Community Bank PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Community Bank Bundle

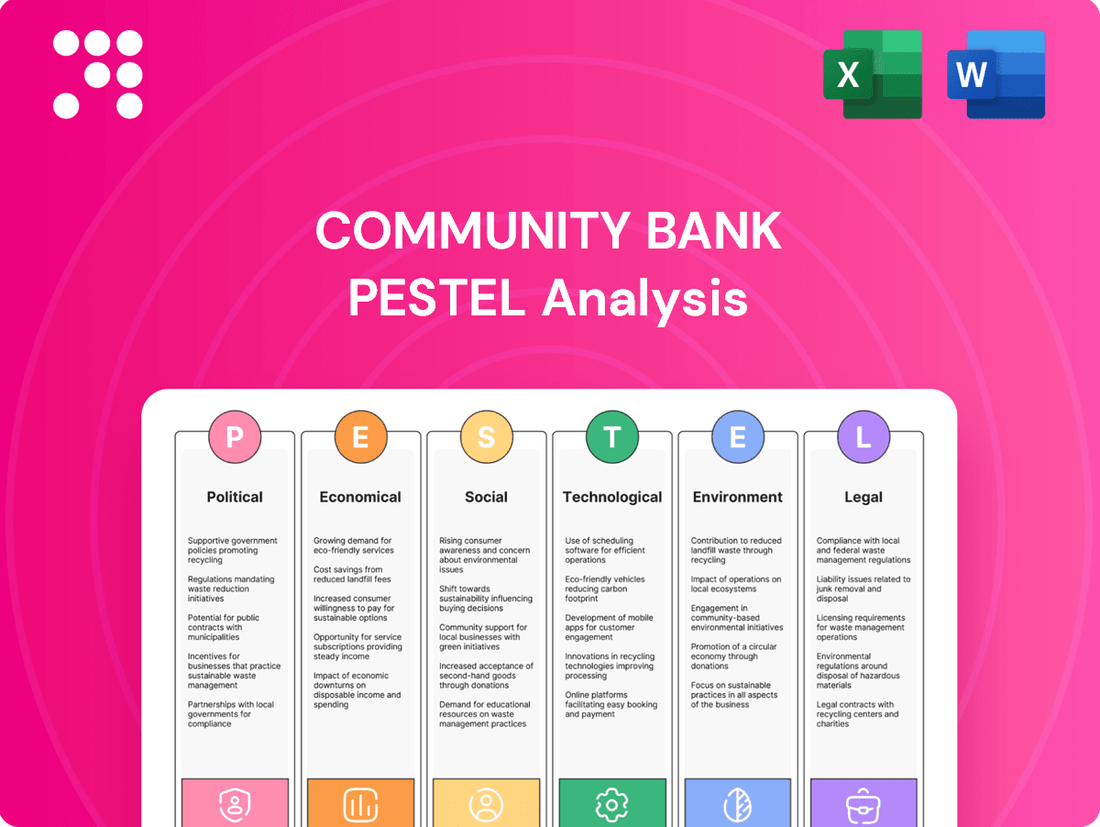

Community Bank operates within a dynamic external environment, shaped by political shifts, economic fluctuations, and evolving social attitudes. Understanding these forces is crucial for strategic planning and sustained growth. Our PESTLE analysis delves deep into these factors, providing actionable insights to navigate challenges and capitalize on opportunities. Download the full version now to gain a competitive edge.

Political factors

Community Bank System operates within a dynamic regulatory landscape. The Federal Reserve's monetary policy decisions, particularly its federal funds rate, directly impact lending margins. For instance, the Fed's series of rate hikes throughout 2022 and 2023 aimed to curb inflation, leading to higher borrowing costs for customers and potentially increased net interest income for banks like Community Bank System, though it also presents risks of slower loan growth.

Political stability is paramount for predictable business operations. Shifts in governmental oversight of the financial sector, such as changes to capital requirements or consumer protection laws, can significantly alter operating costs and strategic planning. For example, discussions around potential regulatory adjustments following the regional banking stress in early 2023 highlight the ongoing sensitivity to political sentiment regarding financial stability.

Government fiscal policy, encompassing spending and taxation, directly shapes the economic landscape. For instance, in the US, the Congressional Budget Office projected a federal deficit of $1.9 trillion for fiscal year 2024. Increased government spending, particularly on infrastructure or social programs, can stimulate economic activity, potentially boosting demand for loans and other banking services. Conversely, higher taxes or reduced government spending (austerity) can dampen economic growth, leading to lower borrowing demand and potentially impacting Community Bank System's revenue streams.

While Community Bank System's operations are largely domestic, global trade policies and geopolitical shifts can indirectly influence the economic health of the regions it serves. For instance, changes in international trade agreements or tariffs can impact the confidence of businesses operating within the bank's footprint, potentially altering their investment strategies and their need for commercial financing. In 2024, ongoing trade disputes, particularly between major global economies, have created a degree of uncertainty, which can trickle down to affect the lending environment for small and medium-sized enterprises that rely on stable export markets.

Consumer Protection Regulations

Consumer protection regulations, a significant political factor for Community Bank System, impose strict rules on lending practices, fee disclosures, and data privacy. For instance, the Consumer Financial Protection Bureau (CFPB) actively enforces regulations like the Truth in Lending Act (TILA) and the Fair Credit Reporting Act (FCRA), impacting how banks communicate loan terms and manage customer data. Adherence to these mandates necessitates substantial operational changes, influencing product development and marketing efforts. Failure to comply can result in hefty penalties; the CFPB has issued billions in fines for violations. This regulatory environment directly shapes Community Bank's strategies for customer engagement and risk management.

Key impacts of consumer protection regulations include:

- Increased compliance costs: Banks must invest in technology and personnel to ensure adherence to evolving consumer protection laws.

- Product and service design: Regulations often dictate the structure and transparency of financial products, influencing innovation.

- Reputational risk: Non-compliance can severely damage a bank's standing with customers and regulators, as seen in numerous public enforcement actions.

- Data security mandates: Strict data privacy laws, such as those requiring robust cybersecurity measures, add another layer of operational complexity and cost.

Monetary Policy Implementation

Central banks' monetary policy actions, such as adjusting interest rates or engaging in quantitative easing (QE) or tightening (QT), directly influence the cost of capital for institutions like Community Bank. For instance, the Federal Reserve's aggressive interest rate hikes throughout 2022 and 2023, moving from near zero to a range of 5.25%-5.50%, significantly increased borrowing costs. This shift impacts Community Bank's net interest margins and its ability to offer competitive loan rates.

The frequency and nature of these policy implementations require Community Bank to be agile in its balance sheet management. A shift towards QT, like the Fed's balance sheet reduction, can decrease overall market liquidity, potentially raising funding costs for banks. Community Bank must therefore continuously assess its deposit strategies and wholesale funding sources to ensure stability and profitability amidst these monetary policy shifts.

Key impacts on Community Bank include:

- Increased Cost of Funds: Higher benchmark rates directly translate to more expensive deposits and borrowed funds.

- Loan Demand Sensitivity: Rising interest rates can dampen demand for loans, affecting Community Bank's lending volume and revenue.

- Investment Portfolio Valuation: Changes in interest rates impact the market value of the bank's fixed-income securities, potentially leading to unrealized losses or gains.

- Risk Management Adjustments: The bank must adapt its risk models to account for potential increases in credit risk and interest rate risk stemming from monetary policy changes.

Governmental policies and political stability are foundational to Community Bank System's operating environment. Changes in fiscal policy, such as tax rate adjustments or government spending initiatives, directly influence economic growth and, consequently, loan demand. For example, the U.S. government's projected deficit of $1.9 trillion for fiscal year 2024 indicates ongoing fiscal activity that can stimulate or temper economic conditions relevant to banking.

Regulatory frameworks, often shaped by political agendas, dictate operational parameters for banks. The Federal Reserve's monetary policy, as evidenced by the aggressive rate hikes from near-zero to 5.25%-5.50% between 2022 and 2023, directly impacts Community Bank's net interest margins and the cost of funds. Furthermore, consumer protection laws enforced by bodies like the CFPB, which has levied billions in fines for violations, necessitate significant investment in compliance and influence product design.

Geopolitical events and international trade policies can indirectly affect the bank's clientele. Ongoing trade disputes in 2024 create uncertainty for businesses, potentially impacting their demand for commercial financing. Community Bank must remain adaptable to these macro-level political influences that shape the broader economic landscape.

What is included in the product

This PESTLE analysis provides a comprehensive overview of the external macro-environmental factors impacting the Community Bank, examining Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights and forward-looking perspectives to guide strategic decision-making and capitalize on emerging opportunities while mitigating potential threats.

A PESTLE analysis for Community Bank offers a pain point reliever by providing a clear, summarized version of the full analysis for easy referencing during meetings or presentations, enabling stakeholders to quickly grasp external factors impacting the bank.

Economic factors

Interest rate fluctuations significantly affect Community Bank System's profitability. For instance, the Federal Reserve's monetary policy decisions, such as the series of rate hikes in 2022 and early 2023, directly influenced the bank's net interest margin. While higher rates can boost lending income, they also increase the cost of deposits, requiring careful management of the bank's asset-liability structure to maintain healthy margins.

Inflation significantly impacts purchasing power, influencing consumer spending habits and the real value of Community Bank System's loan portfolios and customer savings. For instance, the US inflation rate, as measured by the Consumer Price Index (CPI), was 3.3% in April 2024, a slight decrease from previous months but still a key factor for banks.

Conversely, deflationary pressures can dampen borrowing and investment activity, potentially reducing loan origination volumes and impacting the bank's net interest margin. While deflation is less common, prolonged periods of low inflation, like the sub-2% rates seen historically, still require careful management of interest rate risk.

Community Bank System must closely monitor these inflation and deflation trends to effectively manage loan demand, attract deposits, and assess the economic stability of its diverse customer base. These macroeconomic shifts directly influence the bank's profitability and strategic planning for the 2024-2025 period.

The United States economy demonstrated resilience through 2024, with real GDP growth projected to be around 2.5% for the year, according to Congressional Budget Office estimates. This steady expansion fuels demand for loans as businesses invest and consumers spend, directly benefiting Community Bank System by increasing lending opportunities and potentially lowering default rates. A healthy GDP growth rate is a strong indicator of a favorable environment for the banking sector.

Unemployment Rates and Income Levels

Low unemployment and rising income levels are generally a boon for Community Bank System, as they translate to more consumer spending, increased savings, and a better ability for customers to repay loans, thereby lowering credit risk. For instance, the U.S. unemployment rate hovered around 3.9% in early 2024, a historically low figure, while wage growth continued to show positive trends, indicating a healthy economic environment for banking institutions.

Conversely, periods of high unemployment can significantly impact a bank's performance. Increased defaults on loans and a dampened demand for banking services, such as mortgages and business loans, can strain a bank's profitability. This directly affects the performance of both the retail and commercial loan portfolios, as seen during economic downturns where delinquency rates typically rise.

Key impacts on Community Bank System include:

- Increased consumer spending capacity: Higher disposable incomes from employment fuel demand for banking products like credit cards and personal loans.

- Reduced credit risk: A stable job market means fewer loan defaults, improving the quality of the bank's loan portfolio.

- Demand for commercial lending: Businesses with confident consumers are more likely to expand, increasing demand for commercial loans and services.

- Potential for higher savings rates: With more disposable income, customers may increase their savings, providing Community Bank System with a larger deposit base.

Credit Market Conditions and Liquidity

Credit market conditions directly influence Community Bank System's operational capacity and lending power. When credit is scarce or expensive, the bank faces higher funding costs, potentially slowing down loan origination. Conversely, robust liquidity in the market can translate to lower borrowing expenses for the bank and encourage more lending activity.

The Federal Reserve's monetary policy plays a significant role here. For instance, as of early 2024, the Federal Funds Rate has remained elevated, impacting the cost of funds for banks. This environment necessitates careful management of liquidity to maintain profitability and lending capacity.

- Funding Costs: Higher benchmark interest rates, like the Federal Funds Rate, increase the cost for community banks to secure funds, directly affecting their net interest margins.

- Loan Demand: Tight credit conditions can dampen demand for loans from businesses and individuals, impacting a community bank's core lending business.

- Liquidity Levels: Ample liquidity in the financial system allows community banks to access funding more readily and at lower costs, supporting loan growth and investment.

Economic factors significantly shape the operating environment for Community Bank System. Interest rate policies, such as the Federal Reserve's actions, directly impact net interest margins. For example, the Fed's target range for the Federal Funds Rate remained at 5.25%-5.50% through early 2024, influencing borrowing costs for the bank and its customers. Inflation, with the US CPI at 3.3% in April 2024, affects purchasing power and the real value of assets and liabilities, requiring careful management to maintain profitability and assess customer financial health. Robust GDP growth, projected around 2.5% for 2024 by the CBO, generally supports loan demand and reduces credit risk, while low unemployment, around 3.9% in early 2024, further bolsters consumer spending and loan repayment capabilities.

| Economic Factor | 2024/2025 Relevance | Impact on Community Bank System |

|---|---|---|

| Interest Rates (Federal Funds Rate) | Target range 5.25%-5.50% (early 2024) | Affects funding costs and net interest margins; influences loan demand. |

| Inflation (US CPI) | 3.3% (April 2024) | Impacts consumer spending, real value of loans/deposits; requires risk management. |

| GDP Growth | Projected ~2.5% (2024, CBO) | Supports loan demand, business investment, and potentially lowers credit risk. |

| Unemployment Rate | ~3.9% (early 2024) | Indicates strong consumer capacity for spending and loan repayment, reducing credit risk. |

Same Document Delivered

Community Bank PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use for your Community Bank PESTLE Analysis. This detailed report covers Political, Economic, Social, Technological, Legal, and Environmental factors impacting community banking. You'll gain comprehensive insights into the external forces shaping the industry, enabling strategic decision-making.

Sociological factors

Demographic shifts significantly shape Community Bank System's market. For instance, the aging population in many of its service areas, particularly in upstate New York and northern Pennsylvania, increases demand for retirement planning services and wealth management. In 2024, the median age in New York was around 40.9 years, indicating a substantial segment of the population approaching or in retirement age.

Changes in income levels and ethnic composition also play a crucial role. As communities become more diverse and income brackets shift, Community Bank needs to adapt its product suite. For example, a growing Hispanic population in certain regions might require more bilingual banking services and tailored mortgage products. In 2023, the U.S. saw continued growth in its Hispanic population, representing a significant and expanding consumer base.

Consumer preferences are rapidly shifting, with a significant portion of the population, particularly younger demographics, expecting seamless digital banking experiences and readily accessible financial planning tools. For instance, in the US, a 2024 survey indicated that over 70% of consumers prefer mobile banking for everyday transactions.

The financial literacy of Community Bank System's customer base directly influences product adoption and the level of customer support needed. A customer base with lower financial literacy might struggle with complex investment products, necessitating more educational resources and personalized guidance.

Public trust in financial institutions significantly shapes customer behavior, and for Community Bank System, this is no different. Following the 2008 financial crisis and ongoing concerns about data breaches, customers are more discerning than ever. A 2024 survey by the American Bankers Association found that 65% of consumers consider a bank's reputation for trustworthiness a primary factor in choosing a financial provider.

Maintaining a robust reputation for reliability and transparency is paramount for Community Bank System to foster customer loyalty and attract new clients. In 2025, banks that demonstrate strong ethical practices and robust cybersecurity measures are likely to see increased customer retention. For instance, banks with consistently high customer satisfaction scores, often linked to perceived trustworthiness, have reported lower customer attrition rates, typically by 2-3% annually.

Cultural Values and Community Engagement

Local cultural values, particularly the emphasis on community support, often steer customer preferences towards community banks rather than larger, national corporations. This inclination is evident in the growing consumer demand for personalized service and local impact, a trend that saw community banks collectively hold approximately $1.8 trillion in assets as of the first quarter of 2024, according to the Independent Community Bankers of America (ICBA).

Community Bank System's proactive involvement in local events and deep understanding of regional specificities are key differentiators. For instance, their commitment to local development is reflected in their consistent support for small businesses, which are the backbone of many community economies. In 2023, community banks nationwide provided over $70 billion in small business loans, showcasing their vital role in local economic ecosystems and reinforcing customer loyalty.

This strong community engagement translates into more robust customer relationships and a distinct brand identity. By aligning with local values and actively participating in community life, these banks foster a sense of trust and shared purpose. This approach is particularly effective in areas where residents prioritize supporting institutions that demonstrably invest back into their neighborhoods.

Key aspects of cultural values and community engagement include:

- Prioritization of local support: Customers often choose community banks due to a shared sense of local identity and a desire to keep resources within their community.

- Brand differentiation through engagement: Active participation in local initiatives helps community banks build a unique brand image that resonates with community-minded consumers.

- Enhanced customer relationships: Understanding and reflecting regional nuances fosters deeper connections and greater customer loyalty compared to impersonal national banking.

- Economic impact and trust: The tangible economic contributions, such as small business lending, build trust and reinforce the value proposition of community banking.

Workforce Demographics and Talent Availability

The availability of skilled talent is a critical sociological consideration for Community Bank System. The banking sector increasingly demands expertise in technology, data analytics, and risk management, areas where talent shortages can impact innovation and operational efficiency. For instance, in 2024, the U.S. Bureau of Labor Statistics projected a 10% growth for information security analysts, a key role for financial institutions.

Attracting and retaining a diverse and skilled workforce is paramount for Community Bank System to remain competitive. A strong talent pipeline ensures the bank can adapt to evolving customer needs, implement new digital solutions, and maintain robust compliance frameworks. In 2024, reports indicated that employee retention in the financial services industry remained a challenge, with many seeking roles offering greater flexibility and technological advancement.

Community Bank System must focus on building a workforce that reflects the diverse communities it serves. This not only enhances customer relations but also brings varied perspectives to problem-solving and strategic planning. Data from 2024 showed that companies prioritizing diversity and inclusion often experienced higher employee engagement and better financial performance.

- Talent Demand: High demand for tech and data analytics skills in banking, with projected growth for information security analysts at 10% in 2024.

- Retention Challenges: Financial services industry faced retention issues in 2024, with employees seeking more flexible and technologically advanced roles.

- Diversity Benefits: Prioritizing diversity and inclusion in 2024 was linked to increased employee engagement and improved financial outcomes.

- Skill Gap: A persistent gap exists in specialized banking skills, impacting the ability of institutions to innovate and manage risk effectively.

Sociological factors significantly influence Community Bank System's operations, driven by demographic shifts like an aging population and increasing diversity, which demand tailored services. Consumer preferences for digital banking, as evidenced by over 70% of US consumers preferring mobile banking in 2024, highlight the need for technological adaptation. Furthermore, public trust, with 65% of consumers in 2024 prioritizing trustworthiness, underscores the importance of reputation and transparency for customer loyalty and acquisition.

Technological factors

Community Bank System must invest in its digital infrastructure to meet growing customer demands for seamless online and mobile banking. By the end of 2024, it's estimated that over 80% of banking interactions for retail customers will occur digitally, a trend that continued to accelerate through early 2025.

The integration of new payment technologies, such as real-time payments and digital wallets, is also crucial. Failure to adapt means risking customer churn to competitors offering more advanced and convenient digital solutions, a challenge many community banks faced in 2024.

As financial transactions increasingly move online, the threat of cyberattacks and data breaches escalates for institutions like Community Bank System. In 2024, the financial services sector experienced a significant rise in sophisticated cyber threats, with reports indicating a 30% increase in ransomware attacks compared to the previous year. This necessitates substantial investment in advanced cybersecurity infrastructure and stringent data protection protocols to safeguard sensitive customer information and preserve client trust.

Community Bank System must prioritize continuous investment in cybersecurity measures to combat evolving threats. The global cost of cybercrime is projected to reach $10.5 trillion annually by 2025, underscoring the financial imperative for robust defenses. Furthermore, adherence to evolving data protection regulations, such as updated GDPR or CCPA provisions impacting financial data handling, is paramount for maintaining compliance and avoiding substantial penalties.

Artificial Intelligence and Machine Learning (AI/ML) are transforming banking. Community Bank System can use AI/ML to boost fraud detection, making transactions safer. For instance, in 2024, the financial services sector saw AI adoption rates climbing, with many institutions reporting improved risk management through these tools.

These technologies also enable more personalized customer experiences and automated financial advice, a key differentiator. By leveraging AI/ML, Community Bank System can streamline operations, leading to greater efficiency and better-informed strategic decisions, potentially reducing operational costs by up to 15% in certain areas by 2025.

Fintech Partnerships and Innovation

The rapid growth of fintech presents community banks like Community Bank System (CBU) with a dual challenge: competition and collaboration. Fintech firms are increasingly offering specialized services that can attract customers away from traditional banks, but they also represent opportunities for strategic partnerships. For instance, by collaborating with fintechs, CBU could quickly integrate innovative digital payment solutions or enhance its mobile banking capabilities, potentially avoiding the lengthy and costly process of developing these technologies internally. This approach allows banks to remain competitive by offering modern, user-friendly services that meet evolving customer expectations.

Staying ahead in the fintech landscape is crucial for sustained growth. Community Bank System, like many of its peers, must actively monitor emerging fintech trends and assess their potential impact and applicability. This includes understanding advancements in areas such as artificial intelligence for customer service, blockchain for transaction security, and personalized financial advice platforms. By strategically engaging with fintech innovators, CBU can leverage external expertise to streamline operations, reduce costs, and broaden its service portfolio, ultimately strengthening its market position.

- Fintech Investment Growth: Global fintech investment reached approximately $100 billion in 2023, highlighting the sector's significant expansion and the potential for impactful partnerships.

- Digital Banking Adoption: By the end of 2024, over 70% of consumers are expected to use digital channels for most of their banking needs, underscoring the necessity for fintech integration.

- Partnership Models: Community banks are exploring various fintech collaboration models, including white-labeling services, joint ventures, and direct investment in promising startups.

Data Analytics and Big Data

The capacity to gather, dissect, and utilize vast amounts of customer and market data is crucial for Community Bank System, offering deep insights into how customers behave, emerging market trends, and potential risks. This data-driven approach enhances strategic planning and refines operational efficiency.

Advanced data analytics directly influences strategic decisions, allowing for the optimization of marketing efforts and the enhancement of personalized customer service. By understanding customer preferences and market dynamics, Community Bank System can tailor its offerings more effectively.

- Customer Data Utilization: In 2024, financial institutions are increasingly leveraging customer data to personalize product offerings, with many reporting a significant uplift in engagement rates from tailored campaigns.

- Market Trend Analysis: Big data analytics tools are vital for identifying shifts in consumer demand and competitive landscapes, enabling proactive strategy adjustments.

- Risk Management Enhancement: Sophisticated data analysis helps in identifying and mitigating financial risks more accurately, contributing to a more stable operational environment.

- Operational Efficiency Gains: By analyzing operational data, Community Bank System can streamline processes, reduce costs, and improve overall service delivery speed and quality.

Community Bank System must prioritize robust cybersecurity measures, as the financial sector experienced a significant increase in cyber threats in 2024, with ransomware attacks up by 30% year-over-year. The global cost of cybercrime is projected to reach $10.5 trillion annually by 2025, making proactive defense essential.

The integration of emerging technologies like AI and machine learning offers opportunities for enhanced fraud detection and personalized customer experiences. By 2025, AI adoption in finance is expected to streamline operations and potentially reduce costs by up to 15% in specific areas.

Collaboration with fintech companies is crucial for community banks to offer competitive digital services. Global fintech investment reached approximately $100 billion in 2023, signaling a strong market for partnerships that can accelerate innovation and service delivery.

Leveraging big data analytics is key for understanding customer behavior and market trends, with financial institutions increasingly using data for personalized offerings in 2024. This data-driven approach enhances strategic planning and operational efficiency.

Legal factors

Community banks operate under a stringent regulatory environment, overseen by federal bodies like the Federal Reserve and the FDIC, alongside state banking authorities. For instance, in 2024, the FDIC's Deposit Insurance Fund maintained a healthy ratio, exceeding its target range, which provides a stable backdrop for banks. However, compliance with capital adequacy ratios, such as the Common Equity Tier 1 (CET1) ratio, and adherence to lending standards remain critical. Failure to meet these requirements can result in significant fines and the potential loss of operating licenses.

The dynamic nature of banking regulations means continuous adaptation is essential. For example, ongoing discussions around Basel III endgame reforms, expected to be fully implemented in the coming years, will likely impact capital requirements for many institutions. Community banks must proactively monitor these shifts and adjust their strategies to ensure ongoing compliance and operational resilience in 2024 and beyond.

Community Bank System must strictly adhere to Anti-Money Laundering (AML) and Counter-Terrorist Financing (CTF) regulations, including the Bank Secrecy Act. This necessitates sophisticated transaction monitoring systems and diligent reporting of suspicious activities to prevent financial crime. Failure to comply can lead to significant fines; for instance, in 2023, the U.S. Treasury's Financial Crimes Enforcement Network (FinCEN) reported over $2.1 billion in AML penalties against financial institutions.

Consumer protection laws like the Truth in Lending Act (TILA) and the Fair Credit Reporting Act (FCRA) are foundational for Community Bank System's operations. These regulations ensure transparency in lending terms and accurate credit reporting, directly impacting customer interactions and trust. For instance, TILA mandates clear disclosure of loan costs, helping consumers make informed decisions.

The Equal Credit Opportunity Act (ECOA) is also critical, prohibiting discrimination in credit transactions based on factors like race, religion, or marital status. Community Bank System must adhere to these fair lending practices to avoid legal challenges and maintain a positive reputation. In 2024, the Consumer Financial Protection Bureau (CFPB) continued to emphasize fair lending enforcement, with significant penalties issued for violations.

Data Privacy Regulations

Community Bank System must navigate a complex landscape of data privacy regulations. The Gramm-Leach-Bliley Act (GLBA) mandates how financial institutions handle customer information, requiring robust security measures. Additionally, evolving state laws like the California Consumer Privacy Act (CCPA) and its successor, the California Privacy Rights Act (CPRA), impose further obligations regarding data collection, use, and consumer rights, impacting how the bank manages customer data in 2024 and beyond.

Compliance isn't just about avoiding penalties; it's crucial for maintaining customer trust. For instance, a data breach can lead to significant financial losses and reputational damage. As of early 2024, the average cost of a data breach in the financial sector was reported to be substantial, underscoring the importance of proactive data protection strategies. Community Bank System's adherence to these legal frameworks directly impacts its ability to operate securely and maintain its customer base.

- GLBA Compliance: Ensuring adherence to federal regulations governing financial institutions' privacy practices.

- State-Specific Laws: Monitoring and complying with emerging state privacy laws like CCPA/CPRA where applicable.

- Customer Trust: Recognizing data protection as a cornerstone for building and maintaining customer confidence.

- Operational Impact: Understanding how privacy regulations influence data management, technology investments, and risk mitigation.

Employment and Labor Laws

Community Bank System, like all employers, must navigate a complex web of federal and state employment and labor laws. These regulations cover everything from minimum wage requirements and overtime pay to workplace safety standards and anti-discrimination statutes. For instance, the Fair Labor Standards Act (FLSA) sets the baseline for these protections nationwide, while state-specific laws can offer even more stringent requirements. In 2024, the Department of Labor continued to emphasize enforcement of wage and hour laws, with significant penalties for non-compliance.

Adhering to these legal mandates is not just about avoiding fines; it's crucial for fostering a stable and productive work environment. Discriminatory hiring or promotion practices, for example, can lead to costly lawsuits and damage the bank's reputation. The Equal Employment Opportunity Commission (EEOC) reported a significant number of workplace discrimination charges filed annually, highlighting the ongoing importance of robust compliance programs. Community Bank must ensure its policies and practices align with laws such as Title VII of the Civil Rights Act and the Americans with Disabilities Act (ADA).

Furthermore, employee benefits are heavily regulated. Laws like the Employee Retirement Income Security Act (ERISA) govern retirement plans and health insurance offerings, requiring transparency and fiduciary responsibility. As of 2025, the landscape of employee benefits continues to evolve, with ongoing discussions around healthcare costs and retirement security. Community Bank's ability to manage these benefits compliantly directly impacts employee morale and retention.

Key legal considerations for Community Bank System include:

- Wage and Hour Compliance: Ensuring adherence to federal and state minimum wage laws, overtime pay regulations, and record-keeping requirements.

- Anti-Discrimination and Equal Employment Opportunity: Implementing policies and training to prevent discrimination based on race, gender, age, religion, disability, and other protected characteristics, in line with EEOC guidelines.

- Workplace Safety: Complying with Occupational Safety and Health Administration (OSHA) standards to provide a safe working environment for all employees.

- Employee Benefits Administration: Managing health insurance, retirement plans, and other benefits in accordance with ERISA and other relevant legislation.

Community banks face a dense regulatory framework, impacting operations from capital requirements to consumer interactions. For instance, the Federal Reserve's ongoing supervision of capital adequacy ratios, like CET1, is crucial for stability; in 2024, these ratios remained a key focus for the banking sector. Compliance with consumer protection laws, such as TILA and ECOA, is paramount to maintaining trust and avoiding penalties, with the CFPB actively enforcing fair lending practices throughout 2024.

Environmental factors

The increasing frequency and intensity of extreme weather events, such as hurricanes and floods, present significant physical risks to Community Bank System's operations. These events can lead to direct damage to physical branches and IT infrastructure, causing service disruptions. For instance, the National Oceanic and Atmospheric Administration (NOAA) reported that in 2023, the U.S. experienced 28 separate weather and climate disasters, each causing at least $1 billion in damages, highlighting the growing threat.

Furthermore, climate change impacts the credit risk of Community Bank System's loan portfolios. Sectors like real estate and agriculture are particularly vulnerable. Droughts can devastate agricultural output, increasing default risk on farm loans, while rising sea levels and increased flooding can devalue properties in coastal areas, affecting mortgage portfolios. This necessitates a closer look at geographic concentrations and sector-specific exposures within the bank's lending activities.

Community Bank System, like all financial institutions, faces increasing pressure from investors, regulators, and the public to prioritize Environmental, Social, and Governance (ESG) factors. This translates into a demand for sustainable finance initiatives, responsible lending practices, and clear reporting on environmental footprints. For instance, in 2024, many banks are setting targets for reducing their financed emissions, reflecting a broader industry trend.

Integrating robust ESG strategies can significantly bolster Community Bank System's reputation and its ability to attract capital. Investors are increasingly scrutinizing banks' exposure to climate-related risks and their contributions to a low-carbon economy. By demonstrating strong ESG performance, Community Bank System can differentiate itself in the market and appeal to a growing segment of environmentally conscious investors, potentially lowering its cost of capital.

Growing concerns over resource scarcity, particularly in energy and water, are prompting financial institutions to re-evaluate their operational impact. For community banks, this translates into a closer look at their own environmental footprint, from the energy consumption of their physical branches to their reliance on paper-based processes. For instance, in 2023, the banking sector's overall energy consumption for its vast network of branches and data centers remained a significant consideration, with many institutions actively exploring renewable energy sources and energy-efficient building designs.

The push for greater sustainability isn't just about environmental responsibility; it's also becoming a driver for cost savings and a way to align with evolving societal values. By implementing eco-friendly practices, such as digitizing more services to reduce paper usage or investing in energy-efficient lighting and HVAC systems for their branches, community banks can realize tangible cost reductions. This focus on sustainability also resonates with a growing customer base that increasingly favors businesses demonstrating a commitment to environmental stewardship, a trend clearly visible in consumer surveys throughout 2024.

Regulatory Focus on Climate Risk in Banking

Regulators are intensifying their focus on how financial institutions, including community banks, identify and manage climate-related financial risks. This scrutiny extends to both a bank's internal operations and its loan portfolios, particularly those exposed to sectors vulnerable to climate change impacts.

Community Bank System, like its peers, may encounter evolving regulatory expectations. These could manifest as enhanced disclosure mandates concerning climate risk exposure or adjustments to capital requirements reflecting the potential financial impact of climate events on their assets. For instance, the Federal Reserve's 2023 scenario analysis for large banks highlighted the potential for significant credit losses in certain climate-sensitive sectors.

Given this evolving landscape, a proactive approach to climate risk management is no longer optional but essential for community banks. This involves developing robust frameworks for assessing physical and transition risks, integrating these considerations into strategic planning, and ensuring adequate data and expertise are in place.

- Regulatory Scrutiny: Regulators globally, including the US Federal Reserve, are increasing oversight of climate risk management in banking.

- Reporting & Capital: Expect potential new reporting requirements and capital implications for banks with significant exposure to climate-vulnerable industries.

- Proactive Management: Banks must develop strategies to assess and mitigate physical (e.g., extreme weather) and transition (e.g., policy changes) climate risks.

- Data & Expertise: Building internal capacity for climate risk analysis and data collection is becoming critical for compliance and sound risk management.

Sustainable Finance and Green Lending Opportunities

The burgeoning sustainable finance market offers significant avenues for Community Bank System. By developing and offering green loans, bonds, or investment products, the bank can tap into a growing demand from environmentally conscious customers. This strategic move can unlock new revenue streams and bolster the bank's image as a forward-thinking financial institution.

For instance, the global green bond market reached an estimated $1 trillion in 2023, indicating a strong investor appetite for sustainable investments. Community Bank System could capitalize on this trend by offering financing for renewable energy projects or energy-efficient building upgrades. This aligns with increasing regulatory pressures and consumer preferences for ESG (Environmental, Social, and Governance) compliant financial products.

- Green Lending Growth: The global sustainable finance market is projected to grow substantially, with green loans expected to see increased adoption by businesses seeking to fund environmentally friendly initiatives.

- New Revenue Streams: Offering specialized green financial products can attract a new customer base and create diversified income sources for Community Bank System.

- Market Positioning: A commitment to sustainable finance enhances brand reputation and can differentiate Community Bank System from competitors in an increasingly ESG-focused financial landscape.

- Investor Demand: With significant global investment flowing into green initiatives, Community Bank System can leverage this trend to attract capital and support its own sustainable lending programs.

Environmental factors pose significant risks and opportunities for Community Bank System. Extreme weather events, like those causing $1 billion+ in damages in 2023, threaten physical assets and increase credit risk in vulnerable sectors such as agriculture and coastal real estate.

The growing demand for ESG compliance means banks must manage their environmental footprint and offer sustainable finance options. This includes addressing resource scarcity and aligning with consumer preferences for eco-friendly practices, a trend observed throughout 2024.

Regulatory bodies are intensifying their focus on climate risk management, potentially leading to new disclosure requirements and capital adjustments for banks exposed to climate-sensitive industries, as indicated by Federal Reserve analyses in 2023.

Community Bank System can leverage the expanding sustainable finance market, estimated at $1 trillion globally in 2023, by offering green loans and products, thereby attracting capital and enhancing its market position.

PESTLE Analysis Data Sources

Our Community Bank PESTLE Analysis is built on a robust foundation of data from official government publications, reputable financial news outlets, and industry-specific research reports. We meticulously gather insights on regulatory changes, economic indicators, technological advancements, and societal trends to ensure comprehensive coverage.