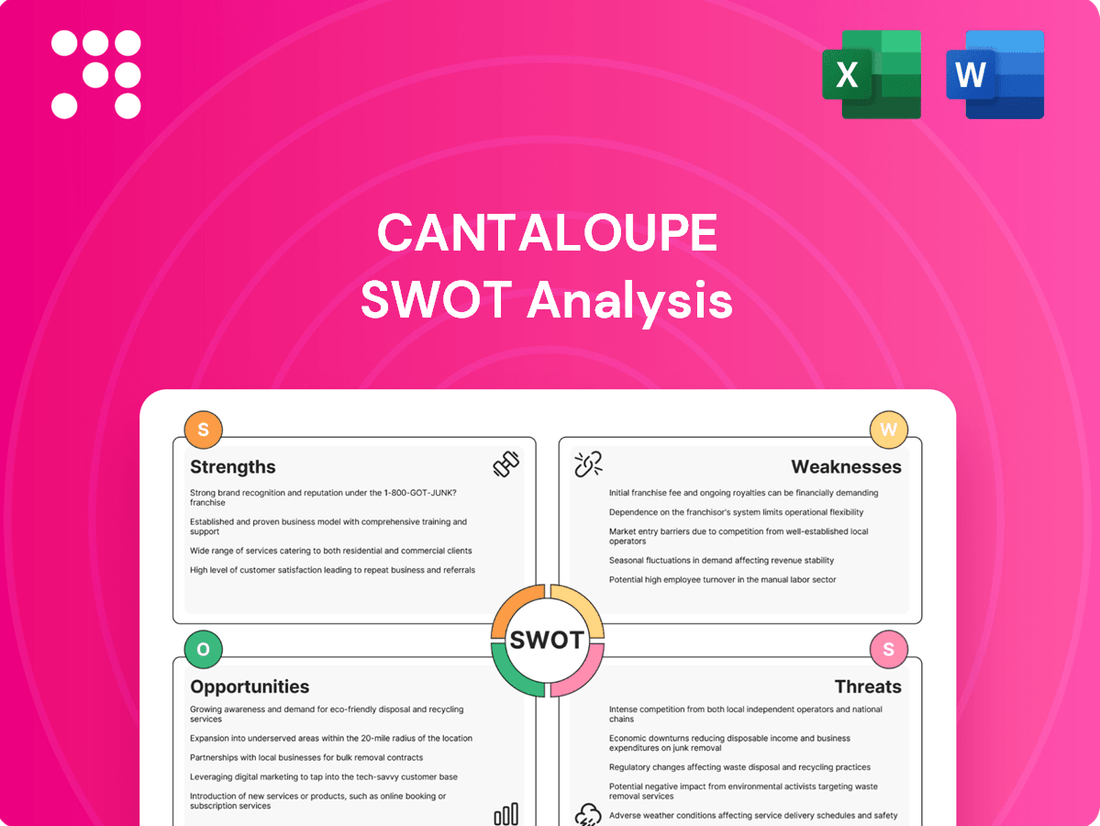

Cantaloupe SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Cantaloupe Bundle

Cantaloupe's sweet flavor and refreshing texture are undeniable strengths, appealing to a broad consumer base. However, its susceptibility to spoilage and seasonal availability present significant challenges. Understanding these dynamics is crucial for anyone involved in the produce industry.

Want the full story behind cantaloupe's market position, including detailed insights into its opportunities and threats? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your strategic planning and market research.

Strengths

Cantaloupe Inc. boasts a specialized end-to-end platform, a significant strength in the unattended retail sector. This integrated solution covers everything from payment processing to inventory management and remote diagnostics, streamlining operations for vending and micro-market businesses.

This deep specialization provides a distinct competitive advantage, as evidenced by their continued growth in a niche market. For instance, in the fiscal year ending September 30, 2023, Cantaloupe reported total revenue of $220.6 million, a substantial increase from the previous year, reflecting the demand for their tailored solutions.

Cantaloupe's robust cashless payment solutions are a significant strength, perfectly aligning with the accelerating global trend towards digital transactions. Their secure and efficient processing systems not only boost consumer convenience but also unlock greater revenue potential for operators by minimizing cash handling and speeding up purchases.

Cantaloupe's advanced remote management and monitoring technology is a significant strength, allowing operators to keep a close eye on machine performance and inventory levels from afar. This real-time visibility is crucial for efficient operations.

This capability directly translates into reduced labor costs and enables proactive maintenance, preventing downtime and ensuring machines are always ready to serve customers. For instance, in 2023, Cantaloupe reported that its Seed™ platform helped operators reduce service calls by up to 20% through predictive maintenance insights.

The ability to manage inventory remotely also minimizes stockouts and overstocking, leading to optimized asset utilization. This enhanced efficiency ultimately boosts customer satisfaction by ensuring product availability and reliable service.

Data-Driven Business Optimization

Cantaloupe's strength lies in its ability to drive business optimization through data. Its platforms provide operators with critical insights into inventory levels and sales performance, enabling smarter choices about product offerings and pricing. This data-driven strategy directly translates to enhanced profitability and minimized waste.

The company's tools offer tangible benefits by facilitating:

- Informed Inventory Management: Reducing overstock and stockouts.

- Targeted Sales Analytics: Identifying best-selling products and peak sales periods.

- Optimized Route Planning: Improving efficiency for delivery and service.

- Data-Backed Pricing Strategies: Maximizing revenue per transaction.

Established Market Position and Customer Base

Cantaloupe's strength lies in its deeply entrenched position within the unattended retail sector. This isn't just about being present; it's about cultivating a substantial and loyal customer base built over time. For instance, as of their fiscal year ending September 30, 2023, Cantaloupe reported serving over 20,000 customer locations, highlighting their reach and the trust operators place in their solutions.

This established market presence translates into significant brand recognition. Operators in the unattended retail space often seek out partners known for reliability and proven performance, and Cantaloupe has cultivated that reputation. Their operational experience, honed through years of serving this niche market, further solidifies their standing. This network effect, where more operators using their services makes the platform more valuable, is a key competitive advantage.

Key aspects of this strength include:

- Significant Market Share: Cantaloupe is a leading provider in the unattended retail technology space.

- Loyal Customer Relationships: Many operators rely on Cantaloupe for their vending and unattended retail needs.

- Brand Recognition: The Cantaloupe name is well-known and respected among industry participants.

- Operational Expertise: Years of experience have equipped them with deep knowledge of the unattended retail ecosystem.

Cantaloupe's specialized, end-to-end platform for unattended retail is a core strength, offering a comprehensive solution from payments to inventory management. This integrated approach simplifies operations for vending and micro-market businesses, a key differentiator in the market.

Their robust cashless payment solutions are a significant advantage, capitalizing on the growing consumer preference for digital transactions. This not only enhances customer convenience but also drives revenue for operators by reducing cash handling complexities and speeding up checkout processes.

The company's advanced remote management capabilities, including predictive maintenance insights, are a major strength. This technology allows operators to monitor machine performance and inventory levels in real-time, leading to reduced service costs and minimized downtime. For instance, in fiscal year 2023, their Seed™ platform helped operators reduce service calls by up to 20%.

Cantaloupe's deeply entrenched market position and loyal customer base, serving over 20,000 locations as of fiscal year-end September 30, 2023, represent a substantial strength. This established presence fosters brand recognition and trust among operators who value their proven reliability and operational expertise in the unattended retail sector.

| Metric | Value (Fiscal Year 2023) | Significance |

|---|---|---|

| Total Revenue | $220.6 million | Demonstrates strong market demand and growth. |

| Customer Locations Served | Over 20,000 | Indicates significant market penetration and operator trust. |

| Service Call Reduction (Seed™) | Up to 20% | Highlights operational efficiency gains for customers through predictive maintenance. |

What is included in the product

Delivers a strategic overview of Cantaloupe’s internal and external business factors, outlining its strengths, weaknesses, opportunities, and threats.

Offers a clear, actionable framework to identify and address cantaloupe market challenges and opportunities.

Weaknesses

Cantaloupe's dedicated focus on the unattended retail sector, while fostering specialization, also creates a significant weakness. This niche market, though growing, inherently has a smaller addressable market compared to broader payment processing or software solutions. For instance, while the global unattended retail market was valued at approximately $24 billion in 2023 and projected to reach $40 billion by 2028, this still pales in comparison to the vastness of general retail payment systems.

This over-reliance on a single segment makes Cantaloupe particularly vulnerable to sector-specific challenges. A downturn in vending, micro-markets, or laundromats, for example, could disproportionately impact revenue. Unlike diversified financial technology companies, Cantaloupe's growth is intrinsically tied to the health and expansion of this specific industry, potentially limiting its overall growth trajectory and competitive positioning against more broadly focused players.

The comprehensive nature of Cantaloupe's end-to-end platform, while offering significant advantages, can translate into substantial upfront investment for operators. This includes costs associated with acquiring new hardware, integrating the software with existing systems, and providing thorough training for staff. For instance, a typical unattended retail setup might require upgrades to payment terminals and back-office software, potentially costing thousands per location.

These considerable implementation costs could act as a deterrent for smaller operators or businesses with tighter capital constraints. This barrier to entry might slow down the broader market penetration of Cantaloupe's solutions, as businesses carefully weigh the long-term benefits against the immediate financial outlay.

Cantaloupe's reliance on external hardware, like vending machines and micro market kiosks, means its service delivery is directly tied to the operational status of this equipment. If these machines experience downtime or malfunctions, Cantaloupe's ability to process transactions and provide its services is compromised.

Furthermore, consistent internet connectivity is crucial for Cantaloupe's cloud-based solutions to function effectively. In 2024, reports indicated that approximately 15% of small businesses still faced challenges with reliable internet access, a statistic that highlights a potential vulnerability for Cantaloupe's customer base, particularly in less developed areas.

Any disruption in the hardware supply chain, which has been a recurring issue globally since 2021, could also hinder the deployment and maintenance of the necessary infrastructure, directly impacting Cantaloupe's growth and customer satisfaction levels.

Vulnerability to Cybersecurity Threats

Cantaloupe's reliance on digital platforms for payment processing and data management exposes it to significant cybersecurity risks. The company handles sensitive financial and operational data, making it a prime target for cyberattacks, data breaches, and fraud. A successful breach could result in substantial financial losses, severe reputational damage, and a critical erosion of customer trust, impacting future business prospects.

The evolving landscape of cyber threats necessitates continuous investment in advanced security measures. For instance, the global cost of cybercrime is projected to reach $10.5 trillion annually by 2025, highlighting the magnitude of the challenge. Cantaloupe must maintain robust defenses to protect its systems and customer data from these escalating threats.

- Data Breach Impact: A single significant data breach could cost companies an average of $4.35 million, according to IBM's 2022 Cost of a Data Breach Report.

- Regulatory Fines: Non-compliance with data protection regulations like GDPR or CCPA can lead to hefty fines, potentially impacting Cantaloupe's financial performance.

- Reputational Damage: Public trust is paramount; a cybersecurity incident can severely damage Cantaloupe's brand image and customer loyalty.

- Operational Disruption: Cyberattacks can disrupt Cantaloupe's payment processing and data management services, leading to downtime and lost revenue.

Competition from Broader Payment Processors

Cantaloupe faces significant competition from larger, more established payment processors. These companies often have broader service offerings and can leverage economies of scale to provide cashless solutions at more competitive price points. For instance, major players in the payment processing industry, which already serve a vast number of businesses, can bundle unattended payment capabilities into their existing merchant services, potentially undercutting Cantaloupe’s specialized offerings.

This broader competitive landscape can put pressure on Cantaloupe’s pricing strategies and potentially erode market share. As of early 2024, the payment processing sector is highly dynamic, with companies like Square (now Block) and PayPal continuously expanding their reach and services. Their ability to integrate various payment methods and offer comprehensive financial tools means they can present a compelling alternative to businesses looking for simpler, all-in-one solutions, even if those solutions are less specialized for the unattended retail market.

The threat is amplified as these larger processors might not need to rely solely on the profitability of unattended retail solutions. They can absorb lower margins or even offer these services at cost to gain a foothold and cross-sell other lucrative services, a strategy Cantaloupe, as a more focused entity, may find harder to match.

Cantaloupe's specialized focus on the unattended retail market, while beneficial for expertise, limits its overall addressable market compared to broader payment solutions. This niche, though growing, represents a smaller segment of the overall financial technology landscape. For example, while the unattended retail market was valued around $24 billion in 2023, it's a fraction of the global digital payments market which exceeded $7 trillion in the same year.

This concentration makes Cantaloupe highly susceptible to downturns within its core industries like vending or micro-markets. Unlike diversified fintech companies, Cantaloupe's revenue is directly tied to the performance of this single sector, potentially capping its growth potential and making it less resilient than broader financial service providers.

The company's reliance on third-party hardware, such as vending machines and kiosks, means its service delivery is dependent on the operational status and availability of this equipment. Malfunctions or downtime in this hardware directly impede Cantaloupe's ability to process transactions and deliver its services. Furthermore, consistent internet connectivity is essential for its cloud-based platform, and in 2024, an estimated 15% of small businesses still faced challenges with reliable internet access, posing a risk to service continuity.

Cantaloupe's dependence on digital platforms for processing and data management exposes it to significant cybersecurity threats. Handling sensitive financial data makes it a target for breaches and fraud, which can lead to substantial financial losses and reputational damage. The global cost of cybercrime was projected to reach $10.5 trillion annually by 2025, emphasizing the ongoing need for robust security investments.

What You See Is What You Get

Cantaloupe SWOT Analysis

You’re previewing the actual Cantaloupe SWOT analysis document. Purchase now to access the full, detailed report, including all strategic insights.

This is a real excerpt from the complete Cantaloupe SWOT analysis. Once purchased, you’ll receive the full, editable version, ready for your business planning.

The preview below is taken directly from the full Cantaloupe SWOT report you'll get. Purchase unlocks the entire in-depth version, providing a comprehensive market overview.

Opportunities

Cantaloupe can significantly grow by bringing its unattended retail solutions to new sectors. Think beyond just snack machines; laundromats, car washes, and even EV charging stations are ripe for smart payment and management systems. This opens up a much larger customer base for Cantaloupe’s technology, tapping into the growing demand for convenient, self-service options across various industries.

Cantaloupe's current operational footprint is concentrated, but the global unattended retail market presents a significant growth avenue. The worldwide market for unattended retail, encompassing vending machines, self-checkout kiosks, and smart lockers, was valued at approximately $25.7 billion in 2023 and is projected to reach over $40 billion by 2030, indicating substantial untapped potential.

Expanding into new international territories, especially those demonstrating a rapid shift towards cashless transactions and a rising acceptance of self-service solutions, offers a clear path to accelerated revenue generation for Cantaloupe. Emerging markets in Southeast Asia and Latin America, for instance, are experiencing robust digital payment adoption, creating fertile ground for the company's offerings.

Cantaloupe can capitalize on the fast-changing payment landscape by integrating innovative methods like QR code payments, advanced biometric security, and a wider array of digital wallets. This move beyond traditional credit card processing can significantly improve customer convenience. For instance, the global digital payment market was projected to reach over $1.5 trillion in 2024, highlighting a massive opportunity for Cantaloupe to capture a larger share by offering diverse payment options.

Strategic Partnerships and Acquisitions

Cantaloupe can unlock significant growth by forming strategic partnerships. Collaborating with major hardware manufacturers could streamline the integration of their payment solutions into new vending machines and unattended retail devices. For instance, a partnership with a leading IoT hardware provider could offer Cantaloupe's technology pre-installed on millions of new units entering the market annually.

Expanding into new markets or service verticals can be accelerated through strategic acquisitions. Acquiring a smaller company with a strong presence in a complementary sector, like cashless payment processing for micro-markets or specialized software for inventory management, could immediately bolster Cantaloupe's service portfolio and customer base. In 2024, the unattended retail market continued its expansion, with projections indicating further growth, making strategic consolidation a key avenue for capturing market share.

- Partnerships with hardware manufacturers: Access to new device deployments and integrated payment solutions.

- Acquisitions of complementary tech companies: Expansion of service offerings and market reach.

- Consolidation of market position: Strengthening competitive advantage in the growing unattended retail sector.

Leveraging Data for Enhanced Services and Monetization

Cantaloupe's extensive collection of transactional and operational data presents a significant opportunity for enhancing its service offerings and creating new revenue streams. By analyzing this data, the company can develop advanced analytics services for its clients, offering deeper insights into consumer behavior and operational efficiency.

The company can also leverage this data for predictive maintenance, which can reduce downtime for its customers' vending machines and other unattended retail devices. This proactive approach not only improves customer satisfaction but also creates a valuable service that can be monetized.

Furthermore, Cantaloupe can utilize the data to offer personalized consumer promotions, driving increased sales for its clients and fostering customer loyalty. In 2024, the unattended retail market saw a significant increase in data-driven personalization, with companies reporting up to a 15% uplift in sales through targeted offers.

Beyond service enhancements, Cantaloupe has the potential for data monetization, provided it implements robust privacy safeguards and anonymization techniques. This could involve selling aggregated, anonymized market trend data to third parties, opening up entirely new avenues for income.

- Advanced Analytics: Offering clients deeper insights into consumer spending patterns and operational performance.

- Predictive Maintenance: Reducing equipment downtime by forecasting potential issues before they occur.

- Personalized Promotions: Driving sales through targeted offers based on consumer purchasing habits.

- Data Monetization: Creating new revenue streams by selling anonymized market trend data.

Cantaloupe can expand its reach by targeting new sectors beyond traditional vending machines, such as laundromats and EV charging stations, leveraging the growing demand for self-service solutions. The global unattended retail market, valued at approximately $25.7 billion in 2023, offers substantial untapped potential for this expansion.

Threats

The unattended retail technology sector is heating up, with both startups and big tech players aggressively pursuing market share. This heightened competition, particularly in areas like smart vending and cashierless stores, could trigger price wars and squeeze profit margins for companies like Cantaloupe. For instance, the global smart vending machine market was valued at approximately $1.7 billion in 2023 and is projected to grow significantly, indicating intense interest and potential saturation in certain segments.

The digital payments and retail solutions landscape is evolving at an unprecedented speed. This rapid pace means Cantaloupe must constantly adapt, as its existing technologies risk becoming outdated quickly. For instance, advancements in AI-driven fraud detection or contactless payment methods could render current systems less competitive.

Competitors are frequently introducing more efficient or secure innovations, creating a significant threat. This necessitates continuous, substantial investment in research and development for Cantaloupe to stay ahead. Failing to do so could lead to a loss of market share to businesses offering cutting-edge solutions, impacting revenue streams.

Economic downturns, like the potential slowdown anticipated in late 2024 and 2025, pose a significant threat to Cantaloupe. During these periods, consumers tend to cut back on discretionary spending, which directly impacts sales in the unattended retail sector.

Operators, facing tighter budgets and reduced revenue, may postpone or scale back their investments in new vending machines, payment systems, and software upgrades. This hesitation directly hinders Cantaloupe's ability to secure new contracts and expand its installed base, thereby impacting its hardware sales and recurring revenue from payment processing and software subscriptions.

For instance, if consumer spending contracts by an estimated 1-2% in 2025, as some forecasts suggest, operators might see a corresponding drop in their own sales, making them less likely to commit capital to new technology. This could lead to a slowdown in Cantaloupe's growth trajectory.

Regulatory Changes and Compliance Burden

The financial technology sector is constantly navigating a complex web of evolving regulations, impacting companies like Cantaloupe. For instance, the Payment Card Industry Data Security Standard (PCI DSS) mandates strict security protocols for handling cardholder data, with non-compliance potentially leading to hefty fines. Similarly, data privacy laws such as the General Data Protection Regulation (GDPR) in Europe and the California Consumer Privacy Act (CCPA) place significant restrictions on how customer data can be collected, processed, and stored, requiring continuous adaptation of operational frameworks.

These regulatory shifts can translate into substantial compliance costs for Cantaloupe. For example, a 2024 report indicated that financial institutions spent an average of $1.3 million annually on PCI DSS compliance alone. Future changes could necessitate costly system overhauls or limit the company's ability to leverage data for business insights, directly affecting its profitability and operational agility.

Specifically, potential threats include:

- Increased Compliance Costs: Adapting to new data privacy laws or security standards could require significant investment in technology and personnel.

- Restrictions on Data Usage: Stricter regulations might limit Cantaloupe's ability to utilize customer data for targeted marketing or service improvements.

- Operational Disruptions: Mandated system modifications to meet new compliance requirements could temporarily disrupt services or introduce inefficiencies.

Data Breaches and Reputational Damage

Despite robust security protocols, Cantaloupe faces the persistent threat of significant data breaches or cyberattacks. Such incidents could result in considerable financial penalties and legal repercussions. For instance, the average cost of a data breach in 2024 reached $4.73 million globally, a figure that could significantly impact Cantaloupe's bottom line.

Beyond financial costs, a successful cyberattack could inflict severe damage on Cantaloupe's reputation. This erosion of trust among its customers and end-users could jeopardize future business opportunities and partnerships, making recovery a long and arduous process.

- Financial Impact: Potential for substantial fines and legal liabilities stemming from data breaches.

- Reputational Harm: Erosion of customer trust and brand image due to security failures.

- Operational Disruption: Cyberattacks can halt operations, impacting service delivery and revenue.

- Loss of Competitive Advantage: Compromised data can lead to a loss of proprietary information and market position.

The unattended retail sector faces intense competition, with rapid technological advancements potentially making Cantaloupe's current offerings obsolete. Economic slowdowns anticipated for late 2024 and 2025 could lead operators to delay investments in new technologies, impacting Cantaloupe's sales and recurring revenue. Furthermore, evolving financial regulations and the ever-present threat of cyberattacks pose significant financial and reputational risks, with data breaches costing an average of $4.73 million globally in 2024.

| Threat Category | Specific Threat | Potential Impact | 2024/2025 Data Point |

|---|---|---|---|

| Competition | Rapid Technological Obsolescence | Loss of market share, reduced competitiveness | Global smart vending market projected for significant growth, indicating intense interest. |

| Economic Factors | Consumer Spending Slowdown | Delayed operator investments, reduced sales and revenue | Estimated 1-2% contraction in consumer spending in 2025 could impact operator revenue. |

| Regulatory Environment | Increased Compliance Costs & Data Restrictions | Higher operational expenses, limited data utilization | Financial institutions spent an average of $1.3 million annually on PCI DSS compliance in 2024. |

| Cybersecurity | Data Breaches and Cyberattacks | Financial penalties, reputational damage, operational disruption | Average cost of a data breach reached $4.73 million globally in 2024. |

SWOT Analysis Data Sources

This Cantaloupe SWOT analysis is built upon a robust foundation of data, drawing from industry-specific market research, consumer trend reports, and operational efficiency metrics. These sources ensure a comprehensive understanding of the competitive landscape and internal capabilities.