Cantaloupe Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Cantaloupe Bundle

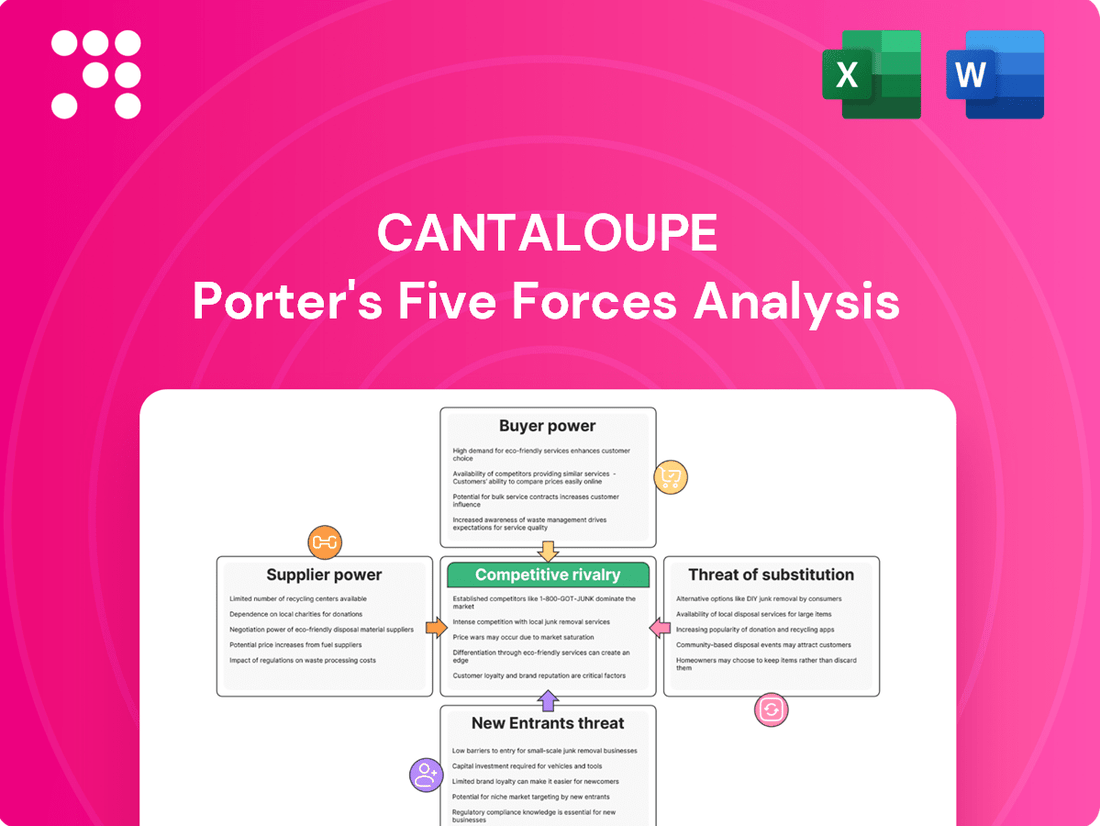

Cantaloupe's Porter's Five Forces analysis reveals a moderately competitive landscape, with moderate buyer power and a low threat of substitutes. However, the intensity of rivalry and the bargaining power of suppliers present significant challenges.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Cantaloupe’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Cantaloupe relies on a diverse range of hardware and software. For common items like microprocessors or cloud storage, the suppliers are numerous and competitive. This means no single supplier can dictate terms, as Cantaloupe can easily find alternatives and secure favorable pricing. In 2024, the global semiconductor market, a key component area, saw continued competition with numerous manufacturers vying for market share, reinforcing this fragmented power dynamic for generic parts.

While many components for payment systems are readily available, specialized hardware like secure card readers and telemetry modules can be sourced from a more limited set of suppliers. These suppliers often hold proprietary technology and specific expertise, which can grant them a degree of bargaining power. This is particularly true if their hardware is essential for regulatory compliance or offers unique functionalities that differentiate Cantaloupe's offerings.

Cantaloupe's reliance on cloud infrastructure providers like Amazon Web Services (AWS), Microsoft Azure, and Google Cloud for its software and data management presents a moderate bargaining power for these suppliers. These providers offer essential, robust services, but the significant costs and technical hurdles associated with migrating data and applications between them create a degree of lock-in for Cantaloupe.

The deep integration of Cantaloupe's operations with these cloud platforms means that switching providers is not a simple undertaking. This dependency limits Cantaloupe's ability to easily negotiate terms or shift to alternative providers, thus granting these infrastructure giants a notable degree of influence.

Software and Security Technology Providers

Software and security technology providers, including those offering core development tools, cybersecurity solutions, and specialized API services, wield considerable bargaining power. This stems from the highly specialized nature of their products and the significant costs associated with switching to alternative providers. For instance, the cybersecurity market alone was projected to reach over $300 billion globally by the end of 2024, highlighting the substantial investment companies make in these critical technologies.

The integration of new security protocols or development environments is a complex and resource-intensive undertaking, often requiring substantial time and expertise. This deep integration creates high switching costs for companies like Cantaloupe, effectively locking them into existing relationships and granting these suppliers leverage during contract negotiations. A 2024 report indicated that the average cost for a business to migrate its core software infrastructure can range from tens of thousands to millions of dollars, depending on complexity.

- Specialized Offerings: Suppliers of niche software development tools and advanced cybersecurity solutions possess strong bargaining power due to the limited availability of comparable alternatives.

- High Switching Costs: The significant investment in time, resources, and potential operational disruption required to switch software or security providers grants these suppliers leverage.

- Market Growth: The expanding cybersecurity market, estimated to exceed $300 billion globally in 2024, underscores the critical reliance and thus the power of its key technology providers.

- Integration Complexity: The intricate process of integrating new development environments or security protocols makes it difficult and costly for companies to change suppliers.

Network Connectivity Providers

Network connectivity providers are important for Cantaloupe, as reliable 4G LTE is essential for their remote machine monitoring services. While there are several providers available, the quality, coverage, and pricing can differ significantly. Cantaloupe's ability to switch between providers generally limits their bargaining power, but reliance on specific regional coverage can increase it.

The landscape of network providers is dynamic. For instance, in 2024, the average cost of a business 4G LTE data plan for IoT devices can range from $5 to $20 per device per month, depending on data allowances and contract terms. Providers often compete on network reliability and the breadth of their coverage, which are critical factors for Cantaloupe's operations.

- Provider Competition: Multiple network operators offer services, creating a competitive environment that can benefit Cantaloupe through better pricing and service agreements.

- Service Quality Dependence: The effectiveness of Cantaloupe's remote monitoring hinges on consistent and high-quality network performance, making provider selection critical.

- Regional Coverage Impact: In areas where only a limited number of providers offer robust coverage, Cantaloupe's dependence on those specific providers increases their bargaining power.

Suppliers of specialized hardware and software, particularly in areas like cybersecurity and integrated development tools, hold significant bargaining power over Cantaloupe. This is due to the proprietary nature of their offerings and the substantial costs and complexities involved in switching providers. The global cybersecurity market's projected growth to over $300 billion by the end of 2024 highlights the critical reliance and thus the leverage these providers possess. Furthermore, the intricate integration of these technologies into Cantaloupe's core operations, with switching costs potentially running into millions of dollars, reinforces this supplier strength.

| Supplier Type | Bargaining Power | Key Factors | 2024 Market Insight |

| Generic Hardware (e.g., Microprocessors) | Low | Numerous suppliers, high competition | Fragmented semiconductor market |

| Specialized Hardware (e.g., Card Readers) | Moderate to High | Proprietary technology, limited suppliers | N/A |

| Cloud Infrastructure (AWS, Azure, GCP) | Moderate | Essential services, high switching costs | Significant investment in cloud migration |

| Software/Security Tech | High | Specialized nature, high switching costs, integration complexity | Cybersecurity market > $300 billion |

| Network Connectivity | Low to Moderate | Provider competition, regional coverage dependence | 4G LTE data plans $5-$20/device/month |

What is included in the product

Uncovers key drivers of competition, customer influence, and market entry risks tailored to Cantaloupe's position in the melon industry.

Instantly identify and address competitive threats with a visual representation of all five forces, simplifying strategic planning.

Customers Bargaining Power

Cantaloupe serves a vast network of over 30,000 active customers, predominantly operators of vending machines, micro markets, and self-service retail. This broad customer base is largely fragmented, meaning no single customer holds significant sway on their own.

However, the presence of large vending and micro-market operators introduces a dynamic where scale can translate into increased bargaining power. These larger entities, by virtue of the sheer volume of devices and services they procure from Cantaloupe, can negotiate for more favorable pricing or tailored service packages.

Customers who adopt Cantaloupe's integrated solutions often encounter substantial switching costs. These include the expense of migrating existing data, the time and resources needed for staff retraining on new systems, and the complexities of integrating potentially new hardware and software. For instance, a vending operator deeply embedded in Cantaloupe's payment processing and telemetry might spend upwards of $5,000 to $10,000 per location to switch to a competitor, factoring in hardware changes and data conversion.

This inherent lock-in significantly diminishes a customer's bargaining power. Once a business is fully utilizing Cantaloupe's comprehensive platform, the effort and financial outlay required to transition elsewhere make it a less attractive option. Cantaloupe's strategy of offering a complete ecosystem, from payment processing to inventory management, is designed to make this transition as unappealing as possible, thereby strengthening its own position.

While Cantaloupe's platform offers a comprehensive solution, customers can still explore alternatives. These include other payment processors, standalone vending management software, or even more manual operational methods. This availability of choice, even if less integrated, grants customers a degree of bargaining power.

For instance, smaller operators might opt for a combination of less integrated but potentially cheaper solutions. This can put pressure on Cantaloupe to remain competitive in pricing and service offerings, as customers can switch or piece together their own systems if they feel the integrated platform is too costly or doesn't meet specific niche needs.

Increasing Customer Expectations for Features and Value

As the unattended retail sector matures, customers are demanding more sophisticated features. This includes real-time inventory tracking, robust security measures, and user-friendly payment systems. Cantaloupe needs to stay ahead of these evolving expectations to keep its customer base satisfied and prevent them from migrating to competitors offering superior functionality or better value.

The 2025 Micropayment Trends Report indicates a strong customer preference for cashless transactions and contactless payment methods like tap-to-pay. This shift directly impacts the bargaining power of customers, as they can easily switch to providers that offer these modern payment conveniences.

- Customer Demand for Advanced Features: Unattended retail customers now expect real-time inventory visibility, enhanced security protocols, and seamless, intuitive user experiences.

- Impact of Payment Preferences: The 2025 Micropayment Trends Report shows a clear shift towards cashless and tap-to-pay options, giving customers more leverage to choose providers that align with these preferences.

- Competitive Pressure on Value: Cantaloupe faces pressure to continuously innovate and demonstrate clear value to retain customers, who are increasingly likely to switch to competitors offering more advanced features or a more cost-effective solution.

Price Sensitivity in a Competitive Market

In the competitive unattended retail sector, smaller operators are particularly attuned to pricing. They weigh the advantages of new technology against their ongoing expenses. This financial consideration naturally amplifies their leverage as customers, pressuring Cantaloupe to keep its subscription and transaction fees competitive. These fees represent the bulk of Cantaloupe's income, making price sensitivity a significant factor.

For instance, in 2024, the average subscription fee for unattended retail solutions can range from $50 to $200 per month per machine, depending on features and support. Transaction fees typically fall between 2% and 5% of the sale value. Operators seeking to maximize their margins will actively compare these costs across providers.

- Price Sensitivity: Smaller operators in unattended retail are highly sensitive to pricing due to their focus on operational costs versus technological benefits.

- Customer Bargaining Power: This price sensitivity directly translates into increased bargaining power for customers, influencing Cantaloupe's pricing strategies.

- Revenue Impact: Cantaloupe must maintain competitive pricing on its subscription and transaction fees, which are critical revenue streams.

- Market Comparison: Operators regularly benchmark pricing, forcing Cantaloupe to remain competitive to retain and attract business.

While Cantaloupe serves many customers, the fragmentation of its user base means individual buyers have limited power. However, larger operators can leverage their volume to negotiate better terms, and the significant switching costs associated with Cantaloupe's integrated platform generally reduce customer bargaining power.

Customers can still exert influence by exploring alternative, less integrated solutions or by demanding advanced features and modern payment options. This competitive landscape pressures Cantaloupe to maintain competitive pricing, with average monthly subscription fees for unattended retail solutions in 2024 ranging from $50 to $200 per machine, plus transaction fees of 2% to 5%.

| Factor | Impact on Cantaloupe | Customer Action |

|---|---|---|

| Customer Fragmentation | Low individual bargaining power | Limited ability for small operators to negotiate |

| Switching Costs | High lock-in, reducing bargaining power | Customers are hesitant to migrate due to financial and operational hurdles |

| Alternative Solutions | Provides some leverage for customers | Customers can opt for less integrated but potentially cheaper options |

| Demand for Features/Payments | Requires continuous innovation | Customers can switch to competitors offering preferred features or payment methods |

| Price Sensitivity | Significant pressure on Cantaloupe's pricing | Operators actively compare costs, influencing Cantaloupe's fee structure |

Same Document Delivered

Cantaloupe Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. You're looking at the actual Cantaloupe Porter's Five Forces Analysis, detailing the competitive landscape and strategic implications for businesses operating within this sector. Once you complete your purchase, you’ll get instant access to this exact file, providing you with a comprehensive understanding of the industry's dynamics.

Rivalry Among Competitors

The unattended retail technology market is a bustling arena, brimming with companies vying for market share. Cantaloupe, a key player, encounters robust competition from a diverse range of firms. These competitors often specialize in areas like payment processing, advanced vending management software, and the increasingly popular micro-market solutions.

This competitive landscape includes both large, established payment processing giants and nimble, specialized tech startups. Many of these firms are actively developing and deploying innovative solutions to capture the growing demand in unattended retail. For instance, the self-checkout and unattended retail payment market was projected to reach $12.3 billion by 2025, according to some industry forecasts, highlighting the intense interest and investment in this sector.

Cantaloupe's competitive edge stems from its integrated end-to-end platform, combining cashless payments, remote device monitoring, and inventory management. This holistic offering directly counters rivals who provide only isolated services, thereby strengthening Cantaloupe's position in a fragmented market. For instance, in 2023, the unattended retail market saw significant growth, with companies increasingly seeking comprehensive solutions to streamline operations.

While Cantaloupe's integrated platform presents a strong differentiator, the competitive landscape is dynamic. Competitors are actively investing in advanced technologies, such as artificial intelligence (AI) and the Internet of Things (IoT), to enhance their own offerings. This ongoing innovation means that while Cantaloupe's current platform provides a distinct advantage, staying ahead requires continuous development and adaptation to emerging technological trends in the unattended retail sector.

The vending machine market is expanding, with cashless systems leading the charge. Projections indicate a 12.2% CAGR for cashless vending machines from 2025 to 2033, suggesting a robust growth trajectory. This expansion offers a larger market for all participants, potentially easing intense rivalry as the overall demand increases.

Acquisition and Partnership Strategies

Cantaloupe's competitive rivalry is intensified by its proactive acquisition and partnership strategies. In 2024, the company acquired CHEQ, a move designed to broaden its reach into the lucrative sports and entertainment sectors. This strategic acquisition, alongside partnerships like the one with Innovative DisplayWorks for smart cooler technology, aims to bolster Cantaloupe's market standing and integrate innovative solutions.

These strategic maneuvers are crucial for enhancing competitive advantage by bringing in new technologies and expanding customer access. The recent acquisition of Cantaloupe by 365 Retail Markets in early 2024 underscores a significant trend toward industry consolidation, which further heats up the competitive landscape. This consolidation means fewer, larger players are likely to dominate, increasing the pressure on remaining independent entities.

- Acquisition of CHEQ (2024): Expanded market presence into sports and entertainment.

- Partnership with Innovative DisplayWorks: Integration of smart cooler technology.

- Acquisition by 365 Retail Markets (2024): Signifies industry consolidation and increased competitive intensity.

- Strategic Goal: Consolidate market position, expand offerings, and gain competitive advantage.

Technological Innovation and Feature Race

Cantaloupe's competitive environment is defined by a relentless pursuit of technological advancement, particularly in areas like contactless payments, mobile wallet integration, artificial intelligence, and the Internet of Things (IoT). This innovation drive is crucial for companies aiming to provide more secure, user-friendly, and data-intensive services.

The push for enhanced features compels rivals to significantly boost their research and development spending. For instance, in 2024, the vending and unattended retail sector saw continued investment in IoT solutions for real-time inventory management and predictive maintenance, with companies like Cantaloupe actively developing and deploying such capabilities to maintain market relevance.

- Contactless Payments: Adoption rates for contactless payments continued to climb in 2024, with many consumers now preferring this method for its speed and convenience.

- Mobile Wallet Integration: Seamless integration with popular mobile wallets like Apple Pay and Google Pay became a standard expectation for operators and consumers alike.

- AI and IoT: Investments in AI for demand forecasting and IoT for remote monitoring and cashless transactions are key differentiators.

- R&D Investment: Companies are allocating substantial budgets to R&D to stay ahead in the feature race, ensuring their offerings meet evolving market demands for efficiency and user experience.

The competitive rivalry within the unattended retail sector is fierce, driven by a dynamic market and a constant push for technological innovation. Companies like Cantaloupe face pressure from both established players and emerging startups, all striving to capture market share through advanced payment solutions, comprehensive software, and integrated hardware. This intense competition necessitates continuous investment in research and development to maintain a competitive edge.

The market's growth, projected to see cashless vending machines expand at a 12.2% CAGR from 2025 to 2033, fuels this rivalry by attracting more participants and encouraging aggressive strategies. Companies are actively pursuing acquisitions and partnerships, as seen with Cantaloupe's 2024 acquisition of CHEQ to expand into new markets. This consolidation trend, exemplified by the 2024 acquisition of Cantaloupe itself by 365 Retail Markets, signals an intensifying competitive landscape where scale and integrated offerings are becoming paramount.

Key competitive battlegrounds include the adoption of contactless payments, seamless mobile wallet integration, and the strategic deployment of AI and IoT technologies. In 2024, the increasing consumer preference for contactless transactions and the expectation of mobile wallet compatibility highlighted these critical areas. Companies are channeling significant R&D resources into these advancements to enhance user experience and operational efficiency, making the feature race a defining characteristic of the industry.

| Key Competitive Factors | 2024 Developments | Impact on Rivalry |

| Technological Innovation (AI, IoT) | Increased investment in IoT for real-time inventory and AI for demand forecasting. | Drives differentiation and requires ongoing R&D spending. |

| Payment Solutions | Continued surge in contactless payment adoption and mobile wallet integration. | Companies must offer seamless and secure payment options to remain competitive. |

| Market Consolidation | Acquisitions and mergers, e.g., 365 Retail Markets acquiring Cantaloupe. | Intensifies competition among remaining players and creates larger, more dominant entities. |

| Strategic Expansion | Targeting new sectors like sports and entertainment through acquisitions (e.g., CHEQ). | Broadens competitive scope and requires rivals to adapt their market strategies. |

SSubstitutes Threaten

While cashless payments are increasingly the norm in micro markets and vending machines, traditional cash payments still represent a substitute. This is particularly true in specific geographic areas or for certain customer demographics who may prefer or rely on cash. For instance, a 2023 survey indicated that while 70% of consumers prefer cashless options for small purchases, 15% still opt for cash, especially in less urbanized settings.

For smaller operators in the unattended retail sector, manual inventory management and machine monitoring still represent a substitute for Cantaloupe's software solutions. These manual methods, while potentially lower in upfront cost, often lack the precision and speed of automated systems.

However, the significant operational efficiencies, real-time data insights, and substantial cost savings Cantaloupe's automated platform provides are making manual processes increasingly less attractive. Businesses aiming to scale and optimize their unattended retail operations find it difficult to compete when relying on outdated, labor-intensive methods.

Operators might opt for generic payment processors paired with standalone vending or micro market software. This approach, while offering a semblance of choice, often creates data silos and fragmented reporting, a stark contrast to Cantaloupe's unified system. For instance, a 2024 industry survey indicated that businesses using integrated solutions reported an average 15% reduction in reconciliation errors compared to those with separate systems.

In-house Developed Solutions by Large Operators

Large operators, particularly major retail chains or established vending companies, possess the financial muscle to develop proprietary payment and management systems. This capability acts as a substitute, though it demands substantial upfront capital, continuous research and development, and ongoing maintenance. For instance, a large operator might allocate millions in capital expenditure to build out such a system, a cost prohibitive for most players in the market.

The threat of in-house solutions is therefore limited to a select few, highly capitalized entities. While these internal systems can offer tailored functionality, the significant investment required means they are not a readily available substitute for the majority of businesses in the sector. In 2024, the average cost for developing a custom enterprise resource planning (ERP) system, which could encompass vending management, often exceeds $1 million, underscoring this barrier.

- Significant Capital Investment: Developing in-house systems requires substantial upfront funding, often in the millions of dollars.

- Ongoing R&D and Maintenance: Continuous investment in research, development, and system upkeep is necessary.

- Limited Viability: This substitute is only practical for a small number of very large and well-resourced operators.

- Customization vs. Cost: While offering tailored solutions, the cost-benefit analysis often favors third-party providers for most.

Emerging General-Purpose Self-Service Kiosks

The expanding market for general-purpose self-service kiosks and automated retail presents a potential long-term threat to specialized providers like Cantaloupe. These adaptable and increasingly cost-effective solutions, even those not exclusively for vending, could capture market share by offering broader unattended retail functionalities.

For instance, the global self-service kiosk market was valued at approximately USD 30.1 billion in 2023 and is projected to grow significantly. If these general-purpose kiosks evolve to efficiently handle a wider array of transactions and customer interactions, they could become attractive alternatives for businesses currently relying on specialized vending management systems.

- Broader Market Scope: General-purpose kiosks cater to diverse unattended retail needs beyond traditional vending.

- Adaptability & Cost-Effectiveness: As technology advances, these systems become more versatile and economical.

- Potential Market Erosion: Highly capable general-purpose solutions could divert customers from specialized vending platforms.

- Market Growth: The self-service kiosk market is experiencing robust growth, indicating increasing adoption of automated retail.

Traditional cash payments remain a substitute, especially in certain demographics and regions, despite the rise of cashless transactions. A 2023 survey found 15% of consumers still prefer cash for small purchases, particularly outside urban centers.

Generic payment processors combined with separate vending software create data silos, unlike Cantaloupe's integrated platform. Businesses using unified systems reported a 15% reduction in reconciliation errors in a 2024 study.

Large, well-capitalized operators can develop proprietary systems, but this requires millions in upfront capital and ongoing investment, making it a substitute only for a select few.

The growing self-service kiosk market, valued at USD 30.1 billion in 2023, poses a long-term threat as these adaptable solutions expand their functionalities beyond traditional vending.

| Substitute Type | Description | Key Consideration | 2024 Data Point |

| Cash Payments | Preference for physical currency | Geographic and demographic reliance | 15% of consumers still prefer cash for small purchases (2023) |

| Disparate Systems | Using separate payment and management software | Data fragmentation and reconciliation issues | Integrated solutions reduce reconciliation errors by 15% (2024) |

| In-House Development | Building custom proprietary systems | High capital expenditure and ongoing maintenance | Custom ERP development can exceed $1 million (2024) |

| General Kiosks | Broad-purpose self-service automated retail | Increasing adaptability and cost-effectiveness | Global self-service kiosk market valued at $30.1 billion (2023) |

Entrants Threaten

New companies looking to offer integrated payment and management solutions similar to Cantaloupe's face enormous upfront costs. Developing and deploying a complete system, encompassing hardware, sophisticated software, and secure payment processing, demands significant capital investment. This barrier is substantial, potentially reaching tens of millions of dollars for a truly competitive offering.

New companies entering the unattended retail market face a significant hurdle in building the extensive network of active devices and customer relationships that Cantaloupe has cultivated. As of early 2024, Cantaloupe boasts over 1.2 million active devices and serves 34,000 customers, a scale that represents years of dedicated effort and substantial investment. Replicating this reach and the associated trust would be a monumental task for any newcomer, making the threat of new entrants relatively low in this specific area.

The unattended payments sector faces significant regulatory and security compliance challenges, acting as a strong deterrent for potential new entrants. Meeting stringent requirements like Payment Card Industry Data Security Standard (PCI DSS) compliance and adhering to data privacy laws, such as GDPR or CCPA, demands substantial investment in specialized knowledge and robust technical infrastructure. For instance, achieving and maintaining PCI DSS Level 1 compliance, the highest level required for entities processing large volumes of card transactions, can cost tens of thousands of dollars annually in audits and security measures alone.

Technological Complexity and Innovation Pace

The high technological complexity and rapid innovation pace in areas like digital payments, IoT, and AI create a significant barrier for new entrants in the cantaloupe industry. Companies must demonstrate advanced technical capabilities and a robust research and development pipeline to compete effectively.

Keeping pace with evolving consumer preferences, such as the increasing demand for contactless and mobile payment solutions, further challenges newcomers. This dynamic environment makes it difficult for new players to quickly establish a strong market position and gain traction.

- R&D Investment: Companies in the fintech and payment processing sectors, which heavily influence cantaloupe transactions, are projected to invest billions in R&D. For instance, global R&D spending in the technology sector reached an estimated $1.8 trillion in 2024, with a significant portion directed towards digital innovation.

- Digital Payment Adoption: The global digital payments market is expected to grow substantially, with transaction values projected to exceed $15 trillion by 2027. This rapid adoption necessitates sophisticated technological infrastructure for any new entrant.

- IoT Integration: The increasing integration of the Internet of Things (IoT) in supply chain management and retail requires advanced data analytics and connectivity solutions, adding another layer of technical expertise needed to enter the market.

Economies of Scale and Network Effects

Established players in the unattended retail sector, like Cantaloupe, leverage significant economies of scale. This translates to lower per-unit costs in hardware production, software engineering, and the processing of countless transactions. For instance, in 2024, the cost efficiency gained from high-volume manufacturing of payment terminals and telemetry devices provides a substantial advantage over smaller competitors.

Network effects also create a formidable barrier. As more consumers and operators utilize Cantaloupe's platform, its value proposition strengthens. This growing user base makes it challenging for new entrants to attract customers unless they can immediately offer a comparable or superior network, which is a difficult hurdle to overcome without an existing foundation.

- Economies of Scale: Lower production costs for hardware and software due to high-volume operations.

- Network Effects: Increased platform value and customer loyalty as more users and transactions are added.

- Barrier to Entry: Newcomers struggle to compete without an established user base and the cost efficiencies of scale.

The threat of new entrants for Cantaloupe remains relatively low due to substantial capital requirements and the need for extensive operational infrastructure. New companies must overcome significant upfront costs in technology development, regulatory compliance, and building a robust network of devices and customer relationships. For example, achieving PCI DSS Level 1 compliance alone can cost tens of thousands of dollars annually.

Existing players benefit from strong economies of scale, with lower per-unit costs in hardware and software, a significant advantage in 2024. Furthermore, network effects enhance Cantaloupe's platform value as more users join, making it challenging for newcomers to attract customers without an established user base. The rapid pace of technological innovation in digital payments and IoT integration also demands advanced technical capabilities, further deterring new entrants.

| Barrier Type | Description | Estimated Cost/Impact (Illustrative) |

| Capital Investment | Developing integrated payment and management solutions | Tens of millions of dollars |

| Network Scale | Replicating Cantaloupe's 1.2 million active devices and 34,000 customers (as of early 2024) | Monumental task requiring years of effort |

| Regulatory Compliance | PCI DSS, data privacy laws (e.g., GDPR, CCPA) | Tens of thousands of dollars annually for audits and security |

| Technological Complexity | Advanced capabilities in IoT, AI, digital payments | Significant R&D investment (global tech R&D ~$1.8 trillion in 2024) |

| Economies of Scale | Lower per-unit costs from high-volume operations | Substantial advantage for established players |

Porter's Five Forces Analysis Data Sources

Our Cantaloupe Porter's Five Forces analysis is built upon data from agricultural market research reports, government agricultural statistics, and industry association publications to assess competitive dynamics.