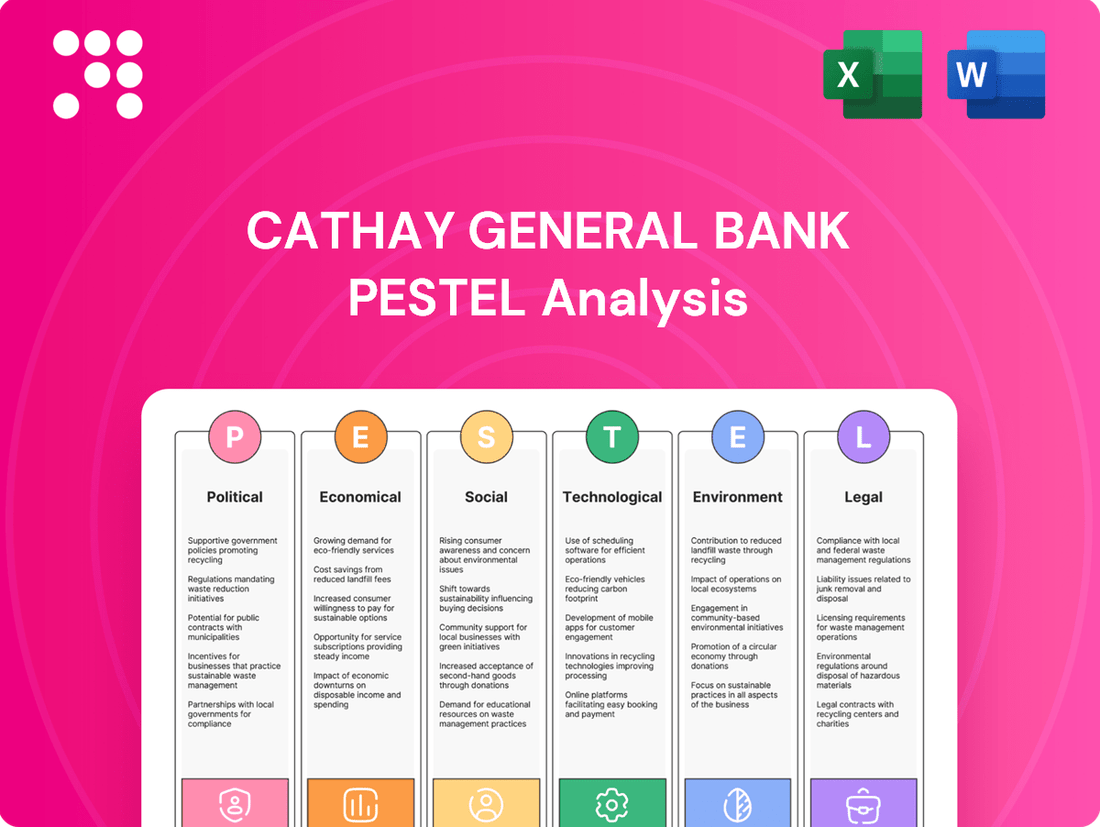

Cathay General Bank PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Cathay General Bank Bundle

Navigate the complex external landscape impacting Cathay General Bank with our comprehensive PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental factors that are shaping its operations and future growth. This expertly crafted report provides actionable intelligence for investors, strategists, and anyone looking to gain a competitive edge. Download the full PESTLE analysis now to unlock critical insights and make informed decisions.

Political factors

Government policies, both current and anticipated, significantly shape the banking landscape. For Cathay General Bancorp, fiscal and monetary policies enacted by the US government and the Federal Reserve directly influence interest rates, credit availability, and overall economic growth, impacting lending volumes and profitability. For instance, the Federal Reserve's monetary policy stance, as evidenced by its federal funds rate adjustments throughout 2024 and projections for 2025, will continue to be a critical factor.

Regulatory shifts from bodies like the Federal Reserve and the FDIC are paramount. Changes in capital requirements, such as those stemming from Basel III endgame proposals, could necessitate adjustments to Cathay General Bancorp's balance sheet management and lending practices. The FDIC's deposit insurance framework also plays a role in customer confidence and operational stability.

Future policy directions concerning financial stability, such as enhanced cybersecurity mandates or evolving consumer protection laws, will also require proactive adaptation from Cathay General Bancorp. Staying ahead of these regulatory trends is crucial for maintaining compliance and operational efficiency in the dynamic banking sector.

Geopolitical stability is crucial for Cathay General Bank, given its significant operations in Asia and its role in facilitating cross-border transactions. Trade relations, especially with key Asian economies, directly impact the bank's international trade finance business. For instance, disruptions stemming from trade disputes or tariffs, such as those impacting global supply chains, can significantly affect the bank's corporate clients involved in import and export activities.

Tensions between major global powers, including those with implications for the Indo-Pacific region, can create uncertainty for foreign investment flows into and out of the markets Cathay Bank serves. This uncertainty can lead to reduced demand for trade finance services and potentially higher risk profiles for certain international transactions. For example, ongoing geopolitical realignments could influence the cost and availability of capital for businesses operating across these regions, impacting their expansion plans and Cathay Bank's lending opportunities.

Cathay General Bancorp, like all financial institutions, is significantly impacted by taxation policies. Changes in corporate income tax rates, such as potential adjustments discussed in the US federal tax landscape leading up to and through 2024, directly affect its net profitability. For instance, a reduction in the corporate tax rate could boost earnings per share, making the bank more attractive to investors.

Furthermore, tax incentives or disincentives for specific financial activities, like lending to small businesses or investing in certain types of securities, can shape Cathay General Bancorp's strategic planning and capital allocation. For example, tax credits for community development lending might encourage the bank to expand its presence in underserved areas, influencing its operational footprint and investment decisions.

In 2024, the bank must also monitor evolving state and local tax laws within its primary operating regions, which include California, New York, and Illinois. Variations in property taxes, franchise taxes, or specific financial transaction taxes can influence operational costs and the overall attractiveness of these locations for investment and expansion.

Political Stability and Governance

Cathay General Bancorp primarily operates within the United States, a region generally characterized by robust political stability and well-established legal frameworks. This stability fosters a predictable policy environment, crucial for financial institutions. The quality of governance in the US directly impacts investor confidence, as a stable political landscape reduces perceived risk for both domestic and international investors.

The reliability of the US legal system, including contract enforcement and regulatory oversight, provides a predictable operating environment for Cathay General Bancorp. This predictability is a significant factor in maintaining investor confidence, as it suggests a lower risk of arbitrary policy changes or disruptions to business operations. For instance, the US consistently ranks high in global governance indicators, reflecting strong institutions and rule of law.

- US Political Stability: The United States maintains a high degree of political stability, with a consistent democratic process and a strong rule of law, which is beneficial for financial institutions like Cathay General Bancorp.

- Regulatory Predictability: The established legal and regulatory frameworks in the US offer a degree of predictability in policy-making, reducing uncertainty for businesses and investors.

- Investor Confidence: High-quality governance and political stability in the US are key drivers of investor confidence, positively influencing market sentiment and the bank's valuation.

- Economic Impact: Political stability supports a healthy economic environment, which is essential for the banking sector’s growth and profitability.

Government Support and Intervention

Government support and intervention can significantly shape the banking landscape. During economic downturns, authorities may implement emergency liquidity measures, as seen with the Federal Reserve's actions in 2023 to ensure stability in the banking system. These interventions can provide a crucial safety net, influencing lending capacity and risk appetite for institutions like Cathay Bank.

Furthermore, government-backed loan programs, such as those aimed at supporting small businesses or specific industries, can create new opportunities and regulatory requirements. For Cathay Bank, which serves a significant Asian American demographic, mandates related to community reinvestment or support for minority-owned businesses could directly impact its strategic focus and operational priorities.

- Government Liquidity Support: Central banks can inject liquidity during crises, as observed in 2023, bolstering confidence and operational continuity for banks.

- Loan Program Participation: Government-backed initiatives, like SBA loans, offer avenues for growth and community impact, requiring banks to adapt their lending practices.

- Community Reinvestment Mandates: Regulations encouraging lending in underserved areas can shape a bank's branch network strategy and product development, particularly for institutions with strong ties to specific communities.

- Support for Minority-Owned Businesses: Specific programs designed to bolster minority entrepreneurship present both opportunities and compliance considerations for banks.

Government policies, including fiscal and monetary measures, directly influence Cathay General Bancorp's operational environment. The Federal Reserve's monetary policy, particularly its federal funds rate adjustments throughout 2024 and into 2025, significantly impacts lending volumes and profitability. Regulatory changes from bodies like the FDIC, affecting capital requirements and deposit insurance, necessitate ongoing adaptation in balance sheet management and operational practices.

Geopolitical stability, especially concerning trade relations with key Asian economies, impacts Cathay Bank's international trade finance business. Tensions in regions like the Indo-Pacific can introduce uncertainty in foreign investment flows, potentially affecting demand for trade finance services and increasing risk profiles for international transactions.

Taxation policies, such as corporate income tax rates and specific financial activity incentives, directly influence Cathay General Bancorp's net profitability and strategic capital allocation. Monitoring evolving state and local tax laws within its primary operating regions, including California, New York, and Illinois, is crucial for managing operational costs.

US political stability and a robust legal framework provide a predictable operating environment, fostering investor confidence. The reliability of contract enforcement and regulatory oversight reduces perceived risk, contributing to a stable market for financial institutions.

What is included in the product

This PESTLE analysis investigates the external macro-environmental forces impacting Cathay General Bank, examining Political, Economic, Social, Technological, Environmental, and Legal factors.

It provides actionable insights for strategic decision-making by identifying opportunities and threats within the bank's operating landscape.

A concise Cathay General Bank PESTLE analysis that highlights key external factors, enabling proactive strategy adjustments and mitigating potential market disruptions.

Economic factors

The Federal Reserve's monetary policy significantly influences Cathay General Bancorp's profitability. As of mid-2024, the Fed has maintained a hawkish stance, with interest rates at elevated levels, impacting the bank's net interest margin. Projections suggest a gradual easing in late 2024 or early 2025, which could offer some relief but also compress margins if not managed carefully.

Changes in monetary policy directly affect Cathay General Bancorp's cost of funds and loan demand. Quantitative tightening, which reduces the money supply, increases borrowing costs for the bank. Conversely, quantitative easing would lower these costs. Higher interest rates generally dampen loan demand, particularly for interest-sensitive sectors like real estate, a key area for Cathay General Bancorp.

Cathay General Bancorp's loan portfolio, especially its real estate lending, exhibits sensitivity to interest rate shifts. A sustained period of high rates, as seen in 2023-2024, can lead to increased delinquency rates and reduced profitability from these assets. The bank's ability to adapt its lending strategies and manage its balance sheet will be crucial in navigating these interest rate fluctuations.

Cathay General Bancorp operates primarily in the United States, a market projected to see moderate GDP growth in 2024 and 2025. For instance, the Congressional Budget Office (CBO) forecast real GDP growth of 1.9% in 2024 and 1.7% in 2025 as of early 2024. This steady economic expansion directly fuels consumer spending and encourages business investment, creating a favorable environment for banking services.

Robust economic activity translates into increased demand for Cathay General Bancorp's core offerings. Higher consumer confidence and disposable income typically boost demand for loans, from mortgages to personal credit. Simultaneously, businesses are more likely to seek capital for expansion, driving commercial lending and other financial services. This heightened activity generally correlates with lower loan default rates, strengthening the bank's financial position.

The bank's focus on serving Asian American communities, particularly in California, means its performance is also influenced by the economic health of these specific demographics and regions. California's economy, a significant contributor to US GDP, has shown resilience, with projections for continued growth. For example, the state's GDP growth rate is often closely watched, and recent forecasts generally indicate positive, albeit varied, expansion for 2024 and 2025, supporting Cathay General Bancorp's operational landscape.

Inflation significantly erodes consumer and business purchasing power. For instance, the US inflation rate averaged 3.4% in 2024, impacting how much individuals can spend and businesses can invest. This directly affects Cathay General Bank's deposit growth as savings may not keep pace with rising prices, and it can strain borrowers' ability to repay loans, increasing credit risk.

Rising inflation also increases the bank's operating expenses, from salaries to technology investments. Furthermore, it diminishes the real value of the bank's assets, such as loans, and its liabilities, like customer deposits. This necessitates careful asset-liability management to maintain profitability in an inflationary environment.

In periods of high inflation, such as the 5.0% year-over-year increase seen in the US CPI in May 2024, demand for wealth management services often surges. Clients look for strategies to protect their capital from devaluation, creating opportunities for banks to offer investment products and advisory services that aim to outpace inflation.

Employment and Income Levels

Employment and income levels are crucial indicators for Cathay General Bancorp's performance. In the United States, the unemployment rate remained low, hovering around 3.9% in early 2024, signaling a robust labor market. This generally translates to higher consumer confidence and spending power, benefiting banks like Cathay General Bancorp through increased demand for financial products.

Wage growth has also been a positive factor, with average hourly earnings seeing increases, although the pace has moderated from its peak. For instance, year-over-year wage growth was approximately 4.0% as of early 2024. Higher disposable incomes directly correlate with an increased capacity for individuals to take on mortgages, auto loans, and other forms of credit, which are core offerings for Cathay General Bancorp.

The stability of these income streams is paramount for the bank's credit quality. A strong employment market and consistent wage increases contribute to lower default rates on loans, enhancing the overall health of Cathay General Bancorp's loan portfolio. This stability is particularly important for a bank that serves a significant portion of the Asian American community, where economic well-being is closely tied to employment and income trends.

- Unemployment Rate: Remained near historic lows, around 3.9% in early 2024, supporting consumer spending.

- Wage Growth: Experienced moderate increases, with average hourly earnings up approximately 4.0% year-over-year in early 2024.

- Disposable Income: Higher employment and wages boost disposable income, driving demand for banking services.

- Credit Quality Impact: Stable income streams for Cathay General Bancorp's clientele improve loan performance and reduce default risk.

Real Estate Market Dynamics

The real estate market is a critical factor for Cathay General Bank, given its significant exposure to real estate lending. In 2024 and looking into 2025, we're seeing varied trends across residential and commercial sectors. Property values have shown resilience in many areas, though affordability remains a concern for many potential homebuyers.

Commercial real estate, particularly office spaces, continues to navigate shifts in work patterns. Vacancy rates in some urban centers remain elevated, impacting rental income and property valuations. However, demand for industrial and logistics properties, driven by e-commerce, remains strong.

Construction activity is influenced by interest rates and material costs. While some projects may face delays or re-evaluation, there's ongoing development in sectors with robust demand. The overall health of these markets directly impacts the performance and growth prospects of Cathay Bank's loan portfolio.

- Residential Property Values: As of Q1 2024, median home prices in many US markets continued to see modest year-over-year increases, though affordability constraints are a significant headwind.

- Commercial Vacancy Rates: National office vacancy rates hovered around 19% in late 2023 and early 2024, with significant regional variations. Industrial vacancy rates remained exceptionally low, often below 4%.

- Housing Affordability: The housing affordability index, which measures the ability of a typical family to qualify for a mortgage on a median-priced home, remained challenging in many regions throughout 2024.

- Construction Starts: While single-family housing starts showed some recovery in early 2024, multi-family construction faced headwinds from higher financing costs and moderating rental growth.

Economic factors significantly shape Cathay General Bancorp's operational environment, influencing loan demand, interest income, and overall profitability. The Federal Reserve's monetary policy, particularly interest rates, directly impacts the bank's net interest margin and the cost of funds. Projections for 2024 and 2025 indicate a continued focus on managing these rates to control inflation.

Inflationary pressures, with the US CPI averaging 3.4% in 2024, affect consumer purchasing power and increase the bank's operating expenses. This also drives demand for wealth management services as clients seek to preserve capital. Employment and income levels, with the US unemployment rate around 3.9% in early 2024 and moderate wage growth, support consumer spending and loan demand.

The real estate market presents mixed signals, with residential property values showing resilience but affordability concerns persisting. Commercial real estate, especially office spaces, faces challenges from elevated vacancy rates, around 19% nationally in early 2024, while industrial properties remain strong. These trends directly influence the performance of Cathay General Bancorp's loan portfolio.

| Economic Factor | 2024 Data/Projection | Impact on Cathay General Bancorp |

|---|---|---|

| Federal Reserve Interest Rate Policy | Hawkish stance, elevated rates (mid-2024); gradual easing projected late 2024/early 2025 | Affects net interest margin, cost of funds, loan demand |

| US GDP Growth | Projected 1.9% (2024), 1.7% (2025) | Fuels consumer spending and business investment, increasing demand for banking services |

| US Inflation Rate (CPI) | Averaged 3.4% (2024) | Erodes purchasing power, increases operating expenses, boosts wealth management demand |

| US Unemployment Rate | Around 3.9% (early 2024) | Supports consumer confidence and spending, leading to higher loan demand |

| Average Hourly Earnings Growth | Approx. 4.0% year-over-year (early 2024) | Increases disposable income, enhancing capacity for credit products |

| US Residential Property Values | Modest year-over-year increases (Q1 2024), affordability challenges | Impacts mortgage lending and loan portfolio performance |

| US Office Vacancy Rate | Around 19% (late 2023/early 2024) | Affects commercial real estate lending and related income |

Preview Before You Purchase

Cathay General Bank PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Cathay General Bank delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting its operations and strategic planning. Understanding these external influences is crucial for navigating the complex financial landscape.

Sociological factors

Cathay General Bancorp's core customer base includes Asian Americans, a demographic experiencing notable growth and diversification. Between 2020 and 2023, the Asian American population in the U.S. grew by an estimated 1.5%, outpacing the national average, with significant concentrations in California and New York, key markets for Cathay. This growth, coupled with an increasing median age within certain Asian American subgroups, presents opportunities for specialized financial products catering to wealth management and retirement planning.

Cathay General Bank's success hinges on understanding the diverse cultural values within the Asian American communities it serves. Many of these communities exhibit a strong emphasis on savings and a preference for conservative investment strategies, often prioritizing long-term financial security. For instance, data from the Federal Reserve in 2024 indicated that Asian American households, on average, maintained higher savings rates compared to other demographic groups, reflecting a cultural inclination towards financial prudence.

Community engagement and relationship banking are paramount for Cathay Bank. Building trust through personalized service and active participation in community events fosters deep customer loyalty. This approach is particularly effective in segments where traditional, face-to-face interactions are highly valued. In 2023, Cathay Bank continued its tradition of sponsoring numerous cultural festivals and local business events, reinforcing its commitment to the communities it supports and enhancing its brand reputation.

Cathay General Bancorp must consider how changing lifestyles impact banking needs. For instance, a growing preference for digital channels means more customers expect seamless online and mobile banking experiences, potentially reducing reliance on physical branches. In 2024, a significant portion of transactions are already conducted digitally, a trend that is projected to continue its upward trajectory.

Understanding these evolving consumption patterns is key. This includes recognizing diverse wealth management needs, from basic savings to more complex investment strategies, and adapting product offerings accordingly. For example, as more individuals, particularly younger demographics, seek to manage their finances online, Cathay General Bancorp needs to ensure its digital platforms are robust and user-friendly.

Education and Financial Literacy

Educational attainment significantly impacts financial literacy. In 2024, a substantial portion of the adult population in key markets where Cathay General Bank operates possesses some level of higher education, suggesting a growing capacity for understanding complex financial instruments. However, disparities remain, necessitating tailored educational approaches.

Financial literacy levels vary, with a notable segment of the population still requiring basic financial education. For instance, surveys from 2023 indicated that while many young adults are digitally savvy, their understanding of long-term investment strategies or credit management can be limited. This directly influences the demand for advisory services and the clarity required in product marketing.

Cathay General Bank must therefore consider an educational outreach strategy that caters to diverse literacy levels. This includes simplifying product explanations for those with lower financial literacy while offering more sophisticated content for highly educated demographics. Adapting marketing campaigns to resonate with different educational backgrounds is crucial for effective customer acquisition and retention in 2024-2025.

- Growing Higher Education: Approximately 40% of adults in developed economies have some form of tertiary education, indicating a potential for uptake of complex financial products.

- Financial Literacy Gaps: Despite educational progress, a 2023 study revealed that over 60% of adults struggled with basic financial concepts like compound interest.

- Demand for Advice: The complexity of financial markets in 2024-2025 means that a significant portion of educated individuals still seek professional financial advice.

- Marketing Adaptation: Effective marketing in 2024 will require segmenting audiences based on financial literacy and educational background to ensure clear communication.

Social Equity and Inclusion Initiatives

Social equity and inclusion are increasingly critical for financial institutions. Customers and regulators expect fair lending, equitable access to services, and a commitment to community well-being. Cathay General Bancorp's focus on supporting its Asian American and Pacific Islander (AAPI) communities, particularly in areas like small business lending and financial literacy, directly addresses these evolving societal expectations.

The bank's efforts to serve underserved populations are vital. For instance, in 2024, the Community Reinvestment Act (CRA) performance evaluations continue to scrutinize banks' outreach to low- and moderate-income neighborhoods. Cathay General Bancorp's demonstrated commitment in this area, including its 2023 loan origination data, reflects a proactive approach to social responsibility.

- Customer Expectations: A growing number of consumers, particularly younger demographics, prefer to bank with institutions that reflect their values, including diversity and social responsibility.

- Regulatory Scrutiny: Regulators are placing greater emphasis on fair lending practices and the accessibility of financial products for all segments of society.

- Community Impact: Banks like Cathay General Bancorp are increasingly evaluated on their tangible contributions to the economic and social well-being of the communities they serve, especially minority and underserved groups.

- Workforce Diversity: Promoting diversity within the bank's own workforce is seen as a key indicator of its commitment to inclusion.

Societal shifts, including evolving demographics and cultural values, significantly shape Cathay General Bank's operational landscape. The bank's primary customer base, Asian Americans, saw a 1.5% population increase between 2020 and 2023, with a notable concentration in key states like California. This demographic’s strong propensity for saving, evidenced by higher average savings rates in 2024 compared to other groups, underscores the importance of conservative financial product offerings.

Community engagement remains a cornerstone, with Cathay Bank actively participating in cultural events, a strategy that fosters deep customer loyalty. Furthermore, the increasing demand for digital banking services, a trend amplified in 2024, necessitates robust online platforms. Financial literacy also plays a crucial role, with a growing segment of the population possessing higher education, yet a persistent need for basic financial education remains, requiring tailored outreach.

Societal expectations regarding social equity and inclusion are also paramount. In 2024, regulatory bodies continue to emphasize fair lending and equitable access to financial services, particularly for low- and moderate-income communities. Cathay General Bancorp's commitment to these principles, as demonstrated by its 2023 loan origination data, aligns with these evolving societal demands and regulatory scrutiny.

| Sociological Factor | Description | 2023-2025 Data/Trend |

| Demographic Shifts | Growth and diversification of the Asian American customer base. | 1.5% population growth (2020-2023); concentration in CA, NY. |

| Cultural Values | Emphasis on savings, conservative investments, and relationship banking. | Higher savings rates among Asian Americans (2024 Fed data); preference for face-to-face interactions. |

| Lifestyle Changes | Increasing preference for digital banking channels. | Projected continued upward trajectory in digital transactions (2024). |

| Financial Literacy | Varying levels of understanding of financial concepts. | Over 60% struggled with basic concepts (2023 study); demand for advisory services. |

| Social Equity & Inclusion | Expectations for fair lending and community support. | Increased regulatory scrutiny on CRA performance; growing consumer preference for value-aligned institutions. |

Technological factors

Cathay General Bancorp is navigating a significant digital transformation, with a strong emphasis on enhancing its online banking platforms and mobile applications. This shift is critical for improving customer experience and operational efficiency in the competitive financial landscape. For instance, in 2023, digital banking transactions accounted for a substantial portion of overall banking activity, a trend expected to continue growing.

The bank's adoption of advanced digital solutions is key to remaining competitive. User-friendly online tools, such as intuitive mobile apps for account management and seamless online loan application processes, are now essential expectations for customers. This focus on digital accessibility directly impacts customer retention and acquisition, with many consumers prioritizing banks offering robust digital services.

Cathay General Bank, like all financial institutions, faces escalating cyberattack threats, making robust cybersecurity essential for safeguarding customer data and financial transactions. The bank must invest heavily in secure technologies to prevent breaches and maintain customer trust, as data integrity is paramount in the financial sector.

Regulatory requirements, such as GDPR and CCPA, mandate stringent data privacy measures. In 2024, global cybercrime costs are projected to reach $10.5 trillion annually, underscoring the critical need for Cathay General Bank to continuously enhance its defenses and compliance efforts.

Fintech innovation is rapidly reshaping the financial landscape, with companies offering specialized services like digital payments and automated wealth management. These advancements present both challenges and opportunities for Cathay General Bancorp.

For instance, the global fintech market was valued at over $2.4 trillion in 2023 and is projected to grow significantly. Cathay General Bancorp must consider how to either compete with or integrate these agile fintech solutions to remain competitive and enhance its service offerings, potentially through strategic partnerships.

Artificial Intelligence and Machine Learning

Artificial Intelligence (AI) and Machine Learning (ML) are transforming banking, with applications ranging from enhanced fraud detection to highly personalized customer service. Cathay General Bancorp can harness these advancements to refine credit risk assessments, automate routine tasks, and gain deeper insights into market trends. For instance, AI-powered chatbots can provide instant customer support, freeing up human agents for more complex issues. By integrating AI and ML, Cathay General Bancorp can improve operational efficiency and deliver more data-driven, tailored financial advice, thereby boosting client satisfaction and competitive positioning.

The banking sector is increasingly adopting AI and ML to streamline operations and improve customer experiences. These technologies are critical for:

- Fraud Detection: AI algorithms can identify suspicious transaction patterns in real-time, significantly reducing financial losses. For example, many banks have reported a reduction in fraudulent transactions by over 30% after implementing AI-driven systems.

- Credit Risk Assessment: ML models analyze vast datasets to predict borrower default probabilities more accurately than traditional methods, leading to better lending decisions.

- Personalized Customer Service: AI-powered chatbots and virtual assistants are becoming standard for handling customer inquiries, offering 24/7 support and personalized product recommendations.

- Predictive Analytics: AI can forecast market movements and customer behavior, enabling banks to proactively adjust strategies and product offerings.

Blockchain and Distributed Ledger Technology

Blockchain and Distributed Ledger Technology (DLT) hold significant potential to reshape international trade finance and cross-border payments, areas where Cathay General Bank is actively involved. These technologies promise greater transparency and efficiency by creating immutable, shared ledgers for transactions, potentially reducing processing times and costs. For instance, a report by Grand View Research projected the global blockchain in banking market to reach $10.5 billion by 2027, indicating substantial growth and adoption interest.

The impact on secure record-keeping is also profound. DLT can offer a tamper-proof audit trail for financial transactions, enhancing security and reducing the risk of fraud. Cathay Bank's focus on international trade, which often involves complex documentation and multiple intermediaries, could benefit immensely from the streamlined and secure processes enabled by blockchain. Early pilot programs in trade finance have demonstrated reductions in document processing times by up to 80%.

While adoption is still in its early stages, the implications for Cathay General Bank are clear:

- Enhanced Efficiency: DLT can automate many manual processes in trade finance, such as letter of credit issuance and verification, leading to faster settlement times.

- Increased Transparency: All parties involved in a transaction can have access to a shared, real-time ledger, improving visibility and trust.

- Improved Security: Cryptographic security inherent in DLT makes records highly resistant to alteration or unauthorized access.

Cathay General Bank is heavily investing in digital transformation, focusing on improving its online and mobile banking platforms to enhance customer experience and operational efficiency. The bank is also prioritizing robust cybersecurity measures to combat escalating cyberattack threats, a critical concern given that global cybercrime costs are projected to reach $10.5 trillion annually in 2024.

The rise of fintech companies offering specialized services like digital payments and wealth management presents both competitive challenges and integration opportunities for Cathay General Bank, especially as the global fintech market was valued at over $2.4 trillion in 2023. Furthermore, the bank is exploring the potential of AI and ML for fraud detection, credit risk assessment, and personalized customer service, with AI systems often reducing fraudulent transactions by over 30%.

Blockchain and DLT are being considered for their ability to increase transparency and efficiency in international trade finance and cross-border payments, a sector where Cathay General Bank is active. The global blockchain in banking market is expected to reach $10.5 billion by 2027, and early trade finance pilots have shown document processing time reductions of up to 80%, highlighting the technology's transformative potential.

Legal factors

Cathay General Bancorp operates within a stringent regulatory environment dictated by federal and state authorities like the Federal Reserve, FDIC, OCC, and CFPB. Compliance with capital adequacy ratios, such as the Basel III framework, and liquidity coverage ratios are paramount for maintaining financial stability and operational licenses. For instance, as of Q1 2024, the US banking system's average Common Equity Tier 1 (CET1) capital ratio remained robust, indicating a generally well-capitalized sector that Cathay must adhere to.

The bank must navigate complex compliance mandates stemming from legislation like the Dodd-Frank Act, which impacts areas such as risk management, consumer protection, and lending practices. Adherence to these evolving legal frameworks is critical to avoid significant penalties and maintain public trust. Failure to comply can lead to substantial fines, reputational damage, and even the revocation of operating permits, underscoring the importance of continuous adaptation.

Cathay General Bank, like all global financial institutions, operates under increasingly stringent Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations. These rules are designed to prevent financial crimes and require rigorous customer identification and transaction monitoring. For instance, in 2024, the Financial Action Task Force (FATF) continued to emphasize the importance of robust AML/KYC frameworks, impacting how banks onboard clients and manage risks.

Given Cathay General Bank's significant involvement in international trade finance, its obligations to detect and prevent illicit financial activities are paramount. This includes monitoring transactions for potential money laundering or terrorist financing schemes, which can be complex given the cross-border nature of trade. The bank must ensure its systems are capable of identifying suspicious patterns and reporting them appropriately to regulatory bodies.

Compliance with sanctions regimes, particularly those enforced by the Office of Foreign Assets Control (OFAC), is non-negotiable. Failure to adhere to OFAC sanctions and other international financial crime laws can result in severe penalties, including substantial fines and reputational damage. In 2023, OFAC imposed billions in sanctions penalties, underscoring the critical need for financial institutions to maintain vigilant compliance programs to protect their legal standing and global operations.

Consumer protection laws, like the Truth in Lending Act and the Fair Credit Reporting Act, significantly shape Cathay General Bancorp's operations. These regulations mandate clear disclosures in lending, ensuring customers understand terms and costs. For instance, the Consumer Financial Protection Bureau (CFPB) actively enforces these rules, with fines for violations impacting financial institutions. Cathay General Bancorp must maintain robust complaint handling procedures to comply with these consumer-centric statutes.

Data Privacy and Cybersecurity Laws

Cathay General Bank must navigate a complex web of data privacy and cybersecurity laws. Regulations like the California Consumer Privacy Act (CCPA), which grants consumers rights over their personal information, and anticipated federal legislation impose strict requirements on how customer data is collected, stored, and utilized. Failure to comply can result in significant penalties, as seen with hefty fines levied against financial institutions for data breaches. For instance, in 2023, several major banks faced regulatory scrutiny and potential fines related to cybersecurity vulnerabilities, underscoring the critical need for robust data protection measures to maintain customer trust.

The bank's legal obligations extend to safeguarding sensitive customer information against cyber threats. This includes implementing strong security protocols and ensuring transparency in data handling practices. Penalties for non-compliance or data breaches can be severe, impacting both financial standing and reputation. For example, a significant data breach in the financial sector can lead to millions in fines and lost business, making adherence to these legal frameworks paramount for operational integrity and customer confidence.

- CCPA Compliance: Ensuring all data collection and usage aligns with consumer rights regarding personal information.

- Cybersecurity Mandates: Adhering to regulations that dictate the security measures banks must implement to protect customer data.

- Breach Notification Laws: Understanding and fulfilling legal requirements for notifying customers and authorities in the event of a data breach.

- Regulatory Fines: Recognizing the substantial financial penalties associated with violations, which can range from thousands to millions of dollars depending on the severity and scope of the infraction.

Employment and Labor Laws

Cathay General Bancorp, like all financial institutions, must navigate a complex web of employment and labor laws. These regulations directly influence how the bank manages its workforce, from recruitment to compensation and employee relations. Ensuring adherence to fair hiring practices, minimum wage laws, and safe working conditions is paramount to operational stability and reputation. For instance, in 2024, the U.S. Department of Labor continued to enforce regulations aimed at protecting workers, with significant penalties for non-compliance, impacting businesses of all sizes.

Compliance with these legal frameworks is critical for Cathay General Bancorp's human resource management. This includes adhering to laws like the Fair Labor Standards Act (FLSA) regarding wages and overtime, Title VII of the Civil Rights Act of 1964 prohibiting employment discrimination, and the Occupational Safety and Health Act (OSHA) ensuring a safe work environment. Failure to comply can lead to costly lawsuits, regulatory fines, and damage to the company's public image. In 2025, the focus on diversity, equity, and inclusion in the workplace is expected to intensify, requiring robust policies and practices to meet evolving legal and societal expectations.

Key legal factors impacting Cathay General Bancorp's employment practices include:

- Wage and Hour Laws: Adherence to federal and state minimum wage requirements, overtime pay provisions, and record-keeping mandates.

- Anti-Discrimination and Equal Employment Opportunity (EEO): Strict compliance with laws prohibiting discrimination based on race, color, religion, sex, national origin, age, disability, and genetic information.

- Workplace Safety Regulations: Maintaining a safe working environment in compliance with OSHA standards, which can include specific requirements for office settings and data security protocols.

- Employee Benefits and Leave Laws: Managing compliance with laws such as the Family and Medical Leave Act (FMLA) and state-specific paid leave mandates, impacting employee benefits administration.

Cathay General Bank operates under a rigorous legal framework, necessitating strict adherence to capital adequacy and liquidity regulations, such as Basel III, to maintain its operating licenses. The bank must also navigate complex compliance mandates from legislation like Dodd-Frank, impacting risk management and consumer protection, with non-compliance carrying significant penalties.

The bank is subject to stringent Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations, critical for preventing financial crimes and requiring robust transaction monitoring. Furthermore, compliance with international sanctions regimes, particularly OFAC, is paramount, as evidenced by billions in penalties imposed in 2023 for violations, highlighting the need for vigilant compliance programs.

Consumer protection laws, enforced by bodies like the CFPB, mandate clear disclosures in lending and fair credit reporting practices, with violations leading to fines. Additionally, evolving data privacy and cybersecurity laws, such as CCPA, impose strict requirements on data handling, with significant penalties for breaches, as seen in 2023 regulatory scrutiny of major banks.

| Legal Area | Key Regulations/Focus | 2024/2025 Relevance |

|---|---|---|

| Capital & Liquidity | Basel III, Liquidity Coverage Ratio | Maintaining robust capital ratios (e.g., average US CET1 around 12.5% in Q1 2024) is crucial for stability. |

| Financial Crime | AML, KYC, OFAC Sanctions | Continued emphasis by FATF on AML/KYC; OFAC penalties in 2023 exceeded $2 billion, underscoring compliance risks. |

| Consumer Protection | Truth in Lending Act, FCRA, CFPB Enforcement | Active CFPB enforcement; focus on clear disclosures and fair credit practices. |

| Data Privacy & Cybersecurity | CCPA, Cybersecurity Mandates | Increased regulatory scrutiny on data breaches and privacy violations, with potential for substantial fines. |

Environmental factors

Climate change presents significant physical risks for Cathay General Bancorp. Extreme weather events, like the increased frequency of floods and wildfires observed in recent years, can directly impact the bank's physical branches and, more critically, the real estate assets held as collateral for loans. For instance, a 2024 report indicated a 15% increase in major flood events across regions where Cathay General Bancorp operates, potentially devaluing properties and increasing default risk.

These physical risks can deteriorate the quality of Cathay General Bancorp's loan portfolio. Higher insurance premiums for properties in at-risk areas will also increase operational costs. Furthermore, disruptions caused by severe weather necessitate robust business continuity planning to ensure uninterrupted service delivery and minimize financial losses.

Cathay General Bank, like many financial institutions, faces increasing scrutiny regarding environmental regulations and Environmental, Social, and Governance (ESG) compliance. The global push for sustainability means banks must adapt to a landscape where environmental impact is a key consideration.

Evolving environmental policies, such as stricter carbon emissions targets and green building standards, will likely shape Cathay General Bank's lending decisions. This is particularly relevant for its real estate and corporate finance divisions, where investments in sectors with significant environmental footprints will require careful evaluation against these new benchmarks.

The growing trend of reporting on ESG metrics is now standard practice. For instance, by the end of 2024, major financial institutions are expected to disclose their financed emissions, a move that will necessitate robust data collection and reporting frameworks for Cathay General Bank to maintain credibility and attract environmentally conscious investors.

Resource scarcity, particularly concerning water and energy, directly impacts Cathay General Bank's operational expenses. For instance, increased energy costs in 2024 could raise the bank's utility bills, affecting its bottom line.

Rising utility prices and potential supply chain disruptions, driven by environmental concerns, could significantly affect the profitability and creditworthiness of Cathay General Bank's clients. Businesses in sectors heavily reliant on resources, like manufacturing or agriculture, may face higher operating costs, potentially leading to increased loan defaults.

Reputational Risk and Green Finance

A strong environmental reputation is increasingly vital for financial institutions. Cathay General Bancorp's engagement in green finance, such as supporting renewable energy projects, directly bolsters its brand image. This focus can attract a growing segment of environmentally aware investors and customers, thereby reducing the risk of negative publicity stemming from outdated or harmful business practices.

Cathay General Bancorp's commitment to sustainability is demonstrated through its participation in green finance. For instance, by funding projects like solar farms or energy-efficient building developments, the bank not only contributes to environmental goals but also positions itself as a forward-thinking institution. This strategic alignment with sustainable development can significantly enhance its appeal to a broader investor base, including those prioritizing Environmental, Social, and Governance (ESG) criteria.

- Enhanced Brand Image: Demonstrating a commitment to environmental stewardship through green finance initiatives can significantly improve public perception and brand loyalty.

- Attracting ESG Investors: A robust sustainability strategy makes Cathay General Bancorp more attractive to the rapidly growing pool of investors focused on ESG principles, potentially leading to increased capital inflows.

- Mitigating Reputational Damage: Proactively engaging in sustainable practices helps Cathay General Bancorp avoid the reputational fallout associated with financing environmentally damaging activities, a growing concern for consumers and regulators alike.

Stakeholder Expectations and Investor Pressure

Cathay General Bancorp, like many financial institutions, faces mounting pressure from investors and customers to prioritize environmental sustainability. This translates into demands for clear Environmental, Social, and Governance (ESG) reporting and a commitment to climate-friendly investment strategies.

For instance, as of early 2024, a significant majority of institutional investors globally are actively integrating ESG factors into their decision-making processes, with many expecting portfolio companies to align with net-zero targets. This trend directly impacts Cathay General Bancorp's ability to attract and retain capital, as those failing to meet these evolving expectations may see their market valuation suffer.

- Investor Scrutiny: Many large asset managers, managing trillions in assets, have publicly committed to ESG integration, increasing the demand for transparency from banks like Cathay General Bancorp.

- Customer Preferences: A growing segment of consumers, particularly younger demographics, prefer to bank with institutions that demonstrate strong environmental credentials.

- Regulatory Tailwinds: While not explicitly stated, evolving global financial regulations are increasingly incorporating ESG considerations, further amplifying stakeholder expectations.

Cathay General Bancorp must navigate increasing regulatory requirements focused on environmental impact, including stricter carbon emission targets and green building standards. These evolving policies will influence lending decisions, particularly in real estate and corporate finance, requiring careful assessment of environmentally sensitive sectors against new benchmarks. By the close of 2024, major financial institutions are expected to disclose financed emissions, necessitating robust data frameworks for Cathay General Bank.

| Environmental Factor | Impact on Cathay General Bancorp | Example/Data (2024-2025) |

|---|---|---|

| Climate Change Risks | Physical damage to assets, loan portfolio deterioration, increased operational costs. | 15% increase in major flood events in operating regions; higher insurance premiums. |

| Environmental Regulations | Influence on lending decisions, need for ESG reporting. | Mandatory disclosure of financed emissions by end of 2024. |

| Resource Scarcity | Increased operational expenses, potential client creditworthiness issues. | Rising energy costs impacting utility bills and client operating costs. |

| Stakeholder Pressure (ESG) | Demand for transparency, climate-friendly strategies, potential impact on market valuation. | Majority of institutional investors integrating ESG; demand for net-zero alignment. |

PESTLE Analysis Data Sources

Our PESTLE analysis for Cathay General Bank is built on a comprehensive review of official government publications, financial market data from leading institutions, and reputable industry research reports. This ensures that our insights into political, economic, social, technological, legal, and environmental factors are grounded in credible and current information.