offer competitive returns and comprehensive financial planning under one roof challenges the market share of banks in key areas.

- Competitive Offerings: Insurance products like annuities and investment-linked policies directly substitute for bank savings and investment vehicles.

- Market Size: The global life insurance market exceeding $3 trillion in 2024 highlights the substantial capital attracted by these substitutes.

- Hybrid Products: Integrated financial solutions blurring banking and insurance lines reduce the need for distinct banking services.

- Wealth Management Impact: The threat is particularly pronounced in wealth management and retirement planning sectors.

The threat of substitutes for Chang Hwa Bank is substantial, driven by the increasing sophistication and accessibility of non-traditional financial services. Digital payment platforms and fintech companies are directly challenging core banking functions, while alternative investment and wealth management solutions are capturing market share. Even insurance providers are offering products that can substitute for traditional bank offerings, particularly in savings and investment. This multifaceted competitive landscape necessitates continuous adaptation by Chang Hwa Bank to retain its customer base and relevance.

| Substitute Type | Key Features | Market Penetration/Growth Indicator | Impact on Chang Hwa Bank |

| Digital Payments & E-wallets | Convenience, speed, peer-to-peer transfers | Taiwan Pay: Over 100 million transactions (2023) | Reduces reliance on traditional bank transfers and card payments |

| Fintech Lending & Investment | Direct lending, P2P platforms, digital wealth management | Robo-advisors: Billions in AUM by mid-2024 | Offers alternative credit and investment avenues, bypassing banks |

| Digital Assets (e.g., Cryptocurrencies) | Decentralized transactions, alternative store of value | Taiwan VASP registration rules effective Jan 2025 | Potential long-term shift from traditional deposits and payment systems |

| Insurance-based Financial Products | Annuities, investment-linked policies | Global life insurance market: >$3 trillion (2024) | Captures savings and investment capital, competes in wealth management |

Entrants Threaten

The Taiwanese banking sector is characterized by high regulatory barriers to entry, significantly deterring new competitors. Stringent licensing requirements, robust capital adequacy standards, and extensive compliance obligations are mandated by authorities, making it exceptionally challenging for new entities to establish full-service commercial banking operations. For instance, as of early 2024, the Financial Supervisory Commission (FSC) in Taiwan maintains strict oversight, requiring substantial capital reserves and adherence to complex operational guidelines, which are difficult for nascent firms to meet.

Establishing and operating a bank demands significant initial capital and continuous maintenance to adhere to stringent regulatory standards and fund day-to-day operations. This substantial financial hurdle effectively deters many prospective entrants, especially those lacking considerable financial resources. For instance, in 2023, Taiwan's banking sector saw a reported average capital adequacy ratio well above the regulatory minimums, demonstrating the sector's robust capitalization and the high barrier to entry.

Taiwan's financial landscape is notably saturated, often described as 'overbanked,' presenting a significant barrier for new entrants. In 2024, with numerous established institutions already serving the market, any newcomer must contend with deeply entrenched customer loyalty. This makes it exceptionally difficult to carve out a substantial market share.

Fintech Regulatory Sandbox and Niche Entry

Taiwan's Financial Supervisory Commission (FSC) established a fintech regulatory sandbox, allowing new entrants to test innovative financial technologies. This initiative lowers barriers for specialized fintech startups, enabling them to enter specific market niches rather than requiring full banking licenses, which remain challenging to acquire.

This sandbox environment specifically fosters entry for companies focusing on areas like embedded finance or tailored payment solutions. For instance, in 2023, Taiwan saw a significant increase in fintech pilot projects approved under such sandboxes, indicating a growing trend of specialized players entering the financial services landscape.

- Niche Focus: Fintech startups can enter with specialized offerings, bypassing the need for comprehensive banking licenses.

- Regulatory Support: The FSC's sandbox provides a controlled environment for testing new financial technologies.

- Market Impact: This facilitates competition in specific service areas, potentially improving customer choice and innovation.

- Entry Facilitation: The sandbox acts as a bridge for innovative firms to gain a foothold in the financial sector.

Incumbent Digitalization and Innovation

Existing financial institutions are significantly boosting their digital capabilities. For instance, in 2024, many major banks allocated substantial portions of their IT budgets towards AI-driven customer service and data analytics platforms. This rapid digital evolution by incumbents means that new digital-only banks face a more sophisticated and technologically advanced competitive landscape than might have been anticipated.

The threat of new entrants is therefore somewhat mitigated by the ongoing innovation within established banks. These incumbents are not standing still; they are actively integrating technologies like blockchain for enhanced security and efficiency, and leveraging big data to personalize customer experiences. This continuous improvement by existing players narrows the potential advantage that a new, digitally native competitor might otherwise exploit.

- Incumbent Banks' Digital Investment: Many traditional banks are channeling billions into digital transformation initiatives in 2024, focusing on AI, cloud computing, and data analytics.

- Enhanced Customer Experience: This investment aims to improve user interfaces, streamline processes, and offer more personalized financial products, directly competing with the core value proposition of many fintech startups.

- Reduced Advantage for New Entrants: As incumbents become more digitally adept, the perceived gap between them and potential new digital-only competitors shrinks, making market entry more challenging for the latter.

While high capital requirements and regulatory hurdles present significant barriers, the threat of new entrants in Taiwan's banking sector is nuanced. The Financial Supervisory Commission's fintech regulatory sandbox, active since 2023, allows specialized startups to test innovative solutions, lowering entry barriers for niche players. For example, a number of fintech pilot projects focusing on areas like digital payments received approval in 2023.

| Factor | Impact on New Entrants | Example (2023-2024) |

|---|---|---|

| Regulatory Barriers | High (Capital, Licensing) | FSC mandates strict capital adequacy ratios, often exceeding 10% for established banks. |

| Market Saturation | Challenging (Customer Loyalty) | Taiwan's banking sector is considered overbanked, with numerous established players. |

| Fintech Sandbox | Facilitates Niche Entry | Increased approvals for pilot projects in digital payments and embedded finance. |

| Incumbent Digitalization | Increases Competition | Banks investing heavily in AI and data analytics, narrowing the tech gap. |

Porter's Five Forces Analysis Data Sources

Our Chang Hwa Bank Porter's Five Forces analysis is built upon a foundation of reliable data, including the bank's official annual reports, filings with Taiwan's Financial Supervisory Commission, and industry-specific publications from financial research firms.

We leverage data from reputable financial databases like Bloomberg and S&P Capital IQ, alongside market research reports and competitor disclosures, to meticulously assess the competitive landscape for Chang Hwa Bank.