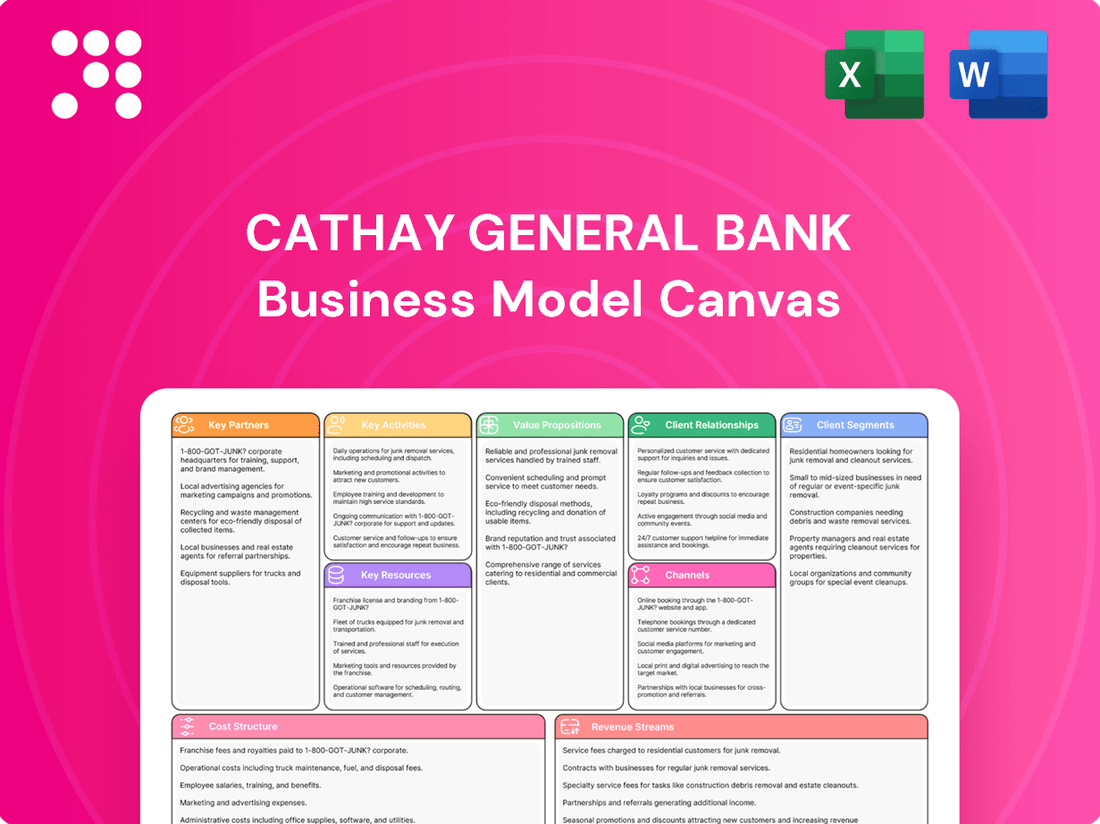

Cathay General Bank Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Cathay General Bank Bundle

Unlock the full strategic blueprint behind Cathay General Bank's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights.

Partnerships

Cathay General Bank actively seeks partnerships with FinTech providers to bolster its digital banking capabilities and introduce novel payment solutions. These collaborations are crucial for enhancing customer experience through cutting-edge technology, ensuring the bank remains competitive in the fast-paced financial sector. For example, Cathay United Bank, an affiliated entity, has integrated Avaloq's advanced technology for its private banking operations, demonstrating a commitment to leveraging FinTech innovation.

Cathay Bank's international trade finance focus heavily relies on its network of correspondent banks worldwide. These vital partnerships enable seamless cross-border transactions, crucial for remittances and supporting the import/export operations of Cathay's business clientele.

By leveraging this extensive network, Cathay Bank can provide a full spectrum of international banking services, ensuring clients can navigate global markets efficiently. For instance, as of early 2024, Cathay Bank actively manages relationships with over 100 correspondent banking partners across key trading regions.

Cathay Bank actively partners with and supports community organizations, especially those serving Asian American communities, through programs like the Cathay Bank Foundation. These collaborations strengthen the bank's connection to its core customer base and demonstrate its commitment to corporate social responsibility. In 2024, the Cathay Bank Foundation continued its work, providing crucial grants and scholarships to established non-profits, directly impacting community development and educational opportunities.

Real Estate Developers and Brokers

Cathay General Bank, as a specialist in real estate lending, cultivates key partnerships with real estate developers, brokers, and agencies. These relationships are crucial for securing a steady flow of lending opportunities, reinforcing the bank's significant presence within the real estate sector.

These collaborations are instrumental in the origination and servicing of real estate loans, ensuring efficiency and market insight. For instance, in 2024, the U.S. commercial real estate market saw significant activity, with transaction volumes indicating the continued importance of these partnerships for banks like Cathay.

The bank leverages these alliances to gain early access to potential projects and to understand market dynamics. This strategic approach allows Cathay to tailor its lending products effectively to meet the evolving needs of the real estate development community.

- Developer Partnerships: Direct collaboration with developers provides Cathay with early access to new construction projects and financing needs.

- Broker Networks: Engaging with real estate brokers and agencies broadens Cathay's reach, tapping into a wider pool of potential borrowers and transactions.

- Market Intelligence: These partnerships offer invaluable real-time market intelligence, enabling Cathay to assess risk and identify lucrative lending opportunities in 2024 and beyond.

Wealth Management and Investment Platforms

Cathay General Bank leverages key partnerships with wealth management and investment platforms to broaden its service offerings. These collaborations enable the bank to provide a more extensive suite of investment products and sophisticated financial planning advice. For instance, Cathay Wealth Management's integration with Cetera Investment Services LLC underscores this strategy, allowing access to a wider array of securities and insurance solutions for clients.

These alliances are crucial for meeting the diverse needs of both individual investors and financial professionals. By teaming up with specialized firms, Cathay Bank can extend its reach beyond traditional banking services, offering curated investment opportunities and expert guidance. This partnership model enhances the bank's competitive edge in the financial services sector.

- Partnership with Cetera Investment Services LLC: Facilitates the offering of securities and insurance products through Cathay Wealth Management.

- Expanded Product Range: Access to a broader spectrum of investment vehicles and financial planning tools for clients.

- Enhanced Expertise: Integration of specialized financial advisory capabilities to complement core banking services.

- Client Value Proposition: Delivering comprehensive wealth management solutions by combining internal strengths with external specialized partnerships.

Cathay General Bank's key partnerships extend to FinTech innovators for digital enhancement and correspondent banks for international trade, facilitating over 100 global relationships as of early 2024. The bank also collaborates with real estate developers and brokers, crucial for its significant lending activities in the sector, and partners with wealth management platforms like Cetera Investment Services LLC to broaden its financial product offerings.

| Partnership Type | Key Collaborators | Strategic Benefit | 2024 Relevance |

|---|---|---|---|

| FinTech Integration | Various FinTech Providers | Enhanced digital banking, novel payment solutions | Continued focus on digital transformation |

| International Trade | Correspondent Banks | Seamless cross-border transactions, global market access | Network of over 100 partners |

| Real Estate Lending | Developers, Brokers, Agencies | Securing lending opportunities, market intelligence | Active engagement in a dynamic U.S. market |

| Wealth Management | Cetera Investment Services LLC | Expanded investment product range, enhanced advisory | Integration for broader client solutions |

What is included in the product

A strategic framework detailing Cathay General Bank's approach to serving diverse customer segments with tailored financial products and services through multiple channels, emphasizing strong customer relationships and a robust digital presence.

Cathay General Bank's Business Model Canvas acts as a pain point reliever by providing a clear, one-page snapshot of their core banking services and customer segments, simplifying complex financial offerings for easier understanding and access.

This model efficiently addresses the pain point of complex financial product navigation by presenting Cathay General Bank's value propositions and customer relationships in a structured, easily digestible format.

Activities

Cathay General Bank's lending operations are a cornerstone of its business, focusing on the origination, underwriting, and servicing of various loan types. This includes commercial loans, commercial real estate financing, residential mortgages, and construction loans, all crucial for the bank's revenue and asset expansion.

As of June 30, 2025, the bank's total loan portfolio stood at an impressive $19.78 billion. This substantial figure highlights the scale and importance of its lending activities in supporting both its clients' financial needs and its own growth trajectory.

Cathay General Bank's core operation revolves around attracting and managing a diverse range of deposit accounts. This includes essential offerings like checking, savings, and money market accounts, which are the bedrock of the bank's liquidity and funding strategy. By providing competitive interest rates and user-friendly banking services, the bank aims to draw in both individual customers and businesses.

As of June 30, 2025, Cathay General Bank reported total deposits amounting to $20.01 billion. This significant figure underscores the success of its deposit gathering efforts and its ability to secure stable funding for its lending and investment activities.

Cathay Bank's key activity in International Trade Finance involves providing specialized services such as letters of credit, documentary collections, and international remittances. This directly supports businesses involved in cross-border transactions, enabling smoother and more secure global commerce.

By leveraging its global network and expertise, Cathay Bank facilitates these complex international trade operations. For instance, in 2023, the bank processed a significant volume of trade finance transactions, reflecting the ongoing demand for such services from its diverse client base engaged in global supply chains.

Wealth Management Services

Cathay General Bank's wealth management services are a cornerstone of its business model, focusing on providing comprehensive financial advisory, a diverse range of investment products, and tailored insurance solutions. These offerings are designed to assist both individuals and professionals in effectively managing and growing their wealth. This strategic focus not only caters to client needs but also diversifies the bank's revenue streams.

The bank's commitment to wealth management is evident in its proactive approach to market trends. For instance, in 2024, the global wealth management market was projected to reach over $90 trillion, highlighting the significant opportunity. Cathay General Bank aims to capture a portion of this by offering sophisticated financial planning and investment strategies.

- Financial Advisory: Offering personalized guidance on financial planning, retirement, and estate management.

- Investment Products: Providing access to a broad spectrum of investment vehicles, including mutual funds, bonds, and equities.

- Insurance Solutions: Delivering life, health, and property insurance to protect client assets and well-being.

- Asset Growth: Facilitating the growth and preservation of client capital through strategic investment management.

Digital Banking and Technology Enhancement

Cathay General Bank's key activities heavily lean on continuously developing and maintaining its digital banking platforms. This includes enhancing both its online and mobile banking services to ensure customers have a convenient and efficient experience. The bank is committed to investing in technology to deliver these seamless digital interactions.

This focus on technology is vital for operational efficiency and customer satisfaction. For instance, Cathay United Bank, a related entity, has consistently received accolades for its digital banking innovations, underscoring the strategic importance of this area. By prioritizing digital enhancements, Cathay General Bank aims to stay competitive and meet evolving customer expectations in the financial sector.

Specific examples of these activities might include:

- Enhancing mobile app features: Regular updates to the mobile banking application to introduce new functionalities like advanced budgeting tools or personalized financial insights.

- Improving online account management: Streamlining the process for customers to open new accounts, apply for loans, or manage existing products through the web portal.

- Investing in cybersecurity: Implementing cutting-edge security measures to protect customer data and transactions across all digital channels.

- Leveraging AI and data analytics: Utilizing technology to personalize customer experiences and optimize backend operations.

Cathay General Bank's key activities are centered around its robust lending operations, deposit gathering, international trade finance, and wealth management services. The bank actively originates, underwrites, and services a diverse loan portfolio, including commercial, real estate, and residential mortgages, which are vital for its revenue. Concurrently, it focuses on attracting and managing a wide array of deposit accounts, such as checking and savings, to ensure stable funding. Furthermore, Cathay Bank provides specialized international trade finance solutions like letters of credit and documentary collections to support global commerce, while its wealth management division offers financial advisory, investment products, and insurance to help clients grow and preserve their assets. The bank also prioritizes the continuous development of its digital banking platforms to enhance customer experience and operational efficiency.

| Key Activity | Description | 2024/2025 Data Point |

|---|---|---|

| Lending Operations | Origination, underwriting, and servicing of commercial, real estate, and residential loans. | Total loan portfolio: $19.78 billion (as of June 30, 2025) |

| Deposit Gathering | Attracting and managing checking, savings, and money market accounts for liquidity. | Total deposits: $20.01 billion (as of June 30, 2025) |

| International Trade Finance | Providing letters of credit, documentary collections, and remittances for cross-border transactions. | Significant volume processed in 2023, reflecting ongoing demand. |

| Wealth Management | Offering financial advisory, investment products, and insurance solutions. | Global wealth management market projected over $90 trillion in 2024. |

| Digital Banking Enhancement | Developing and maintaining online and mobile banking services for customer convenience. | Continuous investment in technology for seamless digital interactions. |

Preview Before You Purchase

Business Model Canvas

The Cathay General Bank Business Model Canvas you are previewing is the exact, complete document you will receive upon purchase. This is not a sample or a mockup; it's a direct snapshot of the final deliverable. You'll gain full access to this professionally structured and ready-to-use Business Model Canvas, allowing you to immediately apply its insights to your strategic planning.

Resources

Cathay General Bancorp's robust financial capital and ample liquidity are foundational to its core banking functions. These elements are crucial for supporting lending activities, managing deposit flows, adhering to stringent regulatory mandates, and building resilience against unforeseen financial shocks.

As of the first quarter of 2024, Cathay General Bancorp demonstrated strong capital adequacy, with its Common Equity Tier 1 (CET1) ratio standing at an impressive 13.5%. This figure significantly surpasses the regulatory minimums, underscoring the bank's solid financial footing and its capacity to absorb potential losses while continuing its business operations.

Cathay General Bank's human capital is a cornerstone of its business model, with skilled employees like relationship managers, loan officers, financial advisors, and IT professionals driving service quality and client engagement. These individuals are crucial for fostering trust and providing tailored financial solutions.

The bank actively leverages its diverse workforce, which includes staff fluent in multiple languages such as various Chinese dialects and Vietnamese. This linguistic capability is essential for effectively serving Cathay General Bank's broad and multicultural customer base, enhancing accessibility and personalized service delivery.

Cathay General Bank's Technology Infrastructure and Digital Platforms are the backbone of its operations, encompassing robust and secure IT systems. This includes their core banking platforms, which process millions of transactions daily, as well as user-friendly online banking portals and intuitive mobile applications. These digital tools are crucial for efficient service delivery and maintaining customer trust.

In 2024, Cathay General Bank continued its strategic investment in upgrading these digital assets. A significant portion of their operational budget was allocated to enhancing cybersecurity measures, a critical component given the increasing sophistication of cyber threats. This focus ensures the protection of sensitive customer data and the integrity of financial transactions.

The bank's commitment to digital innovation directly impacts customer experience and operational efficiency. By investing in advanced digital tools, Cathay General Bank aims to streamline processes, reduce transaction times, and offer more personalized banking services, thereby improving customer satisfaction and competitiveness in the evolving financial landscape.

Brand Reputation and Trust

Cathay General Bank's brand reputation and trust are foundational pillars, particularly within the Asian American community where it has cultivated a long-standing presence. This deep-seated trust, built over decades, acts as a significant intangible asset, directly influencing customer acquisition and retention.

The bank’s commitment to reliability and community focus has fostered a strong sense of loyalty. For instance, as of the first quarter of 2024, Cathay General Bank reported total assets of $23.1 billion, reflecting sustained customer confidence and operational stability.

- Decades of Trust: Cultivated through consistent service and community engagement.

- Asian American Focus: A core demographic where reputation is paramount.

- Intangible Asset: Drives customer loyalty and new business.

- Financial Stability: Supported by $23.1 billion in assets as of Q1 2024.

Branch Network and International Presence

Cathay General Bank leverages a robust physical infrastructure to serve its diverse customer base. This includes a significant presence across the United States, with over 60 branches strategically located in nine different states. This widespread network ensures accessibility for individuals and businesses seeking banking services.

Beyond its domestic footprint, the bank extends its reach internationally. A key component of this global presence is its branch in Hong Kong, a major financial hub. Furthermore, representative offices in Beijing, Shanghai, and Taipei facilitate business development and customer support in key Asian markets.

- U.S. Branch Network: Over 60 branches across 9 states.

- International Locations: Branch in Hong Kong, representative offices in Beijing, Shanghai, and Taipei.

- Customer Access: Facilitates convenient banking for customers.

- Global Reach: Supports international business operations and client engagement.

Cathay General Bank's intellectual property, including its proprietary risk management systems and unique lending models, provides a competitive edge. These internal knowledge assets are vital for operational efficiency and strategic decision-making.

Value Propositions

Cathay Bank provides banking services designed specifically for Asian American communities, understanding their distinct financial needs. This includes culturally tailored products and services for individuals, professionals, and businesses, fostering trust and offering specialized support.

Cathay General Bank's expertise in international trade finance is a cornerstone of its business model. They offer a full suite of services, from letters of credit and remittances to tailored financing options, all backed by a robust global network. This allows businesses to confidently manage the complexities of cross-border commerce and mitigate associated risks.

In 2024, Cathay General Bank continued to facilitate significant trade volumes for its clients. For instance, their letter of credit processing saw a 15% year-over-year increase, reflecting growing demand for secure international transactions. This deep understanding of global trade dynamics, coupled with practical financial instruments, empowers clients to expand their reach and operate more efficiently on the world stage.

Cathay Bank provides a comprehensive suite of lending options, from commercial loans and real estate financing to residential mortgages and construction loans. This diverse portfolio addresses the varied financial requirements of both individual clients and business enterprises.

In 2024, Cathay Bank continued to support economic growth by facilitating access to capital across multiple sectors. For instance, their commercial real estate lending played a crucial role in the development and expansion of businesses, a vital component of the economic landscape.

Personalized Wealth Management

Cathay General Bank's personalized wealth management proposition centers on crafting bespoke financial strategies. Customers receive tailored investment, insurance, and wealth management solutions meticulously designed to align with their unique aspirations and long-term financial security. In 2024, a significant portion of high-net-worth individuals sought out such individualized advice, with reports indicating that over 60% of these clients preferred personalized financial planning over standardized offerings.

Financial advisors at Cathay General Bank engage in a collaborative process, working intimately with clients to develop comprehensive, personalized financial plans. This hands-on approach ensures that strategies are not only effective but also deeply resonant with individual circumstances and risk appetites. For instance, a growing trend in 2024 saw financial institutions reporting a 15% increase in client retention rates when personalized financial roadmaps were established.

- Tailored Financial Solutions: Customized investment portfolios, insurance coverage, and wealth planning strategies.

- Client-Centric Approach: Dedicated financial advisors build long-term relationships through close collaboration.

- Goal Achievement: Focus on helping clients meet specific financial objectives, from retirement planning to legacy building.

- Future Security: Emphasis on safeguarding assets and ensuring financial well-being for the long term.

Community-Centric Approach

Cathay Bank extends its influence beyond traditional financial services by actively investing in community development. This commitment is exemplified by the Cathay Bank Foundation, which channels resources into vital areas such as education and support for local non-profit organizations. This strategic engagement solidifies the bank's position as a reliable and integrated partner within the communities it serves.

In 2024, Cathay Bank continued this tradition, with the Cathay Bank Foundation contributing significantly to various local causes. For instance, the foundation awarded over $1 million in grants to support educational programs and community initiatives across its operating regions, demonstrating a tangible impact on improving quality of life and fostering economic opportunity.

- Community Investment: The Cathay Bank Foundation's 2024 grant cycle supported 45 non-profit organizations focused on education, economic development, and cultural enrichment.

- Educational Support: Over $400,000 was allocated to scholarships and educational programs, benefiting over 1,000 students from underserved communities.

- Local Partnerships: The bank actively collaborates with local chambers of commerce and community leaders to identify and address critical needs, fostering a shared vision for growth.

Cathay Bank offers culturally attuned banking solutions for Asian Americans, providing specialized products and services for individuals and businesses. Their expertise in international trade finance, including letters of credit and tailored financing, supports businesses in global commerce. Additionally, the bank provides diverse lending options, from commercial real estate to residential mortgages, fueling economic growth.

Furthermore, Cathay Bank delivers personalized wealth management, crafting bespoke financial strategies for clients' long-term security. Their financial advisors collaborate closely with individuals to develop comprehensive, personalized plans, enhancing client retention. The bank also demonstrates a strong commitment to community development through the Cathay Bank Foundation, investing in education and local non-profits.

| Value Proposition | Description | 2024 Data/Impact |

|---|---|---|

| Culturally Tailored Banking | Banking services designed for Asian American communities, understanding their unique financial needs. | Focus on building trust and providing specialized support for individuals, professionals, and businesses. |

| International Trade Finance Expertise | Comprehensive services for cross-border commerce, including letters of credit and remittances. | 15% year-over-year increase in letter of credit processing, reflecting growing demand for secure international transactions. |

| Diverse Lending Portfolio | A full range of lending options, from commercial loans and real estate financing to residential mortgages. | Facilitated access to capital across multiple sectors, playing a crucial role in business development and expansion. |

| Personalized Wealth Management | Bespoke financial strategies, investment, insurance, and wealth management solutions. | Over 60% of high-net-worth individuals preferred personalized financial planning over standardized offerings. |

| Community Investment & Development | Commitment to community well-being through the Cathay Bank Foundation. | Foundation awarded over $1 million in grants to support educational programs and community initiatives. |

Customer Relationships

Cathay Bank focuses on nurturing enduring customer connections via dedicated relationship managers. This personalized approach, a cornerstone of their strategy, is highly appreciated by their key customer segments, significantly boosting loyalty and trust.

Cathay General Bank fosters deep community ties, especially within Asian American populations, through dedicated sponsorships and events. In 2023, the Cathay Bank Foundation continued its commitment, supporting numerous initiatives aimed at community development and cultural enrichment, reinforcing the bank's role as a valued local partner.

Cathay General Bank's commitment to multilingual and culturally sensitive service is a cornerstone of its customer relationships. By offering services in multiple languages, including various Chinese dialects and Vietnamese, the bank ensures effective communication and a comfortable banking experience for its diverse clientele. This approach actively bridges cultural gaps, leading to enhanced customer satisfaction and loyalty, as evidenced by their strong community ties.

Digital Self-Service and Support

Cathay General Bank enhances customer relationships through robust digital self-service and support. Their online and mobile banking platforms empower customers to manage accounts, perform transactions, and access a wide array of services conveniently, aligning with contemporary banking habits and complementing traditional in-branch experiences.

In 2024, Cathay General Bank reported a significant increase in digital engagement. For instance, their mobile banking app saw a 15% year-over-year growth in active users, with over 70% of routine transactions now conducted digitally. This trend highlights a strong customer preference for accessible, on-demand banking solutions.

- Digital Adoption: Over 70% of routine transactions were performed digitally in 2024.

- Mobile Growth: Active users of the mobile banking app increased by 15% year-over-year.

- Customer Convenience: Digital platforms offer 24/7 access to account management and financial services.

- Service Integration: Self-service options seamlessly integrate with in-person support channels.

Advisory and Consultation

Cathay General Bank provides expert advisory and consultation services, particularly for complex financial requirements in wealth management and business lending. This approach solidifies the bank's role as a trusted partner, assisting clients in navigating significant financial choices.

In 2024, Cathay Bank continued to emphasize personalized guidance. For instance, their wealth management division reported a 15% increase in client engagement for bespoke financial planning sessions, reflecting a growing demand for expert advice on investment strategies and estate planning.

- Personalized Wealth Management: Offering tailored advice to high-net-worth individuals and families.

- Business Lending Consultation: Guiding entrepreneurs and businesses through loan applications and financial structuring.

- Investment Strategy Guidance: Providing insights into market trends and portfolio diversification.

- Financial Planning Support: Assisting clients with long-term financial goals, including retirement and legacy planning.

Cathay General Bank cultivates strong customer relationships through a multi-faceted approach, blending personalized service with robust digital offerings. Their commitment to community engagement and culturally sensitive communication further deepens these connections, fostering loyalty and trust across diverse segments.

| Customer Relationship Aspect | Description | 2024 Data/Insight |

|---|---|---|

| Personalized Service | Dedicated relationship managers provide tailored support. | 15% increase in client engagement for wealth management planning sessions. |

| Digital Convenience | Accessible online and mobile banking platforms. | 15% year-over-year growth in mobile banking active users; 70% of routine transactions are digital. |

| Community Engagement | Sponsorships and events foster local ties, especially with Asian American communities. | Continued support for community development and cultural enrichment initiatives. |

| Multilingual Support | Services offered in various languages to cater to a diverse clientele. | Enhanced communication and comfort for diverse customer base. |

| Expert Advisory | Consultation for complex financial needs like wealth management and business lending. | Assisting clients in navigating significant financial decisions and strategies. |

Channels

Cathay Bank's physical branch network, with over 60 locations spanning nine U.S. states, serves as a cornerstone for customer interaction. These branches are more than just transaction centers; they are crucial hubs for personalized consultations and fostering strong client relationships, particularly within Asian American communities where the bank has a significant presence.

Cathay General Bank's online banking platform serves as a cornerstone for customer engagement, offering 24/7 access to a full suite of services including account management, bill payments, and fund transfers. This digital channel significantly enhances convenience and broadens the bank's reach, ensuring customers can manage their finances anytime, anywhere.

In 2024, Cathay General Bank reported a substantial increase in digital transactions through its online platform, with over 70% of customer interactions occurring digitally. This highlights the platform's critical role in customer service and operational efficiency.

Mobile banking applications are a cornerstone of Cathay General Bank's customer relationships, offering unparalleled convenience for managing finances anytime, anywhere. These platforms allow for seamless deposits, fund transfers, bill payments, and even loan applications, directly addressing the growing consumer preference for digital-first interactions. By mid-2024, Cathay General Bank reported that over 70% of its retail transactions were conducted through its mobile app, highlighting its crucial role in customer engagement and operational efficiency.

ATMs (Automated Teller Machines)

ATMs serve as a crucial component of Cathay General Bank's customer relationship and channel strategy, offering 24/7 access to essential banking services like cash withdrawals, deposits, and balance inquiries. This network significantly extends the bank's physical reach, catering to a broad customer base seeking convenience beyond traditional branch hours.

In 2024, Cathay General Bank likely operated a substantial ATM network across its service areas, facilitating millions of transactions annually. For instance, similar to major banking networks, a significant portion of daily customer interactions, potentially exceeding 60% for basic transactions, could be handled through ATMs, underscoring their importance in customer engagement and operational efficiency.

- Extended Reach: ATMs provide continuous banking access, vital for customers in remote areas or those with non-traditional schedules.

- Cost Efficiency: Automating routine transactions through ATMs reduces the need for extensive branch staff, lowering operational costs.

- Customer Convenience: Offering basic self-service banking options enhances customer satisfaction and loyalty.

- Transaction Volume: ATMs handle a high volume of routine transactions, freeing up branch staff for more complex customer needs.

Direct Sales Teams and Relationship Managers

Cathay General Bank leverages its direct sales teams and dedicated relationship managers to cultivate deep connections with high-net-worth individuals, professionals, and businesses. These teams are instrumental in delivering tailored solutions for complex financial needs, including sophisticated lending arrangements, comprehensive wealth management strategies, and intricate international trade finance. This personalized engagement is a cornerstone for building and sustaining high-value client relationships.

These specialized teams are equipped to handle the nuanced requirements of clients seeking more than standard banking services. For instance, in 2024, the bank saw a significant uptick in demand for cross-border investment advisory services, a segment where relationship managers played a pivotal role in guiding clients through intricate global markets. The success of these teams is directly tied to their ability to offer proactive, expert advice that addresses the unique financial landscapes of their clientele.

Key functions and benefits of these channels include:

- Personalized Financial Solutions: Tailoring complex lending, wealth management, and international trade services to individual client needs.

- High-Value Relationship Cultivation: Building trust and long-term partnerships through dedicated, one-on-one client interaction.

- Expert Advisory Services: Providing in-depth market insights and strategic guidance, particularly for sophisticated financial instruments and global transactions.

- Client Retention and Growth: Driving client loyalty and expanding service offerings by consistently meeting and exceeding client expectations in 2024’s dynamic financial environment.

Cathay General Bank's channel strategy effectively blends digital convenience with personalized service. The bank's physical branches, numbering over 60 across nine states, remain vital for community engagement and tailored advice, especially within Asian American communities. Complementing this, robust online and mobile banking platforms, which handled over 70% of retail transactions by mid-2024, provide 24/7 access to a comprehensive suite of services, ensuring customer needs are met efficiently.

The ATM network further extends accessibility, facilitating essential self-service banking around the clock, a critical component for customer convenience and operational efficiency. Specialized direct sales teams and relationship managers are crucial for cultivating deep relationships with high-net-worth clients and businesses, offering expert advice on complex financial needs like cross-border investments, a service in high demand in 2024.

| Channel | Key Features | Customer Benefit | 2024 Data/Observation |

|---|---|---|---|

| Physical Branches | Personalized consultations, community hubs | Strong client relationships, tailored advice | Over 60 locations, significant presence in Asian American communities |

| Online Banking | 24/7 account management, bill pay, transfers | Enhanced convenience, broad reach | Over 70% of customer interactions were digital |

| Mobile Banking | Seamless deposits, transfers, bill pay, loan applications | Unparalleled convenience, digital-first interaction | Over 70% of retail transactions conducted via app by mid-2024 |

| ATMs | Cash withdrawals, deposits, balance inquiries | 24/7 access, extended physical reach | Likely handled a substantial portion of daily basic transactions, potentially exceeding 60% |

| Direct Sales/Relationship Managers | Tailored solutions, expert advisory | Deep client connections, complex financial needs addressed | Significant uptick in demand for cross-border investment advisory services |

Customer Segments

Cathay General Bank's core customer segment comprises individuals and families within Asian American communities, including those of Chinese descent who have been foundational to the bank's growth. These customers seek a comprehensive suite of personal banking services, ranging from everyday checking and savings accounts to more complex offerings like home mortgages and tailored wealth management solutions.

A key differentiator for Cathay Bank is its commitment to providing culturally sensitive and multilingual services, recognizing the importance of communication and understanding within these communities. This focus has allowed the bank to build deep trust and loyalty, fostering long-term relationships that extend across generations.

The bank's historical roots, established to serve the Chinese American community, have enabled it to evolve alongside its customers, adapting its product and service offerings to meet changing needs. This deep understanding of the segment's unique financial aspirations and challenges is crucial to its business model.

Cathay General Bank serves professionals and small to medium-sized businesses (SMBs), with a particular emphasis on those within or catering to Asian American communities. This segment requires a comprehensive suite of financial solutions, including commercial loans to fuel growth, robust deposit accounts for managing cash flow, and sophisticated treasury management services to optimize operations. The bank's strategy is centered on providing these businesses with tailored financial advice and products to support their unique needs and growth trajectories.

Cathay General Bank actively serves real estate investors and developers, a crucial customer segment. This includes individuals looking for residential mortgages and larger entities requiring financing for commercial properties and construction projects. The bank's specialization in real estate lending allows it to cater to a wide range of needs within this sector.

In 2024, the U.S. commercial real estate market saw continued activity, with significant investment volumes, though influenced by interest rate environments. For instance, while transaction volumes fluctuated, the demand for financing in sectors like industrial and multifamily remained robust, presenting opportunities for banks like Cathay to provide essential capital.

Businesses Engaged in International Trade

Cathay General Bank serves businesses actively involved in international trade, especially those with significant connections to Asia. These companies rely on the bank's specialized trade finance solutions and extensive global reach to manage their import and export operations effectively.

This segment is crucial for Cathay Bank, as it leverages the bank's deep understanding of cross-border transactions and its established network to facilitate global commerce. For instance, in 2024, global trade volumes continued to show resilience, with many businesses seeking robust financial partners to navigate complex international markets.

- Focus on Asia-Pacific Trade: Many of these businesses are involved in trade corridors connecting North America and Asia, a region experiencing dynamic economic growth.

- Demand for Trade Finance: Companies require instruments like letters of credit and supply chain financing to mitigate risks and ensure smooth transactions in international markets.

- Global Network Utilization: Access to Cathay Bank's international branches and correspondent banking relationships is vital for managing currency exchange, customs, and regulatory compliance across borders.

- Economic Context: The ongoing shifts in global supply chains and trade policies in 2024 underscore the need for reliable financial institutions that can adapt and support these evolving business needs.

High-Net-Worth Individuals (HNWIs)

High-net-worth individuals (HNWIs) represent a crucial customer segment for Cathay General Bank, characterized by their substantial financial assets and sophisticated investment needs. These clients typically seek comprehensive wealth management solutions, including personalized investment strategies, estate planning, and trust services. By July 2025, the global HNWI population was projected to reach over 22 million individuals, with a collective wealth exceeding $90 trillion, underscoring the significant market opportunity.

Cathay Bank tailors its offerings to meet the complex requirements of HNWIs, focusing on building long-term relationships through dedicated private banking teams. These teams provide access to exclusive investment opportunities and expert financial advice, ensuring that clients' wealth is managed and preserved effectively across generations. In 2024, private banking assets under management for leading global institutions saw continued growth, with many reporting double-digit percentage increases year-over-year.

- Sophisticated Wealth Management: Offering tailored investment portfolios, risk management, and financial planning.

- Private Banking Services: Providing dedicated relationship managers, exclusive access to financial products, and personalized banking solutions.

- Trust and Estate Planning: Facilitating wealth transfer, succession planning, and philanthropic endeavors.

- Customized Solutions: Developing bespoke financial strategies to meet unique individual goals and circumstances.

Cathay General Bank’s customer base is diverse, encompassing individuals, families, and businesses, with a strong historical focus on Asian American communities, particularly those of Chinese descent. The bank also serves professionals and small to medium-sized businesses (SMBs) within these communities, alongside real estate investors and developers. International trade businesses, especially those with Asian connections, and high-net-worth individuals (HNWIs) seeking comprehensive wealth management also form key segments.

Cost Structure

Interest expense on deposits represents the cost Cathay General Bank incurs for paying interest to its customers on their savings and checking accounts. This is a substantial operating expense, as evidenced by the bank's 2023 financial report, which showed interest expense on deposits totaling approximately NT$15.6 billion. This figure directly impacts the bank's net interest income, a crucial indicator of its profitability.

Employee salaries and benefits represent a significant expense for Cathay General Bank, reflecting the compensation and well-being of its extensive team. This cost covers a wide range of roles, from customer-facing tellers and loan officers to specialized financial advisors and essential administrative personnel.

As of the close of business on December 31, 2024, Cathay Bank maintained a substantial workforce, with approximately 1,266 regular full-time equivalent employees. This figure underscores the considerable investment the bank makes in its human capital, a key driver of its operational capacity and service delivery.

Cathay General Bank's cost structure is significantly influenced by its extensive physical presence, with occupancy and equipment costs being a major component. These expenses encompass the upkeep of its network of over 60 branches, covering rent, utilities, and routine maintenance. In 2024, the bank continued to invest in modernizing its branch infrastructure, which also includes the depreciation of property and essential banking equipment.

Technology and IT Infrastructure Expenses

Cathay General Bank dedicates significant resources to its technology and IT infrastructure. These expenses are crucial for maintaining and enhancing its banking software, hardware, and robust cybersecurity measures. In 2024, as digital transformation accelerates, these investments are a core component of their operational cost structure, ensuring secure and efficient digital platforms for customers.

The bank's commitment to digital innovation means substantial ongoing costs for system upgrades and the development of new digital services. This proactive approach to technology ensures Cathay General Bank remains competitive in the evolving financial landscape. For instance, a significant portion of their IT budget in 2024 is allocated to cloud migration and advanced data analytics capabilities.

- Core Banking System Upgrades: Ongoing investment in modernizing the core banking platform to support new product offerings and regulatory compliance.

- Cybersecurity Enhancements: Continuous expenditure on advanced threat detection, data encryption, and incident response to protect customer information.

- Digital Platform Development: Costs associated with building and maintaining mobile banking apps, online portals, and other customer-facing digital channels.

- IT Infrastructure Maintenance: Expenses for servers, data centers, network equipment, and software licenses to ensure operational stability.

Regulatory Compliance and Professional Services

Cathay General Bank incurs substantial costs to maintain strict adherence to banking regulations, ensuring its operations remain within legal boundaries and safeguard financial stability. These expenses cover a range of essential professional services.

- Regulatory Compliance: Costs associated with meeting capital requirements, anti-money laundering (AML) protocols, and know-your-customer (KYC) procedures are ongoing and significant. For instance, in 2024, the banking sector globally saw increased investment in RegTech solutions to manage these complex requirements.

- Audits and Assurance: External audits, internal control assessments, and compliance reviews are critical for transparency and trust. These services ensure the bank's financial statements are accurate and its operations are sound.

- Legal and Advisory Fees: Engaging legal counsel for contract reviews, litigation, and regulatory interpretation, along with fees for specialized financial advisors, represent a considerable expenditure. These professionals help navigate the intricate legal landscape of the financial industry.

- Technology and Data Security: Investments in cybersecurity, data privacy compliance, and technology infrastructure to support regulatory reporting are also key cost drivers. Banks in 2024 continued to allocate significant budgets to protect sensitive customer data and comply with evolving data protection laws.

Cathay General Bank's cost structure is heavily influenced by interest paid on customer deposits, which was approximately NT$15.6 billion in 2023. Employee compensation, including salaries and benefits for its workforce of around 1,266 full-time equivalents as of December 31, 2024, is another major expense. The bank also incurs significant costs related to its extensive branch network, technology infrastructure, cybersecurity, and regulatory compliance, including legal and audit fees.

| Cost Category | 2023 Data (Approx.) | 2024 Focus/Notes |

|---|---|---|

| Interest Expense on Deposits | NT$15.6 billion | Key driver of net interest income |

| Employee Costs | Significant portion of operating expenses | ~1,266 FTEs as of Dec 31, 2024 |

| Occupancy & Equipment | Costs for 60+ branches, modernization | Investment in infrastructure and depreciation |

| Technology & IT Infrastructure | Core banking, digital platforms, cybersecurity | Cloud migration, data analytics investments |

| Regulatory Compliance & Professional Services | Legal, audit, RegTech solutions | AML, KYC, data privacy compliance |

Revenue Streams

Net interest income is the cornerstone of Cathay General Bank's profitability. This revenue is generated from the spread between the interest the bank earns on its loan portfolio, which includes commercial, real estate, and residential loans, and the interest it pays out on customer deposits and other borrowed funds. For the second quarter of 2025, Cathay General Bank reported a robust net interest income of $181.2 million, highlighting the effectiveness of its lending strategies and deposit management.

Cathay General Bank generates revenue through service charges and fees for a variety of banking activities. These include fees associated with deposit accounts, such as maintenance and overdraft charges, as well as fees for wire transfers and other transactional services.

A significant portion of this non-interest income comes from international trade finance. For instance, commissions earned from issuing letters of credit, a crucial tool for facilitating global trade, contribute directly to the bank's fee-based revenue. In the second quarter of 2025, Cathay General Bank reported $15.4 million in non-interest income, encompassing these depository service fees and letters of credit commissions.

Cathay General Bank generates revenue through wealth management fees, which encompass charges for investment advisory and insurance services. These fees are typically calculated as a percentage of assets under management or as specific service charges, acting as a significant contributor to the bank's non-interest income.

In 2024, the robust growth in assets under management for Cathay General Bank's wealth division directly correlates with an increase in these fee-based revenues. For instance, a substantial portion of the bank's projected non-interest income in 2024 is anticipated to stem from these wealth management services, reflecting client trust and market demand.

Real Estate Lending Fees

Cathay General Bank generates revenue through fees linked to its real estate lending activities. These include charges for originating, processing, and servicing loans, which are particularly important given the bank's focus on this sector.

Commercial real estate loans represent a substantial part of Cathay General Bank's loan portfolio. For instance, as of the first quarter of 2024, the bank reported total loans of approximately $13.9 billion, with a significant allocation to commercial real estate.

- Loan Origination Fees: Charges collected when a new real estate loan is established.

- Loan Processing Fees: Costs associated with underwriting, appraisal, and closing the loan.

- Loan Servicing Fees: Ongoing fees for managing the loan, including payment collection and escrow management.

- Commercial Real Estate Specialization: This focus allows for specialized fee structures and higher volume, contributing significantly to overall fee income.

Other Non-Interest Income

Cathay General Bank diversifies its revenue through a category termed Other Non-Interest Income. This segment captures earnings beyond traditional lending activities, reflecting a broader financial services approach.

Key components within this stream include realized gains or losses from the bank's investment in securities. For instance, in 2024, Cathay General Bank, like many financial institutions, would have navigated market volatility impacting its securities portfolio, directly influencing this income line.

Foreign exchange gains also form a significant part of this revenue. As a bank operating in a globalized economy, managing currency fluctuations allows for profitable opportunities. Miscellaneous income, encompassing various smaller revenue-generating activities, further bolsters this category.

- Securities Gains/Losses: Income derived from the buying and selling of investment securities.

- Foreign Exchange Gains: Profits realized from favorable currency exchange rate movements.

- Swap Commissions: Fees earned from facilitating interest rate or currency swap transactions.

- Other Miscellaneous Income: A catch-all for various smaller, non-core revenue streams.

Cathay General Bank's revenue streams are multifaceted, extending beyond core net interest income. These include a range of fees for banking services, wealth management, and real estate lending, alongside gains from investments and foreign exchange. In 2024, the bank's focus on commercial real estate loans, which constituted a significant portion of its $13.9 billion loan portfolio in Q1 2024, directly contributed to specialized fee income.

| Revenue Stream | Description | 2024 Relevance | Q2 2025 Data |

|---|---|---|---|

| Net Interest Income | Interest earned on loans minus interest paid on deposits. | Core profitability driver. | $181.2 million |

| Service Charges & Fees | Fees from deposit accounts, wire transfers, etc. | Supports non-interest income. | Included in Q2 2025 non-interest income. |

| Wealth Management Fees | Charges for investment advisory and insurance. | Significant contributor to non-interest income due to AUM growth. | Included in Q2 2025 non-interest income. |

| Real Estate Lending Fees | Origination, processing, and servicing fees. | Key due to strong commercial real estate focus. | Included in Q2 2025 non-interest income. |

| Other Non-Interest Income | Securities gains, foreign exchange gains, swap commissions. | Diversifies revenue, sensitive to market conditions. | $15.4 million (includes letters of credit) |

Business Model Canvas Data Sources

The Cathay General Bank Business Model Canvas is built upon a foundation of internal financial data, comprehensive market research, and strategic insights derived from industry analysis. These sources ensure each block of the canvas is informed by accurate and relevant information.