Cantaloupe Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Cantaloupe Bundle

Curious about Cantaloupe's product portfolio performance? Our BCG Matrix preview reveals the strategic positioning of their offerings, highlighting potential growth areas and those needing attention.

To truly understand how Cantaloupe is navigating the market and where its future investments should lie, dive into the full BCG Matrix.

Purchase the complete report for a detailed quadrant breakdown, data-driven insights, and actionable strategies to optimize your own product portfolio.

Stars

Cantaloupe's digital payment processing for micro markets is a stellar example of a Question Mark, poised for significant growth. The shift towards cashless transactions is undeniable, with 96% of micro market payments being cashless, highlighting a strong consumer demand. This segment is experiencing rapid expansion, and Cantaloupe's investment here positions it to capitalize on this trend.

Cantaloupe's Seed™ Vending Management Platform is a shining star in their portfolio, thanks to continuous updates and modernization. Enhancements like an improved user interface and mobile accessibility are key. This core software is vital for operators in the expanding unattended retail market, boosting efficiency and making things easier to use.

The company's commitment to investing in Seed™ keeps it relevant and dominant in a fast-changing industry. For example, in fiscal year 2023, Cantaloupe reported a 22% increase in revenue for their software and payment solutions, highlighting the growing demand and success of their VMS.

Following the February 2024 acquisition of CHEQ, Cantaloupe has strategically expanded its footprint into the dynamic sports, entertainment, and hospitality industries. This move positions Cantaloupe to offer robust self-service payment and Point-of-Sale (POS) solutions, tapping into a market experiencing significant growth. The company is leveraging CHEQ's advanced mobile-first technology to broaden its customer base and market penetration.

Cantaloupe's integration of CHEQ's capabilities is designed to capture substantial growth opportunities within these specialized verticals. The combined offerings are expected to enhance customer experience and operational efficiency for venues, solidifying Cantaloupe's market presence. This expansion aligns with the company's strategy to diversify its service offerings and address evolving consumer payment preferences.

International Expansion through Strategic Acquisitions

Cantaloupe's acquisition of SB Software in September 2024 for an undisclosed sum marks a significant stride in its international expansion strategy, particularly targeting high-growth European markets. This move directly addresses the need to bolster its presence in the UK and Ireland, regions with substantial unattended retail potential. The integration of SB Software's established customer base and operational capabilities is expected to accelerate Cantaloupe's penetration into these key geographies.

This strategic acquisition is designed to enhance Cantaloupe's operational capabilities and expand its market reach across Europe. By integrating SB Software, Cantaloupe aims to standardize its payment processing solutions, a critical step in building a cohesive global offering. The company anticipates this will not only solidify its position in existing European markets but also open doors for further growth and market share acquisition.

The investment in SB Software underscores Cantaloupe's commitment to tapping into new geographic markets with high unattended retail potential. This aligns with the company's broader objective of becoming a leading global provider of payment and software solutions for the unattended retail sector. The UK and Ireland represent a crucial stepping stone in this larger international expansion plan, offering a robust foundation for future European endeavors.

Key highlights of this strategic move include:

- Targeted Market Entry: Acquisition of SB Software provides immediate access to the UK and Ireland, key European markets for unattended retail.

- Enhanced Capabilities: Integration of SB Software's vending and coffee management solutions strengthens Cantaloupe's product portfolio and service offerings.

- Global Footprint Expansion: The deal is a significant step towards standardizing payment processing solutions and growing Cantaloupe's international presence.

- Future Growth Potential: The acquisition positions Cantaloupe to capitalize on the significant unattended retail potential within Europe.

Cantaloupe Smart Stores

Cantaloupe's Smart Stores, launched in December 2024 with models like the Smart Store 600 and 700, are positioned as Stars in the BCG matrix. These solutions directly confront significant retail challenges including labor scarcity, shoplifting, and the complexities of inventory oversight. Their design facilitates swift deployment and scalability across diverse locations such as airports and university campuses, highlighting substantial growth prospects and Cantaloupe's strategic aim to pioneer the future of unattended retail.

The market for unattended retail is expanding, and Cantaloupe's innovative Smart Stores are well-equipped to capture a considerable share. By offering advanced self-service technology, Cantaloupe is addressing key pain points for retailers seeking efficient and secure automated sales solutions. This strategic move into next-generation retail technology underscores their commitment to innovation and market leadership.

- Market Entry: December 2024 launch of Smart Store 600 and 700 models.

- Addressing Challenges: Solutions target labor shortages, theft, and inventory management.

- Growth Potential: Rapid adoption and expansion into new sectors like airports and campuses.

- Market Position: Aiming to lead the next generation of unattended retail solutions.

Cantaloupe's Smart Stores, introduced in late 2024, are prime examples of Stars within their product portfolio. These innovative solutions directly address critical retail pain points such as labor shortages and inventory management challenges. Their design allows for rapid deployment and scalability in high-traffic areas like airports and university campuses, indicating strong growth potential.

The unattended retail market is experiencing robust growth, and Cantaloupe's Smart Stores are strategically positioned to capture a significant portion of this expansion. By offering advanced self-service technology, the company is meeting the evolving needs of retailers for efficient and secure automated sales. This focus on next-generation retail technology solidifies their market leadership ambitions.

The Smart Store 600 and 700 models, launched in December 2024, are designed for quick setup and can be scaled across various locations. This adaptability is crucial for capturing market share in the rapidly expanding unattended retail sector. Cantaloupe's investment in these solutions signifies a commitment to pioneering the future of automated retail experiences.

| Product/Service | BCG Category | Key Growth Drivers | Market Position |

|---|---|---|---|

| Smart Stores (600/700) | Star | Labor scarcity, theft reduction, inventory management, rapid deployment | Pioneering next-gen unattended retail |

| Seed™ VMS | Star | Continuous updates, mobile accessibility, operator efficiency | Dominant in unattended retail software |

| Digital Payment Processing | Question Mark | Shift to cashless, strong consumer demand (96% cashless) | Poised for significant growth |

| CHEQ Acquisition | Star (potential) | Expansion into sports, entertainment, hospitality; mobile-first tech | Broadening customer base and market penetration |

| SB Software Acquisition | Star (potential) | European expansion (UK/Ireland), international standardization | Accelerating European market penetration |

What is included in the product

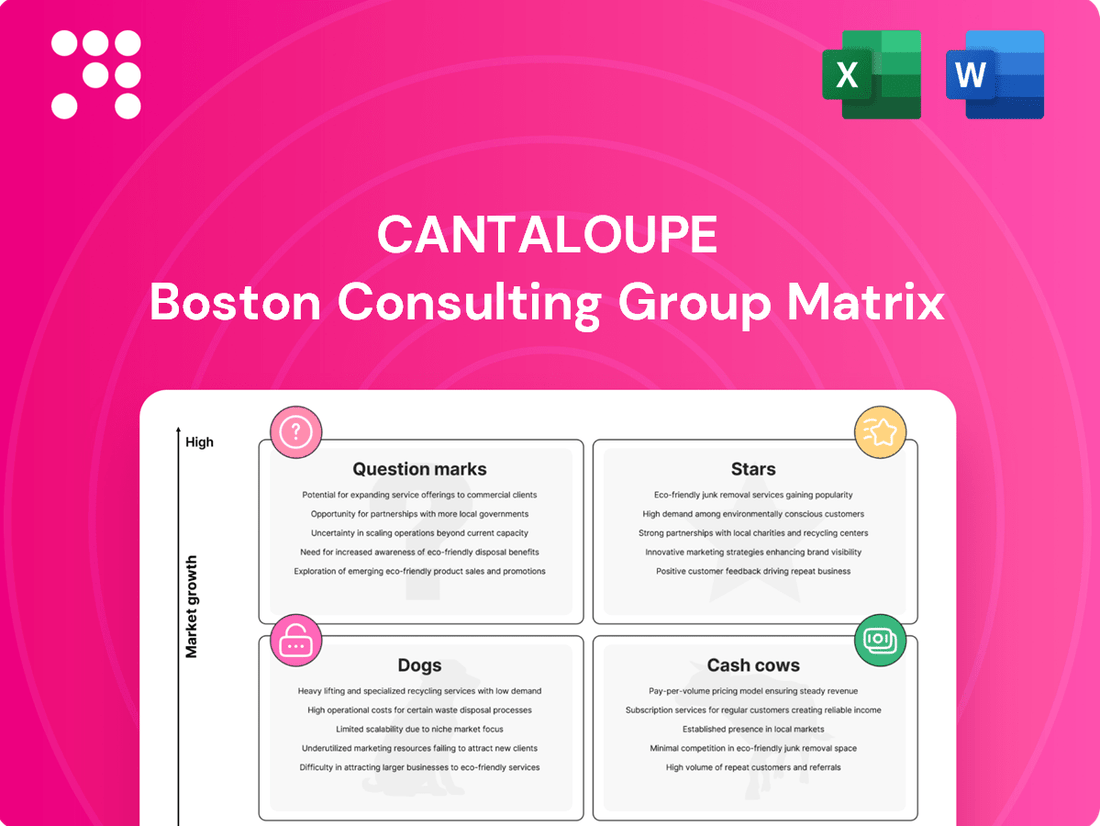

The Cantaloupe BCG Matrix categorizes products into Stars, Cash Cows, Question Marks, and Dogs.

It guides strategic decisions on investment, holding, or divesting based on market growth and share.

The Cantaloupe BCG Matrix offers a clear, one-page overview to identify underperforming "dogs," alleviating the pain of resource misallocation.

Cash Cows

Cantaloupe's core digital payment transaction services, primarily for vending and self-service retail, are a classic Cash Cow. These services boast a high market share in a relatively stable industry, consistently delivering substantial transaction fee revenue.

As of the first quarter of fiscal year 2024, Cantaloupe reported that its payment services segment continued to be a primary revenue driver, contributing to the company's overall financial stability. The ongoing demand for convenient payment options in unattended retail ensures a predictable and robust cash flow from this established offering.

Cantaloupe's basic remote machine monitoring and inventory management software represents a classic Cash Cow within its product portfolio. This foundational service is a cornerstone for many of their clients, providing essential operational insights.

The recurring subscription model for this software ensures a predictable and high-margin revenue stream for Cantaloupe. In 2024, the company continued to see strong adoption, with a significant portion of its revenue derived from these established, low-cost-to-maintain offerings.

Cantaloupe's established vending machine card readers represent a classic Cash Cow within the BCG matrix. Despite some pressure on equipment sales margins, the sheer volume of these readers already installed on traditional vending machines ensures a consistent flow of transaction revenue and associated fees.

These mature products boast high market penetration, meaning they require minimal marketing spend to maintain their revenue stream. The extensive network of active devices generates steady, reliable income, a hallmark of a strong Cash Cow.

Overall Subscription Fee Revenue from Existing Customers

Cantaloupe's substantial and expanding customer base, exceeding 34,000 active clients, generates a significant and consistent stream of subscription fee revenue. This recurring income is a core strength, highlighting the platform's enduring value and customer loyalty.

This predictable revenue acts as a financial bedrock, providing the necessary capital for Cantaloupe to fund new initiatives and cover ongoing operational needs.

- Recurring Revenue: Cantaloupe's over 34,000 active customers provide a stable and predictable income through subscription fees.

- Platform Stickiness: This revenue demonstrates how well operators are integrated with and rely on Cantaloupe's services.

- Financial Stability: The consistent cash flow from subscriptions supports strategic investments and day-to-day operations.

Standard Seed Platform Management Features

The Standard Seed Platform Management Features, including route planning, pre-kitting, and back-office management, are the bedrock of Cantaloupe's offering for vending, micro market, and office coffee service operators. These functionalities are deeply integrated into daily customer operations, signifying a mature product with a substantial market share. In 2024, Cantaloupe reported that its Seed platform continued to be a primary driver of recurring revenue, demonstrating the stable demand for these essential management tools.

These features represent a classic Cash Cow within the BCG matrix. They generate consistent, reliable revenue streams with minimal need for further investment, allowing Cantaloupe to allocate resources to other areas of its business. The platform's widespread adoption and the essential nature of its management capabilities ensure a steady income. For instance, the broad adoption of route optimization alone can lead to significant operational efficiencies for operators, solidifying its value proposition.

- Core Functionality: Route planning, pre-kitting, and back-office management are vital for efficient vending and micro market operations.

- Market Dominance: These features have achieved high market penetration, indicating strong customer reliance.

- Revenue Generation: They consistently produce significant, predictable revenue for Cantaloupe.

- Low Investment Need: As a mature product, they require minimal additional capital for growth.

Cantaloupe's digital payment transaction services are a prime example of a Cash Cow. These services, crucial for vending and self-service retail, hold a significant market share in a stable industry, consistently generating substantial revenue from transaction fees.

The company's basic remote machine monitoring and inventory management software also fits the Cash Cow profile. This foundational service is vital for many clients, offering essential operational insights and contributing to a predictable, high-margin revenue stream through its subscription model.

The established vending machine card readers are another key Cash Cow. Despite some margin pressure on equipment sales, the vast number of installed readers ensures a steady inflow of transaction revenue and associated fees, a testament to their mature market penetration.

Cantaloupe's extensive customer base, exceeding 34,000 active clients, fuels a consistent stream of subscription fee revenue. This recurring income acts as a financial bedrock, providing capital for new ventures and covering operational costs.

| Product/Service | BCG Category | Market Share | Market Growth | Revenue Contribution |

|---|---|---|---|---|

| Digital Payment Transaction Services | Cash Cow | High | Low | High & Stable |

| Basic Remote Monitoring & Inventory Software | Cash Cow | High | Low | High & Stable |

| Vending Machine Card Readers | Cash Cow | High | Low | High & Stable |

What You See Is What You Get

Cantaloupe BCG Matrix

The Cantaloupe BCG Matrix preview you are currently viewing is the definitive document you will receive upon purchase. This means the analysis, formatting, and strategic insights are identical to the final, unwatermarked file ready for your immediate use. You can confidently assess the comprehensive breakdown of your product portfolio's market share and growth potential, knowing the purchased version will be exactly as presented. This ensures a seamless transition from evaluation to strategic implementation without any hidden surprises or alterations.

Dogs

Certain older vending machine hardware and legacy payment devices that Cantaloupe may still support likely fit into the Dogs category of the BCG Matrix. These items typically see low sales volume and declining demand, contributing little to the company's overall revenue or strategic growth.

For instance, if a particular payment terminal model, introduced several years ago, now accounts for less than 5% of new installations and has seen a year-over-year revenue decline of over 15% as of late 2024, it would be a prime example of a Dog. Cantaloupe's strategic focus is increasingly on newer, integrated solutions that offer enhanced functionality and better customer experiences, making these legacy products less of a priority.

Within Cantaloupe's extensive product suite, certain ancillary services, like specialized reporting add-ons or less common payment integrations, fall into the 'Dogs' category. These are offerings that have not gained significant traction, meaning their adoption rates remain low across the customer base.

These low-adoption services typically contribute very little to Cantaloupe's overall revenue. For instance, if a niche reporting tool was adopted by less than 5% of their vending operator clients in 2023, it would likely be categorized here. Such offerings often demand support resources that outweigh their financial contribution, making them inefficient.

The strategic focus for these 'Dogs' is generally to minimize investment and potentially phase them out if they continue to drain resources without showing signs of growth. Cantaloupe's emphasis remains on its core payment processing and management solutions, which drive the majority of its growth and market presence.

Within Cantaloupe's business, certain equipment sales, especially those in highly competitive niches with shrinking profit margins, could be considered Dogs. These sales might be essential for maintaining the integrity of their software and service ecosystem, even if they don't contribute substantially to overall profitability or future growth on their own.

For example, if Cantaloupe sells a particular type of vending machine component that has seen significant price erosion due to numerous competitors entering the market, this segment would likely fall into the Dog category. While these components are still needed to complete a sale or service, the low margins mean they are not a growth driver.

Geographically Limited or Underperforming Legacy Operations

Geographically limited or underperforming legacy operations within Cantaloupe's portfolio could be categorized as Dogs. These might include older vending machine networks in less populated areas that haven't adopted newer payment technologies or integrated seamlessly with the company's cloud-based management system. For instance, if a specific regional deployment of older hardware in 2024 showed a mere 1.5% year-over-year revenue growth compared to the company's overall 12% growth, it would highlight underperformance.

These segments often struggle with economies of scale and may represent a declining market share in their niche. Their inability to leverage Cantaloupe's modern platform can lead to increased operational costs and reduced efficiency. A report from early 2025 might indicate that these legacy areas represent only 3% of Cantaloupe's total active vending units but consume 7% of the support budget, a clear sign of a Dog.

- Stagnant or declining regional market share.

- Limited adoption of new payment technologies.

- Higher operational costs relative to revenue contribution.

- Poor integration with the broader Cantaloupe platform.

Standalone, Non-Integrated Software Tools

Standalone, non-integrated software tools, prior to recent platform consolidations, represent a potential 'Question Mark' in Cantaloupe's BCG Matrix. These legacy applications, often with limited user adoption and lacking modern functionalities, may not align with the company's strategic vision for an end-to-end platform. For instance, if Cantaloupe had a niche reporting tool that wasn't adopted by its core user base, it would likely fall into this category.

These tools typically exhibit low market share within the broader software landscape and may also have low growth potential if they are not actively developed or integrated. Their value is often diminished due to a lack of synergy with the company's main offerings. Consider a scenario where Cantaloupe maintained a separate, older payment processing module that was eventually superseded by its integrated platform; this older module would be a prime example.

- Low Market Share: These tools often serve a small, specific segment of the market, thus holding a minimal share of the overall software industry.

- Limited Growth Potential: Without integration or significant updates, their ability to attract new users or expand their capabilities is severely restricted.

- Potential for Divestment or Sunset: Companies often consider divesting or retiring such assets to focus resources on more promising, integrated solutions.

- Resource Drain: Maintaining these standalone tools can divert valuable engineering and support resources away from core platform development.

Products or services in the Dogs category for Cantaloupe are those with low market share and low growth potential. These offerings often require significant resources to maintain but yield minimal returns. For example, a legacy payment processing module that had only 2% of new activations in 2024, down from 5% in 2023, would be a Dog. The strategic approach is to minimize investment, potentially divesting or phasing out these items to reallocate capital to more promising ventures.

Question Marks

Launched in February 2025, Cantaloupe Capital, in partnership with Fundbox, aims to provide small businesses with crucial capital for growth. This strategic move positions Cantaloupe within the high-potential financial services sector, a market experiencing robust expansion.

Despite the promising market, Cantaloupe Capital's current market share in this specialized financing segment is negligible. Significant investment is therefore necessary to build brand awareness, develop operational capacity, and forge key alliances to secure a substantial market presence.

Cantaloupe's AdVantage program, launched in October 2024, positions the company as a new entrant in the high-growth digital advertising sector by leveraging its existing network of point-of-sale (POS) touchscreen devices. This innovative approach allows brands to directly reach consumers at the moment of purchase, a critical touchpoint for driving sales and brand awareness.

While digital advertising is projected to reach over $600 billion globally by 2024, Cantaloupe's AdVantage program is in its nascent stages, focusing on building foundational brand partnerships. The company's strategy involves demonstrating the unique value proposition of in-store digital advertising to secure a meaningful market share and achieve scalability in this competitive landscape.

While Cantaloupe's Smart Stores are generally considered Stars in the BCG matrix, the newer advanced features like AI-powered dynamic camera vision within them, such as in the Smart Café, are still in their nascent stages of adoption. This places them in a unique position, bordering on Question Marks due to their early-stage market penetration despite operating within a high-growth retail innovation sector. The global retail analytics market, which includes AI and computer vision, was valued at approximately $10.5 billion in 2023 and is projected to grow significantly, indicating the potential for these advanced features.

Deep Penetration into Untapped International Markets

Deep penetration into untapped international markets for Cantaloupe's unattended retail solutions is a key strategic imperative, especially as the company looks to expand beyond established regions like the UK and Ireland. These new markets offer substantial growth opportunities, but they also come with considerable upfront investment. This includes tailoring solutions to local preferences, navigating complex regulatory frameworks, and building distribution networks from the ground up. For instance, entering markets in Southeast Asia or Latin America requires a deep understanding of diverse consumer behaviors and payment infrastructures.

- High Growth Potential: Emerging economies often exhibit a faster adoption rate for new technologies and a growing middle class eager for convenient retail experiences.

- Significant Investment Required: Costs associated with market research, localization, legal compliance, and establishing a physical presence can be substantial, impacting short-term profitability.

- Strategic Partnerships: Collaborating with local distributors or technology providers is often crucial for navigating unfamiliar market dynamics and accelerating market penetration.

- Example Data: In 2024, the global unattended retail market was projected to reach over $25 billion, with significant growth anticipated in regions like Asia-Pacific, indicating the lucrative nature of these untapped markets.

Engage Pulse for the Arcade and Amusement Industry

Engage Pulse, launched in January 2025, is Cantaloupe's new strategic initiative aimed squarely at the arcade and amusement sector. This offering capitalizes on the technological advancements and market access secured through the CHEQ acquisition, positioning Cantaloupe to capture a burgeoning segment within the broader entertainment industry.

While the overall entertainment market shows robust growth, Engage Pulse operates in a relatively nascent niche. Its market share within the arcade and amusement space is currently minimal, reflecting its recent introduction. Significant investment is therefore crucial to establish brand recognition and demonstrate its potential for widespread adoption and scalability.

Within Cantaloupe's BCG Matrix, Engage Pulse would likely be categorized as a Question Mark. This classification is due to its high market growth potential in the arcade and amusement segment, coupled with its current low market share.

- Market Growth: The global amusement and theme park market was valued at approximately $50 billion in 2023 and is projected to grow significantly in the coming years, indicating a strong growth potential for specialized offerings like Engage Pulse.

- Market Share: As a new entrant in 2025, Engage Pulse's market share is currently negligible, requiring substantial effort to build.

- Investment Needs: To gain traction and prove scalability, Engage Pulse will require focused marketing, sales, and product development investment.

- Strategic Focus: Cantaloupe's strategy will need to address how it plans to convert this Question Mark into a Star or Cash Cow through aggressive market penetration and product enhancement.

Question Marks represent business units or products with low market share in high-growth industries. These ventures require careful consideration as they have the potential to become Stars but also carry a significant risk of failure. Significant investment is typically needed to increase market share and achieve profitability.

For Cantaloupe, initiatives like the AdVantage program and Engage Pulse fall into this category. They operate in expanding markets, such as digital advertising and the arcade sector, but are new entrants with minimal current market penetration. The company must strategically invest in these areas to foster growth and determine their future viability.

The key challenge for Question Marks is to convert their high-growth potential into tangible market success. This involves targeted marketing, product refinement, and securing strategic partnerships to overcome initial hurdles and establish a competitive advantage. Without such focused efforts, these ventures may not materialize their promise.

Here's a look at Cantaloupe's Question Marks:

| Business Unit/Product | Industry | Market Growth | Current Market Share | Investment Needs |

|---|---|---|---|---|

| AdVantage Program | Digital Advertising | High (Global market over $600 billion in 2024) | Negligible | Significant for brand awareness, partnerships, and scalability |

| Engage Pulse | Arcade & Amusement | High (Global amusement market ~$50 billion in 2023, growing) | Negligible | Substantial for marketing, sales, and product development |

| Advanced Smart Store Features (e.g., AI Vision) | Retail Analytics/Innovation | High (Retail analytics market ~$10.5 billion in 2023, growing) | Nascent/Low | Investment for adoption and integration |

BCG Matrix Data Sources

Our Cantaloupe BCG Matrix is constructed using comprehensive market data, including sales figures, industry growth rates, and competitor analysis to provide a clear strategic overview.