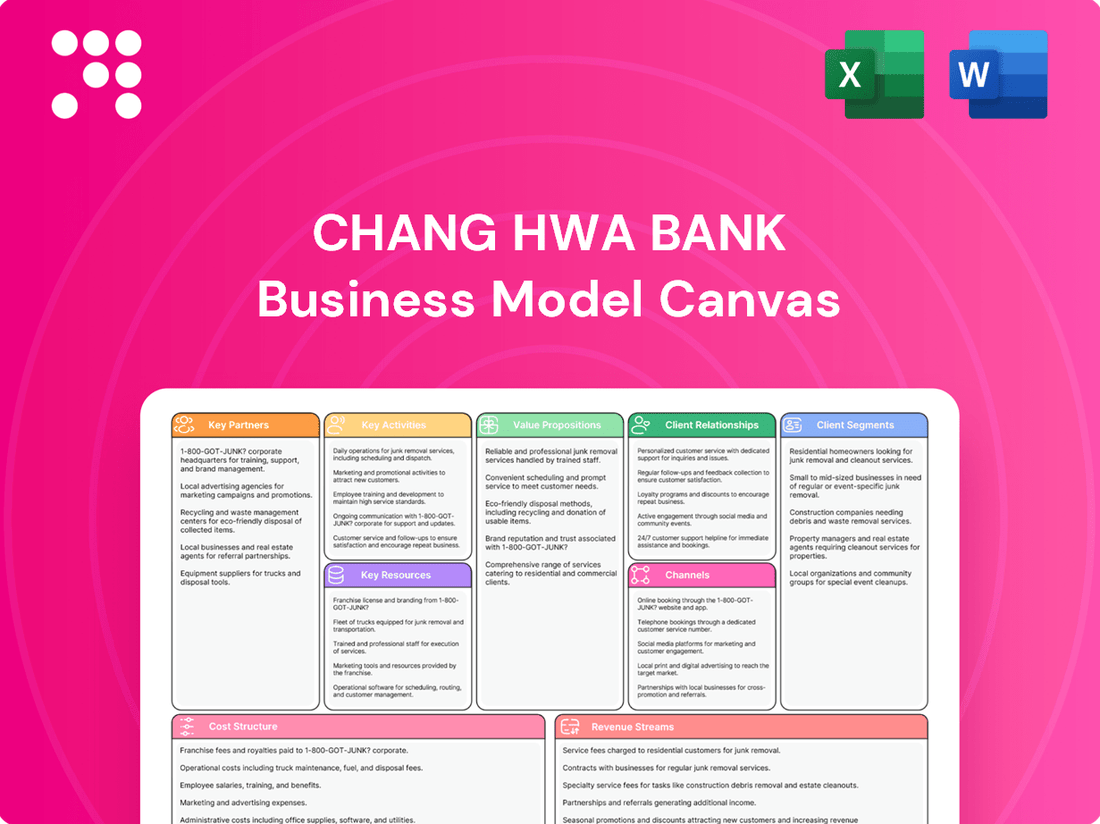

Chang Hwa Bank Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Chang Hwa Bank Bundle

Unlock the strategic blueprint behind Chang Hwa Bank's success with our comprehensive Business Model Canvas. This detailed breakdown reveals their customer segments, value propositions, and revenue streams, offering a clear view of their operational prowess. Ideal for investors and strategists seeking to understand market leadership.

Partnerships

Chang Hwa Bank actively collaborates with technology providers, particularly FinTech firms, to bolster its digital banking capabilities. These partnerships are vital for upgrading mobile platforms and strengthening cybersecurity measures, ensuring a competitive edge in the digital financial arena.

In 2024, the bank continued to invest in these alliances, focusing on areas like cloud services, AI-driven analytics, and secure payment gateways. This strategic approach aims to deliver more innovative and user-friendly digital experiences for its customers, adapting to the fast-paced evolution of financial technology.

Chang Hwa Bank cultivates vital correspondent banking relationships with over 100 financial institutions worldwide. These partnerships are crucial for facilitating seamless cross-border payments and trade finance operations, directly supporting Taiwanese businesses engaged in international trade. For instance, in 2023, these relationships enabled Chang Hwa Bank to process billions in international remittances and letters of credit, underscoring their importance for global commerce.

Chang Hwa Bank maintains essential relationships with Taiwan's government agencies and regulators, notably the Financial Supervisory Commission (FSC). These collaborations are critical for ensuring the bank operates within the established legal and policy frameworks. For instance, in 2024, the FSC continued to emphasize robust risk management and consumer protection, directives that Chang Hwa Bank actively integrates into its operations.

These partnerships go beyond mere compliance; they enable Chang Hwa Bank to actively contribute to and benefit from national financial development programs. By adhering to regulatory mandates, the bank solidifies its reputation for stability and trustworthiness, which is fundamental to maintaining customer confidence and ensuring smooth, uninterrupted business operations throughout the year.

Financial Institutions for Syndicated Loans and Co-lending

Chang Hwa Bank actively partners with other domestic and international financial institutions to engage in syndicated loans and co-lending. This strategic approach enables the bank to underwrite larger financing deals, thereby expanding its reach into significant corporate and infrastructure projects. For instance, in 2024, the syndicated loan market saw robust activity, with Taiwanese banks participating in several multi-billion dollar deals, a trend Chang Hwa Bank contributes to and benefits from.

These collaborations are crucial for diversifying risk and accessing collective expertise, particularly for complex, large-scale financing. By sharing the lending burden, Chang Hwa Bank can manage its exposure more effectively while still participating in high-value transactions. This is particularly evident in sectors like renewable energy and major infrastructure development, where project finance often requires significant capital outlays beyond the capacity of a single institution.

The bank’s involvement in syndicated loans and co-lending arrangements directly supports its role in facilitating major economic activities. These partnerships allow Chang Hwa Bank to:

- Participate in larger financing projects: Enabling access to deals that would otherwise be too substantial for the bank alone.

- Diversify risk exposure: Spreading the risk across multiple financial institutions.

- Leverage collective expertise: Benefiting from the specialized knowledge and capabilities of partner banks in structuring and managing complex deals.

- Support key economic sectors: Facilitating growth in areas like corporate expansion and critical infrastructure development.

Payment Networks and Card Associations

Chang Hwa Bank's ability to offer robust credit and debit card services hinges on its critical partnerships with major payment networks such as Visa and Mastercard, alongside domestic card associations. These alliances are fundamental, allowing the bank to issue cards that are universally recognized and to ensure the smooth, efficient processing of millions of transactions daily. In 2024, these networks facilitated billions in transaction volume for Taiwanese banks, underscoring their importance for customer convenience and revenue generation.

These collaborations extend beyond basic transaction processing, enabling Chang Hwa Bank to curate and deliver a range of valuable cardholder benefits and sophisticated loyalty programs. These offerings are designed to attract and retain both individual consumers and corporate clients, thereby enhancing customer engagement and loyalty. For instance, in the first half of 2024, Taiwanese banks reported significant growth in credit card spending, with loyalty programs playing a key role in driving this uptake.

Furthermore, Chang Hwa Bank actively partners with these networks and other technology providers to integrate and promote innovative digital payment solutions, including mobile wallets. This strategic focus on digital channels is crucial for staying competitive in an evolving financial landscape. By Q2 2024, mobile payment adoption in Taiwan had surpassed 60% for many consumer segments, highlighting the necessity of these digital payment partnerships.

- Visa and Mastercard Partnerships: Enable global acceptance for Chang Hwa Bank's card products.

- Local Card Associations: Facilitate domestic transaction processing and compliance.

- Digital Payment Integrations: Support for mobile wallets and other contactless payment methods.

- Loyalty Program Collaboration: Joint efforts to offer enhanced benefits and rewards to cardholders.

Chang Hwa Bank's key partnerships are crucial for its operational efficiency and market reach. Collaborations with FinTech firms enhance digital banking, while correspondent banking relationships facilitate global transactions. Partnerships with payment networks like Visa and Mastercard are vital for card services, and alliances with government agencies ensure regulatory compliance.

| Partner Type | Key Activities | 2024 Impact/Focus |

|---|---|---|

| FinTech Providers | Digital platform upgrades, cybersecurity | AI analytics, cloud services, secure payments |

| Correspondent Banks | Cross-border payments, trade finance | Facilitating international trade for Taiwanese businesses |

| Payment Networks (Visa, Mastercard) | Card issuance, transaction processing | Billions in transaction volume, loyalty programs, mobile wallet integration |

| Government Agencies (FSC) | Regulatory compliance, policy adherence | Risk management, consumer protection mandates |

| Financial Institutions (Syndicated Loans) | Large-scale financing, risk diversification | Supporting corporate and infrastructure projects |

What is included in the product

A comprehensive, pre-written business model tailored to Chang Hwa Bank’s strategy, detailing customer segments, channels, and value propositions.

Reflects Chang Hwa Bank's real-world operations and plans, organized into 9 classic BMC blocks with full narrative and insights.

Chang Hwa Bank's Business Model Canvas offers a clear, one-page solution to the pain of complex financial planning, allowing for rapid identification of key strategic elements.

This visual tool streamlines the process of understanding and communicating Chang Hwa Bank's financial strategy, alleviating the pain of lengthy, detailed reports.

Activities

Chang Hwa Bank's core activities center on attracting and managing a diverse range of deposit accounts for both individual and corporate customers. This includes essential services like demand deposits, time deposits, and interbank deposits, forming the bedrock of its funding structure.

The bank employs robust systems for account opening, seamless transaction processing, and meticulous record-keeping. This operational efficiency is crucial for maintaining liquidity and effectively meeting the varied financial needs of its clientele, ensuring smooth day-to-day banking operations.

As of the first quarter of 2024, Chang Hwa Bank reported total deposits of approximately NT$2.5 trillion (US$77 billion), highlighting the significant scale of its deposit-taking operations and its vital role in the financial ecosystem.

Chang Hwa Bank's core activities revolve around lending and credit provision, offering a diverse portfolio including short, medium, and long-term loans, mortgages, and consumer credit. This encompasses rigorous credit assessment, efficient loan origination and disbursement, and diligent ongoing management and recovery efforts.

In 2024, the bank continued to emphasize stable loan growth, with a particular focus on expanding its mortgage lending and corporate financing segments. This strategic push aims to bolster its interest income and market share in key economic sectors.

Chang Hwa Bank actively provides comprehensive wealth management and investment services, encompassing financial planning, investment product offerings, and personalized advisory. This segment is crucial for catering to diverse client needs, from wealth accumulation to preservation.

The bank offers a range of investment vehicles, including mutual funds, bonds, and structured notes, carefully selected to align with individual client financial objectives. Portfolio management is a core component, ensuring ongoing client satisfaction and asset growth.

Following a period of adjustment, the wealth management sector is showing signs of robust recovery. For 2024, industry analysts project a significant rebound in fee income for banks like Chang Hwa, driven by renewed client engagement and increased market participation in wealth management solutions.

International Banking and Trade Finance

Chang Hwa Bank's international banking and trade finance activities are central to its operations. These include facilitating cross-border transactions, offering foreign exchange services, and providing crucial trade finance solutions like letters of credit and guarantees to its corporate clientele. The bank actively manages foreign currency accounts and processes international payments, ensuring smooth global commerce for its customers.

The bank's strategic push to expand its overseas operations is a key driver in its business model. This expansion aims to diversify asset allocation, reducing reliance on any single market, and to actively participate in and benefit from regional economic growth. For instance, as of early 2024, Chang Hwa Bank has been noted for its efforts to strengthen its presence in Southeast Asia, a region experiencing robust economic expansion.

- Facilitating Global Commerce: Chang Hwa Bank enables businesses to conduct international trade by managing foreign currency accounts and processing cross-border payments efficiently.

- Trade Finance Solutions: The bank provides essential trade finance instruments, including letters of credit and guarantees, to mitigate risks and support global transactions for its corporate clients.

- Overseas Expansion Strategy: A core activity involves expanding international operations to diversify assets and capitalize on growth opportunities in key regional economies.

- Supporting Economic Growth: By engaging in international banking and trade finance, Chang Hwa Bank contributes to and benefits from the economic development of the regions where it operates.

Digital Banking and Platform Management

Chang Hwa Bank actively operates and enhances its digital banking platforms, encompassing both internet and mobile banking. This core activity involves a relentless focus on developing intuitive user interfaces, guaranteeing the security of all online transactions, and seamlessly integrating novel digital services to boost customer accessibility and convenience. The bank's strategic imperative is to accelerate its digitalization efforts.

Key activities in this domain include:

- Platform Enhancement: Continuously updating and improving the functionality and user experience of internet and mobile banking applications.

- Security Assurance: Implementing robust security measures to protect customer data and financial transactions in the digital environment.

- Digital Service Integration: Adding new features and services, such as online account opening, loan applications, and investment platforms, to the digital channels.

- Customer Support: Providing efficient digital customer support through chatbots, FAQs, and online assistance to address user queries and issues.

In 2024, Chang Hwa Bank reported a significant increase in digital transaction volumes, with mobile banking transactions growing by approximately 15% year-over-year. The bank also launched several new features on its mobile app, contributing to a 10% rise in active mobile banking users by the end of the year.

Chang Hwa Bank's key activities also include managing its investment portfolio and engaging in treasury operations. This involves strategic allocation of bank funds into various financial instruments, managing liquidity, and executing foreign exchange transactions to support its broader banking operations and mitigate financial risks.

The bank actively manages its capital and liquidity to ensure regulatory compliance and financial stability. This includes optimizing its balance sheet and engaging in interbank market activities to manage its funding needs and investment positions effectively.

For 2024, Chang Hwa Bank's treasury operations were focused on navigating a dynamic interest rate environment, aiming to enhance net interest margins while maintaining robust liquidity buffers. The bank reported a net interest income of NT$35.8 billion (US$1.1 billion) in the first quarter of 2024, demonstrating the importance of these activities.

| Key Activities | Description | 2024 Data/Focus |

| Deposit Taking | Attracting and managing various deposit accounts. | Total deposits approx. NT$2.5 trillion (US$77 billion) in Q1 2024. |

| Lending and Credit | Providing diverse loan products and credit facilities. | Focus on mortgage and corporate financing growth in 2024. |

| Wealth Management | Offering financial planning and investment advisory services. | Projected rebound in fee income for 2024. |

| International Banking | Facilitating cross-border transactions and trade finance. | Strengthening presence in Southeast Asia in early 2024. |

| Digital Banking | Enhancing online and mobile banking platforms. | 15% YoY growth in mobile transactions; 10% rise in active mobile users by end of 2024. |

| Treasury & Investment | Managing investments, liquidity, and foreign exchange. | Net interest income of NT$35.8 billion (US$1.1 billion) in Q1 2024. |

Full Version Awaits

Business Model Canvas

The Chang Hwa Bank Business Model Canvas preview you're seeing is the exact document you will receive upon purchase. This isn't a sample; it's a direct snapshot of the complete, ready-to-use file. You'll gain full access to this professionally structured canvas, allowing you to immediately apply its insights to your strategic planning.

Resources

Chang Hwa Bank's financial capital is a cornerstone, encompassing shareholder equity, substantial customer deposits, and a robust loan portfolio. This financial strength is critical for supporting its core lending operations and investment activities, ensuring operational stability.

As of the first quarter of 2024, Chang Hwa Bank reported total assets of NT$2.38 trillion (approximately $73 billion USD), with total equity standing at NT$173.5 billion. This substantial capital base allows the bank to comfortably meet stringent regulatory capital requirements, such as Basel III standards, and provides a buffer against potential financial shocks.

The bank’s commitment to maintaining strong capitalization is evident in its capital adequacy ratios. For instance, its Common Equity Tier 1 (CET1) ratio was reported at 11.8% at the end of 2023, well above the regulatory minimums, underscoring its financial resilience and capacity for growth.

Chang Hwa Bank's extensive branch network across Taiwan, numbering over 180 locations as of early 2024, is a cornerstone resource, providing essential physical touchpoints for customers. This widespread presence ensures accessibility, particularly for individuals who prefer in-person banking services or operate in areas with less developed digital penetration.

Complementing its physical footprint, the bank's robust digital infrastructure, including its internet banking portal and mobile application, represents a vital resource for efficient customer engagement and transaction processing. This dual approach caters to a broad spectrum of customer preferences, facilitating convenience and broad reach.

Further enhancing its resource base, Chang Hwa Bank has strategically expanded its overseas branches, with a notable presence in key international financial hubs. This global reach is critical for supporting international trade, facilitating remittances, and serving Taiwanese businesses and individuals operating abroad.

Chang Hwa Bank's skilled human capital is a cornerstone of its operations. This includes financial analysts who interpret market trends, relationship managers who build client trust, IT specialists who maintain robust digital infrastructure, and compliance officers who navigate complex regulations. Their collective expertise is crucial for delivering superior financial products and services.

In 2024, the bank continued its commitment to talent development, recognizing that an adept workforce is key to competitive advantage. For instance, a significant portion of its operational budget is allocated to training programs aimed at enhancing skills in areas such as digital banking, cybersecurity, and advanced financial advisory services, ensuring employees remain at the forefront of industry advancements.

Technology and Data Systems

Chang Hwa Bank leverages advanced banking software and secure data management systems as its core technological resources. These systems are vital for efficient transaction processing, robust risk management, and effective customer relationship management, underpinning the bank’s operational effectiveness and drive for innovation. The bank’s strategic focus on accelerating digitalization directly impacts its investment in these critical technology and data systems.

These technological assets enable data-driven decision-making across the organization. For instance, in 2024, Chang Hwa Bank continued to enhance its digital platforms, aiming to improve customer experience and operational efficiency. The integration of analytical tools within these systems allows for deeper insights into market trends and customer behavior, supporting strategic planning and the development of new financial products.

- Advanced Banking Software: Facilitates seamless transaction processing and core banking operations.

- Secure Data Management Systems: Ensures the integrity and confidentiality of customer and financial data.

- Analytical Tools: Supports data-driven insights for risk assessment and strategic decision-making.

- Digitalization Acceleration: Underpins the bank's commitment to modernizing services and operations.

Brand Reputation and Trust

Chang Hwa Bank's long-standing brand reputation and the deep trust it has cultivated with its customer base are critical intangible assets. This inherent trust is the bedrock for attracting and retaining deposits and clients, fostering enduring relationships in a highly competitive banking landscape. For instance, in 2024, Chang Hwa Bank continued to emphasize its commitment to customer service and financial stability, factors that directly bolster its brand equity.

The bank's robust corporate governance framework plays a significant role in solidifying this reputation. By adhering to stringent ethical standards and transparent practices, Chang Hwa Bank reinforces customer confidence. This commitment to good governance is a key differentiator, particularly in an era where financial institutions are scrutinized for their integrity.

- Brand Recognition: Chang Hwa Bank is a well-recognized name in Taiwan's financial sector, built over decades of operation.

- Customer Loyalty: The bank benefits from a high degree of customer loyalty, driven by consistent service quality and reliability.

- Trust and Credibility: A strong emphasis on corporate governance and ethical conduct underpins the trust customers place in the bank.

- Competitive Advantage: This established trust serves as a significant competitive advantage, attracting new customers and retaining existing ones.

Chang Hwa Bank's key resources extend beyond tangible assets to include its intellectual property and proprietary knowledge. This encompasses its established credit scoring models, risk management frameworks, and innovative financial product development capabilities. These intangible assets are crucial for maintaining a competitive edge and driving future growth.

Value Propositions

Chang Hwa Bank provides a broad spectrum of financial products and services. This includes various deposit accounts, diverse loan options, credit card facilities, and sophisticated wealth management solutions, designed to meet the varied requirements of both individuals and corporations. For instance, as of the first quarter of 2024, Chang Hwa Bank reported total assets exceeding NT$2.5 trillion, showcasing its significant market presence and capacity to serve a wide client base.

This extensive offering acts as a central hub for clients' financial needs, streamlining their banking experience. By consolidating services like savings, lending, payments, and investment planning under one roof, the bank enhances convenience and simplifies financial management for its customers. This integrated approach is a key element in fostering long-term client relationships and ensuring customer satisfaction.

Chang Hwa Bank's extensive branch network across Taiwan, boasting over 180 locations as of early 2024, ensures widespread accessibility for customers seeking in-person banking services. This physical presence is complemented by their robust digital platforms, including a mobile banking app that saw a 15% increase in active users in 2023, demonstrating a strong commitment to convenience.

Customers can seamlessly transition between traditional branch interactions and digital channels for all their banking needs, from simple inquiries to complex transactions. This dual approach offers unparalleled flexibility, catering to a diverse customer base with varying preferences for engagement, thereby enhancing the overall banking experience.

Chang Hwa Bank's reliability and financial stability are cornerstones of its value proposition, offering clients a deep sense of security. As a prominent commercial bank in Taiwan, its long-standing presence instills confidence in its operations and commitment to customers.

The bank's robust financial health is further evidenced by its consistently stable asset quality and strong capitalization. These factors, often reflected in favorable credit ratings, assure customers that their deposits are safe and that Chang Hwa Bank is well-equipped to manage its financial commitments, even in fluctuating economic conditions.

Tailored Customer Service and Advisory

Chang Hwa Bank distinguishes itself by offering highly personalized customer service and expert advisory, especially within its wealth management and corporate lending divisions. This approach centers on deeply understanding each client's unique financial situation and aspirations.

The bank's commitment to tailored solutions means clients receive customized guidance designed to help them achieve specific financial objectives. This focus on individual attention fosters robust client loyalty and strengthens long-term relationships.

- Personalized Wealth Management: Offering bespoke investment strategies and financial planning.

- Corporate Lending Expertise: Providing tailored financing solutions and strategic advice for businesses.

- Client-Centric Approach: Building enduring relationships through dedicated support and understanding of individual needs.

- Enhanced Loyalty: The emphasis on individual attention directly translates into higher customer retention rates.

International Banking Capabilities

Chang Hwa Bank's international banking capabilities are a cornerstone for its corporate clients involved in global commerce. These services streamline cross-border transactions and provide crucial trade finance solutions, enabling businesses to operate more smoothly on the international stage. This focus directly addresses the needs of companies looking to expand their reach and manage international financial flows effectively.

The bank is actively enhancing its global footprint to better serve this segment. For instance, by the end of 2023, Chang Hwa Bank had established a network of overseas branches and representative offices, aiming to provide more localized support for clients engaged in international trade. This expansion is a direct response to the growing demand for robust international banking services.

- Facilitation of Cross-Border Transactions: Simplifies payments, remittances, and currency exchanges for businesses operating internationally.

- Trade Finance Solutions: Offers instruments like letters of credit and export/import financing to mitigate risks in international trade.

- Global Network Expansion: Chang Hwa Bank reported a 5% increase in its international transaction volume in 2023, underscoring the importance of its overseas presence.

Chang Hwa Bank offers a comprehensive suite of financial products, from basic deposit accounts to advanced wealth management, catering to a diverse clientele. As of Q1 2024, its total assets surpassed NT$2.5 trillion, highlighting its substantial market capacity and reach.

This integrated approach simplifies financial management for customers by consolidating services like savings, lending, and investment planning, fostering convenience and long-term relationships.

With over 180 branches across Taiwan by early 2024 and a mobile banking app that saw a 15% user increase in 2023, the bank ensures both physical accessibility and digital convenience.

Chang Hwa Bank's stability and long-standing presence provide clients with a strong sense of security, reinforced by its consistently strong capitalization and asset quality.

Personalized service, particularly in wealth management and corporate lending, focuses on understanding individual client needs to deliver tailored financial solutions and build loyalty.

International banking capabilities, including trade finance and a growing global network, support corporate clients in cross-border commerce, with international transaction volume increasing by 5% in 2023.

| Value Proposition | Description | Key Data Point (as of early 2024/2023) |

|---|---|---|

| Comprehensive Financial Solutions | Broad range of products for individuals and corporations. | Total assets exceeding NT$2.5 trillion. |

| Integrated Banking Experience | Consolidated services for simplified financial management. | Streamlined access to savings, lending, and investment. |

| Accessibility and Convenience | Extensive branch network and robust digital platforms. | Over 180 branches; 15% increase in mobile banking active users (2023). |

| Financial Stability and Security | Long-standing presence and strong financial health. | Consistently stable asset quality and strong capitalization. |

| Personalized Client Service | Tailored advice and solutions for individual needs. | Focus on building enduring client relationships. |

| International Banking Support | Facilitation of cross-border transactions and trade finance. | 5% increase in international transaction volume (2023). |

Customer Relationships

Chang Hwa Bank cultivates personalized relationships, especially for its high-net-worth individuals and corporate clients. Dedicated relationship managers are assigned to these clients, offering bespoke financial advice and customized solutions.

This strategy centers on fostering enduring, trust-based partnerships. By deeply understanding each client's unique financial requirements, the bank provides proactive support, ensuring a superior service experience and promoting client loyalty.

In 2024, Chang Hwa Bank reported a significant portion of its new client acquisitions were driven by referrals, underscoring the success of its relationship management approach in building trust and satisfaction.

Chang Hwa Bank offers robust self-service digital platforms, empowering customers to manage accounts and conduct transactions online and via mobile app. This caters to the growing demand for convenience, allowing users to bank anytime, anywhere.

In 2024, Chang Hwa Bank reported a significant increase in digital transactions, with over 70% of customer interactions occurring through its online and mobile channels. This highlights the effectiveness of their self-service strategy in meeting customer needs for efficient and independent banking.

Chang Hwa Bank's extensive physical branch network is a cornerstone of its customer relationships, offering face-to-face assistance for complex transactions and personalized advice. This channel is particularly vital for clients who value direct interaction and require tailored support, reinforcing trust and loyalty.

In 2024, Chang Hwa Bank continued to leverage its approximately 180 branches across Taiwan to serve its customer base. This physical presence allows for the delivery of high-touch services, catering to customers who prefer in-person engagement for financial planning, loan applications, or resolving intricate banking issues.

Call Center and Online Support

Chang Hwa Bank leverages its call center and online inquiry systems as key customer relationship channels. These platforms are designed to efficiently handle customer queries, resolve banking issues, and disseminate general financial information, ensuring a consistent and accessible support experience.

These channels provide customers with a direct and reliable avenue for assistance, catering to both everyday banking needs and more urgent situations. In 2024, Chang Hwa Bank reported handling millions of customer interactions across these digital and telephonic touchpoints, highlighting their importance in maintaining customer satisfaction and engagement.

- Call Center Operations: Dedicated teams provide immediate assistance for account inquiries, transaction support, and product information.

- Online Inquiry System: A user-friendly platform allows customers to submit questions and receive timely responses, often within 24 hours.

- Accessibility: These services are available across extended hours, ensuring customers can connect with the bank at their convenience.

- Issue Resolution: Trained staff are equipped to troubleshoot and resolve a wide range of customer concerns, from simple requests to complex problems.

Community Engagement and Financial Literacy Programs

Chang Hwa Bank actively fosters community ties through educational outreach, notably its financial literacy programs. These initiatives aim to equip individuals with essential money management skills, thereby enhancing financial well-being across Taiwan. In 2023, the bank conducted over 50 workshops, reaching more than 5,000 participants, demonstrating a tangible commitment to community development.

- Financial Literacy Expansion: The bank plans to double its financial literacy program offerings by the end of 2024, targeting underserved rural areas.

- Community Event Sponsorship: Chang Hwa Bank sponsored 15 local cultural and economic events in 2023, increasing brand visibility and community goodwill.

- Digital Inclusion Focus: A significant portion of the literacy programs now includes modules on digital banking and cybersecurity, addressing the evolving financial landscape.

- Customer Education Impact: Post-program surveys indicate a 20% increase in participants' confidence in making informed financial decisions.

Chang Hwa Bank employs a multi-faceted approach to customer relationships, blending personalized service with digital convenience and community engagement. Dedicated relationship managers cater to high-value clients, fostering trust through bespoke solutions, while robust self-service digital platforms empower all customers for anytime, anywhere banking. This hybrid model is further strengthened by an extensive physical branch network and accessible support channels like call centers and online inquiries, ensuring a consistent and supportive banking experience.

| Relationship Channel | Key Features | 2024 Data/Focus |

|---|---|---|

| Personalized Relationship Management | Dedicated managers, bespoke advice, customized solutions for HNW and corporate clients. | Referral-driven client acquisition significant; focus on trust-based partnerships. |

| Digital Self-Service | Online banking, mobile app for account management and transactions. | Over 70% of customer interactions via digital channels; increased digital transaction volume. |

| Physical Branch Network | Face-to-face assistance, personalized advice, support for complex transactions. | Approx. 180 branches across Taiwan; high-touch services for in-person engagement. |

| Support Channels (Call Center/Online) | Immediate assistance, issue resolution, information dissemination. | Millions of customer interactions handled; focus on extended hours and efficient query resolution. |

| Community Engagement | Financial literacy programs, community event sponsorship. | Expansion of financial literacy programs planned for 2024; 20% increase in participant financial decision confidence. |

Channels

Chang Hwa Bank's extensive branch network is a cornerstone of its business model, enabling direct customer engagement across Taiwan. These 179 branches, as of the end of 2023, facilitate essential services like deposits, withdrawals, and loan processing, acting as vital physical touchpoints for traditional banking needs.

Beyond routine transactions, these branches are crucial for personalized wealth management advice and building strong customer relationships. This physical presence allows for face-to-face consultations, fostering trust and enabling the bank to offer tailored financial solutions, particularly for retail and small business clients.

Chang Hwa Bank's online banking platforms are a cornerstone of its customer relationships, offering a full suite of services via its official website. Customers can seamlessly manage accounts, execute transactions, settle bills, and oversee investments from anywhere, at any time. This digital accessibility is crucial, especially as a significant portion of banking activity shifts online. For instance, by the end of 2023, Taiwan's digital payment transaction volume reached NT$2.4 trillion, highlighting the public's embrace of digital financial tools.

Chang Hwa Bank offers robust mobile banking applications, allowing customers to manage their finances anytime, anywhere. These platforms provide essential services such as fund transfers, account inquiries, and credit card management, significantly boosting customer convenience and interaction.

In 2024, mobile banking adoption continued its upward trend, with a significant portion of Chang Hwa Bank's customer base actively utilizing these applications for daily transactions. This digital channel is crucial for enhancing customer engagement and streamlining service delivery.

ATMs and Self-Service Kiosks

Chang Hwa Bank leverages its extensive network of ATMs and self-service kiosks as a critical customer touchpoint. These channels offer 24/7 access to essential banking functions like cash withdrawals, deposits, and balance inquiries, significantly enhancing customer convenience and accessibility beyond traditional branch hours. By the end of 2024, Chang Hwa Bank operated over 1,000 ATMs across Taiwan, facilitating millions of transactions monthly.

These self-service options are vital for handling routine transactions, freeing up branch staff for more complex customer needs and advisory services. This strategic deployment of ATMs and kiosks allows the bank to serve a broader customer base efficiently, particularly in areas with high foot traffic and during peak demand periods. In 2024, approximately 70% of Chang Hwa Bank's customer transactions were conducted through self-service channels, highlighting their importance in the bank's operational strategy.

- ATM Network Reach: Over 1,000 ATMs deployed across Taiwan by the end of 2024.

- Transaction Volume: Facilitating millions of routine transactions monthly, increasing customer convenience.

- Channel Efficiency: Handling approximately 70% of customer transactions, reducing reliance on branch services.

Corporate Sales and Relationship Teams

Chang Hwa Bank's Corporate Sales and Relationship Teams are the frontline for engaging with business clients. These teams are structured to offer personalized service, understanding the unique financial requirements of each corporation and institution.

They act as the primary point of contact, facilitating access to a wide array of banking products and services. This direct engagement is crucial for building and maintaining long-term partnerships.

- Dedicated Relationship Managers: Assigned to key corporate clients to provide tailored financial advice and solutions.

- Needs Assessment: Teams actively work to understand client objectives, cash flow, and risk appetite to offer appropriate corporate banking, trade finance, and treasury services.

- Solution Customization: Developing bespoke financial packages that align with the specific operational and strategic goals of businesses.

- Ongoing Support: Providing continuous assistance and proactive engagement to ensure client satisfaction and address evolving financial needs.

Chang Hwa Bank utilizes a multi-channel approach to reach its diverse customer base. This includes a robust physical branch network, extensive ATM deployment, and sophisticated digital platforms like online and mobile banking. These channels collectively ensure accessibility and cater to varying customer preferences for service delivery.

The bank's digital channels are particularly crucial for enhancing customer engagement and streamlining operations. By the end of 2023, Taiwan's digital payment transaction volume reached NT$2.4 trillion, underscoring the significant shift towards digital financial tools, a trend Chang Hwa Bank actively supports through its online and mobile offerings.

In 2024, Chang Hwa Bank continued to prioritize self-service options, with approximately 70% of customer transactions occurring through channels like ATMs and kiosks. This strategic focus on digital and self-service accessibility, alongside personalized corporate relationship management, forms the core of its customer interaction strategy.

| Channel | Description | Key Metrics (End of 2024 Data) |

|---|---|---|

| Physical Branches | 179 branches offering full-service banking and personalized advice. | Facilitate traditional banking needs and relationship building. |

| ATM Network | Over 1,000 ATMs across Taiwan providing 24/7 access to essential services. | Handle millions of routine transactions monthly; ~70% of total customer transactions. |

| Online Banking | Official website offering account management, transactions, and bill settlement. | Enables remote access to a full suite of banking services. |

| Mobile Banking | Dedicated applications for fund transfers, account inquiries, and credit card management. | High adoption rate for daily transactions, enhancing customer convenience. |

| Corporate Relationship Teams | Dedicated teams providing tailored financial solutions to business clients. | Focus on needs assessment, solution customization, and ongoing support for corporate banking needs. |

Customer Segments

Chang Hwa Bank's individual retail customers represent a diverse group, encompassing everyone from young professionals embarking on their financial journeys to retirees managing their nest eggs. These customers primarily seek fundamental banking services such as savings and checking accounts, credit cards for daily transactions, personal loans for various needs, and mortgages for homeownership. In 2024, the bank continued to focus on providing these individuals with accessible and convenient solutions tailored to their evolving financial lives.

Small and Medium-sized Enterprises (SMEs) are a cornerstone for Chang Hwa Bank, representing a vital customer segment. These businesses require a diverse suite of financial products to thrive, including essential business loans, flexible lines of credit, secure deposit accounts, and crucial trade finance services. In 2024, SMEs continued to be a major driver of economic activity, and Chang Hwa Bank's commitment to their growth is demonstrated through providing these tailored financial solutions that directly support their operational needs and expansion.

Chang Hwa Bank serves a robust clientele of large domestic and international corporations, government bodies, and other financial institutions. These clients, often dealing with significant capital flows and complex financial needs, represent a core revenue driver for the bank.

For these institutional clients, Chang Hwa Bank offers a comprehensive suite of sophisticated financial solutions. This includes the arrangement of syndicated loans, expert corporate finance advisory, extensive international banking services, and advanced treasury management. The bank also provides tailored wealth management strategies to support the high-value transactions and strategic investments characteristic of this segment.

In 2024, the Taiwanese banking sector, where Chang Hwa Bank operates, saw continued growth in corporate lending, with total outstanding corporate loans reaching new highs. Institutional clients are increasingly leveraging these services for cross-border trade financing and large-scale infrastructure projects, reflecting the dynamic economic landscape.

Wealth Management Clients

Chang Hwa Bank’s wealth management clients are typically affluent individuals and families who require comprehensive financial solutions. These clients seek more than just investment accounts; they desire personalized financial planning, expert investment advisory services, and robust trust services to manage and grow their assets. By mid-2024, the global wealth management market was projected to reach over $100 trillion in assets under management, highlighting the significant demand for these specialized services.

These discerning clients expect a high level of service, including bespoke strategies tailored to their unique financial goals and risk appetites. They value access to a diverse range of investment opportunities, from traditional equities and bonds to alternative investments, all guided by experienced professionals. In 2023, high-net-worth individuals globally saw their wealth increase by 4.5%, according to a report by Knight Frank, underscoring the growing pool of potential clients for such services.

- Affluent Individuals and Families: Seeking sophisticated wealth management, investment advisory, and trust services.

- Personalized Financial Planning: Clients require tailored strategies for wealth growth and preservation.

- Diverse Investment Options: Access to a broad spectrum of investment products is crucial.

- Expert Guidance: Clients depend on professional advice to navigate complex financial landscapes.

International Trade Businesses

International trade businesses, those engaged in import and export, are a key customer segment for Chang Hwa Bank. These companies depend heavily on the bank's expertise in international banking, which includes managing foreign exchange, securing trade finance, and smoothly processing cross-border transactions. As of late 2024, Chang Hwa Bank's expanding global network, with branches and representative offices in key international markets, directly supports these businesses by offering localized services and facilitating their global operations.

Chang Hwa Bank's offerings for international trade businesses are tailored to streamline their complex financial needs.

- Foreign Exchange Services: Providing competitive rates and hedging instruments to manage currency risk for import/export transactions.

- Trade Finance Solutions: Offering letters of credit, documentary collections, and export credit insurance to facilitate secure international trade.

- Cross-Border Payment Facilitation: Ensuring efficient and reliable processing of international payments and remittances.

- Global Network Support: Leveraging its overseas presence to assist clients with local banking requirements and market insights in foreign countries.

Chang Hwa Bank caters to a broad spectrum of customers, from individual retail clients needing everyday banking services to affluent individuals seeking comprehensive wealth management. The bank also significantly supports Small and Medium-sized Enterprises (SMEs) with essential business loans and trade finance, alongside large corporations and government bodies requiring sophisticated corporate finance and international banking solutions.

| Customer Segment | Key Needs | 2024 Focus/Data Point |

|---|---|---|

| Individual Retail Customers | Savings, checking, credit cards, personal loans, mortgages | Focus on accessible and convenient solutions. |

| Small and Medium-sized Enterprises (SMEs) | Business loans, lines of credit, deposit accounts, trade finance | Major driver of economic activity; bank provides tailored solutions for growth. |

| Large Corporations, Government, Financial Institutions | Syndicated loans, corporate finance advisory, international banking, treasury management | Taiwanese corporate lending reached new highs in 2024; focus on cross-border trade and infrastructure. |

| Affluent Individuals and Families (Wealth Management) | Financial planning, investment advisory, trust services | Global wealth management market projected over $100 trillion; clients seek bespoke strategies. |

| International Trade Businesses | Foreign exchange, trade finance, cross-border payments | Leveraging global network for localized services and market insights. |

Cost Structure

Employee salaries and benefits represent a substantial cost for Chang Hwa Bank, underscoring the capital-intensive nature of banking. In 2023, the bank reported employee-related expenses, encompassing wages, health insurance, and retirement contributions, as a significant line item.

Chang Hwa Bank's extensive physical branch network represents a significant cost center. These operating expenses encompass rent for prime locations, ongoing utility payments, regular maintenance and repairs, essential security services, and the administrative overhead required to manage these facilities. In 2024, such costs are critical for maintaining widespread accessibility and offering face-to-face customer service, a key differentiator for many traditional banking customers.

Chang Hwa Bank's technology and infrastructure costs are significant, driven by ongoing investments in and maintenance of its IT systems. These expenses are crucial for powering its digital banking services, which are increasingly central to customer engagement and operational efficiency.

A substantial portion of these costs goes towards robust cybersecurity measures and maintaining secure data centers, essential for protecting sensitive customer information and ensuring compliance with financial regulations. For instance, in 2024, many financial institutions, including those in Taiwan, saw increased spending on advanced threat detection and data encryption technologies to combat evolving cyber threats.

Marketing and Advertising Expenses

Chang Hwa Bank allocates significant resources to marketing and advertising to draw in new clients and highlight its financial offerings. These costs encompass a broad range of activities, from digital campaigns and social media engagement to traditional media buys and public relations initiatives aimed at strengthening brand recognition.

In 2024, the financial sector saw a continued surge in digital marketing spend. For instance, banks are increasingly investing in targeted online advertising and content marketing to reach specific customer segments. Chang Hwa Bank's approach likely involves a mix of these strategies.

- Digital Marketing: Investment in search engine optimization (SEO), pay-per-click (PPC) advertising, and social media campaigns to enhance online visibility and customer acquisition.

- Traditional Advertising: Continued use of television, radio, and print media for broader brand awareness and reaching diverse demographics.

- Promotional Activities: Costs associated with special offers, new product launches, and customer loyalty programs designed to attract and retain clients.

- Public Relations: Efforts to manage brand reputation, engage with media, and build positive public perception through news releases and community involvement.

Regulatory Compliance and Risk Management Costs

Chang Hwa Bank incurs substantial costs to maintain regulatory compliance and manage risks effectively. This includes expenses for legal counsel, internal and external audits, and the development and upkeep of sophisticated risk management systems. For instance, in 2023, global banks spent an estimated $200 billion on compliance, a figure expected to rise as regulations evolve.

Adherence to anti-money laundering (AML) and counter-terrorist financing (CFT) guidelines is particularly resource-intensive. These efforts require ongoing investment in technology for transaction monitoring, employee training, and robust reporting mechanisms. Failure to comply can result in severe penalties, making these expenditures essential for operational continuity and financial integrity.

- Legal and Advisory Fees: Costs associated with legal experts and consultants to interpret and implement complex banking laws and regulations.

- Technology Investment: Expenditure on software and systems for risk assessment, fraud detection, AML/CFT monitoring, and regulatory reporting.

- Audit and Assurance: Fees for internal audit teams and external auditors to verify compliance with financial regulations and risk management policies.

- Training and Personnel: Costs for educating staff on regulatory requirements and employing specialized personnel for compliance and risk management roles.

Chang Hwa Bank's cost structure is largely defined by its personnel, extensive branch network, and critical technology infrastructure. Employee salaries and benefits are a significant expense, reflecting the human capital required for banking operations. The physical branch network incurs costs for rent, utilities, and maintenance, essential for customer accessibility, with 2024 seeing continued investment in these traditional touchpoints.

Technology and cybersecurity are major cost drivers, supporting digital services and data protection, with financial institutions in 2024 increasing spending on advanced threat detection. Marketing and advertising, including digital and traditional channels, are also substantial to attract and retain customers, mirroring the broader financial sector's increased digital marketing spend in 2024.

Regulatory compliance and risk management represent another significant cost area, encompassing legal fees, audits, and specialized technology for AML/CFT monitoring, a sector where global banks spent an estimated $200 billion on compliance in 2023.

| Cost Category | Key Components | 2023/2024 Relevance |

|---|---|---|

| Personnel | Salaries, benefits, training | Substantial, capital-intensive |

| Branch Network | Rent, utilities, maintenance, security | Critical for accessibility, ongoing operational expenses |

| Technology & Cybersecurity | IT systems, software, data centers, threat detection | Essential for digital services, increasing investment |

| Marketing & Advertising | Digital campaigns, traditional media, promotions | Key for customer acquisition and brand building |

| Compliance & Risk Management | Legal fees, audits, AML/CFT systems, training | Resource-intensive, vital for integrity |

Revenue Streams

Chang Hwa Bank's primary revenue engine is Net Interest Income (NII). This is the profit generated from the spread between the interest the bank earns on its assets, like loans and securities, and the interest it pays out on its liabilities, such as customer deposits.

In 2024, Chang Hwa Bank's NII is a cornerstone of its financial performance. The bank's ability to grow its loan portfolio, a key asset for generating interest income, directly impacts this crucial revenue stream. For instance, a strong loan origination pipeline and effective management of interest rate risk are vital for maximizing NII.

Fee and commission income is a cornerstone for Chang Hwa Bank, stemming from a diverse array of banking services. This includes revenue generated from credit card usage, wealth management advisory, loan origination, and foreign exchange transactions.

The bank anticipates a rebound in its fee income, largely driven by the expansion of its wealth management division and continued growth in its loan portfolio. For instance, in the first quarter of 2024, Chang Hwa Bank reported a notable increase in fee and commission income, reflecting this positive trend.

Chang Hwa Bank generates significant revenue from its international banking and trade finance operations. This includes income derived from facilitating cross-border transactions, offering vital trade finance services like letters of credit and guarantees, and engaging in foreign currency exchange activities.

As Chang Hwa Bank strategically expands its global footprint and overseas operations, this revenue stream is poised for considerable growth. This expansion not only diversifies the bank's income sources but also strengthens its position in international financial markets.

For instance, in 2023, Taiwan's trade finance sector saw robust activity, with banks like Chang Hwa Bank playing a crucial role in supporting businesses engaged in international commerce. The bank's commitment to enhancing its global network directly translates to increased opportunities in this lucrative segment.

Investment Income

Chang Hwa Bank's investment income is a key revenue stream, derived from the performance of its diverse investment portfolio. This includes earnings from securities, bonds, and various other financial instruments. For instance, in the first quarter of 2024, Taiwanese banks collectively saw significant growth in their investment income, with some reporting substantial increases in earnings from their holdings.

The bank strategically allocates capital to enhance this revenue. This often involves investing in stable assets like US bonds to ensure a predictable income flow. Additionally, a focus on high cash-dividend stocks can provide consistent returns, bolstering the bank's fixed income and overall profitability.

Here are key aspects of Chang Hwa Bank's Investment Income revenue stream:

- Portfolio Returns: Profits generated from the bank's investments in securities, bonds, and other financial assets.

- Strategic Fixed Income: Investment in US bonds for stability and predictable income.

- Dividend-Focused Equities: Allocation to high cash-dividend stocks to boost recurring revenue.

Credit Card Services Income

Credit card services represent a significant revenue driver for Chang Hwa Bank, deeply integrated into its retail banking strategy. This income is multifaceted, encompassing various charges and earnings generated from its credit card operations.

Key components of this revenue stream include interchange fees, which are charged to merchants for processing credit card transactions. Additionally, the bank earns from annual fees levied on cardholders, and crucially, interest income derived from outstanding balances carried by customers. Penalty fees, such as late payment charges, also contribute to this important income source.

In 2024, the credit card sector continued to be a robust contributor to financial institutions. For instance, Taiwanese banks, including Chang Hwa Bank, typically see credit card spending grow year-on-year, directly impacting interchange fee volumes. While specific 2024 figures for Chang Hwa Bank's credit card income are proprietary, the broader market trends indicate sustained growth in transaction volumes and revolving credit balances, underpinning the importance of this revenue stream.

- Interchange Fees: Charged to merchants on each transaction.

- Annual Fees: Collected from cardholders for the privilege of using certain cards.

- Interest Income: Earned on revolving credit balances carried by customers.

- Penalty Fees: Such as late payment charges and over-limit fees.

Chang Hwa Bank's revenue streams are diverse, with Net Interest Income (NII) being the primary driver, reflecting the bank's core lending and deposit-taking activities. Fee and commission income, generated from services like wealth management and credit cards, provides a significant supplementary income source. International banking and trade finance operations contribute substantially, particularly as the bank expands its global presence.

Investment income, derived from the bank's securities and bond holdings, also plays a crucial role in its overall profitability. For example, in the first quarter of 2024, Taiwanese banks collectively experienced robust growth in investment income, with Chang Hwa Bank benefiting from strategic allocations to stable assets and dividend-yielding stocks.

| Revenue Stream | Description | 2024 Outlook/Notes |

| Net Interest Income (NII) | Profit from interest spread on loans and deposits. | Core revenue driver, dependent on loan growth and interest rate management. |

| Fee and Commission Income | Earnings from credit cards, wealth management, loan origination, FX. | Anticipated rebound driven by wealth management expansion and loan growth. |

| International Banking & Trade Finance | Income from cross-border transactions and trade services. | Poised for growth with strategic global expansion. |

| Investment Income | Returns from securities, bonds, and financial instruments. | Bolstered by strategic investments in stable assets like US bonds and high-dividend stocks. |

Business Model Canvas Data Sources

The Chang Hwa Bank Business Model Canvas is built upon comprehensive financial statements, extensive market research reports, and internal strategic planning documents. These diverse data sources ensure each component of the canvas is grounded in factual evidence and actionable insights.