Cathay General Bank SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Cathay General Bank Bundle

Cathay General Bank's SWOT analysis reveals a solid foundation built on strong brand recognition and a loyal customer base, but also highlights potential vulnerabilities in its digital transformation efforts and increasing competition.

Want the full story behind Cathay General Bank's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Cathay General Bancorp demonstrates a robust capital position, a significant strength. As of the second quarter of 2025, the bank reported a Tier 1 risk-based capital ratio of 13.35% and a total risk-based capital ratio of 14.92%.

These figures comfortably exceed regulatory minimums, underscoring the bank's financial stability and its capacity to withstand economic volatility. This strong capital foundation also equips Cathay General Bancorp with the agility to pursue strategic expansion initiatives and reward its shareholders.

Cathay General Bank's Net Interest Margin (NIM) has shown a healthy upward trend. In the second quarter of 2025, the NIM reached 3.27%, a slight but positive increase from 3.25% in the first quarter of 2025. This improvement is largely attributed to the bank's success in managing its funding costs, which have decreased more significantly than the modest dip in the yields earned on its assets.

Looking ahead, the bank's management is optimistic, projecting a full-year NIM to fall within the 3.25% to 3.35% range. This forecast suggests a strong ability to adapt and perform well within the prevailing interest rate climate, a key strength for any financial institution.

Cathay General Bank's dedicated focus on Asian American communities cultivates a deeply loyal customer base, translating into a stable deposit foundation. This niche specialization allows for a nuanced understanding of client needs, leading to the development of highly relevant financial products and services.

As of the first quarter of 2024, Cathay General Bank reported total deposits of $21.5 billion, a testament to the strength of its community-centric approach. This focus not only fosters strong client relationships but also provides a competitive edge in serving a specific, often underserved, demographic across its multi-state and international presence.

Diversified Financial Offerings

Cathay General Bank's strength lies in its diversified financial offerings. The bank provides a broad spectrum of products and services, encompassing commercial loans, commercial real estate financing, and residential mortgages, in addition to various deposit accounts and robust wealth management services. This wide array of offerings effectively reduces the risk that comes from depending too heavily on just one area of the financial market.

This strategic diversification extends to its income generation. Beyond traditional lending, Cathay General Bank actively develops non-lending product families. These include significant contributions from wealth management and financial instruments like interest rate swaps, which further diversify the bank's revenue streams and enhance its financial resilience.

The bank's commitment to a comprehensive financial suite is evident in its product mix. For instance, as of early 2024, Cathay General Bank reported substantial growth in its wealth management division, with assets under management increasing by over 15% year-over-year. This growth is directly attributable to the appeal of its diverse investment and advisory services, complementing its core lending businesses.

- Broad Lending Portfolio: Offers commercial, commercial real estate, and residential loans, reducing concentration risk.

- Comprehensive Deposit Services: Provides a variety of deposit accounts catering to diverse customer needs.

- Wealth Management Growth: Significant expansion in assets under management, indicating strong client trust and product appeal.

- Diverse Income Streams: Leverages non-lending products like interest rate swaps to stabilize and grow revenue.

Commitment to Shareholder Returns

Cathay General Bancorp has a strong track record of prioritizing shareholder returns. This commitment is evident in their consistent dividend payouts and proactive share repurchase initiatives. For instance, the company successfully concluded a $125 million share repurchase program in February 2025.

Further underscoring this dedication, Cathay General Bancorp announced a new share repurchase authorization totaling $150 million in June 2025. These actions not only return capital to shareholders but also signal management's confidence in the bank's intrinsic value and its sustained financial stability.

- Consistent shareholder value creation through dividends.

- Completion of a $125 million share repurchase program in February 2025.

- Authorization of a new $150 million share repurchase program in June 2025.

- Management confidence reflected in capital return strategies.

Cathay General Bancorp's robust capital position is a key strength, with a Tier 1 risk-based capital ratio of 13.35% and a total risk-based capital ratio of 14.92% as of Q2 2025. These metrics significantly surpass regulatory requirements, highlighting the bank's financial resilience and capacity for strategic growth.

The bank's Net Interest Margin (NIM) has shown a positive trend, reaching 3.27% in Q2 2025, up from 3.25% in Q1 2025. This improvement is driven by effective management of funding costs, which have decreased more than asset yields.

Cathay General Bank's specialization in Asian American communities fosters a loyal customer base, contributing to a stable deposit foundation of $21.5 billion as of Q1 2024. This niche focus allows for tailored financial products and services.

The bank offers a diversified suite of financial products, including commercial loans, real estate financing, residential mortgages, deposit accounts, and wealth management services. This broad portfolio reduces reliance on any single market segment.

| Metric | Q1 2025 | Q2 2025 |

| Tier 1 Capital Ratio | 13.20% | 13.35% |

| Total Capital Ratio | 14.75% | 14.92% |

| Net Interest Margin (NIM) | 3.25% | 3.27% |

What is included in the product

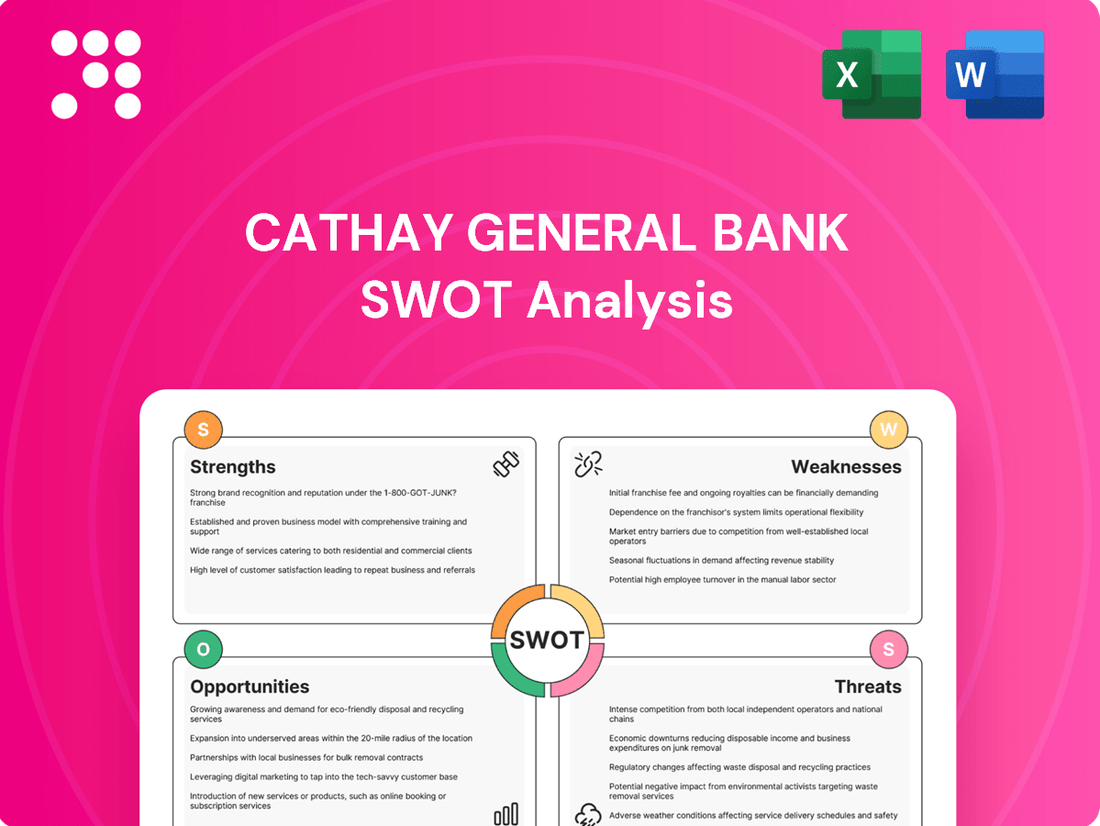

Delivers a strategic overview of Cathay General Bank’s internal and external business factors, identifying key strengths, weaknesses, opportunities, and threats to inform its market position and future growth.

Offers a clear, actionable framework for Cathay General Bank to identify and address key challenges and opportunities, transforming potential weaknesses into strategic advantages.

Weaknesses

Cathay General Bank faced a notable dip in its financial performance, with net income falling to $69.5 million in the first quarter of 2025, down from $80.2 million in the preceding quarter. This decline was largely driven by a substantial 28% decrease in non-interest income, primarily due to net losses incurred from its equity securities portfolio.

While the bank saw a recovery in the second quarter of 2025, the prior period's performance highlights a vulnerability. The significant fluctuations in non-interest income, particularly the impact of equity market volatility, represent an ongoing weakness that could affect profitability in future reporting periods.

Cathay General Bancorp is experiencing a rise in problem loans. Non-performing assets (NPAs) saw a significant jump of 14.9% from the first quarter to the second quarter of 2025, reaching $199.5 million. This increase highlights potential credit quality issues that require careful attention.

Further compounding these concerns, non-accrual loans also grew by 12.6% in the second quarter of 2025. The bank attributes this particular increase largely to a single commercial real estate relationship, indicating a concentrated risk within its loan portfolio.

Cathay General Bank's significant dependence on net interest income, which represented 92.3% of its revenue over the last five years, exposes it to the risks of interest rate volatility. Even with an improving net interest margin (NIM), this heavy reliance means that shifts in interest rates can directly impact the bank's profitability.

While the bank does hold some fixed and hybrid-rate loans, extended periods of low interest rates or sudden, unforeseen rate changes pose a threat to its earnings. For instance, if rates were to decline significantly, the income generated from its interest-earning assets could be compressed, affecting overall financial performance.

Efficiency Ratio Lags Peers

While Cathay General Bancorp has made strides, its efficiency ratio, reported at 45.34% in the second quarter of 2025, still trails some of the top-performing regional banks. This indicates potential areas where the bank can further refine its operations to boost profitability.

The gap suggests that opportunities for cost reduction and process improvements remain. Management's ongoing commitment to optimizing the bank's cost base is therefore crucial for enhancing its competitive standing and financial performance.

- Efficiency Ratio: 45.34% (Q2 2025)

- Comparison: Lags behind some highly efficient regional peers.

- Implication: Room for further cost optimization and operational streamlining.

- Strategic Focus: Continued management attention on cost structure refinement is vital.

Exposure to U.S.-China Trade Tensions

Cathay Bank faces a significant hurdle due to ongoing U.S.-China trade tensions, impacting its borrower base. Specifically, 1.4% of the bank's total loans are exposed to risks stemming from these trade disputes. This exposure can lead to weakened financial health for affected clients.

The repercussions of these tariffs are already evident, with some of Cathay Bank's borrowers curtailing Chinese imports or delaying expansion initiatives. Such actions introduce considerable uncertainty regarding future loan demand and the overall economic outlook for these businesses.

This geopolitical vulnerability directly translates into potential challenges for the bank's loan portfolio performance and its growth trajectory. The uncertainty can affect asset quality and profitability.

- Exposure to U.S.-China Trade Tensions: 1.4% of total loans are at risk.

- Impact on Borrowers: Halting Chinese imports and pausing expansion plans.

- Uncertainty in Loan Demand: Geopolitical factors create future demand ambiguity.

- Direct Effect on Portfolio: Potential impact on loan performance and growth.

Cathay General Bank's profitability is susceptible to market fluctuations, as evidenced by a 28% drop in non-interest income in Q1 2025 due to losses in its equity securities portfolio. This highlights a weakness in managing investment volatility. Furthermore, the bank is grappling with rising problem loans; non-performing assets (NPAs) increased by 14.9% in Q2 2025, signaling potential credit quality concerns, particularly with a 12.6% rise in non-accrual loans linked to a single commercial real estate exposure.

The bank's heavy reliance on net interest income, accounting for 92.3% of revenue over the past five years, makes it vulnerable to interest rate shifts. While its efficiency ratio stood at 45.34% in Q2 2025, it trails some more efficient regional banks, indicating room for operational improvements and cost optimization. Geopolitical risks also pose a threat, with 1.4% of total loans exposed to U.S.-China trade tensions, impacting borrower behavior and creating uncertainty.

| Weakness | Metric | Period | Impact |

| Non-Interest Income Volatility | -28% decrease in non-interest income | Q1 2025 | Net losses from equity securities; impacts overall profitability. |

| Rising Problem Loans | +14.9% increase in NPAs | Q2 2025 | Potential credit quality issues; concentrated risk in CRE. |

| Interest Rate Sensitivity | 92.3% of revenue from Net Interest Income | Last 5 Years | Vulnerability to rate changes affecting earnings. |

| Operational Efficiency | 45.34% Efficiency Ratio | Q2 2025 | Lags peers; indicates potential for cost savings. |

| Geopolitical Exposure | 1.4% of total loans at risk | Current | Impacts borrowers due to trade tensions, creating uncertainty. |

Full Version Awaits

Cathay General Bank SWOT Analysis

This is the actual Cathay General Bank SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. It provides a comprehensive overview of the bank's internal strengths and weaknesses, as well as external opportunities and threats. This detailed report is ready for immediate use.

Opportunities

The global trade finance market is experiencing robust expansion, with projections indicating continued growth driven by digital transformation and the adoption of blockchain technology. This digital shift is expected to reach $15.7 trillion by 2026, up from $11.4 trillion in 2022, according to some market analyses.

Cathay Bank, with its established expertise in international trade finance, is well-positioned to capitalize on this trend. By embracing digitalization, the bank can significantly boost its operational efficiency, refine its risk assessment capabilities, and broaden its customer base.

Furthermore, the strategic implementation of artificial intelligence and advanced data analytics offers a clear pathway for Cathay Bank to streamline its trade finance processes, leading to reduced operational costs and enhanced service delivery.

The commercial real estate (CRE) lending landscape in 2025 is shaping up to be quite favorable, with interest rates showing signs of stabilization and a general uptick in lending activity. This positive momentum creates a fertile ground for financial institutions like Cathay Bank.

A substantial volume of commercial mortgages are scheduled to mature in 2025, estimated to be in the hundreds of billions of dollars across the U.S. This presents a significant wave of refinancing opportunities, allowing Cathay Bank to potentially capture new loan originations and strengthen existing client relationships.

Cathay Bank is well-positioned to capitalize on this trend, particularly by focusing on resilient CRE sectors such as industrial properties and well-located multifamily units, which are expected to see continued demand and stable performance throughout 2025.

Cathay Bank can significantly boost its efficiency by embracing advanced technologies like AI and machine learning. The banking industry is already seeing major shifts, with many institutions using these tools to streamline underwriting and improve how they interact with customers. For instance, by the end of 2024, it's projected that financial institutions globally will spend over $100 billion on AI-driven solutions to enhance customer service and operational workflows.

Investing more in these digital platforms presents a clear opportunity for Cathay Bank. This move can optimize internal processes, reduce reliance on manual tasks, and ultimately allow the bank to offer more competitive products and services. Such advancements are crucial for achieving greater accuracy in risk assessment and delivering a superior customer experience, a key differentiator in today's market.

Expanding Wealth Management and Fee-Based Services

Cathay General Bank has a significant opportunity to expand its wealth management and fee-based services. While non-interest income experienced some volatility in Q1 2025, it demonstrated a robust recovery in Q2 2025, largely driven by increased swap commissions and a notable uptick in wealth management revenue.

This performance highlights the potential for further growth in these fee-generating product lines. By strategically focusing on and expanding these services, Cathay General Bank can effectively diversify its revenue streams, thereby lessening its dependence on traditional net interest income. Such a strategic shift is poised to enhance the bank's overall profitability and financial stability.

- Diversification of Revenue: Growing fee-based services reduces reliance on interest income, which can fluctuate with market conditions.

- Profitability Enhancement: Wealth management and other fee-based services often carry higher profit margins than traditional lending.

- Customer Retention: Offering a broader suite of financial products, including wealth management, can deepen customer relationships and improve loyalty.

- Market Share Growth: A strong push into wealth management can capture a larger share of the growing affluent market in key regions.

Strategic Acquisitions and Market Expansion

Cathay General Bancorp's robust capital position, evidenced by its common equity tier 1 (CET1) ratio which stood at approximately 13.5% as of Q1 2024, presents a prime opportunity for strategic acquisitions. Targeting smaller banks or fintech firms in its core Asian-American communities or adjacent demographic segments could significantly broaden its geographic footprint and customer base. This approach would allow Cathay to leverage its existing strengths in community banking and specialized financial services, potentially increasing its market share in key regions.

These strategic moves could also lead to a more diversified loan and deposit portfolio, mitigating concentration risks. For instance, acquiring a regional player with a strong presence in a complementary market could unlock new revenue streams and enhance cross-selling opportunities. By carefully selecting acquisition targets that align with its strategic vision, Cathay can accelerate its growth trajectory and solidify its competitive position.

- Acquire regional banks to expand into new, underserved markets.

- Target fintech companies to enhance digital offerings and attract younger demographics.

- Integrate acquired entities to leverage synergies and cross-sell opportunities.

- Focus on diversification of loan and deposit products to reduce risk.

Cathay General Bank is strategically positioned to capitalize on the expanding global trade finance market, projected to reach $15.7 trillion by 2026. By embracing digital transformation and technologies like AI, the bank can enhance efficiency, refine risk assessment, and broaden its customer reach. The significant volume of maturing commercial mortgages in 2025, estimated in the hundreds of billions, presents a substantial refinancing opportunity, particularly in resilient sectors like industrial properties and multifamily units.

The bank can significantly boost its efficiency and customer experience by investing in advanced technologies like AI and machine learning, with global financial institutions projected to spend over $100 billion on such solutions by the end of 2024. Furthermore, Cathay General Bank has a clear opportunity to grow its wealth management and fee-based services, which demonstrated robust recovery in Q2 2025, enhancing profitability and financial stability. Its strong capital position, with a CET1 ratio of approximately 13.5% in Q1 2024, also enables strategic acquisitions of smaller banks or fintech firms to expand its footprint and customer base.

| Opportunity Area | Key Driver | Cathay Bank's Position | Data Point/Projection |

|---|---|---|---|

| Global Trade Finance | Digital Transformation, Blockchain | Expertise in international trade | Market to reach $15.7T by 2026 |

| Commercial Real Estate Lending | Maturing Mortgages, Stabilizing Rates | Focus on resilient sectors | Hundreds of billions in CRE mortgages maturing in 2025 |

| Digitalization & AI Adoption | Efficiency, Customer Experience | Investment in advanced technologies | $100B+ global spend on AI in finance by end of 2024 |

| Wealth Management & Fee-Based Services | Revenue Diversification, Profitability | Demonstrated Q2 2025 revenue growth | Robust recovery in wealth management revenue |

| Strategic Acquisitions | Capital Strength, Market Expansion | CET1 ratio of 13.5% (Q1 2024) | Targeting community banks and fintechs |

Threats

Ongoing U.S.-China trade tensions and the potential for new tariffs present a significant threat to Cathay Bank's loan portfolio, especially for clients engaged in Chinese imports. This trade friction can directly impact borrowers' profitability and their ability to repay loans.

The uncertainty surrounding trade policies can dampen loan demand and elevate credit risk across Cathay Bank's customer base. For instance, if new tariffs are imposed, businesses reliant on Chinese supply chains may face increased operational costs, potentially weakening their financial standing.

Broader geopolitical instability, beyond just trade disputes, can disrupt global trade volumes and intricate supply chains. This disruption can negatively affect the bank's core business operations and the overall economic environment in which it operates, potentially leading to increased non-performing loans.

While Cathay General Bank might see overall positive trends in commercial real estate lending, a significant threat looms from deteriorating credit quality, particularly in the office sector. High vacancy rates continue to plague this segment, increasing the risk of rising loan delinquencies. This vulnerability was underscored by an observed increase in non-performing assets in Q2 2025, signaling potential future challenges.

A severe downturn in specific commercial real estate segments, like the struggling office market, could directly impact the bank. This would likely translate into higher loan losses and necessitate increased provisions for credit losses, impacting profitability and capital adequacy.

The banking landscape is fiercely competitive, with established banks, agile non-bank lenders, and specialized private debt funds all actively seeking to capture market share. This intense rivalry, evident in the ongoing pursuit of both borrowers and depositors, presents a significant challenge.

The increasing prevalence of alternative financing options, especially within the commercial real estate sector, poses a direct threat by potentially diverting lending opportunities away from traditional institutions like Cathay Bank. For instance, the commercial real estate debt market saw significant activity in 2024, with non-bank lenders playing an increasingly prominent role.

This heightened competition inevitably exerts downward pressure on crucial financial metrics. Banks face the challenge of maintaining competitive loan yields while simultaneously managing rising deposit costs to attract and retain funding, ultimately impacting overall profitability and net interest margins.

Potential for Adverse Regulatory or Tax Changes

Changes in regulatory requirements or tax legislation, particularly in California where Cathay Bank has a significant presence, could negatively impact its profitability and operational costs. For instance, recent California tax legislation updates have already led to revised effective tax rate guidance, impacting banks operating within the state. Increased regulatory scrutiny or new compliance burdens could also divert resources, potentially affecting the bank's ability to innovate or expand.

These potential shifts pose a significant threat, as they can directly influence a financial institution's bottom line and strategic flexibility. For example, a sudden increase in capital requirements or new consumer protection rules could necessitate costly adjustments to operations and product offerings. The financial sector is highly sensitive to such changes, and proactive risk management is crucial.

- Regulatory Shifts: Potential for new or intensified regulations impacting lending, capital reserves, or operational practices.

- Tax Law Changes: Adverse modifications to corporate tax rates or deductions, especially within key operating jurisdictions like California.

- Compliance Costs: Increased expenses associated with adhering to new or evolving regulatory frameworks.

- Profitability Impact: Direct correlation between regulatory/tax changes and potential reductions in net income or return on equity.

Macroeconomic Headwinds and Economic Slowdown

Broader macroeconomic uncertainties, including persistent inflation and the potential for an economic slowdown, could impact Cathay General Bank's loan growth and deposit levels. For instance, the Federal Reserve's interest rate hikes throughout 2023, aimed at curbing inflation, have increased borrowing costs, potentially dampening demand for loans.

While the bank has shown resilience, a significant economic downturn could lead to increased credit losses across its varied loan portfolio. For example, if unemployment rises sharply, borrowers in sectors like commercial real estate or consumer lending might struggle to repay, impacting the bank's asset quality.

- Inflationary Pressures: Continued high inflation can erode purchasing power, potentially slowing consumer spending and business investment, which are key drivers of loan demand.

- Interest Rate Sensitivity: Rising interest rates, while beneficial for net interest margins to a point, can also increase funding costs and reduce the attractiveness of new loans.

- Recessionary Risks: A broad economic slowdown could lead to higher delinquency rates and charge-offs, particularly in sectors more sensitive to economic cycles.

Intensifying competition from both traditional banks and non-bank lenders, especially in commercial real estate, threatens Cathay Bank's market share and profitability. The rise of alternative financing options in 2024, with non-bank entities actively participating in the CRE debt market, signifies a shift that could divert lending opportunities. This competitive pressure also forces banks to balance attractive loan yields with rising deposit costs, impacting net interest margins.

Geopolitical tensions, particularly U.S.-China trade disputes, create significant risks for Cathay Bank's loan portfolio, impacting clients reliant on Chinese supply chains. Such trade friction can directly affect borrower profitability and repayment capacity, potentially leading to increased credit risk and dampened loan demand. Broader global instability further disrupts supply chains, negatively affecting the bank's operational environment and asset quality.

Deteriorating credit quality in specific commercial real estate sectors, notably the office market with its persistent high vacancy rates, poses a direct threat. An observed increase in non-performing assets in Q2 2025 for this segment highlights this vulnerability, suggesting potential future loan losses and the need for higher credit loss provisions, which would impact profitability.

Macroeconomic uncertainties, including ongoing inflation and the risk of economic slowdown, could hinder Cathay Bank's loan growth and deposit stability. While interest rate hikes in 2023 aimed at inflation increased borrowing costs, a severe economic downturn could lead to higher delinquency rates and charge-offs across various loan portfolios, impacting asset quality.

| Threat Category | Specific Risk | Impact on Cathay Bank | Data Point/Example |

|---|---|---|---|

| Competition | Non-bank lenders in CRE | Loss of market share, margin compression | Non-bank CRE debt market activity significant in 2024 |

| Geopolitical/Trade | U.S.-China trade tensions | Increased credit risk, reduced loan demand | Clients reliant on Chinese supply chains affected |

| Real Estate Market | Office sector downturn | Higher loan losses, increased provisions | Increase in non-performing assets in office CRE in Q2 2025 |

| Macroeconomic | Inflation and potential slowdown | Lower loan growth, higher delinquencies | Federal Reserve rate hikes in 2023 increased borrowing costs |

SWOT Analysis Data Sources

This SWOT analysis is built upon a foundation of robust data, drawing from Cathay General Bank's official financial statements, comprehensive market research reports, and insightful industry expert analyses to provide a well-rounded perspective.