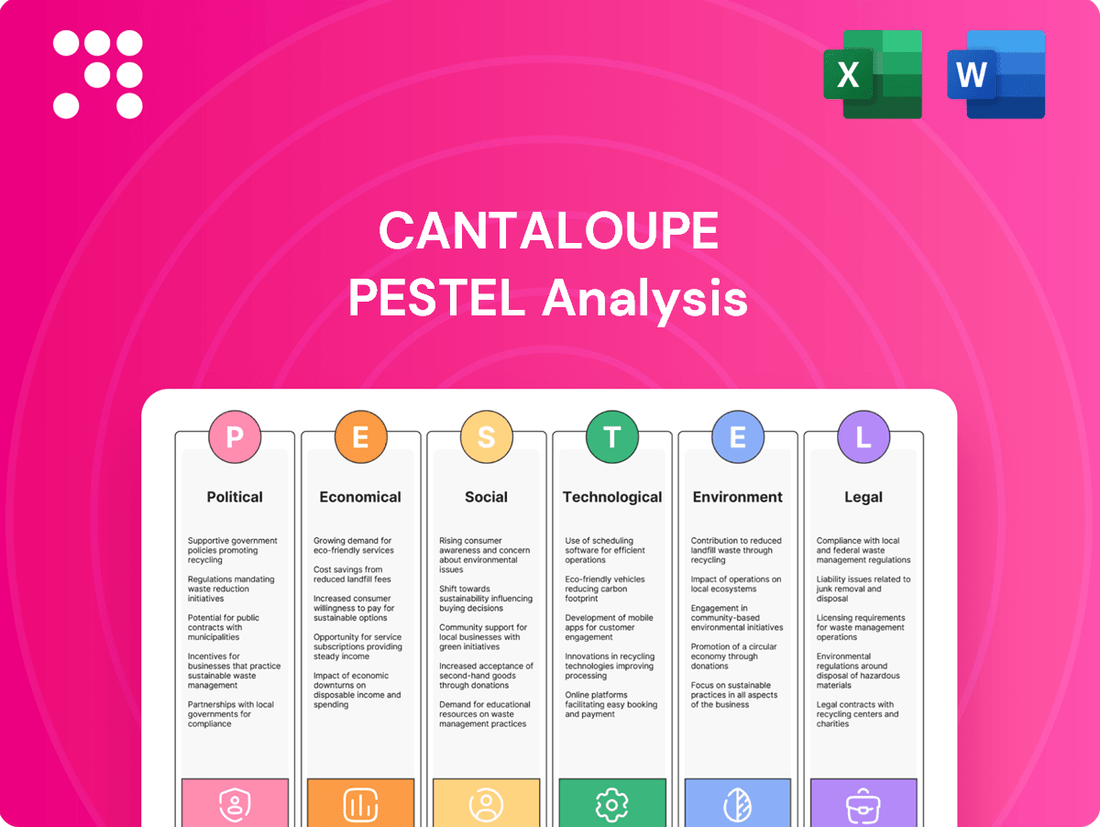

Cantaloupe PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Cantaloupe Bundle

Unlock the full picture of Cantaloupe's operating environment with our comprehensive PESTLE analysis. Understand how political shifts, economic fluctuations, and social trends are impacting its market. Download the complete report to gain actionable intelligence and anticipate future challenges.

Political factors

Governments globally are intensifying their oversight of digital payments, prioritizing security, transparency, and consumer safety. This trend is exemplified by the ongoing implementation of standards like PCI DSS 4.0 and data privacy regulations such as GDPR. New state-specific privacy laws in the United States, becoming effective in 2024 and 2025, directly influence how companies like Cantaloupe manage transaction data and protect customer information, requiring significant adaptation.

These evolving regulatory landscapes present compliance hurdles for businesses operating in the digital payment space. For instance, the expanded scope of data protection laws means increased scrutiny on how sensitive payment information is collected, stored, and processed. However, adherence to these mandates can also cultivate greater consumer confidence, as robust security and privacy measures are becoming critical trust factors for users engaging with digital payment platforms.

The increasing number of data privacy regulations, like the EU's GDPR and various US state laws such as California's CCPA/CPRA, significantly impacts how Cantaloupe handles user information. These laws mandate strict protocols for data collection, usage, and security, requiring substantial investment in compliance infrastructure and transparent practices.

Failure to adhere to these evolving data privacy mandates can result in substantial fines. For instance, GDPR penalties can reach up to 4% of global annual revenue or €20 million, whichever is higher. This underscores the critical need for Cantaloupe to maintain robust data governance and privacy-by-design principles across all its operations to safeguard its reputation and financial health.

Cantaloupe's global ambitions, particularly in markets like the UK, EU, Australia, and Mexico, are directly shaped by prevailing trade policies. These agreements dictate everything from import duties on essential equipment to the regulations governing cross-border data movement, both critical for Cantaloupe's operations.

Favorable trade relations, such as those under the USMCA (United States-Mexico-Canada Agreement) which came into effect in 2020, can significantly ease market entry and reduce operational costs for companies like Cantaloupe expanding into these regions. Conversely, the imposition of tariffs or non-tariff barriers by any of these nations could impede expansion plans and increase the cost of doing business.

The EU's General Data Protection Regulation (GDPR), for instance, impacts how Cantaloupe can handle data across its international operations, highlighting the need for compliance with diverse regulatory landscapes. As of early 2024, ongoing trade negotiations and potential shifts in global trade dynamics, such as those concerning digital trade, will continue to be a key political factor influencing Cantaloupe's international growth strategy.

Government Initiatives for Digital Economy

Government initiatives aimed at fostering digital economies and promoting cashless transactions create a highly conducive environment for Cantaloupe's operations. These programs often involve significant investment in digital infrastructure, such as expanding broadband access and supporting secure payment gateways. For instance, many nations are actively encouraging digital payments through subsidies or tax breaks for businesses that adopt cashless systems, directly aligning with Cantaloupe's service offerings.

Furthermore, regulatory sandboxes established by governments allow for the testing and development of new payment technologies in a controlled setting. This can accelerate the adoption of innovative solutions like those Cantaloupe provides, reducing the time to market and increasing their potential impact. As of late 2024, several countries have reported substantial increases in digital transaction volumes directly attributable to these supportive government policies, with some economies seeing cashless transactions account for over 70% of all retail payments.

- Digital Infrastructure Investment: Governments are channeling billions into improving internet connectivity and digital payment networks to support cashless societies.

- Incentives for Cashless Adoption: Tax credits and grants are being offered to businesses to encourage the transition to digital payment methods.

- Regulatory Sandboxes: These controlled environments facilitate the testing of new fintech solutions, speeding up innovation in the payment sector.

Political Stability and Economic Certainty

Political stability in key markets is crucial for businesses like Cantaloupe, directly influencing investor confidence and the willingness to commit capital to unattended retail solutions. Stable governments foster an environment where businesses can confidently plan for the future, invest in new technologies, and upgrade infrastructure, which is vital for expanding automated retail networks.

Conversely, periods of political upheaval or unpredictable policy changes can significantly dampen business sentiment. For instance, a sudden shift in regulations regarding automated sales or data privacy could create uncertainty, making companies hesitant to invest in new markets or expand existing operations. This uncertainty can slow down the adoption of innovative retail models.

Consider the impact on foreign direct investment (FDI). In 2023, global FDI flows saw a notable slowdown, with reports indicating that geopolitical tensions and economic uncertainty played a significant role. For Cantaloupe, operating in multiple regions means navigating diverse political landscapes, where stability in major markets like the United States and parts of Europe directly supports their growth strategies. A stable political climate generally correlates with increased consumer spending and business investment, creating a more favorable operating environment.

- Political stability fosters long-term business planning and investment in unattended retail infrastructure.

- Policy uncertainty can deter investment and slow the adoption of new retail technologies.

- Global FDI trends in 2023 highlighted the impact of geopolitical tensions on investment, underscoring the importance of stable markets for companies like Cantaloupe.

- Predictable regulatory environments are essential for Cantaloupe to confidently expand its automated retail footprint.

Government policies promoting digital transformation and cashless transactions are a significant tailwind for Cantaloupe. Many nations are actively investing in digital infrastructure and offering incentives, such as tax breaks, to encourage businesses to adopt digital payment systems. For example, several countries reported substantial increases in digital transaction volumes in late 2024, with some seeing cashless payments exceed 70% of retail transactions, directly benefiting companies like Cantaloupe.

Regulatory sandboxes, established by governments, provide controlled environments for testing new payment technologies, accelerating innovation for companies like Cantaloupe. This support for fintech development, coupled with a global push towards digital economies, creates a fertile ground for Cantaloupe's unattended retail solutions. The ongoing development of digital trade agreements also plays a crucial role in shaping Cantaloupe's international expansion strategies.

| Government Initiative | Impact on Cantaloupe | Example/Data Point (2024-2025) |

|---|---|---|

| Digital Infrastructure Investment | Enables wider reach and reliability of payment systems. | Billions invested globally in broadband and secure payment networks. |

| Cashless Adoption Incentives | Reduces barriers for businesses to adopt digital payments. | Tax credits and grants offered to businesses transitioning to digital. |

| Regulatory Sandboxes | Accelerates testing and deployment of new payment technologies. | Facilitates innovation in fintech solutions. |

| Digital Trade Agreements | Shapes international market entry and data movement regulations. | Ongoing negotiations impacting cross-border data flows. |

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors influencing the Cantaloupe market, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights into how these forces create both challenges and prospects, empowering strategic decision-making for stakeholders in the cantaloupe industry.

This Cantaloupe PESTLE analysis offers a clear, summarized version of external factors, acting as a pain point reliever by simplifying complex market dynamics for quick referencing during strategic planning.

Economic factors

Inflation remains a key economic factor, but it hasn't significantly dampened consumer enthusiasm for convenient food and beverage options. Cantaloupe's 2025 Micropayment Trends Report indicates that despite inflationary pressures, self-service sales have shown remarkable strength, suggesting consumers prioritize immediate convenience over marginal price increases.

The report further revealed that food and beverage vending sales surpassed $3.5 billion in 2024, a testament to the sector's resilience. Additionally, micro market sales broke the $1 billion mark for the first time, underscoring a robust consumer willingness to spend within the unattended retail space, even in a higher-cost environment.

The unattended retail market is booming, with strong growth expected to continue. This expansion is fueled by increasing consumer demand for convenient, on-the-go purchasing options and the widespread adoption of digital payment methods.

Projections show the global unattended terminals market is set to reach $2.51 billion by 2028, growing at an impressive 11.8% compound annual growth rate. This upward trend highlights a significant opportunity for companies like Cantaloupe to broaden their market presence and enhance their service offerings.

The global move towards cashless transactions is a major economic force benefiting Cantaloupe. In 2024, this trend was clearly demonstrated with 96% of micro market transactions and a full 100% of Smart Store transactions being cashless.

Furthermore, 77% of all vending transactions were completed using cards or mobile payments. This widespread adoption directly fuels demand for Cantaloupe's digital payment systems, opening up significant new revenue streams.

Average Revenue Per Unit (ARPU) and Transaction Volumes

Cantaloupe's economic performance is showing positive trends in both revenue per unit and transaction activity. The company reported an Average Revenue Per Unit (ARPU) of $206 in Q3 FY25, marking a significant 10.7% increase compared to the same period last year. This growth suggests that customers are increasingly comfortable and willing to spend more in unattended retail settings.

Furthermore, the total dollar volume of transactions processed by Cantaloupe surged to $852.4 million in Q3 FY25. This substantial increase reflects a dual benefit: more consumers are adopting cashless payment methods, and existing users are conducting higher-value transactions.

- ARPU Growth: Cantaloupe's ARPU reached $206 in Q3 FY25, up 10.7% year-over-year.

- Transaction Volume Increase: Total dollar volumes of transactions hit $852.4 million in Q3 FY25.

- Consumer Spending Habits: The data indicates a trend towards increased spending per transaction in unattended retail.

- Cashless Adoption: Rising transaction volumes suggest growing consumer reliance on cashless payment solutions.

Operating Leverage and Profitability

Cantaloupe's strategic emphasis on expanding its operating leverage is clearly paying off, as evidenced by its robust financial performance driven by revenue growth and effective cost management. The company's focus on optimizing its operations has translated into tangible improvements in profitability.

In the third quarter of fiscal year 2025, Cantaloupe reported significant gains in its financial metrics. Gross margins saw an increase, and Adjusted EBITDA also rose, underscoring the company's ability to enhance its earnings from its core subscription and transaction fee businesses. This trend points to a solid financial footing and operational efficiency.

- Increased Gross Margins: The company has demonstrated an ability to grow its gross margins, indicating better cost control relative to revenue.

- Growth in Adjusted EBITDA: Cantaloupe's Adjusted EBITDA has shown an upward trend, reflecting improved operational profitability.

- Subscription and Transaction Fee Strength: Profitability improvements are directly linked to the company's success in its subscription and transaction fee segments.

- Efficient Operations: The financial results suggest that Cantaloupe is effectively managing its operating costs while scaling its business.

The economic landscape continues to favor unattended retail, with inflation not deterring consumers from seeking convenience. Cantaloupe's data shows strong self-service sales, with vending and micro markets exceeding $3.5 billion and $1 billion respectively in 2024, highlighting consumer spending resilience.

The shift to cashless transactions is a significant economic driver, with 96% of micro market and 100% of Smart Store transactions being cashless in 2024. This trend, coupled with 77% of vending transactions using cards or mobile payments, directly benefits Cantaloupe's digital payment solutions.

Cantaloupe's financial performance reflects these positive economic trends, with Average Revenue Per Unit (ARPU) reaching $206 in Q3 FY25, a 10.7% increase year-over-year. Total transaction dollar volume surged to $852.4 million in the same quarter, indicating increased consumer spending and adoption of cashless methods.

| Metric | Q3 FY25 | Year-over-Year Change |

|---|---|---|

| Average Revenue Per Unit (ARPU) | $206 | +10.7% |

| Total Transaction Dollar Volume | $852.4 million | N/A |

| Cashless Vending Transactions | 77% | N/A |

| Cashless Micro Market Transactions | 96% | N/A |

Preview Before You Purchase

Cantaloupe PESTLE Analysis

The preview you see here is the exact Cantaloupe PESTLE Analysis document you’ll receive after purchase—fully formatted and ready to use. This comprehensive analysis covers Political, Economic, Social, Technological, Legal, and Environmental factors impacting the cantaloupe industry. You'll gain valuable insights into market trends, challenges, and opportunities.

Sociological factors

Consumers today are really focused on getting things done quickly and easily. This trend is a big reason why things like unattended retail are becoming so popular. Think about it, who doesn't appreciate a smooth, fast transaction?

The way we pay for things has changed a lot, and contactless payments are a prime example. They're not just a trend; they're significantly faster, reportedly up to 30% quicker than using chip-based payments. This speed directly boosts how happy customers are with their shopping experience.

This strong demand for quick and hassle-free purchases plays right into what Cantaloupe offers. Their self-service solutions are designed to meet this need head-on, making it easier and faster for people to buy what they want, when they want it.

The increasing comfort with contactless payments is a major societal shift, with a significant 82% of global consumers now utilizing these methods, a notable increase from 74% in 2022. This growing preference directly benefits companies like Cantaloupe, as it aligns with the demand for modern, convenient payment solutions in various retail environments.

Mobile wallets are also becoming incredibly mainstream, with projections indicating 5.2 billion users worldwide by the close of 2024. This widespread adoption of digital payment platforms creates a fertile ground for Cantaloupe's offerings, which are designed to integrate seamlessly with these popular mobile payment technologies, enhancing accessibility for consumers.

Generation Z, a powerful consumer bloc, has seen its spending power double since 2019, reaching an estimated $360 billion in 2024. This group, numbering around 68 million in the US alone, is significantly more inclined towards alternative payment methods, with three times the propensity of older generations to use contactless payments. Their comfort with digital environments directly translates into a strong demand for advanced, user-friendly unattended retail solutions that align with their payment preferences and digital-first mindset.

Return to Work Trends and Micro Markets

The ongoing shift back to in-person work is a boon for the unattended retail sector. As more companies encourage or mandate a return to the office, the demand for convenient workplace amenities like micro markets is on the rise. This trend directly translates to increased opportunities for companies like Cantaloupe, whose micro market solutions can cater to this growing need.

Workplace amenities are no longer just perks; they are becoming critical tools for employers looking to entice employees back to the office. Micro markets, offering fresh food, snacks, and beverages in a self-service format, provide a significant draw. For instance, a 2024 survey indicated that 65% of employees consider workplace amenities a key factor in their decision to return to the office.

This societal trend creates a fertile ground for Cantaloupe's expansion. The company's technology and services are well-positioned to meet the evolving demands of corporate environments seeking to enhance the employee experience.

- Increased Demand for Workplace Amenities: Companies are investing in amenities to attract and retain employees in a hybrid or return-to-office environment.

- Micro Markets as a Key Offering: Micro markets are identified as a crucial amenity, providing convenience and choice for employees.

- Growth Potential for Cantaloupe: The trend directly supports the growth of Cantaloupe's micro market solutions within corporate settings.

- Employee Preference Data: Recent surveys highlight that a significant majority of employees view workplace amenities as important for their return-to-office decisions.

Health and Hygiene Concerns Post-Pandemic

The lingering effects of the pandemic have significantly heightened consumer awareness regarding health and hygiene. This elevated concern directly translates into a sustained demand for touch-free transaction methods, a trend that benefits companies like Cantaloupe. Indeed, a late 2024 survey indicated that 65% of consumers now prefer contactless payment options for their perceived safety and convenience.

This societal shift towards minimizing physical interaction continues to fuel the adoption of unattended payment systems. Cantaloupe's solutions, which facilitate secure, cash-free transactions, are perfectly positioned to capitalize on this ongoing preference. The company's technology directly addresses the desire for reduced handling of cash and physical touchpoints, aligning with post-pandemic consumer behavior.

- Increased consumer preference for contactless payments: A significant majority of consumers now prioritize touch-free options due to health concerns.

- Growth in unattended retail: The demand for automated and self-service payment solutions is on the rise.

- Reduced reliance on cash: Societal shifts are accelerating the move away from physical currency, favoring digital transactions.

Societal trends are heavily influencing how consumers interact with retail environments, with a pronounced emphasis on speed, convenience, and safety. The widespread adoption of contactless payments, with 82% of global consumers now using them, and the burgeoning popularity of mobile wallets, projected to reach 5.2 billion users by the end of 2024, directly benefit companies like Cantaloupe. These shifts align perfectly with the demand for seamless, digital transactions, particularly among younger demographics like Generation Z, whose spending power is estimated at $360 billion in 2024 and who exhibit a strong preference for alternative payment methods.

Furthermore, the return-to-office movement is creating new opportunities, as businesses increasingly prioritize workplace amenities to attract employees. Micro markets, offering convenient self-service options, are becoming a key amenity, with 65% of employees in a 2024 survey citing them as important for their return-to-office decisions. This trend directly supports Cantaloupe's micro market solutions, positioning the company to capitalize on the evolving needs of corporate environments seeking to enhance employee experience through readily accessible food and beverage options.

| Societal Trend | Impact on Cantaloupe | Supporting Data (2024/2025) |

|---|---|---|

| Demand for Speed & Convenience | Boosts adoption of self-service and unattended retail. | Contactless payments up to 30% faster than chip. |

| Contactless & Mobile Payment Adoption | Enhances Cantaloupe's payment processing solutions. | 82% of global consumers use contactless payments. Mobile wallet users to reach 5.2 billion. |

| Gen Z Spending Power & Preferences | Drives demand for digital-first, unattended solutions. | Gen Z spending power: $360 billion. 3x more likely to use contactless payments. |

| Return-to-Office & Workplace Amenities | Increases demand for micro markets and workplace solutions. | 65% of employees consider amenities key for return-to-office. |

| Health & Hygiene Awareness | Favors touch-free transactions and reduced cash handling. | 65% of consumers prefer contactless for safety. |

Technological factors

The constant innovation in digital payment methods like NFC, QR codes, and mobile wallets is a direct engine for Cantaloupe's operations. The global market for contactless payments is projected to expand at a robust compound annual growth rate of 18.9% between 2024 and 2030. By the close of 2024, an estimated 5.2 billion individuals worldwide are expected to be using mobile wallets.

The increasing integration of the Internet of Things (IoT) and smart machines is fundamentally reshaping the unattended retail sector. Cantaloupe's platform leverages these advancements to provide operators with unprecedented control and insight into their vending machines and other unattended retail points.

This technological shift translates into tangible benefits for businesses like Cantaloupe's clients. For instance, remote machine monitoring allows for proactive issue resolution, while real-time inventory tracking, a feature highlighted by industry reports in early 2024, helps prevent stockouts and overstocking. Predictive maintenance, a growing area of focus, aims to minimize downtime, with some studies suggesting a potential reduction in service calls by up to 20% through early detection of machine faults.

Ultimately, these capabilities empower operators to optimize stock levels, significantly reduce product waste, and enhance overall operational efficiency. This leads to a more responsive and satisfying customer experience, as machines are more likely to be stocked and operational when needed, a crucial factor in the competitive landscape of 2025.

Artificial intelligence and machine learning are transforming the vending industry, enabling smarter machines that can anticipate top-selling items, manage inventory efficiently, and minimize product spoilage. For instance, vending operators are seeing reductions in out-of-stock items by up to 15% through AI-powered demand forecasting.

AI-driven analytics offer significant opportunities for companies like Cantaloupe to elevate the customer journey by providing tailored product suggestions and adaptive pricing strategies. The global AI in retail market was valued at approximately $10.7 billion in 2023 and is projected to grow substantially, highlighting the increasing adoption of these technologies.

Enhanced Security Measures for Digital Transactions

Enhanced security for digital transactions is paramount, with continuous improvements in encryption, tokenization, and biometric authentication. Cantaloupe's offerings must align with evolving security protocols, such as PCI DSS 4.0, to safeguard consumer information and combat fraud. This commitment to secure payment processing fosters confidence and drives greater acceptance of unattended retail solutions.

The digital payments landscape saw significant growth, with global digital payment transaction volume projected to reach over $15 trillion by 2027, highlighting the critical need for robust security. For instance, biometric authentication, like fingerprint or facial recognition, saw a 20% increase in adoption for payment verification between 2023 and 2024. Cantaloupe's adherence to these advanced security measures directly impacts its ability to secure partnerships and maintain user trust in an increasingly digital marketplace.

- Security Advancements: Ongoing development in encryption, tokenization, and biometrics are key to protecting digital transactions.

- Regulatory Compliance: Adherence to standards like PCI DSS 4.0 is essential for data protection and fraud mitigation.

- Trust and Adoption: A strong security posture builds confidence, encouraging wider use of unattended retail systems.

- Market Growth: The expanding digital payments market underscores the importance of secure and reliable transaction processing.

Development of New Unattended Retail Formats

The unattended retail sector is rapidly evolving, moving past basic vending machines to embrace more sophisticated concepts like micro markets and smart stores. These newer formats blend the convenience and security of traditional vending with the wider product selection typically found in convenience stores, offering a richer customer experience.

Cantaloupe's technology is instrumental in supporting this shift. Their solutions enable operators to effectively manage these diverse, unattended retail environments, opening up new avenues for revenue growth. This is particularly true as operators can now offer higher-margin products beyond just snacks and beverages, tapping into new consumer demands.

The market for unattended retail is showing strong growth. For instance, the global micro market segment alone was valued at over $1.5 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of approximately 12% through 2030, indicating a significant opportunity for companies like Cantaloupe that facilitate these advanced formats.

- Micro Markets: These are self-service kiosks offering a wider variety of fresh food, beverages, and convenience items, often found in workplaces and public spaces.

- Smart Stores: Fully automated retail spaces utilizing AI and sensor technology for seamless checkout and inventory management, representing the cutting edge of unattended retail.

- Revenue Expansion: By supporting these advanced formats, Cantaloupe helps operators increase average transaction value and capture new customer segments, boosting overall profitability.

Technological advancements are reshaping the unattended retail landscape, with digital payment adoption accelerating. By 2025, it's estimated that over 6 billion people worldwide will be using mobile wallets, a significant increase from previous years. Cantaloupe's platform is well-positioned to capitalize on this trend, integrating seamlessly with these evolving payment methods.

Legal factors

Cantaloupe, operating in the digital payment space, must strictly adhere to the Payment Card Industry Data Security Standard (PCI DSS), especially the recently updated PCI DSS 4.0. This global standard is fundamental for safeguarding sensitive cardholder data, employing robust measures like advanced encryption and stringent multi-factor authentication. For instance, a 2024 report indicated that over 70% of companies experienced at least one data breach related to payment card information, highlighting the critical need for such compliance.

The EU's General Data Protection Regulation (GDPR) sets strict rules for how companies like Cantaloupe must handle personal data of EU citizens. This means Cantaloupe must have strong policies in place for data processing, get clear permission from users, and allow them to control their own information, even if Cantaloupe isn't based in the EU.

Many regions and US states are following suit with their own data privacy laws, mirroring GDPR's requirements. For instance, California's Consumer Privacy Act (CCPA) and its successor, the California Privacy Rights Act (CPRA), grant consumers significant rights over their personal data. Cantaloupe needs to adapt its practices to comply with these evolving regulations to avoid penalties and maintain customer trust.

Cantaloupe, operating as a payment processor, must navigate a complex and ever-changing landscape of Anti-Money Laundering (AML) and Counter-Terrorism Financing (CTF) regulations globally. This necessitates robust Know Your Customer (KYC) procedures to rigorously verify user identities, a critical step in preventing illicit financial activities. For instance, in 2024, FinCEN reported a significant increase in Suspicious Activity Reports (SARs) related to money laundering, underscoring the importance of stringent compliance for payment processors like Cantaloupe.

To effectively combat financial crime, Cantaloupe is enhancing its integration of AI-driven transaction analysis tools. These advanced systems are designed to detect patterns and anomalies indicative of suspicious behavior in real-time, far exceeding manual capabilities. The Financial Action Task Force (FATF) continues to emphasize the critical role of technology in AML/CTF efforts, with many jurisdictions implementing stricter data analytics requirements for financial institutions, including payment processors, to identify and report potential financial crimes.

Adherence to these stringent AML and CTF regulations is not merely a legal obligation but a fundamental business imperative for Cantaloupe. Non-compliance can lead to severe financial penalties, reputational damage, and even the loss of operating licenses. For example, in 2023, several major financial institutions faced multi-million dollar fines for AML violations, highlighting the substantial risks associated with inadequate compliance frameworks in the payments industry.

Consumer Protection Laws

Consumer protection laws are a significant legal factor for Cantaloupe, particularly concerning its digital transaction services. These regulations aim to ensure transparency, fairness, and effective dispute resolution for consumers engaging in online commerce. For instance, in the US, the Consumer Financial Protection Bureau (CFPB) oversees various acts designed to protect consumers, such as the Electronic Fund Transfer Act (EFTA), which mandates clear disclosures for electronic transactions. Cantaloupe must ensure its platforms provide easy access to transaction histories and clearly outline all fees associated with its services.

These legal frameworks often dictate how companies handle customer complaints and provide recourse for transactional issues. Failure to comply can result in significant penalties and reputational damage. In 2023, the CFPB reported receiving over 1.4 million consumer complaints, highlighting the active enforcement environment. Cantaloupe's operational strategy must therefore incorporate robust mechanisms for:

- Clear and upfront disclosure of all service fees and charges.

- Accessible and easily understandable transaction history for users.

- Efficient and transparent processes for handling customer disputes and complaints.

- Compliance with data privacy regulations that protect consumer information.

Accessibility Regulations (e.g., EU Accessibility Act)

The EU Accessibility Act, coming into effect on June 28, 2025, will require companies like Cantaloupe to ensure their payment systems and self-service kiosks are accessible to people with disabilities. This legislation aims to create a more inclusive market by setting common accessibility requirements for various products and services. For Cantaloupe, this means focusing on user interface design that accommodates a wider range of users.

This legal shift necessitates that Cantaloupe's payment terminals and digital interfaces are designed with accessibility in mind, potentially impacting development costs and timelines. Compliance will involve ensuring features such as screen reader compatibility, adjustable font sizes, and tactile feedback mechanisms are integrated. Failure to comply could result in penalties and exclusion from the European market.

- EU Accessibility Act effective date: June 28, 2025.

- Impact on Cantaloupe: Mandates inclusive design for payment interfaces and self-service solutions.

- Key compliance areas: Screen reader compatibility, adjustable text, tactile feedback.

- Potential consequences of non-compliance: Penalties and market access restrictions.

Cantaloupe must navigate a complex web of consumer protection laws, ensuring transparency in fees and dispute resolution, as highlighted by the CFPB's over 1.4 million consumer complaints in 2023.

The upcoming EU Accessibility Act, effective June 28, 2025, mandates inclusive design for payment interfaces, impacting development and potentially incurring penalties for non-compliance.

Adherence to PCI DSS 4.0 remains critical, with over 70% of companies experiencing data breaches in 2024, underscoring the need for robust security measures.

| Legal Factor | Description | Relevance to Cantaloupe | Key Date/Statistic |

|---|---|---|---|

| Data Privacy (GDPR, CCPA/CPRA) | Regulations governing the collection, processing, and storage of personal data. | Requires strict data handling policies and user consent mechanisms. | CCPA/CPRA grants consumers significant data rights. |

| AML/CTF Regulations | Laws aimed at preventing money laundering and terrorist financing. | Necessitates robust Know Your Customer (KYC) procedures and transaction monitoring. | FinCEN reported increased SARs in 2024 related to money laundering. |

| Consumer Protection Laws | Ensures fairness, transparency, and dispute resolution for consumers. | Mandates clear fee disclosures and accessible transaction histories. | CFPB received over 1.4 million complaints in 2023. |

| EU Accessibility Act | Requires accessibility for people with disabilities in products and services. | Impacts design of payment terminals and digital interfaces. | Effective date: June 28, 2025. |

Environmental factors

The energy consumption of vending machines and kiosks is a significant environmental consideration. Older models can be particularly inefficient, contributing to a larger carbon footprint for unattended retail operations. For instance, a study from 2024 indicated that a typical vending machine can consume between 1.5 to 4 kWh per day, depending on its age and features.

Cantaloupe's technology plays a role in mitigating this impact. By enabling smart power management and integration with energy-efficient hardware, their solutions can help reduce the overall electricity usage of vending machines and micro markets. This focus on sustainability aligns with growing consumer and regulatory demands for environmentally responsible business practices.

The unattended retail sector is increasingly scrutinized for its environmental impact, driving a push for waste reduction and sustainable packaging. This means operators need to think about how products are presented and managed to minimize their footprint.

Cantaloupe's technology plays a crucial role here. By providing advanced inventory management and remote monitoring, they empower operators to significantly reduce product spoilage. For instance, better stock visibility helps prevent over-ordering and expiration, directly tackling food waste. This optimization can also free up resources for operators to consider more sustainable product sourcing and packaging options.

The market is responding. In 2024, consumer demand for sustainable products in vending and micro-markets continued to rise, with studies showing a significant percentage of consumers willing to pay a premium for eco-friendly options. This trend is expected to accelerate through 2025, making Cantaloupe's waste-reduction capabilities a key enabler for operators looking to meet evolving customer expectations and regulatory pressures.

Cantaloupe's business, which includes hardware like card readers and kiosks, generates electronic waste. As of 2024, global e-waste is projected to reach 61.3 million metric tons, a significant increase from previous years. This growing volume underscores the need for robust recycling and disposal strategies.

The environmental impact of e-waste is substantial, with improper disposal leading to the release of hazardous materials. By 2025, regulations surrounding e-waste management are expected to become even more stringent globally, pushing companies like Cantaloupe to adopt more sustainable practices for their hardware lifecycle.

Supply Chain Environmental Footprint

The environmental footprint of Cantaloupe's supply chain, encompassing everything from component manufacturing to final equipment distribution, is a significant factor. This includes emissions from transportation, energy consumption in production facilities, and waste generation. For instance, the transportation sector alone accounted for approximately 24% of direct CO2 emissions from fuel combustion globally in 2023, highlighting the impact of logistics.

Cantaloupe can mitigate its environmental impact by focusing on responsible material sourcing and optimizing its logistics networks. This involves prioritizing suppliers with strong environmental certifications and exploring more fuel-efficient transportation methods. By working with environmentally conscious partners, the company can reduce the overall carbon footprint associated with its operations, a trend increasingly expected by consumers and investors.

- Reduced Emissions: Implementing greener logistics can cut down on greenhouse gas emissions from transport.

- Sustainable Sourcing: Choosing suppliers committed to environmental responsibility aligns with corporate sustainability goals.

- Waste Minimization: Optimizing packaging and production processes can significantly decrease waste output.

- Energy Efficiency: Investing in energy-efficient manufacturing and distribution centers lowers operational environmental impact.

Demand for Environmentally Conscious Business Practices

Consumers and investors are increasingly prioritizing businesses that showcase genuine environmental stewardship. This trend is evident in market shifts and corporate reporting, with a significant portion of consumers willing to pay more for sustainable products.

Cantaloupe, by embedding sustainable operational strategies, such as optimizing energy usage and minimizing waste streams, can bolster its brand image. This approach also serves to attract a growing segment of customers and investors who actively seek out and support environmentally responsible companies. For instance, a recent survey indicated that over 70% of consumers consider sustainability when making purchasing decisions in 2024.

- Growing Consumer Preference: 73% of global consumers stated they are likely to change their consumption habits to reduce their environmental impact (Nielsen, 2023).

- Investor Scrutiny: ESG (Environmental, Social, and Governance) investing saw significant inflows in 2024, with assets under management reaching trillions globally.

- Brand Reputation Enhancement: Companies with strong sustainability initiatives often report higher brand loyalty and better public perception.

- Operational Efficiency Gains: Energy efficiency measures, for example, can lead to direct cost savings, with many companies reporting double-digit percentage reductions in energy bills after implementing upgrades.

Cantaloupe's operations, particularly its hardware and supply chain, contribute to environmental concerns like energy consumption and e-waste. In 2024, global e-waste was projected to reach 61.3 million metric tons, underscoring the need for responsible disposal. Furthermore, the transportation sector's significant carbon footprint, around 24% of global direct CO2 emissions in 2023, highlights the impact of logistics.

PESTLE Analysis Data Sources

Our Cantaloupe PESTLE Analysis draws data from agricultural market reports, global food industry trends, and government agricultural policies. We analyze economic indicators affecting produce prices and consumer demand, alongside environmental factors impacting cultivation.