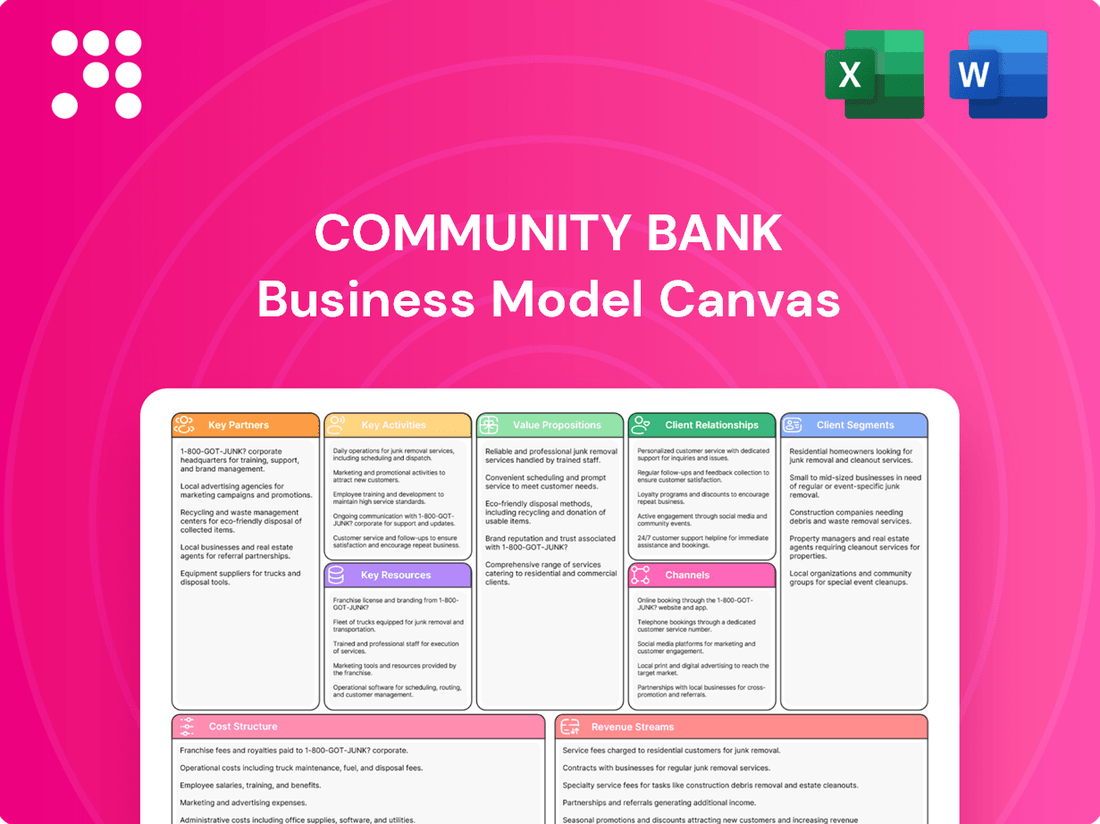

Community Bank Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Community Bank Bundle

Curious about Community Bank's winning formula? Our comprehensive Business Model Canvas breaks down exactly how they connect with customers, deliver value, and generate revenue. Dive into the core of their strategy and unlock actionable insights for your own ventures.

Partnerships

Community Bank System's ability to offer modern digital banking hinges on its technology providers. These partnerships are crucial for developing and maintaining secure, efficient online platforms and mobile applications, ensuring customers have seamless access to their finances.

In 2024, the financial sector saw continued investment in digital transformation. For instance, many community banks are partnering with fintech firms to integrate advanced features like AI-driven fraud detection and personalized financial advice, aiming to match the offerings of larger institutions.

These collaborations also bolster cybersecurity defenses. By leveraging the expertise of specialized technology providers, community banks can implement robust measures to protect sensitive customer data against evolving cyber threats, a critical factor in maintaining trust and compliance.

Collaborating with local businesses and chambers of commerce is crucial for a community bank. These partnerships deepen the bank's roots within the local economy and significantly broaden its access to potential commercial clients. For instance, in 2024, chambers of commerce across the U.S. reported an average increase of 15% in member engagement through collaborative initiatives with financial institutions.

These alliances unlock valuable co-marketing opportunities, allowing the bank to reach a wider audience. Joint events, such as business expos or workshops, further enhance visibility and customer acquisition. In 2024, banks that actively participated in chamber events saw an average 10% uplift in new small business account openings compared to those who did not.

Furthermore, these partnerships enable the development of highly tailored financial solutions specifically designed to meet the unique needs of local enterprises. This localized approach fosters stronger client relationships and supports the growth of the community's economic base. A 2024 survey indicated that 70% of small business owners prefer banking with institutions that demonstrate a clear commitment to their local community.

Community banks rely heavily on mortgage brokers and real estate agents as vital partners to drive residential mortgage loan origination. These professionals act as key referral sources, bringing in new clients actively seeking home financing solutions. For instance, in 2024, the National Association of Realtors reported that approximately 87% of homebuyers used a real estate agent, highlighting the significant reach these partnerships offer.

These collaborations directly fuel the expansion of the bank's loan portfolio and enhance its visibility within the local housing market. By fostering strong relationships with these intermediaries, the bank can tap into a consistent stream of potential borrowers, thereby increasing its market share and overall loan volume.

Employee Benefit Consultants and Brokers

Community Bank System leverages partnerships with employee benefit consultants and brokers to enhance its trust and administration services. These collaborations are crucial for accessing businesses that require robust employee benefit packages, effectively extending the bank's reach across the nation in this specialized market.

- Access to New Clients: Consultants and brokers act as a vital channel, introducing Community Bank System to businesses actively seeking comprehensive employee benefit solutions.

- Market Expansion: These partnerships are instrumental in broadening Community Bank System's national presence within the employee benefits sector.

- Service Integration: The collaborations facilitate the seamless integration of Community Bank System's trust and administration services into broader employee benefit offerings.

Financial Advisors and Wealth Management Firms

Strategic alliances with independent financial advisors and wealth management firms are crucial for community banks aiming to expand their service offerings. These partnerships allow banks to provide more sophisticated financial planning and investment solutions, reaching a wider customer base. For instance, in 2024, many community banks focused on leveraging these relationships to tap into the growing demand for personalized wealth management.

These collaborations can significantly boost client acquisition and retention. By integrating advisor services, community banks can act as a one-stop shop for financial needs, fostering deeper customer loyalty. This synergy also broadens the spectrum of financial advice available to the bank’s existing customers, enhancing the overall value proposition.

- Referral Streams: Partnerships create a consistent flow of new wealth management clients for the bank, complementing organic growth.

- Expanded Expertise: Access to specialized advice from partners enhances the bank's ability to serve diverse client needs, from retirement planning to estate management.

- Revenue Diversification: These alliances offer new revenue streams through shared fees or referral agreements, strengthening the bank's financial resilience.

- Market Reach: Collaborating with established advisory firms extends the bank's market presence and brand recognition within the financial services sector.

Community banks actively partner with credit bureaus and data analytics firms to refine their risk assessment models and improve lending decisions. These collaborations are essential for accessing reliable credit information and leveraging advanced analytics to understand borrower profiles better.

In 2024, the emphasis on data-driven insights intensified, with many community banks adopting AI-powered tools from analytics partners to predict loan defaults and identify fraudulent activities more effectively. This strategic use of data enhances portfolio quality and operational efficiency.

These partnerships also enable community banks to offer more personalized loan products and pricing. By analyzing vast datasets, banks can tailor offerings to specific customer segments, increasing application approval rates and customer satisfaction.

| Partnership Type | 2024 Focus/Benefit | Impact on Community Banks |

| Technology Providers | Digital transformation, AI features, cybersecurity | Enhanced customer experience, improved security |

| Local Businesses/Chambers | Co-marketing, tailored solutions | Increased client acquisition, stronger community ties |

| Mortgage Brokers/Realtors | Referral streams, loan origination | Expanded loan portfolio, increased market share |

| Benefit Consultants/Brokers | Access to businesses, service integration | National presence in benefits sector, new revenue |

| Financial Advisors/Wealth Mgmt | Expanded services, client acquisition | Revenue diversification, enhanced value proposition |

| Credit Bureaus/Data Analytics | Risk assessment, personalized lending | Improved loan quality, operational efficiency |

What is included in the product

A structured framework detailing how a community bank creates, delivers, and captures value, focusing on local customer relationships and tailored financial services.

It outlines key partnerships, activities, resources, cost structures, and revenue streams essential for sustainable community-focused banking operations.

The Community Bank Business Model Canvas acts as a pain point reliever by offering a structured, visual approach to understanding and refining a bank's operations, enabling faster identification of inefficiencies and strategic adjustments.

Activities

A community bank's core activity revolves around attracting and meticulously managing a diverse range of deposit accounts. This includes essential offerings like checking accounts for daily transactions, savings accounts for accessible funds, and money market accounts for slightly higher interest earnings. These deposits form the bedrock of the bank's liquidity, providing the necessary capital to fund its lending operations and generate interest income on loans and investments.

In 2024, community banks continued to be vital financial intermediaries. For instance, data from the Federal Deposit Insurance Corporation (FDIC) indicated that community banks held a significant portion of the nation's deposits. This deposit base is crucial; it directly enables the bank to offer loans to individuals and businesses, thereby supporting local economic growth. The ability to attract and retain these deposits is paramount for the bank's sustained profitability and operational capacity.

Community banks are central to loan origination and servicing, offering a wide array of products including commercial, residential mortgage, and consumer loans. This core activity is vital for their financial health, directly impacting revenue streams and the crucial management of credit risk. For instance, in 2024, the U.S. banking sector saw continued demand for mortgages, with origination volumes fluctuating based on interest rate movements, highlighting the dynamic nature of this key activity.

Community banks are increasingly offering investment management and brokerage services to help clients grow their wealth, moving beyond traditional lending. These services often include personalized financial planning and trust services, creating diversified revenue streams. For instance, in 2024, many community banks reported significant growth in their wealth management divisions, with assets under management rising by an average of 8-10% year-over-year, reflecting client demand for comprehensive financial solutions.

Employee Benefit Trust and Administration

Community banks often engage in the crucial activity of providing employee benefit trust and administration services. This is a significant undertaking for many of their subsidiaries, extending their reach across the nation.

These specialized services are a key driver of diversified fee income for the bank. For instance, in 2024, the employee benefits sector of financial institutions saw continued growth, with many banks leveraging their trust departments to manage retirement plans, health savings accounts, and other employee-focused financial vehicles.

The administration aspect is equally vital, involving the complex management of these plans, ensuring compliance, and providing essential support to both employers and employees. This operational efficiency directly impacts the profitability and client retention within this service line.

- National Reach: Subsidiaries offer employee benefit trust and administration services across the country.

- Fee Income Driver: This specialized service line is a substantial contributor to the bank's overall fee income.

- Diversification: It helps diversify revenue streams beyond traditional lending.

- Client Support: Provides essential administrative and trust management for employee benefit plans.

Branch Network Expansion and Optimization

Community banks actively pursue strategic expansion and optimization of their branch networks as a core activity. This focus is particularly evident in regions like the Northeast, where enhancing market share and customer accessibility are paramount. For instance, as of the first quarter of 2024, many regional banks reported increased investment in physical footprint, with some announcing plans to open new branches in underserved suburban areas.

This expansion often involves a dual approach: organic growth through new branch openings and strategic acquisitions of smaller institutions. These moves are designed to broaden the bank's physical presence and consolidate its position in key markets. Data from late 2023 indicated a slight uptick in merger and acquisition activity among community banks, signaling a trend towards network consolidation and expansion.

- Strategic Branch Network Growth: Focus on expanding physical presence, especially in high-potential markets like the Northeast.

- Acquisition Strategy: Pursue strategic acquisitions to broaden reach and gain market share.

- Customer Accessibility Enhancement: Optimize branch locations to improve convenience and service for a wider customer base.

Community banks actively manage their balance sheets through prudent investment in securities, ranging from government-backed bonds to corporate debt. This activity is crucial for optimizing liquidity, generating interest income, and managing overall risk exposure. In 2024, the investment portfolio of many community banks showed a strategic shift towards shorter-duration assets in response to evolving interest rate environments, aiming to mitigate potential capital losses.

The bank also engages in treasury and capital management, which involves efficiently managing its own capital structure and funding sources. This includes issuing debt, managing equity, and ensuring compliance with regulatory capital requirements. For instance, in 2024, community banks focused on maintaining strong capital ratios, with many exceeding regulatory minimums to ensure financial resilience and support lending growth.

| Key Activity | Description | 2024 Relevance/Data Point |

|---|---|---|

| Investment in Securities | Managing a portfolio of financial instruments to generate income and manage risk. | Strategic shift towards shorter-duration assets to manage interest rate sensitivity. |

| Treasury & Capital Management | Ensuring adequate capital levels and efficient funding for operations. | Focus on maintaining strong capital ratios, exceeding regulatory minimums for resilience. |

Delivered as Displayed

Business Model Canvas

The Community Bank Business Model Canvas you are previewing is the actual, complete document you will receive upon purchase. This isn't a sample or a mockup; it's a direct representation of the file's content and structure. Once your order is processed, you'll gain full access to this professionally designed and ready-to-use Business Model Canvas, allowing you to immediately begin strategizing for your community bank.

Resources

Financial capital, comprising equity and borrowed funds, is the primary engine for a community bank's operations, directly fueling its lending and investment activities. In 2024, community banks continued to rely heavily on this capital to support economic growth within their local areas.

The deposit base is equally critical, acting as a stable and often low-cost source of funding. As of the first quarter of 2024, deposits held by U.S. commercial banks reached approximately $17.5 trillion, underscoring their immense importance as a key resource for lending and overall financial stability.

Human capital, specifically a highly skilled workforce, is a cornerstone for community banks. This includes experienced bankers, knowledgeable financial advisors, meticulous trust officers, and efficient benefits administrators. Their collective expertise is crucial for building strong customer relationships, ensuring smooth operations, and delivering specialized financial services that set community banks apart.

The value of this skilled workforce is evident in their ability to foster trust and provide personalized guidance. For instance, in 2024, community banks continued to rely on their human capital to navigate evolving customer needs and regulatory landscapes, often seeing higher customer retention rates in branches with specialized staff.

The bank's approximately 200 customer facilities are a cornerstone, enabling direct engagement and personalized service delivery. This extensive physical footprint is crucial for fostering community trust and providing accessible, traditional banking solutions.

These branches are more than just service points; they are hubs for community interaction, facilitating face-to-face relationships that are vital for a community bank's success. In 2024, these branches continued to be the primary channel for many customer transactions and relationship building.

Technology Infrastructure and Digital Platforms

A community bank's technological backbone, encompassing secure online banking portals, intuitive mobile applications, and robust internal systems, is fundamental to its operational efficiency and customer engagement. These digital platforms facilitate seamless transactions, personalized financial management, and secure data handling, directly impacting customer satisfaction and operational costs.

In 2024, community banks are heavily investing in upgrading these digital assets. For instance, many are focusing on enhancing their mobile banking features, with a significant portion of customer interactions now occurring through these apps. This digital shift is not just about convenience; it's about maintaining competitiveness and meeting evolving customer expectations for instant access and personalized service.

- Digital Channels Usage: By the end of 2023, over 70% of community bank customers regularly used online or mobile banking for routine transactions.

- Cybersecurity Investment: Community banks allocated an average of 15-20% of their IT budget in 2024 to cybersecurity measures, up from 10-15% in previous years, to protect sensitive customer data.

- Platform Integration: Successful integration of core banking systems with digital platforms is a key priority, aiming to reduce manual processing and improve data accuracy.

- Customer Experience Focus: Enhancements in 2024 are largely driven by improving the user experience on digital platforms, leading to higher engagement rates.

Brand Reputation and Trust

A strong brand reputation and the trust built within the communities a community bank serves are indeed invaluable intangible resources. This trust is a bedrock for customer loyalty and a magnet for new clients, directly supporting the bank's sustained growth and long-term viability.

In 2024, banks that actively engaged in community initiatives and maintained transparent communication often saw higher customer retention rates. For instance, studies indicated that community banks with strong local ties reported an average customer retention of 90%, significantly outperforming larger, less localized institutions.

- Community Involvement: Banks sponsoring local events or supporting small businesses build significant goodwill.

- Customer Service Excellence: Consistent, personalized service fosters trust and loyalty.

- Transparency and Ethics: Open communication about fees and practices solidifies a bank's reputation.

- Longevity and Stability: A long history of serving a community signals reliability.

Financial capital, including equity and debt, is the lifeblood of a community bank, enabling lending and investment. In 2024, this capital was crucial for local economic development. The deposit base, representing stable and cost-effective funding, is equally vital. U.S. commercial banks held roughly $17.5 trillion in deposits by Q1 2024, highlighting their significance for lending and financial stability.

Human capital, the expertise of bankers and advisors, is a cornerstone for building relationships and offering specialized services. This skilled workforce is essential for navigating evolving customer needs and regulations, as seen in 2024 with community banks leveraging staff expertise for higher customer retention.

Physical branches, numbering around 200, serve as vital points for direct customer engagement and trust-building. These facilities are key channels for transactions and relationship development, reinforcing the bank's community presence. In 2024, these branches remained central to customer interaction.

The technological infrastructure, including online and mobile platforms, drives efficiency and customer engagement. Community banks invested heavily in digital upgrades in 2024, with mobile banking becoming a primary interaction channel to meet customer expectations for instant access and personalized service.

A strong brand reputation and community trust are invaluable intangible assets, fostering loyalty and attracting new clients. Banks with active community involvement in 2024 reported higher retention, with those having strong local ties achieving around 90% customer retention.

| Key Resource | Description | 2024 Relevance/Data |

|---|---|---|

| Financial Capital | Equity and borrowed funds | Primary engine for lending and investment; crucial for local economic support. |

| Deposit Base | Customer deposits | Stable, low-cost funding source; U.S. commercial banks held ~$17.5 trillion in Q1 2024. |

| Human Capital | Skilled workforce | Essential for customer relationships, specialized services, and navigating evolving needs. |

| Physical Branches | Customer facilities | Approx. 200 locations; vital for direct engagement, trust-building, and community presence. |

| Technological Infrastructure | Digital platforms | Online/mobile banking; focus on upgrades in 2024 to enhance customer experience and competitiveness. |

| Brand Reputation & Trust | Community standing | Invaluable intangible asset; strong local ties led to ~90% customer retention in 2024. |

Value Propositions

Community banks act as a financial hub, offering everything from checking and savings accounts to mortgages, business loans, and even wealth management. This comprehensive suite of services means customers don't need to juggle multiple providers, streamlining their financial lives. For instance, many community banks in 2024 reported significant growth in their small business lending portfolios, with some seeing double-digit increases, demonstrating their commitment to supporting local economies through diverse financial solutions.

Community banks excel by prioritizing personalized service, deeply embedding themselves within their local areas. This focus allows them to tailor offerings, like specialized small business loans or tailored mortgage products, directly to the unique economic landscape of their communities. For instance, many community banks reported strong local loan growth in 2023, with some seeing increases of over 8% in their commercial and industrial loan portfolios, demonstrating their commitment to local economic development.

Community Bank leverages specialized subsidiaries to deliver expert employee benefit trust and administration services. This allows businesses to efficiently manage retirement plans and other benefits, ensuring compliance and optimizing employee financial well-being.

Furthermore, the bank offers comprehensive wealth management and trust services, catering to the complex financial needs of high-net-worth individuals. This dual focus provides significant value, addressing both corporate and individual financial objectives.

For instance, as of Q1 2024, Community Bank's wealth management division saw a 15% increase in assets under management, reaching $2.5 billion, driven by strong client retention and new business acquisition in employee benefit solutions.

Financial Stability and Reliability

Community Bank System's robust capitalization and strong financial footing provide a bedrock of security for its customers. This stability translates into a reliable partner for individuals and businesses alike, fostering trust through consistent performance and strict adherence to regulatory requirements.

In 2024, Community Bank System maintained a solid capital position, with its Tier 1 Capital Ratio consistently exceeding regulatory minimums. This financial strength is a key component of its value proposition, assuring customers that their deposits and investments are well-protected.

- Capital Strength: Demonstrating a commitment to financial resilience, Community Bank System's capital ratios remain robust, providing a significant buffer against economic downturns.

- Regulatory Compliance: The bank's unwavering adherence to all banking regulations underscores its dedication to safe and sound financial practices, enhancing customer confidence.

- Consistent Performance: Year after year, Community Bank System has shown steady financial results, reinforcing its reputation for reliability and predictable service.

Convenient Access and Digital Accessibility

Community banks are doubling down on convenience, blending their familiar branch presence with advanced digital tools. This dual approach is crucial for meeting customer expectations in 2024, where seamless access is paramount. For instance, many community banks reported significant growth in their digital transaction volumes throughout 2023, with mobile banking often seeing double-digit percentage increases year-over-year.

The strategy focuses on making banking accessible on the customer's terms. Whether it's a quick check of balances via a mobile app or a face-to-face discussion at a local branch, the goal is to offer flexibility. By 2024, over 80% of community bank customers are expected to utilize at least one digital channel for their banking needs.

- Widespread Branch Network: Maintaining a physical presence in communities fosters trust and caters to customers who prefer in-person interactions.

- Robust Online Platforms: Offering comprehensive online banking services allows for 24/7 account management, transfers, and bill payments.

- Mobile Banking Apps: Intuitive and feature-rich mobile applications enable customers to perform most banking tasks on the go, including mobile check deposit and P2P payments.

- Omnichannel Experience: Integrating these channels ensures a consistent and convenient banking experience, regardless of how the customer chooses to interact with the bank.

Community banks offer a full spectrum of financial services, from everyday accounts to specialized business lending and wealth management. This all-in-one approach simplifies finances for customers, fostering convenience. In 2024, many community banks saw substantial growth in their small business loan portfolios, with some reporting double-digit increases, underscoring their role as local economic engines.

Their value lies in deep community integration and personalized service, allowing for tailored financial products that meet local needs. This focus on local economies is evident in their lending practices. For instance, in 2023, community banks reported strong growth in commercial and industrial loans, with some experiencing over 8% increases, highlighting their commitment to local business development.

Community banks provide a crucial blend of accessibility and digital convenience, meeting customers wherever they are. This omnichannel strategy is key in 2024, with digital banking usage soaring. Throughout 2023, many community banks observed significant upticks in digital transaction volumes, particularly in mobile banking, which often saw year-over-year growth in the double digits.

| Value Proposition | Description | 2023/2024 Data Example |

|---|---|---|

| Comprehensive Financial Services | One-stop shop for accounts, loans, and wealth management. | Double-digit growth in small business lending portfolios (2024). |

| Personalized Local Focus | Tailored products and services based on community needs. | Over 8% increase in commercial and industrial loans (2023). |

| Accessible Banking Channels | Integration of physical branches with advanced digital platforms. | Double-digit percentage increases in mobile banking transaction volumes (2023). |

Customer Relationships

Community banks excel at personalized relationship management, fostering deep connections with their clientele. For commercial clients, this often means assigning dedicated relationship managers who understand their specific business needs and financial goals. This hands-on approach ensures a tailored experience, building trust and loyalty over time.

At the branch level, personalized service is paramount. Staff are trained to recognize and remember customers, offering assistance that goes beyond simple transactions. This focus on individual needs, rather than a one-size-fits-all model, is a key differentiator. For instance, many community banks reported customer retention rates exceeding 90% in 2023, a testament to the strength of these personal relationships.

Community banks actively engage in local areas by sponsoring events and participating in community initiatives, which builds trust and deepens relationships. For instance, in 2024, many community banks increased their local event sponsorships by an average of 15% compared to the previous year, directly supporting local economies and fostering goodwill.

This commitment to a community-first approach cultivates strong customer loyalty and highlights the bank's dedication to the well-being of the regions it serves. Data from 2024 surveys indicated that customers of community banks with a strong local presence reported a 20% higher satisfaction rate than those banking with larger, national institutions.

Community banks are increasingly investing in digital self-service and support to meet customer expectations. In 2024, over 80% of community banks reported offering robust online and mobile banking platforms, enabling customers to perform transactions, check balances, and access customer service without direct human interaction. This focus on digital channels enhances convenience and broadens accessibility, allowing customers to manage their finances anytime, anywhere.

Advisory and Consultative Services

For more intricate financial requirements, community banks extend advisory and consultative services. These go beyond basic transactions, focusing on areas like comprehensive financial planning, sophisticated wealth management strategies, and tailored employee benefits packages. This approach fosters deeper client relationships built on expert guidance and customized solutions designed to meet specific, often long-term, financial objectives.

These consultative relationships are crucial for client retention and increasing the bank's share of wallet. For instance, in 2024, banks that actively promoted wealth management services saw an average increase of 15% in non-interest income compared to those with a more transactional focus. This highlights the financial benefit of investing in these specialized advisory roles.

- Financial Planning: Offering personalized roadmaps for achieving goals like retirement or education funding.

- Wealth Management: Providing investment advice, portfolio management, and estate planning services.

- Employee Benefits: Designing and administering retirement plans, health savings accounts, and other benefits for businesses.

- Client Engagement: These services typically involve dedicated relationship managers and regular, in-depth consultations.

Proactive Communication and Financial Education

Community banks are actively enhancing customer relationships through proactive communication and financial education. This approach fosters trust by keeping clients informed about relevant financial opportunities and market trends. For instance, many banks in 2024 are offering personalized digital content, with over 60% of community banks reporting an increase in digital engagement tools to deliver these insights.

By providing guidance on financial wellness and smart money management, these institutions empower their customers. This educational focus is crucial, especially as economic conditions evolve. A recent survey indicated that 75% of community bank customers feel more confident in their financial decisions after participating in educational workshops or accessing online resources.

Key initiatives include:

- Personalized financial advice: Offering tailored guidance based on individual customer needs and goals.

- Educational workshops and webinars: Hosting sessions on topics like budgeting, investing, and retirement planning.

- Market insights and trend analysis: Sharing timely information to help customers navigate financial markets.

- Digital resource hubs: Providing accessible online platforms with educational articles, tools, and calculators.

Community banks cultivate strong customer relationships through personalized service, community involvement, and tailored financial advice. Their focus on individual needs, often supported by dedicated relationship managers, drives high customer retention, with many reporting over 90% retention in 2023. In 2024, community banks increased local event sponsorships by approximately 15%, further solidifying community ties and boosting customer satisfaction by an estimated 20% compared to national banks.

| Relationship Type | Key Features | 2024 Impact/Focus |

|---|---|---|

| Personalized Service | Branch staff recognition, tailored assistance | Customer retention exceeding 90% (2023) |

| Community Engagement | Local event sponsorships, community initiatives | 15% increase in sponsorships (2024), enhanced goodwill |

| Advisory Services | Financial planning, wealth management, employee benefits | 15% increase in non-interest income for banks promoting these services (2024) |

| Digital Support | Online/mobile banking, self-service options | 80%+ of banks offering robust platforms (2024) |

| Financial Education | Workshops, webinars, market insights, digital resources | 75% of customers feel more confident after participation (recent survey) |

Channels

The physical branch network, comprising around 200 locations, acts as the bedrock for traditional banking services and direct customer interaction. These branches are vital for fostering community ties and offering personalized assistance for essential banking needs.

These physical hubs are instrumental in core banking activities such as accepting deposits and processing loan applications. In 2024, community banks with robust branch networks often reported higher customer retention rates, with some studies indicating that customers value the ability to visit a branch for complex transactions or advice.

The extensive reach of these branches allows for significant community engagement, providing a tangible presence for the bank. For instance, many community banks utilize their branches for local events and financial literacy workshops, reinforcing their role as community partners.

Online and mobile banking platforms are crucial digital channels, offering customers secure 24/7 access to manage accounts, pay bills, and transfer funds. By 2024, a significant majority of community bank customers expect these digital conveniences, driving adoption rates for features like mobile check deposit and digital loan applications.

An accessible ATM network offers customers convenient access for withdrawals, deposits, and balance checks, extending the bank's physical presence. In 2024, community banks continued to leverage their ATM networks as a primary self-service channel, with many reporting over 80% of customer transactions occurring at ATMs or digital platforms. This physical touchpoint remains crucial for customer engagement and operational efficiency.

Call Centers and Customer Service

Call centers serve as a crucial direct channel for community banks, offering immediate support for inquiries, technical issues, and problem resolution. This human-centric approach caters to customers who value phone interaction or need prompt assistance, fostering stronger relationships.

In 2024, the average cost per call for customer service in the banking sector hovered around $3.50 to $5.00, highlighting the operational investment in this channel. However, effective call centers can significantly boost customer retention, which is vital for community banks relying on loyal customer bases.

- Customer Support: Provides direct, real-time assistance for account inquiries, transaction support, and general banking questions.

- Problem Resolution: Acts as a primary channel for addressing and resolving customer complaints or service disruptions.

- Relationship Building: Offers a personal touchpoint that can enhance customer loyalty and satisfaction, especially for complex issues.

- Accessibility: Ensures customers who prefer or require phone communication have a readily available support option.

Sales and Relationship Management Teams

Sales and relationship management teams are the frontline for community banks, focusing on direct engagement with commercial clients, municipalities, and high-net-worth individuals. These specialized teams are tasked with understanding unique client needs to offer bespoke financial solutions, fostering loyalty and long-term partnerships. Their success directly impacts client acquisition and retention, which are vital for sustained growth.

These teams are instrumental in driving revenue by identifying cross-selling opportunities and ensuring client satisfaction. For instance, in 2024, many community banks reported that personalized client outreach by relationship managers led to a significant increase in loan origination and deposit growth from their key commercial segments. This hands-on approach differentiates community banks from larger institutions.

- Client Acquisition: Relationship managers actively seek new business relationships through networking and targeted outreach.

- Client Retention: Proactive communication and problem-solving by sales teams ensure existing clients remain with the bank.

- Tailored Solutions: Offering customized loan products, treasury management services, and investment advice based on client needs.

- Revenue Generation: These teams are directly responsible for a substantial portion of the bank's interest and fee income.

Channels are the conduits through which community banks deliver their value proposition to customers. These include the familiar physical branch network, digital platforms like online and mobile banking, ATMs for self-service, and dedicated call centers for direct support. Additionally, specialized sales and relationship management teams engage directly with key client segments.

In 2024, community banks continued to balance their investments in physical and digital channels to meet diverse customer preferences. While digital adoption surged, the physical branch remained a critical touchpoint for complex transactions and relationship building, particularly in local markets.

The effectiveness of these channels is measured by customer reach, transaction volume, and the ability to foster loyalty. For instance, in 2024, community banks with strong digital offerings saw a significant increase in new account openings through their mobile apps, while those with well-maintained ATM networks reported high utilization for everyday transactions.

Relationship managers played a pivotal role in 2024, driving growth in commercial lending and treasury services by providing personalized advice and solutions, directly contributing to revenue streams and client retention.

| Channel | Primary Function | 2024 Customer Engagement Trend | Key Benefit |

|---|---|---|---|

| Physical Branches | Core banking, direct interaction, community presence | Continued importance for complex needs and relationship building | Trust, personalized service, local engagement |

| Online & Mobile Banking | 24/7 account management, transactions, payments | Rapidly increasing adoption for convenience and self-service | Accessibility, efficiency, cost-effectiveness |

| ATM Network | Cash withdrawals, deposits, balance inquiries | High utilization for routine transactions, extending physical reach | Convenience, immediate access to funds |

| Call Centers | Customer support, problem resolution, inquiries | Essential for complex issues and customers preferring phone interaction | Personalized assistance, problem solving, relationship maintenance |

| Sales & Relationship Management | Client acquisition, tailored solutions, business development | Crucial for commercial and high-net-worth segments, driving revenue | Customized offerings, deep client understanding, loyalty building |

Customer Segments

Individuals and households represent a core customer segment for community banks, seeking essential financial services. These include everyday needs like checking and savings accounts, along with major life purchases such as mortgages and auto loans. In 2024, community banks continued to be a primary source for these services, with many offering competitive rates on savings accounts, aiming to attract deposits amidst evolving economic conditions.

The bank's offerings extend to personal loans for various needs, from debt consolidation to unexpected expenses. Furthermore, investment products are crucial for long-term financial planning, with community banks providing access to mutual funds, retirement accounts, and brokerage services tailored to individual risk tolerance and goals. As of early 2024, the average savings account yield across community banks hovered around 1.5%, a slight increase from the previous year.

Small and medium-sized businesses (SMBs) form a cornerstone for community banks, representing a significant demand for commercial loans, essential business banking accounts, and sophisticated treasury management services. These enterprises often seek a financial partner deeply invested in their local success, looking for tailored solutions that can adapt to their growth. For instance, in 2024, SMBs continued to be a driving force in the economy, with data from the U.S. Small Business Administration highlighting their crucial role in job creation and innovation.

Community banks strive to be more than just a lender to these SMBs; they aim to be a comprehensive financial ally. This includes offering services that streamline operations, such as payroll processing and payment solutions, and even extending to employee benefit programs like retirement plans. The bank’s value proposition lies in its ability to provide personalized attention and build lasting relationships, understanding the unique challenges and opportunities faced by local businesses.

Community banks are crucial partners for municipalities, offering specialized deposit accounts and financing for vital public projects. These governmental entities often have complex regulatory landscapes and unique operational needs that community banks are well-equipped to handle. For instance, in 2024, many local governments rely on these banks for managing tax revenues and funding infrastructure improvements, such as road repairs or school upgrades.

The financial services provided extend beyond simple deposits, encompassing loans for capital expenditures and treasury management solutions. This segment is characterized by a need for reliable, long-term financial relationships and a deep understanding of public finance. In 2023, community banks played a significant role in facilitating municipal bond issuances, helping local governments secure capital efficiently.

High-Net-Worth Individuals

High-net-worth individuals (HNWIs) are a key customer segment for community banks, particularly those seeking comprehensive wealth management, financial planning, and trust services, often delivered through specialized bank subsidiaries. These clients expect and require sophisticated financial advice, including tailored investment strategies and estate planning, to preserve and grow their wealth effectively.

The demand for these services remains robust. For instance, in 2024, the global wealth management market continued its upward trajectory, with HNWIs increasingly turning to trusted financial institutions for personalized guidance. Banks that can offer integrated solutions, from investment management to philanthropic planning, are well-positioned to capture this lucrative segment.

- Targeted Services: Wealth management, financial planning, and trust services are primary offerings for HNWIs.

- Sophisticated Needs: Clients require customized investment strategies and complex financial advice.

- Market Trend: In 2024, HNWIs demonstrated a continued preference for integrated financial solutions from their banking partners.

- Growth Potential: Banks effectively serving this segment can achieve significant fee-based income and client loyalty.

Employers (for Employee Benefits)

Community banks, through subsidiaries like BPAS, cater to businesses of all sizes seeking comprehensive employee benefit trust and administration services. This segment is crucial for growth, with BPAS alone administering over $120 billion in assets as of early 2024.

These employers rely on these services for efficient retirement plan administration, including defined contribution and defined benefit plans. They also utilize actuarial consulting to ensure compliance and financial health of their benefit programs.

- Retirement Plan Administration: Offering services for 401(k), 403(b), and pension plans, ensuring smooth operation and compliance for employers.

- Actuarial Consulting: Providing expert analysis for pension funding, post-retirement medical benefits, and other complex actuarial needs.

- Nationwide Reach: Serving a broad spectrum of businesses across the country, demonstrating scalability and broad market appeal.

- Asset Growth: BPAS’s significant asset under administration highlights the trust and demand from employers for these specialized financial services.

Community banks serve a diverse customer base, from individuals and small businesses to larger corporations and even municipalities. Each segment has unique financial needs, ranging from basic banking and loans to complex wealth management and public finance solutions. Understanding these distinct requirements allows community banks to tailor their offerings and build strong, lasting relationships.

In 2024, community banks continued to be a vital financial resource for their local economies. They provide essential services to individuals and households, such as checking accounts, mortgages, and personal loans, while also supporting small and medium-sized businesses with commercial loans and treasury management. Additionally, they partner with municipalities for public project financing and cater to high-net-worth individuals with wealth management services.

| Customer Segment | Key Needs | 2024 Focus/Trends |

|---|---|---|

| Individuals & Households | Checking, savings, mortgages, auto loans, personal loans, investments | Competitive savings rates, personalized loan options |

| Small & Medium-Sized Businesses (SMBs) | Commercial loans, business accounts, treasury management, payroll, payment solutions | Tailored financing, operational streamlining services |

| Municipalities | Deposit accounts, public project financing, treasury management | Managing tax revenues, funding infrastructure improvements |

| High-Net-Worth Individuals (HNWIs) | Wealth management, financial planning, trust services, tailored investments | Integrated financial solutions, personalized guidance |

Cost Structure

Interest expense on customer deposits is a significant cost for community banks, directly impacting their profitability by influencing the net interest margin. For instance, in the first quarter of 2024, the average interest rate paid on savings deposits across U.S. community banks hovered around 0.40%, a figure that has seen some upward pressure as the Federal Reserve maintained higher policy rates.

This cost is fundamental as these deposits serve as the bank's primary source of funds for its core business of lending. Effectively managing these interest expenses, especially in a fluctuating rate environment, is crucial for ensuring the bank can lend profitably and maintain its financial health.

Employee salaries and benefits represent a significant operational cost for community banks. These expenses cover compensation, healthcare, retirement plans, and other perks for a diverse workforce. In 2024, the average salary for a bank teller in the US was around $37,000, while branch managers could earn upwards of $70,000 annually, not including the substantial cost of benefits.

Community banks face substantial expenses tied to their physical presence. This includes the costs of rent, utilities, and regular maintenance for their numerous branch locations and corporate headquarters. In 2024, these occupancy costs represent a significant portion of operational expenditures for many regional financial institutions.

Beyond just the physical spaces, equipment depreciation is another key cost. This covers everything from ATMs and teller machines to computer systems and office furniture. The ongoing need to update and maintain this technology contributes to the overall financial outlay for maintaining the extensive branch network.

Technology and Cybersecurity Investments

Community banks are increasingly channeling significant resources into technology and cybersecurity. These ongoing investments are critical for maintaining operational efficiency, safeguarding sensitive customer data, and offering competitive digital banking services. For instance, in 2024, many community banks allocated between 5% and 10% of their operating expenses towards technology upgrades and robust cybersecurity defenses.

These expenditures cover a wide range of areas, from core banking software modernization to cloud infrastructure and advanced threat detection systems. The goal is to ensure seamless digital experiences for customers while mitigating the ever-evolving landscape of cyber threats.

- Software Development and Licensing: Costs associated with acquiring, customizing, and maintaining banking software, including online and mobile banking platforms.

- Cybersecurity Infrastructure: Investments in firewalls, intrusion detection systems, data encryption, security audits, and employee training to protect against breaches.

- Cloud Computing Services: Expenses related to migrating and managing data and applications on cloud platforms for scalability and accessibility.

- Digital Platform Enhancements: Funding for improving user interfaces, developing new digital products, and ensuring compliance with digital regulations.

Regulatory Compliance and Administrative Costs

Community banks face significant expenses related to regulatory compliance and administration. These costs are essential for maintaining operational integrity and trust within the financial system.

Key cost drivers include adherence to banking laws, legal counsel, mandatory audits, and the operational overhead for risk management and reporting functions. For instance, in 2024, the financial services sector continued to see substantial investments in compliance technology and personnel to navigate evolving regulatory landscapes.

- Regulatory Compliance: Costs associated with meeting federal and state banking regulations, including Know Your Customer (KYC) and Anti-Money Laundering (AML) requirements.

- Legal and Audit Fees: Expenses for legal advice, external audits, and internal compliance reviews to ensure adherence to all applicable laws.

- Risk Management and Reporting: Investment in systems and staff for credit risk, market risk, operational risk management, and regulatory reporting.

- Administrative Overhead: General operating costs such as salaries for administrative staff, IT infrastructure for compliance, and office expenses.

Marketing and advertising are crucial for community banks to attract new customers and retain existing ones. These costs cover a range of activities aimed at building brand awareness and promoting services. In 2024, community banks continued to invest in digital marketing strategies, including social media campaigns and targeted online advertising, to reach a broader audience.

These efforts are essential for competing in an increasingly digital financial landscape. The aim is to highlight the bank's community focus and personalized service offerings. For example, a local bank might spend on sponsoring community events or running ads in local publications to reinforce its connection to the area.

Other significant costs include loan loss provisions, which are funds set aside to cover potential defaults on loans. This is a critical component of risk management. Additionally, operational expenses like payment processing fees and correspondent banking services also contribute to the overall cost structure.

Revenue Streams

Net Interest Income (NII) is the lifeblood of community banks, stemming from the spread between interest earned on loans and investments and interest paid out on customer deposits. This core profitability driver allows banks to fund operations and generate returns for shareholders.

For instance, in 2024, many community banks reported robust NII growth, bolstered by a generally stable interest rate environment. Data from the Federal Reserve indicates that the net interest margin for community banks, a key metric reflecting NII, remained competitive, though specific figures vary by institution and region.

Community banks generate revenue through service charges and fees on deposit accounts. These include monthly maintenance fees, overdraft fees, and charges for specific transactions, all contributing to the bank's non-interest income. For instance, in 2024, many community banks saw continued reliance on these fees, with some reporting that fees from deposit accounts constituted a significant portion of their overall non-interest revenue.

Community banks increasingly rely on non-interest income, a vital component for sustained profitability. In 2024, fees generated from wealth management, retail brokerage, trust services, and financial planning represented a significant portion of these revenues, demonstrating a strategic diversification away from traditional lending margins.

Employee Benefit Trust and Administration Fees

Community banks generate significant revenue by offering employee benefit trust and administration services. These specialized services, often provided through dedicated subsidiaries, create a reliable and recurring income stream, similar to a subscription model.

For instance, in 2024, many community banks saw a notable increase in fee income from these services. This growth is driven by businesses increasingly outsourcing their employee benefit management to specialized financial institutions. The stability of this revenue makes it a valuable component of a bank's overall financial health.

Key aspects of this revenue stream include:

- Stable Fee Income: These services typically involve ongoing administrative fees, providing predictable revenue.

- Growing Demand: Businesses are increasingly relying on external expertise for complex benefit plans.

- Diversification: This revenue stream diversifies a bank's income beyond traditional lending.

- Customer Retention: Offering these services can strengthen relationships with business clients.

Insurance Services Commissions and Fees

Community banks often generate revenue through commissions and fees earned from their insurance services subsidiaries. This strategy diversifies income streams and capitalizes on existing customer relationships. For instance, a community bank might own an insurance agency that offers various policies, earning a percentage of each sale.

In 2024, this revenue stream can be particularly robust as economic conditions may drive demand for insurance products. A bank's established trust with its clientele makes it a natural conduit for insurance sales, turning customer loyalty into a tangible financial benefit. This approach not only adds to the bank's bottom line but also provides a more comprehensive financial service offering to its customers.

- Diversified Income: Commissions from insurance sales provide an additional revenue stream beyond traditional lending and deposit services.

- Leveraging Relationships: Existing customer trust and loyalty are utilized to cross-sell insurance products.

- Comprehensive Services: Offering insurance enhances the bank's role as a full-service financial partner.

- Potential for Growth: Market trends and customer needs can drive increased demand for insurance, boosting commission revenue.

Community banks also generate revenue through loan origination and servicing fees, which include charges for processing, underwriting, and managing loans. These fees provide an additional income stream that complements net interest income.

In 2024, the demand for various loan products, from mortgages to small business loans, remained strong, leading to increased fee generation for banks adept at efficient loan processing. For example, data from the Independent Community Bankers of America (ICBA) indicated that fee income from loan activities contributed positively to many community banks' profitability in the past year.

Furthermore, banks earn income from selling loans into the secondary market, such as through Fannie Mae or Freddie Mac. This activity generates upfront fees and can also free up capital for further lending, boosting overall revenue and operational efficiency.

| Revenue Stream | Description | 2024 Trend Example | Key Driver |

|---|---|---|---|

| Loan Origination & Servicing Fees | Fees for processing, underwriting, and managing loans. | Increased due to steady demand for mortgages and business loans. | Loan volume and processing efficiency. |

| Secondary Market Loan Sales | Income from selling loans to investors or government-sponsored enterprises. | Contributed to capital liquidity and generated upfront fees. | Mortgage market activity and capital management strategies. |

Business Model Canvas Data Sources

The Community Bank Business Model Canvas is built using a blend of internal financial data, customer feedback, and local market research. This ensures a realistic and actionable representation of the bank's operations and strategic direction.