Cathay General Bank Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Cathay General Bank Bundle

Cathay General Bank operates within a dynamic financial landscape shaped by several key competitive forces. Understanding the intensity of rivalry, the bargaining power of buyers and suppliers, and the threats of new entrants and substitutes is crucial for strategic planning.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Cathay General Bank’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Depositors act as crucial suppliers of capital for Cathay General Bancorp, and their bargaining power is generally moderate, though it's showing signs of growth, particularly for larger, institutional depositors. This influence means that competition for these funds can push up the interest rates the bank needs to offer to attract and keep them. For instance, Cathay General Bancorp initiated promotional campaigns for time deposits in Q1 2025, a clear strategy to bolster its core deposit base and manage funding costs in a competitive environment.

Technology and software providers wield moderate bargaining power over Cathay General Bancorp. This stems from the specialized nature of their banking technology, software, and cybersecurity solutions, coupled with the significant costs and complexities involved in switching to new systems. For instance, integrating a new core banking system can take years and cost millions, making banks hesitant to switch providers.

Cathay General Bancorp's strategic investments in advanced digital infrastructure, such as artificial intelligence for fraud detection and cloud computing for scalability, further amplify the leverage of these technology vendors. In 2023, the global banking software market was valued at approximately $30 billion, and the demand for cybersecurity solutions within the financial sector continues to grow, underscoring the importance and influence of these suppliers.

The bargaining power of skilled employees, especially in high-demand sectors like wealth management and digital banking, is a key factor for Cathay General Bank. In 2024, the competition for top talent remains intense, pushing banks to offer more attractive compensation and benefits packages. This directly influences the bank's operational expenses and its ability to innovate and maintain service quality.

Attracting and retaining specialized talent in areas such as international trade finance requires significant investment in competitive salaries, comprehensive benefits, and clear career progression paths. For instance, reports from early 2024 indicate that average salaries for experienced wealth managers in competitive markets can range from $100,000 to $150,000 annually, plus bonuses, reflecting the high demand and specialized knowledge required.

Broader economic conditions and industry-specific employment trends significantly shape this bargaining power. With a growing emphasis on digital transformation and specialized financial services, the demand for employees with niche skills is likely to increase, further strengthening their negotiating position with institutions like Cathay General Bank.

Interbank and Wholesale Funding Market

The bargaining power of suppliers in the interbank and wholesale funding market for Cathay General Bancorp is influenced by entities like the Federal Home Loan Bank (FHLB) and other financial institutions. Their power stems from market liquidity conditions and prevailing interest rates. For instance, in late 2023 and early 2024, while interest rates remained elevated, the availability of wholesale funding played a crucial role in managing liquidity for banks.

Cathay General Bancorp's financial disclosures highlight its ability to mitigate this supplier power. As of the first quarter of 2024, the bank reported significant unused borrowing capacity from the Federal Home Loan Bank, demonstrating a robust liquidity position. This access reduces its immediate reliance on external wholesale funding, thereby lessening the leverage of these suppliers.

- Federal Home Loan Bank (FHLB) Access: Cathay General Bancorp maintains substantial access to FHLB funding, providing a stable and often cost-effective source of liquidity.

- Market Liquidity Impact: The overall liquidity in the financial system directly affects the bargaining power of wholesale funding providers. Tighter liquidity generally increases their leverage.

- Interest Rate Sensitivity: Prevailing interest rates are a key determinant of the cost of wholesale funds, influencing the bargaining power of suppliers who can adjust their offered rates.

- Cathay General Bancorp's Liquidity Position: The bank's strong liquidity, evidenced by its unused borrowing capacity, acts as a counter-balance to the bargaining power of wholesale funding suppliers.

Commercial Real Estate Market Dynamics

The bargaining power of suppliers in the commercial real estate (CRE) market, particularly concerning Cathay General Bank's lending specialization, is influenced by the concentration of property developers and large real estate investors. These entities can negotiate terms that affect the bank's lending conditions and risk profile. For instance, in 2024, a tightening CRE market with rising interest rates could empower developers to demand more favorable loan terms, impacting Cathay's profitability on its real estate loan portfolio.

The health of the CRE market directly impacts Cathay's lending. Trends like increasing delinquencies or shifts in property values can alter the demand for and quality of Cathay’s real estate loans. For example, if a significant number of developers face challenges meeting loan obligations due to economic headwinds, Cathay's exposure to this sector increases, potentially leading to higher provisions for loan losses.

- Developer Leverage: In 2024, major property developers, especially those with strong balance sheets and access to alternative financing, can exert considerable bargaining power on lenders like Cathay, potentially securing lower interest rates or more flexible repayment schedules.

- Investor Influence: Large institutional real estate investors, by consolidating demand and offering substantial deal volumes, can also influence lending standards and pricing for commercial properties.

- Market Conditions Impact: A downturn in the CRE market, evidenced by rising vacancy rates or declining property values, can amplify the bargaining power of well-capitalized developers and investors who are less reliant on traditional bank financing.

- Interest Rate Sensitivity: As of mid-2024, the prevailing interest rate environment significantly shapes negotiations. Higher rates generally increase the cost of capital for developers, potentially reducing their bargaining power unless they can pass these costs on to tenants or buyers.

Cathay General Bancorp's bargaining power with its suppliers is generally moderate, with key areas of influence stemming from its deposit base and technology partnerships.

Depositors, especially larger institutional ones, hold moderate power, influencing interest rates offered by Cathay. For example, in Q1 2025, Cathay actively pursued promotional campaigns for time deposits to strengthen its funding. Technology and software providers also exert moderate leverage due to the specialized nature of their offerings and the high switching costs for banks.

Skilled employees, particularly in digital banking and wealth management, possess significant bargaining power in 2024, driving up compensation demands. Furthermore, wholesale funding providers like the Federal Home Loan Bank (FHLB) have influence, though Cathay's strong liquidity, evidenced by substantial unused FHLB borrowing capacity as of Q1 2024, mitigates this power.

| Supplier Type | Bargaining Power (2024) | Key Influencing Factors | Cathay's Mitigation Strategy |

|---|---|---|---|

| Depositors | Moderate to Growing | Competition for funds, size of deposit | Promotional campaigns, relationship management |

| Technology Providers | Moderate | Specialized solutions, high switching costs | Strategic partnerships, phased integration |

| Skilled Employees | High | Demand for specialized skills, competition | Competitive compensation, career development |

| Wholesale Funding Providers (e.g., FHLB) | Moderate | Market liquidity, interest rates | Strong liquidity position, diversified funding |

What is included in the product

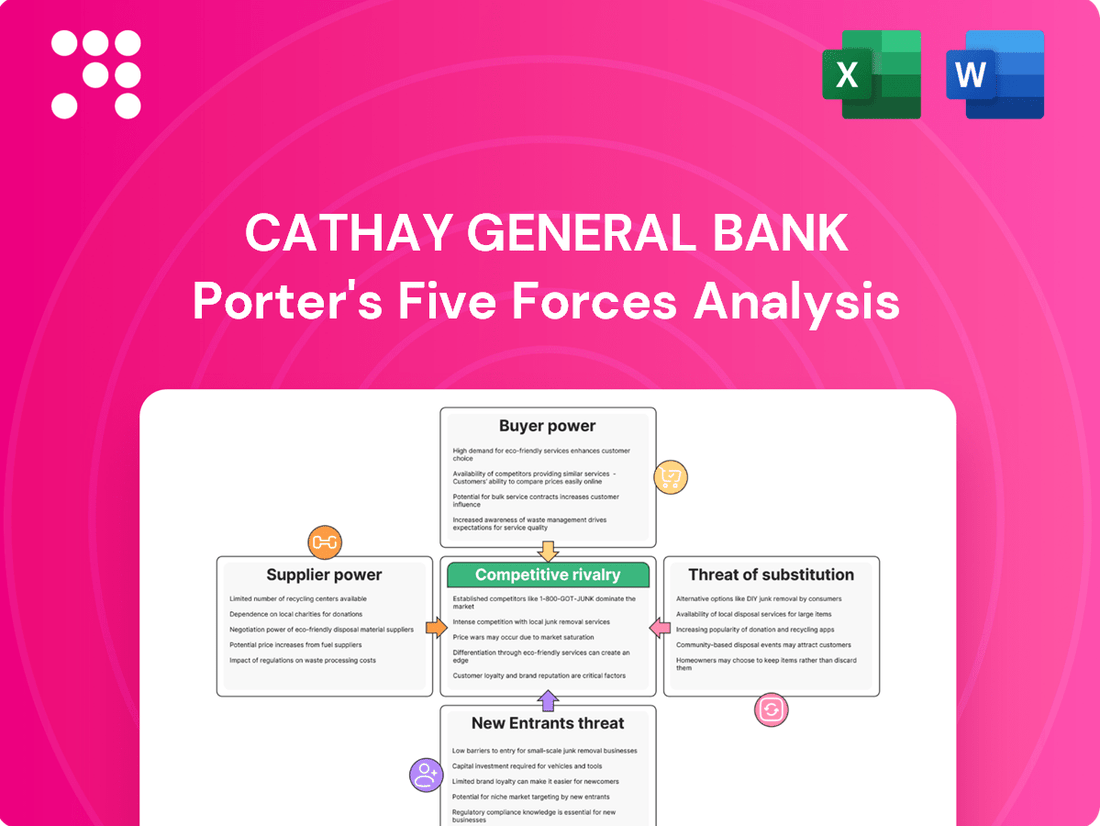

This analysis tailors Porter's Five Forces to Cathay General Bank, examining the intensity of rivalry, the bargaining power of customers and suppliers, the threat of new entrants, and the impact of substitute financial products.

A dynamic framework that helps Cathay General Bank anticipate and mitigate competitive threats by clearly visualizing the impact of each force.

Provides actionable insights into industry attractiveness and potential profit pools, enabling strategic adjustments to enhance competitive advantage.

Customers Bargaining Power

Individual and business deposit account holders wield growing bargaining power, largely due to the ease with which they can switch financial institutions and their keen sensitivity to interest rate differentials on savings and time deposits. Cathay General Bancorp, therefore, faces pressure to maintain competitive interest rates and a compelling suite of services to both attract and retain this crucial customer base.

This dynamic is underscored by Cathay General Bancorp's Q1 and Q2 2025 performance, where total deposits saw an increase, partly attributed to targeted promotional campaigns and prevailing seasonal economic factors. Such growth highlights the direct correlation between attractive offerings and deposit acquisition, a key indicator of customer responsiveness to rate incentives.

Borrowers, particularly larger corporations and real estate developers, wield considerable influence because they can access financing from numerous banks and alternative lenders. This competition forces Cathay General Bancorp to offer competitive loan terms, attractive interest rates, and high-quality service, especially in crucial areas like commercial and real estate lending.

Wealth management clients, especially high-net-worth individuals and professionals within Asian American communities, wield significant bargaining power. Their demand for highly personalized, sophisticated, and sometimes niche services means Cathay General Bancorp must actively adapt its offerings to retain these valuable clients. For instance, in 2024, a significant portion of wealth management clients sought services beyond basic investment management, including estate planning and philanthropic advisory, indicating a clear need for specialized expertise.

Asian American Community Niche

While Cathay General Bancorp (CATY) has carved out a significant niche serving the Asian American community, the bargaining power of these customers can still be considerable. If other banks or financial technology companies begin to offer equally tailored, culturally resonant services, customers may find it easier to switch, especially if pricing or convenience becomes a deciding factor. For instance, while CATY reported strong net interest income growth in 2024, continued innovation in digital banking by competitors could shift customer preferences.

Cathay General Bancorp’s deep roots and established trust within the Asian American demographic are key strengths, fostering customer loyalty. However, this loyalty isn't absolute. Customers will still evaluate offerings based on service quality, product breadth, and competitive rates. A slight uptick in fees or a perceived decline in personalized service could prompt customers to explore alternatives, particularly if those alternatives demonstrate a similar understanding of their unique financial needs and cultural nuances.

The bargaining power of customers in this niche is influenced by several factors:

- Availability of Alternatives: The presence of other financial institutions, traditional or digital, that cater to or can adapt to serve the Asian American market increases customer options.

- Switching Costs: While Cathay General Bancorp aims to minimize these, the effort involved in moving accounts or establishing new relationships can influence a customer's decision to stay or leave.

- Information Availability: Increased transparency and accessibility of information about competing financial products and services empower customers to make informed comparisons.

- Price Sensitivity: Even within a niche, customers are sensitive to fees, interest rates, and the overall value proposition offered by their bank.

Digital Banking Expectations and Switching Costs

The increasing prevalence of digital banking and fintech solutions significantly bolsters customer bargaining power. These platforms offer intuitive, mobile-first experiences, making it easier for consumers to compare services and switch providers. For Cathay General Bancorp, this means a heightened imperative to invest in digital transformation to meet evolving customer expectations for seamless, user-friendly banking.

Customers now expect readily accessible, efficient digital tools, and the ability to switch financial institutions with minimal friction. This shift places considerable pressure on established banks to innovate. For instance, a significant portion of banking transactions are now conducted digitally, highlighting customer preference for convenience. In 2024, many banks reported over 70% of customer interactions occurring through digital channels, underscoring the need for robust online and mobile offerings.

- Digital Adoption: Customer engagement with digital banking channels continues to grow, with a substantial percentage of transactions now occurring online or via mobile apps.

- Fintech Competition: Fintech firms are setting new benchmarks for user experience, forcing traditional banks to enhance their own digital capabilities.

- Switching Behavior: Lower perceived switching costs in the digital age empower customers to move to providers offering superior digital services.

- Investment Imperative: Cathay General Bancorp must prioritize digital infrastructure upgrades and user experience enhancements to retain and attract customers.

The bargaining power of Cathay General Bancorp's customers is substantial, driven by the ease of switching financial institutions and a keen eye on competitive interest rates and service quality. This is particularly true for deposit holders and borrowers who have access to a wide array of banking and lending alternatives. For example, in 2024, the Federal Reserve's interest rate adjustments directly influenced customer deposit shifts, demonstrating their sensitivity to rate differentials.

Wealth management clients, especially those within the Asian American community, also exert significant influence by demanding personalized and specialized financial services. Cathay General Bancorp must continuously adapt its offerings to meet these evolving needs, as evidenced by the growing demand for estate planning and philanthropic advisory services observed in 2024.

The increasing prevalence of digital banking and fintech solutions has further amplified customer bargaining power by lowering switching costs and raising expectations for user experience. Banks like Cathay General Bancorp must prioritize digital investments to remain competitive, as a significant portion of banking interactions, often exceeding 70% in 2024, occurred through digital channels.

| Customer Segment | Key Bargaining Factors | Impact on Cathay General Bancorp | 2024/2025 Data Point Example |

|---|---|---|---|

| Deposit Account Holders | Interest rate sensitivity, ease of switching | Pressure to offer competitive rates and services | Deposit growth influenced by promotional campaigns in Q1/Q2 2025 |

| Borrowers (Corporate/Real Estate) | Access to multiple lenders, loan terms | Need for competitive loan pricing and service | |

| Wealth Management Clients | Demand for personalized/niche services | Requirement for specialized expertise and client retention efforts | Increased demand for estate planning in 2024 |

| Digital Banking Users | User experience, low switching costs | Imperative for digital transformation and innovation | Over 70% of banking interactions in 2024 occurred digitally |

Preview Before You Purchase

Cathay General Bank Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. It details the competitive landscape of Cathay General Bank through Porter's Five Forces, analyzing the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the banking sector.

Rivalry Among Competitors

The banking sector is notably fragmented, with a vast number of traditional banks, regional players, and community banks all vying for customer deposits and loans. Cathay General Bancorp, therefore, contends with a broad spectrum of competitors, many of whom offer comparable services or are actively pursuing niche markets, including specific ethnic demographics.

This intense fragmentation fuels aggressive price competition, particularly on interest rates for loans and deposits, and drives a continuous push for service innovation as institutions seek to differentiate themselves. For instance, in 2024, the U.S. banking industry saw over 4,000 FDIC-insured institutions, highlighting the sheer number of entities competing for business.

Fintech companies and neobanks are a major competitive force, offering specialized, cost-effective, and convenient services like mobile payments and AI-driven financial advice. These agile new entrants challenge traditional banks like Cathay General Bank, pushing them to accelerate innovation and digitalization to match their customer-centric approaches.

Competitive rivalry at Cathay General Bancorp is fierce, with rivals actively competing across a spectrum of financial products like loans, savings accounts, and investment services. This intense competition means banks are always looking for an edge.

Cathay General Bancorp carves out its niche by focusing on serving Asian American communities and specializing in international trade finance and real estate lending. These specialized areas are key differentiators for the bank.

Despite these specializations, competitors are persistent in their efforts to match or even surpass Cathay General Bancorp's unique offerings. For instance, the overall banking sector saw a net interest margin of around 3.1% for many regional banks in early 2024, highlighting the pressure on profitability across the board.

Interest Rate Environment and Net Interest Margin Pressure

Fluctuations in interest rates and the broader economic landscape significantly ramp up competition among banks. This environment forces institutions like Cathay General Bancorp to aggressively compete for both deposits and loans, all in an effort to protect or enhance their net interest margin.

For Cathay General Bancorp, the net interest margin showed positive movement, increasing in the first and second quarters of 2025. However, this upward trend faces persistent challenges from rivals. Competitors continue to exert pressure on deposit costs, making it more expensive to attract and retain customer funds, while simultaneously impacting loan yields, which are the returns banks earn on their lending activities.

- Intensified Competition: Banks are actively competing for customer deposits and loan opportunities, especially during periods of interest rate volatility.

- Net Interest Margin (NIM) Sensitivity: NIM is directly affected by the cost of deposits and the yield on loans, making it a critical metric in a competitive banking environment.

- Cathay General Bancorp's Performance: The bank experienced an increase in its NIM during Q1 and Q2 2025, indicating some success in managing these pressures.

- Ongoing Challenges: Despite recent gains, Cathay General Bancorp continues to face sustained competitive pressure on both deposit pricing and loan origination yields.

Regulatory Landscape and Compliance Costs

The banking sector operates under a dense and ever-changing regulatory framework, which acts as a significant competitive force. For Cathay General Bancorp, like many financial institutions, navigating these rules presents a constant challenge.

Compliance costs, including those related to capital adequacy ratios and anti-money laundering (AML) measures, can be substantial. For instance, in 2024, banks continue to invest heavily in technology and personnel to meet stringent requirements set by bodies like the Federal Reserve and the Office of the Comptroller of the Currency (OCC). These expenses can divert resources from innovation and growth, potentially giving an edge to larger banks with greater economies of scale or nimble fintech companies that may operate under different regulatory umbrellas.

- Increased Operational Burden: Banks must dedicate significant resources to understanding and implementing new regulations, impacting operational efficiency.

- Capital Requirements: Stricter capital requirements, such as those influenced by Basel III Endgame proposals, necessitate holding more capital, which can limit lending capacity and return on equity.

- Competitive Disadvantage: Smaller and regional banks may find it harder to absorb compliance costs compared to larger, globally diversified institutions.

- Innovation Constraints: The need to ensure regulatory adherence can sometimes slow down the adoption of new technologies or business models.

Cathay General Bancorp faces intense rivalry from a broad spectrum of financial institutions, including traditional banks, regional players, and agile fintech companies. This competition is particularly sharp in areas like loan pricing and deposit rates, with the U.S. banking industry featuring over 4,000 FDIC-insured institutions in 2024, underscoring the crowded market. The bank's strategic focus on Asian American communities and specialized services like international trade finance helps differentiate it, though competitors actively seek to match these offerings. Despite Cathay General Bancorp's positive net interest margin trends in early 2025, ongoing pressure on deposit costs and loan yields from rivals remains a significant challenge.

| Competitor Type | Key Competitive Actions | Impact on Cathay General Bancorp |

|---|---|---|

| Traditional & Regional Banks | Aggressive pricing on loans and deposits; expansion into niche markets. | Pressure on net interest margins; need for service innovation. |

| Fintech & Neobanks | Digital-first offerings; lower cost structures; specialized services (e.g., mobile payments, AI advice). | Accelerated need for digitalization; customer experience enhancement. |

| Specialized Lenders | Focus on specific sectors like real estate or international trade. | Direct competition in core specialized areas; potential loss of market share. |

SSubstitutes Threaten

The proliferation of online direct lending platforms and peer-to-peer (P2P) lending services presents a significant threat of substitution for Cathay General Bancorp. These platforms often provide quicker loan approvals and can offer more competitive interest rates or flexible repayment schedules, directly appealing to borrowers seeking alternatives to traditional banking. For instance, by mid-2024, the online lending market continued its robust growth, with some estimates suggesting the total volume of online consumer loans originated could exceed $200 billion annually in the US alone.

Investment and robo-advisory apps present a significant threat to Cathay General Bank's wealth management and deposit services. These digital platforms offer automated, low-cost alternatives that attract tech-savvy customers seeking convenience and reduced fees. For instance, by mid-2024, the robo-advisory market continued its robust growth, with assets under management projected to reach hundreds of billions globally, indicating a substantial shift in customer preference towards these digital solutions.

These apps can divert both investment capital and deposit balances away from traditional banking institutions like Cathay Bank. As more individuals embrace digital-first financial management, the appeal of personalized, albeit more expensive, traditional banking services diminishes. This trend is further amplified by the increasing accessibility and user-friendliness of fintech solutions, making it easier for customers to move their money without significant friction.

Non-bank financial institutions, such as credit unions and specialized finance companies, present a significant threat of substitutes to traditional banks like Cathay General Bank. These entities often cater to specific market segments, offering competitive rates and tailored services that can draw customers away from conventional banking products. For instance, credit unions, with their member-owned structure, can sometimes offer more favorable loan terms or deposit rates.

The shadow banking system, encompassing entities like money market funds and peer-to-peer lending platforms, also provides alternative avenues for financial services, particularly in credit provision and investment. These institutions, often subject to less stringent regulations than traditional banks, can react more nimbly to market changes and offer innovative solutions. By mid-2024, the global shadow banking sector was estimated to be worth trillions of dollars, highlighting its substantial capacity to substitute traditional bank functions.

Cryptocurrencies and Digital Currencies

The long-term threat of cryptocurrencies and central bank digital currencies (CBDCs) as substitutes for traditional banking services is growing, even as they remain relatively new for mainstream adoption. These digital assets present alternative ways to make payments and store value, potentially bypassing traditional deposit and payment infrastructures. For instance, by mid-2024, several countries, including China with its digital yuan, were actively piloting or expanding CBDC usage, indicating a tangible shift towards digital fiat. This evolution could disintermediate established banking models.

Cryptocurrencies and CBDCs offer functionalities that could directly compete with core banking services.

- Alternative Payment Rails: Cryptocurrencies facilitate peer-to-peer transactions, potentially reducing reliance on traditional payment networks.

- Value Storage: Some cryptocurrencies are viewed as digital stores of value, offering an alternative to traditional savings accounts.

- Disintermediation Potential: CBDCs, in particular, could enable direct transactions between central banks and individuals, reducing the role of commercial banks in holding deposits and facilitating payments.

- Regulatory Landscape: As of July 2025, regulatory frameworks for digital currencies are still evolving globally, impacting their substitutive potential and adoption rates across different banking sectors.

Internal Corporate Finance and Self-Funding

For large, established corporations, internal corporate finance departments and self-funding options act as significant substitutes for traditional bank loans. These companies can leverage retained earnings or issue corporate bonds directly, bypassing the need for commercial lending from institutions like Cathay General Bancorp. This trend is particularly noticeable among financially robust entities.

In 2024, the corporate bond market remained a strong alternative. For instance, non-financial corporate bond issuance globally reached substantial figures, indicating a preference for direct market access over bank financing for many large firms. This directly impacts the demand for commercial lending services.

- Internal Funding: Retained earnings provide a direct source of capital, reducing reliance on external debt.

- Corporate Bonds: In 2024, investment-grade corporate bond yields offered attractive financing options for creditworthy companies.

- Reduced Demand: The ability of large corporations to self-fund directly diminishes the market share for commercial banks in lending to these segments.

The threat of substitutes for Cathay General Bancorp is multifaceted, encompassing digital financial platforms, non-traditional lenders, and even internal corporate financing capabilities. These alternatives often offer greater speed, lower costs, or more tailored solutions, directly challenging Cathay Bank's traditional offerings. The increasing sophistication and accessibility of fintech solutions, coupled with evolving digital currencies, further amplify these substitutive pressures.

In 2024, the digital lending market continued its expansion, with some projections indicating over $200 billion in US consumer loans originated online. Similarly, the global robo-advisory market's assets under management were in the hundreds of billions, demonstrating a clear shift in consumer preference towards automated, low-fee investment services. This trend directly siphons potential customers and assets away from traditional banking models.

Furthermore, large corporations increasingly bypass traditional bank loans by utilizing retained earnings or issuing corporate bonds. In 2024, global non-financial corporate bond issuance remained robust, highlighting this self-funding trend. This directly reduces the demand for commercial lending services from institutions like Cathay General Bancorp, particularly within the corporate segment.

Entrants Threaten

The banking sector presents formidable challenges for newcomers due to extensive regulatory oversight and significant capital demands. For instance, Cathay General Bank, like its peers, must adhere to strict capital adequacy ratios. As of the first quarter of 2024, many established banks maintained robust Tier 1 leverage ratios well above the minimum regulatory requirements, demonstrating the substantial financial foundation needed to operate, making it difficult for new entities to compete without similar backing.

Cathay General Bancorp, like many established financial institutions, benefits significantly from its long-standing brand reputation and the trust it has cultivated over years of operation. This deep-seated credibility makes it harder for new players to attract customers who are comfortable with familiar names and proven service. For instance, in 2023, Cathay General Bancorp reported total assets of $22.8 billion, reflecting a substantial and trusted presence in the market.

New entrants into the banking sector face a considerable hurdle in replicating this level of trust and recognition. They must invest heavily in marketing and customer acquisition to even begin to chip away at the loyalty enjoyed by incumbents. Building a robust branch network, a key differentiator for many traditional banks, also represents a significant capital expenditure and time commitment for newcomers, further increasing the threat of new entrants.

Incumbent banks like Cathay General Bank benefit from significant economies of scale. This means they can spread their operational, technological, and marketing costs over a much larger customer base, leading to lower per-unit costs. For instance, in 2024, major banks continued to invest billions in digital transformation, a cost that is more manageable for established institutions than for startups.

New entrants face a substantial hurdle in matching these cost advantages. They often lack the large deposit base that allows incumbents to fund operations and offer competitive interest rates. Building a comparable technological infrastructure and customer acquisition network from scratch requires immense capital, making it difficult for newcomers to compete on price or service breadth.

Fintech Startups and Niche Market Entry

Fintech startups present a significant threat to traditional banks like Cathay General Bank by targeting specific, profitable niches. These agile companies bypass the high capital and regulatory hurdles of full banking licenses, instead focusing on areas like digital payments or specialized lending. For instance, the global fintech market was valued at over $11 trillion in 2023 and is projected to grow substantially, indicating ample opportunity for new entrants to carve out market share.

These new players leverage technology to offer more streamlined and often cheaper services, directly challenging established players. Consider the rapid growth of buy now, pay later (BNPL) services, which have captured a segment of the consumer credit market. In 2024, BNPL transaction volumes are expected to continue their upward trajectory, demonstrating the ease with which fintechs can gain traction by addressing unmet customer needs.

- Niche Focus: Fintechs can enter specific segments like mobile payments, P2P lending, or wealth management without needing a full banking charter.

- Technological Advantage: Leveraging AI, blockchain, and advanced data analytics allows for efficient operations and innovative customer experiences.

- Agility and Speed: Startups can adapt quickly to market changes and customer demands, a stark contrast to the slower pace of traditional institutions.

- Market Penetration: By offering specialized services, fintechs can rapidly acquire customers and build brand loyalty in targeted areas.

Cybersecurity and Data Security Demands

New entrants into the financial services sector, particularly those aiming to compete with established institutions like Cathay General Bank, face substantial hurdles related to cybersecurity and data security demands. To even consider entering the market, prospective competitors must allocate significant capital towards building and maintaining state-of-the-art cybersecurity infrastructure and comprehensive data protection protocols. This is not merely a matter of good practice; it's a regulatory imperative and a critical component of earning and retaining customer trust in an era of heightened data privacy concerns.

The escalating sophistication of cyber threats, ranging from ransomware attacks to advanced persistent threats (APTs), presents a continuous and evolving challenge. The financial fallout from a data breach can be catastrophic, encompassing not only direct financial losses but also severe reputational damage, regulatory fines, and legal liabilities. For instance, the average cost of a data breach in the financial sector reached $5.90 million in 2023, according to IBM’s Cost of a Data Breach Report. This high cost of defense and the potential for devastating losses create a formidable barrier, disproportionately impacting smaller or less capitalized new entrants who may lack the resources to adequately address these risks.

- High Capital Investment: New entrants must invest millions in cybersecurity infrastructure, compliance, and ongoing threat monitoring.

- Regulatory Compliance: Adherence to stringent data protection laws like GDPR and CCPA requires significant resources and expertise.

- Customer Trust Factor: A single major data breach can erode customer confidence, making it difficult for new players to gain market share.

- Talent Acquisition: The demand for skilled cybersecurity professionals is high, driving up recruitment and retention costs for new entrants.

The threat of new entrants for Cathay General Bank is moderate, primarily due to high capital requirements and extensive regulatory hurdles in the banking sector. While fintechs can enter specific niches, establishing a full-service bank requires substantial investment and navigating complex compliance landscapes. For instance, in 2024, the ongoing investment in digital infrastructure and cybersecurity by established banks like Cathay General Bancorp, which reported total assets of $22.8 billion in 2023, sets a high bar for newcomers. These factors, combined with the need to build brand trust and achieve economies of scale, limit the ease with which new competitors can emerge and challenge incumbents.

| Factor | Impact on New Entrants | Example for Cathay General Bank (2023-2024) |

|---|---|---|

| Capital Requirements | High | Minimum capital adequacy ratios for established banks often exceed regulatory minimums, requiring significant upfront investment. |

| Regulatory Hurdles | High | Licensing, compliance, and ongoing oversight demand substantial legal and operational resources. |

| Brand Reputation & Trust | High Barrier | Customers prefer established institutions; building comparable trust takes years and significant marketing spend. |

| Economies of Scale | Significant Advantage | Incumbents leverage vast customer bases to spread costs of technology, marketing, and operations. |

| Cybersecurity Demands | High Cost & Risk | Average cost of a data breach in finance was $5.90 million in 2023, a major deterrent for new entrants. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Cathay General Bank is built on a foundation of publicly available financial statements, annual reports, and industry-specific market research. We also incorporate data from regulatory filings and economic indicators to provide a comprehensive view of the competitive landscape.